TIDMPDL

26 October 2021 LSE: PDL

Petra Diamonds Limited

("Petra" or the "Company" or the "Group")

Q1 FY 2022 Trading Update

Petra Diamonds Limited announces the following unaudited Trading Update for the

three months ended 30 September 2021 ("Q1 FY 2022", "Q1" or the "Quarter").

Richard Duffy, Chief Executive of Petra Diamonds, commented:

"It is pleasing to see the improvement in our safety performance, which is due

to the unrelenting focus of our team on striving for a zero-harm work

environment. The Company has delivered a very strong revenue result due to the

contribution of Exceptional Stone sales, supported by the continued strength in

the diamond market. Production was lower than Q1 FY 2021, due to planned

decreases in tonnages and grade as part of the strategy to mitigate the waste

ingress at the Finsch mine, but a significant improvement over the previous

quarter and remains on track to deliver full year guidance"

Note: all figures in this announcement, unless indicated otherwise, exclude the

Williamson mine in Tanzania, which is currently classified as an asset held for

sale.

Q1 FY 2022 Summary:

* Lost Time Injury Frequency Rate ("LTIFR") down 52% to 0.31 (Q1 FY 2021:

0.65), reflecting the positive impact of remedial actions and

behaviour-based intervention programmes launched during FY 2021. Total

injuries, including LTIs down 38% to eight (Q1 FY 2021: 13).

* Production totalled 861,991 carats, increasing 8% on the preceding quarter

(Q4 FY 2021: 794,952 carats), following steps to address the impact of

waste ingress at the Finsch mine; year-on-year production down 12% (Q1 FY

2021: 974,346 carats), largely attributable to Finsch's high levels of

production before the impact of the waste ingress and resultant planned

decrease in throughput and grade to mitigate its impact from Q2 FY 2021.

* At the end of the Quarter, the Cullinan mine experienced tunnel convergence

in Tunnel 41 ("T41") on the eastern side of the C-Cut block cave, impacting

18 of a total 187 draw points. Mitigating steps are being evaluated. Group

production guidance for FY 2022 remains unchanged, although Cullinan's

production is now expected to be towards the bottom half of the Company's

earlier guidance of 1.7 to 1.9 Mcts, if no mitigating steps are taken.

* Revenue up 48% to US$114.9 million (Q1 FY 2021: US$77.7 million) driven by

proceeds from the sale of Exceptional Stones during the Quarter totalling

US$50.2 million. Diamond prices on a like-for-like basis up ca. 3% compared

to Q4 FY 2021.

* Production ramp-up at Williamson commenced during Q1 with 0.36 Mt ROM

processed, yielding 14.4 Kcts.

* Balance Sheet as at 30 September 2021:

+ Consolidated net debt of US$207.6 million (30 June 2021: US$228.2

million).

+ Unrestricted cash of US$203.6 million (30 June 2021: US$147.7 million).

+ Diamond debtors of US$0.1 million (30 June 2021: US$38.3 million).

+ Diamond inventory valued at US$76.0 million (30 June 2021: US$45.1

million) driven by timing of first tender closing early September.

Q1 FY 2022 Production, Sales - Summary

Unit FY 2022 FY 2021

Q1 Q1 Q2 Q3 Q4 TOTAL

Current Comparative Preceding

Total ore Mt 2.2 2.3 2.0 1.8 2.0 8.1

processed

Total diamonds Carats 861,991 974,346 766,516 704,498 794,952 3,240,312

Revenue US$M 114.9 77.7 95.8 106.0 122.8 402.3

* Outlook (excluding Williamson):

+ FY 2022 production guidance of 3.1 to 3.4 Mcts, notwithstanding

Cullinan's production guidance has been impacted by the convergence;

Capex guidance for the South African operations remains unchanged at

US$70 to US$82 million.

+ The re-engineering projects at Finsch and Koffiefontein initiated in

July 2021 continue and the Company will be in a position to provide

further information on these projects in its Interim results in

February 2022.

+ South Africa has exited the third wave of COVID-19 with daily

infections reducing to below 1,000 since the start of October; there

has been a limited impact on our South Africa operations during the

third wave. The Company will continue to monitor developments in the

country while actively encouraging employees to get vaccinated.

+ Proposed share consolidation of one new share for every 50 existing

shares in issue to be voted on at the Company's AGM on 19 November

2021. Further information can be found in the Company's 2021 Notice of

AGM at https://www.petradiamonds.com/investors/shareholders/meetings/.

