TIDMPIRI

RNS Number : 7761L

Pires Investments PLC

15 September 2021

15 September 2021

Pires Investments PLC

("Pires" or the "Company")

Unaudited interim results for the six months ended 30 June

2021

Pires Investments plc (AIM: PIRI), the investment company

focused on next generation technology, is pleased to announce its

unaudited interim results for the six-month period ended 30 June

2021.

Highlights

Company highlights

-- Profit achieved of GBP1.53 million during the period (six

months ended 30 April 2020: loss before taxation of GBP427,000)

-- Net asset value ("NAV") of GBP7,080,000 as at the period end

(31 December 2020: GBP2,926,000), equating to NAV per share of 4.94

pence, an increase of over 80% since 31 December 2020

Portfolio highlights

-- Interest in Sure Valley Ventures ("SVV") increased to circa

20% via the purchase of a shareholding in Sure Ventures plc ("SV

plc")

-- New investments made by SVV include Virtex, PreCog,

Smarttech247 and follow-on investments in Warducks and

Getvisibility

-- Significant increase in valuation of the majority of

portfolio companies based on new funding rounds involving third

party investors

o Portfolio continues to attract international investors such as

EQT, University of Tokyo, Foresight Williams Technology (a joint

collaboration between Foresight Group and Williams Advanced

Engineering), Business Growth Fund, Puma Investments, Japanese

Miyako Capital, Austrian APEX Ventures and Silicon Valley's R42

Group

-- New direct investment made in PreCog and follow-on

investments in Low6 and Getvisibility, coupled with an increase in

valuation of Getvisibility

-- Investments made in the digital assets technology sector

Post-period end highlights

-- GBP11 million raised by VividQ from investors including the

University of Tokyo, Foresight Williams Technology and Silicon

Valley's R42 Group

-- EUR3 million raised by Ambisense through funding round led by

BGF and supported by existing investors, including SVV, Atlantic

Bridge and Enterprise Ireland

-- CameraMatics announced a partnership with UK transport and

logistics operator Maritime Transport Ltd

-- Balance of proceeds received from the sale of Artomatix

-- Capital restructuring of the Company's balance sheet approved by shareholders

-- Smarttech247, a recent portfolio investment, is already actively pursuing an IPO

Nicholas Lee, Director of Pires, commented:

"This has been another very busy and exciting period for the

Company, with a significant level of investment activity and gains

made across the portfolio. We strongly believe that our investment

portfolio has the potential to deliver a high level of return, as

demonstrated by the progress made to date. In particular, our

investment in SVV is performing beyond the Board's expectation,

with the majority of the portfolio companies attracting additional

investment from other investors at significantly higher valuations

compared to the level of original investment and thereby also

ensuring that these companies are well funded going forward.

Furthermore, SVV has almost completed its initial portfolio

investment deployment and we anticipate further increases in the

value of the portfolio companies and subsequent exits over the

medium term. We are also excited about our investment in the

digital asset technology sector where we have already achieved

substantial gains."

Investment overview

The Company's principal investment portfolio categories are

summarised below:

Category Cost or valuation Cost or valuation

at 30 June at 31 December

2021 2020

GBP000s GBP000s

------------------ ------------------

Sure Valley Ventures 3,851 1,507

------------------ ------------------

Direct investments 884 419

------------------ ------------------

Digital assets sector 1,951 -

------------------ ------------------

Cash/other listed securities 474 1,122

------------------ ------------------

Total 7,160 3,048

------------------ ------------------

Investment in SVV

During the period, the Company increased its exposure to SVV

through the purchase of 1.5 million shares in SV plc using new

Pires shares as consideration. SV plc has a 25.9% interest in SVV

and a direct investment in VividQ, one of the SVV portfolio

companies. As a result of this transaction, Pires now has an

aggregate (direct and indirect) interest in SVV of around 20%.

Within the SVV portfolio, new investments have been made in:

Virtex, a company building a platform for the next-generation of

live, immersive entertainment within the virtual reality gaming and

e-sports industries; PreCog, a security solution platform company

that provides data intelligence to combat crime, terrorism and

protect vulnerable people; and Smarttech247, a global artificial

intelligence based cyber security cloud business that protects

enterprises as they migrate to cloud-based IT operations.

