TIDMJOG

RNS Number : 5275M

Jersey Oil and Gas PLC

22 September 2021

22 September 2021

Jersey Oil and Gas plc

("Jersey Oil & Gas", "JOG" or the "Company")

Interim Results for the Six Month Period Ended 30 June 2021

Jersey Oil & Gas (AIM: JOG), an independent upstream oil and

gas company focused on the UK Continental Shelf ("UKCS") region of

the North Sea, is pleased to announce it's unaudited Interim

Results for the six month period ended 30 June 2021.

Highlights :

-- Material increase in our resource estimates for the Buchan

oil field following completion of extensive reservoir simulation

modelling

o Contingent P50 technically recoverable resources for the

Buchan oil field now estimated at 126 MMstb

o Contingent P50 technically recoverable resources for the

Greater Buchan Area ("GBA") Core Area (Buchan, J2 and the Verbier

discoveries) increased to an estimated 172 MMboe

-- Concept Select Report completed and submitted to the UK's Oil and Gas Authority ("OGA")

o Detailed report sets out a three phase development, with Phase

1 designed to develop the Buchan oil reservoir; Phase 2 the J2

West, J2 East and Verbier East oil discoveries; and Phase 3 the

Verbier West oil discovery (the "GBA Development")

o Report also includes JOG's preference for the GBA Development

to be powered by electricity, which would significantly reduce the

carbon emissions associated with production from the GBA

Development

-- Oversubscribed placing and subscription to raise, in aggregate, GBP16.6m gross

-- Acquisition of the remaining 12% interest in licence P2170

containing the Verbier discovery from CIECO V&C (UK) Limited to

bring our interest to 100% across all of our GBA licences

-- Appointment of Les Thomas to the Board as a non-executive director

-- Launched sales process to farm-out an interest in our GBA

licences to secure an industry partner and funding towards our

future share of costs in the development

-- Strong cash position of approximately GBP17m at the period end

Post Period End :

-- Offshore survey to acquire geotechnical and environmental baseline data completed

-- Technical and economic evaluation of P2497 (Zermatt) and

P2499 (Glenn) licences completed, with JOG electing not to progress

to the next licence phase and relinquish these non-core

licences

-- OGA has approved JOG's application to be the 'Installation

Operator' for the 'Design Phase' of the planned Buchan platform

Outlook :

-- Farm-out process ongoing and engaged in discussions with both industry parties and potential infrastructure funders

-- Regional electrification collaboration within the Central

North Sea is building momentum amongst industry parties, with the

GBA ideally located to be an integral part of this initiative

Andrew Benitz, CEO of Jersey Oil & Gas, said:

"The first half of 2021 has been a busy period for JOG.

Extensive reservoir modelling was completed leading to a

significant increase in management's estimates of the GBA's

resources and the delivery to the OGA of the GBA Concept Select

Report, which includes our preference for a fully electrified

platform. The OGA's approval of the appointment of JOG as OSD

Installation Operator represents a significant endorsement of our

capabilities and competencies to deliver GBA facilities of the

highest technical integrity that will be both safe to operate and

environmentally sound.

"Our GBA farm-out process was launched and is ongoing, with

active engagement with both industry parties and infrastructure

funders, the latter having expressed funding interest particularly

with respect to electrification of the development and the

potential regional collaboration opportunities that exist. We also

launched our Carbon Policy and are targeting 'Net Zero' emissions

from our GBA Development project at the start of first oil.

"I would like to thank shareholders for their ongoing support

and look forward to providing further updates on our future

progress."

Enquiries :

Jersey Oil and Gas plc Andrew Benitz, CEO C/o Camarco:

Tel: 020 3757 4983

Strand Hanson Limited James Harris Tel: 020 7409 3494

Matthew Chandler

James Bellman

Arden Partners plc Paul Shackleton Tel: 020 7614 5900

finnCap Ltd Christopher Raggett Tel: 020 7220 0500

Tim Redfern

Camarco Billy Clegg Tel: 020 3757 4983

James Crothers

Notes to Editors :

Jersey Oil & Gas is a UK E&P company focused on building

an upstream oil and gas business in the North Sea. The Company

holds a significant acreage position within the Central North Sea

referred to as the Greater Buchan Area ("GBA"), which includes

operatorship and 100% working interests in blocks that contain the

Buchan oil field and J2 oil discovery and an 100% working interest

in the P2170 Licence Blocks 20/5b & 21/1d, that contain the

Verbier oil discovery and other exploration prospects.

JOG's total GBA acreage is estimated by management to contain

172 million barrels of oil equivalent ("MMboe") of discovered P50

recoverable resources net to JOG, in addition to significant

exploration upside potential of approximately 168MMboe of

prospective resources in close proximity to the Company's planned

Buchan platform. JOG has recently concluded the Concept Select

phase of an FDP for the Greater Buchan Area and plans to progress

into Front-End Engineering and Design (FEED) following greater

clarity being obtained on regional electrification options and

funding.

JOG is focused on delivering shareholder value and growth

through creative deal-making, operational success and licensing

rounds. Its management is convinced that opportunity exists within

the UK North Sea to deliver on this strategy and the Company has a

solid track-record of tangible success.

The information contained within this announcement is deemed by

the Company to constitute inside information as stipulated under

the Market Abuse Regulation (EU) No. 596/2014 as it forms part of

United Kingdom domestic law by virtue of the European Union

(Withdrawal) Act 2018.

Chairman's Statement

Overview

During the first six months of 2021, Jersey Oil and Gas ("JOG"

or the "Company") has focused on developing its core licence

interests, which we refer to as the Greater Buchan Area (the "GBA")

consisting of licences P2498 (the Buchan oil field and J2 oil

discovery) and P2170 (the Verbier oil discovery). Our activities

took place against a Brent oil price that started the year at

approximately US$50 per barrel and that had risen to approximately

US$70 per barrel at the end of the half year.

Operational Highlights

During the period, we were pleased to report a material increase

in our resource estimates for the Buchan oil field following the

completion of extensive reservoir simulation modelling. Our

estimate of contingent P50 technically recoverable resources for

the Buchan oil field is now 126 million stock tank barrels

("MMstb"), with our estimate of contingent P50 technically

recoverable resources for the GBA Core Area (Buchan, J2 and the

Verbier discoveries) being increased to 172 million barrels of oil

equivalent ("MMboe"). We also completed our Concept Select Report

("CSR"), which has been submitted to the OGA. This detailed report

sets out how the resources in our core GBA licence interests will

be developed which, after assessing numerous alternatives, has been

structured into three phases with Phase 1 designed to develop the

Buchan oil reservoir, Phase 2 the J2 West, J2 East and Verbier East

oil discoveries, and Phase 3 the Verbier West oil discovery. This

phased approach has the advantage of generating an early income

stream which can be offset against future phased development

expenditure. The CSR also includes JOG's preference for the GBA

Development to be powered by electricity supplied by a cable from

shore to the proposed GBA production platform, which would

significantly reduce the carbon emissions associated with

production of oil and gas from the GBA Development. In support of

this we have undertaken a subsea survey to cover a potential cable

route from shore to the proposed Buchan platform location.

