TIDMMTL

RNS Number : 5117G

Metals Exploration PLC

27 July 2021

METALS EXPLORATION PLC

QUARTERLY UPDATE TO 30 JUNE 2021

Metals Exploration plc (AIM: MTL) ("Metals Exploration", the

"Company" or the "Group"), a Philippine gold producer, is pleased

to announce its quarterly results for Q2 2021.

Finance and corporate

-- Gold sold during Q2 2021 of 16,429 ounces at an average

realised gold price of US$1,807 per ounce (Q1 2021: 18,316 ounces

at an average gold price of US$1,788 per ounce).

-- Gold sales of US$29.7 million in Q2 2021 (Q1 2021: US$32.8 million).

-- Positive free cash flow of US$5.5 million in Q2 2021 (Q1 2021: US$11.5 million).

-- Senior debt repaid during Q2 2021 was US$8.3 million (Q1 2021: US$12.3 million).

-- Net debt as at 30 June 2021 was US$111.0 million (31 March 2021: US$112.7 million).

-- Appointment of new independent Non-executive Chairman and two

additional non-executive directors.

Mining Operations

-- No lost time injuries during the period.

-- Ore and waste mined for the quarter was below forecast, at

2.66Mt (Q1 2021: 2.43Mt) of which total ore mined was 288kt (Q1

2021: 423kt).

-- Access development to mine plan Stages 3 & 4, and

resettlement of the remaining illegal miners away from these areas

continues. Access to Stages 3 & 4 continues to be impacted.

Further actions in relation to access development and resettlement

activities will be made in the forthcoming quarters.

Processing Operations

-- Gold poured during Q2 2021 of 16,591 ounces (Q1 2021: 18,725 ounces).

-- Gold recovery for Q2 2021 was 80% (Q1 2021: 81.9%).

COVID-19 Impacts

-- The Philippines suffered from a surge in COVID-19 cases

during Q2 2021, including the Municipality of Quezon and

neighbouring cities/towns near the Runruno mine site.

-- The number of COVID-19 cases recorded amongst personnel at

the project site has reduced since quarter end.

-- All infected personnel and their traced close contacts have been/were isolated.

-- General access to mine site for non-operational personnel continues to be restricted.

-- Normal mining and processing operations continue notwithstanding COVID-19 pandemic impacts.

-- Despite ongoing and changing travel restrictions key senior

personnel were able to return to the mine site from 1 May 2021.

-- COVID-19 vaccinations for all Company employees have been

ordered and are due to be received during Q3 2021.

Darren Bowden, CEO of Metals Exploration, commented :

" The second quarter of the year, whilst having been a

challenging one, has seen the Company continue to produce strong

results from Runruno.

The safety of our staff remains a key priority, and we continue

to have an exceptional safety record with over 14 million hours

worked without a reportable injury as at the quarter-end. We also

continue to be stringent regarding COVID-19, especially in light of

the recent surge that beset the Philippines. We continue to take

appropriate actions to safeguard and help our staff and their

communities. It is also extremely satisfying that we will shortly

be able to offer all our staff COVID-19 vaccinations.

We believe we are well placed for the second half of 2021 to

continue delivering good operational progress at Runruno. We look

forward to providing further updates during the course of the

year."

Production and Finance Summary

Runruno Project

Report Quarter Quarter FY 2021 FY 2020

---------- ---------- ---------- ----------

FY 2021 Actual Actual Actual Actual

---------- ---------- ---------- ----------

PHYSICALS Units Q2 2021 Q2 2020 6 Months 6 Months

------------- ---------- ----------

Mining

------------- ---------- ----------

Ore Mined Tonnes 287,866 567,973 713,742 1,125,138

-------------- ---------- ----------

Waste Mined Tonnes 2,371,708 1,856,423 4,537,749 4,414,126

-------------- ---------- ----------

Total Mined Tonnes 2,659,574 2,424,396 5,251,491 5,539,264

-------------- ---------- ----------

Au Grade Mined g/tonne 1.10 1.46 1.27 1.44

-------------- ---------- ----------

Strip Ratio 7.42 3.27 5.92 3.92

---------- ----------

Processing

------------- ---------- ----------

Ore Milled Tonnes 511,536 544,980 1,048,290 1,039,806

-------------- ---------- ----------

Au Grade g/tonne 1.26 1.26 1.29 1.39

-------------- ---------- ----------

S(2) Grade % 1.17 1.20 1.11 1.28

-------------- ---------- ----------

Au Milled (contained) ounces 20,745 22,034 43,620 46,609

-------------- ---------- ----------

Recovery % 80.0 68.7 81.0 68.5

-------------- ---------- ----------

Au Recovered/Poured ounces 16,591 15,146 35,316 31,940

-------------- ---------- ----------

Sales

------------- ---------- ----------

Au Sold ounces 16,429 14,908 34,745 32,121

-------------- ---------- ----------

Au Price US$/oz 1,807 1,722 1,797 1,647

-------------- ---------- ----------

FINANCIALS (Unaudited)

