TIDMPEBB

RNS Number : 5137X

Pebble Group PLC (The)

06 May 2021

6 May 2021

THE PEBBLE GROUP PLC

("The Pebble Group", the "Company" or the "Group")

(AIM: PEBB)

Posting of Annual Report and Notice of AGM

The Pebble Group, a leading provider of technology, services and

products to the global promotional products industry, announces

that its Annual Report and Accounts for the year ended 31 December

2020 and the Notice of

its 2021 Annual General Meeting ("AGM") are now available on the Group's website at www.thepebblegroup.com

Copies of both documents will be posted to shareholders later

today.

The AGM will be held at Broadway House, Trafford Wharf Road,

Trafford Park, Manchester M17 1DD on Thursday 3 June 2021 at

1.00pm.

Format of the AGM

The Company's board of Directors ("Board") continues to monitor

the coronavirus pandemic and has noted, in particular, the gradual

easing of public health restrictions across England in line with

the government's "COVID-19 Response - Spring 2021" roadmap

published in February. Based on that roadmap and associated

guidance, it is currently anticipated that attendance in person at

the meeting will not be unlawful. It is therefore intended that the

directors will be present in person at the AGM, observing relevant

social distancing guidelines in place on the date of the meeting.

However, given ongoing public health considerations, shareholders

are strongly encouraged not to attend the meeting in person and to

appoint the Chair of the meeting as proxy.

Engagement

The Board recognises the importance of the AGM to shareholders

and is keen to ensure engagement in this year's AGM as effectively

as practicable. As such, a webcast will be accessible for

shareholders to view and listen to the AGM remotely. Details are

set out in the Notice of the AGM.

Questions can be put to the Board relating to the business to be

conducted at the AGM either by emailing

investors@thepebblegroup.com in advance or by submitting a question

during the AGM through the webcast facility. Any questions

shareholders wish to submit in advance of the AGM must be received

by 1:00pm on Tuesday 1 June 2021.

Change of circumstances

The coronavirus pandemic is an evolving situation and therefore

the AGM arrangements are subject to change, including at short

notice, if circumstances and/or public health guidance changes. The

Board recommends that shareholders monitor the Company's

announcements for any updates by registering to receive RNS alerts:

www.thepebblegroup.com/investors/rns-alerts/

Resolutions contained in the Notice of AGM

Resolutions 1 to 10 below will be proposed as ordinary

resolutions and resolutions 11 to 15 will be proposed as special

resolutions.

Receipt of audited accounts and reports

1. To receive the Company's audited accounts and the auditor's

and directors' reports for the year ended 31 December 2020.

Approval of directors' remuneration report

2. To approve the directors' remuneration report, as set out in

the Company's annual report and accounts for the year ended 31

December 2020.

Re-election of directors

3. To re-elect Richard Law as a director.

4. To re-elect Christopher Lee as a director.

5. To re-elect Claire Thomson as a director.

6. To re-elect Yvonne Monaghan as a director.

7. To re-elect Stuart Warriner as a director.

Re-appointment and remuneration of the auditor

8. To re-appoint PricewaterhouseCoopers LLP as the Company's auditor.

9. To authorise the audit committee of the board of directors to

determine the auditor's remuneration.

Authority to allot shares

10. That the directors are generally and unconditionally

authorised pursuant to section 551 of the Companies Act 2006 to

exercise all the powers of the Company to allot shares in the

Company and to grant rights to subscribe for or to convert any

security into such shares (Allotment Rights), but so that:

(i) the maximum amount of shares that may be allotted or made

the subject of Allotment Rights under this authority are shares

with an aggregate nominal value of GBP1,105,175, of which one-half

may be allotted or made the subject of Allotment Rights in any

circumstances and the other half may be allotted or made the

subject of Allotment Rights pursuant to any rights issue or

pursuant to any arrangements made for the placing or underwriting

or other allocation of any shares or other securities included in,

but not taken up under, such rights issue;

(ii) this authority shall expire at the close of business on 30

June 2022 or, if earlier, on the conclusion of the Company's annual

general meeting to be held in 2022;

(iii) the Company may make any offer or agreement before such

expiry which would or might require shares to be allotted or

Allotment Rights to be granted after such expiry and the directors

may allot shares or grant Allotment Rights under any such offer or

agreement as if the authority had not expired; and

(iv) all authorities vested in the directors on the date of the

notice of this meeting to allot shares or to grant Allotment Rights

that remain unexercised at the commencement of this meeting are

revoked.

