TIDMTPX

RNS Number : 0757I

Panoply Holdings PLC (The)

10 August 2021

10 August 2021

The Panoply Holdings PLC

("The Panoply", or the "Group")

Issue of Shares and PDMR dealings

The Panoply Holdings PLC, the digitally-enabled technology

services group focused on digital transformation, announces that

the Group has today issued 239,814 new ordinary shares of 1 pence

each in respect of outstanding acquisition consideration totalling

GBP637,339 ("Earnout Shares") and 4,614 new ordinary shares of 1

pence in respect of the Share Incentive Plan ("SIP").

The SIP Trustees (Cytec Trustees Limited) acquired a total of

4,614 shares (the "Partnership Shares") on 9 August 2021 at a price

of GBP2.40 per Ordinary Share and total cost of GBP11,074. The

Partnership Shares were acquired by purchase in the market and

allocated to those Group employees participating in its Share

Incentive Plan (SIP) scheme. As set out at the time of the

announcement of The Panoply's interim results on 30 November 2020,

this SIP Plan is designed to reward and incentivise employees of

the Group through tax-efficient salary sacrifice and a free

matching award of Ordinary Shares on a one-for-one basis.

Accordingly, on 9 August 2021, the SIP Trustees also allocated a

total of 4,614 matching shares (the "Matching Shares") under the

SIP. The Matching Shares are covered by the Group's block listing

as announced on 15 January 2021.

Neal Gandhi and Oliver Rigby received Earnout Shares in respect

of the acquisitions, together with Partnership Shares and Matching

Shares under the SIP as follows:

Name Earnout Partnership Matching Total Shares post Percentage

Shares Shares acquired Shares issue (including of issued

issued issued shares held by share capital

the SIP on behalf

of the relevant

PDMR)

Neal

Gandhi 40,071 62 62 10, 277,899 12. 3%

-------- ----------------- --------- ------------------- ---------------

Oliver

Rigby 1,114 62 62 5, 104,437 6. 1%

-------- ----------------- --------- ------------------- ---------------

Remaining value of acquisition consideration to be issued

Following the issue, the Company has additional consideration to

pay totalling GBP 7,320,608. The maximum further shares to be

issued as a result of this consideration is 9,047,787, which

reduces to 3,082,361 assuming the share price remained constant at

GBP2.375, being the closing mid-market price on 3 August 2021.

Further details of the share issues are set out below:

Value Minimum share Max shares to Shares to be issued calculated

GBP'000s price be issued '000s based on price of GBP2.

375

2,753 74p 3,720 1,159

-------------- ----------------- -------------------------------

1,306 82p 1,593 550

-------------- ----------------- -------------------------------

769 82.5p 932 324

-------------- ----------------- -------------------------------

1,987 83.125p 2,390 836

-------------- ----------------- -------------------------------

506 122.5p 413 213

-------------- ----------------- -------------------------------

7,321 9,048 3,082

-------------- ----------------- -------------------------------

Timing of payment of acquisition Value GBP'000s

consideration

Within the next 6 months 3,866

--------------

Between 6-12 months 1,848

--------------

After 12 months 1,607

--------------

Admission to trading and total voting rights

An application has been made for the admission of the Earnout

Shares to trading on AIM which is expected to take place on or

around 1 3 August 2021. The Matching Shares are covered by the

Group's block listing as announced on 15 January 2021.

Following this issue of Earnout Shares and Matching Shares the

Company will have 83,644,140 Ordinary Shares in issue and no

Ordinary Shares in treasury. Therefore, the total voting rights in

The Panoply will be 83,644,140. T his figure may be used by

shareholders as the denominator for the calculation by which they

may determine if they are required to notify their interest in, or

change to their interest in, the Group under the FCA's Disclosure

Guidance and Transparency Rules.

Enquiries:

The Panoply Holdings Via Alma PR

Neal Gandhi (CEO)

Oliver Rigby (CFO)

Stifel Nicolaus Europe Limited

(Nomad and Joint Broker) +44 (0)207 710

7600

Fred Walsh

Alex Price

Dowgate Capital Limited

(Joint Broker)

James Serjeant +44 (0)203 903

David Poutney 7715

Alma PR panoply@almapr.co.uk

(Financial PR) +44(0)203 405

Susie Hudson 0209

Kieran Breheny

Matthew Young

About The Panoply

The Panoply is a digitally-native technology services company,

built to service clients' digital transformation needs. Founded in

2016, with the aim of identifying and acquiring best-of-breed

specialist information technology, design and innovation consulting

businesses, the Group collaborates with its clients to deliver the

technology outcomes they're looking for at the pace that they

expect and demand.