------------------------- ------------- ---------- ----------

Revenue

------------- ---------- ----------

Gold Sales (US$000's) 29,682 25,669 62,439 52,891

-------------- ---------- ----------

Operating Costs

- Summary

------------- ---------- ----------

Mining (US$000's) 6,415 4,485 11,950 9,748

-------------- ---------- ----------

Processing (US$000's) 7,876 7,027 15,363 14,760

-------------- ---------- ----------

G&A (US$000's) 2,638 2,741 5,548 5,564

-------------- ----------

Total Operating

Costs (US$000's) 16,929 14,253 32,860 30,072

-------------- ----------

Excise Duty (US$000's) 1,190 1,031 2,541 2,127

-------------- ---------- ----------

UK/Philippine G&A (US$000's) 1,897 1,698 3,496 3,065

-------------- ---------- ----------

Total Direct Production

Costs (US$000's) 20,016 16,983 38,897 35,264

-------------- ---------- ----------

Net Cash Income (US$000's) 9,666 8,686 23,543 17,817

-------------- ---------- ----------

Total Capital Costs (US$000's) 4,209 2,640 6,553 6,416

-------------- ---------- ----------

Total non-cash costs (US$000's) 3,583 4,240 7,907 8,402

-------------- ---------- ----------

Free Cashflow ( US$000's) 5,457 6,046 16,989 11,210

-------------- ---------- ----------

Cash Cost / oz Sold

- C1 US$/oz 1,014 895 946 930

-------------- ---------- ----------

Cash Cost / oz Sold

- AISC US$/oz 1,458 1,229 1,309 1,279

-------------- ---------- ----------

Note: AISC includes all UK Corporate costs.

Review of Operations

During Q2 2021 the Philippines suffered from a new wave of

COVID-19 infection that spread across the country. This increase in

COVID-19 cases was particularly evident in the neighbouring

cities/towns near the Runruno mine site. Despite enhanced on-site

testing and strict site access protocols approximately 35 on-site

cases of COVID-19 were detected. These cases were concentrated

within the administrative and other supporting non-operational

departments, and to date there has been no interruption to

mining/processing operations. Importantly, at quarter end the

frequency in identified COVID-19 infections both within Company

employees/contractors and the general local population has reduced

substantially, with this trend continuing post-quarter end.

The COVID-19 cases detected and the Company's responses have

been reported to the appropriate government agencies and the

Company continues to be compliant with all relevant government

directives with regards COVID-19.

Other than the recent on-site outbreak of COVID-19, the main

operational disruption from the pandemic has been the ongoing and

regularly changing restrictions on the movement of people in and

out of the country.

In mid-March, the Philippine government implemented a ban on

international personnel returning to the country. This travel ban

was lifted on 1 May 2021 and key senior personnel have managed to

travel back to the project site. The unpredictability of

international travel brought about by the changing nature of the

COVID-19 pandemic, will continue to challenge the Company's ability

to maintain its senior expat management on-site roster.

Notwithstanding the above issues, Q2 2021 resulted in gold sales

of US$29.7 million (Q1 2021: US$32.8 million), at an average

realised gold price of US$1,807 per ounce (Q1 2021: average gold

price of US$1,788 per ounce); producing a positive free cash flow

of US$5.5 million (Q1 2021: US$11.5 million).

During Q2 2021 a total of US$8.3 million (Q1 2021: US$12.3

million) in debt repayments were made, bringing the net Group debt

position as at 30 June 2021 to US$111.0 million (Q1 2021: US$112.7

million).

Mining Operations

Mining production of ore and waste for Q2 2021 was below

forecast at 2.66Mt (Q1 2021: 2.43Mt), and the total ore mined for

Q2 2021 of 288Kt (Q1 2021: 423kt). Total material movement has been

negatively impacted by reliability issues with the Company's

equipment fleet. Longer than normal delays in sourcing certain

essential replacement parts continue to impact in this area.

Mining in Stage 1 is well advanced with backfill operations into

this area on track to commence in Q4 2021.

Notwithstanding continued delays in completing the resettlement

of the illegal miners from Stages 3 and 4 of the Project site, the

new access road to mine plan Stages 3 and 4 has been completed and

preliminary development work in Stage 3 and 4 has commenced.

Although the Company does not have full access to these areas,

negatively impacting the Company's mining schedule, the programme

of infill resource and mine plan drilling is underway in mine plan

Stages 3 and 4. The Company continues to work diligently with the

local authorities to complete the process of removal and

resettlement.

Process Plant

Throughput for Q2 2021 was 512kt (Q1 2021: 537kt). Gold

production for Q2 2021 was 16,591 ounces at a recovery rate of

80.0% (Q1 2021: 18,725 ounces at a recovery rate of 81.9%). Ongoing

delays in accessing mine plan Stages 3 and 4 continues to affect

the head grade with higher grade material from Stage 3 now not

scheduled to be accessed until Q1 2022.

During the quarter, major shutdowns were undertaken to install

the SAG mill variable speed drive and to replace the SAG mill

liners. Unplanned downtime consisted in the main of tails line

failures and conveyor belt repairs.

