Jupiter Further Expands US Commitment; Opens NYC Hub to Strengthen Research and Distribution

27 Septiembre 2021 - 6:00AM

Business Wire

Jupiter Asset Management, a specialist, high-conviction active

management firm, announced today its continued expansion into the

US market with the opening of a New York City hub. The new office

will host a US-focused credit research team and bring its sales

team closer to a growing list of institutional clients.

The three-member credit team is an extension of Jupiter’s

UK-based $17.9B AUM* global fixed income team, headed by Ariel

Bezalel. The US-focused effort, headed by Joel Ojdana, brings the

team closer to US issuers, affording deeper relationships with US

companies and enhanced research.

Mr. Ojdana joined the company in London in 2018 and returned to

the US with the opening of Jupiter’s Denver-based operation in

October 2020. Also joining the US credit team in New York will be

David Rowe and Jordan Sonnenberg. Mr. Rowe joins Jupiter from JP

Morgan where he served as a leveraged loan and high-yield credit

analyst. Mr. Sonnenberg joins from Deutsche Bank, where he served

as a research associate with the high-yield credit research team.

The analysts will work closely with the entire UK-based credit

research team.

“Jupiter’s NYC hub reflects on the firm’s resolve to continually

build on the strength of our active research capabilities and to be

recognized as a more localized, yet global partner to our

institutional clients,” said CEO Andrew Formica. The firm recently

announced the hiring of David Schrock, head of US Institutional

from Janus Henderson Investors. Mr. Schrock joined Taylor

Carrington, CFA, formerly of Allianz Global Investors, who is

spearheading the firm’s US growth initiatives.

*Source: Jupiter, gross AUM as at June 30, 2021

Important Information

The information contained in this press release is intended

solely for members of the media and should not be relied upon by

private investors or any other persons to make financial

decisions.

This communication, including any data and views in it, is not a

financial promotion as defined in MiFID II. It does not constitute

an invitation to invest or investment advice in any way. Every

effort is made to ensure the accuracy of any information provided

but no assurances or warranties are given.

Market and exchange rate movements can cause the value of an

investment to fall as well as rise, and you may get back less than

originally invested.

The views expressed are those of the Fund Manager at the time of

writing, are not necessarily those of Jupiter as a whole and may be

subject to change. This is particularly true during periods of

rapidly changing market circumstances.

Issued in the UK by Jupiter Asset Management Limited, registered

address: The Zig Zag Building, 70 Victoria Street, London, SW1E 6SQ

is authorised and regulated by the Financial Conduct Authority.

Issued in the EU by Jupiter Asset Management International S.A.

(JAMI, the Management Company), registered address: 5, Rue

Heienhaff, Senningerberg L-1736, Luxembourg which is authorised and

regulated by the Commission de Surveillance du Secteur Financier.

Jupiter Asset Management US LLC with a principal place of business

in Denver, Co. is registered with the US Securities and Exchange

Commission (“SEC”) as an investment adviser.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20210927005179/en/

Taylor Carrington Head of US Distribution

1-303-506-2947

Despina Constantinides Head of Communications +44 (0)20

3817 1278 / +44 (0)7801 337 677

despina.constantinides@jupiteram.com

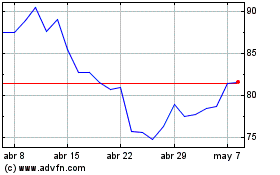

Jupiter Fund Management (LSE:JUP)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Jupiter Fund Management (LSE:JUP)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024