Capital Raising

In March 2021, we undertook an oversubscribed placing and

subscription which raised, in aggregate, GBP16.6m gross.

100% Ownership of the Verbier Discovery

During the first half of the year we also completed the

acquisition of CIECO V&C (UK) Limited, whose sole asset in the

UKCS was the 12% interest in the Verbier discovery not already

owned by the Company, thereby bringing JOG's interest in the P2170

licence up to 100%.

Non-Executive Director Appointment

In April 2021, we were very pleased to announce the appointment

of Les Thomas as a non-executive director of the Company. Mr Thomas

has substantial experience in the oil and gas industry, including

being a former CEO of Ithaca Energy Inc., which operates in the

UKCS.

Regional Electrification

Since acquiring our licence interests in the GBA, in August

2019, there has been a significant shift in industry attitude and

government policy towards implementing a low carbon approach to

extracting hydrocarbons from the UKCS. As part of this process, JOG

has sought to lead the way through selecting our preferred

development concept for the GBA to be a low carbon, fully

electrified project powered from shore. At the same time, the GBA

has the potential to be an integral part of an area-wide

electrification project via collaboration with other industry

parties and stakeholders. Such a collaborative approach has the

advantage of potentially materially reducing capex and opex through

shared investment, thereby enhancing project economics for the GBA.

We look forward to working with other industry parties as regional

studies advance during the remainder of this year.

Financing the GBA Development

In Q2 2021, we launched a farm-out process seeking to secure an

industry partner in this early phase of the GBA Development to join

JOG in unlocking the considerable value that we believe exists in

this project. This process is ongoing, and we will be updating

shareholders as soon as we are in a position to do so.

Energy Transition

We fully support a managed transition away from CO(2) intensive

power supply for the UK. We believe that this process will take

time and that there needs to be a smooth and coordinated approach

to such a transition whereby a low carbon, fully electrified GBA

Development has an important part to play, helping to mitigate the

need for the UK to acquire high greenhouse gas ("GHG") emissions

produced oil from the international markets, often supplied by

companies without the governance and regulatory framework which UK

operators benefit from. A co-ordinated industry effort to invest in

making the UK North Sea a basin leader in low-carbon energy supply

will help provide a robust social licence to operate for those

investing in and providing longer-term energy security for the UK,

as the transition process proceeds. Like all of the other North Sea

industry participants, we will be closely following the United

Nations Climate Change Conference (COP26) taking place in Glasgow

in early November 2021, which we expect will continue to reflect

the current government policy of maximising the economic returns

from the UK North Sea, whilst reducing emissions from existing and

new production.

Marcus Stanton

Non-Executive Chairman

22 September 2021

Chief Executive's Report

Overview

A busy first half of 2021 saw the Company complete its

subsurface evaluation and concept select work in respect of its

flagship Greater Buchan Area (GBA) Development project and the

subsequent launch of our planned farm-out process. We were pleased

to report a material increase in our technically recoverable

resource estimates for the Buchan oil field following completion of

extensive reservoir simulation modelling. Our preferred development

concept is based on P50 technically recoverable resource estimates

of, in aggregate, 172 MMboe of light sweet crude and associated gas

within the core GBA Development, which includes the Buchan oil

field and J2 and Verbier oil discoveries.

JOG aims to deliver production from the planned GBA Development

project at an industry-leading carbon intensity level by way of the

provision of power via platform electrification, as evidenced in

certain fields in the Norwegian sector. Overall carbon emissions

from the GBA Development, utilising platform electrification, are

estimated by management at <1kg/boe, against an industry average

in the UK North Sea of approximately 22kg/boe. We also announced

highly attractive estimated project economics for this low carbon

concept, with pre-tax free cashflow of US$6.4 billion with an NPV

(pre-tax) of US$1.7 billion. Operating costs during plateau

production are estimated at US$8/boe to US$9/boe, with a payback

period estimated at under 3 years. Plateau production is estimated

for more than 3 years. Total project costs based on current day

values are estimated to be approximately US$30/boe.

Our sales process is ongoing with engagement with both industry

parties and infrastructure funders, the latter having expressed

funding interest particularly with respect to electrification of

the development and the potential regional collaboration

opportunities that exist.

Operational Update

Working closely with Schlumberger Oilfield UK plc

("Schlumberger"), JOG completed extensive simulation modelling of

the Buchan reservoir, using their proprietary INTERSECT high

resolution reservoir simulation software, which was peer reviewed

by Vysus Group ("Vysus"). As a consequence, our estimate of

contingent resources for the Buchan oil field was significantly

increased to 126 MMstb, with our estimate of contingent resources

for the GBA Core Area (Buchan, J2 and the Verbier discoveries)

being increased to 172 MMboe.

Having completed our extensive subsurface evaluation across the

GBA, we were pleased to outline our preferred development concept

for delivering the project in three Phases. Phase 1 will deliver a

single integrated wellhead, production, utilities and quarters

(WPUQ) platform located at the Buchan field. Production from the

reservoirs will be supported by injection of both produced water

and seawater. The facility will be normally manned. The Buchan

wells will be drilled utilising a heavy-duty jack-up (HDJU) rig

located over a 12 slot well bay. The Phase 1 facilities will be

designed to accommodate Phase 2 and Phase 3 of the development.

Phase 2 will develop the J2 West, J2 East and Verbier East

discoveries via a subsea tie-back to the planned GBA Development

platform. Phase 3 will develop the Verbier West discovery via

connection to the Phase 2 subsea infrastructure.

In June 2021, JOG commenced an offshore survey to support Phase

1 of the GBA Development. The survey has acquired geotechnical and

environmental baseline data along the proposed subsea power cable

route and oil/gas export option routes. This data will be input

into the subsea facilities Front-End Engineering and Design

("FEED") work and support the preparation of the Environmental

Statement, required for the Field Development Plan. The data

acquisition stage of these surveys was completed during August 2021

with analysis of the acquired data ongoing. Vessel availability for

our planned geotechnical survey to acquire soils data over Buchan

was limited due to a poor weather window, and, consequently, JOG

took the decision to re-tender this survey for Spring 2022.

The Buchan location benefits from close proximity to existing

export infrastructure for both oil and gas. Negotiations with

pipeline operators are being conducted in accordance with Oil &

Gas UK's Infrastructure Code of Practice.

A Concept Select Report for the GBA Development was submitted

for approval to the OGA during the period in compliance with JOG's

commitment under the P2498 Licence.

