TIDMPEBB

RNS Number : 9013K

Pebble Group PLC (The)

07 September 2021

7 September 2021

The information communicated within this announcement is deemed

to constitute inside information as stipulated under the Market

Abuse Regulations (EU) No. 596/2014. Upon the publication of this

announcement, this inside information is now considered to be in

the public domain.

THE PEBBLE GROUP PLC

("The Pebble Group", the "Group" or the "Company")

UNAUDITED HALF YEAR RESULTS 2021

Strong recovery with positive outlook

The Pebble Group, a leading provider of technology, services and

products to the global promotional products industry, announces its

unaudited results for the six months ended 30 June 2021 ("HY 21" or

the "Period"), which demonstrate a swift recovery. With strong

progress in HY 21, the Board is confident that performance will be

at least in line with market expectations for the year ending 31

December 2021 ("FY 21").

Financials

Adjusted results HY 21 HY 20 HY 19 FY 20

Revenue GBP46.8m GBP33.6m GBP48.1m GBP82.4m

Gross profit GBP17.2m GBP13.6m GBP17.4m GBP31.0m

Gross profit margin 36.8% 40.6% 36.1% 37.6%

Adjusted EBITDA(1) GBP4.4m GBP2.6m GBP5.3m GBP9.8m

Adjusted operating profit(2) GBP2.6m GBP1.2m GBP4.2m GBP6.8m

Adjusted profit before tax(3) GBP2.4m GBP0.9m GBP0.7m GBP6.1m

Underlying operating cash GBP(10.5)m GBP(3.6)m GBP3.0m GBP7.2m

flow(4)

Net (debt) / cash(5) GBP(4.2)m GBP1.9m GBP(63.7)m GBP7.1m

Adjusted earnings per share(6) 1.08p (0.05)p (0.50)p 2.96p

Statutory results HY 21 HY 20 HY 19 FY 20

Operating profit/(loss) GBP2.2m GBP0.9m GBP(0.2)m GBP5.7m

Profit/(loss) before tax GBP1.9m GBP0.6m GBP(3.6)m GBP5.0m

Basic profit/(loss) per

share 0.85p (0.18)p (44.79)p 2.44p

Diluted profit/(loss) per

share 0.84p (0.18)p (44.79)p 2.44p

(1) Adjusted EBITDA means operating profit before depreciation,

amortisation, share-based payments charge and exceptional

items in note 4

(2) Adjusted operating profit means operating profit before

amortisation of acquired intangible assets, share-based

payments charge and exceptional items

(3) Adjusted profit before tax means profit before tax before

amortisation of acquired intangible assets, share-based

payments charge and exceptional items

(4) Underlying operating cash flow is calculated as Adjusted

EBITDA less movements in working capital, capital expenditure

and lease payments excluding movements in transaction related

accruals and payments in respect of acquisitions

(5) Net (debt)/cash is calculated as cash and cash equivalents

less borrowings (excluding lease liabilities)

(6) Adjusted Earnings Per Share ("EPS") represents Adjusted

Earnings meaning profit after tax before amortisation of

acquired intangible assets, share-based payments charge

and exceptional items divided by a weighted average number

of shares

Group highlights and outlook

-- The recovery in HY 21 has been strong with Group revenues

at GBP46.8m being 39.3% ahead of HY 20 (GBP33.6m) and slightly

lower than HY 19 (GBP48.1m)

-- Facilisgroup US Dollar ("USD") Annual Recurring Revenue

("ARR") was 27.0% ahead of HY 20 and 44.8% ahead of HY 19

-- Facilisgroup achieved Adjusted EBITDA margins of 54.6%,

with further investment in people and technology, as we

remain focused on our stated aspiration to grow ARR to $50m

by the end of FY 24

-- Brand Addition revenues for FY 21 are expected to be well

ahead of FY 20 and slightly ahead of FY 19, demonstrating

its ability to win, grow and retain major client contracts

-- Cash outflow in HY 21 has supported the high value of Brand

Addition Consumer Promotion revenue in HY 21 amplifying

the normal in-year cycle. Working capital is reducing as

expected as client receipts are collected to terms

-- Net debt at 6 September was GBP4.8m and we expect Net cash

at 31 December 2021 to be ahead of previous market expectations

at no less than GBP8.0m (31 December 2020: GBP7.1m)

-- The Board is very encouraged by the Group's performance

in HY 21 and expects FY 21 to be at least in line with market

expectations

Facilisgroup

-- FY 21 USD ARR growth over prior year is expected to be approaching

30%

-- 190 Partners at 31 August 2021 with a further 7 contracted

awaiting implementation

-- The increase in purchases through Preferred Suppliers is

ahead of management expectations

-- H2 21 Gross Merchandise Value running at 136% of H2 20 and

141% of H2 19

-- New ecommerce solution launched in beta form with 51 Partners

in early access

Brand Addition

-- Total FY 21 revenues expected to be well ahead of FY 20

and slightly ahead of FY 19

-- Significant growth in Consumer Promotions revenue expected

in FY 21, compared to both FY 20 and FY 19

-- Growth in Corporate Programmes revenue expected in FY 21,

compared to FY 20, supported by new business wins from FY

20 and recovery continues against FY 19

-- Total orders invoiced or received to be invoiced in 2021

at 31 August amounted to GBP81.8m, being 153% of 2020 (GBP53.4m)

and 114% of 2019 (GBP71.3m)

Enquiries:

The Pebble Group plc

Chris Lee, Chief Executive Officer

Claire Thomson, Chief Financial

Officer +44 (0) 161 786 0415

Grant Thornton UK LLP (Nominated

Adviser)

Samantha Harrison / Harrison Clarke

/ Lukas Girzadas +44 (0) 20 7184 4384

Berenberg (Corporate Broker)

Chris Bowman / Jen Clarke / Arnav

Kapoor +44 (0) 20 3207 7800

Belvedere Communications (Financial thepebblegrouppr@belvederepr.com

PR) +44 (0) 7715 769 078

Cat Valentine +44 (0) 7967 816 525

Keeley Clarke

About The Pebble Group plc - www.thepebblegroup.com

The Pebble Group is a provider of technology, services and

products to the global promotional products industry, comprising

two differentiated businesses, focused on specific areas of the

promotional products market:

Facilisgroup - www.facilisgroup.com

Facilisgroup focuses on supporting the growth of mid-sized

Promotional Product businesses in North America by providing a

technology platform, which enables those businesses to benefit from

significant business efficiency and gain meaningful supply chain

advantage from the ability to purchase from quality suppliers under

preferred terms.

Brand Addition - www.brandaddition.com

Brand Addition focuses upon providing promotional products and

related services under contract to some of the world's most

recognisable brands. Its largest contracts are valued in the

millions of pounds with the products and services supplied being

used for brand building, customer engagement and employee rewards.

Working in close collaboration with its clients, Brand Addition

designs products and product ranges, hosts client-branded global

web stores and provides international sourcing and distribution

solutions.

We categorise our revenues into two divisions, Corporate

Programmes, that supports our clients' general marketing

activities, and Consumer Promotions, that supports our clients in

driving their own sales volumes.

A copy of the Half Year Results 2021 Investor Presentation will

be available on the Company's website later today

https://www.thepebblegroup.com/investors/results-reports-and-presentations/.

CHIEF EXECUTIVE OFFICER'S REVIEW

Overview

The focus during HY 21 has been the continued investment in our

people and technology to support the excellent growth prospects of

Facilisgroup, alongside demonstrating the ability of Brand Addition

to recover quickly from the revenue reduction suffered in 2020. We

have made good progress on these objectives.