Smarttech247 is profitable with high forecast revenue growth and

has over 100 technology partners, including Tanium and CrowdStrike,

and 50 clients based in Europe and the US. Smarttech247 has also

recently announced its intention to seek a listing by way of a

reverse takeover transaction which is expected to complete later in

the year.

Additionally, during the period, a number of the portfolio

companies have been revalued upwards based on new funding rounds

which have taken place at higher valuations compared to the

valuation at the time of the initial investment. These companies

include:

-- CameraMatics raised EUR4 million in additional funding at a

valuation that represents over 300% of the CameraMatics' valuation

as at the time of SVV's initial investment in November 2017. The

round was led by Puma Investments, a leading provider of growth

capital. CameraMatics also announced a major partnership with UK

transport and logistics operator Maritime Transport Ltd.

-- Getvisibility completed a further funding round at a

significant premium to the last round. This was led by Herb Hribar

who was formerly CEO of Eircom, the largest telecoms group in

Ireland and is currently a director of ScienceLogic, Inc, a leading

provider of AI-based operations technology which recently completed

its own US$105 million round. Mr Hribar, who is based in the US,

recently become Chairman of Getvisibility and is leading

Getvisibility's dialogue with potential Silicon Valley

investors.

-- Post the period end, VividQ has also raised new funds (GBP11

million) at a significant premium to previous valuations. This

funding was led by a consortium of new international investors

including the University of Tokyo, Foresight Williams Technology (a

joint collaboration between Foresight Group and Williams Advanced

Engineering), Japanese Miyako Capital, Austrian APEX Ventures and

Silicon Valley's R42 Group and follow-on investments from SVV,

University of Tokyo Edge Capital (UTEC) and Essex Innovation. SV

plc has a significant direct investment in VividQ thereby providing

Pires with a disproportionately greater interest in VividQ through

its shareholding in SV plc.

VR Education ("VRE"), one of the portfolio companies which is

already listed on AIM, and from which funds have already been

returned to Pires, has also made significant progress during the

period with revenue up 83% for the half year to 30 June 2021. In

particular, its ENGAGE product has now reached the milestone of

over 130 commercial customers, including Abbott Laboratories, KPMG,

MongoDB, and the US State Department as recent additions. Its

strategic partner HTC Corporation ("HTC") has commenced selling its

ENGAGE product, VIVE Sessions, in China, as part of a software

bundle with HTC's new headset, the VIVE Focus 3, and with new HP

ProBook laptops being sold in the region. In June 2021, VRE

announced the planned development of a new fully featured corporate

metaverse called "ENGAGE Oasis" with the launch expected in the

first half of 2022. In addition, it raised EUR9.0 million (GBP7.7

million) before expenses at a price of GBP0.16 per share by way of

an oversubscribed placing, announced on 18 June 2021 - the

company's net cash position was EUR9.2 million as at 30 June

2021.

As at the period end, SVV had a portfolio of 13 investee

companies at different stages of development spanning a range of

sectors. The portfolio provides Pires with exposure to a number of

key, cutting-edge and rapidly growing technology sectors. Further

details of the portfolio companies and recent developments are set

out below:

Artificial intelligence

Ambisense Provides an Artificial Intelligence platform

to deliver environmental risk assessment

to allow real-time gas and environmental

monitoring using both IoT and sensor solutions.

The company has already been awarded a number

of major contracts and has a substantial

pipeline of opportunities.

------------------------------------------------------

Buymie An artificial intelligence-based same day

grocery delivery company operating in both

the UK and Ireland working with companies

such as Tesco, Lidl, Asda and the Co-op.

------------------------------------------------------

Security

------------------------------------------------------

Nova Leah An artificial intelligence cyber-security

assessment and protection platform for connected

medical devices.

------------------------------------------------------

Getvisibility An artificial intelligence security company

addressing the substantial problem faced

by corporations in storing, sorting, accessing

and protecting data. Recently raised additional

funds at a significant premium and has been

voted as one of Ireland's top 18 start-ups.

------------------------------------------------------

PreCog A security solution platform company that

provides data intelligence to combat crime,

terrorism and protect vulnerable people.

The company recently completed a GBP1 million

fundraising round. Customers include leading

law enforcement and security agencies and

transport infrastructure groups.

