TIDMJADE

RNS Number : 2753M

Jade Road Investments Limited

20 September 2021

20 September 2021

JADE ROAD INVESTMENTS LIMITED

(" Jade Road Investments ", " JADE ", the " Company " or the "

Group ")

INTERIM CONSOLIDATED RESULTS FOR THE SIX MONTHSED 30 JUNE

2021

Jade Road Investments Limited (AIM: JADE), the London quoted

pan-Asian diversified investment vehicle focused on providing

shareholders with attractive uncorrelated, risk-adjusted long-term

returns, is pleased to announce its interim results for the six

months ended 30 June 2021.

Financial Highlights:

-- Total income increased to US$1.25 million from interest

payments and fair value adjustments (H1 2020: US$1.19 million).

-- Net loss of US$0.27 million (H1 2020: US$0.70 million). The

core drivers of the net loss are a US$259k finance expense, mainly

related to the interest payable on the Company's corporate

bond.

-- Consolidated loss per share (basic) of US$0.24 cents (H1 2020: US$0.69 cents).

-- Consolidated NAV at 30 June 2021 decreased slightly by 0.25%

to US$106.2 million/GBP76.8 million (31 December 2020: US$106.5

million/GBP77.9 million). The decrease in NAV stems from a decrease

in cash.

-- NAV per share at 30 June 2021 US$0.90 (GBP0.65) (30 June 2020 US$0.95/GBP0.75).

-- Period end cash position of US$2.56 million (30 June 2020: US$3.2 million).

Investment and Operational Highlights:

-- Future Metal Holdings Limited ( "Future Metal ")

o In March 2021, a new contractor was appointed to further

enhance the efficiency of the operation and reach customers with a

further geographical radius.

o Sales have seen an upward trend in the first half of 2021

compared to 2020.

-- Fook Lam Moon (" FLM ")

o FLM's business was impacted by the COVID-19 pandemic in 2020,

which severely limited inbound tourism, particularly from Mainland

China.

o As the Hong Kong government eases COVID-19 restrictions on

restaurants and some air travellers in 2021, the food and beverage

industry is gradually recovering to pre-pandemic levels.

-- DocDoc Pte Ltd (" DocDoc ")

o In November 2020, DocDoc partnered with SpesNet Global Group,

a leading healthcare technology provider, to integrate its digital

third-party administrator ("TPA") technology and provide a

first-of-its-kind complete digital health ecosystem to insurers,

supporting their policyholders through the continuum of care.

o Under this agreement, DocDoc will receive exclusive access to

SpesNet's platform to include Singapore, Malaysia, Thailand, Hong

Kong, India, and the People's Republic of China.

-- Meize Energy Industries Holdings Limited (" Meize ")

o Meize has maintained a full order book from its clients in

2021 due to the strong market demand, especially the offshore wind

market.

o The Jiangsu plant initiated an expansion in early 2021 to meet

the rising demand, which was completed and commenced operation in

June 2021.

Chairman of Jade Road Investments, John Croft, commented:

"The Company's portfolio has continued to weather the pandemic

storm with the Company's investment manager, Harmony Capital,

driving phase two of a three-phase investment strategy focused on

exits, restructuring our legacy assets and seeking investments in

smaller fast growing companies at IPO or pre-IPO stages.

Harmony Capital set out a three-phase strategy to reposition

Jade Road. This has involved rehabilitating legacy assets, such as

Future Metal Holdings Limited (FMHL) and Meize Energy, towards a

full or partial exit and reinvesting the resulting cash into new

income-generating assets, prioritising high-growth Asian SMEs in

the Healthtech, Medtech and Fintech sectors.

With Asian SMEs increasingly starved of capital, Jade Road is

assessing an exceptionally strong pipeline of investee candidates

which, with an emphasis on credit instruments such as secured debt

or non-mandatory convertible bonds, will result in a

well-constructed portfolio with near-term downside protection.

The Board believes Jade Road's new investment strategy is well

positioned to construct a solid base of exciting, income generating

assets for high-quality growth, promoting long-term value for our

shareholders."

For further information on JADE, please visit the Company's

website at www.jaderoadinvestments.com and follow the Company on

Twitter (@ JadeFinance ).

FOR FURTHER INFORMATION, PLEASE CONTACT:

Jade Road Investments Limited +44 (0) 778 531 5588

John Croft

WH Ireland Limited - Nominated

Adviser +44 (0) 20 7220 1666

James Joyce

Andrew de Andrade

Hybridan LLP - Corporate Broker +44 (0) 203 764 2341

Claire Noyce

Lionsgate Communications - Communications

Adviser +44 (0) 779 189 2509

Jonathan Charles

About Jade Road Investments

Jade Road Investments Limited is quoted on the AIM Market of the

London Stock Exchange and is committed to providing shareholders

with attractive uncorrelated, risk-adjusted long-term returns from

a combination of realising sustainable capital growth and

delivering dividend income.