Our teams across Asia, Europe and North America continue to be

incredibly flexible and adapt quickly to support their colleagues,

clients, Partners and suppliers. Their dedication and talent has

resulted in our Group recovering strongly from the end-market

demand challenges of 2020. The promotional products industry is

recovering, albeit with disruption remaining within the supply

chain which we expect to continue until at least Q2 22. Here again,

our teams continue to lean on their experience, working with our

suppliers for the long-term benefit of all stakeholders.

Against this backdrop, the Board is very encouraged by the

Group's performance in HY 21.

In HY 21, Group revenue was GBP46.8m (HY 20: GBP33.6m, HY 19:

GBP48.1m), generating Adjusted EBITDA of GBP4.4m (HY 20: GBP2.6m,

HY 19: GBP5.3m) and Operating profit of GBP2.2m (HY 20: GBP0.9m, HY

19: GBP(0.2m)).

Below we summarise the results and progress of our

businesses.

Facilisgroup

HY revenue and profit analysis Facilisgroup

HY 21 HY 20 HY 19

Recurring revenue GBP5.4m GBP4.8m GBP4.1m

Other revenue GBP0.2m GBP0.3m GBP0.5m

-------- ------- ----------

Total revenue GBP5.6m GBP5.1m GBP4.6m

Gross profit GBP5.6m GBP5.1m GBP4.6m

Gross profit margin 100% 100% 100%

Adjusted EBITDA GBP3.1m GBP2.9m GBP2.4m

Operating profit/(loss) GBP2.2m GBP2.3m GBP(2.2m)

Our vision is to be the leading technology provider for the

promotional products industry, using technology and services to

propel forward the growth and efficiency of entrepreneurial

distributors (Partners) and suppliers.

Our aspiration is to grow ARR to $50m by the end of 2024 through

increasing user numbers and introducing new technology products

into the promotional products industry.

We continue to be pleased with the progress made by the

business. Total revenue in the Period has increased to GBP5.6m,

11.5% ahead of the same period in 2020 when measured in Sterling.

Recurring revenue at $7.5m was encouragingly 27.0% ahead of HY 20,

when measured in Facilisgroup's home currency of USD, and 44.8%

ahead of HY 19.

We have made further investment in people and technology to

support our aspirational growth plans. Alongside this investment,

Facilisgroup delivered Adjusted EBITDA returns of 54.6% (HY 20:

57.8%, HY 19: 53.3%) and Operating profit of 39.2% (HY 20: 45.5%,

HY 19: (48.5%)), demonstrating the highly profitable dynamics of

the business model.

The number of Partners, a key value driver, has increased

throughout the Period. Partner numbers today total 190 (31 December

2020: 175), with a further 7 contracted and awaiting

implementation.

The Gross Merchandise Value (GMV) processed by Partners through

Facilisgroup technology in the Period to 31 August 2021 was strong

at $668m. This figure is comparable with HY 20, which included a

small number of large value sales of personal protective equipment

creating a spike in GMV.

To date in H2 21, GMV has been accelerating compared to prior

years, running at 136% of H2 20 and 141% of H2 19, a positive

reflection of the increasing Partner numbers and the recovering end

markets of our Partners.

The fee structures within the business result in a very robust

and predictable recurring revenue stream.

Our Management Fee (c.70% divisional income in FY 20) has grown

in line with Partner numbers.

Our Marketing Fund (c.25% divisional income in FY 20) has

benefited from an increase in the proportion of purchases made with

Preferred Suppliers, which is returning towards FY 19 levels along

with an underlying fee improvement from the delivery of additional

efficiencies in the Preferred Supplier to Partner workflow.

As planned, our first ecommerce product, allowing for the easy

implementation of online popup stores, was launched in beta form to

our Partners in the Period. Uptake has been positive with 51

Partners utilising the product in early access. The revenue impact

from this product is expected to start from Q2 22.

Integration of this ecommerce platform, which includes the

online popup store, into our existing order workflow software is

now expected to be in Q2 22, as recent development time has been

focused on enhanced functionality following Partner feedback. The

launch of this product into the wider promotional products market

is expected in late 2022.

In order to clearly articulate our expanded offering to our

target markets within the North American promotional products

industry, we have rebranded our order workflow product, upon which

the business has traded to date, from @ease to Syncore and our new

ecommerce platform will go to market under the brand Commercio.

From the above activities, we expect to meet our FY 21

aspirational milestones, as set out in our Audited Final Results

2020 announcement of 23 March 2021, and USD ARR growth to be

approaching 30% in FY 21.

Brand Addition

HY revenue and profit analysis Brand Addition

HY 21 HY 20 HY 19

Revenue GBP41.1m GBP28.5m GBP43.6m

Gross profit GBP11.6m GBP8.6m GBP12.8m

Gross profit margin 28.2% 30.0% 29.4%

Adjusted EBITDA GBP2.5m GBP0.4m GBP3.3m

Operating profit/(loss) GBP1.2m GBP(0.7)m GBP2.5m

Our vision is to be recognised as the supplier of choice for

global brands that use creative merchandise as a key stakeholder

engagement tool.

Our strategy is to grow revenues organically through long-term,

contracted relationships, by expanding the spend of our existing

clients, whilst attracting new client contracts.

Revenue for HY 21 has increased to GBP41.1m, being 144% of 2020

and 94.4% of 2019. This recovery over HY 20 and return towards HY

19 revenue reflects an excellent performance, underpinned by

significant growth in our Consumer Promotions division (40% FY 20

divisional sales) as existing clients have consolidated their spend

across geographies using Brand Addition as a preferred and trusted

supplier.

Gross profit decreased slightly in the Period, as expected, to

28.2% (HY 20: 30.0%, HY 19: 29.4%), as the business successfully

continues to manage its clients through the supply chain challenges

resulting from Brexit and global freight and labour disruption

together with implementing two significant new business wins from

2020. Our medium term aim remains a 30% Gross profit target.

The costs between Gross profit and Adjusted EBITDA are

predominately people related. These costs have increased from HY

20, when we utilised the UK Job Retention Scheme and were supported

by our team taking temporary salary reductions. Neither of these

reductions to costs have been applicable in HY 21.

The above resulted in Adjusted EBITDA returns of 6.1% (HY 20:

1.2%, HY 19: 7.5%) and Operating profit returns of 2.9% (HY 20:

(2.4%), HY 19: 5.7%).

Looking to FY 21, total orders invoiced or received to be

invoiced in 2021 at 31 August amounted to GBP81.8m, being 153% of

2020 (GBP53.4m) and 114% of 2019 (GBP71.3m) against FY 20 revenue

of GBP72.6m and FY 19 revenue of GBP97.9m.

Through the normal order receipt to invoice cycle, the majority

of our Consumer Promotion orders that will be invoiced in FY 21

have now been received. Therefore, the revenue in the remainder of

the year will be generated primarily from our Corporate Programmes

division, which is recovering towards 2019 levels. Corporate

Programme orders in the five weeks to the end of August were c.90%

of the comparable period in 2019.

From the strong value of orders already received, alongside

current activity, we expect FY 21 revenues in Brand Addition to be

significantly ahead of FY 20 and slightly ahead of FY 19.

Added to the above, the business has continued to attract new

client contracts which will positively impact sales in 2022.

Environmental, Social and Governance ("ESG")

We are pleased to announce that we will be publishing our first

ESG Report in October 2021, which will set out the strategy and

framework that underpins our approach. Details of how to access

this report will be announced on publication.