The Group is being increasingly recognised as a leading

alternative digital transformation provider to the UK public

services sector, with 71% of its client base representing public

services and 29% representing the commercial sector.

More information is available at www.thepanoply.com

1 Details of the person discharging managerial

responsibilities / person closely associated

a) Name Neal Gandhi

------------------------- ----------------------------------------------------

2 Reason for the notification

------------------------- ----------------------------------------------------

a) Position/status Chief Executive Officer

------------------------- ----------------------------------------------------

b) Initial notification Initial notification

/Amendment

------------------------- ----------------------------------------------------

3 Details of the issuer, emission allowance

market participant, auction platform, auctioneer

or auction monitor

------------------------- ----------------------------------------------------

a) Name The Panoply Holdings Plc

------------------------- ----------------------------------------------------

b) LEI 2138004S9O18Q6F9MS74

------------------------- ----------------------------------------------------

4 Details of the transaction(s): section to

be repeated for (i) each type of instrument;

(ii) each type of transaction; (iii) each

date; and (iv) each place where transactions

have been conducted

------------------------- ----------------------------------------------------

a) Description of Ordinary Shares

the financial

instrument, type

of instrument

Identification ISIN: GB00BGGK0V60

code

------------------------- ----------------------------------------------------

b) Nature of the Receipt of vendor consideration shares and

transaction purchase and allocation of Partnership and

Matching Shares, respectively, under The

Panoply Holdings PLC Share Incentive Plan

------------------------- ----------------------------------------------------

c) Price(s) and volume(s) Earnout Shares:

5,571 ordinary shares at 268.10p

34,500 ordinary shares at 260.28p

Matching Shares:

62 ordinary shares at 240p

Partnership Shares:

62 ordinary shares at 240p

--------------------------------------------------

d) Aggregated information Earnout Shares:

40,071 shares

GBP104,732

- Aggregated volume Matching Shares:

62 shares

GBP150

- Price Partnership Shares:

62 shares

GBP150

------------------------- ----------------------------------------------------

e) Date of the transaction 10 August 2021

------------------------- ----------------------------------------------------

f) Place of the transaction Earnout Shares and Matching Shares took place

outside a trading venue

Partnership Shares acquired on AIM

------------------------- ----------------------------------------------------

1 Details of the person discharging managerial

responsibilities / person closely associated

------------------------- ----------------------------------------------------

a) Name Oliver Rigby

------------------------- ----------------------------------------------------

2 Reason for the notification

------------------------- ----------------------------------------------------

a) Position/status Chief Financial Officer

------------------------- ----------------------------------------------------

b) Initial notification Initial notification

/Amendment

------------------------- ----------------------------------------------------

3 Details of the issuer, emission allowance

market participant, auction platform, auctioneer

or auction monitor

------------------------- ----------------------------------------------------

a) Name The Panoply Holdings Plc

------------------------- ----------------------------------------------------

b) LEI 2138004S9O18Q6F9MS74

------------------------- ----------------------------------------------------

4 Details of the transaction(s): section to

be repeated for (i) each type of instrument;

(ii) each type of transaction; (iii) each

date; and (iv) each place where transactions

have been conducted

------------------------- ----------------------------------------------------

a) Description of Ordinary Shares

the financial

instrument, type

of instrument

Identification ISIN: GB00BGGK0V60

code

------------------------- ----------------------------------------------------

b) Nature of the Receipt of vendor consideration shares and

transaction purchase and allocation of Partnership and

Matching Shares, respectively, under The

Panoply Holdings PLC Share Incentive Plan

------------------------- ----------------------------------------------------

c) Price(s) and volume(s) Earnout Shares:

1,114 ordinary shares at 268.10p

Matching Shares:

62 ordinary shares at 240p

Partnership Shares:

62 ordinary shares at 240p

--------------------------------------------------

d) Aggregated information Earnout Shares:

1,114 shares

GBP2,987

- Aggregated volume Matching Shares:

62 shares

GBP150

- Price Partnership Shares:

62 shares

GBP150

------------------------- ----------------------------------------------------

e) Date of the transaction 10 August 2021

------------------------- ----------------------------------------------------

f) Place of the transaction Earnout Shares and Matching Shares took place

outside a trading venue

Partnership Shares acquired on AIM

------------------------- ----------------------------------------------------

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

DSHSSAFUUEFSESA

(END) Dow Jones Newswires

August 10, 2021 02:00 ET (06:00 GMT)

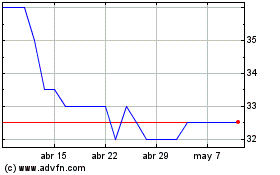

Tpximpact (LSE:TPX)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Tpximpact (LSE:TPX)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024