TIDMJADE

RNS Number : 6350F

Jade Road Investments Limited

19 July 2021

19 July 2021

RNS

JADE ROAD INVESTMENTS LIMITED

(" Jade Road " or the " Company ")

Investment update:

Future Metal Holdings: Competent Persons Report (CPR)

SRK Consulting Report Published

Jade Road Investments Limited, the London-quoted, pan-Asian

diversified investment vehicle focused on providing shareholders

with attractive uncorrelated, risk-adjusted long-term returns, is

pleased to announce an investment update, and confirms that the

full SRK report dated March 2021 ("CPR") on Future Metal Holdings

("FMHL" or the "Quarry") has been published on

https://jaderoadinvestments.com/home and will be published on

https://futuremetalholdings.com in due course. Jade Road has an 85%

shareholding in Future Metal Holdings Limited.

Highlights:

-- The CPR confirms a JORC Code Compliant Mineral Resources of

the Zhuangpeng Mine of 35.95 million tonnes ("Mt") with an average

grade of 20.74% dolomite oxide ("MgO") (Measured); 81.40Mt with an

average grade of 20.48% MgO (Indicated); and 31.81Mt with an

average grade of 20.61% MgO (Inferred) (see resources table

below)

-- The Quarry has already obtained all necessary operational licences and permits

-- The CPR, incorporating the expanded ("3Mt") production rate,

estimates a net present value of the asset is RMB487.47 million

(c.USD75.5 million) by using the discounted cash flow method with a

9% discount rate. The assumptions are also set out below. The

internal rate of return is 28.55%. Jade Road applied a further 17%

discount to the independent valuation conducted by SRK and as of

31st of December 2020, the asset was valued at USD50.4m in the

portfolio

-- The Quarry is currently in production at a rate of 300kt pa

Summary of the Report:

Geologically, the dolomite quarry project ("Quarry") is located

approximately 40 kilometres ("km") east of Xi County, 90km

northwest of Linfen City, or 220km southwest of Taiyuan, the

capital city of Shanxi Province, P.R. China. The main ore mineral

is dolomite.

Mining and stripping operations are conducted under conventional

contract mining, and environmental risk is well managed under

Chinese national requirements. The estimated ore loss rate and

dilution rate are both 5%, respectively. As of 31 December 2020, at

a cut-off grade of 19% dolomite oxide ("MgO"), the JORC Code

Compliant Measured, Indicated and Inferred Mineral Resources of the

Zhuangpeng Mine were:

-- Measured:35.95 million tonnes ("Mt") with an average grade of 20.74% MgO;

-- Indicated: 81.40Mt with an average grade of 20.48% MgO; and

-- Inferred: 31.81Mt with an average grade of 20.61% MgO, respectively .

Based on the parameters mentioned above, as of 31 December 2020,

the Quarry has a Proved and Probable Reserves of 113Mt, out of

approximately 149Mt of dolomite as calculated by Measured,

Indicated and Inferred Resource.

SUMMARY OF RESERVES AND RESOURCES BY STATUS

Category Gross Net attributable (85% Operator

to Jade Road)

Ore/Mineral Tonnes Grade Contained Tonnes Grade Contained

Reserves (millions) MgO Metal (millions) MgO Metal

per asset (%) (%)

------------ ------ ---------- ------------ ------ ---------- -------------

Future Metal

Proved 34.89 19.70 n/a 29.59 19.70 n/a Holdings

------------ ------ ---------- ------------ ------ ---------- -------------

Future Metal

Probable 78.51 19.47 n/a 66.58 19.47 n/a Holdings

------------ ------ ---------- ------------ ------ ---------- -------------

Subtotal 113.40 19.54 n/a 96.16 19.54 n/a

------------ ------ ---------- ------------ ------ ---------- -------------

Mineral

Resource

per asset

------------ ------ ---------- ------------ ------ ---------- -------------

Future Metal

Measured 35.95 20.74 n/a 30.49 20.74 n/a Holdings

------------ ------ ---------- ------------ ------ ---------- -------------

Future Metal

Indicated 81.40 20.48 n/a 69.03 20.48 n/a Holdings

------------ ------ ---------- ------------ ------ ---------- -------------

Future Metal

Inferred 31.81 20.61 n/a 26.97 20.61 n/a Holdings

------------ ------ ---------- ------------ ------ ---------- -------------

Subtotal 149.2 20.57 n/a 126.49 20.57 n/a

------------ ------ ---------- ------------ ------ ---------- -------------

Source: SRK

The Quarry has already all necessary operational licenses and

permits, the most important being the Mining Licence and the Work

Safety Permit which are valid until March 2023 and August 2023,

respectively. In December 2020, the Quarry also obtained approval

of its onsite environmental facilities from the local Ministry of

Ecology and Environment.