Following JOG's application, the OGA approved its wholly-owned

subsidiary, Jersey Petroleum Ltd, to be appointed as the

Installation Operator for the Design Phase of the planned Buchan

platform. This appointment is significant as it indicates that the

OGA are satisfied that JOG has suitable and sufficient processes in

place to manage the design and specification of the safety and

environmentally critical systems and equipment that will be

incorporated into the new facilities. OSD Installation Operatorship

is necessary in order to submit the Design Notification to the

Offshore Major Accident Regulator in the FEED phase, which in turn

is an important step to the submission of the Safety Case later in

the design process.

Carbon Policy

The energy transition is a central component of JOG's corporate

strategy and, as such, JOG was pleased to introduce its inaugural

Carbon Policy. Through this Carbon Policy, as well as the

strategies and programmes that stem from it, JOG will seek to

position itself as a leading player in energy transition on the

UKCS.

Importantly, JOG is targeting 'Net Zero' emissions from its GBA

Development project at the start of first oil. JOG will seek to

identify Scope 1, Scope 2 and material Scope 3 emissions

(internationally recognised definitions developed by the GHG

(Greenhouse gas) Protocol) and minimise, measure and report Scope 1

and 2 emissions associated with its operations on an absolute

basis.

Overall carbon emissions from the GBA Development with platform

electrification are estimated by management to be <1kg/boe. This

compares to estimated carbon emissions from the GBA Development

using gas turbines of 13kg/boe.

Regional Electrification Opportunities

The GBA is optimally located at the heart of the UK Central

North Sea ("CNS"), such that there is exciting potential for JOG

and its GBA Development to be an integral part of a regional

electrification scheme. JOG is currently involved in discussions in

relation to a regional CNS electrification scheme, which is

building momentum amongst industry parties.

Collaboration with other regional operators could serve to

reduce overall capital costs associated with the cable

infrastructure as well as future operating costs associated with

power prices. Additionally, engagement with infrastructure funders

has indicated that there is potential interest in financing the

capital costs, in return for future tariff payments.

In order to accommodate near-term studies on regional

electrification and potentially align with an area-wide

collaboration scheme, JOG elected to re-phase its FEED entry, FID

(field Investment decision) and first oil milestone dates for the

GBA Development project.

Licensing activity

During the first half of the year, JOG completed its previously

announced corporate acquisition of CIECO V&C (UK) Limited

thereby adding a further 12% working interest in Licence P2170, to

take our ownership to 100% and adding some brought forward tax

losses. We also completed on our successful application in the UKCS

32nd Licensing Round for part block 20/5e which contains an

extension of the J2 oil discovery. This block was subsequently

merged into Licence P2498.

Further to undertaking a comprehensive technical and economic

evaluation of our P2497 (Zermatt) and P2499 (Glenn) licences and

meetings held with the OGA, the OGA confirmed that it was satisfied

that the Phase A Firm Commitments for the licences had been

fulfilled. JOG elected not to progress to the next licence phase,

which would have involved committing to a firm well in each

licence. Accordingly, the licences automatically ceased and

determined at the end of Phase A of their Initial Terms on 29

August 2021.

JOG's Acquisition Strategy

The first half of 2021 ushered in a return of M&A activity

across the UK North Sea, with several sizeable deals announced. Our

primary focus is on securing funding and a partner(s) for our

flagship GBA Development project, but with increased activity and

some motivated sellers, JOG is, nonetheless, reviewing a number of

potential acquisitions and/or opportunties for possible business

combinations.

Financial Review

JOG's cash position was approximately GBP17.1 million as of 30

June 2021. As an oil and gas exploration and development company,

JOG had no production revenue during the year and received only a

small amount of interest on its cash deposits.

The loss for the period, before and after tax, was approximately

GBP2.0m (2020: GBP1.2m). Our main expenditure during the first half

of 2021 related to Concept Select and pre-FEED work on our GBA

Development project.

In March 2021, we were pleased to announce an oversubscribed

equity placing as well as an offer for subscription for existing

shareholders, raising gross proceeds of approximately GBP16.6

million. The net proceeds from the fundraising strengthened the

Company's balance sheet as we launched our farm-out process and are

being utilised to maintain momentum and ensure that time and

funding pressures do not interfere in the efficient delivery of the

overall GBA Development project.

Summary and outlook

The GBA Development project represents a major opportunity in

the UK Central North Sea to extract locally sourced hydrocarbons

profitably and at low-cost, with basin-leading low carbon

emissions. The UK requires responsibly produced hydrocarbons to

support its planned energy transition, as recent industry

underinvestment risks driving prices higher, thereby making energy

less affordable for consumers.

We are excited to seek to bring in the right industry partner(s)

and funding to join us in unlocking the considerable value

potential of the GBA Development. The project is ambitious and will

be a major long-term capital commitment for our industry, and the

rewards and expected rapid payback serve, in our opinion, to make

it a very compelling investment proposition. As we continue to

progress our farm-out discussions, I am particularly grateful to

our shareholders for their ongoing support.

Andrew Benitz

Chief Executive Officer

22 September 2021

JERSEY OIL AND GAS PLC

CONSOLIDATED STATEMENT OF COMPREHENSIVE INCOME

FOR THE SIX MONTHSED 30 JUNE 2021

6 months 6 months Year to

to to

30/06/21 30/06/20 31/12/20

(unaudited) (unaudited) (audited)

Notes GBP GBP GBP

CONTINUING OPERATIONS

Revenue - - -

Cost of sales 66,403 (45,731) (53,046)

GROSS LOSS 66,403 (45,731) (53,046)

Other gains and (losses) - - (637,028)

Administrative expenses (1,986,483) (1,145,657) (2,111,532)

OPERATING LOSS (1,920,080) (1,191,388) (2,801,606)

Finance income 5 1,127 24,080 27,937

Finance expense 5 (2,788) (1,221) (8,262)

LOSS BEFORE TAX (1,921,741) (1,168,529) (2,781,931)

Tax 6 - - -

LOSS FOR THE PERIOD (1,921,741) (1,168,529) (2,781,931)

OTHER COMPREHENSIVE INCOME - - -

TOTAL COMPREHENSIVE LOSS FOR

THE PERIOD (1,921,741) (1,168,529) (2,781,931)

============ ============ ============

Total comprehensive loss attributable

to:

Owners of the parent (1,921,741) (1,168,529) (2,781,931)

============ ============ ============

Loss per share expressed

in pence per share:

Basic 7 (7.15) (5.35) (12.74)

Diluted 7 (7.15) (5.35) (12.74)

============ ============ ============

The above consolidated statement of comprehensive income should

be read in conjunction with the accompanying notes.