Outlook

The highly recurring nature of the revenues at Facilisgroup and

the value of orders received to date at Brand Addition lead the

Board to be confident that FY 21 performance will be at least in

line with market expectations.

We believe the prospects for the Group to be strong.

Christopher Lee

Chief Executive Officer

7 September 2021

CHIEF FINANCIAL OFFICER'S REVIEW

HY 21 HY 20 FY 20

Unaudited Unaudited Audited

GBP'm GBP'm GBP'm

Revenue 46.8 33.6 82.4

Gross profit 17.2 13.6 31.0

Gross profit margin 36.8% 40.6% 37.6%

Adjusted EBITDA 4.4 2.6 9.8

Adjusted EBITDA margin 9.5% 7.6% 11.8%

Depreciation and amortisation (2.0) (1.7) (3.5)

Share-based payment charge (0.2) - -

Exceptional items - - (0.6)

Operating profit 2.2 0.9 5.7

Net finance costs (0.3) (0.3) (0.7)

Profit before tax 1.9 0.6 5.0

Tax (0.5) (0.9) (0.9)

Profit/(Loss) for the Period 1.4 (0.3) 4.1

Weighted average number of

shares 167,450,893 167,450,893 167,450,893

Adjusted EPS 1.08p (0.05)p 2.96p

Basic EPS 0.85p (0.18)p 2.44p

Revenue

Revenue for the Period to 30 June was GBP46.8m (HY 20:

GBP33.6m), an increase of GBP13.2m (39.3%) compared to the same

period in 2020. Of this increase, GBP12.6m relates to Brand

Addition from growth in the Consumer Promotions division (GBP7.2m)

and a recovery in the Corporate Programmes division (GBP5.4m).

Facilisgroup total revenues increased GBP0.6m (11.5%) with the

Sterling growth against prior year being reduced by the strength of

Sterling against USD. Facilisgroup ARR growth when measured in its

home currency of USD was 27.0%. This was achieved through increases

in our Management Fees from additional Partner numbers and a growth

in our Marketing Fund where we benefited from Partners returning

towards normal purchasing patterns through our Preferred Suppliers

and an underlying fee increase.

Gross profit

Gross profit as a percentage of revenue was 36.8% (HY 20:

40.6%). This largely reflects the impact of the increased weighting

of Brand Addition sales as a proportion of the total Group, as the

business recovers from the sales impact in 2020. In Brand Addition,

there was also a 1.8 p.p.t reduction in margin as new business,

which has lower than average initial margins, impacted the sales

mix in the short term and the business navigating a period of

increased costs associated with Brexit, freight rate pricing, and

freight capacity challenges.

Adjusted EBITDA

Adjusted EBITDA was GBP4.4m (HY 20: GBP2.6m). The movement from

HY 20 is made up as follows:

- Facilisgroup GBP0.2m increase from incremental revenue net

of the costs of investment in the team to support delivery

of the 2024 recurring revenue aspirations;

- Brand Addition GBP2.1m increase driven by GBP3.0m incremental

sales volumes offset in part by GBP0.9m additional people

costs as HY 20 included contributions or savings from the

use of Government furlough or equivalent schemes, and temporary

salary and bonus reductions; and

- Central costs increased by GBP0.5m in the period, GBP0.1m

from temporary salary savings in HY 20, the balance being

incremental costs through the growth of the team and the

Group's investment in ESG.

The Adjusted EBITDA margin increased to 9.5% (HY 20: 7.6%) as

revenues in Brand Addition return towards 2019 levels.

Depreciation and amortisation

The total charge for the Period was GBP2.0m (HY 20: GBP1.7m) of

which GBP1.1m (HY 20: GBP0.9m) related to the amortisation of

intangible assets. This increase is in line with expectation and

reflects the Group's continued investment in its technology.

GBP0.7m of the charge relates to depreciation on leases capitalised

in accordance with IFRS 16, an increase of GBP0.2m on the previous

year. Both increases reflect investment in the Group's

infrastructure as it scales to meet its 2024 aspirations.

Share-based payments

The total charge for the Period under IFRS 2 "Share-based

payments" was GBP0.2m (HY 20: nil). This charge related to the 2020

awards made under the 2019 Long Term Incentive Plan.

Operating profit

Operating profit for the Period was GBP2.2m (HY 20:

GBP0.9m).

Taxation

The tax charge for the Period to 30 June was GBP0.5m (2020:

GBP0.9m) and is based on full year Group expected tax rates for

2021 of c.25%. This is higher than the UK Corporation tax rate due

to the proportion of Group profits earned overseas where the rates

are higher than the UK.

Earnings per share

Adjusted weighted average earnings per share for the Period was

1.08p (HY 20: (0.05)p) reflecting the increase in Adjusted EBITDA

for the Period as discussed above.

Basic earnings per share was 0.85p (HY 20: (0.18)p).

Dividends

On admission to AIM in December 2019, the Group's stated

intention was to make dividend payments of c.30% of profit after

tax. This policy remains in place. However, as we believe the

opportunities ahead of us are significant, in particular investment

in Facilisgroup, we have taken the decision to retain cash in the

business and not to pay an interim dividend in 2021. The timing of

implementing our stated dividend policy will be considered again

against the Group's full year progress and an update provided at

that time.

Cashflow

The Group had a cash balance of GBP3.6m at 30 June 2021 (30 June

2020: GBP10.2m), which included GBP7.7m drawn down from its

GBP10.0m committed revolving credit facility (30 June 2020:

GBP8.4m).

Cashflow for the Period is set out below

HY 21 HY 20 FY 20

Unaudited Unaudited Audited

GBP'm GBP'm GBP'm

Adjusted EBITDA 4.4 2.6 9.8

Movement in working capital excluding

IPO related accruals (12.3) (4.4) 1.7

Capital expenditure excluding acquisition

of intangible assets (2.0) (1.3) (3.1)

Leases (0.6) (0.5) (1.2)

---------- ---------- --------

Underlying operating cash flow (10.5) (3.6) 7.2

Movement in working capital IPO related

accruals (0.4) (3.4) (3.5)

Acquisition of intangible assets (0.2) - (2.6)

---------- ---------- --------

Adjusted operating cash flow (11.1) (7.0) 1.1

Tax paid (0.1) (0.2) (1.3)

Net finance cash flows 7.5 8.1 (0.7)

Exceptional items - - (0.5)

Exchange loss 0.2 0.5 (0.4)

---------- ---------- --------

Net cash flow (3.5) 1.4 (1.8)

The movement in working capital in the Period was GBP(12.3m) (HY

20: GBP(4.4m)). The outflow has supported the high value of Brand

Addition Consumer Promotion revenue in HY 21 amplifying the normal

in-year cycle which peaks in Q3 as these orders are delivered and

invoiced. The incremental outflow of GBP7.9m relates to the

significant increased trading volumes principally (i) GBP2.5m

Consumer Promotions orders in transit to the customer; and (ii)

GBP5.4m trade receivables net of trade payables.

Capital expenditure in the Period was GBP2.0m (HY 20: GBP1.3m).

The GBP0.7m additional spend relates to the ongoing investment in

Facilisgroup technology products.

Lease payments relate to leases capitalised in accordance with

IFRS 16. The increase arises as the Group entered into a new office

for Facilisgroup in December 2020.

Net finance cash flows in the Period of GBP7.5m (HY 20: GBP8.1m)

relate to utilisations on committed facilities less interest

payments in respect of leases capitalised in accordance with IFRS

16.