+ Discussions with the South African Lender Group around the possible

refinancing of the first lien debt commenced during the Quarter and are

expected to be concluded during Q2 FY 2022.

* Outlook - Williamson

+ Williamson is estimated to add between 0.22 to 0.27 Mcts for the Year.

+ Discussions with the Government of Tanzania to reach agreement on

various issues at the Williamson mine are ongoing, with a view to

conclude during FY 2022.

Results Webcasts - 9:30am and 4:00pm BST today

Petra's Chief Executive Richard Duffy and Finance Director Jacques Breytenbach

will host a results webcast at 9:30am BST on 26 October 2021. Participants can

join the webcast by registering at:

https://www.petradiamonds.com/go/tu26oct21-09h30

A recording of the webcast will be available later that day on Petra's website

at:

https://www.petradiamonds.com/investors/results-reports/ and on the link above.

There will be a second webcast on 26 October 2021 for international investors

at 4:00pm BST. Participants can join the webcast by registering at:

https://www.petradiamonds.com/go/tu26oct21-16h00

Trading Update

Health and safety

The Lost Time Injury Frequency Rate ("LTIFR") for Q1 FY 2022 decreased to 0.31

(Q1 FY 2021: 0.65). The LTIs during the Quarter continued to be of low severity

and mostly behavioural in nature. The various remedial actions and

behaviour-based intervention programmes previously announced aim to address the

root causes of the safety incidents. The total number of injuries during Q1 FY

2022, which includes LTIs, decreased to eight (Q1 FY 2021: 13). Petra continues

to target a zero-harm working environment.

COVID-19 remains a significant risk to the health and safety of the Group's

workforce. Petra has implemented systems and strategies across all its

operations aimed at preventing and/or containing the spread of the virus.

Petra's focus is now on a vaccination drive of its employees. In South Africa,

2,208 vaccines have been administered to date, leading to 1,124 employees being

fully vaccinated (51% of the workforce) and 741 being partially vaccinated (34%

of the workforce). The roll-out has been slower in Tanzania, as disclosed in

the Company's recent Annual Report, but to date a total of 36 Williamson

employees and 202 mine camp residents have been vaccinated in Tanzania.

More information on the Company's response to the pandemic is available on its

website: https://www.petradiamonds.com/sustainability/health-and-safety/

our-response-to-covid-19/.

Production and Operations

Q1 FY 2022 production was in line with guidance and totalled 861,991 carats,

showing an 8% increase on the preceding quarter (Q4 FY 2021: 794,952), as the

steps to address the waste ingress at Finsch continued to yield positive

results. Year-on-year production was down 12% (Q1 FY 2021: 974,346 carats)

largely attributable to Finsch's high levels of production before the impact of

the waste ingress and resultant planned decrease in throughput and grade to

mitigate its impact from Q2 FY 2021.

The C-Cut Phase 1 block cave at the Cullinan mine consists of eight tunnels and

107 draw bells with 187 individual draw points. During September 2021, the

southern part of T41, the most eastern tunnel, experienced a sudden and rapid

onset of convergence, calling for immediate intervention. This resulted in the

installation of additional support to protect the tunnel for the longer term,

and the closure of the southern access to T41. This, together with the

previously reported closure of the northern access to the tunnel, has resulted

in the 18 draw points in T41 not being accessible for the remainder of FY 2022.

An investigation to determine the root cause of this convergence is in

progress, together with the development of a plan to mitigate its impact on the

mine's production. Whilst opportunities to mitigate the impact of the

above-mentioned measures are being investigated, early indications are that

without any mitigation, the convergence could result in a reduction of around

75 to 100 kcts in the mine's FY 2022 production. Although Group production

guidance for FY 2022 remains unchanged, Cullinan's production is now expected

to be at the lower end of the Company's earlier guidance of 1.7 to 1.9 Mcts, if

no mitigating steps are taken.

The re-engineering projects at Finsch and Koffiefontein that were initiated in

July 2021 to comprehensively review and improve the mines' cost bases and

enhance operating margins, remain in progress and the Company will be in a

position to provide more information on these projects at its Interim results

in February 2022.

Production ramp-up at Williamson commenced during Q1 with 0.36 Mt ROM

processed, yielding 14.4 Kcts. Encounters with illegal miners have continued

and, while the Company is working hand-in-hand with local law enforcement

agencies, local communities and district and regional government officials to

counter these incursions, the ramp-up of operating activities post the care and

maintenance period may be adversely impacted.

