TIDMJSE

RNS Number : 0080J

Jadestone Energy PLC

18 August 2021

Guidance and Operations Update

18 August 2021-Singapore: Further to the announcement on 9 June

2021 and the closing of the SapuraOMV Peninsular Malaysia

acquisition earlier this month, Jadestone Energy plc ("Jadestone",

the "Company" or together with subsidiaries, the "Group"), an

independent oil and gas production company focused on the Asia

Pacific region, provides updated operational and financial guidance

for 2021 ahead of its H1 2021 operating and financial results on 9

September 2021:

l H1 2021 Group production was slightly ahead of plan at 9,934

bbls/d;

l Average full-year 2021 production guidance of between

11,500-13,500 boe/d remains unchanged

- Includes 9,000-10,500 bbls/d from the Australia assets,

reflecting H1 2021 performance, and the revised contributions from

the Montara H6 infill well and the Skua 10 and 11 subsea well

workovers, due to the late arrival of the Valaris 107 drilling rig

and longer than expected drilling at the Montara H6 well causing a

circa one month delay in the work programme;

- Slight delays to Stag workovers due to COVID restrictions on people and equipment; and

- Includes daily production from the Peninsular Malaysia assets

of a little over 6,000 boe/d, post-closing on 1 August 2021 net to

Jadestone and consistent with production levels at the time of the

announcement of the acquisition, with some potential upside,

equivalent to 2,500-3,000 boe/d annualised production.

l Average 2021 unit production cost guidance is unchanged at

US$25.50-29.50/boe, and reflects the updated production guidance

outlined above;

l Spending in 2021 of US$105-115 million, compared to US$85-95

million previously, which includes capital expenditure and major

non-recurring opex

- Reflects updated estimates on the anticipated scope of work

necessary to restore production from the Skua subsea wells, and the

revised cost of the H6 infill well at Montara, where the well has

been sidetracked due to mechanical equipment issues.

l While Jadestone and the seller remain committed to the

Company's acquisition of the 69% operated working interest in the

Maari asset offshore New Zealand, the Company believes it is

prudent to exclude the asset from guidance until there is further

clarity on the timing of requisite government approvals. With the

economic date of the transaction unchanged at 1 January 2019, all

production and resultant free cash flow generated from the asset

since that point continues to accrue to the Company up to the

completion date, subject to completion; and

l Reiterate commitment to pay a 2021 cash dividend, in keeping

with the Company's dividend policy, and to maintain and grow

dividends in line with underlying cashflow generation.

Paul Blakeley, President and CEO commented:

"2021 marks the return to a phase of active investment across

our producing assets, following an extraordinarily challenging

2020, and we welcome the relative stability and more favourable

investment climate our industry is seeing this year. Further, we

remain well positioned to capitalise on the growing number of

acquisition opportunities in our core areas, without sacrificing

our rigorous sub-surface screening and clear focus on returns.

"With more than half of 2021 behind us, we have updated our

guidance to reflect the delayed timing of work programme activities

and Maari closing, offset by the recent Peninsular Malaysia

transaction. Full year production guidance remains unchanged at

11,500 - 13,500 boe/d.

"We have removed the impact of the Maari transaction for this

year, reflecting ongoing uncertainty in the timing of New Zealand

government approval. While the government seems more focused on new

legislation to provide clarity around decommissioning security, we

have, in the meantime, provided all the information requested by

the relevant regulator in seeking their approval . Importantly,

removing Maari from guidance is more than offset by the inclusion

of the Peninsular Malaysia acquisition from 1 August.

"The quality of the opportunity set across our asset portfolio

remains unchanged and the incremental cashflow from rising

production will benefit the business in the last quarter this year

and throughout 2022, rather than during last year's depressed price

environment. I look forward to the successful completion of the

Montara activity programme and the full benefit of the Peninsular

Malaysia assets increasing Jadestone's production towards 20,000

boe/d."

H1 2021 report and new Investor Relations Manager

The Company intends to publish its unaudited H1 2021 operating

and financial results on 9 September 2021 and will host a

conference call that day. Details will be published in due

course.