The Company is focused on providing growth capital and financing

to emerging and established Small and Medium Enterprises (SME)

sector throughout Asia, well-diversified by national geographies,

instruments and asset classes. This vital segment of the economy is

underserved by the traditional banking industry for regulatory and

structural reasons.

The Company's investment manager, Harmony Capital, seeks to

capitalise on its team's established investment expertise and broad

networks across Asia. Through rigorous diligence and disciplined

risk management, Harmony Capital is dedicated to delivering

attractive income and capital growth for shareholders with

significant downside protection through selectively investing in

assets and proactively managing them.

Harmony Capital is predominately sourcing private opportunities

and continues to create a strong pipeline of attractive

income-generating assets from potential investments in growth

sectors across Asia, including healthcare, fintech, hospitality, IT

and property.

Chairman's Statement

For the first half of 2021, Jade Road has been progressing phase

two of a three-phase investment strategy focused on rehabilitating

legacy assets, exits and seeking investments in smaller, IPO and

pre-IPO investments.

Jade Road has delivered a stable financial performance in the

period. Total income increased to US$1.24 million from interest

earned and fair value adjustments for the first six months of the

year (H1 2020: US$1.19 million).

Investment Strategy

I am pleased to report that in spite of the long shadow that

COVID-19 has cast over the world in the past 18 months, the

Company's existing portfolio has largely avoided any major

impairments successfully navigating the challenges presented by the

pandemic.

Jade Road is currently undergoing phase two of a three-phase

investment strategy focused on the portfolio restructuring of its

legacy assets which are not fully aligned with the Company's

revised investment approach by exiting either through full or

partial sales, or IPOs. In addition, the Company is aiming to build

a new portfolio of pan-Asian investments providing income and

capital gain.

Jade's large legacy assets in China: Future Metal Holdings

Limited (FMHL), the largest magnesium dolomite quarry in Shanxi

Province, and Meize Energy Industries, one of the largest wind

turbine blade manufacturing companies with factories in Inner

Mongolia, Ningxia Province, and Jiangsu Province, both reported

significant progress for the first six months of 2021.

On our website you can find SRK Consulting's updated Competent

Persons Report (CPR) for FMHL, which includes JORC Mineral

Resources and Ore Reserves estimates totalling 113 million tonnes

of dolomite as measured by Proved and Probable Reserves, and 149

million tonnes of dolomite as calculated by Measured, Indicated and

Inferred Resource. As magnesium prices recover from recent

weakness, we expect demand for FMHL's products to increase as the

year progresses.

Meize Energy initiated an expansion of its third

state-of-the-art turbine blade manufacturing plant in Jiangsu,

commencing operations in June 2021. The factories are operating at

full capacity, producing internationally certified blades for both

onshore and offshore wind turbines.

Our Michelin-starred Fook Lam Moon restaurants in Hong Kong are

recovering to pre-pandemic levels and our luxury resort projects in

Niseko, Japan are accepting bookings for this upcoming skiing

season, although uncertainty remains over the exact timing of a

full opening of the resort.

The core strategy is to build a base of income generating assets

that covers overheads, management fees and finance costs, with a

growing surplus to fund dividends.

As part of this core strategy, Jade Road will look to invest in

Asian High Growth Companies via equity (in listed companies and/or

pre-IPO investments) as part of its existing investment policy.

While Jade Road will consider opportunities in all sectors as they

arise, potential opportunities in Technology, including Healthtech,

Medtech and Fintech will be prioritised. The Total Allocation under

this expanded investment focus will be no more than 10% of Jade

Road's present NAV, as of 30 June at US$106.2 million, down

slightly from US$106.4 million (31 December 2020) and no more than

20% once the NAV exceeds US$150 million. Investments in each

company will not exceed 5% of the total allocation, in order to

mitigate risk through diversification.

At the same time, we aim to limit single country and industry

exposures to 20% of the overall portfolio and reduce portfolio

exposure to China towards 30-40% in the near term.

By targeting the broad Asian SME subsector, Jade Road can access

an immense market in which it can leverage both its capital, and

its investment manager's direct relevant experience.

From a corporate perspective, Jade Road sees strong appeal in

the vibrant start-up environment in regions such as Hong Kong and

Singapore, typified by our investment in Singapore-based DocDoc, a

leading pan-Asian virtual network of physicians, clinics and

hospitals.

Investment candidates are undergoing detailed review from a

pipeline of potential opportunities in IT, Fintech, Healthcare and

online commerce.

In terms of ESG (Environmental, Social, Corporate Governance),

Jade Road has been incorporating ESG principles into our risk

management and due diligence processes. All potential investment

candidates must demonstrate that they are taking ESG seriously and

working towards being as fully ESG compliant for the stage of

company, taking proportionality into account.

It is my strong belief that government policy to encourage more

sustainable business models, technologies and consumption patterns

in Asia is likely to create greater demand for private capital.