Diamond market

The diamond market remained firm, with prices for rough diamonds supported by

buoyant demand in the midstream and in the key jewellery retail markets,

notably the US and China, during the Quarter. There is a positive outlook for

the market for the remainder of CY 2021 and into CY 2022 due to the continued

pressure on supply, given the significant recent contraction in global output,

as well as promising forecasts for retail demand during the festive buying

period.

During the Quarter, the industry welcomed the launch of the Natural Diamond

Council's ("NDC") second global, multi-channel generic advertising campaign,

starring the Hollywood actress and NDC Global Ambassador Ana de Armas, in

September 2021. This campaign is timed to support the market in the lead-up to

the festive retail buying season.

Visit the campaign website: https://www.naturaldiamonds.com/

for-moments-like-no-other/.

The Company continues to closely monitor the impact of COVID-19 on its clients'

ability to attend tenders and will continue its flexible approach in planning

its upcoming sales events.

Diamond Sales

Q1 FY 2022 revenue increased 48% to US$114.9 million (Q1 FY 2021: US$77.7

million) driven by the sale of Exceptional Stones for US$50.2 million (Q1 FY

2020: US$nil), being the sale of the exceptional 39.34ct blue diamond,

recovered during April 2021, for US$40.18 million and a 342.92 carat Type IIa

white diamond which sold for US$10 million; the Company has retained a 50%

interest in the profit uplift of the polished proceeds, after costs, of the

342.92 carat white diamond, as well as a 18.30 carat Type IIb blue diamond

which sold for US$3.5 million.

Q1 Revenue also benefited from realised diamond prices on a like-for-like basis

rising ca. 3% versus those achieved in Q4 FY 2021.

Sales volumes reduced in line with normal tender timing, with only one tender

held during the Quarter. During the comparative period, significantly higher

volumes were sold, mostly off-tender, following the inventory build witnessed

late in FY 2020 after the initial COVID-19 outbreak.

Project 2022 Update

As at October 2021, Project 2022, which commenced in July 2019, is now 27

months into a 36 month project. Since the launch of the project, a standardised

business improvement process has become part of the Company's operating model

and is used not only to improve throughput and reduce costs, but to also

generate improvements in other key areas of the business such as safety.

Through a process of idea generation, various ideas were selected and

implemented as closely monitored projects with the objective of improving

throughput at all of the Company's operations, and to optimise operating and

capital expenditure across the Group. As detailed in the Company's FY 2021

Preliminary Results announcement, annualised operating cashflow benefits of

circa US$70 million are expected to be delivered through these Project 2022

initiatives, and are expected to result in the Group meeting its US$100 to

US$150 million net free cashflow target by the end of June 2022.

The first and second phases of the Project 2022 Organisational Design ("OD")

Review have been completed, which involved updating role descriptions, grading

these roles and amending the Group's Remuneration Policy to address both market

competitiveness and internal equity to strategically manage the investment in

our employees. The focus of the OD Project in FY 2022 is on improving

performance management through developing and aligning KPIs across the business

to further enhance accountability and delivery.

Corporate and Financial

Consolidated net debt reduced further to US$207.6 million as at 30 September

2021, from US$228.2 million at the end of June 2021, and US$692.3 million as at

30 September 2020.

Petra had unrestricted cash of US$203.6 million (30 June 2021: US$147.7

million), available undrawn banking facilities of US$3.9 million (30 June 2021:

US$7.7 million), diamond debtors of US$0.1 million (30 June 2021: US$38.3

million), and diamond inventory valued at US$76.0 million as at 30 September

2021 (30 June 2021: US$45.1 million).

The ZAR/USD exchange rate closed the Quarter at ZAR15.09/USD1 (Q1 FY 2021:

ZAR16.73/USD1), with an average rate for Q1 FY 2022 of ZAR14.62/USD1 (Q1 FY

2021: ZAR16.91/USD1).

Update on Independent Grievance Mechanism and remedial programmes at the

Williamson Mine in relation to allegations of human rights abuses

As stated in the Company's 12 May 2021 announcement, the Company's settlement

agreement with Leigh Day included a framework for Petra making an additional

payment in respect of up to 25 additional potential claimants who came forward

in the final stages of the settlement negotiations. During Q1 FY 2022, a

settlement, on a no admission of liability basis, was reached with Leigh Day in

relation to these additional claims and a provision for this settlement was

included in the Company's FY 2021 accounts.

