TIDMPEBB

RNS Number : 6430A

Pebble Group PLC (The)

03 June 2021

3 June 2021

THE PEBBLE GROUP PLC

("The Pebble Group", the "Company" or the "Group")

(AIM: PEBB)

AGM STATEMENT

Ahead of the Annual General Meeting ("AGM"), which is being held

later today, The Pebble Group announces the following trading

update.

The Board is pleased to say that the positive start to the new

financial year, which was reported in the Group's Final Results

2020 announced on 23 March 2021, has continued, with the business

performing well and in line with management expectations.

Facilisgroup

Facilisgroup is developing as anticipated. Our three key

performance measures are making good progress and are on track to

meet the management's milestones for FY 21, as set out in our Final

Results 2020, being the first step to the aspiration of $50m

recurring revenue by the end of 2024.

-- Partner (customer) numbers now total 186 (31 December 2020:

175), with a further 4 contracted and awaiting implementation

-- Gross Merchandise Value ("GMV") processed through our

technology is in line with our expectation. For the five months to

May 2021, GMV is 78% of 2020, a period when a number of our

Partners processed a high value of PPE sales. Positively, GMV is

116% of the same period in 2019, an important indicator

demonstrating the strong recovery of like-for-like Partner sales

together with the increase in our Partner numbers

-- Preferred Supplier purchases made by our Partners have

increased and are, as anticipated, moving back towards the

pre-COVID-19 percentage levels of 2019 of circa 45%

We continue to invest in the team both in terms of numbers and

skill sets to ensure that our infrastructure supports our

aspirations. This includes the development of our ecommerce

platform, allowing for the easy implementation of online stores to

existing and new Partners, which remains firmly on track. We will

integrate this ecommerce platform into our existing order workflow

software in 2021 and launch this product into the wider promotional

products market in early 2022.

The positive trajectory in our three key performance measures is

driving year on year growth in our Annual Recurring Revenue and

gives us confidence in our strategy and the opportunities set out

for Facilisgroup.

Brand Addition

Brand Addition's order intake for 2021 has been strong. In the

five months to the end of May 2021, total sales orders invoiced or

received are GBP64.8m, an increase of 62% compared to 2020 and an

increase of 28% compared to 2019, a period before any sales impact

resulting from COVID-19.

In our Corporate Programmes division (60% FY 20 divisional

revenues), order intake to date is well ahead of 2020, when, in

April and May 2020, initial lockdowns severely affected our sales.

Comparing to 2019, like-for-like order intake is recovering. New

clients won in 2020 are performing well and in line with our

expectation.

In our Consumer Promotions division (40% FY 20 divisional

revenues), we have benefited from a significant increase in sales

orders, as existing clients have consolidated their spend across

geographies using Brand Addition as a preferred and trusted

supplier. Due to the bespoke nature and long lead times of these

orders, the majority of Consumer Promotion orders that will be

invoiced in FY 21 are now received, resulting in good visibility of

what will be a very positive year for our Consumer Promotions

division.

To provide some context of recent trading, total Brand Addition

sales order intake in the month of May 2021 was 115% of May

2019.

The value of Brand Addition orders received to date and our

current activity level is encouraging and we stay consistent with

our previous messaging of targeting a return towards FY 19 revenues

in FY 21.

Outlook

The Board remains excited in the prospects for the Group and

looks forward to fully updating shareholders on its progress when

issuing the Half Yearly Results for the six months to 30 June 2021

on 7 September 2021.

Enquiries:

The Pebble Group plc

Chris Lee, Chief Executive Officer

Claire Thomson, Chief Financial Officer +44 (0) 161 786 0415

Grant Thornton UK LLP (Nominated Adviser)

Samantha Harrison / Harrison Clarke /

Lukas Girzadas +44 (0) 20 7184 4384

Berenberg (Corporate Broker)

Chris Bowman / Jen Clarke / Arnav Kapoor +44 (0) 20 3207 7800

Belvedere Communications (Financial thepebblegrouppr@belvederepr.com

PR) +44 (0) 7715 769 078

Cat Valentine +44 (0) 7967 816 525

Keeley Clarke +44 (0) 7407 023 147

Llew Angus

About The Pebble Group plc - www.thepebblegroup.com

The Pebble Group is a provider of technology, services and

products to the global promotional products industry, comprising

two differentiated businesses, focused on specific areas of the

promotional products market:

Facilisgroup - www.facilisgroup.com

Facilisgroup focuses on supporting the growth of mid-sized

Promotional Product businesses in North America by providing a

technology platform, which enables those businesses to benefit from

significant business efficiency and gain meaningful supply chain

advantage from the ability to purchase from quality suppliers under

preferred terms.

Brand Addition - www.brandaddition.com

Brand Addition focuses upon providing promotional products and

related services under contract to some of the world's most

recognisable brands. Its largest contracts are valued in the

millions of pounds with the products and services supplied being

used for brand building, customer engagement and employee rewards.

Working in close collaboration with its clients, Brand Addition

designs products and product ranges, hosts client-branded global

web stores and provides international sourcing and distribution

solutions.

We categorise our revenues into two divisions, Corporate

Programmes, that supports our clients' general marketing

activities, and Consumer Promotions, that supports our clients in

driving their own sales volumes.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

AGMSSWFMEEFSELM

(END) Dow Jones Newswires

June 03, 2021 02:00 ET (06:00 GMT)

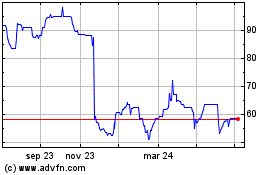

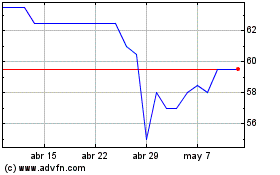

The Pebble (LSE:PEBB)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

The Pebble (LSE:PEBB)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024