JERSEY OIL AND GAS PLC

CONSOLIDATED STATEMENT OF FINANCIAL POSITION

AS AT 30 JUNE 2021

30/06/21 30/06/20 31/12/20

(unaudited) (unaudited) (audited)

Notes GBP GBP GBP

NON-CURRENT ASSETS

Intangible assets

- Exploration costs 8 17,359,856 12,625,032 14,991,295

Property, plant and

equipment 9 57,187 51,243 74,549

Right-of-use assets 10 125,415 269,333 197,374

Deposits 28,420 82,642 82,642

------------- ------------- -------------

17,570,878 13,028,250 15,345,860

------------- ------------- -------------

CURRENT ASSETS

Trade and other receivables 11 593,643 591,134 401,440

Cash and cash equivalents 12 17,056,538 8,881,309 5,081,515

------------- ------------- -------------

17,650,181 9,472,443 5,482,955

------------- ------------- -------------

TOTAL ASSETS 35,221,059 22,500,693 20,828,815

============= ============= =============

EQUITY

SHAREHOLDERS' EQUITY

Called up share capital 13 2,566,795 2,466,144 2,466,144

Share premium account 110,358,234 93,851,526 93,851,526

Share options reserve 2,308,462 2,031,994 2,109,969

Accumulated losses (80,431,559) (76,896,417) (78,509,819)

Reorganisation reserve (382,543) (382,543) (382,543)

------------- ------------- -------------

TOTAL EQUITY 34,419,389 21,070,704 19,535,277

------------- ------------- -------------

NON-CURRENT LIABILITIES

Lease liabilities 10 74,200 136,975 101,270

------------- ------------- -------------

74,200 136,975 101,270

------------- ------------- -------------

CURRENT LIABILITIES

Trade and other payables 14 643,419 914,042 1,069,620

Provisions - 200,000 -

Lease liabilities 10 84,051 178,972 122,648

------------- ------------- -------------

727,470 1,293,014 1,192,268

------------- ------------- -------------

TOTAL LIABILITIES 801,670 1,429,989 1,293,538

------------- ------------- -------------

TOTAL EQUITY AND

LIABILITIES 35,221,059 22,500,693 20,828,815

============= ============= =============

The above consolidated statement of financial position should be

read in conjunction with the accompanying notes.

JERSEY OIL & GAS PLC

CONSOLIDATED STATEMENT OF CHANGES IN EQUITY

FOR THE SIX MONTHSED 30 JUNE 2021

Called Share Share Re-

up share premium options Accumulated organisation Total

capital account reserve Losses reserve equity

GBP GBP GBP GBP GBP GBP

(unaudited) (unaudited) (unaudited) (unaudited) (unaudited) (unaudited)

At 1 January

2020 2,466,144 93,851,526 1,928,099 (75,727,888) (382,543) 22,135,338

Loss for the

period

and total

comprehensive

income - - - (1,168,529) - (1,168,529)

Share based

payments - - - 103,895 - - 103,895

At 30 June 2020 2,466,144 93,851,526 2,031,994 (76,896,417) (382,543) 21,070,704

============= ============= ============= ============== ============== =============

At 1 January

2021 2,466,144 93,851,526 2,109,969 (78,509,819) (382,543) 19,535,277

Loss for the

period

and total

comprehensive

income - - - (1,921,741) - (1,921,741)

Issue of share

capital 100,651 16,506,709 - - - 16,607,360

Share based

payments - - - 198,493 - - 198,493

At 30 June 2021 2,566,795 110,358,235 2,308,462 (80,431,560) (382,543) 34,419,389

============= ============= ============= ============== ============== =============

The following describes the nature and purpose of each reserve

within owners' equity:

Reserve Description and purpose

Called up share capital Represents the nominal value of shares

issued

Share premium account Amount subscribed for share capital in

excess of nominal value

Share options reserve Represents the accumulated balance of

share based payment charges recognised in respect of share options

granted by the Company less transfers to retained deficit in

respect of options exercised or cancelled/lapsed

Accumulated losses Cumulative losses recognised in the

Consolidated Statement of Comprehensive Income

Reorganisation reserve Amounts resulting from the restructuring

of the Group

The above consolidated statement of changes in equity should be

read in conjunction with the accompanying notes

JERSEY OIL AND GAS PLC

CONSOLIDATED STATEMENT OF CASH FLOWS

FOR THE SIX MONTHSED 30 JUNE 2021

6 months 6 months Year

to to to

30/06/21 30/06/20 31/12/20

(unaudited) (unaudited) (audited)

Notes GBP GBP GBP

CASH FLOWS FROM OPERATING ACTIVITIES

Cash used in operations 15 (2,196,448) (879,953) (2,160,164)

Net interest received 5 1,127 24,080 27,937

Net interest paid 5 (2,788) (1,221) (8,262)

------------- ------------

Net cash used in operating activities (2,198,109) (857,094) (2,140,489)

------------- ------------------- ------------

CASH FLOWS FROM INVESTING ACTIVITIES

Proceeds on sale of tangible assets - - -

Purchase of intangible assets 8 (2,368,561) (2,532,468) (4,898,731)

Purchase of tangible assets 9 - (47,665) (84,865)

Net cash used in investing activities (2,368,561) (2,580,133) (4,983,596)

------------- ------------------- ------------

CASH FLOWS FROM FINANCING ACTIVITIES

Proceeds of issue of shares 16,607,360 - -

Principal elements of lease payments (65,667) - (112,936)

Net cash generated from financing

activities 16,541,693 - (112,936)

INCREASE/(DECREASE) IN CASH AND

CASH EQUIVALENTS 11,975,023 (3,437,227) (7,237,021)

CASH AND CASH EQUIVALENTS AT BEGINNING

OF PERIOD 5,081,515 12,318,536 12,318,536

------------- ------------------- ------------

CASH AND CASH EQUIVALENTS AT

OF PERIOD 12 17,056,538 8,881,309 5,081,515

============= =================== ============

The above consolidated statement of cash flows should be read in

conjunction with the accompanying notes

JERSEY OIL AND GAS PLC

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

FOR THE SIX MONTHSED 30 JUNE 2021

1. GENERAL INFORMATION

Jersey Oil and Gas plc (the "Company") and its subsidiaries

(together, "the Group") are involved in the upstream oil and gas

business in the UK.

The Company is a public limited company incorporated and

domiciled in the United Kingdom and quoted on AIM, a market

operated by London Stock Exchange plc. The address of its

registered office is 10 The Triangle, ng2 Business Park,

Nottingham, NG2 1AE.

2. SIGNIFICANT ACCOUNTING POLICIES

The accounting policies adopted are consistent with those

applied in the previous financial year, unless otherwise

stated.

These consolidated interim financial statements have been

prepared under the historic cost convention, using the accounting

policies applied in the Group's statutory financial information for

the year ended 31 December 2020 and in accordance with the

Disclosure and Transparency Rules of the Financial Conduct

Authority and with IAS 34 'Interim financial reporting'. The

condensed interim financial statements should be read in

conjunction with the annual financial statements for the year ended

31 December 2020, which have been prepared in accordance with IFRS

as adopted by the European Union.