In May 2021, the Company also announced the findings of the Tunajali Committee,

a Board Sub-Committee comprised of independent Non-Executive Directors, in

relation to the alleged breaches of human rights within the Williamson mine

lease area in Tanzania. The Company and the mine operator, Williamson Diamonds

Limited ("WDL"), took a number of measures prior to and following the findings

of the Tunajali Committee, which are set out in Petra's 12 May 2021

announcement.

One of the measures taken was the establishment of a Tier 1 operational

grievance mechanism ("OGM") for complaints and grievances related to

operational impacts. Having established the OGM, the Company has, with

specialist external support from Synergy Global Consulting ("Synergy"),

continued during Q1 FY 2022 with the process of designing and implementing a

non-judicial Tier 2 independent grievance mechanism ("IGM") which will consider

any incidents of potential human rights violations and provide remedy as

necessary.

During Q1 FY 2022, a series of engagements with Government Ministries and

Agencies, Civil Society and NGOs were conducted in Dodoma and Dar es Salaam,

seeking feedback and support on the proposed design of the IGM. The Company is

targeting the launch of the pilot phase of the IGM by the end of FY 2022 and

the IGM becoming fully operational by the end of Q1 FY 2023.

Whilst the IGM is still being developed, WDL has set up a mechanism to enable

community members to confidentially and securely register Tier 2 grievances.

The IGM will, however, only be able to investigate and resolve these grievances

once it becomes operational. A significant number of alleged historical Tier 2

grievances have already been registered through this mechanism. As the IGM is

not yet operational and therefore unable to commence the investigation of

alleged grievances, it is too early to evaluate the merits of grievances that

have been brought forward.

As previously announced, various projects are being put in place to provide

sustainable benefits to the communities located close to the mine, with in

excess of £1 million of agreed funding paid by Petra into an escrow account to

fund these projects. Synergy Global Consulting has been appointed to manage

these funds and they will work closely with the communities and local NGOs on

the formulation and implementation of the projects.

During Q1 FY 2022, there were a total of 143 reported incidents of illegal

incursions onto the Williamson mine lease area, resulting in six security

officials and two police officials suffering minor injuries and 15 arrests

being made. We believe the contracted security teams and Tanzanian police acted

in accordance with the Voluntary Principles on Security and Human Rights.

The Company is continuing its extensive engagement with communities around the

mine to highlight the dangers of illegal mining, seeking to reduce illegal

incursions onto the Williamson mine lease area, with a focus on reducing the

involvement of minors in illegal mining.

The Company will continue to monitor the effects of the actions taken to date

and is committed to the programmes and initiatives detailed in its 12 May 2021

announcement.

The 12 May 2021 announcement and other documents pertaining to this matter,

including an update on the community projects referenced above, can be found on

the Company's website at: https://www.petradiamonds.com/our-operations/

our-mines/williamson/allegations-of-human-rights-abuses-at-the-williamson-mine/

.

Ends

For further information, please contact:

Petra Diamonds, London

Telephone: +44 20 7494 8203

Cathy Malins

investorrelations@petradiamonds.com

Des Kilalea

Marianna Bowes

Notes:

1. The following definitions have been used in this announcement:

a. Exceptional Stones: diamonds with a valuation and selling price of US$5m or

more per stone

b. cpht: carats per hundred tonnes

c. Kcts: thousand carats

d. Kt: thousand tonnes

e. LOM: life of mine

f. LTI: lost time injury

g. LTIFR: lost time injury frequency rate

h. Mcts: million carats

i. Mt: million tonnes

j. FY: financial year

k. Q: quarter of the financial year

l. ROM: run-of-mine (i.e. production from the primary orebody)

m. SLC: sub level cave

n. m: million

About Petra Diamonds Limited

Petra Diamonds is a leading independent diamond mining group and a supplier of

gem quality rough diamonds to the international market. The Company's portfolio

incorporates interests in three underground producing mines in South Africa

(Finsch, Cullinan and Koffiefontein) and one open pit mine in Tanzania

(Williamson).

Petra's strategy is to focus on value rather than volume production by

optimising recoveries from its high-quality asset base in order to maximise

their efficiency and profitability. The Group has a significant resource base

of ca. 230 million carats, which supports the potential for long-life

operations.