Company off-market purchase of deferred shares

11. That for all purposes (including section 694 Companies Act

2006) the terms of a conditional agreement dated 29 April 2021 and

made between (1) Claire Thomson, Christopher Lee, David Landes,

Siobhan Howlett, Adelfo Marino, Rowland Deighton, Karl Whiteside

and Charles W. Fandos Revocable Trust U/T/A dated May 30, 1997 and

(2) the Company for the purchase by the Company of 12,564,501

deferred shares of GBP0.01 each in the capital of the Company

(being all of the shares of that class currently in issue), a copy

of which is now produced to this meeting and initialled for the

purposes of identification by the Chair, be authorised, such

authority to expire on 30 June 2021, and that the directors be

authorised to cause the Company to complete such agreement in

accordance with its terms.

New articles of association of the Company

12. That, with effect from the time at which all of the issued

deferred shares of GBP0.01 each in the capital of the Company are

cancelled upon their purchase by the Company pursuant to the

agreement referred to in resolution 11 in the notice of this

meeting, the regulations contained in the document produced to the

meeting and initialled for the purposes of identification by the

Chair be adopted as the new articles of association of the Company

in substitution for, and to the exclusion of, the existing articles

of association of the Company.

Disapplication of pre-emption rights

13. That, subject to the passing of resolution 10 in the notice

of this meeting, the directors are empowered pursuant to sections

570 and 573 of the Companies Act 2006 to allot equity securities

(as defined in section 560 of that Act) for cash, pursuant to the

authority conferred on them by resolution 10 in the notice of this

meeting or by way of a sale of treasury shares, as if section 561

of that Act did not apply to any such allotment, provided that this

power is limited to:

(i) the allotment of equity securities in connection with any

rights issue or open offer or any other pre-emptive offer that is

open for acceptance for a period determined by the directors to the

holders of ordinary shares on the register on any fixed record date

in proportion to their holdings of ordinary shares (and, if

applicable, to the holders of any other class of equity security in

accordance with the rights attached to such class), subject in each

case to such exclusions or other arrangements as the directors may

deem necessary or appropriate in relation to fractions of such

securities, the use of more than one currency for making payments

in respect of such offer, treasury shares, any legal or practical

problems in relation to any territory or the requirements of any

regulatory body or any stock exchange; and

(ii) the allotment of equity securities (other than pursuant to

paragraph (i) above) with an aggregate nominal value of GBP83,725,

and shall expire on the revocation or expiry (unless renewed) of

the authority conferred on the directors by resolution 10 in the

notice of this meeting, save that, before the expiry of this power,

the Company may make any offer or agreement which would or might

require equity securities to be allotted after such expiry and the

directors may allot equity securities under any such offer or

agreement as if the power had not expired.

14. That, subject to the passing of resolution 10 in the notice

of this meeting and in addition to the power contained in

resolution 13 set out in the notice of this meeting, the directors

are empowered pursuant to sections 570 and 573 of the Companies Act

2006 to allot equity securities (as defined in section 560 of that

Act) for cash, pursuant to the authority conferred on them by

resolution 10 in the notice of this meeting or by way of sale of

treasury shares, as if section 561 of that Act did not apply to any

such allotment, provided that this power is:

(i) limited to the allotment of equity securities up to an

aggregate nominal value of GBP83,725; and

(ii) used only for the purposes of financing (or refinancing, if

the power is to be exercised within six months after the date of

the original transaction) a transaction which the directors

determine to be an acquisition or other capital investment of a

kind contemplated by the Statement of Principles on Disapplying

Pre-Emption Rights most recently published by the Pre-Emption Group

prior to the date of the notice of this meeting,

and shall expire on the revocation or expiry (unless renewed) of

the authority conferred on the directors by resolution 10 in the

notice of this meeting, save that, before the expiry of this power,

the Company may make any offer or agreement which would or might

require equity securities to be allotted after such expiry and the

directors may allot equity securities under any such offer or

agreement as if the power had not expired.

