TIDMIRR

RNS Number : 5173K

IronRidge Resources Limited

02 September 2021

2 September 2021

High-Grade Drill Intersections

New Mineralised Pegmatite Confirmed at Grasscutter

Mineralised Pegmatites Extended at Ewoyaa North

Ghana, West Africa

IronRidge Resources Limited (AIM: IRR, "IronRidge" or the

"Company"), the African focussed minerals exploration company, is

pleased to report additional broad and high-grade lithium pegmatite

drill intersections at new targets adjacent to the Ewoyaa Lithium

Project ("Ewoyaa" or "ELP"), where the Company has defined a JORC

compliant mineral resource estimate of 14.5Mt at 1.31% Li(2) O in

the inferred and indicated category, including 4.5Mt at 1.39% Li(2)

O in the indicated category in Ghana, West Africa.

Figures and Tables referred to in this release can be viewed in

the PDF version available via this link:

http://www.rns-pdf.londonstockexchange.com/rns/5173K_1-2021-9-2.pdf

HIGHLIGHTS:

Ø New high-grade lithium pegmatite intersections reported in

initial reverse circulation ("RC") drilling results at the

Grasscutter target adjacent to the ELP, including highlights at a

0.4% Li(2) O cut-off and maximum 4m of internal dilution of:

o GRC0368: 49m at 1.21% Li(2) O from 122m

o GRC0362: 29m at 1.49% Li(2) O from 71m

o GRC0364: 26m at 1.57% Li(2) O from 126m

o GRC0365: 23m at 1.55% Li(2) O from 73m

o GRC0363: 23m at 1.41% Li(2) O from 62m

o GRC0366: 21m at 1.36% Li(2) O from 150m

o GRC0367: 18m at 1.5% Li(2) O from 53m

o GRC0359: 21m at 0.92% Li(2) O from 68m

o GRC0361: 12m at 1.44% Li(2) O from 47m

Ø Additional high-grade lithium pegmatite intersections reported

in ongoing reverse circulation ("RC") drilling results at the

Ewoyaa North and Anokyi Main targets adjacent to the ELP, including

highlights at a 0.4% Li(2) O cut-off and maximum 4m of internal

dilution of:

o GRC0351: 30m at 1.53% Li(2) O from 109m

o GRC0348: 30m at 1.3% Li(2) O from 81m

o GRC0356: 14m at 1.1% Li(2) O from 83m

o GRC0349: 14m at 0.88% Li(2) O from 77m

o GRC0334: 7m at 1.47% Li(2) O from 72m

o GRC0350: 6m at 1.63% Li(2) O from 123m

Ø RC resource extension drilling now completed for a total

25,612m in 205 holes; assay results reported herewith for an

additional 6,921m of the current programme.

Ø Infill resource drilling, metallurgical diamond core drilling

and planning for hydro monitoring drilling, mining and engineering

studies now commenced with five drill rigs on site.

Ø Ideal infrastructure support: projects located within 110km of

the operating Takoradi deep-sea port, within 100km of the capital

Accra and adjacent to the sealed Takoradi - Accra highway and

high-power transmission lines.

Ø Highly supportive government; long mining history, strong

diversification drive and pro-renewable and stored energy space

initiatives.

Ø Increasing lithium demand due to its role in the stored energy

transition.

Commenting on the Company's latest progress, Vincent Mascolo,

Chief Executive Officer of IronRidge, said:

"We are highly encouraged by the ongoing results received from

new targets adjacent to Ewoyaa, which continue to confirm high

grades in new exploration targets tested within the ELP area.

"We have defined a new mineralised structure at the Grasscutter

target, where broad pegmatite intersections, including 49m at 1.21%

Li(2) O, have been reported within 620m of the resource footprint.

The board is confident the additional exploration targets will

increase resource scale and improve project economics, where we

have defined Ghana's first lithium resource of 14.5Mt at 1.31%

Li(2) O, within 110km of an operating deep-sea port.

"We remain energised to be advancing the Project with our new

partner Piedmont Lithium, with infill resource, metallurgical and

hydrogeological drilling underway, and five drill rigs currently on

site. The Company reaffirms that it is ideally positioned to take

advantage of the increasing global demand for lithium."

Ongoing Drilling Results

New high-grade drilling results for 6,921m in 50 holes have been

received for the ongoing drill programme. Multiple high-grade drill

intersections have been returned, with highlights reported in Table

1 and Figure 1 at a 0.4% Li(2) O cut-off and maximum 4m of internal

dilution (refer Appendix 1 for all reported intersections). Cross

sections for highlight holes over the new Grasscutter target are

shown in Figure 2 and Figure 3 .

All sampling was completed at 1m sampling intervals at the drill

site and submitted for analysis at Intertek laboratory with sample

preparation completed in Ghana and sample analysis in Perth,

Western Australia. All results passed internal and laboratory QA/QC

protocols, providing confidence in the reported results.

The drilling programme was designed to test multiple new

spodumene-bearing pegmatites identified through the Company's

recent and ongoing auger drill programme; to add resource tonnes

within the immediate ELP mine corridor area (refer Figure 4 ). The

programme will also advance the regional exploration pipeline by

drill testing the Ndasiman, Amoanda and Hweda targets within the

Saltpond and Apam West licenses respectively (refer Figure 5 ).

The original planned 12,500m RC drilling programme was increased

to 16,500m to test strike extensions of drilled pegmatites and

further increased to 25,000m to include the recently defined

Grasscutter and Ewoyaa North targets.