Petra strives to conduct all operations according to the highest ethical

standards and only operates in countries which are members of the Kimberley

Process. The Company aims to generate tangible value for each of its

stakeholders, thereby contributing to the socio-economic development of its

host countries and supporting long-term sustainable operations to the benefit

of its employees, partners and communities.

Petra is quoted with a premium listing on the Main Market of the London Stock

Exchange under the ticker 'PDL'. The Company's US$336.7 million notes due in

2026 are listed on the Irish Stock Exchange and admitted to trading on the

Global Exchange Market. For more information, visit www.petradiamonds.com.

APPENDIX - CORPORATE & FINANCIAL AND PRODUCTION, SALES & CAPEX TABLES

(EXCLUDING WILLIAMSON)

Unit 30 September 30 June 31 December 30 September

2021 2021 2020 2020

Closing exchange rate R15.09:US$1 R14.27:US$1 R14.69:US$1 R16.73:US$1

used for conversion

Cash at bank (including US$M 219.4 163.8 103.8 58.9

restricted cash) 1

Diamond inventories1, 2 US$M 76.0 45.1 93.6 80.3

Carats 844,504 560,699 1,308,425 1,317,848

Diamond debtors US$M 0.1 38.3 3.7 19.1

US$336.7m loan notes US$M 336.8 327.3 - -

(issued March 2021)3

US$650m loan notes US$M - - 702.0 673.6

(issued April 2017)4

Bank loans and US$M 90.3 103.0 61.2 53.8

borrowings5

BEE partner bank US$M - - 47.2 42.9

facilities5

Bank facilities undrawn US$M 3.9 7.7 - -

and available4

Consolidated net debt5 US$M 207.6 228.2 702.9 692.3

Notes:

1. Cash at bank and diamond inventories exclude balances at Williamson due to

Williamson being classified as an asset held for sale as at 30 June 2021.

Comparatives for 31 December 2020 and 30 September 2020 have been adjusted

to exclude balances attributable to Williamson.

2. Recorded at the lower of cost and net realisable value.

3. The US$336.7 million loan notes have a carrying value of US$336.8 million

which represents the gross capital of US$336.7 million of notes, plus

accrued interest and net of unamortised transaction costs capitalised,

issued following the capital restructuring (the "Restructuring") completed

during March 2021.

4. The US$650 million loan notes represent the gross capital of US$650 million

of notes issued on April 2017, plus accrued and unpaid interest for the

relevant periods; these loan notes were settled in full following the

completion of the Restructuring.

5. Bank loans and borrowings represent amounts drawn under the Group's

refinanced South African bank facilities as part of the Restructuring and

comprise the ZAR961.9 million term loan (US$63.7 million), net of

unamortised transaction costs capitalised and ZAR402.1 million (US$26.6

million) drawn (including accrued interest) under the ZAR459.2 million

(US$30.4 million) revolving credit facility. Under the revolving credit

facility, ZAR59.2 million (US$3.9 million) remains undrawn and available.

During FY 2021 and as part of the Restructuring, the BEE partner bank

facilities (which comprised the BEE guarantees) were settled by the Group

through proceeds of the ZAR1.2 billion term loan.

6. Consolidated Net Debt is bank loans and borrowings plus loan notes, less

cash, less diamond debtors and includes the Black Economic Empowerment

guarantees of ZARnil as at 30 September 2021 (ca. US$42.9 million (ZAR717.7

million) as at 30 September 2020).

Q1 FY 2022 Group Production, Sales and Capex - Summary (excluding Williamson1)

FY 2022 FY 2021

Unit

Q1 Q1 Q2 Q3 Q4 TOTAL

Sales

Diamonds sold Carats 578,186 906,518 775,939 1,069,205 1,178,474 3,930,136

Revenue US$M 114.9 77.7 95.8 106.0 122.8 402.3

Production

ROM diamonds Carats 795,926 916,905 727,941 656,461 756,553 3,057,860

Tailings diamonds Carats 66,065 57,441 38,575 48,037 38,399 182,452

Total diamonds Carats 861,991 974,346 766,516 704,498 794,952 3,240,312

Tonnages

(rounded)

