TIDMJSE

RNS Number : 2436L

Jadestone Energy PLC

09 September 2021

2021 Half Year Results and Interim Dividend Declaration

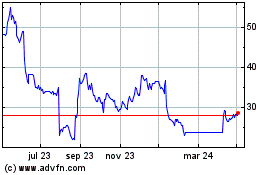

9 September 2021-Singapore: Jadestone Energy plc (AIM:JSE)

("Jadestone" or the "Company"), an independent oil and gas

production company and its subsidiaries (the "Group"), focused on

the Asia Pacific region, reports today its unaudited condensed

consolidated interim financial statements, as at and for the

six-month period ended 30 June 2021 (the "Financial

Statements").

Management will host a conference call today at 9:00 a.m. UK

time, details of which can be found in the release below.

Paul Blakeley, President and CEO commented:

" I am pleased to report a solid 2021 first half across the

business, with production from our Australian assets slightly

better than expected, ahead of implementing the activity plan on

Montara and Stag that was deferred from last year due to low oil

prices. I am also pleased to report safe operational performance

through the year to date, while we remain vigilant on the

well-being of our workforce given the continued significant impact

of the COVID-19 pandemic.

"During the period, global demand for hydrocarbons has been

recovering, creating strong market fundamentals including an

increase in benchmark oil prices. Jadestone's average oil price

realisations in the first half were 45% higher than the same period

last year. This translated into positive operating cash flows of

US$54.4 million in H1 2021. Adding the proceeds of a June Montara

lifting which were received in early July, pro-forma cash balances

at mid-year were just short of US$100 million.

"With no debt, our financial position at the end of the first

half was very strong, allowing us to increase the interim dividend

by 10%. Going forward, we will continue to balance dividend growth

against the significant organic and inorganic growth opportunities,

and associated capital needs, across the business.

"I am particularly pleased with the Peninsular Malaysia

acquisition announced during H1 2021. Due to the concerted efforts

of our team, we closed the transaction just three months after

announcing, with net cash due to Jadestone of US$9.2 million.

Further, we remain committed to our acquisition of a 69% operated

interest in the Maari project, shallow water offshore New Zealand,

and remain confident that the transaction will be completed, though

timing of government approvals is beyond our control.

"Our gas developments have also seen positive progress during

the first half. At Lemang, in Indonesia, the regulator has

allocated future gas sales from the project, which provides

certainty as we work toward both formalising gas sales contracts

and progressing the various workstreams leading toward a final

investment decision. In Vietnam, we have re-engaged with regulators

to press toward a target for both the production profile and first

gas date, as a key precursor to establishing gas sales agreement

details.

"Today, we have reaffirmed production guidance for 2021 of

11,500 - 13,500 boe/d, key to which is the contribution of the H6

development well on Montara, which is currently in the completions

phase before being tied in and brought onstream shortly. This well,

together with the Skua workovers and the contribution of the

Peninsular Malaysia assets, would give us clear line of sight on a

production rate of 20,000 boe/d towards the end of the year."

Paul Blakeley

EXECUTIVE DIRECTOR,

PRESIDENT AND CHIEF EXECUTIVE OFFICER

2021 FIRST HALF RESULTS SUMMARY

USD'000 except where indicated H1 2021 H1 2020 FY 2020

-------------------------------------------- -------- -------- ------------

Production, bbls/day 9,934 12,116 11,438

Realised oil price per barrel (US$/bbl)(1) 67.70 46.47 44.79

Revenue(2) 138,158 115,669 217,938

Operating costs per barrel (US$/bbl)(3) 28.16 23.27 23.10

Adjusted EBITDAX(3) 65,179 36,606 62,582

Profit/(Loss) after tax 2,495 5,360 (60,178)(4)

Earnings/(Loss) per ordinary share:

basic & diluted (US$) 0.01 0.01 (0.13)

Dividend per ordinary share (US

) 0.59 0.54 1.62

Operating cash flows before movement

in working capital 54,376 57,054 86,883

Capital expenditure 16,221 19,521 24,065

Outstanding debt(3) - 25,574 7,386

Net cash(3) 48,291 78,281 82,055

Financial

l H1 2021 production of 9,934 bbls/d, slightly ahead of plan but

18% lower than H1 2020, in part due to natural field production

decline, deferred workovers and an unplanned shutdown at Montara

for critical valve repairs;

l Average realised oil prices(1) in H1 2021 were US$67.70/bbl,

46% higher than H1 2020. Realised prices included an average

premium over the benchmark of US$3.12/bbl(5) (H1 2020:

US$8.19/bbl);

l Net revenue for H1 2021 of US$138.2 million, up 50% from H1

2020 before hedging income(2) , due to the increase in oil prices

since the beginning of 2021 and higher lifted volumes;

l Unit operating costs(6) of US$28.16/bbl, up 21% from H1 2020

of US$23.27/bbl, in part due to lower production, coupled with

higher operational staff costs and repair & maintenance

costs;

l Net profit after tax of US$2.5 million, down from US$5.4

million in H1 2020, which includes the impact of several one-off

expenses of US$3.4 million arising from costs associated with the

acquisition of SapuraOMV Upstream (PM) Inc. as well as other

business development costs and costs associated with the corporate

reorganisation , and a net hedging loss of US$4.6 million;

l H1 2021 positive operating cash flows of US$54.4 million,

before movements in working capital, down 5% compared to H1 2020

;

l Capital expenditure of US$16.2 million, down 17% compared to

the prior period. Capital expenditure incurred in H1 2021 is

primarily related to costs of the drilling of the H6 development

well at Montara. H1 2020 development spend was primarily on the Nam

Du/U Minh field prior to the project activity being deferred during

the early stages of the COVID-19 pandemic;

l The 2018 reserves based loan was fully repaid on 31 March

2021, leaving the Group now entirely free of any interest bearing

financial indebtedness;

l Net cash as at 30 June 2021 of US$48.3 million (H1 2020:

US$78.3 million) and zero outstanding debt (H1 2020: US$ 25.6

million). The lower gross cash balance is partly due to timing

differences in liftings, with proceeds of US$46.1 million from a

Montara June 2021 lifting received in July 2021; and

l A 2021 interim dividend of 0.59 US cents/share has been declared.

(1) Realised oil price represents the actual selling price and

before any impact from hedging. The H1 2020 realised price is net

of marketing fees of US$0.08/bbl, whereas full year 2020 and H1

2021 realised oil prices are before marketing fees which are

recorded in production costs pursuant to IFRS 15 Revenue from

Contracts with Customers.

(2) Revenue in H1 2020 and FY 2020 includes hedging income of

US$23.7 million and US$31.4 million, respectively, pursuant to the

characterisation of the two-year capped swap programme as cashflow

hedges under IFRS9 Financial Instruments. Losses realised on the H1

2021 swaps of US$4.6 million have been recognised in other

expenses, pursuant to the characterisation of the ad hoc H1 2021

six-month swap programme as derivative instruments measured at fair

value through profit or loss. The H1 2021 swap programme covered a

short time span (not exceeding a half yearly reporting period),

whereas the capped swap programme crossed three annual reporting

periods.

(3) Operating costs per bbl, adjusted EBITDAX, outstanding debt

and net cash are non-IFRS measures and are explained below.

(4) Loss after tax for the year ended 31 December 2020 included

an impairment of US$50.5 million associated with the capitalised

intangible exploration costs at SC56.

(5) With the change to the shuttle tanker model at Stag, the

premium negotiated for each Stag lifting is now typically based on

a CIF (cost, insurance and freight) basis rather than a FOB (free

on board) basis. Care needs to be taken in making comparisons with

2020 premia for the period up until September 2020 when the switch

to the tanker model occurred.

(6) Unit operating costs per barrel before workovers, but

including net lease payments and certain other adjustments (see

non-IFRS measures below).

Business development

l Announced the acquisition of SapuraOMV's interests in

Peninsular Malaysia for an initial headline cash consideration of

US$9.0 million, plus customary adjustments and certain subsequent

contingent payments. The acquisition was completed on 1 August

2021, resulting in a net cash receipt of US$9.2 million after

adjustments; and

l Both Jadestone and the Maari seller continue to work to

satisfy the remaining outstanding conditions to complete the Maari

acquisition .

