TIDMJOG

RNS Number : 9417Q

Jersey Oil and Gas PLC

03 March 2021

3 March 2021

Jersey Oil and Gas plc

("Jersey Oil & Gas", "JOG" or the "Company")

Greater Buchan Area Development Project

Concept Select Update

"Potential for 172 MMboe 2C contingent resource estimates to be

developed from a fully electrified platform"

Jersey Oil & Gas (AIM: JOG), an independent upstream oil and

gas company focused on the UK Continental Shelf ("UKCS") region of

the North Sea, is pleased to announce the key findings of its

detailed and comprehensive Concept Select Report ("CSR") in respect

of its Greater Buchan Area ("GBA") Development Project which

contains an aggregate 172 million barrels of oil equivalent

("MMboe") 2C contingent resource estimates of light sweet crude and

associated gas. The planned development is centred on resuming

production at the Buchan oil field and producing the J2 and Verbier

oil discoveries as well as other existing and yet to find

discoveries within the GBA as future upside.

Highlights

- A three-phase development centered around a single integrated

wellhead, production, utilities and quarters platform located at

the Buchan field - the GBA hub

- The development concept is based on P50 Technically

Recoverable Resource estimates of, in aggregate, 172 MMboe of light

sweet crude and associated gas within the Core GBA, which includes

the Buchan oil field and J2 and Verbier oil discoveries

- JOG aims to deliver production from the planned GBA

Development Project at an industry leading carbon intensity level

due to Platform Electrification, as seen in certain fields in the

Norwegian sector

o Overall carbon emissions from the GBA with platform

electrification estimated by management at <1kg/boe

- Project economic estimates by management for the Core GBA

selecting Platform Electrification as our preferred low carbon

power solution, are:

o Pre-tax free cashflow of US$6.4 billion with an NPV (pre-tax)

of US$1.7 billion

o Payback period under 3 years

o Project internal rate of return ("IRR") greater than 25%

- Development costs (Capex and Opex) based on today's values are

estimated to be approximately US$30/boe

o Capex estimate for Phase 1 of approximately GBP1 billion

(including 20% contingency)

o Opex estimate during plateau production of US$8/boe to

US$9/boe

- The GBA hub nameplate capacity has been set at 40,000 barrels

of oil per day ("bopd") with expected plateau production of more

than 3 years

- Significant upside potential from 4 drill ready exploration

prospects within the GBA that have combined prospective resource

estimates totaling an additional 219 MMboe

o The close proximity of the GBA exploration prospects, will

enable their development, on discovery, as low cost subsea

tie-backs to the planned GBA hub

o A discovery in line with P50 estimates at any of the drill

ready exploration prospects has the potential to extend plateau

production significantly and materially increase project

economics

- With the preferred development concept identified, JOG is now

ready to launch its planned and previously announced farm-out

process for the GBA

A concept select update presentation is also available to

download on the Company's website at:

www.jerseyoilandgas.com/investors/presentations/

Andrew Benitz, CEO of Jersey Oil & Gas, commented :

"The GBA has the scale to be extremely low carbon through

platform electrification at the same time as offering highly

favourable project economics. As a result of a significant amount

of work from Jersey Oil & Gas' excellent project team, working

with specialist contractors, consultants and service providers, we

are well on track to deliver on our Licence commitment to deliver

the Concept Select to the Oil and Gas Authority ("OGA") by July

this year.

"We now plan to launch a farm-out process , which we expect to

be highly attractive to a wide range of oil companies in light of

the project's scale, economics and low carbon potential through

platform electrification, characteristic of certain fully

electrified fields offshore Norway."

Summary of Concept Select Findings

Delivering Concept Select has been a comprehensive work effort

led by our project team requiring over 14,000 JOG hours and 18,000

contractor hours. In early 2020, JOG completed an Appraise phase

assessment of the various development options for the GBA. This

option screening phase concluded that development of the GBA's

resources via a fixed production platform located at the Buchan

field, offered the optimum solution when considering environmental

factors, safety issues, technical feasibility, execution risk,

schedule, capital and operating costs, project economics,

availability and operability.