The licence covers an area of 2.3 square kilometres and allows a

mining capacity of 0.3 million tonnes per year ("Mtpa"). The

designed capacity, which the Directors understand is feasible upon

expansion, is 3Mtpa. The expected mine life is 40 years with a

two-year construction period for the expansion design.

The net present value of the asset is RMB487.47 million

(c.USD75.5 million) by using the discounted cash flow method with a

9% discount rate (the assumptions are set out below). The internal

rate of return is 28.55%.

Risks regarding geology and resource, mining, processing,

environment and capital and operating costs are considered by SRK

to be relatively low since the Quarry is already in production

stage. Finally, the Directors believe that enhancing the product

market and sales would be the key to achieve better economic

goals.

Jade Road applied a further 17% discount to the independent

valuation conducted by SRK and as of 31(st) of December 2020, the

Company valued the asset on its Balance Sheet at USD50.4m.

Economic Assumptions for the expanded plant, as of 31 December

2020

Item Unit Amount

Ore Reserve

Proved + Probable Ore Reserves (JORC

Code 2012) Mt 113.40

------------ -------

Production Plan

Dolomite Production Rate Mtpa 3.0

------------ -------

Qualified* Dolomite Yield % 80

------------ -------

Unqualified** Dolomite Yield % 20

------------ -------

Saleable Wall Rock Yield % 92

------------ -------

Construction Period Proposed year 2

------------ -------

Life of Mine year 38

------------ -------

Calculation period year 40

------------ -------

Economy

Construction Expenditure M'RMB 286.50

------------ -------

Working Capital M'RMB 46.64

------------ -------

Sustained Capital (Project Investment

Base) % 2.5

------------ -------

Stripping Cash Operating Cost RMB /t 7.69

------------ -------

Mining and Crushing Cash Operating Cost RMB/t 12.37

------------ -------

Dolomite Load and Haul Cost on Site RMB/t 1.00

------------ -------

Wall Rock Load and Haul Cost on Site RMB/t 1.50

------------ -------

Depreciation and Amortization M'RMB/year 19.56

------------ -------

G&A M'RMB/year 33.01

------------ -------

Financial Expenses M'RMB/year 1.96

------------ -------

Sales Expenses (Sales Revenue Base) % 1.00

------------ -------

Price of Qualified Dolomite (including

VAT) RMB/t 75.00

------------ -------

Price of Unqualified Dolomite (including

VAT) RMB/t 20.00

------------ -------

Price of Saleable Wall Rock (including

VAT) RMB/t 20.00

------------ -------

Resource Tax (sales revenue based) % 5.00

------------ -------

Value-added Tax (VAT) % 13.00

------------ -------

City Maintenance and Development Tax

(payable VAT based) % 7.00

------------ -------

Educational-surtax and Local Educational-surtax

(payable VAT based) % 5.00

------------ -------

Corporate Tax Rate (grass profit based) % 25.00

------------ -------

Discount Rate % 9

------------ -------

Exchange rate as of 14(th) July: 1RMB-0.15$USD

*Qualified Dolomite: Carbonate mineral sold as raw material for

magnesium smelting.

** Unqualified Dolomite: Carbonate mineral unsuitable for

smelting and sold as building stone.