Summary

Our focus throughout 2021 is on exits, restructurings and

investing in smaller, exciting IPO and pre-IPO investments that

potentially possess substantial upside. Some of these smaller

investments could have a disproportionate interest to our retail

investors.

In a market in which Asian SMEs are increasingly starved of

capital, Jade Road has seen opportunities to negotiate and invest

in structured instruments. Its preference for income-generating

assets puts an emphasis on credit instruments such as secured debt

or non-mandatory convertible bonds when structuring investments,

which the Company believes will result in a better constructed

portfolio with near-term downside protection.

The Board would like to take this opportunity to thank the

investment teams for their hard work and commitment during these

challenging times.

Jade Road is well positioned for the future with an experienced

investment management team, the development of a constructed base

of income generating assets for high quality growth, and a

resilient liquidity position and balance sheet. I hope to report

further progress against this strategy by the end of 2021.

The principal assets as of 30 June 2021 are detailed below:

Principal Effective Instrument Valuation Credit Cash receipts Equity Valuation

assets interest type at 31 income US$ million investment/ at 30

% December US$ other June

2020 million movement 2021

US$ million US$ million US$ million

Convertible

FLM Holdings - Bond 28.4 0.7 - - 29.1

Future

Metal Holdings Structured

Limited 84.8 Equity 50.4 0.3 - - 50.7

Meize Energy Redeemable

Industrial convertible

Holdings preference

Ltd 7.9 shares 8.2 - - - 8.2

DocDoc Convertible

Pte Ltd - Bond 2.4 0.1 - - 2.5

Infinity

Capital Secured

Group - Loan Notes 2.3 0.2 - - 2.5

Infinity

TNP 40 Equity 7.3 - - - 7.3

GCCF &

Other

investments - 8.3 - - - 8.3

Corporate

debt - (3.5) - - - (3.5)

Other

liabilities - (1.5) - - - (1.5)

Cash 4.1 - - (1.5) 2.6

Total N et Asset

Value 106.4 1.3 - (1.5) 106.2

----------------------------- ------------- ------------- --------- -------------- ------------- -------------

Future Metal Holdings Limited ("FMH")

Our largest asset by value is the dolomite quarry project

("Quarry") in China, Future Metal Holdings Limited ("FMHL"), which

was previously known as Hong Kong Mining Holdings. The Company has

an 85% shareholding in FMHL.

Starting from March 2021, a new contractor was appointed to

further enhance the efficiency of the operation and reach customers

with a further geographical radius. In line with the wide-ranging

industrial activities in China, sales have seen an upward trend.

The management of the Quarry is now in contact with external

parties regarding a potential business collaboration of highway

construction. Together with the potential demand growth from the

construction sector, the local team also noted the recovery in the

magnesium market. In August 2021, magnesium prices reached a 13

year high surging from RMB21,200 (USD3,270) to RMB22,500 (USD3,470)

per tonne due to a lack of supply in the market. The local team is

actively looking for potential smelters in the local region to

establish additional sales channels. JADE has been exploring the

option of a partial or full exit of this investment by actively

engaging with interested parties on the ground in the Shanxi

Province as well as with brokers in Mainland China, Hong Kong and

Singapore.

Including loan disbursements provided by the Company to FMHL and

its subsidiaries and accrued PIK interest, the estimated fair value

of the Company's investment is US$50.7 million as of 30 June

2021.

FLM Holdings ("FLM")

Our second largest investment by value is in the controlling

shareholder of a Hong Kong-based restaurant group Fook Lam Moon

("FLM").

The Company holds a Convertible Bond of US$26.5 million in Fook

Lam Moon Holdings. The Convertible Bond has a maturity of 5 years

and pays a coupon of 5.0% per annum (3.0% paid in cash with the

remainder rolled up with the principal amount outstanding).

FLM's business was impacted by the COVID-19 pandemic in 2020,

which severely limited inbound tourism, particularly from Mainland

China. However, FLM is an over 70-year-old business that has

weathered many past crises such as SARS and the Company is

confident in FLM's resilience and ability to ensure its long-term

future. As the Hong Kong government eases COVID-19 restrictions on

restaurants and some air travellers in 2021, the food and beverage

industry is gradually recovering to the pre-pandemic levels.

As of 30 June 2021, the carrying value of the Convertible Bond

was US$29.1 million taking into account the current face value of

the instrument, accrued PIK interest and cash interest receivable,

less an Expected Credit Loss ("ECL") provision of US$0.7 million

against aged cash interest receivables.

Meize Energy Industries Holdings Limited ("Meize")

Swift Wealth Investments Limited, a 100% (2019: 100%) owned

subsidiary of the Company incorporated in the British Virgin

Islands, holds a 7.2% stake in Meize through a redeemable

preference share structure.

Meize is a privately owned company that designs and manufactures

blades for both onshore and offshore wind turbines.

