TIDMIRR

RNS Number : 3261O

IronRidge Resources Limited

07 October 2021

07 October 2021

Corporate Update

APPLICATION FOR SHARE TRADING ON THE OTCQX MARKET

IronRidge targeting North American investors

IronRidge Resources Limited (AIM: IRR, "IronRidge" or the

"Company") is pleased to announce that it has filed an application

for the Company to trade on the OTC Market's OTCQX Best Market

("OTCQX") trading platform in the USA, which will make IronRidge's

shares more widely available to North American investors.

The Company has identified a supporting broker and market maker

and is completing the necessary regulatory documentation and

application materials for submission to the OTC Market's compliance

group.

Trading on the OTC QX market will have no impact on the trading

of IronRidge 's existing ordinary shares on AIM and no new ordinary

shares will be issued as part of the cross-trade facility.

IronRidge will continue to adhere to all regulatory requirements

relating to its listing on the AIM market of the London Stock

Exchange and will have no Sarbanes-Oxley or SEC reporting

requirements.

The OTCQX is in the top tier of OTC markets and lists companies,

including blue-chip level companies, which are not listed on

traditional exchanges in the USA. Companies listed on the OTCQX

market have to follow certain rules and criteria and are subject to

their home market regulation, in this instance the AIM market of

the London Stock Exchange plc in the U.K.

The Company believes that listing on the OTCQX Market, under the

ticker symbol "IRRLF", is a natural step forward to address global

Lithium interest and will potentially provide enhanced investor

benefits, including easier access in the United States, and greater

liquidity.

Commenting, Vincent Mascolo, Chief Executive Officer of

IronRidge, said:

" Following our recent landmark partnership with Piedmont

Lithium Inc., which will fully fund the Company's standout Ewoyaa

Lithium Project in Ghana to production for US$102m , coupled with

President Joe Biden 's comments concerning the importance of

Lithium, we have started a process of inter-listing the Company's

shares in New York on the OTC Market's OTCQX trading platform which

is a natural and beneficial step for the Company and all

shareholders. The Board looks forward to updating shareholders on

progress in this respect in due course."

Market Abuse Regulation (MAR) Disclosure

This announcement contains inside information for the purposes

of Article 7 of the Market Abuse Regulation (EU) 596/2014 as it

forms part of UK domestic law by virtue of the European Union

(Withdrawal) Act 2018 ("MAR"), and is disclosed in accordance with

the Company's obligations under Article 17 of MAR.

For any further information, please contact:

IronRidge Resources Limited Tel: +61 2 8072 0640

Vincent Mascolo (Chief Executive Officer)

Amanda Harsas (Company Secretary)

www.ironridgeresources.com.au

SP Angel Corporate Finance LLP Tel: +44 (0)20 3470 0470

Nominated Adviser

Jeff Keating

Charlie Bouverat

Canaccord Genuity Limited Tel: +44 (0) 20 7523 4500

Joint Company Broker

Raj Khatri

James Asensio

Harry Rees

Liberum Capital Limited Tel: +44 (0) 20 3100 2000

Joint Company Broker

Scott Matheson

Edward Thomas

Kane Collings

SI Capital Limited Tel: +44 (0) 1483 413

Joint Company Broker 500

Nick Emerson Tel: +44 (0) 207 871 4038

Jon Levinson

Yellow Jersey PR Limited Tel: +44 (0)20 3004 9512

Henry Wilkinson

Dominic BarrettoMatthew McHale

Notes to Editors:

About IronRidge

www.ironridgeresources.com.au

IronRidge Resources is an AIM-listed, Africa focused minerals

exploration company with a significant lithium pegmatite discovery

in Ghana, extensive gold portfolios in Côte d'Ivoire and a

potential new gold province discovery in Chad. As announced on 1

June 2021, IronRidge intends to demerge its suite of gold assets

into a separate listed entity. As announced on 31 August 2021,

Piedmont Lithium to fully fund the Ewoyaa lithium project in

Ghana.

Ghana

The Cape Coast Lithium portfolio covers some 684km(2) and

includes the newly discovered Ewoyaa Lithium Project with a maiden

Mineral Resource estimate of 14.5Mt at 1.31% Li(2) O in the

inferred and indicated category including 4.5Mt at 1.39% Li(2) O in

the indicated category (reported in accordance with the JORC Code)

. The Company entered into earn-in arrangements with Obotan

Minerals Limited, Merlink Resources Limited, Barari Developments

Limited and Joy Transporters Limited of Ghana, West Africa,

securing the first access rights to acquire the historical

Egyasimanku Hill spodumene rich lithium deposit, estimated to be in

the order of 1.48Mt at 1.67% Li(2) O and surrounding tenements. The

tenure package is also prospective for tin, tantalum, niobium,

caesium and gold, which occur as accessory minerals within the

pegmatites and host formations.

Côte d'Ivoire

The Company entered into conditional earn-in arrangements in

Côte d'Ivoire, West Africa; securing access rights to highly

prospective gold mineralised structures and pegmatite occurrences

covering a combined 3,982km2 and 774km2 area respectively. The

projects are well located within access of an extensive bitumen

road network and along strike from multi-million-ounce gold

projects and mines. The Company's most advanced project is the

Zaranou gold project which includes high-grade gold drilling

intersections along 8km strike including 6m at 6.44g/t gold from

132m, 6m at 15.11g/t gold from 26m, 4m at 5.16g/t gold from 110m

and 22m at 3.39g/t gold from 8m within a broader 47km long gold

anomalous structure.

Chad

The Company's Tekton Minerals Pte Ltd of Singapore holds an

extensive portfolio covering 746km(2) of highly prospective gold

and other mineral projects in Chad, Central Africa. IronRidge

acquired 100% of Tekton including its projects and team to advance

the Dorothe, Echbara, Am Ouchar, Nabagay and Kalaka licenses, which

host multiple, large scale gold projects. Trenching results at

Dorothe, including 84m at 1.66g/t Au (including 6m at 5.49g/t &

8m at 6.23g/t), 4m at 18.77g/t Au (including 2m at 36.2g/t), 32m at

2.02g/t Au (including 18m at 3.22g/t), 24m at 2.53g/t Au (including

6m at 4.1g/t (including 2m at 6.2g/t) and 2m at 6.14g/t), 14.12g/t

Au over 4m, 34.1g/t over 2m and 63.2g/t over 1m, have defined

significant gold mineralised quartz veining zones over a 3km by 1km

area including the steep dipping 'Main Vein' and shallow dipping

'Sheeted Vein' zones.

Corporate

IronRidge made its AIM debut in February 2015, successfully

securing strategic alliances with three international companies;

Assore Limited of South Africa, Sumitomo Corporation of Japan and

DGR Global Limited of Australia. Assore is a high-grade iron,

chrome and manganese mining specialist. Sumitomo Corporation is a

global resources, mining marketing and trading conglomerate. DGR

Global is a project generation and exploration specialist.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

MSCUPGPGUUPGUCM

(END) Dow Jones Newswires

October 07, 2021 02:00 ET (06:00 GMT)

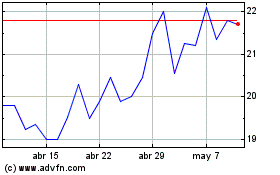

Atlantic Lithium (LSE:ALL)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Atlantic Lithium (LSE:ALL)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024