Guidance

l Full year guidance unchanged from 18 August 2021 update:

o Production : 11,500 - 13,500 boe/d;

o Unit opex: US$25.50 - 29.50/boe; and

o Capex: US$105 - 115 million.

Enquiries

Jadestone Energy plc +65 6324 0359 (Singapore)

Paul Blakeley, President and CEO

Dan Young, CFO + 44 7713 687 467 (UK)

Phil Corbett, Investor Relations Manager ir@jadestone-energy.com

Stifel Nicolaus Europe Limited (Nomad, +44 (0) 20 7710 7600

Joint Broker) (UK)

Callum Stewart / Jason Grossman / Ashton

Clanfield

Jefferies International Limited (Joint +44 (0) 20 7029 8000

Broker) (UK)

Tony White / Will Soutar

Camarco (Public Relations Advisor) +44 (0) 203 757 4980

(UK)

Billy Clegg / James Crothers jadestone@camarco.co.uk

Conference call and webcast

The management team will host an investor and analyst conference

call at 9:00 a.m. (London)/4:00 p.m. (Singapore) today, Thursday, 9

September 2021, including a question-and-answer session.

The live webcast of the presentation will be available at the

below webcast link. Dial-in details are provided below. Please

register approximately 15 minutes prior to the start of the

call.

The results for the financial period ended 30 June 2021 will be

available on the Company's website at:

www.jadestone-energy.com/investor-relations/

Webcast link:

https://produceredition.webcasts.com/starthere.jsp?ei=1485258&tp_key=efaeb2a81e

Event conference title: Jadestone Energy plc - Half Year

Results

Start time: 9:00 a.m. (London)/4:00 p.m. (Singapore)

Date: Thursday, 9 September 2021

Conference ID: 24719928

Dial-in number details:

Country Dial-In Numbers

United Kingdom 08006522435

---------------

Australia 1800076068

---------------

Canada (Toronto) 416-764-8688

---------------

Canada (Toll free) 888-390-0546

---------------

New Zealand 0800453421

---------------

Singapore 8001013217

---------------

United States (Toll free) 888-390-0546

---------------

France 0800916834

---------------

Germany 08007240293

---------------

Germany (Mobile) 08007240293

---------------

Hong Kong 800962712

---------------

Indonesia 0078030208221

---------------

Ireland 1800939111

---------------

Ireland (Mobile) 1800939111

---------------

Japan 006633812569

---------------

Malaysia 1800817426

---------------

Switzerland 0800312635

---------------

Switzerland (Mobile) 0800312635

---------------

DIVID DECLARATION

On 9 September 2021, the directors have declared a 2021 interim

dividend of 0.59 US cents/share (or equivalent to 0.43 GB

pence/share based on the current spot exchange rate of 0.7257 ),

equivalent to a total distribution of US$ 2.8 million. The dividend

will be paid on a gross basis, in US dollars. The timetable for the

dividend payment is as follows:

l Ex-dividend date: 16 September 2021

l Record date: 17 September 2021

l Payment date: 1 October 2021

The Company's growth-oriented strategy remains unchanged; the

business model is highly cash-generative, and, as a result, is

fundamentally pre-disposed to providing cash returns, after

allowing for organic reinvestment needs, whilst maintaining a

conservative capital structure, and not unduly limiting options for

further inorganic growth. The Company intends to maintain and grow

the dividend over time, in line with underlying cash flow

generation. The Company does not offer a dividend reinvestment

plan, and does not offer dividends in the form of ordinary

shares.

ENVIRONMENT, SOCIAL AND GOVERNANCE ("ESG")

As a leading oil and gas development and production company in

the Asia Pacific region, Jadestone strives to deliver sustainable

value for all of its stakeholders in a safe, secure,

environmentally and socially responsible manner. Jadestone

published its second Sustainability Report in June this year, which

covered the Group's approach to ESG and performance across key

focus areas for the 2020 calendar year, as well as commitments to

further improvements in 2021.

ESG Performance

Through H1 2021, the Group maintained safe operations and had no

significant recordable personnel or environmental incidents, and no

disruptions to offshore operations due to the COVID-19 pandemic.

Jadestone has committed to 2021 ESG targets across all of its

material matters, which form a part of annual executive key

performance indicators, translating directly to performance

pay.

Jadestone has continued its focus on reducing the carbon

footprint of its operations, through the work of the Operational

and Executive subgroups of the Climate Change Working Group

("CCWG"). In 2021, the Company is targeting a 5% reduction in both

flared volumes and diesel use compared to 2020 levels.

Initiatives to reduce GHG emissions in 2021 include:

l continuing to increase the uptime of the reinjection

compressor at the Montara asset;

l prioritising usage of produced gas over diesel to run Montara

operations; and

l enhancing internal GHG emissions reporting to support improved

operational practices.

The Operational CCWG is currently reviewing the recently

acquired Peninsular Malaysia assets to identify sources of

emissions, opportunities to reduce emissions, as well as

integrating asset-level GHG reporting.

The Company has also been rolling out its community engagement

programmes in all countries of operations, to further enhance its

positive contribution to the local communities. Throughout 2021,

the focus in the regions has been on identifying most pressing

community needs and looking for optimal channels of delivery, that

prioritise employee safety. Jadestone has also continued its

employee-facing programmes, including running the Plastic Free July

campaign, where feasible.

UN Sustainable Development Goals

Jadestone's ESG framework continues to align with the wider

societal challenges addressed by the UN's Sustainable Development

Goals ("SDGs"). Whilst its business activities touch directly or

indirectly on many of the SDGs, Jadestone has selected the goals

that most closely align with its current business strategy,

activities, values and purpose. These are set out in the Company's

Sustainability Report, contained within the 2020 Annual Report.

Task Force on Climate-Related Financial Disclosures

In 2020, Jadestone commenced its alignment with the Task Force

on Climate-Related Financial Disclosures ("TCFD"), utilising it as

a practical tool for navigating the transition to a low-carbon

economy and increasing business resiliency.

In H1 2021 the Company has continued to implement the TCFD

recommendations in its reporting and programmes, with a particular

focus on climate risk integration and strategy considerations.

Jadestone will disclose its progress in TCFD adoption in its 2021

Sustainability Report, to be published in H1 2022.

Governance

The Group adopted the Quoted Companies Alliance corporate

governance code ("QCA code") at the end of 2020. The resultant

changes that arise from the adoption of the QCA code have been

implemented and are a testament to the Company's commitment to

further strengthening transparent and effective corporate

governance practices.

Further details and enhanced disclosures of ESG can be found in

the Company's 2020 Sustainability Report, as part of the 2020

Annual Report, from pages 36 to 81.

OPERATIONAL REVIEW

Producing assets

Australia

Montara project

The Montara assets, in production licences AC/L7 and AC/L8, are

located 254km offshore Western Australia, in a water depth of

approximately 77 metres. The Montara assets, comprising the three

separate fields being Montara, Skua and Swift/Swallow, are produced

through an owned FPSO, the Montara Venture. As at 31 December 2020,

the Montara assets had proven plus probable reserves of 23.4mm

barrels of oil, 100% net to Jadestone.

The fields produce light sweet crude ( 42(o) API, 0.067% mass

sulphur), which typically sells at a premium to Dated Brent. The

premium in H1 2021 ranged between US$0.39/bbl to US$0.66/bbl. The

most recent lifting was agreed at a premium of US$1.17/bbl.

During H1 2021, there was an unplanned shutdown to replace a

significant number of critical valves on the FPSO. The shutdown was

for 16 days resulting in around 102,000 bbls of deferred

production. The original valves were installed during the FPSO's

construction and the replacements should last for the remaining

life of the field.

The Montara assets produced an average of 7,269 bbls/d in the

first half of 2021 (H1 2020: 9,440 bbls/d). This was lower than H1

2020 in part due to natural field production decline and the

unplanned shutdown to replace the defective critical valves.

The Group took the Valaris 107 drilling rig on hire on 14 June

2021 and commenced drilling the H6 development well on 28 June

2021. During the initial attempt to drill the horizontal section in

the well, mechanical issues with downhole equipment resulted in a

deviation from the planned well path, which necessitated a

sidetrack. The sidetrack was successful, resulting in a circa 1,200

metre horizontal section in the reservoir, encountering good

quality oil-bearing sands. The well is currently in the completions

phase before being tied in to the Montara infrastructure, after

which the rig will proceed with the Skua 11 and 10 workovers.