------------------------------------------------------

Smarttech247 A global artificial intelligence based cyber

security cloud business that protects enterprises

as they migrate to cloud-based IT operations.

The company has recently won a major new

contract with a Fortune Global-1000 company

employing over 100,000 staff and already

has a purchase order under this contract

for EUR6 million. It has also recently announced

its intention to list via an RTO process.

------------------------------------------------------

Immersive Technologies

------------------------------------------------------

VR Education A developer of virtual reality and immersive

experiences with a specific focus on education

and enterprise learning and development.

The company is listed on AIM, has over 100

commercial customers and is rapidly growing

revenue and margins. It recently raised EUR9.0

million in new funds.

------------------------------------------------------

Admix A platform enabling the monetisation of interactive

programmatic brand placements in, for example,

video games and other AR/VR applications.

The company is rapidly growing revenues and

numbers of active users.

------------------------------------------------------

Warducks A game development studio known for the production

of leading games and is soon to launch an

AR game that could be the next Pokémon

Go.

------------------------------------------------------

VividQ A deep tech software company which has developed

a framework for real-time 3D holographic

displays for use in heads-up displays and

AR headsets and glasses. The company recently

completed a significant GBP11 million funding

round at a significant premium.

------------------------------------------------------

Volograms A reality capture and volumetric video company.

It is currently trialling a new app which

has had very positive feedback to date.

------------------------------------------------------

Virtex A company building a platform for the next-generation

of live, immersive entertainment within the

virtual reality ("VR") gaming and e-sports

industries. It is actively developing its

new Stadium app.

------------------------------------------------------

Internet of things

------------------------------------------------------

CameraMatics Platform enabling transport fleet managers

to reduce risk, increase driver safety and

comply with growing industry governance and

compliance. It recently raised EUR4 million

at a 300% uplift in valuation. The company

is growing revenues significantly and building

its presence in the very significant US market

where it has already won a number of new

contracts.

------------------------------------------------------

Wia Provides a platform solution for smart buildings.

Its platform provides full device and application

management, security, data capture and storage,

analysis and control.

------------------------------------------------------

Direct investments

During the period, the Company increased its investment in Low6,

an influencer-led B2B gamification company for sports franchises

around the world. Low6 recently raised an additional GBP6.5 million

in July 2021 in an over-subscribed pre-IPO fund raising. Its user

base continues to increase and it now has over 250,000 users. Low6

is also actively progressing its IPO.

The Company made a new investment of GBP250,000 in PreCog, a

security solution platform company that provides data intelligence

to combat crime, terrorism and protect vulnerable people, as part

of its GBP1 million fundraising round. Its customers include

leading law enforcement and security agencies and transport

infrastructure groups.

Pires also made a follow-on investment in Getvisibility, as part

of a EUR1.1 million funding round led by a new lead investor Herb

Hribar, who has also become Chairman of the company. This new

funding took place at a significant premium to the valuation at

which Pires made its original investment of EUR250,000 in March

2020. The funds raised will be used to enhance the company's

marketing and sales capability in addition to deepening its

technology and research know-how The company is accelerating

customer growth and is also now servicing customers in Europe and

the MENA region.

Digital assets sector

The Company completed its first investment in the digital assets

sector through an investment in De Tech Studio Limited and YOP

tokens. Certain YOP tokens were sold to realise a substantial cash

profit and the balance of the investment was used to subscribe for

shares in Pluto Digital Assets plc ("Pluto"). The rationale for

this transaction was to diversify and de-risk the investment and

provide greater liquidity given Pluto's intention to list.

Pluto is a software technology company and operator in the

decentralised finance ("DeFi") and non-fungible tokens

("NFT")/Metaverse (virtual environments) sectors. It is currently

developing a DeFi software platform, that provides a highly usable

web DeFi portal to open up DeFi to a mass audience. This platform

provides vault middleware to find and categorise a set of

proprietary DeFi vaults to offer users the ability to generate

yield from crypto currencies. Furthermore, Pluto has partnered with

a leading NFT metaverse platform and is currently engaging with

owners of digital media and rights to offer their content to the

NFT community. In addition to Pluto's operational activities, it

has made further investments in Web3 ventures and has acquired an

NFT portfolio including assets such as Cryptopunks, Artblocks and

BAYCs.

