TIDMNCC

RNS Number : 4088N

NCC Group PLC

29 September 2021

NCC Group plc

(the "Company" or the "Group")

Notice of Annual General Meeting 2021

The Company confirms that its Notice of Annual General Meeting

2021 ("AGM Notice") and its Annual Report and Accounts for the year

ending 31 May 2021 ("Annual Report") have been posted or otherwise

been made available to shareholders and published on the Investor

Relations section of its website

(www.nccgroup.com/investor-relations). The Annual General Meeting

will be held at 2.00pm on Thursday 4 November 2021 at the Company's

Head Office, XYZ Building, 2 Hardman Boulevard, Spinningfields,

Manchester, M3 3AQ.

Copies of the Annual Report and the AGM Notice have been

submitted to the National Storage Mechanism and will shortly be

available for inspection at

https://www.fca.org.uk/markets/primary-markets/regulatory-disclosures/national-storage-mechanism

A condensed set of the Company's financial statements and

extracts were included in the Company's preliminary results for the

year ended 31 May 2021 released on 14 September 2021 (the

"Preliminary Announcement"). The information included within the

Preliminary Announcement together with the information set out

below, which is extracted from the Annual Report, constitute the

material required by Disclosure Guidance and Transparency Rule

6.3.5 to be communicated to the media in full unedited text through

a Regulatory Information Service. This announcement and the

Preliminary Announcement are not a substitute for reading the full

Annual Report. Page numbers and cross-references in the extracted

information below refer to page numbers and cross-references in the

Annual Report. To view the Preliminary Announcement, please visit

the Investor Relations section of the Company's website at

www.nccgroup.com/investor-relations

Directors' responsibilities statement

The following statement is extracted from page 123 of the Annual

Report and is repeated here for the purposes of Disclosure Guidance

and Transparency Rule 6.3.5. This statement relates solely to the

Annual Report and is not connected to the extracted information set

out in this announcement or the Preliminary Announcement:

"Statement of Directors' responsibilities in respect of the

Annual Report and Accounts and the Financial Statements

The Directors are responsible for preparing the Annual Report

and Accounts and the Group and Parent Company Financial Statements

in accordance with applicable law and regulations.

Company law requires the Directors to prepare Group and Parent

Company Financial Statements for each financial year. Under that

law they are required to prepare the Group Financial Statements in

accordance with International Accounting Standards in conformity

with the requirements of the Companies Act 2006 and applicable law

and have elected to prepare the Parent Company Financial Statements

on the same basis. In addition the Group Financial Statements are

required under the Financial Conduct Authority's Disclosure

Guidance and Transparency Rules (DTRs) to be prepared in accordance

with International Financial Reporting Standards adopted pursuant

to Regulation (EC) No 1606/2002 as it applies in the European Union

('IFRSs as adopted by the EU').

Under company law the Directors must not approve the Financial

Statements unless they are satisfied that they give a true and fair

view of the state of affairs of the Company and of the Group's

profit or loss for that period. In preparing each of the Group and

Parent Company Financial Statements, the Directors are required

to:

-- Select suitable accounting policies and then apply them consistently

-- Make judgements and estimates that are reasonable, relevant and reliable

-- State whether they have been prepared in accordance with

International Accounting Standards in conformity with the

requirements of the Companies Act 2006 and, as regards the Group

Financial Statements, International Financial Reporting Standards

adopted pursuant to Regulation (EC) No 1606/2002 as it applies in

the European Union ('IFRSs as adopted by the EU')

-- Assess the Group and Parent Company's ability to continue as

a going concern, disclosing, as applicable, matters related to

going concern

-- Use the going concern basis of accounting unless they either

intend to liquidate the Group or the Parent Company or to cease

operations, or have no realistic alternative but to do so

The Directors are responsible for keeping adequate accounting

records that are sufficient to show and explain the Parent

Company's transactions and disclose with reasonable accuracy at any

time the financial position of the Parent Company and enable them

to ensure that its Financial Statements comply with the Companies

Act 2006. They are responsible for such internal control as they

determine is necessary to enable the preparation of Financial

Statements that are free from material misstatement, whether due to

fraud or error, and have general responsibility for taking such

steps as are reasonably open to them to safeguard the assets of the

Group and to prevent and detect fraud and other irregularities.

Under applicable law and regulations, the Directors are also

responsible for preparing a Strategic Report, Directors' Report,

Directors' Remuneration Report and Corporate Governance Statement

that comply with that law and those regulations.