In the second half of 2020, Meize completed a third plant in

Jiangsu Province, which commenced operations in August 2020. The

Jiangsu Plant will be solely focused on producing offshore blades

due to demand in the market for this product. In terms of

production, it is the largest production site and produces 24 sets

of blades each month. The Jiangsu site is looking to double its

production by the middle of 2021.

Meize has maintained a full order book from its clients in 2021

due to the strong market demand, especially the offshore wind

market, and driven by their largest existing customer. The Jiangsu

plant initiated an expansion in early 2021 to meet the rising

demand, which was completed and commenced operation in June

2021.

As of 30 June 2021, the Company's interest in Meize had a fair

value of US$8.2 million based on a Discounted Cash Flow analysis.

The carrying amount represents a discount of over 50% to the full

redemption value of the Company's investment.

Infinity TNP

The Company maintains a 40% equity stake of Infinity Capital

Group Limited's ("ICG") wholly-owned subsidiary Infinity TNP, which

holds units in a luxury hotel-condominium called Tellus Niseko.

Tellus Niseko is a unique development in Hirafu Village, with

its high-end concierge service, an in-house Michelin star

chef-managed restaurant, in-room onsen (hot spring) baths, and

prime location just minutes away from the Grand Hirafu ski

lifts.

Tellus Niseko is in late stage discussions with several buyers

in the Asia-Pacific region to sell a number of units in the

development. The management team has been monitoring the local

market performance to ensure prices are reflected

appropriately.

As of 30 June 2021, the carrying value of its investment was

US$7.3 million.

Infinity Capital Group Limited ("ICG")

Ultimate Prosperity Limited, a 100% owned subsidiary of the

Company incorporated in the British Virgin Islands, holds a Secured

Loan to ICG.

ICG develops premium residential projects in Hirafu Village, a

world-class ski village in Niseko, Japan - one of the most popular

winter travel destinations in the world. The Company agreed to

provide a US$4.0 million Secured Loan note facility to ICG in

December 2018. The facility included two equal tranche drawdowns,

carrying a coupon of 17.5% per annum in cash. The first tranche and

second tranche were drawn on 31 January 2019 and 30 August 2019,

respectively. The Company was also issued detachable warrants,

which give it the right to purchase shares in ICG or its parent

company should either undertake a liquidity event, such as an

Initial Public Offering.

ICG has been closely monitoring the local tourism market to

decide on the winter operation plan. As soon as the pandemic

restrictions are lifted in Niseko, ICG shall recommence the

operations immediately.

As of 30 June 2021, the carrying value of the Secured Loan was

US$2.5 million taking into account the current face value of the

instrument and cash interest receivable, less an Expected Credit

Loss ("ECL") provision of US$47.2k against aged cash interest

receivables.

DocDoc Pte Ltd. ("DocDoc")

DocDoc is a Singapore-headquartered online network of over

23,000 doctors, 600 clinics, and 100 hospitals serving a wide array

of specialities. It uses artificial intelligence, cutting-edge

clinical informatics, and proprietary data to connect patients to

doctors which fit their needs at an affordable price. In November

2020, DocDoc partnered with SpesNet Global Group, a leading

healthcare technology provider, to integrate its digital

third-party administrator ("TPA") technology and provide a

first-of-its-kind complete digital health ecosystem to insurers,

supporting their policyholders through the continuum of care.

Under this agreement, DocDoc will receive exclusive access to

SpesNet's platform to include Singapore, Malaysia, Thailand, Hong

Kong, India, and the People's Republic of China. Going forward,

DocDoc will integrate SpesNet's digital TPA technology with

DocDoc's telemedicine platform and AI-powered doctor discovery

platform, HOPE (Heuristic for Outcome, Price and Experience), which

matches policyholders to relevant healthcare providers, to power a

holistic offering.

As of 30 June 2021, the carrying value of the Convertible Bond

was US$2.5 million. An annual coupon of 8% (4.0% cash and 4%

Payment-in-Kind was converted to 8% Payment-in-Kind).

John Croft

Chairman

CONDENSED CONSOLIDATED STATEMENT OF COMPREHENSIVE INCOME

Six months ended Year ended

30 June 30 June 31 December

2021 2020 2020

Unaudited Unaudited Audited

Note US$000 US$000 US$000

Income from unquoted

financial assets 575 525 1,137

Finance income from

loans 673 668 1,337

Gross portfolio income 4 1,248 1,193 2,474

Fair value changes on

financial assets at

fair value through profit

or loss 48 (14) 5,045

Expected credit loss

provision 9 - (322) (779)

------------ ------------- ------------

Net portfolio income 4 1,296 857 6,740

Management fees 13 (914) (900) (1,888)

Incentive fees - (40) (1,750)

Administrative expenses (394) (436) (1,017)

Operating (loss)/profit (12) (519) 2,085

Finance expense (259) (179) (442)

(Loss)/profit before

taxation (271) (698) 1,643

------------ ------------- ------------

Taxation 5 - - -

Other comprehensive

income

Foreign currency translation

differences - - -

Profit/(Loss) and total

comprehensive expense

for the year (271) (698) 1,643

============ ============= ============

Earnings per share 7

Basic (0.24)cents (0.69)cents 1.56 cents

============ ============= ============

Diluted (0.24)cents (0.69)cents 1.34 cents

============ ============= ============

The results above relate to continuing operations.