There were three liftings during H1 2021, resulting in total

sales of 1,536,307 bbls, compared to 1,461,096 bbls in H1 2020 from

the same number of liftings.

Stag oilfield

The Stag oilfield, in block WA-15-L, is located 60km offshore

Western Australia, in a water depth of approximately 47 metres. As

at 31 December 2020, the field contained total proved plus probable

reserves of 13.7mm barrels of oil, 100% net to Jadestone.

The Stag oilfield produces heavier sweet crude ( 18(o) API,

0.14% mass sulphur), which historically sells at a premium to Dated

Brent. The premium in 2021 ranged between US$8.30/bbl to

US$13.88/bbl(1) . The most recent lifting was agreed at a premium

of US$10.15/bbl.

During H1 2021, the Group continued its workover and maintenance

programme. As a result of COVID-19 constraints, production

continues to be impacted by a backlog of workovers that are

scheduled to be complete by the end of 2021.

Production was 2,665 bbls/d during H1 2021, compared to 2,676

bbls/d in H1 2020.

There were two liftings during H1 2021, generating total sales

of 504,485 bbls, compared to 518,193 bbls in H1 2020 from the same

number of liftings.

Malaysia

PM 323 and PM 329 PSCs (operated), PM 318 and AAKBNLP PSCs

(non-operated)

On 30 April 2021, the Group announced the execution of a sale

and purchase agreement ("SPA") with SapuraOMV Upstream Sdn. Bhd.

("SapuraOMV") to acquire SapuraOMV's Peninsular Malaysia assets

(the "PenMal Assets"), for an initial cash consideration of US$9.0

million, plus customary adjustments. Further contingent payments of

up to US$6.0 million are payable to SapuraOMV, which are tied to

potential full year oil price outcomes in 2021 and 2022(2) .

The acquisition completed on 1 August 2021, following the

satisfaction of all conditions precedent, resulting in a total

final cash consideration of US$20.0 million, comprising the

headline cash consideration of US$9.0 million plus adjustments of

US$11.0 million. The economic effective date of the acquisition was

1 January 2021, meaning the Group was entitled to all net cash

generated since 1 January 2021 up to the completion date. As a

result, at completion the Group obtained cash held by SapuraOMV

Upsteam (PM) Inc. of US$29.2 million, resulting in a net cash

receipt of US$9.2 million from the acquisition.

The PenMal Assets consist of four licences, two of which are

operated by the Group. The two operated licences comprise a 70%

operated interest in the PM329 PSC, containing the East Piatu

field, and a 60% operated interest in the PM323 PSC, which contains

the East Belumut, West Belumut and Chermingat fields. Both PSCs are

located approximately 230km northeast of Terengganu. All fields are

in production, and have been developed by way of fixed wellhead and

central processing platforms. The two non-operated licences consist

of 50% working interests in each of the PM318 PSC and in the Abu,

Abu Kecil, Bubu, North Lukut, and Penara oilfields ("AAKBNLP")

PSC.

The PenMal Assets add immediate cash flow from around 6,000

barrels of oil equivalent per day of low operating cost production,

on a net working interest basis, of which over 90% is oil. The

Group's Malaysian operated assets produce a very light sweet crude

that is blended to Tapis grade (43 API, 0.04% mass sulphur). The

PenMal Assets also increase the Group's 2P reserves by 34%, adding

12.5mm boe, representing the net working interest 2P reserves as at

31 December 2020, based on Jadestone's best estimate 2P reserves

production profile.

(1) With the change to the shuttle tanker model at Stag, the

premium negotiated for each Stag lifting is now typically based on

a CIF basis rather than a FOB basis. Care needs to be taken in

making comparisons with 2020 premia for the period up until

September 2020 when the switch to the tanker model occurred.

(2) If the average daily price of Dated Brent crude oil in

calendar 2021 (calendar 2022) exceeds US$65/bbl (US$70/bbl), then

Jadestone pays SapuraOMV an additional US$3.0 million (US$3.0

million).

The Group believes there is scope to add incremental value in

the near term through both reservoir optimisation and production

enhancement activities across both operated licences. Gas

re-injection is expected to be a key part of reservoir

optimisation, while production enhancement will initially be

focused on restoring idle wells to production.

There is also significant potential for further development

activity on the PenMal Assets. The focus will initially be on

infill drilling in the East Belumut field within the PM 323 PSC,

where the Group sees the potential for several infill campaigns

over the next few years. East Belumut has a medium heavy oil, which

is similar to the Stag field offshore Australia, where we have

experience of increasing recovery factors through tightening of the

well pattern. There are also some targeted opportunities on the

East Piatu and West Belumut fields, which will be evaluated in

parallel with the East Belumut infill potential.

In H1 2021, average production from the PenMal assets was 12,560

boe/d, equivalent to 7,492 boe/d, net to Jadestone's working

interest. The net average realised prices incorporated into the

liftings was US$ 65.90 /bbl.

Pending acquisition

New Zealand

Maari oilfield

On 16 November 2019, the Group executed an SPA with OMV New

Zealand Limited ("OMV New Zealand"), to acquire an operated 69%

interest in the Maari project, located 120km offshore New Zealand,

in a water depth of 100 metres, for a total headline cash

consideration of US$50.0 million and subject to customary closing

adjustments.

The transaction has achieved several key milestones with regard

to regulatory approvals, and the Group continues to focus on

securing the remaining ministerial consents from the New Zealand

Government, including the approval for transfer of operatorship.

Jadestone and OMV New Zealand continue to work towards completion

of the transaction, including extending the long stop date under

the SPA from 31 August 2021 to 31 December 2021, as announced on 8

September 2021.

The Group would assume the operatorship of the Maari project

upon completion of the transaction. The economic benefits from 1

January 2019 until the closing date will be adjusted in the final

consideration price. This is now anticipated to be a net receipt to

the Group.

As at 31 December 2020, the Maari project holds net 2P audited

reserves of 10.6mm barrels of oil.

Pre-production assets

Vietnam

Block 51 PSC and Block 46/07 PSC

Jadestone holds a 100% operated working interest in Block 46/07

PSC and Block 51 PSC, both in shallow waters in the Malay Basin,

offshore Southwest Vietnam.

The two contiguous blocks hold three discoveries: the Nam Du gas

field in Block 46/07 and the U Minh and Tho Chu gas/condensate

fields in Block 51, with 2C resources of 93.9mm boe.

The formal field development plan ("FDP") in respect of the Nam

Du/U Minh development was submitted to the Vietnam regulatory

authorities in late 2019. The Group deferred the project in

mid-March 2020, amid delays in Vietnamese Government approvals and

the drop in global oil prices due to COVID-19.

Discussions are continuing with Petrovietnam to agree a gas

production profile for the development, as a precursor to a gas

sales contract, and ultimately attaining government sanction for

the field development.

Indonesia

Lemang PSC

The Lemang PSC is located onshore Sumatra, Indonesia. The block

includes the Akatara gas field, with a net to Jadestone 2C resource

of 16.8mm boe.

The asset has been substantially de-risked with 11 wells drilled

into the structure, plus three years of oil production history, up

until the field ceased production of oil in December 2019.

On 30 June 2021, the Minister of Mines and Energy of Indonesia

issued a Ministerial decree, allocating gas sales from the Akatara

gas field in the Lemang PSC to a subsidiary of the national

electricity utility, PT Perusahaan Listrik Negara ("PLN").

The Ministerial decree facilitates the development and

commercialisation of the Akatara gas field and also the associated

production and sales of liquefied petroleum gas to the local

domestic market in Jambi, together with condensate sales to a local

buyer.

A heads of agreement ("HoA") in relation to gas sales from

Jadestone's planned development has also been executed with the PLN

subsidiary, PT Pelayanan Listrik Nasional Batam ("PLN Batam"), as

buyer. A fully termed gas sales agreement is currently under

negotiation with PLN Batam.

The Ministerial decree and HoA specify a gross sales volume of

20 BBtu/d starting in Q1 2024, and a plant gate sales price of

US$5.60/mmBtu, at a delivery point approximately 17 kilometres from

the field.