ROM tonnes Mt 2.1 2.2 1.9 1.6 1.9 7.7

Tailings & other Mt 0.1 0.1 0.1 0.1 0.1 0.4

tonnes

Total tonnes Mt 2.2 2.3 2.0 1.8 2.0 8.1

1. Results for Williamson are shown separately on page 10.

Cullinan - South Africa

FY 2022 FY 2021

Unit

Q1 Q1 Q2 Q3 Q4 TOTAL

Sales

Revenue US$M 92.8 33.8 73.5 62.9 80.4 250.6

Diamonds sold Carats 372,296 469,954 424,804 651,268 715,032 2,261,058

Average price per US$ 249 72 173 97 112 111

carat

ROM Production

Tonnes treated Tonnes 1,207,343 1,180,477 1,158,996 1,054,978 1,220,351 4,614,802

Diamonds produced Carats 431,967 475,374 428,252 388,666 459,198 1,761,490

Grade1 Cpht 35.8 40.3 37.8 36.8 37.6 38.2

Tailings Production

Tonnes treated Tonnes 115,593 105,097 116,288 105,826 118,327 445,538

Diamonds produced Carats 66,065 57,441 38,575 48,037 38,399 182,452

Grade1 Cpht 57.2 54.7 33.2 45.4 32.5 41.0

Total Production

Tonnes treated Tonnes 1,322,936 1,285,574 1,275,284 1,160,803 1,338,678 5,060,339

Diamonds produced Carats 498,032 532,815 476,827 436,703 497,597 1,943,942

1. The Company is not able to precisely measure the ROM / tailings grade split

because ore from both sources is processed through the same plant; the

Company therefore back-calculates the grade with reference to resource

grades.

Finsch - South Africa

FY 2022 FY 2021

Unit

Q1 Q1 Q2 Q3 Q4 TOTAL

Sales

Revenue US$M 19.3 34.3 20.5 31.4 37.3 123.5

Diamonds sold Carats 201,652 424,576 344,071 391,921 441,744 1,602,312

Average price per US$ 96 81 60 80 84 77

carat

ROM Production

Tonnes treated Tonnes 701,378 757,402 565,598 460,057 538,139 2,311,195

Diamonds produced Carats 350,368 420,774 274,534 253,607 288,305 1,237,219

Grade Cpht 50.0 55.6 48.5 55.1 54.6 53.5

Total Production

Tonnes treated Tonnes 701,378 757,402 565,598 460,057 538,139 2,311,195

Diamonds produced Carats 350,368 420,774 274,534 253,607 288,305 1,237,219

Koffiefontein - South Africa

FY 2022 FY 2021

Unit

Q1 Q1 Q2 Q3 Q4 TOTAL

Sales

Revenue US$M 2.8 9.4 1.8 11.7 5.1 28.0

Diamonds sold Carats 4,238 11,881 7,064 26,007 21,698 66,650

Average price per US$ 664 790 253 451 233 419

carat

ROM Production

Tonnes treated Tonnes 192,184 299,931 193,730 130,494 130,214 754,369

Diamonds produced Carats 13,592 20,758 15,155 12,188 9,050 59,151

Grade Cpht 7.1 6.9 7.8 10.9 7.0 7.8

Total Production

Tonnes treated Tonnes 192,184 299,931 193,730 130,494 130,214 754,369

Diamonds produced Carats 13,592 20,758 15,155 12,188 9,050 59,151

Williamson - Tanzania

FY 2022 FY 2021

Unit

Q1 Q1 Q2 Q3 Q4 TOTAL

Sales

Revenue US$M 0 4.6 0 0 0 4.6

Diamonds sold Carats 0 30,339 0 0 0 30,339

Average price per US$ 0 150 0 0 0 150

carat

ROM Production

Tonnes treated Tonnes 365,138 0 0 0 0 0

Diamonds produced Carats 14,420 0 0 0 0 0

Grade Cpht 3.9 0 0 0 0 0

Total Production

Tonnes treated Tonnes 365,138 0 0 0 0 0

Diamonds produced Carats 14,420 0 0 0 0 0

END

(END) Dow Jones Newswires

October 26, 2021 02:00 ET (06:00 GMT)

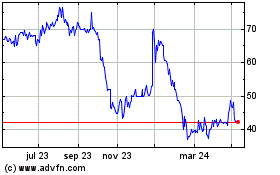

Petra Diamonds (LSE:PDL)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

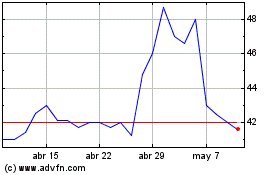

Petra Diamonds (LSE:PDL)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024