CONDENSED CONSOLIDATED STATEMENT OF FINANCIAL POSITION

30 June 31 December

30 June 2020 2020

2021 Unaudited Audited

Unaudited (Restated) (Restated)

Note US$000 US$000 US$000

----------------------------- ----- ----------- ------------- --------------

Assets

Unquoted financial assets

at fair value through

profit or loss 8 73,991 68,054 73,423

Loans and other receivables 9 34,681 33,691 33,970

Cash and cash equivalents 2,560 3,190 4,093

Total assets 111,232 104,935 111,486

----------- ------------- --------------

Liabilities

Other payables and accruals 1,515 1,227 1,530

Current liabilities 1,515 1,227 1,530

----------- ------------- --------------

Loans & borrowings 10 3,536 3,472 3,504

----------- ------------- --------------

Total liabilities 5,051 4,699 5,034

----------- ------------- --------------

Net assets 106,181 100,236 106,452

=========== ============= ==============

Equity and reserves

Share capital 11 148,903 145,084 148,903

Treasury share reserve (615) (671) (615)

Share based payment reserve 2,936 2,937 2,936

Accumulated losses (45,043) (47,113) (44,772)

----------- ------------- --------------

Total equity and reserves

attributable to owners

of the parent 106,181 100,236 106,452

=========== ============= ==============

CONDENSED CONSOLIDATED STATEMENT OF CHANGES IN EQUITY

Share

Treasury based

Share share payment Accumulated

capital reserve reserve losses Total

US$000 US$'000 US$000 US$000 US$000

Group balance at 1

January 2020 145,027 (671) 2,936 (46,415) 100,877

Loss for the period - - - (698) (698)

Other comprehensive

income - - - - -

--------- --------- --------- ------------ --------

Total comprehensive

expense for the period - - - (698) (698)

Transactions with

owners:

Issue of shares 57 - - - 57

Share buybacks - - - - -

Group balance at 30

June 2020 145,084 (671) 2,936 (47,113) 100,236

--------- --------- --------- ------------ --------

Profit for the period - - - 2,341 2,341

Other comprehensive

income - - - - -

--------- --------- --------- ------------ --------

Total comprehensive

income for the period - - - 2,341 2,341

Transactions with

owners:

Issue of shares 3,819 - - - 3,819

Treasury shares acquired - (201) - - (201)

Treasury shares sold - 257 - - 257

Share-based payments - - - - -

Group balance at 31

December 2020 and

1 January 2021 148,903 (615) 2,936 (44,772) 106,452

--------- --------- --------- ------------ --------

Loss for the period - - - (271) (271)

Other comprehensive

income - - - - -

--------- --------- --------- ------------ --------

Total comprehensive

income for the period - - - (271) (271)

Group balance at 30

June 2021 148,903 (615) 2,936 (45,043) 106,181

========= ========= ========= ============ ========

CONDENSED CONSOLIDATED STATEMENT OF CASH FLOWS

Six months ended Year ended

30-Jun 31 December

30-Jun 2020 2020

2021 Unaudited Audited

Unaudited (Restated) (Restated)

US$'000 US$'000 US$'000

------------------------------------- ----------- ------------ ------------

Cash flow from operating activities

Profit/(Loss) before taxation (271) (698) 1,643

Adjustments for:

Finance income (673) (668) (1,336)

Finance expense 259 179 442

Exchange (gain)/loss (58) 19 (197)

Fair value changes on unquoted

financial assets at fair value

through profit or loss (566) (511) (5,923)

Share-based expenses - - 479

Decrease in other receivables (16) 398 992

(Decrease)/Increase in other

payables and accruals (15) (1,072) 202

----------- ------------ ------------

Net cash used in operating

activities (1,340) (2,353) (3,698)

----------- ------------ ------------

Cash flow from investing activities

Purchase of unquoted financial

assets at fair value through

profit and loss - (207) (207)

Net cash (used in)/generated

from investing activities - (207) (207)

----------- ------------ ------------

Issue of Shares - 2,367

Sale of treasury shares - - 257

Purchase of treasury shares - - (201)

Proceeds from loans and borrowings - 1,720 1,720

Payment of interest on loans

and borrowings (228) (245) (476)

----------- ------------ ------------

Net cash (used in)/generated

from financing activities (228) 1,475 3,667

----------- ------------ ------------

Net (decrease)/increase in

cash & cash equivalents during

the period (1,568) (1,085) (238)

Cash and cash equivalents and

net debt at the beginning of

the period 4,093 4,275 4,275

Foreign exchange on cash balances 35 - 56

Cash & cash equivalents and

net debt at the end of the

period 2,560 3,190 4,093

=========== ============ ============

NOTES TO THE FINANCIAL INFORMATION

1. CORPORATE INFORMATION

The Company is a limited company incorporated in the British

Virgin Islands ("BVI") under the BVI Business Companies Act 2004 on

18 January 2008. The address of the registered office is Commerce

House, Wickhams Cay 1, P.O. Box 3140, Road Town, Tortola, British

Virgin Islands VG 1110 and its principal place of business is

19/F., CMA Building, 64 Connaught Road Central, Central, Hong

Kong.