Competent Person Statement

Information in this announcement relating to the exploration

results is based on data reviewed by Mr Lennard Kolff (MEcon.

Geol., BSc. Hons ARSM), Chief Geologist of the Company. Mr Kolff is

a Member of the Australian Institute of Geoscientists who has in

excess of 20 years' experience in mineral exploration and is a

Qualified Person under the AIM Rules. Mr Kolff consents to the

inclusion of the information in the form and context in which it

appears.

This announcement contains inside information for the purposes

of Article 7 of the Market Abuse Regulation (EU) 596/2014 as it

forms part of UK domestic law by virtue of the European Union

(Withdrawal) Act 2018 ("MAR"), and is disclosed in accordance with

the Company's obligations under Article 17 of MAR.

For any further information please contact:

IronRidge Resources Limited Tel: +61 2 8072 0640

Vincent Mascolo (Chief Executive Officer)

Amanda Harsas (Company Secretary)

www.ironridgeresources.com.au

SP Angel Corporate Finance LLP Tel: +44 (0)20 3470 0470

Nominated Adviser

Jeff Keating

Charlie Bouverat

Tel: +44 (0) 20 3100 2000

Liberum Capital Limited

Joint Company Broker

Scott Matheson

Edward Thomas

Kane Collings

SI Capital Limited Tel: +44 (0) 1483 413

Joint Company Broker 500

Nick Emerson Tel: +44 (0) 207 871 4038

Jon Levinson

Yellow Jersey PR Limited Tel: +44 (0)20 3004 9512

Henry WilkinsonMatthew McHale

Dominic Barretto

Notes to Editors:

About IronRidge

www.ironridgeresources.com.au

IronRidge Resources is an AIM-listed, Africa focused minerals

exploration company with a significant lithium pegmatite discovery

in Ghana, extensive gold portfolios in Côte d'Ivoire and a

potential new gold province discovery in Chad. As announced on 1

June 2021, IronRidge intends to demerge its suite of gold assets

into a separate listed entity. As announced on 31 August 2021,

Piedmont Lithium to fully fund the Ewoyaa lithium project in

Ghana.

Ghana

The Cape Coast Lithium portfolio covers some 684km(2) and

includes the newly discovered Ewoyaa Lithium Project with a maiden

Mineral Resource estimate of 14.5Mt at 1.31% Li(2) O in the

inferred and indicated category including 4.5Mt at 1.39% Li(2) O in

the indicated category (reported in accordance with the JORC Code)

. The Company entered into earn-in arrangements with Obotan

Minerals Limited, Merlink Resources Limited, Barari Developments

Limited and Joy Transporters Limited of Ghana, West Africa,

securing the first access rights to acquire the historical

Egyasimanku Hill spodumene rich lithium deposit, estimated to be in

the order of 1.48Mt at 1.67% Li(2) O and surrounding tenements. The

tenure package is also prospective for tin, tantalum, niobium,

caesium and gold, which occur as accessory minerals within the

pegmatites and host formations.

Côte d'Ivoire

The Company entered into conditional earn-in arrangements in

Côte d'Ivoire, West Africa; securing access rights to highly

prospective gold mineralised structures and pegmatite occurrences

covering a combined 3,584km(2) and 1,172km(2) area respectively.

The projects are well located within access of an extensive bitumen

road network and along strike from multi-million-ounce gold

projects and mines. The Company's most advanced project is the

Zaranou gold project which includes high-grade gold drilling

intersections along 8km strike including 6m at 6.44g/t gold from

132m, 6m at 15.11g/t gold from 26m, 4m at 5.16g/t gold from 110m

and 22m at 3.39g/t gold from 8m within a broader 47km long gold

anomalous structure.

Chad

The Company entered into an agreement with Tekton Minerals Pte

Ltd of Singapore concerning its portfolio covering 746km(2) of

highly prospective gold and other mineral projects in Chad, Central

Africa. IronRidge acquired 100% of Tekton including its projects

and team to advance the Dorothe, Echbara, Am Ouchar, Nabagay and

Kalaka licenses, which host multiple, large scale gold projects.

Trenching results at Dorothe, including 84m at 1.66g/t Au

(including 6m at 5.49g/t & 8m at 6.23g/t), 4m at 18.77g/t Au

(including 2m at 36.2g/t), 32m at 2.02g/t Au (including 18m at

3.22g/t), 24m at 2.53g/t Au (including 6m at 4.1g/t (including 2m

at 6.2g/t) and 2m at 6.14g/t), 14.12g/t Au over 4m, 34.1g/t over 2m

and 63.2g/t over 1m, have defined significant gold mineralised

quartz veining zones over a 3km by 1km area including the steep

dipping 'Main Vein' and shallow dipping 'Sheeted Vein' zones.

Corporate

IronRidge made its AIM debut in February 2015, successfully

securing strategic alliances with three international companies;

Assore Limited of South Africa, Sumitomo Corporation of Japan and

DGR Global Limited of Australia. Assore is a high-grade iron,

chrome and manganese mining specialist. Sumitomo Corporation is a

global resources, mining marketing and trading conglomerate. DGR

Global is a project generation and exploration specialist.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

UPDGZGGLKZDGMZG

(END) Dow Jones Newswires

September 02, 2021 02:00 ET (06:00 GMT)

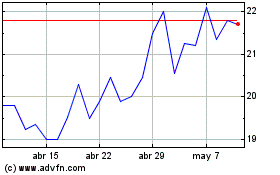

Atlantic Lithium (LSE:ALL)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Atlantic Lithium (LSE:ALL)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024