Subsequently, the Company has progressed this development option

through the Concept Select phase, with work commencing in April

2020. The objective of this Select Phase was to deliver a single,

economically acceptable concept to develop the GBA in order to take

the project forward into the Define Phase.

The selected concept for the GBA Development is planned to be

executed in three Phases. Phase 1 will deliver a single integrated

wellhead, production, utilities and quarters (WPUQ) Platform

located at the Buchan field. Production from the reservoirs will be

supported by injection of both produced water and seawater. The

facility will be normally manned. The Buchan wells will be drilled

utilising a heavy-duty jack-up (HDJU) located over a 12 slot well

bay. The Phase 1 facilities will be designed to accommodate Phase 2

and Phase 3 of the development. Phase 2 will develop the J2 West,

J2 East and Verbier East discoveries via a subsea tie-back to the

GBA platform. Phase 3 will develop the Verbier West discovery via

connection to the Phase 2 subsea infrastructure. Field life is

anticipated to be 31 years.

The Buchan location benefits from close proximity to existing

export infrastructure for both oil and gas. Selection of the final

oil and gas export routes will be subject to a detailed economic

and risk assessment through formal requests for service issued in

February 2021. Initial negotiations with pipeline operators will be

conducted in accordance with Oil & Gas UK's Infrastructure Code

of Practice. It is scheduled that this work will be completed to

inform FEED (Front End Engineering and Design), currently planned

to take place later this year.

Work has also been conducted to identify the optimum type of

artificial lift for the production wells. Gas lift and electrical

submersible pumps (ESPs) were investigated. The use of ESPs was

shown to deliver a higher production rate and thus greater

recoverable volumes over the same period than gas lifted wells.

Project Economic and Cost estimates

Cost estimates for each phase have been prepared in accordance

with the detailed work break down structures for Phase 1, 2 and 3.

The CAPEX, OPEX and DRILLEX estimates were developed in line with

the American Association of Cost Engineers International (AACEI)

Class 4, with an expected accuracy of +/- 30%. CAPEX costs for

Phase 1 are estimated to be approximately GBP1 billion. Operating

costs during plateau production are estimated at US$8/boe to

US$9/boe, with a payback period estimated at under 3 years. Plateau

production is estimated for more than 3 years. Total project costs

based on current day values are estimated to be approximately

US$30/boe.

Summary economic estimates by management for the Core GBA

Project selecting platform electrification as the Company's

preferred low carbon power solution:

Commodity Pricing Brent Phase 1 Core GBA

Inflation (2%) Nominal Nominal

-------- -----------------------------

Economic Resources Mmboe 122 162

Life of Field Years 31 31

CO(2) / Production kg/boe <1kg <1kg

Pre-Tax cumulative cash

flow $bn 4.7 6.4

Post-Tax cumulative cash

flow $bn 3.1 4.2

NPV (Pre-Tax) $bn 1.3 1.7

NPV (Post-Tax) $bn 0.9 1.1

IRR % >25% >25%

Payback from first oil (years) 1.9 2.8

Phase 1 Core GBA

Real Real

-------- ---------

CAPEX $bn 1.4 2.1

OPEX $bn 2.6 2.7

CAPEX / boe $/boe 11.1 13.1

OPEX / boe $/boe 21.0 16.9

ABEX / boe $/boe 1.6 2.6

The following economic assumptions have been used in the

Company's economic model:

-- An oil price of US$65/bbl in 2021, escalated by 2% per annum from 2022

-- Economic date of 1(st) January 2021

-- All costs are referenced to 2021 and inflated by 2% per annum from 1(st) January 2022

-- All cost inputs are in GBP and are converted to US$ using a

constant foreign exchange rate of 1.3

-- Discount rate of 10%

Electrification

In line with the UK Government's Net Zero policies, JOG

recognises the need for a low carbon power solution and has an

aspiration to deliver production from the GBA Development Project

at an industry-leading carbon intensity level. Accordingly, options

have been assessed that offer the opportunity to eliminate carbon

dioxide emissions associated with power generation on the planned

production facility. Economics have been run based on the provision

of power from the UK national grid via the installation of a subsea

cable to shore.