The Company is quoted on the AIM Market of the London Stock

Exchange (code: JADE) and the Quotation Board of the Open Market of

the Frankfurt Stock Exchange (code: 1CP1).

The principal activity of the Company is investment holding. The

Company is principally engaged in investing primarily in unlisted

assets in the areas of mining, power generation, health technology,

telecommunications, media and technology ("TMT"), and financial

services or listed assets driven by corporate events such as

mergers and acquisitions, pre-IPO, or re-structuring of state-owned

assets.

The condensed consolidated interim financial information was

approved for issue on 20 September 2021.

2. BASIS OF PREPARATION

The condensed consolidated interim financial information has

been prepared in accordance with International Accounting Standard

("IAS") 34 "Interim Financial Reporting" and presented in US

Dollars.

3. PRINCIPAL ACCOUNTING POLICIES

The condensed consolidated interim financial information has

been prepared on the historical cost convention, as modified by the

revaluation of certain financial assets and financial liabilities

at fair value through the income statement.

The accounting policies and methods of computation used in the

condensed consolidated financial information for the six months

ended 30 June 2021 are the same as those followed in the

preparation of the Group's annual financial statements for the year

ended 31 December 2020 and are those the Group expects to apply

into financial statements for the year ending 31 December 2021.

The seasonality or cyclicality of operations does not impact the

interim financial information.

4. SEGMENT INFORMATION

The operating segment has been determined and reviewed by the

Board to be used to make strategic decisions. The Board considers

there to be a single business segment, being that of investing

activity.

The reportable operating segment derives its revenue primarily

from debt investment in several companies and unquoted

investments.

The Board assesses the performance of the operating segments

based on a measure of adjusted Earnings Before Interest, Taxes,

Depreciation and Amortisation ("EBITDA"). This measurement basis

excludes the effects of non-recurring expenditure from the

operating segments such as restructuring costs. The measure also

excludes the effects of equity-settled share-based payments and

unrealised gains/losses on financial instruments.

The segment information provided to the Board for the reportable

segment for the periods are as follows:

Six months ended Year ended

30 June 30 June 31 December

2021 2020 2020

US$000 US$000 US$000

Income on unquoted financial

assets 575 525 1,137

Financial income on loans

& receivables 673 668 1,336

Gross portfolio income 1,248 1,192 2,473

--------- -------- ------------

Expected credit loss provision - (322) (529)

Other provisions - - (250)

Foreign exchange 48 (14) 215

Equity fair value adjustments - - 4,831

Portfolio income through

profit or loss 1,296 857 6,740

--------- -------- ------------

Net assets:

FMHL 50,696 45,263 50,400

Meize 8,201 8,201 8,200

GCCF 2,745 2,745 2,745

DocDoc 2,491 2,301 2,395

ICG 2,522 2,207 2,346

Infinity TNP 7,320 7,320 7,320

Other 16 17 17

--------- -------- ------------

Unquoted assets at fair

value through profit or

loss 73,991 68,054 73,423

Loans and other receivables

at fair value through the

profit or loss (third party) 34,681 33,691 33,970

Cash 2,560 3,190 4,093

Liabilities (5,051) (4,699) (5,034)

Net assets 106,181 100,236 106,452

The impact of fair value changes on the investments in the

portfolio are as follows:

Six months ended Year ended

30 June 30 June 31 December

2021 2020 2020

US$000 US$000 US$000

Income on unquoted financial

assets through profit or

loss 575 525 1,137

Equity fair value adjustments:

* FMHL - - 4,831

* ICG - - -

--------- -------- ------------

- - 4,831

Expected credit loss provision:

- ICG - (62)

Foreign exchange on unquoted

financial assets at fair

value through profit or

loss (9) (14) 17

Total fair value changes

on financial assets at

fair value through profit

or loss 566 511 5,923

========= ======== ============

5. TAXATION

The Company is incorporated in the BVI and is not subject to any

income tax.

6. DIVID

The Board does not recommend the payment of an interim dividend

in respect of the six months ended 30 June 2021 (30 June 2020:

Nil).