Going Concern

The Company is required to have sufficient resources to cover

the expected running costs of the business for a period of at least

12 months after the issue of these financial statements. Further to

completion of the detailed studies in connection with the GBA

Concept Select contracted work programmes, there are currently no

material firm work commitments on any of our licences, other than

ongoing Operator overheads and licence fees. Other work that the

Company is undertaking in respect of the GBA licences and

surrounding areas is modest relative to its current cash reserves.

The Group's current cash reserves, as the principal source of

funding for the Company, are therefore expected to more than exceed

its estimated liabilities. Based on these circumstances, the

Directors have considered it appropriate to adopt the going concern

basis of accounting in preparing its consolidated financial

statements.

The reports for the six months ended 30 June 2021 and 30 June

2020 are unaudited and do not constitute statutory accounts as

defined by the Companies Act 2006. The financial statements for 31

December 2020 have been prepared and delivered to the Registrar of

Companies. The auditors' report on those financial statements was

unqualified. Their report did not contain a statement under section

498 of the Companies Act 2006.

Changes in Accounting Policies and Disclosures

a) New and amended standards adopted by the Company:

At the start of the year the following standards were

adopted:

-- Covid-19-Related Rent Concessions (Amendment to IFRS 16);

-- Interest Rate Benchmark Reform - Phase 2 (Amendments to IFRS

9, IAS 39, IFRS 7, IFRS 4 and IFRS 16);

-- IFRS3 conceptual framework amendment;

-- Covid-19-Related Rent Concessions beyond 30 June 2021

(Amendment to IFRS 16);

b) Certain new accounting standards and interpretations have

been published that are not mandatory for 30 June 2021

reporting periods and have not been early adopted by the Group.

These standards are not expected to have a material impact on the

entity in the current or future reporting periods and on

foreseeable future transactions.

The Group's results are not impacted by seasonality.

Significant Accounting Judgements and Estimates

The preparation of the financial statements requires management

to make estimates and assumptions that affect the reported

amounts of revenues, expenses, assets and liabilities at the

date of the financial statements. If in future such estimates

and

assumptions, which are based on management's best judgement at

the date of the financial statements, deviate from the actual

circumstances, the original estimates and assumptions will be

modified as appropriate in the period in which the

circumstances

change. The Group's accounting policies make use of accounting

estimates and judgements in the following areas:

-- The assessment of the existence of impairment triggers

-- The estimation of share-based payment costs

Impairments

The Group tests its capitalised exploration licence costs for

impairment when facts and circumstances suggest that the

carrying

amount exceeds the recoverable amount. The recoverable amounts

of Cash Generating Units are determined based on fair value

less costs of disposal calculations. There were no impairment

triggers in the first half of 2021 and no impairment charge has

been recorded.

Revenue recognition

Revenue is recognised to the extent that it is probable that

economic benefits will flow to the Group and the revenue can be

reliably measured. It is measured at the fair value of

consideration received or receivable for the sale of goods.

Acquisitions, Asset Purchases and Disposals

Acquisitions of oil and gas properties are accounted for under

the purchase method where the acquisitions meet the definition

of

a business combination.

Transactions involving the purchase of an individual field

interest, farm-ins, farm-outs, or acquisitions of exploration and

evaluation licences for which a development decision has not yet

been made that do not qualify as a business combination, are

treated as asset purchases. Accordingly, no goodwill or deferred

tax arises. The purchase consideration is allocated to the assets

and liabilities purchased on an appropriate basis. Proceeds on

disposal (including farm-ins/farm-outs) are applied to the carrying

amount of the specific intangible asset or development and

production assets disposed of and any surplus is recorded as a gain

on disposal in the Consolidated Statement of Comprehensive

Income.

Intangible assets are recognised at acquisition at the cost paid

using the cost accumulation model. Variable payments are not

included in the carrying amount of the asset at acquisition, and no

liability is recognised for the contingent consideration. The Group

does not recognise a liability because, following the IFRIC agenda

decision (March 2016), it is not clear that there is an obligation

before the uncertainty is resolved.

Exploration and Evaluation Costs

The Group accounts for oil and gas exploration and evaluation

costs using IFRS 6 "Exploration for and Evaluation of Mineral

Resources". Such costs are initially capitalised as Intangible

Assets and include payments to acquire the legal right to

explore,

together with the directly related costs of technical services

and studies, seismic acquisition, exploratory drilling and testing.

The

Group only capitalises costs as intangible assets once the legal

right to explore an area has been obtained. The Group assesses the

intangible assets for indicators of impairment at each reporting

date. The Group considers this to be appropriate due to the future

interdependency of these fields.

Potential indicators of impairment include but are not limited

to:

a. the period for which the Group has the right to explore in

the specific area has expired during the period or will expire in

the near future, and is not expected to be renewed.

b. substantive expenditure on further exploration for and

evaluation of oil and gas reserves in the specific area is

neither

budgeted nor planned.

c. exploration for and evaluation of oil and gas reserves in the

specific area have not led to the discovery of commercially viable

quantities of oil and gas reserves and the entity has decided to

discontinue such activities in the specific area.

d. sufficient data exist to indicate that, although a

development in the specific area is likely to proceed, the carrying

amount of the exploration and evaluation asset is unlikely to be

recovered in full from successful development or by sale.

In the event an impairment trigger is identified the Group

performs a full impairment test for the asset under the

requirements of

IAS 36 Impairment of assets. An impairment loss is recognised

for the amount by which the exploration and evaluation assets'

carrying amount exceeds their recoverable amount. The

recoverable amount is the higher of the exploration and evaluation

assets' fair value less costs to sell and their value in use.

Cost of Sales

Within the statement of comprehensive income, costs directly

associated with generating revenue are included in cost of sales.

The Group only capitalises costs as intangible assets once the

legal right to explore an area has been obtained, any costs

incurred prior to the date of acquisition are recognised as cost of

sales within the Statement of Comprehensive Income.

Property, Plant and Equipment

Property, plant and equipment is stated at historic purchase

cost less accumulated depreciation. Asset lives and residual

amounts are reassessed each year. Cost includes the original

purchase price of the asset and the costs attributable to bringing

the asset to its working condition for its intended use.

Depreciation on these assets is calculated on a straight-line

basis as follows:

Computer & office equipment 3 years

Leases

From 1 January 2019, leases are recognised as a right-of-use

asset and a corresponding liability at the date at which the leased

asset is available for use by the Group.

Assets and liabilities arising from a lease are initially

measured on a present value basis. Lease liabilities include the

net present value of the following lease payments:

-- fixed payments (including in-substance fixed payments), less

any lease incentives receivable;

-- variable lease payments that are based on an index or a rate,

initially measured using the index or rate as at the

commencement

date;

-- amounts expected to be payable by the Group under residual

value guarantees;

-- the exercise price of a purchase option if the Group is

reasonably certain to exercise that option; and

-- payments of penalties for terminating the lease, if the lease

term reflects the Group exercising that option.