Cash and liquidity

The Group's working capital cycle is unwinding as expected, the

high point experienced in the period from June to August 2021 is

reducing as we move through the year, with clients and Partners

continuing to pay to agreed terms. The Group had Net debt of

GBP4.8m at 6 September 2021. This includes a GBP9.2m drawdown from

the GBP10.0m committed revolving credit facility. We expect Net

cash at the full year end, 31 December 2021 to be ahead of previous

expectation at no less than GBP8.0m (31 December 2020:

GBP7.1m).

Claire Thomson

Chief Financial Officer

7 September 2021

CONSOLIDATED INCOME STATEMENT

Unaudited Unaudited Audited

Period ended Period ended Year ended

30 June 30 June 31 December

Notes 2021 2020 2020

-------------- -------------- -------------

GBP'000 GBP'000 GBP'000

Revenue 46,759 33,564 82,374

Cost of goods sold (29,533) (19,951) (51,382)

-------------- -------------- -------------

Gross profit 17,226 13,613 30,992

Operating expenses (15,064) (12,717) (24,781)

Operating expenses - exceptionals 4 - - (542)

-------------- -------------- -------------

Total operating expenses (15,064) (12,717) (25,323)

-------------- -------------- -------------

Operating profit 2,162 896 5,669

Analysed as:

Adjusted EBITDA(1) 4,448 2,564 9,755

Depreciation 8 (986) (719) (1,567)

Amortisation 7 (1,071) (949) (1,963)

Share-based payment charge 12 (229) - (14)

Exceptional items 4 - - (542)

Operating profit 2,162 896 5,669

----------------------------------- -------- -------------- --------------

Finance expense (269) (303) (700)

-------------- -------------- -------------

Profit before taxation 1,893 593 4,969

Income tax expense 5 (473) (897) (889)

-------------- -------------- -------------

Profit/(loss) for the period 1,420 (304) 4,080

============== ============== =============

Basic profit/(loss) per share 6 0.85p (0.18)p 2.44p

============== ============== =============

Diluted profit/(loss) per

share 6 0.84p (0.18)p 2.44p

============== ============== =============

Note 1: Adjusted EBITDA, which is defined as operating profit

before depreciation, amortisation, exceptional items and

share-based payment charge is a non-GAAP metric used by management

and is not an IFRS disclosure.

CONSOLIDATED STATEMENT OF OTHER COMPREHENSIVE INCOME

Unaudited Unaudited Audited

Period ended Period ended Year ended

30 June 30 June 31 December

2021 2020 2020

-------------- -------------- -------------

GBP'000 GBP'000 GBP'000

Items that may be subsequently reclassified

to profit and loss

Foreign operations - foreign currency

translation differences (218) 1,299 (708)

-------------- -------------- -------------

Other comprehensive (expense)/income

for the period/year (218) 1,299 (708)

Profit/(loss) for the period/year 1,420 (304) 4,080

-------------- -------------- -------------

Total comprehensive income for the

period/year 1,202 995 3,372

============== ============== =============

CONSOLIDATED STATEMENT OF FINANCIAL POSITION

Unaudited Unaudited Audited

As at As at As at 31

30 June 30 June December

Notes 2021 2020 2020

---------- ---------- ----------

GBP'000 GBP'000 GBP'000

ASSETS

Non-current assets

Intangible assets 7 54,387 51,140 54,017

Property, plant and equipment 8 8,460 6,182 9,102

Deferred tax asset 316 167 493

Total non-current assets 63,163 57,489 63,612

---------- ---------- ----------

Current assets

Inventories 9 15,635 12,404 12,109

Trade and other receivables 30,032 18,920 20,988

Cash and cash equivalents 3,601 10,249 7,066

Current tax asset 533 - 829

---------- ---------- ----------

Total current assets 49,801 41,573 40,992

---------- ---------- ----------

TOTAL ASSETS 112,964 99,062 104,604

========== ========== ==========

LIABILITIES

Non-current liabilities

Lease liability 10 7,068 5,388 7,645

Trade and other payables - - 930

Deferred tax liability 2,630 1,904 2,637

Total non-current liabilities 9,698 7,292 11,212

---------- ---------- ----------

Current liabilities

Borrowings 7,750 8,368 -

Lease liability 10 1,422 1,003 1,334

Trade and other payables 26,399 17,647 25,775

Current tax liability - 859 -

Total current liabilities 35,571 27,877 27,109

---------- ---------- ----------

TOTAL LIABILITIES 45,269 35,169 38,321

========== ========== ==========

NET ASSETS 67,695 63,893 66,283

========== ========== ==========

Share capital 1,675 1,800 1,800

Share premium 78,451 78,451 78,451

Capital reserve 125 - -

Merger reserve (103,581) (103,581) (103,581)

Translation reserve (1,822) 403 (1,604)

Share-based payments reserve 223 - 13

Retained earnings 92,624 86,820 91,204

---------- ---------- ----------

TOTAL EQUITY 67,695 63,893 66,283

========== ========== ==========

CONSOLIDATED STATEMENT OF CHANGES IN EQUITY

Share-based

Share Share Capital Merger Translation payments Retained Total

capital premium reserve reserve reserve reserve earnings equity

---------- -------- --------- --------- ------------- ----------- --------- -------

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

At 1 January 2020 1,800 78,451 - (103,581) (896) - 87,124 62,898

========== ======== ========= ========= ============= =========== ========= =======

Loss for the period - - - - - - (304) (304)

Other comprehensive

income for the period - - - - 1,299 - - 1,299

Total comprehensive

income/(expense) - - - - 1,299 - (304) 995

At 30 June 2020 1,800 78,451 - (103,581) 403 - 86,820 63,893

---------- -------- --------- --------- ------------- ----------- --------- -------

Profit for the period - - - - - - 4,384 4,384

Other comprehensive

expense for the period - - - - (2,007) - - (2,007)

---------- -------- --------- --------- ------------- ----------- --------- -------

Total comprehensive

income/(expense) - - - - (2,007) - 4,384 2,377

---------- -------- --------- --------- ------------- ----------- --------- -------

Employee share schemes

- value of employee

services - - - - - 13 - 13

---------- -------- --------- --------- ------------- ----------- --------- -------

Total transactions

with owners recognised

in equity - - - - - 13 - 13

---------- -------- --------- --------- ------------- ----------- --------- -------

At 31 December 2020 1,800 78,451 - (103,581) (1,604) 13 91,204 66,283

---------- -------- --------- --------- ------------- ----------- --------- -------

Profit for the period - - - - - - 1,420 1,420

Other comprehensive

expense for the period - - - - (218) - - (218)

Total comprehensive

income/(expense) - - - - (218) - 1,420 1,202

Purchase of deferred

shares (125) - 125 - - - - -

Employee share schemes

- value of employee

services - - - - - 210 - 210

Total transactions

with owners recognised

in equity (125) - 125 - - 210 - 210

At 30 June 2021 1,675 78,451 125 (103,581) (1,822) 223 92,624 67,695

---------- -------- --------- --------- ------------- ----------- --------- -------

CONSOLIDATED CASH FLOW STATEMENT

Unaudited Unaudited Audited

Period ended Period ended Year ended

30 June 30 June 31 December

Notes 2021 2020 2020

-------------- -------------- -------------

GBP'000 GBP'000 GBP'000

Operating profit 2,162 896 5,669

Adjustments for:

* Amortisation 7 1,071 949 1,963

* Depreciation 8 986 719 1,567

* Share-based payments charge 12 229 - 13

- 10 -

* Loss on disposal of fixed assets

Cash flows from operating activities

before changes in working capital 4,448 2,574 9,212

* Change in inventories (3,526) (4,452) (4,157)

* Change in trade receivables (9,044) 6,624 4,556

* Change in trade payables (129) (9,920) (2,146)

-------------- -------------- -------------

Cash flows (used in)/from operating

activities (8,251) (5,174) 7,465

* Income taxes paid (46) (236) (1,313)

-------------- -------------- -------------

Net cash flows (used in)/from operating

activities (8,297) (5,410) 6,152

-------------- -------------- -------------

Cash flows from investing activities

* Purchase of property, plant and equipment (257) (236) (806)

* Purchase of intangible assets (1,983) (1,054) (4,871)

Net cash flows used in investing

activities (2,240) (1,290) (5,677)

-------------- -------------- -------------

Cash flows from financing activities

* Lease payments (594) (521) (1,141)

* Interest paid (269) (303) (700)

* Receipts from secured loan facilities 7,750 8,368 -

Net cash flows from/(used in) financing

activities 6,887 7,544 (1,841)

-------------- -------------- -------------

NET CASH FLOWS (3,650) 844 (1,366)

============== ============== =============

Cash and cash equivalents at beginning

of period 7,066 8,861 8,861

Effect of exchange rate fluctuations

on cash held 185 544 (429)

-------------- -------------- -------------

Cash and cash equivalents at end

of period 3,601 10,249 7,066

-------------- -------------- -------------

NOTES TO THE UNAUDITED CONSOLIDATED INTERIM FINANCIAL

INFORMATION

1. GENERAL INFORMATION

The principal activity of The Pebble Group plc (the "Company")

is that of a holding company and the principal activity of the

Company and its subsidiaries (the "Group") is the sale of products,

services and technology to the promotional merchandise industry.

The Group has two segments, Brand Addition and Facilisgroup. For

Brand Addition this is the sale of promotional products

internationally, to many of the world's best-known brands, and for

Facilisgroup the provision of technology, consolidated buying power

and community learning and networking events to SME promotional

product distributors in North America, its Partners, through

subscription-based services.

The Company was incorporated on 27 September 2019 in the United

Kingdom and is a public company limited by shares registered in

England and Wales. The registered office of the Company is Broadway

House, Trafford Wharf Road, Trafford Park, Manchester, England M17

1DD. The Company registration number is 12231361.

2. BASIS OF PREPARATION

These condensed consolidated interim financial statements of the

Group are for the period ended 30 June 2021. They have been

prepared on the basis of the policies set out in the 2020 annual

financial statements and in accordance with UK adopted IAS 34.

Financial information for the period ended 30 June 2020 included

herein is derived from the condensed consolidated interim financial

statements for that period.

The condensed consolidated interim financial statements have not

been reviewed or audited, nor do they comprise statutory accounts

for the purpose of Section 434 of the Companies Act 2006, and do

not include all of the information or disclosures required in the

annual financial statements and should therefore be read in

conjunction with the Group's 2020 annual financial statements,

which were prepared in accordance with international accounting

standards in conformity with the requirements of the Companies Act

2006 and international financial reporting standards adopted

pursuant to Regulation (EC) No 1606/2002 as it applies in the

European Union.

Financial information for the year ended 31 December 2020

included herein is derived from the statutory accounts for that

year, which have been filed with the Registrar of Companies. The

auditors' report on those accounts was unqualified, did not contain

an emphasis of matter paragraph and did not contain a statement

under Section 498 of the Companies Act 2006.

The condensed consolidated interim financial statements are

presented in the Group's functional currency of pounds Sterling and

all values are rounded to the nearest thousand (GBP'000) except

when otherwise indicated.

Accounting Policies

The accounting policies adopted in the preparation of the

condensed consolidated interim financial statements are consistent

with those followed in the preparation of the Group's annual

financial statements for the year ended 31 December 2020 as

described in the Group's Annual Report and full financial

statements for that year and as available on the Group's website (

www.thepebblegroup.com ).

Taxation

Taxes on income in the interim periods are accrued using

management's best estimate of the weighted average annual tax rate

that would be applicable to expected total annual earnings.

Forward looking statements

Certain statement in these condensed consolidated interim

financial statements are forward looking with respect to the

operations, strategy, performance, financial condition and growth

opportunities of the Group. The terms "expect", "anticipate",

"should be", "will be", "is likely to" and similar expressions

identify forward-looking statements. Although the Board believes

that the expectations reflected in these forward-looking statements

are reasonable, by their nature these statements are based on

assumptions and are subject to a number of risks and uncertainties.

Actual events could differ materially from those expressed or

implied by these forward-looking statements. Factors which may

cause future outcomes to differ from those foreseen in

forward-looking statements include, without limitation: general

economic conditions and business conditions in the Group's markets;

customers' expectations and behaviours; supply chain developments;

technology changes; the actions of competitors; exchange rate

fluctuations; and legislative, fiscal and regulatory developments.

Information contained in these condensed consolidated interim

financial statements relating to the Group should not be relied

upon as a guide to future performance.

Key risks and uncertainties

The Group has in place a structured risk management process

which identifies key risks and uncertainties along with their

associated mitigants. The key risks and uncertainties that could

affect the Group's medium-term performance, and the factors that

mitigate those risks have not substantially changed from those set

out in the Group's Annual Report which can be found on the Group's

website ( www.thepebblegroup.com ) and are summarised below.

Market Strategic Financial Operational

* Pandemic related disruption * Concentrated client base * Currency and foreign exchange * Retaining and attracting key personnel

* Macroeconomic environment * Acquisition risk * Reliance on IT systems

* Breach of IT security

* Climate Change

------------------------------- ------------------------------------ ---------------------------------------------

Going Concern statement

The Group meets its day-to-day working capital requirements

through its own cash balances and committed banking facilities. In

assessing the appropriateness of adopting the going concern basis

in the preparation of these condensed consolidated interim

financial statements, the Directors have prepared cash flow

forecasts and projections up to 31 December 2022.

The forecasts and projections, which the Directors consider to

be prudent, have been further sensitised by applying reductions to

revenue growth and margin, to consider a severe but plausible

downside. Under both the base and sensitised case the Group is

expected to have headroom against covenants and a sufficient level

of financial resources available through existing facilities when

the future funding requirements of the Group are compared with the

level of committed available facilities. Based on this, the

Directors are satisfied that the Group has adequate resources to

continue in operational existence for the foreseeable future. For

this reason, they continue to adopt the going concern basis in

preparing the condensed consolidated interim financial

statements.

3. SEGMENTAL ANALYSIS

The chief operating decision-maker has been identified as the

Board of Directors. The Board of Directors reviews The Pebble Group

Plc's internal reporting in order to assess performance and

allocate resources. The Board of Directors has determined that the

operating segments are those of Brand Addition and

Facilisgroup.