Pluto has advised the Company that it currently holds treasury

assets including Bitcoin, Ethereum, Polkadot, Cardano and Solana.

The company has also advised that, overall, its portfolio of

venture and treasury assets has been performing well and the

company's current NAV per share exceeds 6 pence, the price at which

Pluto carried out its most recent fund raise in March 2021.

During the summer of 2021, Pluto has been focusing on expanding

its product team and forming key partnerships. This work has

progressed well and the company now believes that it is

well-positioned to proceed with its planned IPO.

The Company's equity holding in Pluto is valued at almost GBP2

million based on the price of 6 pence per share, which represents a

significant uplift on the Company's initial investment in this

sector.

Key financial indicators

The key unaudited performance indicators are set out below:

Performance indicator 30 June 2021 31 December Change

2020

-------------------------------- ------------- ----------- ---------

GBP000s GBP000s

Profit/(loss) attributable GBP1,532 GBP(687)

Net asset value GBP 7,080 GBP 2,926 +142%

Net asset value - fully diluted

per share 4.94p 2.7p +83%

The Company has generated significant profits during the period

driven by increases in value of its investment portfolio. At the

same time, the Company's net assets have continued to increase over

the period, although we do not believe that the Company's net

assets fairly represent its financial potential, given the scope

for significant valuation uplift for the companies within the

portfolio. This is clearly demonstrated by the gains, both realised

and unrealised, that have been achieved to date from its investment

portfolio. Furthermore, realisations that are achieved within the

SVV portfolio result in cash distributions to the Company and are

not retained within the fund thereby delivering a real cash return

to the Company.

During the period, the holders of warrants over 17,053,579

ordinary shares in the Company exercised their warrants at 4 pence

per share with total net proceeds to the Company of GBP682,143.

There are currently unexercised warrants over 33,221,403 new

ordinary shares in the Company which expire in June 2022.

The Company is also very pleased to welcome a new Director,

David Palumbo, to the Board. David is currently CEO of EQTEC plc

and brings a wealth of experience in the venture capital and

technology sectors. Also, at the recent AGM, Peter Redmond retired

from the Board. W e would therefore like to thank Peter for his

time at Pires and his valuable contribution to the progress that

the Company has made over recent years. We all wish Peter the very

best in his future endeavours.

Furthermore, at the Company's recent AGM, shareholders approved

the Company to proceed with a capital restructuring and reduction

in order to both simplify the Company's capital and reserves and to

eliminate the historical deficit on the profit and loss account in

order to allow the Company to pay dividends and make distributions

going forward.

With regard to Covid-19, the Company has remained fortunate in

being able to trade as normal, with very limited impact on its

investments.

In summary, the Company's investment in the technology sector

has already proven to have been successful, with a substantial

amount of the original investment already having been returned.

Going forward, the Company is very well positioned to become a

leading next generation technology investment company with an

interest in a portfolio of high-tech companies that have the

potential for significant growth.

This announcement contains inside information for the purposes

of the UK Market Abuse Regulation. The person who arranged the

release of this information is Nicholas Lee, Director of the

Company.

Enquiries:

Pires Investments plc

Nicholas Lee, Director Tel: +44 (0) 20 3368 8961

Nominated Adviser

Cairn Financial Advisers LLP Tel: +44 (0) 20 7213 0880

Liam Murray/Ludovico Lazzaretti

Joint broker

Peterhouse Capital Limited Tel: +44 (0) 20 7469 0935

Lucy Williams/Duncan Vasey

Joint broker

Tennyson Securities Tel: +44 (0) 20 3167 7221

Peter Krens

Financial media and PR

Yellow Jersey Tel: +44 (0) 20 3004 9512

Sarah Hollins

Henry Wilkinson

Annabelle Wills

Notes to Editors

About Pires Investments plc

Pires Investments plc (AIM: PIRI) is an investment company

providing investors with access to a portfolio of next generation

technology businesses with significant growth potential.

The Company is building an investment portfolio of high-tech

businesses across areas such as Artificial Intelligence, Internet

of Things, Cyber Security, Machine Learning, Immersive Technologies

and Big Data, which the Board believes demonstrate evidence of

traction and the potential for exponential growth, due to

increasing global demand for development in these sectors.

For further information, visit: https://piresinvestments.com/

.