Lease payments to be made under reasonably certain extension

options are also included in the measurement of the liability.

The lease payments are discounted using the interest rate

implicit in the lease. If that rate cannot be readily determined,

which is generally the case for leases in the Group, the lessee's

incremental borrowing rate is used, being the rate that the

individual lessee would have to pay to borrow the funds necessary

to obtain an asset of similar value to the right-of-use asset in a

similar economic environment with similar terms, security and

conditions.

To determine the incremental borrowing rate, the Group where

possible, uses recent third-party financing received by the

individual lessee as a starting point, adjusted to reflect

changes in financing conditions since third party financing was

received.

Lease payments are allocated between principal and finance cost.

The finance cost is charged to profit or loss over the lease

period to produce a constant periodic rate of interest on the

remaining balance of the liability for each period.

Right-of-use assets are measured at cost comprising the

following:

-- the amount of the initial measurement of lease liability;

-- any lease payments made at or before the commencement date

less any lease incentives received;

-- any initial direct costs; and

-- restoration costs.

Right-of-use assets are generally depreciated over the shorter

of the asset's useful life and the lease term on a straight-line

basis. If the Group is reasonably certain to exercise a purchase

option, the right-of-use asset is depreciated over the underlying

asset's useful life.

Payments associated with short-term leases of equipment and

vehicles and all leases of low-value assets are recognised on a

straight-line basis as an expense in profit or loss. Short-term

leases are leases with a lease term of 12 months or less. Low-value

assets comprise any lease with a value of GBP5,000 or less.

Provisions

Provisions for legal claims, service warranties and make good

obligations are recognised when the group has a present legal or

constructive obligation as a result of past events, it is probable

that an outflow of resources will be required to settle the

obligation, and the amount can be reliably estimated. Provisions

are not recognised for future operating losses. Provisions are

measured at the present value of management's best estimate of the

expenditure required to settle the present obligation at the end of

the reporting period.

Joint Ventures

The Group participates in joint venture agreements with

strategic partners. The Group accounts for its share of assets,

liabilities, income and expenditure of these joint venture

agreements and discloses the details in the appropriate Statement

of Financial Position and Statement of Comprehensive Income

headings in the proportion that relates to the Group per the joint

venture agreement.

Financial instruments

Financial assets and financial liabilities are recognised in the

Group's Statement of Financial Position when the Group becomes

party to the contractual provisions of the instrument. The Group

does not have any derivative financial instruments.

Cash and cash equivalents include cash in hand and deposits held

on call with banks with a maturity of three months or less.

The simplified approach requires expected lifetime losses to be

recognised from initial recognition of the receivables. This

involves determining the expected loss rates using a provision

matrix that is based on the Company's historical default rates

observed over the expected life of the receivable and adjusted

forward-looking estimates. This is then applied to the gross

carrying amount of the receivable to arrive at the loss allowance

for the period.

The three-stage approach assesses impairment based on changes in

credit risk since initial recognition using the past due criterion

and other qualitative indicators such as increase in political

concerns or other macroeconomic factors and the risk of legal

action, sanction or other regulatory penalties that may impair

future financial performance. Financial assets classified as stage

1 have the expected credit losses (ECL) measured as a proportion of

their lifetime ECL that results from possible default events that

can occur within one year, while assets in stage 2 or 3 have their

ECL measured on a lifetime basis. If the borrower has sufficient

accessible highly liquid assets in order to repay the loan if

demanded at the reporting date, the expected credit loss is

considered immaterial.

If the borrower does not have sufficient accessible highly

liquid assets, the ECL is determined by projecting the probability

of default (PD), loss given default (LGD) and exposure at default

(EAD).

The PD is based on default rates determined by external rating

agencies for the counterparties. The LGD is determined based on

management's estimate of expected cash recoveries after considering

the historical pattern of the receivable, and it assesses the

portion of the outstanding receivable that is deemed to be

irrecoverable at the reporting period. For intercompany balances,

the discounted cashflows of the lender are also considered in

calculating the LGD. The EAD is the total amount of outstanding

receivable at the reporting period.

These three components are multiplied together, and adjusted for

forward looking information, such as crude oil prices, to arrive at

a summed ECL in relation to base, optimistic and downturn

scenarios, that carry different probability weightings.

Loss allowances for financial assets measured at amortised cost

are deducted from the gross carrying amount of the related

financial assets and the amount of the loss is recognised in the

statement of comprehensive income.

Trade payables are stated initially at fair value and

subsequently measured at amortised cost.

Foreign Currencies

The functional currency of the Group is Sterling. Monetary

assets and liabilities in foreign currencies are translated into

Sterling at the rates of exchange ruling at the reporting date.

Transactions in foreign currencies are translated into Sterling at

the rate of exchange ruling at the date of the transaction. Gains

and losses arising on retranslation are recognised in the

Consolidated Statement of Comprehensive Income.

Share Capital

Ordinary shares are classified as equity.

Incremental costs directly attributable to the issue of new

ordinary shares or options are shown in equity as a deduction, net

of tax, from the proceeds.

Share Based Payments

The Group currently has a number of share schemes that give rise

to share-based charges. The charge to operating profit for these

schemes for the period amounted to GBP198,493, (2020: GBP103,895).

For the purposes of calculating the fair value of the share

options, a Black-Scholes option pricing model has been used. Based

on past experience, it has been assumed that options will be

exercised, on average, at the mid-point between vesting and

expiring. The share price volatility used in the calculation is

based on the actual volatility of the Company's shares, since 1

January 2017. The risk-free rate of return is based on the implied

yield available on zero coupon gilts with a term remaining equal to

the expected lifetime of the options at the date of grant.

3. SEGMENTAL REPORTING

The Directors consider that the Group operates in a single

segment, that of oil and gas exploration, appraisal, development

and production, in a single geographical location, the North Sea of

the United Kingdom and do not consider it appropriate to

disaggregate data further from that disclosed.