The Directors are responsible for the maintenance and integrity

of the corporate and financial information included on the

Company's website. Legislation in the UK governing the preparation

and dissemination of Financial Statements may differ from

legislation in other jurisdictions.

Responsibility statement of the Directors in respect of the

annual financial report

We confirm that to the best of our knowledge:

-- The Financial Statements, prepared in accordance with the

applicable set of accounting standards, give a true and fair view

of the assets, liabilities, financial position and profit or loss

of the Company and the undertakings included in the consolidation

taken as a whole

-- The Strategic Report includes a fair review of the

development and performance of the business and the position of the

issuer and the undertakings included in the consolidation taken as

a whole, together with a description of the principal risks and

uncertainties that they face

We consider the Annual Report and Accounts, taken as a whole, is

fair, balanced and understandable and provides the information

necessary for shareholders to assess the Group's position and

performance, business model and strategy."

Principal risks and uncertainties

The principal risks and uncertainties relating to the Company

are set out on pages 40 to 47 of the Annual Report from which the

following is extracted in full and unedited text:

"Risk management

Risk is an inherent part of doing business and risk management

is a fundamental part of good corporate governance. A successful

risk management process balances risk and reward and is underpinned

by sound judgement of their impact and likelihood. The Board has

overall responsibility for ensuring that NCC Group has an effective

risk management framework, which is aligned to our business

objectives.

The Board has established a Risk Management Policy, which has

established protocols, including:

-- Roles and responsibilities for the risk management framework

-- Risk scoring framework

-- A definition of risk appetite

The integrated approach to risk management diagram summarises

the Group's overall approach to risk management, which is supported

by a web-based tool - the Integrated Risk Management System (IRMS).

The tool is designed to follow the risk management model described

in the next section and records both strategic and operational risk

registers and tracks risk mitigation action plans, helping embed

ownership of risks and treatment actions while also providing

access to live management information, which is used at both a

Board and operational management level.

NCC Group's approach to risk management

NCC Group adopts both a "top down" and "bottom up" approach to

risk, to manage risk exposure across the Group to enable the

effective pursuit of strategic objectives. The approach is

summarised in the diagram on page 41.

The approach is one of collaboration, which supports our

comprehensive approach to risk identification, from the "top down"

and "bottom up". The Group believes that this is the most efficient

and effective way to identify its business risks.

Top down

The Board, Audit Committee and Cyber Security Committee review

risks on an ongoing basis and are supported by the Executive

Committee and subject matter specialists (including Software

Resilience, Assurance, information security, data protection and

health and safety). The Board gives consideration to the Group's

strategic objectives and any barriers to their achievement.

Bottom up

The Board and senior leadership team engage with colleagues at

every level of the Group in recognition of the importance of their

expertise, contribution and views. In relation to matters of

wrongdoing, or risks not being recognised and adequately managed,

the Group has a robust and effective whistleblowing procedure,

which is supported by the Safecall reporting line.

Risk management model

The Board has overall responsibility for ensuring that NCC Group

adopts an effective risk management model, which is aligned to our

objectives and promotes good risk management practice. We have

therefore adopted the model described in this section and

summarised in the diagram above.

The Board, Audit Committee, Cyber Security Committee and

Executive Team review risks on an ongoing basis throughout the

year. The appropriateness and relevance of the risks and issues

tracking system - IRMS - are monitored by the global governance

team to ensure that it continues to be updated, meets the needs of

the Group and remains in line with good risk management practice.

In addition, there is a robust process in place for monitoring and

reporting the implementation of agreed actions.

We are satisfied that the Risk Management Policy, framework and

model currently in place are sufficient to manage risk across the

Group.

The key areas of identifying, assessing, addressing and

monitoring risks are explained in more detail below:

Identify

Risks exist within all areas of our business and it is important

for us to identify and understand the degree to which their impact

and likelihood of occurrence will affect the delivery of our key

objectives. This is achieved through day-to-day working practices

and incorporates risks in both the internal and external

environment. Examples of identification include horizon scanning

for legislative and market changes, operational and delivery

reviews (such as SGT), procedures in relation to projects and

change and independent systems audits.

All identified risks are initially assessed for their "inherent"

risk (risk with no controls in place), using a scoring mechanism

that accounts for the likelihood of an event occurring and the

impact that it may have on the Group. The scoring mechanism adopted

takes account of high impact, low likelihood events and these risks

are managed in a timely manner.