Indonesia's upstream regulator, SKK Migas, has approved the HoA

which is fully aligned with the Ministerial decree.

Exploration assets

Philippines

Service Contract 56 ("SC56")

Jadestone held a 25% interest in SC56 in partnership with

operator Total E&P Philippines B.V. ("Total").

On 18 November 2020, Total and Jadestone expressed their

intention to the Philippines Department of Energy ("DOE") to

voluntarily surrender the entire interest in SC56 and accordingly,

to terminate the contract. The effective date of termination was 21

December 2020.

Following the termination, the Group is liable for 25% of the

unfulfilled minimum work programme as at the termination date. At

the end of June 2021, the Group received the finalised unfulfilled

commitment amount from the DOE and is required to pay US$1.5

million, net 25% to Jadestone. The payment of this unfulfilled

commitment amount will be funded from the net arbitration proceeds

of US$2.2 million received from Total in 2020.

Service Contract 57 ("SC57")

The Group holds a 21% working interest in SC57, but it has been

under force majeure since 2011, and these conditions are expected

to continue for the foreseeable future.

FINANCIAL REVIEW

The following table provides selected financial information of

the Group, which was derived from, and should be read in

conjunction with, the unaudited condensed consolidated interim

financial statements for the period ended 30 June 2021.

Twelve

Six months Six months months

ended ended ended

30 June 30 June 31 December

USD'000 except where indicated 2021 2020 2020

-------------------------------------------- ----------- ----------- -------------

Sales volume, barrels (bbls) 2,040,792 1,979,289 4,165,612

Production, bbls/day 9,934 12,116 11,438

Realised oil price per barrel (US$/bbl)(1) 67.70 46.47 44.79

Revenue(2) 138,158 115,669 217,938

Production costs (62,492) (44,466) (105,338)

Operating costs per barrel (US$/bbl)(3) 28.16 23.27 23.10

Adjusted EBITDAX(3) 65,179 36,606 62,582

Unit depletion, depreciation &

amortisation (US$/bbl) 15.70 16.14 16.24

Impairment - - 50,455

Profit/(Loss) before tax 11,148 12,787 (57,238)

Profit/(Loss) after tax 2,495 5,360 (60,178)

Earnings/(Loss) per ordinary share:

basic & diluted (US$) 0.01 0.01 (0.13)

Dividend per ordinary share (US

) 0.59 0.54 1.62

Operating cash flows before movement

in working capital 54,376 57,054 86,883

Capital expenditure 16,221 19,521 24,065

Outstanding debt(3) - 25,574 7,386

Net cash(3) 48,291 78,281 82,055

Benchmark commodity price and realised price

The average benchmark Dated Brent crude oil price increased 62%

to US$64.98/bbl in the first half of 2021, compared to US$40.07/bbl

in H1 2020. The average benchmark Dated Brent oil price

incorporated into the Group's liftings was US$64.58/bbl in H1 2021,

a 68% increase compared to US$38.36/bbl in H1 2020.

(1) Realised oil price represents the actual selling price and

before any impact from hedging. The H1 2020 realised price is net

of marketing fees of US$0.08/bbl, whereas full year 2020 and H1

2021 realised oil prices are before marketing fees which are

recorded in production costs pursuant to IFRS 15 Revenue from

Contracts with Customers . With the change to the shuttle tanker

model at Stag, the premium negotiated for each Stag lifting is now

typically based on a CIF basis rather than a FOB basis. Care needs

to be taken in making comparisons with 2020 premia for the period

up until September 2020 when the switch to the tanker model

occurred.

(2) Revenue in H1 2020 and FY 2020 includes hedging income of

US$23.7 million and US$31.4 million, respectively, pursuant to the

characterisation of the two-year capped swap programme as cashflow

hedges under IFRS9 Financial Instruments. Losses realised on the H1

2021 swaps of US$4.6 million have been recognised in other

expenses, pursuant to the characterisation of the ad hoc H1 2021

six-month swap programme as derivative instruments measured at fair

value through profit or loss. The H1 2021 swap programme covered a

short time span (not exceeding a half yearly reporting period),

whereas the capped swap programme crossed three annual reporting

periods.

(3) Net cash at June 2021 excludes a Montara June lifting of

US$46.1 million, the proceeds of which were received in July 2021

(by comparison, there were no Montara or Stag liftings in December

2020 or June 2020). Operating costs per bbl, adjusted EBITDAX,

outstanding debt and net cash are non-IFRS measures and are

explained below.

The actual average realised price in H1 2021 increased by 4 6 %

to US$67.70/bbl, compared to US$46.47/bbl in H1 2020. The average

premium during the period was US$3.12/bbl, compared to US$8.19/bbl

in H1 2020. Premiums continue to improve with the latest liftings

achieving US$10.15/bbl and US$ 1.17/bbl at Stag and Montara,

respectively. With the change to the shuttle tanker model at Stag,

the premium negotiated for each Stag lifting is now typically based

on a CIF basis rather than a FOB basis. Care needs to be taken in

making comparisons with 2020 premia for the period up until

September 2020 when the switch to the tanker model occurred.

Production and liftings

The Group generated average production in H1 2021 of 9,934

bbls/d (H1 2020: 12,116 bbls/d). Production at Montara was lower

compared to H1 2020, primarily the result of natural field

production decline and an unplanned shutdown at Montara for 16 days

resulting in around 102,000 bbls of deferred production.

The Group had five liftings during the period, resulting in

sales of 2,040,792 bbls (H1 2020: 1,979,289 bbls, five

liftings).

Revenue

The Group generated US$138.2 million of revenue in H1 2021,

compared to US$115.7 million for the same period in 2020, an

increase of 19%. The increase in revenue was predominately due

to:

-- Higher average realised prices in H1 2021, compared to H1

2020 (US$67.70/bbl vs US$46.47/bbl), contributing an additional

US$41.8 million;

-- A 3% increase in lifted volumes in H1 2021, compared to H1

2020, generating additional revenue of US$4.2 million; and

-- Hedging income was nil(1) in H1 2021, a decline of US$23.7

million compared to H1 2020. The Group's two-year capped swap

cashflow hedge programme ran through to 30 September 2020.

Production costs

Production costs in H1 2021 were US$62.5 million (H1 2020:

US$44.5 million), an increase of US$18.0 million compared to H1

2020, predominately due to:

-- An additional US$8.8 million of net movement in closing crude

inventories of 448kbbls, due to liftings exceeding production

between the comparable periods;

-- Operational staff costs were higher by US$2.0 million, due to

additional contractors recruited to support repair and maintenance

activities and unfavorable foreign exchange movements in non-US$

salaries;

-- Repair and maintenance ("R&M") costs increased by US$2.2

million compared to H1 2020, due to additional spending on

fabrication and inspection activities on both Stag and Montara;

-- Workover costs were higher by US$4.4 million, due to limited

activity in 2020 in response to COVID-19 impacts on oil prices and

restrictions in crew movements. The Group resumed its workover

campaigns at Stag during H2 2020, with more workovers and well

interventions activities in the first half of 2021 compared to H1

2020; and

-- Transportation costs of US$0.5 million (H1 2020: nil)

following the change in offtake arrangements at Stag.

The termination of the Dampier Spirit FSO lease resulted in

estimated cash savings of US$3.7 million during H1 2021.

(1) The hedging loss in H1 2021 of US$4.6 million was recognised

as other expenses, as opposed to offsetting against revenue, due to

the adoption of a different accounting treatment for the H1 2021

commodity swap contracts. The two-year capped swap programme was

characterised as cashflow hedges under IFRS9 Financial Instruments

and realised gains recognised as part of revenue. Losses realised

on the H1 2021 swaps have been recognised in other expenses,

pursuant to the characterisation of the ad hoc H1 2021 six-month

swap programme as derivative instruments measured at fair value

through profit or loss. The H1 2021 programme covered a short time

span (not exceeding a half yearly reporting period), whereas the

capped swap programme crossed three annual reporting periods.

Unit operating costs per barrel were US$28.16 (H1 2020:

US$23.27/bbl) before workovers, an increase on H1 2020,

predominately due to lower production as a result of natural field

decline production, coupled with higher operational staff costs and

R&M costs as explained above.