7. EARNINGS PER SHARE

The calculation of the basic and diluted earnings per share

attributable to owners of the Group is based on the following:

Six months ended Year ended

30 June 30 June 31 December

2021 2020 2020

US$000 US$000 US$000

Numerator

Basic/Diluted: Net profit/(loss) (271) (698) 1,643

--------- -------- ------------

Number of shares

'000 '000 '000

Denominator

Basic: Weighted average shares 115,278 101,618 105,518

Dilutive effect of warrants - - 17,568

Diluted: Adjusted weighted average shares 115,278 101,618 123,086

--------- -------- ------------

Earnings per share

Basic (cents) (0.24) (0.69) 1.56

Diluted (cents) (0.24) (0.69) 1.34

For the six months ended 30 June 2021 and 2020, the warrants

issued to the Investment Manager are anti-dilutive and therefore

there is no impact on the weighted average shares in issue.

8. UNQUOTED FINANCIAL ASSETS AT FAIR VALUE THROUGH PROFIT OR LOSS

30 June 30 June 31 December

2021 2020 2020

US$000 US$000 US$000

At the beginning of the period 73,423 67,172 67,172

Fair value changes through

profit and loss 568 544 5,975

Expected credit loss provision

through profit and loss - - (62)

Additions - 182 264

Reclassification - 156 156

Payment of cash interest - - (81)

At the end of the period 73,991 68,054 73,423

======== ======== ============

9. LOANS AND OTHER RECEIVABLES AT FAIR VALUE THROUGH PROFIT OR LOSS

30 June 30 June 31 December

2021 2020 2020 (Restated)

US$000 US$000 US$000

At the beginning of the

period 33,970 33,516 33,516

Additions - 364 64

Reclassification - (156) (156)

Fair value changes through

profit and loss 38 (33) (324)

Expected credit loss provision

through profit and loss - - (467)

Finance income on loans 673 - 1,337

At the end of the period 34,681 33,691 33,970

======== ======== =================

Note 31 December

30 June 30 June 2020

2021 2020 (Restated) (Restated)

US$000 US$000 US$000

Loans 29,081 27,820 28,408

Other receivables 14 5,600 5,442 5,562

Amounts receivable from - 429 -

related parties

Total loans and borrowings 34,681 33,691 33,970

======== ================= ============

Loans represent the Convertible Bond issued by Fook Lam Moon

Holdings plus accrued interest. The Group has assessed the

recoverability of Loans in accordance with its policy, and

determined that an ECL allowance is required in respect of accrued

cash interest relating to its fixed interest credit investment. The

breakdown of Loans is as follows:

30 June 30 June 31 December

2021 2020 2020

US$000 US$000 US$000

Loan principal 26,500 26,500 26,500

Accrued PIK interest 1,408 860 1,132

Accrued interest payable in

cash 1,877 1,019 1,480

-------- -------- ------------

Gross loans receivable 29,785 28,379 29,112

-------- -------- ------------

Lifetime ECL allowance recognised (704) (559) (704)

Net loans receivable 29,081 27,820 28,408

======== ======== ============

30 June 30 June 31 December

2021 2020 2020

US$000 US$000 US$000

At the beginning of the period 704 237 237

ECL allowance charged to profit

or loss - 322 467

At the end of the period 704 559 704

======== ======== ============

10. LOANS AND BORROWINGS

30 June 30 June 31 December

2021 2020 2020

US$000 US$000 US$000

Corporate debt 3,536 3,472 3,504

Total loans and borrowings 3,536 3,472 3,504

======== ======== ============

The movement in loans and borrowings is as follows:

30 June 30 June 31 December

2021 2020 2020

US$000 US$000 US$000

Opening balance 3,504 1,909 1,909

Proceeds from issue of loan

notes - 1,720 1,720

Termination of lease - (34) (34)

Capitalised borrowing costs - (57) (57)

Borrowing costs amortised 32 24 56

Interest expense accrued 228 155 386

Payment of interest liability (228) (245) (476)

Closing balance 3,536 3,472 3,504

======== ======== ============

11. SHARE CAPITAL

Number of Amount

Shares US$000

Authorised, called-up and fully paid

ordinary shares of no-par value each

at 30 June 2020 101,755,422 144,413

Sale of treasury shares 1,264,000 257

Purchase of treasury shares (595,000) (201)

Share issue - open offer and placement 8,356,663 2,699

Share issue - HCIL incentive fees 4,496,784 1,453

Share issue costs - (333)

Authorised, called-up and fully paid

ordinary shares of no-par value each

at 31 December 2020 and at 30 June 2021 115,277,869 148,288

------------ --------

Consisting of:

Authorised, called-up and fully paid

ordinary shares of no-par value each

at 30 June 2021 117,925,673 148,903

Authorised, called-up and fully paid

ordinary shares of no-par value held

as treasury shares by the Company at

30 June 2021 (2,647,804) (615)

(i) Under the BVI corporate laws and regulations, there is no

concept of "share premium", and all proceeds from the sale of

no-par value equity shares are deemed to be share capital of the

Company.