In addition to ongoing risk identification, an annual exercise

is undertaken to review the Group's strategic risk universe by the

Board. This exercise is reliant on the "top down" "bottom up"

approach discussed earlier.

Assess

Post identification of the Group's inherent risk exposure, a

comprehensive assessment of the effectiveness of current mitigating

controls is undertaken. This exercise takes account of the design

of the current control environment and the application of these

controls prior to assessing the Group's current exposure to risk -

mitigated risk score. The Board uses a number of sources of

information to support the scoring of risk and these include, but

are not limited to:

-- Management updates

-- Action tracking and reporting

-- Control environment policies and procedures

-- Independent audit activity

-- Project monitoring reports

Address

Having identified and assessed the risks faced by the Group, the

risks are scored according to likelihood of occurring and impact to

the business should they occur. The risks are then mapped according

to their rating onto a risk heat map, which reflects the Group's

overall risk appetite set by the Board. The Group's Risk Management

Policy then provides guidance on the expected level of response to

those risks, depending on where they sit on the risk heat map. The

heat map shows the four bandings in the different shades of risks

as set out below as well as expected actions and responses to risks

in these areas:

Green - within appetite. Ongoing monitoring in place

Amber - out of appetite. Some actions are required to treat the

risk to bring this within acceptable levels

Purple - significantly out of appetite. High combination of

residual probability and impact. Management actions required, with

some urgency, to treat the risk, reducing this to acceptable

levels

Grey/black - risks that are deemed to have such an impact that

they could theoretically impact the ability of the business to

continue in existence. If any, they would need consideration in

assessing in the Directors' Viability Statement

An assessment of whether additional actions are required to

reduce our risk exposure is undertaken, with actions falling into

the one of four categories:

-- Treat - develop an action plan (applying responsibility,

deadlines and prioritisation) that may include the implementation

of additional controls, or increase the requirement for additional

assurance over the adequacy and effectiveness of the existing

controls

-- Transfer - use a third party specialist to undertake the activity, thus mitigating the risk

-- Tolerate - determine the risk is within appetite

-- Terminate - exit the activity

Output from the evaluation of strategic risks has resulted in

milestone plans owned by senior business leaders, or has been used

in the development of the Group's transformation programme.

Monitor

Ongoing monitoring of risks and related actions is key to the

implementation of our risk management model and, therefore, NCC

Group is committed to making enterprise-wide risk management part

of business as usual. Examples of ongoing monitoring of business

risks include, but are not limited to:

-- Annual review of the external audit strategy and plan by the

Audit Committee and Chief Financial Officer to ensure inclusion of

key financial risks

-- Annual review of the annual internal audit plan to validate

that it incorporates key areas of business risk

-- At each Audit Committee, a review of internal audit reports

issued during the period, including a summary of progress against

previously raised management actions

-- Annual review of the strategic risk register by the

Enterprise Risk Management Steering Group (introduced in FY21) and

Board to ensure that it includes risks arising in year

Internal control

Whilst risk management identifies threats to the Group achieving

its strategic objectives, internal controls are designed to provide

assurance that these objectives are being achieved, such as the

effectiveness and efficiency of operations and delivery, accurate

and reliable financial reporting, and compliance with applicable

laws and regulation.

NCC Group has established a robust internal control framework

which is made up of a number of components:

Control environment

The control environment has primarily been established taking

account of the Group's values (working together, being brilliantly

creative and embracing difference) and its Code of Ethics, which

sets the foundations for the expected behaviours, values and

competencies for all colleagues across the Group. The Board,

Executive Committee and extended leadership team lead by example

and strive to maintain effective control environments, whilst also

maintaining integrity and transparency.

Risk assessments

Risk assessments are conducted at both a strategic and

operational level of the Group and support the Group in

understanding the risks that it faces and the controls in place to

mitigate them. Importantly, they provide a mechanism to identify

operational improvements which is vital in our transformational

programmes.

Policies and procedures

Established policies communicate expected behaviours and these

are supported through procedures and guidelines defining required

processes and controls. This in turn supports the business to adopt

efficient and effective control environments.

Information and communication

Access to accurate and timely data is key in supporting our

colleagues to make decisions and to be well informed in order to

conduct, manage and control their areas of responsibility. During

the year, the Group has continued to focus on its data systems -

rolling out the Workday Finance system to support consistent

controls and reporting.