DD&A, other operating expenses and income

DD&A charges in H1 2021 were US$39.7 million, versus H1 2020

of US$39.2 million, reflecting the slightly higher lifted volumes.

The DD&A on a unit basis for oil and gas properties remained

consistent with prior periods, while depreciation for right-of-use

assets reduced primarily as a result of the September 2020

termination of the Dampier Spirit leased FSO at Stag.

Other expenses in H1 2021 were US$12.5 million (H1 2020: US$16.6

million), including the fair value loss on commodity swaps of

US$4.6 million, and several one-off expenses including costs

associated with the acquisition of SapuraOMV's interests in

Peninsular Malaysia of US$0.8 million, business development related

expenses of US$1.3 million, COVID-19 related expenses of US$0.7

million, and costs associated with the corporate reorganisation of

US$ 1.1 million . In comparison, other expenses in H1 2020 mainly

comprised litigation expenses of US$8.8 million in relation to the

SC56 arbitration with Total, rig contract deferral costs in

Australia of US$3.0 million, and seismic acquisition costs incurred

at Montara of US$1.0 million.

H1 2021 other income totalled US$3.7 million (H1 2020: US$15.4

million), arising from rebate income of US$2.7 million, generated

from the sublease of right-of-use assets under the Group's

helicopter lease contract, and foreign exchange gains of US$1.0

million. In comparison, other income in H1 2020 included US$11.1

million awarded to the Group, for the breach of the SC56 farm out

agreement by Total, and fair value gain on capped swaps of US$2.1

million.

Taxation

The overall net tax expense of US$8.7 million (H1 2020: US$7.4

million) comprises current income tax expense of US$8.9 million (H1

2020: US$10.5 million), reduced by a deferred tax credit of US$0.2

million (H1 2020: US$3.1 million).

Current income tax expense of US$8.9 million (H1 2020: US$10.5

million) consists of corporate income tax of US$11.4 million,

offset by a PRRT tax credit of US$2.5 million, with a PRRT refund

received in August, as annual deductible cash payments exceeded

assessable cash receipts.

The deferred tax credit of US$0.2 million (H1 2020: US$3.1

million) has arisen from timing differences between the tax and

accounting treatment of depreciation for oil and gas

properties.

H1 2021 RECONCILIATION OF CASH

USD'000 USD'000

--------------------------------------------- --------- ------------

Cash and cash equivalents, 31 December 2020 80,996

Restricted cash, 31 December 2020 8,445

------------

Total cash and cash equivalent, 31 December

2020 89,441

Revenue 138,158

Other operating income 2,908

Operating costs (62,492)

Staff costs (11,427)

General and administrative expenses (12,771)

Cash flows from operations 54,376

Movement in working capital (53,254)(1)

Tax paid (8,004)

Interest paid (768)

Purchases of intangible exploration assets,

oil and gas properties, and

plant and equipment(2) (15,865)

Other investing activities 38

Financing activities (17,673)

------------

Total cash and cash equivalent, 30 June

2021 48,291(1)

============

NON-IFRS MEASURES

The Group uses certain performance measures that are not

specifically defined under IFRS, or other generally accepted

accounting principles. These non-IFRS measures comprise operating

cost per barrel (opex/bbl), adjusted EBITDAX, outstanding debt, and

net cash.

The following notes describe why the Group has selected these

non-IFRS measures.

(1) Total cash does not include a June lifting at Montara for

US$46.1 million, the proceeds of which were received in July 2021.

There were no December 2020 liftings/no outstanding trade

receivable from a lifting at the December 2020 year end. The

receivable from the June lifting is reflected in trade receivables

as at 30 June 2021.

(2) Total capital expenditure was US$16.2 million, comprising

total capital expenditure paid of US$15.9 million, plus accrued

capital expenditure of US$0.3 million.

Operating costs per barrel (Opex/bbl)

Opex/bbl is a non-IFRS measure used to monitor the Group's

operating cost efficiency, as it measures operating costs to

extract hydrocarbons from the Group's producing reservoirs on a

unit basis. Opex/bbl is defined as total production costs excluding

oil inventories movement, write down of inventories, workovers (to

facilitate better comparability period to period) and non-recurring

repair and maintenance. It also includes lease payments related to

operational activities, net of any income earned from right-of-use

assets involved in production, and foreign exchange gains arising

from foreign exchange forwards in respect of local currency

operating expenditure, and excludes depletion, depreciation and

amortisation and short term COVID-19 subsidies. Adjusted aggregate

production cost is then divided by total produced barrels for the

prevailing period, to determine the unit cost per barrel.

Six months Six months Twelve months

ended ended ended

30 June 30 June 31 December

USD'000 except where indicated 2021 2020 2020

---------------------------------------- ----------- ----------- -------------

Production costs (reported) 62,492 44,466 105,338

Adjustments

Lease payments related to

operating activities(1) 6,444 10,005 17,548

Movement in oil inventories(2) (5,642) 3,204 2,806

Workover costs(3) (10,027) (5,675) (21,686)

Write down of oil inventories(4) - (695) -

Impact from foreign exchange

derivatives

apportioned to production

costs(5) - - (2,649)

Other income(6) (2,286) - (3,634)

Non-recurring repair and maintenance(7) - - (1,619)

Transportation costs (541) - -

Australian Government JobKeeper

scheme 196 - 600

Adjusted production costs 50,636 51,305 96,704

----------- ----------- -------------

Total production, barrels 1,797,989 2,205,042 4,186,478

Operating costs per barrel 28.16 23.27 23.10

=========== =========== =============

(1) Lease payments related to operating activities are lease

payments considered to be operating costs in nature, including

leased helicopters for transporting offshore crews, and the Dampier

Spirit FSO rental fees prior to the lease termination in September

2020. The lease payments are added back to reflect the true cost of

production.

(2) Movement in oil inventories are added back to the

calculation to match the full cost of production with the

associated production volumes.

(3) Workover costs are excluded from opex/bbl so as to enhance

comparability. The frequency of workovers can vary significantly,

across reporting periods, particularly at Stag.

(4) Write down of oil inventories in H1 2020 is a non-cash

adjustment based on the requirements of IAS 2 Inventories to

reflect the closing inventories being recorded at the lower of cost

or net realisable value. It is not considered a production

cost.

(5) A portion of the net impact from foreign exchange hedging

instruments in 2020 was apportioned to production costs, based on

the Group's actual local currency expenditure during the hedging

period.

(6) Other income represents the rental income from a helicopter

rental contract (a right-of-use asset) to a third party.

(7) Non-recurring repair and maintenance costs in 2020 relates

to costs associated with Cyclone Damien.

Adjusted EBITDAX

Adjusted EBITDAX is a non-IFRS measure which does not have a

standardised meaning prescribed by IFRS. This non-IFRS measure is

included because management uses the information to analyse cash

generation and financial performance of the Group.

Adjusted EBITDAX is defined as profit from continuing activities

before income tax, finance costs, interest income, DD&A, other

financial gains and exploration.

The calculations of adjusted EBITDAX are as follow:

Six months Six months Twelve months

ended ended ended

30 June 30 June 31 December

USD'000 2021 2020 2020

Revenue 138,158 115,669 217,938

Production costs (62,492) (44,466) (105,338)

Staff costs (12,067) (11,425) (21,903)

Impairment of assets - - (50,455)

Other expenses (12,501) (16,642) (26,918)

Other income, excluding interest

income 3,643 11,075 26,119

Other financial gains - 359 359

----------- ----------- --------------

Unadjusted EBITDAX 54,741 54,570 39,802

Non-recurring

Net loss/(gain) from oil

price derivatives 4,633 (23,695) (30,889)

Impairment of assets - - 50,455

Non-recurring opex(1) 1,574 3,311 8,270

Net litigation income - (2,295) (3,005)

Rig contract deferred costs - 3,000 3,000

Gain on contingent consideration - (359) (359)

Gain from termination of

FSO lease - - (6,429)

Others(2) 4,231 2,074 1,737

----------- ----------- --------------

10,438 (17,964) 22,780

----------- ----------- --------------

Adjusted EBITDAX 65,179 36,606 62,582

=========== =========== ==============

(1) Includes one-off major maintenance/well intervention

activities, in particular the workover campaigns at Skua 10, Skua

11 during H1 2021 and H3 in 2020, as well as other non-recurring

production expenditures such as the repair and maintenance costs

associated with weather downtime in 2020.