Purchase of own ordinary shares

15. That the Company is generally and unconditionally authorised

pursuant to section 701 of the Companies Act 2006 to make market

purchases (as defined in section 693 of that Act) of ordinary

shares in its capital, provided that:

(i) the maximum aggregate number of such shares that may be

acquired under this authority is 16,745,000;

(ii) the minimum price (exclusive of expenses) which may be paid

for such a share is its nominal value;

(iii) the maximum price (exclusive of expenses) which may be

paid for such a share is 5 per cent. above the average of the

middle market quotations for an ordinary share (as derived from the

London Stock Exchange's Daily Official List) for the five business

days immediately preceding the date on which the share is

contracted to be purchased;

(iv) this authority shall expire at the close of business on 30

June 2022 or, if earlier, at the conclusion of the Company's annual

general meeting to be held in 2022, and

(v) before such expiry the Company may enter into a contract to

purchase shares that would or might require a purchase to be

completed after such expiry and the Company may purchase shares

pursuant to any such contract as if the authority had not

expired.

Enquiries:

The Pebble Group plc

Chris Lee, Chief Executive Officer

Claire Thomson, Chief Financial Officer +44 (0) 161 786 0415

Grant Thornton UK LLP (Nominated Adviser)

Samantha Harrison / Harrison Clarke /

Lukas Girzadas +44 (0) 20 7184 4384

Berenberg (Corporate Broker)

Chris Bowman / Jen Clarke / Arnav Kapoor +44 (0) 20 3207 7800

Belvedere Communications (Financial thepebblegrouppr@belvederepr.com

PR) +44 (0) 7715 769 078

Cat Valentine +44 (0) 7967 816 525

Keeley Clarke +44 (0) 7407 023 147

Llew Angus

About The Pebble Group plc - www.thepebblegroup.com

The Pebble Group is a provider of technology, services and

products to the global promotional products industry, comprising

two differentiated businesses, focused on specific areas of the

promotional products market:

Facilisgroup - www.facilisgroup.com

Facilisgroup focuses on supporting the growth of mid-sized

Promotional Product businesses in North America by providing a

technology platform, which enables those businesses to benefit from

significant business efficiency and gain meaningful supply chain

advantage from the ability to purchase from quality suppliers under

preferred terms.

Brand Addition - www.brandaddition.com

Brand Addition focuses upon providing promotional products and

related services under contract to some of the world's most

recognisable brands. Its largest contracts are valued in the

millions of pounds with the products and services supplied being

used for brand building, customer engagement and employee rewards.

Working in close collaboration with its clients, Brand Addition

designs products and product ranges, hosts client-branded global

web stores and provides international sourcing and distribution

solutions.

We categorise our revenues into two divisions, Corporate

Programmes, that supports our clients' general marketing

activities, and Consumer Promotions, that supports our clients in

driving their own sales volumes.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

NOADKQBNQBKDPPK

(END) Dow Jones Newswires

May 06, 2021 03:00 ET (07:00 GMT)

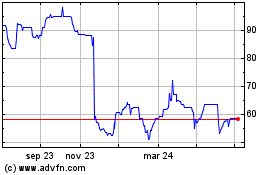

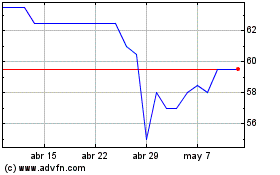

The Pebble (LSE:PEBB)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

The Pebble (LSE:PEBB)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024