Activity monitoring

Financial minimum controls were established during FY20 for

local finance teams. The financial minimum controls have been

self-assessed by all finance teams and a programme of audit against

these standards launched in FY21. The financial minimum controls

framework was established in consultation with the Chief Financial

Officer, Group Financial Controller and local Finance Directors and

has taken account of the implementation of Workday Finance. Further

enhancement of the framework is being considered in preparation for

potential changes proposed in the Brydon Review and related white

paper issued by the Department for Business, Energy and Industrial

Strategy.

Financial accounting and reporting follows generally accepted

accounting practices.

Group review and approval procedures exist in relation to major

areas of risk and require Executive Committee/Board approval,

including mergers and acquisitions, major contracts, capital

expenditure, litigation, treasury management and taxation

policies.

Compliance with all legislation, current and new, is closely

monitored.

Risk and control reporting structure

During the current financial year, NCC Group has focused on

establishing the "three lines of defence" to provide a robust

internal controls structure that will support the Board, Audit

Committee, Cyber Security Committee, Executive Committee and

extended leadership team with accurate and reliable information in

relation to the systems of internal control.

Three lines of defence:

-- First line - Group policies and procedures

-- Second line - Global Governance function, incorporating

Health and Safety; Information Security; Data Protection;

Compliance and Standards; and Corporate Legal

-- Third line - independent challenge and assessment, including

ISO certification and internal and external audit

Principal risks and uncertainties

The Group continues to operate in a particularly dynamic and

evolving marketplace. The current strategic risk register has been

developed to reflect those factors and includes those risks that

would threaten its business model, future performance, solvency or

liquidity. Detailed descriptions of the current principal risks and

uncertainties faced by the Group, their potential impact and

mitigating processes and controls are set out below. A risk related

to sustainability (10) has been added to the strategic risks for

FY21 and reflects the importance being placed on a sustainable

business strategy by NCC Group and its investors.

The heat map provides a pictorial representation of the Group's

strategic risks and their direction of travel.

Risk areas Impact Key controls and mitigating

factors

Business A poor strategy (High impact, risk exposure

strategy or ineffective unchanged from 2020)

A comprehensive execution of a Members of the Board have

business strategy could significant experience

strategy have a material in evolving business strategies.

is essential negative impact The Board is significantly

to the on the Group's engaged in both setting

continued financial performance and reviewing strategy

success of the and value. It would and held a dedicated strategy

Group as we potentially weaken session in March 2021.

strive the Group compared

to maximise to its competitors

shareholder and risk the Group's

value. established position

in the marketplace.

-------------------------------------------------------- ---------------------------------------------------------------

Management of Poor change management (Low impact, risk exposure

strategic could lead to ineffective unchanged from 2020)

change implementation The Group has established

As the Group of projects that a strategic change management

adapts and then cost more capability and this includes

executes to deliver, take access to programme management

its strategy longer to deliver professionals and the

there are a and result in fewer deployment of associated

number benefits being change management processes,

of complex realised (or all for example the operation

projects three). Poor delivery of senior change oversight

and initiatives of change could committees.

that not only ultimately impair

need to be business performance.

delivered

but also

require

understanding

and support

from

all colleagues.

-------------------------------------------------------- ---------------------------------------------------------------

Global pandemic The potential impact (Medium impact, risk exposure

- Covid-19 of a pandemic globally decreased from 2020)

NCC Group has is closed offices, During 2021, we successfully

a number of people who are moved to remote working

features unwell and unable during the lockdown periods

which give the to work for periods across our offices and

Group greater of time and a slow-down were able to deliver our

resilience in in business from services off client sites.

the face of a our clients. We have also used remote

global working as an opportunity

pandemic. to develop our services

Failure to to support remote delivery.

prepare In addition, the Group

for this may has developed an office

cause re-opening programme,

disruption which has taken into account

and uncertainty the health and wellbeing

to our of our colleagues, which

business, has further supported

as well as risk our successful service

the health and delivery.

safety of our

people. Any

disruption

or uncertainty

could have an

adverse effect

on our

business,

financial

results

and operations.