(2) Includes Maari transition team costs, Australian Government

JobKeeper scheme, business development and corporate

re-organisation costs, as well as Montara seismic acquisition costs

associated with the non-licence area and gain on contingent

consideration in 2020.

Outstanding debt

Total borrowings, as recorded in the Group's consolidated

statement of financial position, represents the carrying amount of

the Group's interest bearing financial indebtedness, measured at

amortised cost pursuant to IFRS 9 Financial Instruments.

Outstanding debt is a non-IFRS measure which does not have a

standardised meaning prescribed by IFRS. Management uses this

measure to manage the capital structure, and make adjustments to

it, based on the funds available to the Group. Outstanding debt is

defined as long and short-term interest bearing debt, with

effective interest method financing costs added back (i.e.

excluded), and excluding derivatives.

As at 30 June 2021, the Group has no outstanding interest

bearing financial indebtedness of any kind, following the final

scheduled repayment of the 2018 reserves based loan at the end of

Q1 2021.

30 June 30 June 31 December

USD'000 2021 2020 2020

----------------------------- -------- -------- -----------

Short term borrowing - 25,053 7,296

Add back: effective interest

method financing costs - 521 90

--------- -------- -----------

Outstanding debt - 25,574 7,386

========= ======== ===========

Net cash

Net cash is a non-IFRS measure which does not have a

standardised meaning prescribed by IFRS. Management uses this

measure to analyse the financial strength of the Group. The measure

is used to ensure capital is managed effectively in order to

support its ongoing operations, and to raise additional funds, if

required.

30 June 30 June 31 December

USD'000 2021 2020 2020

-------------------------- -------- ---------- -----------

Outstanding debt - (25,574) (7,386)

Cash and cash equivalents 47,291 95,457 80,996

Restricted cash 1,000 8,398 8,445

-------- ---------- -----------

Net cash 48,291 78,281 82,055

======== ========== ===========

Net cash is defined as the sum of cash and cash equivalents less

outstanding debt. Net cash as at 30 June 2021 excludes a Montara

June lifting of US$46.1 million, the proceeds of which were

received in July 2021 (by comparison, there were no Montara or Stag

liftings in December 2020 or June 2020). The net cash as at 30 June

2020 included the minimum working capital balance of US$15.0

million required under the Group's RBL, and restricted cash of

US$8.4 million in the RBL debt service reserve account, less

outstanding debt. The restricted cash of US$1.0 million as at 30

June 2021 represents a cash collateralised bank guarantee placed

with the Indonesian regulator with respect to a joint study

agreement entered into by the Group in Indonesia. The bank

guarantee was released in August 2021.

2021 PRINCIPAL FINANCIAL RISKS AND UNCERTAINTIES

The Group manages principal risks and uncertainties via its risk

management framework. The Group is exposed to a variety of

political, technological, environmental, operational and financial

risks which are monitored and/or mitigated to acceptable

levels.

The Group's risk management framework provides a systematic

process for the identification of the principal risks which have

the possibility of impacting the Group's strategic objectives. The

board regularly reviews the principal risks and defines corporate

targets based on acceptable levels of risk. The board assesses

material risks quarterly with a full review of the risk matrix at

least twice per year.

Details of the principal risks and uncertainties facing the

Group as at 30 June 2021 remain unchanged from the risks disclosed

in the 2020 Annual Report pages 32 to 34. The Group's risk

mitigation activities also remain unchanged.

GOING CONCERN

The directors have adopted the going concern basis in preparing

these unaudited condensed consolidated interim financial

statements, having considered the principal financial risks and

uncertainties of the Group.

The directors believe that the Group is well placed to manage

its financing and other business risks satisfactorily. The

directors have a reasonable expectation that the Group will have

adequate resources to continue in operation for at least 12 months

from the date of these unaudited condensed consolidated interim

financial statements. They therefore consider it appropriate to

adopt the going concern basis of accounting in preparing these

financial statements.

STATEMENT OF DIRECTORS' RESPONSIBILITIES

The directors confirm that to the best of their knowledge:

a. the condensed consolidated interim set of financial

statements has been prepared in accordance with IAS 34 Interim

Financial Reporting ;

b. the interim management report includes a fair review of the

information required by DTR 4.2.7R (indication of important events

during the first six months and description of principal risks and

uncertainties for the remaining six months of the year); and

c. the interim management report includes a true and fair review

of the information required by DTR 4.2.8R (disclosure of related

parties' transactions and changes therein).

By order of the Board,

Paul Blakeley Dan Young

Executive Director Executive Director

President & Chief Executive Officer Chief Financial

Officer

9 September 2021 9 September 2021

Cautionary statements

This announcement may contain certain forward-looking statements

with respect to the Company's expectations and plans, strategy,

management's objectives, future performance, production, reserves,

costs, revenues and other trend information. These statements are

made by the Company in good faith based on the information

available at the time of this announcement, but such statements

should be treated with caution due to inherent risks and

uncertainties. These statements and forecasts involve risk and

uncertainty because they relate to events and depend upon

circumstances that may occur in the future. There are a number of

factors which could cause actual results or developments to differ

materially from those expressed or implied by these forward-looking

statements and forecasts. The statements have been made with

reference to forecast price changes, economic conditions and the

current regulatory environment. Nothing in this announcement should

be construed as a profit forecast. Past share performance cannot be

relied upon as a guide to future performance. The Company does not

assume any obligation to publicly update the information, except as

may be required pursuant to applicable laws.

The oil, natural gas and natural gas liquids information in this

announcement has been prepared in accordance with National

Instrument 51-101 - Standards of Disclosure for Oil and Gas

Activities and the Canadian Oil and Gas Evaluation Handbook.

A barrel of oil equivalent ("boe") is determined by converting a

volume of natural gas to barrels using the ratio of six thousand

cubic feet ("mcf") to one barrel. Boes may be misleading,

particularly if used in isolation. A boe conversion ratio of 6

mcf:1 boe is based on an energy equivalency conversion method

primarily applicable at the burner tip and does not represent a

value equivalency at the wellhead. Given that the value ratio based

on the current price of oil as compared to natural gas is

significantly different from the energy equivalency of 6:1,

utilising a conversion on a 6:1 basis may be misleading as an

indication of value.

The technical information contained in this announcement has

been prepared in accordance with the June 2018 guidelines endorsed

by the Society of Petroleum Engineers, World Petroleum Congress,

American Association of Petroleum Geologists and Society of

Petroleum Evaluation Engineers Petroleum Resource Management

System.

Henning Hoeyland of Jadestone Energy plc, Group Subsurface

Manager with a Masters degree in Petroleum Engineering, and who is

a member of the Society of Petroleum Engineers and has been

involved in the energy industry for more than 19 years, has read

and approved the technical disclosure in this regulatory

announcement.

The information contained within this announcement is considered

to be inside information prior to its release, as defined in

Article 7 of the Market Abuse Regulation No. 596/2014 which is part

of UK law by virtue of the European Union (Withdrawal) Act 2018,

and is disclosed in accordance with the Company's obligations under

Article 17 of those Regulations.