Production Schedule

Item Unit Ramp-up Stage Production Stage

2021 2022 2023 2024-2038 2039-2042 2043-2045

---------- ------- ---------- ---------- ---------- ----------

Mined ore kt 300 300 2,100 3,000 3,000 3,000

------ ---------- ------- ---------- ---------- ---------- ----------

Stripping

rock kt 7,300 9,700 7,900 7,000 6,500 3,230

------ ---------- ------- ---------- ---------- ---------- ----------

Stripping m3/

ratio m3 24.33 32.33 3.76 2.33 2.17 1.08

------ ---------- ------- ---------- ---------- ---------- ----------

Ore and waste

rock in total kt 7,600 10,000 10,000 10,000 9,500 6,230

------ ---------- ------- ---------- ---------- ---------- ----------

Rock for

sale kt 550 9,260 7,540 6,690 6,210 3,080

------ ---------- ------- ---------- ---------- ---------- ----------

Qualified

dolomite

for sale kt 240 240 1,680 2,400 2,400 2,400

------ ---------- ------- ---------- ---------- ---------- ----------

Unqualified

dolomite

for sale kt 60 60 420 600 600 600

------ ---------- ------- ---------- ---------- ---------- ----------

Item Unit Production Stage

------ -------------------------------------------------------------------

2046-2053 2054 2055-2056 2057-2058 2059 2060

------ ---------- ------- ---------- ---------- ---------- ----------

Mined ore kt 3,000 3,000 3,000 3,000 3,000 3,000

------ ---------- ------- ---------- ---------- ---------- ----------

Stripping

rock kt 1,500 1,200 1,000 700 400 200

------ ---------- ------- ---------- ---------- ---------- ----------

Stripping m3/

ratio m3 0.5 0.4 0.33 0.23 0.13 0.07

------ ---------- ------- ---------- ---------- ---------- ----------

Ore and waste

rock in total kt 4,500 4,200 4,000 3,700 3,400 3,200

------ ---------- ------- ---------- ---------- ---------- ----------

Rock for

sale kt 1,430 1,150 960 670 380 190

------ ---------- ------- ---------- ---------- ---------- ----------

Qualified

dolomite

for sale kt 2,400 2,400 2,400 2,400 2,400 2,400

------ ---------- ------- ---------- ---------- ---------- ----------

Unqualified

dolomite

for sale kt 600 600 600 600 600 5,400

------ ---------- ------- ---------- ---------- ---------- ----------

Future Metal Holdings Update:

During Q1 2020, the Quarry recommenced activities with the

construction of a steel structure to enclose its stockpile site as

well as the process of land hardening to comply with the local

environmental requirements. The construction of both the land

hardening and the enclosed structure was completed around the end

of Q2 2020. Due to the two construction projects, production was

suspended between April and May 2020. In line with the wide-ranging

industrial activities in China, the Quarry resumed operations in

June 2020.

In 2020, the Directors understand intense efforts were exerted

to maximise the value of the project. In order to expand the

Quarry's sales channels, the local team engaged a new contractor in

2021 to help expand the local networks and to facilitate the

process of product selling to downstream customers.

With the appointment of the new contractor, it is intended that

the Quarry's products will reach customers with a further

geographical radius. Currently, all the mined dolomite is sold to

mixing plants in the local region for construction purposes. The

Directors also understand that the management team of the Quarry is

in contact with external parties regarding a potential business

collaboration of a highway construction project using dolomite and

wall rock. Jade Road will continue to keep investors informed of

project updates in this area. The Directors of Jade Road will also

continue to focus on enhancing the asset's efficiency of operations

and actively seeking potential or partial exits where possible.

John Croft, Executive Chairman of Jade Road, commented:

'We are very pleased to share the full SRK Report on Future

Metal Holdings, one of Jade Road's main assets. The notable

improvement in the Asset between 2019 and 2020 is mainly attributed

to the effort made to substantially improve the Quarry from the

completion of its external structure in 2019 to the different

licences secured to comply with the latest environmental

regulations in 2020. Furthermore, the production schedule shows a

strong commitment to develop the different resources on site and

the local Management Team is in constant interaction with external

parties for potential business collaborations. Our objective

remains to maximise the value of the asset whilst also positioning

it for a possible monetisation event, which would ultimately

benefit the Shareholders of Jade Road'.

FOR FURTHER INFORMATION, PLEASE CONTACT:

Jade Road Investment Limited +44 (0) 778 531 5588

John Croft

---------------------

Lionsgate Communications - Communications

Adviser +44 (0) 779 189 2509

---------------------

Jonathan Charles

---------------------

Hybridan LLP - Corporate Broker +44 (0)203 764 2341

---------------------

Claire Noyce

---------------------

WH Ireland Limited - Nominated Adviser +44 (0) 20 7220 1666

---------------------

James Joyce

---------------------

James Sinclair Ford

---------------------

About Jade Road Investments Limited

Jade Road Investments Limited (Jade Road) is quoted on the AIM

Market of the London Stock Exchange and is committed to providing

shareholders with attractive uncorrelated, risk-adjusted long-term

returns from a combination of realising sustainable capital growth

and delivering dividend income.

The Company is focused on providing growth capital and financing

to emerging and established Small and Medium Enterprises (SME)

sector throughout Asia, well diversified by national geographies,

instruments and asset classes. This vital segment of the economy is

underserved by the traditional banking industry for regulatory and

structural reasons.

The Company's investment manager, Harmony Capital, seeks to

capitalise on its team's established investment expertise and broad

networks across Asia. Through rigorous diligence and disciplined

risk management, Harmony Capital is dedicated to delivering

attractive income and capital growth for shareholders with

significant downside protection through selectively investing in

assets and proactively managing them.

Harmony Capital is predominately sourcing private opportunities

and continues to create a strong pipeline of attractive

income-generating assets from potential investments in growth

sectors across Asia, including healthcare, fintech, hospitality, IT

and property.

For further information, please visit the Company's website at

https://jaderoadinvestments.com and follow the Company on Twitter

(@JadeRoadInvest).

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

UPDEKLBFFDLZBBX

(END) Dow Jones Newswires

July 19, 2021 02:00 ET (06:00 GMT)

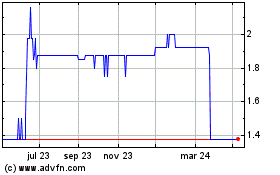

Jade Road Investments (LSE:JADE)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Jade Road Investments (LSE:JADE)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024