The provision of power from shore offers the opportunity to

remove rotating equipment from the offshore facilities along with

supporting utilities, e.g. fuel gas treatment equipment. A fully

electrified facility also allows for the removal of traditional

utility systems such as instrument air. This provides both a CAPEX

reduction for the topside facilities and an associated OPEX

reduction due to the lower maintenance burden. Removing the

requirement to utilise associated gas as fuel also increases gas

export revenues. Such CAPEX and OPEX reductions are however offset

by the cost of the grid connection and subsea cable and the

in-service purchase price of electricity.

A "Net Zero" solution for the GBA Development Project is

economically attractive, despite a 'Green Premium' compared to the

conventional case utilising gas turbines. The costs associated with

the provision of a subsea cable and grid connection outweigh the

cost reductions associated with the removal of gas turbines and

associated utility systems, resulting in a CAPEX increase of

approximately GBP80 million.

Overall carbon emissions from the GBA with platform

electrification are estimated to be <1kg/boe. This compares to

estimated carbon emissions from the GBA development using gas

turbines of 13kg/boe, which is less than the UKCS average of

approximately 20kg/boe.

The forecast economic outturn for the power from shore case

relative to the conventional gas turbine case is based on current

UK Government carbon tax forecasts up to 2030 and the cost of

sourcing power from the UK. Based on these assumptions, the "Green

Premium" results in a project NPV reduction of approximately

8%.

The GBA is optimally located in the heart of the UK Central

North Sea such that there is exciting potential for JOG to be an

enabler for regional electrification. Collaboration with other

regional operators could reduce overall capital costs associated

with the cable infrastructure. Additionally early stage engagement

with infrastructure funds has indicated that there is potential

interest in financing the capital costs in return for future tariff

payments. The Company continues to progress studies that may lead

to electrification costs reducing in line with conventional power

solutions.

A decision to adopt a power from shore case takes into account

environmental, social and corporate governance (ESG) and Licence to

Operate considerations and details of our Corporate Carbon Policy

will be announced shortly.

Regional Hub Potential

Collaborative studies conducted in parallel with the GBA Concept

Select Phase, have identified the potential for significant

synergies with neighbouring, third party discovered resources. The

production of such resources through the GBA facility offers the

potential for both parties to realise reductions in development

costs and OPEX costs offering the potential to increase incremental

recovery of oil from the GBA and neighbouring discoveries.

JOG continues to seek further collaboration with neighbouring,

third party discovered resources, with the aim of providing JOG and

owners of neighbouring fields with details of the costs and

associated economic outturns for various development scenarios.

Future Exploration Upside

As detailed in JOG's announcement of 14(th) December 2020, the

GBA includes four drill ready exploration prospects, namely Wengen,

Cortina, Verbier Deep and Zermatt, which have combined P50

prospective resource estimates of an additional 219 MMboe. An

assessment has been performed to determine the optimum drilling

sequence of these various exploration prospects, resulting in the

following sequence (subject to funding).

-- Wengen - Q2 2023

-- Cortina NE - Q2 2023

Analysis shows that in a P50 resource success case, each

exploration prospect offers a highly economic tie-back opportunity

to the GBA development. A successful outcome at either of the

Wengen or Cortina prospects has been shown to offer the potential

to extend the GBA Development Project's plateau production period

into the mid- to late- 2030s with enhanced economics.

Next Steps

A separate Concept Select Report summarising the Company's

findings, as outlined herein, will be submitted for approval to the

OGA by 31(st) July 2021 in compliance with JOG's commitment under

the P2498 licence, which contains Buchan. Work continues apace with

respect to the issuance of tenders for marine surveys to support

the Environmental Statement required for the Field Development

Plan. Tendering processes for the provision of FEED engineering

services is also underway. JOG is currently working towards being

ready to enter the FEED phase of the GBA project in Q3 2021, with

FID (Final Investment Decision) currently anticipated for H2

2022.

With its Concept Select Report finalised, JOG is now in a

position to launch its previously announced farm-out process to

seek to secure an industry partner for the GBA Development Project.