-------------------------------------------------------- ---------------------------------------------------------------

Availability If the Group's (High impact, risk exposure

of critical critical systems decreased from 2020)

information failed, this could The Group continues to

systems affect the Group's make significant investment

The Group is ability to provide in its IT infrastructure

heavily reliant services to our to ensure it continues

on continued customers. to support the growth

and of the organisation. This

uninterrupted has been particularly

access to its pertinent during home

IT systems. As working as part of the

well as response to Covid-19.

environmental The Group has controls

and physical in place in order to reduce

threats, the the risk of actual loss

Group is a of critical systems; this

natural has included a review

target for of single points of failure

individuals and these have been mitigated.

who may seek Further, controls are

to disrupt the operated to ensure the

Group's availability of backup

commercial media in the event of

activities. prolonged loss of systems.

The Group also standardises

and simplifies processes

whilst increasing resilience.

Additional focus is given

to proving the recoverability

of systems and data.

-------------------------------------------------------- ---------------------------------------------------------------

Attracting and Loss of key colleagues (Medium impact, risk exposure

retaining or significant decreased from 2020)

appropriate colleague turnover Colleagues are offered

colleague could result in a rewarding career structure

capacity a lack of necessary and attractive salary

and capability expertise or continuity and benefits packages,

The Group would to execute the which can include participation

be adversely Group's strategy. in share schemes.

impacted if it An inability to Comprehensive communications

were unable to attract and retain with our colleagues are

attract and sufficient high-calibre ongoing and include all-hands

retain colleagues could calls, The Wire and Group

the right become a barrier and local communications.

calibre to the continued Linked to the development

of skilled success and growth of our people, the Group

colleagues. of NCC Group. continues to review our

Some roles values and continues to

within use personal performance

the Group management processes,

operate and aligned development

in highly programmes, which are

technical linked to succession planning.

and extremely

specialised

areas

in which there

are shortages

of skilled

people.

-------------------------------------------------------- ---------------------------------------------------------------

Information Failure to maintain (Medium impact, risk exposure

security control over customer, unchanged from 2020)

risk (including colleague, commercial The Board operates a Cyber

cyber risk) and/or operational Security Committee chaired

Due to the data could lead by the Chair of the Board

nature to a range of impacts, and is responsible for

of the services including reputational the ongoing oversight

provided by NCC damage. The misuse of this risk and related

Group, clients of personal data, control environments.

have a high for example without All colleagues globally

expectation the customer's are required to undertake

of the systems, consent, or retaining annual security training

processes and data for longer and updates to alert them

people handling than is necessary, to potential methods of

their data. may also result security breach and to

In addition, in reputational their responsibilities

as a cyber harm, regulatory in safeguarding information

security investigations and reporting potential

provider, NCC and potential fines. issues.

Group is more Security testing is regularly

exposed to its carried out on the Group's

systems being infrastructure and there

maliciously are extensive response

compromised. plans, which were reviewed

As a result, during the year, in the

NCC Group could event of a major security

experience a incident.

malicious Comprehensive plans are

cyber-attack, in place and being delivered

inadvertent associated with discharging

disclosure our data protection obligations.

and/ or

compromise

of confidential

data and/or any

other

information

security

incident.

-------------------------------------------------------- ---------------------------------------------------------------

Quality of Suboptimal business (High impact, risk exposure

Management decision making decreased from 2020)

Information and performance The Group finance function

Systems as key financial has developed a forward-facing

(MIS) and performance data Finance Functional Strategy.

internal is not available Enhancements were identified

business or trusted. covering system and process

processes standardisation. A comprehensive

We need to milestone plan is in place

ensure and progress is tracked

that trusted and reported to each Audit

and relevant Committee.

MIS are The rollout of Workday

available across our global finance

on a day-to-day teams has been significantly

basis to inform completed and will support

management the standardisation of

decisions policies and procedures,

and drive in addition to improving

performance. efficiency and effectiveness.

Standardised business

process control standards

are in place across all

parts of the Group. Financial

year 2021 has seen the

implementation of the

new control self-assessment

questionnaires along with

an aligned programme of

internal audits.

-------------------------------------------------------- ---------------------------------------------------------------

Quality and The risk of the (High impact, risk exposure

Security Group failing to decreased from 2020)

Management retain a core standard, We operate a comprehensive

Systems e.g. 9001, 27001 programme to ensure the

We aspire to or PCI, with a retention of our core

attain and consequential loss standards. This includes

retain of key customer a portfolio of aligned

key accounts or ability policies and cascading

internationally to operate. business processes. A

recognised programme of internal

standards, audit provides assurance

which form an over the design and application

important of these policies and

component procedures.

for many of our External assessors provide

customers. a further layer of review

and challenge, confirming

during the year the retention

of our Quality and Security

standards, which were

renewed in April 2021.