Condensed Consolidated Statement of Profit or Loss and Other

Comprehensive Income

for the six months ended 30 June 2021

Six months Six months Twelve months

ended ended ended 31

30 June 30 June December

2021 2020 2020

Unaudited Unaudited Audited

Notes USD'000 USD'000 USD'000

------------------------------------ ------ ----------- ----------- --------------

Consolidated statement

of profit or loss

Revenue 138,158 115,669 217,938

Production costs 6 (62,492) (44,466) (105,338)

Depletion, depreciation

and amortisation 6 (39,697) (39,230) (84,642)

Staff costs (12,067) (11,425) (21,903)

Other expenses 6 (12,501) (16,642) (26,918)

Impairment of assets 7 - - (50,455)

Other income 3,681 15,356 26,376

Finance costs 8 (3,934) (6,834) (12,655)

Other financial gains - 359 359

----------- ----------- --------------

Profit/(Loss) before tax 11,148 12,787 (57,238)

Income tax expense 9 (8,653) (7,427) (2,940)

----------- ----------- --------------

Profit/(Loss) for the period/year 2,495 5,360 (60,178)

=========== =========== ==============

Earnings/(Loss) per ordinary

share

Basic and diluted (US$) 10 0.01 0.01 (0.13)

=========== =========== ==============

Consolidated statement

of comprehensive

Income

Profit/(Loss) for the period/year 2,495 5,360 (60,178)

Other comprehensive income/(loss)

Items that may be reclassified

subsequently

to profit or loss:

Gain on unrealised cash

flow hedges - 26,765 26,093

Hedging gain reclassified

to profit or loss - (23,697) (31,364)

----------- ----------- --------------

- 3,068 (5,271)

Tax (expense)/credit relating

to

components of other comprehensive

income/(loss) - (921) 1,583

----------- ----------- --------------

Other comprehensive income/(loss) - 2,147 (3,688)

----------- ----------- --------------

Total comprehensive income/(loss)

for the

period/year 2,495 7,507 (63,866)

=========== =========== ==============

Condensed Consolidated Statement of Financial Position as at 30

June 2021

30 June 30 June 31 December

2021 2020 2020

Unaudited Unaudited Audited

Notes USD'000 USD'000 USD'000

---------------------------------- ------ ---------- -------------- -----------------

Assets

Non-current assets

Intangible exploration

assets 11 96,443 135,105 100,670

Oil and gas properties 12 303,625 347,829 317,676

Plant and equipment 12 1,584 1,680 1,652

Right-of-use assets 12 18,358 51,070 23,673

Other receivables 13 4,451 - 4,404

Restricted cash - 10,000 -

Deferred tax assets 16,318 16,535 19,727

---------- -------------- -----------------

Total non-current assets 440,779 562,219 467,802

---------- -------------- -----------------

Current assets

Inventories 34,812 46,399 45,361

Trade and other receivables 13 63,135 12,637 7,110

Derivative financial instruments 19 - 10,417 -

Restricted cash 1,000 8,398 8,445

Cash and cash equivalents 47,291 95,457 80,996

---------- -------------- -----------------

Total current assets 146,238 173,308 141,912

---------- -------------- -----------------

Total assets 587,017 735,527 609,714

========== ============== =================

Equity and liabilities

Equity

Capital and reserves

Share capital 14 392 466,573 466,979

Merger reserve 15 146,269 - -

Share based payments reserve 25,625 24,492 24,985

Hedging reserve - 5,835 -

Accumulated losses (12,710) (263,291) (331,322)

---------- -------------- -----------------

Total equity 159,576 233,609 160,642

---------- -------------- -----------------

Non-current liabilities

Provisions 16 290,693 283,194 288,224

Lease liabilities 9,086 33,881 13,305

Tax liabilities - - 26,896

Deferred tax liabilities 54,564 63,155 58,229

---------- -------------- -----------------

Total non-current liabilities 354,343 380,230 386,654

---------- -------------- -----------------

30 June 30 June 31 December

2021 2020 2020

Unaudited Unaudited Audited

Notes USD'000 USD'000 USD'000

---------------------------------- ------ ---------- -------------- -----------------

Current liabilities

Borrowings 17 - 25,053 7,296

Lease liabilities 11,625 20,420 12,478

Trade and other payables 18 22,760 22,574 32,192

Provisions 16 3,091 1,705 4,558

Derivative financial instruments 19 - - 471

Tax liabilities 35,622 51,936 5,423

---------- -------------- -----------------

Total current liabilities 73,098 121,688 62,418

---------- -------------- -----------------

Total liabilities 427,441 501,918 449,072

---------- -------------- -----------------

Total equity and liabilities 587,017 735,527 609,714

========== ============== =================

Condensed Consolidated Statement of Changes in Equity as at 30

June 2021

Share

based

Share Merger payments Hedging Accumulated

capital reserve reserve reserve losses Total

USD'000 USD'000 USD'000 USD'000 USD'000 USD'000

--------------------- ---------- -------- --------- --------- ------------ ---------

As at 1 January

2020 466,573 - 23,857 3,688 (268,651) 225,467

Profit for

the period - - - - 5,360 5,360

Other

comprehensive

income for

the

period - - - 2,147 - 2,147

---------- --------- --------- ------------ ---------

Total

comprehensive

income for

the

period - - - 2,147 5,360 7,507

---------- -------- --------- --------- ------------ ---------

Share-based

compensation - - 635 - - 635

--------

As at 30

June 2020 466,573 - 24,492 5,835 (263,291) 233,609

========== ======== ========= ========= ============ =========

As at 1 January

2020 466,573 - 23,857 3,688 (268,651) 225,467

Loss for

the year - - - - (60,178) (60,178)

Other

comprehensive

loss for

the year - - - (3,688) - (3,688)

---------- --------- --------- ------------ ---------

Total

comprehensive

loss for

the year - - - (3,688) (60,178) (63,866)

---------- -------- --------- --------- ------------ ---------

Dividend

paid - - - - (2,493) (2,493)

Share-based

compensation - - 1,128 - - 1,128

Shares issued,

net of

transaction

costs 406 - - - - 406

---------- -------- --------- --------- ------------ ---------

Total transactions

with owners,

recognised

directly

in equity 406 - 1,128 - (2,493) (959)

---------- --------- --------- ------------ ---------

As at 31

December

2020 466,979 - 24,985 - (331,322) 160,642

========== ======== ========= ========= ============ =========

Share

based

Share Merger payments Hedging Accumulated

capital reserve reserve reserves losses Total

USD'000 USD'000 USD'000 USD'000 USD'000 USD'000

--------------------- ---------- -------- --------- --------- ------------ ---------

As at 1 January

2021 466,979 - 24,985 - (331,322) 160,642

Profit for

the period,

representing

total

comprehensive

income for

the

period - - - - 2,495 2,495

---------- -------- --------- --------- ------------ ---------

Dividend

paid - - - - (5,000) (5,000)

Share-based

compensation - - 640 - - 640

Shares issued,

net of transaction

costs 799 - - - - 799

Capital reduction (467,386) 146,269 - - 321,117 -

---------- -------- --------- --------- ------------ ---------

Total transactions

with owners,

recognised

directly

in equity (466,587) 146,269 640 - 316,117 (3,561)

---------- -------- --------- --------- ------------ ---------

As at 30

June 2021 392 146,269 25,625 - (12,710) 159,576

========== ======== ========= ========= ============ =========

Condensed Consolidated Statement of Cash Flows for the six

months ended 30 June 2021

Six months Six months Twelve

ended ended months ended

30 June 30 June 31 December

2021 2020 2020

Unaudited Unaudited Audited

Notes USD'000 USD'000 USD'000

------------------------------------ ------ ----------- ----------- -------------

Operating activities

Profit/(Loss) before tax 11,148 12,787 (57,238)

Adjustments for:

Depletion, depreciation

and amortisation 6 33,338 30,352 68,414

Depreciation of right-of-use 6 /

assets 12 6,359 8,878 16,228

Other finance costs 7 3,784 5,260 10,289

Share based payments 640 635 1,128

Provision for doubtful 201 - -

debts

Interest expense 7 150 1,574 2,366

Unrealised foreign exchange

(gain)/loss (735) - 1,495

Reversal of fair value (471) - -

loss on oil derivatives

Interest income (38) (251) (257)

Write down of inventories - 695 -

Loss on ineffective hedge

recycled to profit

or loss - 2 4

Fair value gain on foreign

exchange forward

Contracts - (2,076) -

Change in Stag FSO provision - (443) (5,047)

Decrease in fair value

of Montara contingent

Payments - (359) (359)

Impairment of intangible

exploration assets 7 - - 50,455

Fair value loss on oil

derivatives - - 471

Inventories written off - - 173

Provision of slow moving

inventories - - 143

Gain from termination of

right-of-use asset - - (1,382)

Operating cash flows before

movements in

working capital 54,376 57,054 86,883

(Increase)/Decrease in trade

and other

receivables (53,777) 29,646 35,560

Decrease/(Increase) in inventories 5,719 (10,234) (14,071)

(Decrease)/Increase in trade

and other

payables (5,196) (10,163) 3,736

----------- ----------- -------------

Cash generated from operations 1,122 66,303 112,108

Interest paid (768) (1,110) (1,542)

