TIDMPALM

Panther Metals PLC

22 November 2021

NOT FOR RELEASE, PUBLICATION OR DISTRIBUTION, IN WHOLE OR IN

PART, DIRECTLY OR INDIRECTLY IN OR INTO AUSTRALIA, CANADA, JAPAN,

THE REPUBLIC OF SOUTH AFRICA, THE UNITED STATES OR ANY OTHER

JURISDICTION WHERE TO DO SO WOULD CONSTITUTE A VIOLATION OF THE

RELEVANT LAWS OF SUCH JURISDICTION

FOR IMMEDIATE RELEASE

PANTHER METALS PLC

("Panther" or the "Company")

(Incorporated in the Isle of Man with company number

009753V)

22 November 2021

Canada - Obonga Project Additional Claim Purchase Option

Panther Metals PLC (LSE:PALM) a company focused on mineral

exploration in Canada and Australia, is pleased to announce the

signing of a purchase option agreement over four multicell mining

claims (the "Properties" or "Claims") covering a total area of

7.7km(2) to supplement the Obonga Project's 235km(2) of prospective

greenstone belt coverage,160km north of Thunder Bay in the Province

of Ontario, Canada.

Darren Hazelwood, Chief Executive Officer, commented:

"Site visits. Favourable inspection of visual core. Result, the

acquisition of four more licence areas."

Property Details

The purchase option agreement covers the four named properties:

Wig; Z2 Gold; Tommy W; and Otter Gold, as outlined below. Each of

the properties consists a single multicell mining claim held by Mr

Aki Siltamaki. A map showing the location of the Properties is

available at the following link:

https://www.panthermetals.co.uk/images/2021/Obonga_Project_-_Aki_Siltamaki_Properties_Map.jpg

Wig Property

The Wig Property is directly adjacent to the north-western side

of Panther's current Awkward Conduit Prospect ("Awkward") on the

southern flank of the Awkward Lake zoned mafic intrusive body. Wig

supplements and extends the Awkward prospect area which is

targeting intrusive hosted palladium, platinum, nickel, copper, and

cobalt.

Z2 Gold Property

The Z2 Gold property is located on the southern boundary of the

Obonga Project and covers magnetic and electromagnetic geophysical

targets. A limited amount of diamond drilling was conducted in this

area during the 1970s, with 6 drill holes on two 725m spaced

cross-sections perpendicular to the geophysical anomaly. Given the

historical drilling intercepts of up to 0.76m @ 5.64g/t Au on the

eastern section and up to 14m of disseminated sulphides, including

3m @ 0.49% Zn, on the western section, this area is considered

worthy of further investigation.

Tommy W Property

The Tommy W property adjoins and provides a westward extension

to Panther's Tommyhow Gold Prospect which is a structural target

prospective for shear hosted orogenic gold mineralisation.

Otter Gold Property

The Otter Gold Property is immediately southwest of Panther's

Wishbone VMS - Base Metals & Gold prospect area. Panther's

recent drilling campaign has centred on Wishbone, with drill core

assays currently awaited.

Transaction Details

The purchase option agreement ("Purchase Option") for the four

Properties, listed in Table 1 and held 100% by Mr Aki Siltamaki,

allows Panther the option to purchase the Claims for a total cash

consideration of CAN$200,000 and the award of a 1.5% net smelter

return ("NSR") royalty as summarised below.

In addition, in order to complete the purchase Panther will need

to have drilled no less than an aggregate 1,800 metres within the

total package of claims during the four-year option period, and as

a minimum will need to conduct at least one diamond drill hole on

each of the individual claim areas.

Deal Summary:

The Purchase Option price, payable on the signing of the

agreement is CAD$30,000 with further payments of CAD$10,000 due on

each anniversary of the date of signing for three consecutive

years.

The Purchase Option gives Panther the option to purchase the

Claims, and the project documents for a consideration

comprising:

-- CAD$200,000 in cash; and

-- 1.5% NSR royalty (which has provision for Panther to reduce the royalty to 1.0% NSR through a CAD$1,000,000 buy-back).

The 1.5% NSR royalty is on the net value of all ores, minerals,

metals, and materials mined and removed from the four claims

included in the option agreement and sold or deemed to have been

sold by or for the Royalty Payor and a 1.5% a gross overriding

royalty for diamonds.

Table 1: Claims subject to the Purchase Option

Multicell Mining Claim Property Name Area (km(2) )

Number

672121 Wig 3.12

-------------- --------------

672124 Z2 Gold 2.50

-------------- --------------

672125 Tommy W 1.25

-------------- --------------

585222 Otter Gold 0.83

-------------- --------------

Obonga Project Overview

The Obonga Project covers a total area of over 235km(2) and

constitutes an 88% coverage of the Obonga Greenstone Belt which

consists of a 32km long by up to 9km wide, broadly east-west

striking, tract of Archean age metamorphosed volcanic, sedimentary

and intrusive rocks. It is a highly prospective setting for the

formation of orogenic shear-hosted gold deposits, volcanogenic

massive sulphide copper-lead-zinc-silver deposits,

komatiite/ultramafic associated nickel-copper-platinum group metal

("PGM") deposits and porphyry style base metal mineralisation.

Panther's Obonga Project currently includes seven high

prospectivity targets for gold, nickel, PGM and base metals

identified by partner company Broken Rock Resources Ltd. The

remaining ground over the belt is either designated areas as

environmental reserves and not available for exploration, or under

minor landholding by third parties.

Panther's aim at Obonga is to create shared value that benefits

local communities and to explore and develop projects in an

environmentally sensitive manner.

For further information please contact:

Panther Metals PLC:

Darren Hazelwood, Chief Executive Officer: +44(0) 1462 429

743

+44(0) 7971 957 685

Mitchell Smith, Chief Operating Officer: +1(604) 209 6678

Broker:

SI Capital Limited

Nick Emerson +44(0) 1438 416 500

This information is provided by Reach, the non-regulatory press

release distribution service of RNS, part of the London Stock

Exchange. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

Reach is a non-regulatory news service. By using this service an

issuer is confirming that the information contained within this

announcement is of a non-regulatory nature. Reach announcements are

identified with an orange label and the word "Reach" in the source

column of the News Explorer pages of London Stock Exchange's

website so that they are distinguished from the RNS UK regulatory

service. Other vendors subscribing for Reach press releases may use

a different method to distinguish Reach announcements from UK

regulatory news.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

NRAEFLFLFFLXFBE

(END) Dow Jones Newswires

November 22, 2021 02:00 ET (07:00 GMT)

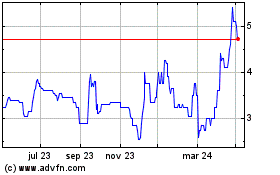

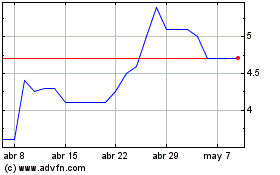

Panther Metals (LSE:PALM)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Panther Metals (LSE:PALM)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024