The 4(th) blower to BIOX will be installed during Q3 2021, with

the aim to increase the available air for, and hence the efficiency

of, the BIOX circuit.

Implementation of minor design modifications to the flotation

circuit continue; with the aim to increase the consistency of gold

recovery of this circuit.

Residual Storage Impoundment ("RSI")

RSI construction continues with the d am water freeboard level

well above design levels. Studies into designing the RSI final

in-rock spillway have determined the optimal design and detailed

planning is underway. The Stage 6 lift to the dam was completed

during the quarter under the supervision of international

engineering consultants, GHD.

Occupational Health & Safety

Runruno continues to record an exceptional safety record with

over 14 million man hours without a reportable injury as at the

quarter end.

Environment and Compliance

Compliance matters continue to be successfully monitored and the

mine remains compliant, with no outstanding material issues.

Community & Government Relations

The Company, in conjunction with relevant government agencies,

continues in its efforts to complete the removal of the remaining

illegal miners, including their infrastructure and dwellings, from

those areas scheduled to be mined as part of mine plan Stages 3 and

4. Further actions in relation to access development and the

resettlement activities will be made in the forthcoming

quarters.

This announcement contains inside information for the purposes

of Article 7 of EU Regulation 596/2014, which forms part of United

Kingdom domestic law by virtue of the European (Withdrawal) Act

2018. Upon the publication of this Announcement, this inside

information is now considered to be in the public domain.

- -

-

For further information please visit or contact

www.metalsexploration.com

Metals Exploration PLC

Via Tavistock Communications

Limited +44 (0) 207 920 3150

-------------------------

Nominated & Financial STRAND HANSON LIMITED

Adviser:

-------------------------

James Spinney, James

Dance, Rob Patrick +44 (0) 207 409 3494

-------------------------

Financial Adviser & Broker: HANNAM & PARTNERS

-------------------------

Nilesh Patel +44 (0) 207 907 8500

-------------------------

Public Relations: TAVISTOCK COMMUNICATIONS

LIMITED

-------------------------

Jos Simson, Nick Elwes +44 (0) 207 920 3150

-------------------------

Competent Person's Statement

Mr Darren Bowden, a director of the Company, a Member of the

Australasian Institute of Mining and Metallurgy and who has been

involved in the mining industry for more than 25 years, has

compiled, read and approved the technical disclosure in this

regulatory announcement in accordance with the AIM Rules - Note for

Mining and Oil & Gas Companies.

Forward Looking Statements

Certain statements relating to the estimated or expected future

production, operating results, cash flows and costs and financial

condition of Metals Explorations, planned work at the Company's

projects and the expected results of such work contained herein are

forward-looking statements which are based on current expectations,

estimates and projections about the potential returns of the Group,

industry and markets in which the Group operates in, the Directors'

beliefs and assumptions made by the Directors . Forward-looking

statements are statements that are not historical facts and are

generally, but not always, identified by words such as the

following: "expects", "plans", "anticipates", "forecasts",

"believes", "intends", "estimates", "projects", "assumes",

"potential" or variations of such words and similar expressions.

Forward-looking statements also include reference to events or

conditions that will, would, may, could or should occur.

Information concerning exploration results and mineral reserve and

resource estimates may also be deemed to be forward-looking

statements, as it constitutes a prediction of what might be found

to be present when and if a project is actually developed.

These statements are not guarantees of future performance or the

ability to identify and consummate investments and involve certain

risks, uncertainties and assumptions that are difficult to predict,

qualify or quantify. Among the factors that could cause actual

results or projections to differ materially include, without

limitation: uncertainties related to raising sufficient financing

to fund the planned work in a timely manner and on acceptable

terms; changes in planned work resulting from logistical, technical

or other factors; the possibility that results of work will not

fulfil projections/expectations and realize the perceived potential

of the Company's projects; uncertainties involved in the

interpretation of drilling results and other tests and the

estimation of gold reserves and resources; risk of accidents,

equipment breakdowns and labour disputes or other unanticipated

difficulties or interruptions; the possibility of environmental

issues at the Company's projects; the possibility of cost overruns

or unanticipated expenses in work programs; the need to obtain

permits and comply with environmental laws and regulations and

other government requirements; fluctuations in the price of gold

and other risks and uncertainties.

The Company expressly disclaims any obligation or undertaking to

disseminate any updates or revisions to any forward looking

statements contained herein to reflect any change in the Group's

expectations with regard thereto or any change in events,

conditions or circumstances on which any such statements are based

unless required to do so by applicable law or the AIM Rules.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

UPDRFMFTMTMTBRB

(END) Dow Jones Newswires

July 27, 2021 02:00 ET (06:00 GMT)

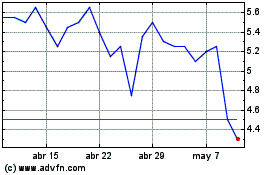

Metals Exploration (LSE:MTL)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Metals Exploration (LSE:MTL)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024