UNAUDITED STATEMENT OF COMPREHENSIVE INCOME

for the six months ended 30 June 2021

Unaudited Unaudited Audited

14 month

6 months 6 months period

ended ended ended

30-Jun 30-Apr 31-Dec

2021 2020 2020

Continuing activities GBP000s GBP000s GBP000s

Notes

Revenue

Investment income - - -

Other income - - 1

Total revenue - - 1

Gains/(Losses) on investments

held at fair value through profit

or loss 1,802 (261) (149)

Operating expenses (270) (166) (539)

---------- ---------- -----------

Operating profit from continuing

activities 1,532 (427) (687)

Profit before taxation from

continuing activities 1,532 (427) (687)

Tax - - -

Profit for the period from continuing

activities 1,532 (427) (687)

---------- ---------- -----------

Profit for the period and total

comprehensive income attributable

to equity holders of the Company 1,532 (427) (687)

========== ========== ===========

Basic profit/ (loss) per share 3

Equity holders

Basic and diluted 1.07p (0.81)p (0.64)p

UNAUDITED STATEMENT OF FINANCIAL POSITION

As at 30 June 2021

Unaudited Unaudited Audited

As at As at As at

30-Jun 30-Apr 31-Dec

2021 2020 2020

GBP000s GBP000s GBP000s

Notes

CURRENT ASSETS

Investments 6,800 1,684 2,029

Trade and other

receivables 4 1,031 15

Cash and cash equivalents 360 400 1,019

---------- ---------- ---------

TOTAL CURRENT ASSETS 7,164 3,115 3,063

---------- ---------- ---------

TOTAL ASSETS 7,164 3,115 3,063

========== ========== =========

EQUITY

Called up share

capital 12,214 11,996 12,135

Shares to be issued - 132 -

Share premium account 7,701 4,249 5,158

Share premium account - 808 -

for shares to be

issued

Retained earnings (13,000) (14,272) (14,532)

Capital redemption

reserve 165 165 165

---------- ---------- ---------

TOTAL EQUITY 4 7,080 3,078 2,926

LIABILITIES

CURRENT LIABILITIES

Trade and other

payables 84 37 137

---------- ---------- ---------

TOTAL LIABILITIES

AND CURRENT LIABILITIES 84 37 137

TOTAL EQUITY AND

LIABILITIES 7,164 3,115 3,063

========== ========== =========

UNAUDITED CASH FLOW STATEMENT

For the six months ended 30 June 2021

Unaudited Unaudited Audited

6 months 6 months 14 month period

ended ended ended

30-Jun 30-Apr 31-Dec

2021 2020 2020

GBP000s GBP000s GBP000s

Cash flows from operating

activities - Profit /(Loss)

for the period 1,532 (427) (687)

Depreciation - - -

Realised (gain) on disposal

of investments - (284) (128)

Fair value movement in

investments (1,802) 545 277

Finance income - - (1)

(Increase)/decrease in

receivables 10 (1,019) (4)

Increase/(decrease) in

payables (53) (3) 98

Net cash absorbed by

operating activities (312) (1,188) (445)

Cash flows from investing

activities

Payments to acquire investments (2,969) (1,700) (2,217)

Proceeds of sale of investments - 920 1,205

Finance income received - - 1

Net cash from investing

activities (2,969) (780) (1,011)

Cash flows from financing

activities

Proceeds receivable from

shares to be issued - 941 -

Net proceeds from shares

issued 2,622 - 1,048

Net cash from financing

activities 2,622 941 1,048

Net (decrease) in cash

and cash equivalents

during the period (659) (1,027) (408)

Cash and cash equivalents

at beginning of the period 1,019 1,427 1,427

Cash and cash equivalents

at end of the period 360 400 1,019

Notes to the Unaudited Interim Report

1. GENERAL INFORMATION

Pires Investments plc (the "Company") is a company domiciled in

England whose registered office address is 9(th) Floor, 107

Cheapside, London EC3V 6DN. The condensed interim financial

statements of the Company for the six months ended 30 June 2021 is

that of the Company only.

The condensed interim financial statements do not constitute

statutory accounts as defined in Section 434 of the Companies Act

2006.