Segment information about the above segments is presented

below:

Income statement for the period ended 30 June 2021

Period ended

Central 30 June

Brand Addition Facilisgroup operations 2021

--------------- ------------- ------------ -------------

GBP'000 GBP'000 GBP'000 GBP'000

Revenue 41,124 5,635 - 46,759

Cost of goods sold (29,533) - - (29,533)

--------------- ------------- ------------ -------------

Gross profit 11,591 5,635 - 17,226

Operating expenses (10,379) (3,428) (1,257) (15,064)

Total operating expenses (10,379) (3,428) (1,257) (15,064)

--------------- ------------- ------------ -------------

Operating profit/(loss) 1,212 2,207 (1,257) 2,162

Analysed as:

Adjusted EBITDA 2,523 3,076 (1,151) 4,448

Depreciation (705) (260) (21) (986)

Amortisation (533) (538) - (1,071)

Share-based payment charge (73) (71) (85) (229)

Operating profit/(loss) 1,212 2,207 (1,257) 2,162

------------------------------- --------------- ------------- ------------

Finance expense (191) (15) (63) (269)

--------------- ------------- ------------ -------------

Profit/(loss) before taxation 1,021 2,192 (1,320) 1,893

Income tax expense (255) (548) 330 (473)

--------------- ------------- ------------ -------------

Profit/(loss) for the period 766 1,644 (990) 1,420

=============== ============= ============ =============

Due to the timing on the delivery of orders, the Brand Addition

segment of The Pebble Group Plc traditionally raises a higher

number of invoices in the period July to December which results in

The Pebble Group Plc's performance being weighted to the second

half of the year.

All the above revenues are generated from contracts with

customers.

Income statement for the period ended 30 June 2020

Period ended

Central 30 June

Brand Addition Facilisgroup operations 2020

--------------- ------------- ------------ -------------

GBP'000 GBP'000 GBP'000 GBP'000

Revenue 28,511 5,053 - 33,564

Cost of goods sold (19,951) - - (19,951)

--------------- ------------- ------------ -------------

Gross profit 8,560 5,053 - 13,613

Operating expenses (9,251) (2,752) (714) (12,717)

Total operating expenses (9,251) (2,752) (714) (12,717)

--------------- ------------- ------------ -------------

Operating profit/(loss) (691) 2,301 (714) 896

Analysed as:

Adjusted EBITDA 355 2,923 (714) 2,564

Depreciation (612) (107) - (719)

Amortisation (434) (515) - (949)

Exceptional items - - - -

------------- ------------ -------------

Operating profit/(loss) (691) 2,301 (714) 896

------------------------------- --------------- ------------- ------------ -------------

Finance expense (219) (15) (69) (303)

--------------- ------------- ------------ -------------

Profit/(loss) before taxation (910) 2,286 (783) 593

Income tax expense (303) (594) - (897)

--------------- ------------- ------------ -------------

Profit/(loss) for the period (1,213) 1,692 (783) (304)

=============== ============= ============ =============

Income statement for the year ended 31 December 2020

Year ended

Central 31 December

Brand Addition Facilisgroup operations 2020

--------------- ------------- ------------ -------------

GBP'000 GBP'000 GBP'000 GBP'000

Revenue 72,608 9,766 - 82,374

Cost of goods sold (51,382) - - (51,382)

--------------- ------------- ------------ -------------

Gross profit 21,226 9,766 - 30,992

Operating expenses (18,233) (5,077) (1,471) (24,781)

Operating expenses - exceptional (429) (42) (71) (542)

Total operating expenses (18,662) (5,119) (1,542) (25,323)

Operating profit/(loss) 2,564 4,647 (1,542) 5,669

Analysed as:

Adjusted EBITDA 5,209 5,994 (1,448) 9,755

Depreciation (1,316) (242) (9) (1,567)

Amortisation (900) (1,063) - (1,963)

Share-based payment charge - - (14) (14)

Exceptional items (429) (42) (71) (542)

Total operating profit/(loss) 2,564 4,647 (1,542) 5,669

---------------------------------- --------------- ------------- ------------

Finance expense (433) (29) (238) (700)

--------------- ------------- ------------ -------------

Profit/(loss) before taxation 2,131 4,618 (1,780) 4,969

Income tax expense (176) (1,182) 469 (889)

