TIDMPHTM

RNS Number : 9918H

Photo-Me International PLC

09 December 2020

The information contained within this announcement is deemed to

constitute inside information as stipulated under the Market Abuse

Regulations (EU) No. 596/2014. Upon the publication of this

announcement, this inside information is now considered to be in

the public domain.

9 December 2020

Photo-Me International plc

("Photo-Me" or "the Group")

Trading Update

Photo-Me International plc (PHTM.L), the instant-service

equipment group, announces an update on the Group's trading and

cash position.

Trading Update

Since publication of the Group's results on 7 July 2020, trading

across all of the Group's end markets and business areas has

continued to be severely impacted by the COVID-19 pandemic as a

result of significantly lower consumer demand for its vending

equipment and services.

The Group's instant-service machines are typically situated in

busy locations, such as travel hubs and shopping centres. Ongoing

government lockdown restrictions, constraints on international

travel, and social distancing rules across its jurisdictions have

significantly impacted consumer activity, most notably for

photobooths (-26% from 1 May to 31 October 2020 compared to last

year same period) and more deeply for children's rides, which

represented only 1.2% of total Group revenue during the same

six-month period.

The Group saw a slight return of consumer activity as

countrywide and regional lockdowns were eased across Europe in the

summer. However, since then the increase in infection rates

resulted in new national and local government lockdown measures

being implemented, and revenue has once again been significantly

impacted. Nevertheless, Revolution laundry machines remain

resilient with average revenue down only -2% compared with the same

period last year.

Consequently, total Group revenue for the six months ended 31

October 2020 is expected to be 26% lower than in the six months

ended 31 October 2019.

Profit before tax for FY20 (18 months to 31 October 2020),

excluding IFRS16 impact, is expected to be approximately GBP0.5

million, taking account of the previously announced GBP23.7 million

impact from exceptional items, provisions and impairment in the 12

months ended 30 April 2020, and a second impact of approximately

GBP7 million in the six months ended 31 October 2020 . The Group

was cash flow positive in the period.

As a result of the difficult operating environment, the Group

utilised government furlough schemes where available and may seek

to continue to use the schemes as necessary in the future.

Diversification of the Group's product offering has remained a

key priority for the Board during this time. The expansion of the

Group's Laundry operations has continued, with 203 Revolution

machines being installed between May to October 2020. In addition,

new professional apple and pineapple juice machines have been

developed and are undergoing market testing with promising results

in a number of locations across France and Belgium.

Update on restructuring programmes

The Group has made good progress with its previously announced

restructuring programmes to remove unprofitable machines across the

UK, China and South Korea, and is adapting to a lower consumer

activity environment. These machines are predominately photobooths

and children's rides which will be decommissioned, refurbished or

relocated to other countries or sold to third parties, depending on

the age and condition of the machine.

The Group now expects to remove approximately 3,000 photobooths

in the UK, 700 units in China and 200 units in South Korea. In

Continental Europe (mainly France, the Netherlands and Spain), the

Group plans to remove 1,000 machines. Together, these programmes

will reduce the number of photobooths in operation by around 17%,

successfully streamlining the business and aligning its vending

estate to expected lower consumer activity in the short to medium

term.

Update on funding and liquidity

As at 31 October 2020, the Group had a net cash balance of GBP22

million.

The Group continues to comply with its banking covenants, with

the exception of a breach of the covenant relating to the loan from

BNP Paribas ("BNP") owing to the impacts caused by the COVID-19

pandemic. However, BNP has confirmed that this covenant has been

waived owing to the exceptional circumstances that gave rise to it.

Photo-Me and BNP have agreed in principle to amend the existing

gross cash to debt covenant, to give Photo-Me more flexibility in

the current environment. Subject to agreeing the amended terms, the

Group does not expect to breach this covenant going forward.

In the light of the second wave of COVID-19 and further lockdown

measures, the Board's scenario planning indicates that the Group

has sufficient liquidity to navigate this uncertain period

following the amendment of the Group's BNP loan facility as

described above .

Governance

The Group announces, in accordance with Listing Rule 9.6.11

that, Jean-Marc Janailhac will step down as a member of the

Remuneration Committee and Audit Committee with immediate effect.

Mr. Janailhac was appointed an Executive Director of Photo-Me on 17

July 2020, having served as a Non-executive Director since July

2019. He chairs the Strategic Committee whose members include the

top five managers of the Group and the CEO.