-------------------------------------------------------- ---------------------------------------------------------------

Post-Brexit There remains some (Low impact, risk exposure

uncertainty around decreased from 2020)

Failure to the detail of EU

comply regulatory changes Similar to any UK company,

with changing as these are finalised we list post-Brexit as

EU regulations (for example, finalisation a significant risk due

as a result of of trade negotiations to the continued uncertainty

Brexit may with the wider surrounding the final

cause world), which may EU post-Brexit trade deals

disruption to impact on some with Europe and other

our business. of the services international countries,

Any disruption delivered by the which are still being

could have an Group, which fall negotiated.

adverse effect under export control As our operations around

on our business regulations. the world include business

operations. entities based in Continental

Europe and the wider world,

we believe NCC Group is

structurally resilient

to the post-Brexit trading

environment. The main

risks to our business

post-Brexit are:

* Changes to export control requirements and related

tariffs being implemented which may impact on some

areas of service delivery

* Real or perceived differences in data protection

standards, which impact our global ways of working

-------------------------------------------------------- ---------------------------------------------------------------

Sustainability Non-compliance (New impact, no risk exposure)

with the Group's

NCC Group frameworks related The Group has developed

recognises to ESG will impact an ESG framework which

the importance on our ability continues to evolve. Examples

of good to display robust of progress to date include:

environment, working practices,

social and grounded in good * Ongoing review of key policies, such as the Code of

governance working practice, Ethics, Whistleblowing Policy, Anti-Bribery and

(ESG) which take account Corruption Policy and Anti-Trust Policy. These

frameworks of our environment, policies reflect our global footprint and will be

as a key people and communities. translated into all of our jurisdictional languages

indicator This in turn could in 2022

of the Group's impact on our ability

sustainability to develop and

and ethical maintain business

impact relationships and * Maintained our corporate governance and

of our may lead to the decision-making structures during the "move to

business. loss of key customer remote" during Covid-19 lockdowns

accounts and shareholder

investment.

More examples are outlined

in the sustainability

section of the report.

-------------------------------------------------------- ---------------------------------------------------------------

Acquisition of Ineffective implementation (New impact, no risk exposure)

IPM of the integration The Group has established

(Intellectual plan may lead to: a comprehensive integration

Property plan, which has been sub-divided

Management) * Staggered transition to key systems into specific workstreams,

including, but not limited

NCC Group to, finance; legal; compliance;

obtained and IT.

shareholder * Increased costs against the budgeted GBP2.5m Each workstream has specific

approval deliverables, along with

to acquire Iron deadlines, and these are

Mountain's being regularly monitored

Intellectual to validate "on time"

Property delivery and to enable

Management additional actions/resource

(IPM), post to be deployed if required.

extensive

due diligence

on 1 June 2021.

The acquisition

of the IPM

division

significantly

grows the US

Software

Resilience

customer base

and allows us

to support them

with a broader

set of

services.

A comprehensive

integration

plan

has been

established

to support the

effective and

efficient

transition

of IPM into the

Group.

-------------------------------------------------------- ---------------------------------------------------------------

Extraordinary risk during the year

During the year, the global pandemic of Covid-19 continued, with

minimal impact on financial performance; it also provided

opportunities. The Group mobilised its Executive Support Team and

its business continuity plan in January 2020 and this enabled a

number of planned initiatives to be brought forward to support a

Group-wide response to remote working and delivery.

We have continued to successfully negotiate with our customers

where appropriate to work remotely, which has minimised disruption

to service delivery."

LEI - 213800DJCGZRB6523934

Classification - Annual Report and Financial Statements and

Notice of AGM.

Enquiries:

NCC Group plc 0161 209 5200

Adam Palser - CEO 0161 209 5200

Tim Kowalski - CFO 0161 209 5374

Jonathan Williams, Deputy Company Secretary

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

NOABBGDCDBDDGBC

(END) Dow Jones Newswires

September 29, 2021 08:18 ET (12:18 GMT)

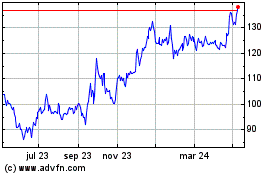

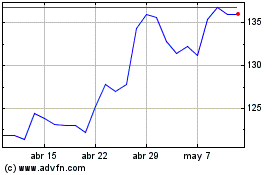

Ncc (LSE:NCC)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Ncc (LSE:NCC)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024