JOG's Board anticipates that this will be well received by the

industry as an exciting investment opportunity, in light of its

scale, economics and low carbon production approach, and currently

intends to conclude this process before the end of 2021.

Enquiries :

Jersey Oil and Gas plc Andrew Benitz, CEO C/o Camarco:

Tel: 020 3757 4983

Strand Hanson Limited James Harris Tel: 020 7409 3494

Matthew Chandler

James Bellman

Arden Partners plc Paul Shackleton Tel: 020 7614 5900

Benjamin Cryer

Camarco Billy Clegg Tel: 020 3757 4983

James Crothers

Qualified Person's Statement

The information contained in this announcement has been reviewed

and approved by Ronald Lansdell, Chief Operating Officer of Jersey

Oil & Gas, a qualified Geologist and Fellow of the Geological

Society, who has over 40 years' relevant experience within the

sector.

Notes to Editors :

Jersey Oil & Gas is a UK E&P company focused on building

an upstream oil and gas business in the North Sea. The Company

holds a significant acreage position within the Central North Sea

referred to as the Greater Buchan Area ("GBA"), which includes

operatorship and 100% working interests in blocks that contain the

Buchan oil field and J2 and Glenn oil discoveries and an 100%

working interest in the P2170 Licence Blocks 20/5b & 21/1d

(subject to OGA approval of the acquisition of CIECO V&C UK

Limited as announced on 26 November 2020), that contain the Verbier

oil discovery and other exploration prospects

JOG's total GBA acreage is estimated by management to contain

190 million barrels of oil equivalent ("mmboe") of discovered P50

recoverable resources net to JOG, in addition to significant

exploration upside potential of approximately 220 mmboe of

prospective resources in close proximity to our planned Buchan

platform. JOG has recently concluded the Concept Select Phase of an

FDP for the Greater Buchan Area and plans to progress into Front

End Engineering and Design (FEED) later this year.

JOG is focused on delivering shareholder value and growth

through creative deal-making, operational success and licensing

rounds. Its management is convinced that opportunity exists within

the UK North Sea to deliver on this strategy and the Company has a

solid track-record of tangible success.

The information contained within this announcement is deemed by

the Company to constitute inside information as stipulated under

the Market Abuse Regulation (EU) No. 596/2014 as it forms part of

United Kingdom domestic law by virtue of the European (Withdrawal)

Act 2018.

This announcement includes "forward-looking statements" which

include all statements other than statements of historical facts,

including, without limitation, those regarding the Group's

financial position, business strategy, plans and objectives of

management for future operations, or any statements preceded by,

followed by or that include the words "targets", "believes",

"expects", "aims", "intends", "will", "may", "anticipates",

"would", "could" or similar expressions or negatives thereof. Such

forward-looking statements involve known and unknown risks,

uncertainties and other important factors beyond the Company's

control that could cause the actual results, performance or

achievements of the Group to be materially different from future

results, performance or achievements expressed or implied by such

forward-looking statements. Such forward-looking statements are

based on numerous assumptions regarding the Group's present and

future business strategies and the environment in which the Group

will operate in the future. These forward-looking statements speak

only as at the date of this announcement. The Company expressly

disclaims any obligation or undertaking to disseminate any updates

or revisions to any forward-looking statements contained herein to

reflect any change in the Company's expectations with regard

thereto or any change in events, conditions or circumstances on

which any such statements are based unless required to do so by

applicable law or the AIM Rules.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

UPDUUSORAKUORUR

(END) Dow Jones Newswires

March 03, 2021 02:00 ET (07:00 GMT)

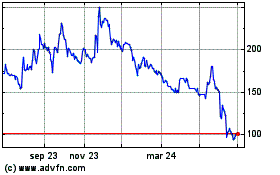

Jersey Oil And Gas (LSE:JOG)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

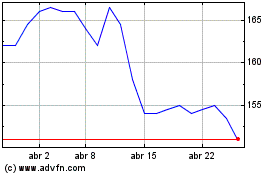

Jersey Oil And Gas (LSE:JOG)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024