The financial information for the 14-month period ended 31

December 2020 has been extracted from the statutory accounts for

that period which were prepared in accordance with International

Financial Reporting Standards ("IFRS"). The auditors' report on the

statutory accounts was unqualified. A copy of those financial

statements has been filed with the Registrar of Companies.

The financial information for the six months ended 30 April 2020

and 30 June 2021 were also prepared in accordance with IFRS.

The condensed interim financial statements do not include all of

the information required for full annual financial statements.

The condensed interim financial statements were authorised for

issue on 14 September 2021.

2. BASIS OF ACCOUNTING

The financial statements are unaudited and have been prepared on

the historical cost basis in accordance with International

Financial Reporting Standards as adopted by the EU ("IFRS") using

the same accounting policies and methods of computation as were

used in the annual financial statements for the 14-month period

ended 31 December 2020. As permitted, the interim report has been

prepared in accordance with the AIM rules for Companies and is not

compliant in all respects with IAS 34 Interim Financial Statements.

The condensed interim financial statements do not include all the

information required for full annual financial statements and hence

cannot be construed as in full compliance with IFRS.

3. PROFIT/LOSS PER SHARE

The calculation of the basic loss per share is based on the

following data:

Unaudited Unaudited Audited

6 months 6 months 14 month

period

ended ended ended

30-Jun 30-Apr 31-Dec

2021 2020 2020

GBP000s GBP000s GBP000s

Profit/(Loss) on continuing activities

after tax 1,532 (427) (687)

Basic and fully diluted

Basic and fully diluted earnings per share have been computed

based on the following data:

Number of shares

Weighted average number of ordinary

shares for the period 143,210,371 52,766,010 107,298,817

Basic earnings per share from

continuing activities (p) 1.07 (0.81) (0.64)

There were no dilutive instruments that would give rise to diluted

earnings per share.

4. STATEMENT OF CHANGES IN EQUITY

Share Capital Shares to Share Premium Capital Retained Earnings Total

be issued Redemption

Reserve

GBP000s GBP000s GBP000s GBP000s GBP000s GBP000s

At 1 November

2019 11,996 - 4,249 165 (13,845) 2,565

Shares to be

issued - 941 - 941

Loss for the

6 months ended

30 April 2020 - - - - (427) (427)

----------

At 30 April

2020 11,996 941 4,249 165 (14,272) 3,078

Issue of shares

(net of costs) 139 (941) 909 - - 107

Loss for the

8 months ended

31 December

2020 - - - - (260) (260)

----------

At 31 December

2020 12,135 - 5,158 165 (14,532) 2,926

Issue of shares

(net of costs) 79 - 2,543 - - 2,622

Profit for the

6 months ended

30 June 2021 - - - - 1,532 1,532

----------

At 30 June 2021 12,214 - 7,701 165 (13,000) 7,080

============= ---------- ============= =========== ================= =======

5. DISTRIBUTION OF INTERIM REPORT

Copies of the Interim Report for the six months ended 30 June

2021 are available on the Company's website,

www.piresinvestments.com .

Caution regarding forward looking statements

Certain statements in this announcement, are, or may be deemed

to be, forward looking statements. Forward looking statements are

identi ed by their use of terms and phrases such as "believe",

"could", "should" "envisage", "estimate", "intend", "may", "plan",

"potentially", "expect", "will" or the negative of those,

variations or comparable expressions, including references to

assumptions. These forward-looking statements are not based on

historical facts but rather on the Directors' current expectations

and assumptions regarding the Company's future growth, results of

operations, performance, future capital and other expenditures

(including the amount, nature and sources of funding thereof),

competitive advantages, business prospects and opportunities. Such

forward looking statements re ect the Directors' current beliefs

and assumptions and are based on information currently available to

the Directors.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR SFAFMLEFSEIU

(END) Dow Jones Newswires

September 15, 2021 01:59 ET (05:59 GMT)

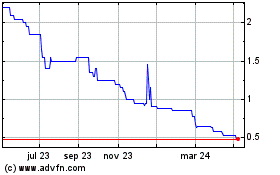

Mindflair (LSE:MFAI)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

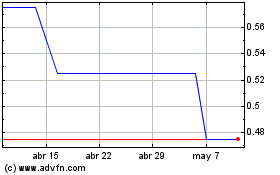

Mindflair (LSE:MFAI)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024