JZ Capital Ptnrs Ltd Senior Facility Amendments

07 Octubre 2021 - 1:00AM

UK Regulatory

TIDMJZCP TIDMJZCC TIDMJZCN

JZ CAPITAL PARTNERS LIMITED (the "Company" or "JZCP")

(a closed-end collective investment scheme incorporated with limited liability

under the laws of Guernsey with registered number 48761)

LEI: 549300TZCK08Q16HHU44

SENIOR FACILITY AMENDMENTS

7 October 2021

JZ Capital Partners Limited, the London listed fund that invests in US and

European microcap companies and US real estate, announces that it has agreed

with its existing senior lenders to borrow a further amount of US$16.0 million

under its senior secured debt facility.

The increase in loan amount will constitute 'first out loans' under the senior

facility, being senior priority loans entitled to repayment in full prior to

any principal payments being made on the 'last out loans' under the facility,

each as further described in the Company's announcement made on 17 May 2021.

The new 'first out loans' will be subject to the same terms as the previous

'first out loans' (having been earlier repaid in full in June 2021) including

with respect to interest rate (being Libor + 9.75 per cent., with a 1 per cent.

floor) and use of proceeds (with 90 per cent. of net cash proceeds derived from

realisations still required to be applied towards their repayment). The terms

of the 'last out loans' also remain unchanged and the Company's US$31.5 million

of loan notes earlier issued will remain fully subordinated to all loans

outstanding under the senior facility.

Whilst the Company's intention remains as being to realise the maximum value of

its investments and, after repaying its debt obligations, to return capital to

shareholders, the Company acknowledges that this is likely to be contingent on

its ability to implement an alternative debt restructuring plan over an

appropriate timeframe and, as a result, considers it prudent given the

potential relative illiquidity of its investments to maintain sufficient cash

liquidity to support its existing portfolio investments and obligations as they

fall due, including the senior facility which remains as maturing on 12 June

2022, the subordinated loan notes which mature on 11 September 2022 and the

redemption of its zero dividend preference shares which fall due on 1 October

2022. The Company remains committed to the delivery of its investment policy

(including to make no further investments outside of its existing obligations

or to the extent which an investment may be made to support an existing

portfolio company) and confirms that the increase in loan amount will be used

in a manner consistent with that policy.

For completeness, following the increase in loan amount, the total amount

outstanding under the senior facility will be US$51,953,440.05, of which

US$16,000,000 will be 'first out loans' and US$35,953,440.05 will be 'last out

loans'.

For further information:

Ed Berry +44 (0)7703 330 199

FTI Consulting

David Zalaznick +1 (212) 485 9410

Jordan/Zalaznick Advisers, Inc.

Sam Walden +44 (0) 1481 745385

Northern Trust International Fund

Administration Services (Guernsey)

Limited

Important Notice

This announcement also includes statements that are, or may be deemed to be,

"forward-looking statements". These forward-looking statements can be

identified by the use of forward-looking terminology, including the terms

"believes", "estimates", "anticipates", "expects", "intends", "may", "will" or

"should" or, in each case, their negative or other variations or comparable

terminology. These forward-looking statements relate to matters that are not

historical facts. By their nature, forward-looking statements involve risks and

uncertainties because they relate to events and depend on circumstances that

may or may not occur in the future. Forward-looking statements are not

guarantees of future performance. The Company's actual investment performance,

results of operations, financial condition, liquidity, policies and the

development of its strategies may differ materially from the impression created

by the forward-looking statements contained in this announcement. In addition,

even if the investment performance, result of operations, financial condition,

liquidity and policies of the Company and development of its strategies, are

consistent with the forward-looking statements contained in this announcement,

those results or developments may not be indicative of results or developments

in subsequent periods. These forward-looking statements speak only as at the

date of this announcement. Subject to their legal and regulatory obligations,

each of the Company, JZAI and their respective affiliates expressly disclaims

any obligations to update, review or revise any forward-looking statement

contained herein whether to reflect any change in expectations with regard

thereto or any change in events, conditions or circumstances on which any

statement is based or as a result of new information, future developments or

otherwise.

END

(END) Dow Jones Newswires

October 07, 2021 02:00 ET (06:00 GMT)

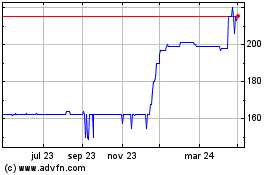

Jz Capital Partners (LSE:JZCP)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

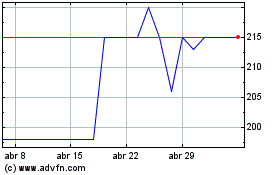

Jz Capital Partners (LSE:JZCP)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024