--------------- ------------- ------------ -------------

Profit/(loss) for the year 1,955 3,436 (1,311) 4,080

=============== ============= ============ =============

Statement of Financial Position as at 30 June 2021

As at

Central 30 June

Brand Addition Facilisgroup operations 2021

--------------- ------------- ------------ ---------

GBP'000 GBP'000 GBP'000 GBP'000

ASSETS

Non-current assets

Intangible assets 37,744 16,643 - 54,387

Property, plant and equipment 5,146 3,215 99 8,460

Deferred tax asset 41 19 256 316

Total non-current assets 42,931 19,877 355 63,163

--------------- ------------- ------------ ---------

Current assets

Inventories 15,635 - - 15,635

Trade and other receivables 27,524 2,456 52 30,032

Cash and cash equivalents 2,967 394 240 3,601

Current tax asset (193) 194 532 533

--------------- ------------- ------------ ---------

Total current assets 45,933 3,044 824 49,801

--------------- ------------- ------------ ---------

TOTAL ASSETS 88,864 22,921 1,179 112,964

=============== ============= ============ =========

LIABILITIES

Non-current liabilities

Lease liability 4,630 2,438 - 7,068

Deferred tax liability - 2,630 - 2,630

Total non-current liabilities 4,630 5,068 - 9,698

--------------- ------------- ------------ ---------

Current liabilities

Borrowings 7,750 - - 7,750

Lease liability 1,100 322 - 1,422

Trade and other payables 23,462 2,405 532 26,399

Total current liabilities 32,312 2,727 532 35,571

--------------- ------------- ------------ ---------

TOTAL LIABILITIES 36,942 7,795 532 45,269

=============== ============= ============ =========

NET ASSETS 51,922 15,126 647 67,695

=============== ============= ============ =========

Statement of Financial Position as at 30 June 2020

As at

Central 30 June

Brand Addition Facilisgroup operations 2020

--------------- ------------- ------------ ---------

GBP'000 GBP'000 GBP'000 GBP'000

ASSETS

Non-current assets

Intangible assets 37,313 13,827 - 51,140

Property, plant and equipment 5,440 742 - 6,182

Deferred tax asset 167 - - 167

Total non-current assets 42,920 14,569 - 57,489

--------------- ------------- ------------ ---------

Current assets

Inventories 12,404 - - 12,404

Trade and other receivables 17,044 1,746 130 18,920

Cash and cash equivalents 3,101 2,412 4,736 10,249

--------------- ------------- ------------ ---------

Total current assets 32,549 4,158 4,866 41,573

--------------- ------------- ------------ ---------

TOTAL ASSETS 75,469 18,727 4,866 99,062

=============== ============= ============ =========

LIABILITIES

Non-current liabilities

Lease liability 5,082 306 - 5,388

Deferred tax liability - 1,904 - 1,904

Total non-current liabilities 5,082 2,210 - 7,292

--------------- ------------- ------------ ---------

Current liabilities

Borrowings 8,368 - - 8,368

Lease liability 879 124 - 1,003

Trade and other payables 14,837 2,004 806 17,647

Current tax liability 372 532 (45) 859

Total current liabilities 24,456 2,660 761 27,877

--------------- ------------- ------------ ---------

TOTAL LIABILITIES 29,538 4,870 761 35,169

=============== ============= ============ =========

NET ASSETS 45,931 13,857 4,105 63,893

=============== ============= ============ =========

Statement of financial position as at 31 December 2020

As at 31

Central December

Brand Addition Facilisgroup operations 2020

--------------- ------------- ------------ ----------

GBP'000 GBP'000 GBP'000 GBP'000

ASSETS

Non-current assets

Intangible assets 37,839 16,178 - 54,017

Property, plant and equipment 5,558 3,424 120 9,102

Deferred tax asset 23 - 470 493

Total non-current assets 43,420 19,602 590 63,612

--------------- ------------- ------------ ----------

Current assets

Inventories 12,109 - - 12,109

Trade and other receivables 19,353 1,571 64 20,988

Cash and cash equivalents 5,677 538 851 7,066

Current tax asset 310 474 45 829

Total current assets 37,449 2,583 960 40,992

--------------- ------------- ------------ ----------

TOTAL ASSETS 80,869 22,185 1,550 104,604

=============== ============= ============ ==========

LIABILITIES

Non-current liabilities

Lease liability 4,893 2,661 91 7,645

Trade and other payables - 930 - 930

Deferred tax liability - 2,637 - 2,637

Total non-current liabilities 4,893 6,228 91 11,212

--------------- ------------- ------------ ----------

Current liabilities

Lease liability 1,096 218 20 1,334

Trade and other payables 22,995 2,181 599 25,775

Total current liabilities 24,091 2,399 619 27,109

--------------- ------------- ------------ ----------

TOTAL LIABILITIES 28,984 8,627 710 38,321

=============== ============= ============ ==========

NET ASSETS 51,885 13,558 840 66,283

=============== ============= ============ ==========

4. OPERATING EXPENSES - EXCEPTIONAL

Unaudited Unaudited Audited

Period ended Period ended Year ended

30 June 30 June 31 December

2021 2020 2020

--------------- --------------- -------------

GBP'000 GBP'000 GBP'000

Reorganisation and restructuring - - 430

Transaction costs - - 112

- - 542

=============== ================================================== =============

Exceptional items relate to the following:

-- reorganisation and restructuring - costs were incurred in

Brand Addition as a result of changes made to headcount to align

people costs with anticipated ongoing sales volumes; and

-- transaction costs - incremental external costs related to the

acquisition of software assets and a license.

5. INCOME TAX EXPENSE

The income tax expense for the period ended 30 June 2021 is

based upon management's best estimate of the weighted average

annual tax rate expected for the full year ending 31 December 2021.

The income tax expense is higher than the standard rate of 19% due

to higher standard income tax rates in overseas territories,

overseas losses carried forward and non-deductible expenses. The

income tax expense for the year ended 31 December 2020 was lower

than the standard rate due to the benefit in year from corporate

interest rate deductions that were previously disallowed for

taxation purposes.

6. EARNINGS PER SHARE

Basic and diluted earnings per share are calculated by dividing

the earnings attributable to equity shareholders by the weighted

average number of ordinary shares in issue during the year. As at

30 June 2020, no instruments with a potential or actual dilutive

impact were in issue and therefore diluted EPS was the same as

basic EPS. The impact of the potentially dilutive share options

issued under The Pebble Group Plc Long-Term Incentive Plan on 21

December 2020 and 8 June 2021 as detailed in note 12 is 0.01p for

the period ended 30 June 2021.

When calculating diluted earnings per share, the weighted

average number of shares is adjusted to assume conversion of

1,363,350 (2019: nil) of dilutive options granted to employees.

The calculation of basic and diluted profit per share is based

on the following data:

Statutory EPS

Unaudited Unaudited Audited

Period Period Year ended

ended ended 31 December

30 June 30 June 2020

2021 2020

------------ -------------- -------------

Earnings (GBP'000)

Earnings/(loss) for the purposes of basic

and diluted earnings per share

being profit/(loss) for the period attributable

to equity shareholders 1,420 (304) 4,080

------------ -------------- -------------

Number of shares

Weighted average number of shares for

the purposes of basic earnings/(loss)

per share 167,450,893 167,450,893 167,450,893

Weighted average dilutive effects of conditional

share awards 1,363,350 - -

Weighted average number of shares for

the purposes of diluted earnings/(loss)

per share 168,814,243 167,450,893 167,450,893

------------ -------------- -------------

Profit/(loss) per ordinary share (pence)

Basic profit/(loss) per ordinary share 0.85 (0.18) 2.44

Diluted profit/(loss) per ordinary share 0.84 (0.18) 2.44

------------ -------------- -------------

Adjusted EPS

The calculation of adjusted earnings per share is based on the

after tax adjusted operating profit after adding back certain costs

as detailed in the table below. Adjusted earnings per share figures

are given to exclude the effects of amortisation of acquired

intangible assets, share based payment charges and exceptional

items, all net of taxation, and are considered to show the

underlying performance of the Group.

Unaudited Unaudited Audited

Period Period Year ended

ended ended 31 December

30 June 30 June 2020

2021 2020

------------ -------------- -------------

Earnings (GBP'000)

Earnings/(loss) for the purposes of basic

and diluted earnings per share being adjusted

earnings/(loss) 1,808 (83) 4,965

------------ -------------- -------------

Number of shares

Weighted average number of shares for the

purposes of basic earnings/(loss) per share 167,450,893 167,450,893 167,450,893

Weighted average dilutive effects of conditional

share awards 1,363,350 - -

Weighted average number of shares for the

purposes of diluted earnings/(loss) per

share 168,814,243 167,450,893 167,450,893

------------ -------------- -------------

Adjusted earnings/(loss) per ordinary share

(pence)

Basic adjusted earnings/(loss) per ordinary

share 1.08 (0.05) 2.96

Diluted adjusted earnings/(loss) per ordinary

share 1.07 (0.05) 2.96

------------ -------------- -------------

The calculation of basic adjusted earnings per share is based on

the following data:

Unaudited Unaudited Audited

Period Period Year ended

ended ended 31 December

30 June 30 June 2020

2021 2020

------------- ------------- -------------

GBP'000 GBP'000 GBP'000

Profit/(loss) for the period attributable

to equity shareholders 1,420 (304) 4,080

------------- ------------- -------------

Add back/(deduct):

Amortisation charge on acquired intangible

assets 250 273 537

Share-based payments charge 229 - 14

Exceptional items - - 542

Tax effect of the above (91) (52) (208)

------------- ------------- -------------

Adjusted earnings/(loss) 1,808 (83) 4,965

============= ============= =============

7. INTANGIBLE ASSETS

Software

Customer and Development Work in

Goodwill relationships costs progress Total

--------- --------------- ----------------- ---------- --------

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Cost

Balance at 31 December

2019 35,882 10,437 11,156 336 57,811

--------- --------------- ----------------- ---------- --------

FX difference on translation 184 658 142 - 984

Additions - - 920 134 1,054

Disposals - - (278) - (278)

Reclassifications - - 35 (35) -

Balance at 30 June

2020 36,066 11,095 11,975 435 59,571

--------- --------------- ----------------- ---------- --------

FX difference on translation (264) (951) (163) - (1,378)

Additions - - 4,946 159 5,105

Reclassifications - - 372 (372) -

--------- --------------- ----------------- ---------- --------

Balance at 31 December

2020 35,802 10,144 17,130 222 63,298

--------- --------------- ----------------- ---------- --------

FX difference on translation (86) (183) (76) - (345)

Additions - - 1,612 174 1,786

Balance at 30 June

2021 35,716 9,961 18,666 396 64,739

--------- --------------- ----------------- ---------- --------

Accumulated amortisation

Balance at 31 December

2019 - 635 7,009 - 7,644

--------- --------------- ----------------- ---------- --------

FX difference on translation - 33 80 - 113

Charge for the period - 273 676 - 949

Disposals - - (275) - (275)

--------- --------------- ----------------- ---------- --------

Balance at 30 June

2020 - 941 7,490 - 8,431

--------- --------------- ----------------- ---------- --------

FX difference on translation - (48) (116) - (164)

Charge for the period - 264 750 - 1,014

--------- --------------- ----------------- ---------- --------

Balance at 31 December

2020 - 1,157 8,124 - 9,281

--------- --------------- ----------------- ---------- --------

Charge for the period - 250 821 - 1,071

Balance at 30 June

2021 - 1,407 8,945 - 10,352

--------- --------------- ----------------- ---------- --------

Net book value

--------- --------------- ----------------- ---------- --------

At 31 December 2019 35,882 9,802 4,147 336 50,167

--------- --------------- ----------------- ---------- --------

At 30 June 2020 36,066 10,154 4,485 435 51,140

--------- --------------- ----------------- ---------- --------

At 31 December 2020 35,802 8,987 9,006 222 54,017

--------- --------------- ----------------- ---------- --------

At 30 June 2021 35,716 8,554 9,721 396 54,387

========= =============== ================= ========== ========

The Group tests annually for impairment, or more frequently if

there are indicators that goodwill might be impaired.