Tax paid (8,004) (3,260) (25,969)

----------- ----------- -------------

Net cash (used in)/generated

from operating

activities (7,650) 61,933 84,597

----------- ----------- -------------

Six months Six months Twelve

ended ended months ended

30 June 30 June 31 December

2021 2020 2020

Unaudited Unaudited Audited

Notes USD'000 USD'000 USD'000

------------------------------------ ------ ----------- ----------- -------------

Investing activities

Net cash outflows on acquisition

of Lemang

PSC - - (11,959)

Payment for oil and gas

properties 12 (14,173) (1,750) (4,732)

Payment for plant and equipment 12 (216) (106) (473)

Payment for intangible exploration

assets 11 (1,476) (11,129) (14,253)

Transfer from debt service

reserve account 7,445 5,087 5,040

Interest received 38 251 257

----------- ----------- -------------

Net cash used in investing

activities (8,382) (7,647) (26,120)

----------- ----------- -------------

Financing activities

Net proceeds from issuance

of shares 799 - 406

Release of deposit for bank

guarantee - - 10,000

Dividends paid (5,000) - (2,493)

Repayment of borrowings (7,356) (24,570) (42,766)

Repayment of lease liabilities (6,116) (10,193) (18,562)

Net cash used in financing

activities (17,673) (34,763) (53,415)

----------- ----------- -------------

Net (decrease)/increase

in cash and cash

equivalents (33,705) 19,523 5,062

Cash and cash equivalents

at beginning of the

period/year 80,996 75,934 75,934

----------- ----------- -------------

Cash and cash equivalents

at end of the

period/year 47,291 95,457 80,996

=========== =========== =============

Explanation Notes to the Condensed Consolidated Interim

Financial Statements

for the six months ended 30 June 2021

1. GENERAL INFORMATION

Jadestone Energy plc (the "Company" or "Jadestone") is an oil

and gas company incorporated in England and Wales. The Company was

incorporated on 22 January 2021, company registration number

13152520. The Company became the ultimate parent company on 23

April 2021, following the completion of a corporate reorganisation

(see below).

The Company's shares are traded on AIM under the symbol

"JSE".

The financial statements are expressed in United States

Dollars.

The Company and its subsidiaries (the "Group") are engaged in

production, development, exploration and appraisal activities in

Australia, Malaysia, Vietnam, Indonesia and the Philippines. The

Group's producing assets during H1 2021 were in the Vulcan

(Montara) and Carnarvon (Stag) basins, offshore Western

Australia.

The Company's head office is located at 3 Anson Road, #13-01

Springleaf Tower, Singapore 079909. The registered office of the

Company is Suite 1, 3rd Floor, 11 - 12 St James's Square, London

SW1Y 4LB.

These financial statements were authorised for issue and release

by the Company's board of directors on 9 September 2021, on the

recommendation of the audit committee.

2. DIVIDS

On 11 June 2021, the directors declared a second interim 2020

dividend of 1.08 US cents/share, equivalent to 0.77 GB pence/share,

based on an exchange rate of 0.7087, equivalent to a total

distribution of US$5.0 million, or US$7.5 million in respect of

total 2020 dividends. The dividend was paid on 30 June 2021.

On 9 September 2021, the directors declared a 2021 interim

dividend of 0.59 US cents/share (or equivalent to 0.43 GB

pence/share based on the current spot exchange rate of 0.7257 ),

equivalent to a total distribution of US$ 2.8 million. The dividend

will be paid on a gross basis, in US dollars.

3. SIGNIFICANT EVENTS DURING THE PERIOD

Corporate reorganisation

The Company completed an internal reorganisation on 23 April

2021, with Jadestone Energy plc becoming the ultimate holding

company of the Jadestone group of companies. The shares of

Jadestone Energy Inc., the former ultimate holding company, have

been replaced on a one-for-one basis with shares of Jadestone

Energy plc. Following the completion of the internal

reorganisation, Jadestone Energy plc was admitted to AIM for

trading on 26 April 2021 (Jadestone Energy Inc. shares ceased

trading on 23 April 2021).

The internal reorganisation has not resulted in a change in

control in the ultimate holding company of the Group and,

accordingly, has not resulted in a change in control in the

ultimate shareholding in any of the companies or assets of the

Group. Further, the internal reorganisation has not resulted in a

change in the management of any of the Group's companies or

assets.

Acquisition of SapuraOMV Peninsular Malaysia assets

On 30 April 2021, the Group executed a sale and purchase

agreement with SapuraOMV Upstream Sdn. Bhd. ("SapuraOMV") to

acquire SapuraOMV's Peninsular Malaysia assets (the "PenMal

Assets"), for a total cash consideration of US$20.0 million, which

included a headline price of US$9.0 million plus further working

capital adjustments of US$11.0 million, and subject to certain

subsequent contingent payments related to the price of average

annual Dated Brent throughout 2021 and 2022. The acquisition was

completed on 1 August 2021.

The economic effective date of the acquisition was 1 January

2021, meaning the Group is entitled to all net cash generated from

the PenMal Assets from 1 January 2021 to 31 July 2021. As a result,

at completion the Group obtained cash held by SapuraOMV Upstream

(PM) Inc. of US$29.2 million, resulting in a net cash receipt of

US$9.2 million for the acquisition.

The PenMal Assets comprise four licences, two of which are

operated by the Group. These consist of a 70% operated interest in

the PM329 PSC, containing the East Piatu field, and a 60% operated

interest in the PM323 PSC, which contains the East Belumut, West

Belumut and Chermingat fields. The other two licences consist of

50% non-operated working interests in the PM318 and AAKBNLP

PSCs.

Oil price commodity contracts

On 16 February 2021, the Group entered into commodity swap

contracts to hedge 31% of its planned production volumes from April

to June 2021, to provide downside oil price protection during the

period leading into the 2021 offshore Australia capital programme.

The average swap price, referenced to Dated Brent, was set at

US$61.40/bbl.

4. SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

BASIS OF PREPARATION

These unaudited condensed consolidated interim financial

statements (the "financial statements") are prepared in accordance

with International Accounting Standard IAS 34 Interim Financial

Reporting, as adopted by the European Union, on a going concern

basis under the historical cost convention.

These unaudited condensed consolidated interim financial

statements do not comprise statutory accounts within the meaning of

section 435 of the Companies Act 2006 ("the Act"). They do not

contain all disclosures required by IFRS for annual financial

statements and should be read in conjunction with Jadestone's

audited consolidated financial statements for the year ended 31

December 2020. Jadestone's auditors reported on those accounts;

their report was unqualified and did not draw attention to any

matters by way of emphasis.

These financial statements have been prepared on an historical

cost basis, except for financial instruments classified as

financial instruments at fair value, which are stated at their fair

values, and operating leases which are stated at the present value

of future cash payments.

In addition, these financial statements have been prepared using

the accrual basis of accounting.

Common control transaction

As disclosed in Note 3, the Company has completed an internal

reorganisation, with the shares of Jadestone Energy Inc. having

been replaced on a one-for-one basis with shares of Jadestone

Energy plc. Accordingly, Jadestone Energy plc was admitted to AIM

for trading on 26 April 2021. There is no change in control in the

ultimate holding company of the Group arising from the completion

of the internal reorganisation.

IFRS 3 Business Combinations does not prescribe the presentation

and disclosure requirements under common control transaction. The

Group has chosen to issue these unaudited condensed consolidated

interim financial statements under the name of Jadestone Energy plc

, as if they are a continuation of the financial statements of

Jadestone Energy Inc. and Jadestone Energy plc had been in

existence throughout the reported financial period. The following

have been reflected in these unaudited condensed consolidated

interim financial statements in relation to the common control

transaction:

a) the asset and liabilities of Jadestone Energy plc and

Jadestone Energy Inc. ("JEI") Group have been recognised at their

book values immediately prior to the internal reorganisation;

b) the pre-internal reorganisation accumulated losses recognised

in these consolidated financial statements are those of JEI

Group;

c) the amount recognised as issued equity instruments in these

consolidated financial statements is the issued and paid-up share

capital share capital of JEI immediately before the internal

reorganisation;

d) the equity structure appearing in these consolidated

financial statements (i.e. the number and type of equity