JERSEY OIL AND GAS PLC

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

FOR THE SIX MONTHSED 30 JUNE 2021

4. FAIR VALUE OF NON-DERIVATIVE FINANCIAL ASSETS AND FINANCIAL LIABILITIES

Maturity analysis of financial assets and liabilities

Financial Assets

30/06/21 30/06/20 31/12/20

(unaudited) (unaudited) (audited)

------------ ------------ ----------

GBP GBP GBP

Up to 3 months 629,860 635,775 446,082

3 to 6 months 10,704 35,980 35,980

Over 6 months 106,914 271,354 199,395

------------ ------------ ----------

747,478 943,109 681,457

============ ============ ==========

Financial Liabilities

30/06/21 30/06/20 31/12/20

(unaudited) (unaudited) (audited)

GBP GBP GBP

Up to 3 months 683,332 1,173,219 1,116,332

3 to 6 months 13,384 39,633 40,231

Over 6 months 104,954 217,137 136,975

------------ ------------ ----------

801,670 1,429,989 1,293,538

============ ============ ==========

5. NET FINANCE COSTS

30/06/21 30/06/20 31/12/20

(unaudited) (unaudited) (audited)

Interest received: GBP GBP GBP

Interest received 1,127 24,080 27,937

Finance costs (2,788) (1,221) (8,262)

Net Finance income / (costs) (1,661) 22,859 19,675

============ ============ ==========

6. TAX

Jersey Oil and Gas plc is a trading company but no liability to

UK corporation tax arose on the ordinary activities for the period

ended 30 June 2021 due to trading losses. As at 31 December 2020,

the Group held tax losses of approximately GBP46 million (2019:

GBP39 million).

In April 2023 the rate of corporation tax will increase to 25%

as announced in the March 2021 Budget.

7. EARNINGS/(LOSS) PER SHARE

Basic loss per share is calculated by dividing the losses

attributable to ordinary shareholders by the weighted average

number of ordinary shares outstanding during the period.

Diluted loss per share is calculated using the weighted average

number of shares adjusted to assume the conversion of all dilutive

potential ordinary shares.

Earnings Weighted

attributable average

to ordinary number Per share

shareholders of shares amount

GBP Pence

Period ended 30 June 2021

Basic and Diluted EPS

Loss attributable to ordinary

shareholders (1,921,741) 26,861,760 (7.15)

============== =========== ==========

JERSEY OIL AND GAS PLC

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

FOR THE SIX MONTHSED 30 JUNE 2021

8. INTANGIBLE ASSETS

Exploration

Costs

GBP

COST

At 1 January 2021 15,166,536

Additions 2,368,561

At 30 June 2021 17,535,097

============

ACCUMULATED AMORTISATION

At 1 January 2021 175,241

At 30 June 2021 175,241

============

NET BOOK VALUE at 30 June

2021 17,359,856

============

9. PROPERTY, PLANT AND EQUIPMENT

Computer

and office

equipment

GBP

COST

At 1 January 2021 228,447

Additions -

At 30 June 2021 228,447

============

ACCUMULATED AMORTISATION, DEPLETION AND

DEPRECIATION

At 1 January 2021 153,898

Charge for period 17,362

At 30 June 2021 171,260

===========

NET BOOK VALUE at 30 June

2021 57,187

===========

JERSEY OIL AND GAS PLC

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

FOR THE SIX MONTHSED 30 JUNE 2021

10. LEASES

Amounts Recognised in the Statement of financial position

30/06/21 30/06/20 31/12/20

(unaudited) (unaudited) (audited)

Right-of-use Assets GBP GBP GBP

Buildings 125,415 269,333 197,374

Equipment - - -

Vehicles - - -

Other - - -

------------ ------------ ----------

125,415 269,333 197,374

============ ============ ==========

30/06/21 30/06/20 31/12/20

Lease liabilities (unaudited) (unaudited) (audited)

GBP GBP GBP

Current 84,051 178,972 122,648

Non-Current 74,200 136,975 101,270

------------ ------------ ----------

158,251 315,947 223,918

============ ============ ==========

On adoption of IFRS 16, the Group recognised lease liabilities

in relation to leases which had previously been classified as

'operating leases' under the principles of IAS 17, 'Leases'. These

liabilities were measured at the present value of the remaining

lease payments, discounted using the lessee's incremental borrowing

rate as of 1 January 2019. The weighted average lessee's

incremental borrowing rate applied to the lease liabilities is 3%.

The borrowing rate applied for 2020 and 2021 remains at 3% and the

leases pertain solely to Jersey Oil and Gas's offices in London and

Jersey.

Amounts Recognised in the Statement of comprehensive income

30/06/21 30/06/20 31/12/20

(unaudited) (unaudited) (audited)

GBP GBP GBP

Depreciation charge of right-of-use

asset

Buildings 71,959 63,534 135,493

71,959 63,534 135,493

============ ============ ==========

30/06/21 30/06/20 31/12/20

(unaudited) (unaudited) (audited)

GBP GBP GBP

Interest expenses (included in finance

cost)

Buildings 2,768 4,316 8,230

2,768 4,316 8,230

============ ============ ==========

11. TRADE AND OTHER RECEIVABLES

30/06/21 30/06/20 31/12/20

(unaudited) (unaudited) (audited)

GBP GBP GBP

Other receivables 30 187,514 91,020

Prepayments and accrued income 270,019 194,147 149,309

Deposits 54,222 - -

Value added tax 269,372 209,473 161,111

593,643 591,134 401,440

============ ============ ==========

As at 30 June 2021 there were no trade receivables past due nor

impaired. There are immaterial expected credit losses recognised on

these balances.

JERSEY OIL AND GAS PLC

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

FOR THE SIX MONTHSED 30 JUNE 2021

12. CASH AND CASH EQUIVALENTS

The amounts disclosed in the consolidated statement of cash

flows in respect of cash and cash equivalents are in respect of

these consolidated statement of financial position amounts:

Period ended 30 June 30/06/21 30/06/20 31/12/20

2021

(unaudited) (unaudited) (audited)

GBP GBP GBP

Cash and cash equivalents 17,056,538 8,881,309 5,081,515

------------ ------------

17,056,538 8,881,309 5,081,515

============ ============ ==========

13. CALLED UP SHARE CAPITAL

30/06/21 30/06/20 31/12/20

(unaudited) (unaudited) (audited)

GBP GBP GBP

Issued and fully paid:

Number: 31,894,293 (2020:

21,829,227)

Ordinary class 2,566,795 2,466,144 2,466,144

2,566,795 2,466,144 2,466,144

============ ============ ==========

14. TRADE AND OTHER PAYABLES

30/06/21 30/06/20 31/12/20

(unaudited) (unaudited) (audited)

GBP GBP GBP

Trade payables 267,385 510,461 451,857

Accrued expenses 303,979 154,814 465,291

Other payables 4 183,486 74,905

Taxation and Social Security 72,051 65,281 77,567

643,419 914,042 1,069,620

============ ============ ==========

JERSEY OIL AND GAS PLC

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

FOR THE SIX MONTHSED 30 JUNE 2021

15. NOTES TO THE CONSOLIDATED STATEMENT OF CASH FLOWS

RECONCILIATION OF LOSS BEFORE TAX TO CASH USED IN OPERATIONS

30/06/21 30/06/20 31/12/20

(unaudited) (unaudited) (audited)

GBP GBP GBP

Loss for the period before

tax (1,921,741) (1,168,529) (2,781,931)

Adjusted for:

Amortisation, impairments,

depletion and depreciation 17,362 10,083 23,977

Depreciation right-of-use

asset 71,959 63,534 135,493

Share based payments (net) 198,493 103,895 181,870

Provisions - 200,000 -

Finance costs 2,788 1,221 8,262

Finance income (1,127) (24,080) (27,937)

------------ ------------ ------------

(1,632,266) (813,876) (2,460,266)

Decrease in inventories

(Increase)/decrease in trade

and other receivables (137,980) (385,788) (27,352)

Increase/(decrease) in trade

and other payables (426,202) 319,711 327,454

------------ ------------ ------------

Cash used in operations (2,196,448) (879,953) (2,160,164)

============ ============ ============

16. CONTINGENT LIABILITIES & PROVISIONS

30/06/21 30/06/20 31/12/20

(unaudited) (unaudited) (audited)

GBP GBP GBP

Provisions - 200,000 -

============ ============ ==============

In December 2020 the Company reached a settlement with TGS-Nopec

Geophysical Company ASA ("TGS") pursuant to an agreement entered

into with TGS on 9 February 2018. Under the agreement, TGS claimed

uplift payments from JOG totalling US$1,050,838 in respect of: a)

licence awards to Jersey Petroleum Ltd ("JPL") in the Oil & Gas

Authority's 31st Supplementary Offshore Licencing Round; and b) the

acquisition by JPL of Equinor UK Limited's 70% interest in Licence

P2170 (Verbier). The Company disputed the validity of both claims

and, as a precautionary measure, provisioned GBP200,000 in 2020,

however following which two hearings took place in the Norwegian

courts. Subsequent to these hearings and, on the basis of legal

advice received, the Company agreed a final settlement payment to

TGS of US$850,000 (GBP637,028).

(i) 2015 settlement agreement with the Athena Consortium: In

accordance with a 2015 settlement agreement reached with the Athena

Consortium, although Jersey Petroleum Ltd remains a Licensee in the

joint venture, any past or future liabilities in respect of its

interest can only be satisfied from the Group's share of the

revenue that the Athena Oil Field generates and up to 60 per cent.

of net disposal proceeds or net petroleum profits from the Group's

interest in the P2170 licence which is the only remaining asset

still held that was in the Group at the time of the agreement with

the Athena Consortium who hold security over this asset. Any future

repayments, capped at the unpaid liability associated with the

Athena Oil Field, cannot be calculated with any certainty, and any

remaining liability still in existence once the Athena Oil Field

has been decommissioned will be written off. A payment was made in

2016 to the Athena Consortium in line with this agreement following

the farm-out of P2170 (Verbier) to Equinor and the subsequent

receipt of monies relating to that farm-out.

(ii) Equinor UK Limited: In January 2020, Jersey Oil Limited

announced that it had entered into a conditional Sale and Purchase

Agreement ("SPA") to acquire operatorship of, and an additional 70%

working interest in, Licence P2170 (Blocks 20/5b and 21/1d) from

Equinor UK Limited ("Equinor"), this transaction completed in May

2020. The consideration for the Acquisition consisted of two

milestone payments, which are considered contingent

liabilities:

-- US$3 million upon sanctioning by the UK's Oil & Gas

Authority ("OGA") of a Field Development Plan

("FDP") in respect of the Verbier Field; and

-- US$5 million upon first oil from the Verbier Field.

The earliest of the milestone payments in respect of the

Acquisition is not currently anticipated being payable before the

start of 2022.

(iii) ITOCHU Corporation and Japan Oil, Gas and Metals National

Corporation: In November 2020, Jersey Oil Limited announced that it

had entered into a conditional Sale and Purchase Agreement ("SPA")

to acquire the entire issued share capital of CIECO V&C (UK)

Limited, which was owned by ITOCHU Corporation and Japan Oil, Gas

and Metals National Corporation, this transaction completed in

April 2021. The consideration for the Acquisition included a

completion payment of GBP150k and two future milestone payments,

which are considered contingent liabilities:

-- GBP1.5 million in cash upon consent from the UK's Oil &

Gas Authority ("OGA") for a Field Development Plan ("FDP") in

respect of the Verbier discovery in the Upper Jurassic (J62-J64)

Burns Sandstone reservoir located on Licence P2170; and

-- GBP1 million in cash payable not later than one year after

first oil from all or any part of the area which is the subject of

the Field Development Plan.

The earliest of the milestone payments in respect of the

Acquisition is not currently anticipated being payable before the

start of 2022.

17. RELATED PARTIES

During the period, the Company made loans available to its

wholly owned subsidiaries and received loans from its wholly owned

subidiaries. At the end of the period, Jersey Petroleum Ltd owed

GBP86,409,726 (30 June 2020: GBP80,712,810) to the Company and

Jersey Oil & Gas E&P Ltd owed GBP3,755,742 (30 June 2020:

GBP2,826,957) to the Company. At the end of the period, the Company

owed Jersey North Sea Holdings Ltd GBP211,676 (30 June 2020:

GBP211,676).

During the period, Jersey Oil and Gas PLC charged management

fees to Jersey Petroleum Ltd amounting to GBP1,323,123 (30 June

2020: GBP1,107,008), and Jersey Oil and Gas E&P Ltd charged

management fees to Jersey Petroleum Ltd amounting to GBP447,776 (30

June 2020: GBP487,125).

18. POST BALANCE SHEET EVENTS

Further to undertaking a comprehensive technical and economic

evaluation of licences P2497 and P2499 and meetings recently held

with the OGA, the OGA confirmed that it was satisfied that the

Phase A Firm Commitments for both licences had been fulfilled. JOG

decided not to progress to the next licence phase, which would have

required committing to a firm well in each of these two licence

areas. Accordingly, the licences automatically ceased and

determined at the end of Phase A of their Initial Term on 29 August

2021.

19. AVAILABILITY OF THE INTERIM REPORT 2021

A copy of these results will be made available for inspection at

the Company's registered office during normal business hours on any

weekday. The Company's registered office is at 10 The Triangle, ng2

Business Park, Nottingham, Nottinghamshire NG2 1AE. A copy can also

be downloaded from the Company's website at

www.jerseyoilandgas.com. Jersey Oil and Gas plc is registered in

England and Wales with registration number 7503957.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR FFLLLFKLZBBL

(END) Dow Jones Newswires

September 22, 2021 02:00 ET (06:00 GMT)

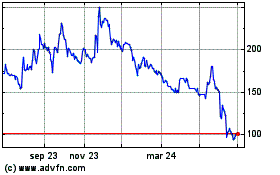

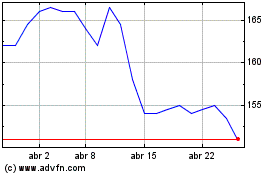

Jersey Oil And Gas (LSE:JOG)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Jersey Oil And Gas (LSE:JOG)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024