12. FINANCIAL INSTRUMENTS

Financial assets

As at As at

30 June 30 June As at

2021 2020 31 December

(Restated) 2020 (Restated)

US$'000 US$'000 US$'000

Unquoted financial assets

at fair value 73,991 68,054 73,423

Loans at fair value 29,081 27,820 28,408

Other receivables at fair

value 5,559 5,831 5,536

Cash and cash equivalents

at amortised cost 2,560 3,190 4,093

--------- --- ------------ --- -----------------

Financial assets 111,191 104,895 111,460

========= === ============ === =================

Financial liabilities

As at As at As at

30 June 30 June 31 December

2021 2020 2020

US$'000 US$'000 US$'000

Other payables and accruals

at amortised cost 1,515 1,227 1,530

Corporate debt at amortised

cost 3,536 3,472 3,504

--------- --------- -------------

Financial liabilities 5,051 4,699 5,034

========= ========= =============

The Corporate Bond has a remaining term of over 1 year, due for

repayment in October 2022. All other financial liabilities are due

within 12 months.

Financial assets at fair value through profit or loss

The following table provides an analysis of financial

instruments that are measured subsequent to initial recognition at

fair value, grouped into Level 1, 2 or 3 based on the degree to

which the fair value is observable:

Note As at As at

30 June 31 December

As at 2020 2020

30 June (Restated)

2021 (Restated)

US$000 US$000 US$000

Level 3

Unquoted financial assets at

fair value 8 73,991 68,054 73,423

Loans at fair value 9 29,081 27,820 28,408

Other receivables at fair value 9,14 5,559 5,831 5,536

108,631 101,705 107,367

There is no transfer between levels in the current period.

Carrying values of all financial assets and liabilities are

approximate to fair values. The value of level 3 investments has

been determined using the yield capitalisation (discounted cash

flow) method.

13. RELATED PARTY TRANSACTIONS

During the period under review, the Group entered into the

following transactions with related parties and connected

parties:

30 June 30 June 31 December

2021 2020 2020

Notes US$000 US$000 US$000

Remuneration payable to Directors 159 122 256

Harmony Capital

Management fee (i) 914 900 1,888

Incentive fee - 40 1,750

Amount due to Harmony Capital at period end 1,289 974 1,289

(i) Harmony Capital has been appointed as the Investment Manager

of the Group. The management fee, which was calculated and paid

bi-annually in advance calculated at a rate of 0.875% of the net

asset value of the Company's portfolio of assets at 30 June and 31

December in each calendar year.

Harmony Capital is entitled to receive an incentive fee from the

Company in the event that the audited net asset value for each year

is (1) equal to or greater than the audited net asset value for the

last year in relation to which an incentive fee became payable

("High Water Mark"); and (2) in excess of 105% of the audited net

asset value as at the last calendar year-end ("the Hurdle").

Subject to the High Water Mark and Hurdle being excessed in respect

of any calendar year, the incentive fee will be equal to 20% of the

difference between the current year-end NAV and the previous

year-end NAV. 50% of the incentive fee shall be paid in cash and

the remaining 50% of the incentive fee shall be paid by ordinary

shares.

14. PRIOR YEAR ERROR

In the previous financial year, cash held on account by

investment brokers was presented as part of the other receivables

balance. This was an error, as the balances were held for the

purposes of meeting short term cash commitments rather than for

investment. The broker accounts were not subject to restrictions

and were readily convertible into cash at short notice. Therefore,

the accounts met the definition of cash equivalents detailed in the

Company's accounting policies and should be reclassified from loans

and other receivables to cash and cash equivalents. The impact of

the restatement at the beginning and the end of the prior period is

as follows:

(Reported) (Restated) (Restated)

1 January

31 December 31 December 1 January 2020

2020 2020 2020 US$000

US$000 US$000 US$000

Loans and other receivables

at fair value through

profit or loss 34,390 33,970 33,720 33,516

Cash and cash equivalents 3,673 4,093 4,071 4,275

15. EVENTS AFTER THE REPORTING PERIOD

The Management Team at the Quarry is in late stage discussions

for a large off-take agreement for a construction project that is

underway.

16. COPIES OF THE INTERIM REPORT

The interim report is available for download from

www.jaderoadinvestments.com.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR EAKNEAELFEEA

(END) Dow Jones Newswires

September 20, 2021 02:07 ET (06:07 GMT)

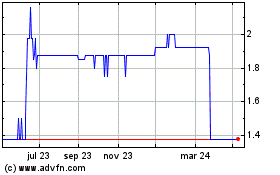

Jade Road Investments (LSE:JADE)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

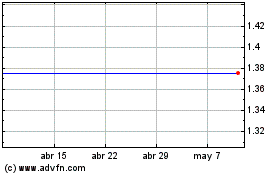

Jade Road Investments (LSE:JADE)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024