Petra Diamonds Temporary suspension of debt securities' listing

02 Noviembre 2021 - 5:48AM

UK Regulatory

TIDMPDL

2 November 2021 LSE: PDL

Petra Diamonds Limited

("Petra" or the "Company")

Temporary suspension of debt securities' listing

The Company's US$336,656,000 notes due in 2026 were admitted to listing on the

Irish Stock Exchange and admitted to trading on the Global Exchange Market in

May 2021 following the Petra group's capital restructuring. Euronext Dublin has

confirmed by announcement today a temporary suspension of this listing. The

suspension is an automatic consequence of a delay by Petra Diamonds US$

Treasury plc (the "Issuer") to publish its audited financial statements by 29

October 2021, as publication of such statements within four months' of an

issuer's financial year end is a requirement of the Issuer's retail notes'

listing.

The Issuer's audited financial statements have already been prepared and are

expected to be audited and signed-off within the next fortnight at which point

the financial statements will be published as required. The temporary

suspension from listing will be lifted immediately following such publication.

Petra announced the 2021 financial year end results for the Petra group in its

July trading update and announced its first quarter financial year 2022 results

last month. These updates can be found here: https://www.petradiamonds.com/

investors/news/

Ends

For further information, please contact:

Petra Diamonds, London Telephone: +44

20 7494 8203

Cathy Malins

investorrelations@petradiamonds.com

Marianna Bowes

Des Kilalea

About Petra Diamonds Limited

Petra Diamonds is a leading independent diamond mining group and a supplier of

gem quality rough diamonds to the international market. The Company's portfolio

incorporates interests in three underground producing mines in South Africa

(Finsch, Cullinan and Koffiefontein) and one open pit mine in Tanzania

(Williamson).

Petra's strategy is to focus on value rather than volume production by

optimising recoveries from its high-quality asset base in order to maximise

their efficiency and profitability. The Group has a significant resource base

of ca. 230 million carats, which supports the potential for long-life

operations.

Petra strives to conduct all operations according to the highest ethical

standards and only operates in countries which are members of the Kimberley

Process. The Company aims to generate tangible value for each of its

stakeholders, thereby contributing to the socio-economic development of its

host countries and supporting long-term sustainable operations to the benefit

of its employees, partners and communities.

Petra is quoted with a premium listing on the Main Market of the London Stock

Exchange under the ticker 'PDL'. The Company's US$336.7 million notes due in

2026 are listed (subject to temporary suspension) on the Irish Stock Exchange

and admitted to trading on the Global Exchange Market. For more information,

visit www.petradiamonds.com.

END

(END) Dow Jones Newswires

November 02, 2021 07:48 ET (11:48 GMT)

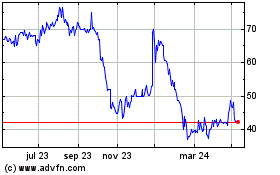

Petra Diamonds (LSE:PDL)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

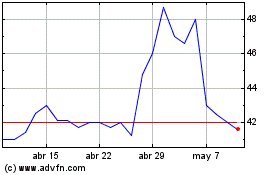

Petra Diamonds (LSE:PDL)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024