TIDMPEBB

RNS Number : 0819J

Pebble Group PLC (The)

18 December 2020

18 December 2020

The information communicated within this announcement is deemed

to constitute inside information as stipulated under the Market

Abuse Regulations (EU) No. 596/2014. Upon the publication of this

announcement, this inside information is now considered to be in

the public domain.

THE PEBBLE GROUP PLC

("The Pebble Group," the "Company" or the "Group")

AIM: PEBB

ACQUISITION OF SOFTWARE ASSETS

To accelerate the expansion of Facilisgroup's services

The Pebble Group, a leading provider of technology, services and

products to the global promotional products industry, is pleased to

announce that its Facilisgroup business has acquired software

assets from CoreXpand, a US based software developer, for a total

cash consideration of $5.3 million (the "Acquisition").

Acquisition rationale

-- The Acquisition will expand the services offered by Facilisgroup

through its ecommerce platform via another robust technology

solution, allowing for the easy development of e-stores

ranging from online pop-up shops through to complex inventoried

online stores for its existing and potential Partners (customers)

-- The expanded suite of technologies further enhance Facilisgroup's

compelling credentials, amongst entrepreneurial and growing

businesses in the North American promotional products industry,

as a leading provider of ecommerce platform services which

help businesses manage and grow their operations effectively

-- The Board believes that the addition of such technology

has the potential to significantly expand the subscription

services utilised by existing Partners plus support the

attraction of new Partners to the Facilisgroup platform

The software assets acquired comprise two separate products. The

first, full intellectual property rights on software which supports

online pop-up shops. The second, an in-perpetuity licence with

exclusivity in the global promotional products industry, for

software which supports the customer-facing element of complex

inventory online stores. Together, these products accelerate the

delivery to market a strong Facilisgroup e-stores solution.

Expected impact of the Acquisition

The cash consideration of $5.3m is being funded through cash

flow generated by Facilisgroup, with $1.8m of this deferred and

payable over the next 18 months. In addition to the consideration,

up to $2.0m of in-house development time is expected to be

capitalised in 2021 evolving the acquired assets, expanding their

capabilities and building the back-office element of the complex

inventory online stores.

The resultant product offering is expected to begin generating

revenue by the end of H1 21 with a full suite of product

capabilities expected to be in market in H1 22.

Facilisgroup's vision is to become the ecommerce leader in the

promotional products industry. The growth strategy has three clear

points of focus:

1. responsibly increasing Partner numbers, ensuring Partner

quality remains high and the community relationships we

create with our Partners and suppliers remain strong;

2. developing additional income streams that augment the benefits

available to our existing Partners and suppliers; and

3. developing our technology and strong industry relationships

to offer an adaptation of our existing services to industry

entrepreneurs in the early stage of their business development.

The Acquisition is an important step in adding value to the

business through points one and two above. Our plans are advancing

on point three. We look forward to updating investors on the

progress being made against these three strategies in the Group's

Final Results for the year ending 31 December 2020 ("FY 20"), which

we expect to announce towards the end of Q1 21.

Trading update

The Board is pleased to report that the Group continues to trade

positively and in line with current market expectations for FY 20,

as announced on 26 November 2020.

Enquiries

The Pebble Group plc

Chris Lee, Chief Executive Officer

Claire Thomson, Chief Financial Officer +44 (0) 161 786 0415

Grant Thornton UK LLP (Nominated Adviser)

Samantha Harrison / Harrison Clarke +44 (0) 20 7184 4384

Berenberg (Corporate Broker)

Chris Bowman / Simon Cardron / Arnav

Kapoor +44 (0) 20 3207 7800

Belvedere Communications (Financial thepebblegrouppr@belvederepr.com

PR) +44 (0) 7715 769 078

Cat Valentine +44 (0) 7967 816 525

Keeley Clarke +44 (0) 7407 023 147

Llew Angus

About The Pebble Group plc - www.thepebblegroup.com

The Pebble Group is a provider of technology, services and

products to the global promotional products industry, comprising

two differentiated businesses, focused on specific areas of the

promotional products market:

Brand Addition - www.brandaddition.com

The Group's promotional product merchandise business, Brand

Addition, is a leading provider of promotional products to global

brands. Brand Addition utilises its global network to source and

deliver complex and creative promotional product solutions to

support the marketing efforts of its multi-national clients, who

operate in sectors which include health & beauty, fast moving

consumer goods, transport, technology, banking & finance and

charity. Brand Addition's clients primarily comprise major global

brands under contract.

Facilisgroup - www.facilisgroup.com

The Group's SaaS business, Facilisgroup, provides

subscription-based services to SME promotional product distributors

(Partners) in the United States and Canada. Facilisgroup's suite of

services includes business intelligence software, buying power and

community events. Through its @ease proprietary software,

Facilisgroup offers a SaaS technology platform that enables its

network of Partners to improve order management, CRM and sales

analysis and reporting. Facilisgroup also provides its Partners

with access on favourable terms to a selected group of preferred

suppliers, by consolidating the purchasing power of its Partners.

This attracts rebates from suppliers, who in turn benefit from

efficient access to a network of high-quality distributors.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

ACQTRBRTMTIBBPM

(END) Dow Jones Newswires

December 18, 2020 02:00 ET (07:00 GMT)

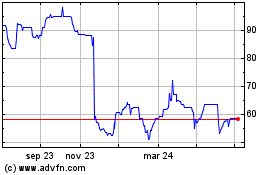

The Pebble (LSE:PEBB)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

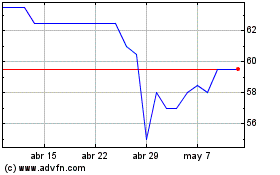

The Pebble (LSE:PEBB)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024