8. PROPERTY, PLANT AND EQUIPMENT

Leasehold Fixtures Computer Right-of-use

property and fittings hardware Assets Total

---------- -------------- ---------- ------------- --------

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Cost

Balance at 31 December

2019 1,250 2,604 2,275 10,506 16,635

---------- -------------- ---------- ------------- --------

Impact of foreign exchange

translation 17 110 58 374 559

Additions 19 72 145 379 615

Disposals - (340) (133) (969) (1,442)

Balance at 30 June 2020 1,286 2,446 2,345 10,290 16,367

---------- -------------- ---------- ------------- --------

Impact of foreign exchange

translation (45) (115) (71) (401) (632)

Additions 71 79 434 3,474 4,058

Disposals - (9) - (568) (577)

Balance at 31 December

2020 1,312 2,401 2,708 12,795 19,216

---------- -------------- ---------- ------------- --------

Impact of foreign exchange

translation (7) (28) (18) (129) (182)

Additions - 20 237 269 526

Disposals - - - (175) (175)

---------- -------------- ---------- ------------- --------

Balance at 30 June 2021 1,305 2,393 2,927 12,760 19,385

---------- -------------- ---------- ------------- --------

Accumulated depreciation

Balance at 31 December

2019 1,036 2,108 1,865 5,545 10,554

---------- -------------- ---------- ------------- --------

Impact of foreign exchange

translation 7 88 44 208 347

Charge for the period 21 81 94 523 719

Disposals - (354) (120) (961) (1,435)

---------- -------------- ---------- ------------- --------

Balance at 30 June 2020 1,064 1,923 1,883 5,315 10,185

---------- -------------- ---------- ------------- --------

Impact of foreign exchange

translation (29) (89) (47) (178) (343)

Charge for the period 21 45 141 641 848

Disposals - - - (576) (576)

---------- -------------- ---------- ------------- --------

Balance at 31 December

2020 1,056 1,879 1,977 5,202 10,114

---------- -------------- ---------- ------------- --------

Impact of foreign exchange

translation (2) (20) (9) (30) (61)

Charge for the period 23 70 161 732 986

Disposals - - - (114) (114)

---------- -------------- ---------- ------------- --------

Balance at 30 June 2021 1,077 1,929 2,129 5,790 10,925

---------- -------------- ---------- ------------- --------

Net book value

---------- -------------- ---------- ------------- --------

Balance at 31 December

2019 214 496 410 4,961 6,081

---------- -------------- ---------- ------------- --------

Balance at 30 June 2020 222 523 462 4,975 6,182

---------- -------------- ---------- ------------- --------

Balance at 31 December

2020 256 522 731 7,593 9,102

---------- -------------- ---------- ------------- --------

Balance at 30 June 2021 228 464 798 6,970 8,460

========== ============== ========== ============= ========

Right-of-use assets - net

book value

---------- -------------- ---------- ------------- --------

Balance at 31 December

2019 4,800 21 140 - 4,961

---------- -------------- ---------- ------------- --------

Balance at 30 June 2020 4,855 - 120 - 4,975

---------- -------------- ---------- ------------- --------

Balance at 31 December

2020 7,267 227 99 - 7,593

---------- -------------- ---------- ------------- --------

Balance at 30 June 2021 6,710 184 76 - 6,970

---------- -------------- ---------- ------------- --------

9. INVENTORIES

Inventory levels are higher at the June period end compared to

December predominantly due to higher levels of stock in transit to

satisfy higher sales activity in the second half of the financial

year to December.

10. LEASES

Amounts recognised in the Consolidated Statement of Financial

Position

In addition to the right-of-use assets included within Note 8

above, the Consolidated Statement of Financial Position shows the

following amounts relating to leases:

Unaudited Unaudited Audited

Period Period Year ended

ended ended 31 December

30 June 30 June 2020

Lease liabilities 2021 2020

---------- ---------- -------------

GBP'000 GBP'000 GBP'000

Maturity analysis - contractual undiscounted

cash flows:

Less than one year 1,818 1,404 1,761

More than one year, less than two years 1,529 1,230 1,703

More than two years, less than three

years 1,330 1,053 1,403

More than three years, less than four

years 1,173 988 1,204

More than four years, less than five

years 1,193 926 1,185

More than five years 2,872 2,467 3,513

---------- ---------- -------------

Total undiscounted lease liabilities

at period end 9,915 8,068 10,769

Finance costs (1,425) (1,677) (1,790)

---------- ---------- -------------

Total discounted lease liabilities

at period end 8,490 6,391 8,979

---------- ---------- -------------

Lease liabilities included in the statement

of financial position

Current 1,422 1,003 1,334

Non-current 7,068 5,388 7,645

---------- ---------- -------------

8,490 6,391 8,979

---------- ---------- -------------

Amounts recognised in the Consolidated Income Statement

The Consolidated Income Statement shows the following amounts

relating to leases:

Unaudited Unaudited Audited

Period Period Year ended

ended ended 31 December

30 June 30 June 2020

2021 2020

---------- ---------- -------------

GBP'000 GBP'000 GBP'000

Depreciation charge - leasehold property 670 485 1,069

Depreciation charge - fixtures and fittings 40 16 51

Depreciation charge - computer hardware 22 22 44

---------- ---------- -------------

732 523 1,164

========== ========== =============

Interest expense (within finance expense) 197 222 433

========== ========== =============

11. FINANCIAL INSTRUMENTS

The fair values of all financial instruments included in the

Consolidated Statement of Financial Position are a reasonable

approximation of their carrying values.

12. SHARE-BASED PAYMENTS

The Group operates an equity-settled share-based payment plan

for certain employees of the Group under The Pebble Group Plc

Long-Term Incentive Plan (the 'LTIP').

On 8(th) June 2021, under the LTIP, the Group made awards of

960,510 conditional shares to certain Directors and employees.

The Group recognised total expenses of GBP229,000 (period ending

30 June 2020: GBPnil) in respect of equity-settled share-based

payment transactions for the period ended 30 June 2021.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR DKABDOBKDOCK

(END) Dow Jones Newswires

September 07, 2021 02:00 ET (06:00 GMT)

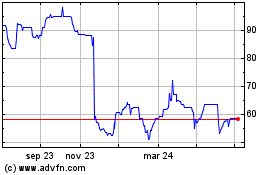

The Pebble (LSE:PEBB)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

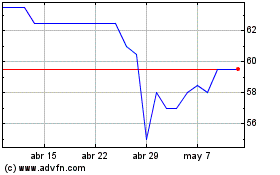

The Pebble (LSE:PEBB)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024