The Company is pleased to announce the appointment of Phil

Corbett as Investor Relations Manager from early August 2021.

Contact details can be found below.

For further information, please contact:

Jadestone Energy plc

Paul Blakeley, President and CEO +65 6324 0359 (Singapore)

Dan Young, CFO

Phil Corbett, Investor Relations Manager +44 7713 687467 (UK)

ir@jadestone-energy.com

Stifel Nicolaus Europe Limited (Nomad, +44 (0) 20 7710 7600 (UK)

Joint Broker)

Callum Stewart

Jason Grossman

Ashton Clanfield

Jefferies International Limited (Joint +44 (0) 20 7029 8000 (UK)

Broker)

Tony White

Will Soutar

Camarco (Public Relations Advisor) +44 (0) 203 757 4980 (UK)

Billy Clegg jse@camarco.co.uk

James Crothers

About Jadestone Energy

Jadestone Energy plc is an independent oil and gas company

focused on the Asia Pacific region. It has a balanced, low risk,

full cycle portfolio of development, production and exploration

assets in Australia, Malaysia, Indonesia, Vietnam and the

Philippines.

The Company has a 100% operated working interest in the Stag

oilfield and in the Montara project, both offshore Australia. Both

the Stag and Montara assets include oil producing fields, with

further development and exploration potential. The Company also has

interests in four oil producing licences offshore Peninsula

Malaysia; two operated and two non-operated positions. Further, the

Company has a 100% operated working interest in two gas development

blocks in Southwest Vietnam, and an operated 90% interest in the

Lemang PSC, onshore Sumatra, Indonesia, which includes the Akatara

gas field.

In addition, the Company has executed a sale and purchase

agreement to acquire an operated 69% interest in the Maari Project,

shallow water offshore New Zealand, and anticipates completing the

transaction in 2021, upon receipt of customary approvals.

Led by an experienced management team with a track record of

delivery, who were core to the successful growth of Talisman's

business in Asia, the Company is pursuing an acquisition strategy

focused on growth and creating value through identifying,

acquiring, developing and operating assets in the Asia Pacific

region.

Jadestone Energy plc is listed on the AIM market of the London

Stock Exchange. The Company is headquartered in Singapore. For

further information on the Company please visit

www.jadestone-energy.com .

Cautionary statements

This announcement may contain certain forward-looking statements

with respect to the Company's expectations and plans, strategy,

management's objectives, future performance, production, reserves,

costs, revenues and other trend information. These statements are

made by the Company in good faith based on the information

available at the time of this announcement, but such statements

should be treated with caution due to inherent risks and

uncertainties. These statements and forecasts involve risk and

uncertainty because they relate to events and depend upon

circumstances that may occur in the future. There are a number of

factors which could cause actual results or developments to differ

materially from those expressed or implied by these forward-looking

statements and forecasts. The statements have been made with

reference to forecast price changes, economic conditions and the

current regulatory environment. Nothing in this announcement should

be construed as a profit forecast. Past share performance cannot be

relied upon as a guide to future performance. The Company does not

assume any obligation to publicly update the information, except as

may be required pursuant to applicable laws.

The information contained within this announcement is considered

to be inside information prior to its release, as defined in

Article 7 of the Market Abuse Regulation No. 596/2014 which is part

of UK law by virtue of the European Union (Withdrawal) Act

2018.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

UPDPPMATMTTBMMB

(END) Dow Jones Newswires

August 18, 2021 02:00 ET (06:00 GMT)

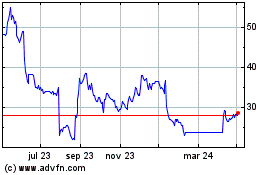

Jadestone Energy (LSE:JSE)

Gráfica de Acción Histórica

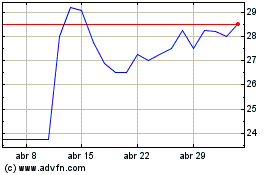

De Mar 2024 a Abr 2024

Jadestone Energy (LSE:JSE)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024