Following this change, members of the Audit Committee and

Remuneration Committee are set out below:

Audit Committee

- Jean-Marcel Denis, Non-executive Director (Committee Chairman)

- Sir John Lewis OBE, Non-executive Chairman

- Emmanuel Olympitis, Non-executive Director

- Francoise Coutaz-Replan, Non-executive Director

- Yitzhak Apeloig, Non-executive Director

Remuneration Committee

- Emmanuel Olympitis, Non-executive Director (Committee Chairman)

- Sir John Lewis OBE, Non-executive Chairman

- Jean-Marcel Denis, Non-executive Director

Membership of the Nomination Committee remains as follows:

- Sir John Lewis OBE (Committee Chairman)

- Emmanuel Olympitis, Non-executive Director

- Jean-Marcel Denis, Non-executive Director

Looking forward

The Board has acted, and continues to act, to mitigate the

impact of the current trading environment on the business and to

preserve cash. The COVID-19 situation is being closely monitored as

government lockdown measures across the Group's operating

jurisdictions change. The Board will continue to closely review its

vending estate in light of the continuing uncertainty and assess

the need for further restructuring measures and will seek to take

action as required.

Due to the second wave of COVID-19 and its possible long-term

global effects on the economy and social interactions, the Board

has very limited visibility on how the market will be in 2021.

Nevertheless, subject to the above, the Board estimates and has

budgeted for revenue of GBP175 million in FY21 (12 months to 31

October 2021), and estimates profit before tax will be GBP9 million

before any exceptional items, and also estimates that the Group

will be cash flow positive. Even in a downside scenario, the Board

believes that the Group's existing financial resources will be

sufficient for the Group to withstand the uncertain economic

conditions which are currently expected in 2021.

As announced in March 2020, the Board extended the Group's

financial year end by six months to 31 October 2020. The Group will

publish its results for the 18 months ended 31 October 2020 in

February 2021.

ENQUIRIES

Photo-Me International plc +44 (0) 1372 453 399

Serge Crasnianski, CEO

Stéphane Gibon, CFO

Hudson Sandler +44 (0) 20 7796 4133

Wendy Baker/ Emily Dillon/ Nick Moore photo-me@hudsonsandler.com

NOTES TO EDITORS

Photo-Me International plc (LSE: PHTM) operates, sells and

services a wide range of instant-service vending equipment,

primarily aimed at the consumer market.

The Group operates vending units across 18 countries and its

technological innovation is focused on three principal areas:

-- Identification: photobooths and integrated biometric identification solutions

-- Laundry: unattended laundry services, launderettes, B2B services

-- Kiosks: high-quality digital printing

The Group entered the self-service fresh fruit juice equipment

market in April 2019, with the acquisition of Sempa. T his will

become a key business area ('KIS Food') alongside Identification,

Laundry and Kiosks, and will be a significant part of the Group's

future growth strategy.

In addition, the Group operates vending equipment such as

children's rides, amusement machines and business service

equipment.

Whilst the Group both sells and services this equipment, the

vast majority of units are operated and maintained by Photo-Me.

Photo-Me pays the site owner a commission based on turnover, which

varies depending on the country and location of the machine.

The Group has built long-term relationships with major site

owners and its equipment is generally sited in prime locations in

areas of high footfall such as supermarkets, shopping malls

(indoors and outdoors) and public transport venues. The equipment

is maintained and serviced by an established network of 700 field

engineers.

The Company's shares have been listed on the London Stock

Exchange since 1962.

, the news service of the London Stock Exchange. RNS is approved by

the Financial Conduct Authority to act as a Primary Information

Provider in the United Kingdom. Terms and conditions relating to

the use and distribution of this information may apply. For further

information, please contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

TSTEAEAPESSEFAA

(END) Dow Jones Newswires

December 09, 2020 02:00 ET (07:00 GMT)

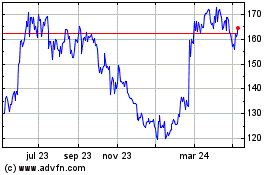

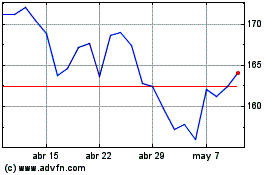

Me (LSE:MEGP)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Me (LSE:MEGP)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024