Phoenix Spree Deutschland Limited New Loan Facility & Refinancing of Existing Debt (4466Z)

25 Enero 2022 - 1:00AM

UK Regulatory

TIDMPSDL

RNS Number : 4466Z

Phoenix Spree Deutschland Limited

25 January 2022

25 January 2022

Phoenix Spree Deutschland Limited

(The "Company" or "PSDL")

Completion of new EUR60 million loan facility and refinancing of

existing debt.

Increased flexibility to maintain investment into existing

Portfolio of assets and pursue potential future acquisitions

As part of its ongoing financing activities, Phoenix Spree

Deutschland Limited (LSE: PSDL.LN), the UK listed investment

company specialising in Berlin residential real estate, announces

the completion of a new EUR60 million loan facility (the "New

Facility") and the refinancing of existing debt on improved terms

(the "Refinancing")

New Facility agreed with Natixis

The New Facility agreed with Natixis Pfandbriefbank AG

("Natixis") on 29 December 2021, comprises two components: a EUR45

million Acquisition Facility (the "Acquisition Facility") and a

EUR15 million Capex Facility (the "Capex Facility").

The New Facility matures in September 2026 and carries an

interest rate of 1.15% over 3-month Euribor. It can be used to

finance up to 100% of the total cost of both acquisitions and

capex. When drawn, it is non-amortising and terms to protect

against future adverse interest rate movements have been

agreed.

The Acquisition Facility provides the Company with additional

flexibility to pursue potential future acquisitions if suitable

opportunities, which offer clear value for shareholders, arise.

The Capex Facility will allow the Company to continue to

undertake its extensive capex programme. The Company remains

committed to improving living standards for its tenants and

fulfilling its environmental obligations and, following the removal

of the Berlin rent controls ("the Mietendeckel"), has been able to

resume its comprehensive programme of vacant apartment renovations

and modernisations.

Refinancing agreed with Berliner Sparkasse

Additionally, the Company is pleased to announce the refinancing

of existing debt provided by Berliner Sparkasse. The Refinancing

was agreed on 17 January 2022 and leverages the increase in

valuation of certain underlying assets within the Portfolio,

releasing a further EUR14.9 million of equity. Following

completion, the total value of the loans that have been refinanced

is EUR49.7 million and the maturities remain unchanged (at between

five and six years). The interest rate payable on these loans is

lower than the current portfolio average and no additional hedging

instruments for adverse interest rate movements are required.

The equity released by the Refinancing can be reinvested into

the Portfolio, including future potential share buy-backs.

Robert Hingley, Chairman of Phoenix Spree Deutschland Limited,

commented:

"We are delighted that we continue to deepen our relationship

with Natixis and Berliner Sparkasse by agreeing further credit

facilities which provide the Company with the flexibility to pursue

potential future acquisitions and to continue with our significant

levels of investment into the existing Portfolio of assets. Against

positive long-term demographic trends and a stabilising political

backdrop, the completion of these transactions underpins our

confidence in the future of the Berlin residential property market

and will allow us to continue to deliver value to our

shareholders."

The Company expects to report its Portfolio Valuation for the

financial year ended 31 December 2021 in early February 2022.

Legal Entity Identifier: 213800OR6IIJPG98AG39

For further information, please contact:

Phoenix Spree Deutschland Limited

Stuart Young +44 (0)20 3937 8760

Numis Securities Limited (Corporate Broker)

David Benda +44 (0)20 3100 2222

Tulchan Communications (Financial PR)

Elizabeth Snow

Oliver Norgate +44 (0)20 7353 4200

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

MSCEAPFLAEKAEFA

(END) Dow Jones Newswires

January 25, 2022 02:00 ET (07:00 GMT)

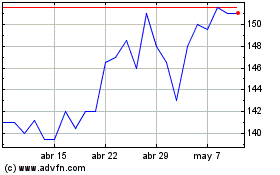

Phoenix Spree Deutschland (LSE:PSDL)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Phoenix Spree Deutschland (LSE:PSDL)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024