TIDMPOLR

RNS Number : 0417T

Polar Capital Holdings PLC

22 November 2021

Polar Capital Holdings plc ("Polar Capital" or "the Group")

Unaudited interim results for six months ended 30 September

2021

65% increase in core profits

Highlights

-- Assets under Management ("AuM") at 30 September 2021 GBP23.4bn (31 March 2021: GBP20.9bn)

-- Core operating profit GBP36.3m (30 September 2020: GBP22.0m)

-- Pre-tax profit GBP31.7m (30 September 2020: GBP27.0m)

-- Basic earnings per share 26.5p (30 September 2020: 23.4p) and

adjusted diluted total earnings per share 28.1p (30 September 2020:

22.1p)

-- Interim dividend per ordinary share of 14.0p (January 2021:

9.0p) declared to be paid in January 2022 (*)

-- Shareholders' funds GBP146.8m (30 September 2020: GBP114.4m)

including cash and investments of GBP140.5m (30 September 2020:

GBP111.3m)

T he non-GAAP alternative performance measures shown here are

described and reconciled to IFRS measures on the Alternative

Performance Measures (APM) page

* Further details on the timetable for the interim dividend are

described on the shareholder information page

Gavin Rochussen, Chief Executive Officer, commented:

" In the six months to 30 September 2021, AuM increased by

GBP2.5bn from GBP20.9bn to GBP23.4bn, an increase of 12% over the

period and since then has increased to GBP25.0bn as at 12 November

2021.

"Core operating profit (excluding performance fees, other income

and exceptional items) was up 65% to GBP36.3m compared to the

comparable prior half year period and up 23% from GBP29.5m in the

immediately preceding six-month period to 31 March 2021.

"This time last year, Polar Capital established a new Head of

Sustainability role and put in place separate Sustainability and

Diversity committees to increase focus on these areas, in

investment and for the Group. Six of Polar Capital's funds have

been classified as Article 8 under the European Union's SFDR

regulations and there is a pipeline of funds aiming to reclassify

as Article 8. The recently launched Smart Energy and Smart Mobility

funds are classified as Article 9 funds.

"There is much greater concern about the impact of climate

change, and this will result in growing demand for greener

technologies and the investment landscape will be shaped by the

conversations and outcomes from COP26 held in Glasgow.

"The launch of the Polar Capital Smart Energy and Smart Mobility

Funds in September 2021 were well received with early flows and

demonstrable appetite from potential investors in these funds.

"Our diverse and differentiated range of sector, thematic and

regional fund strategies and our performance led culture where 74%,

93% and 99% of our AuM is in the top two quartiles against peers

over three years, five years and since inception respectively

together with significant remaining capacity provides confidence

that momentum will continue."

For further information please contact:

Polar Capital +44 (0)20 7227 2700

Gavin Rochussen (Chief Executive)

Samir Ayub (Finance Director)

Numis Securities- Nomad and Joint Broker +44 (0)20 7260 1000

Charles Farquhar

Stephen Westgate

Giles Rolls (QE)

Peel Hunt - Joint Broker +44 (0)20 3597 8680

Andrew Buchanan

Rishi Shah

Camarco +44 (0)20 3757 4995

Ed Gascoigne-Pees

Jennifer Renwick

Monique Perks

Phoebe Pugh

Assets Under Management

AuM split by type

30 September 31 March 2021

2021

--------------------- --------------- -------------------- ----------------

GBPbn % GBPbn %

--------------------- -------- ----- -------------------- --------- -----

Open-ended funds 17.8 76% Open-ended funds 16.6 79%

Investment trusts 4.5 19% Investment trusts 3.9 19%

Segregated mandates 1.1 5% Segregated mandates 0.4 2%

--------------------- -------- ----- -------------------- --------- -----

Total 23.4 Total 20.9

--------------------- -------- ----- -------------------- --------- -----

AuM split by strategy

(Ordered according to launch date)

30 September 31 March 2021

2021

------------------------- --------------- ----------------------- ----------------

GBPbn % GBPbn %

------------------------- -------- ----- ----------------------- -------- ------

Technology 10.7 46% Technology 10.2 49%

Japan 0.2 0.8% Japan 0.1 0.5%

European Long/Short 0.1 0.4% European Long/Short 0.2 1%

Healthcare 3.8 16% Healthcare 2.9 14%

Financials 0.5 2% Financials 0.3 1%

Insurance 1.7 7% Insurance 1.7 8%

Emerging Markets

Emerging Markets Income - - Income 0.1 0.5%

Convertibles 0.8 3% Convertibles 0.8 4%

North America 0.9 4% North America 0.8 4%

European Income 0.1 0.4% European Income 0.2 1%

UK Value 1.7 7% UK Value 1.4 7%

Emerging Markets and Emerging Markets

Asia 0.9 4% and Asia 0.4 2%

Phaeacian 0.6 3% Phaeacian 0.5 2%

European Opportunities 1.3 6% European Opportunities 1.1 5%

European Absolute European Absolute

Return 0.1 0.4% Return 0.1 0.5%

Melchior Global Equity * - Melchior Global Equity 0.1 0.5%

Sustainable Thematic ** - Sustainable Thematic - -

Equity Equity

------------------------- -------- ----- ----------------------- -------- ------

Total 23.4 Total 20.9

------------------------- -------- ----- ----------------------- -------- ------

* AuM as at 30 September 2021 was GBP5m.

** AuM as at 30 September 2021 comprised of seed capital of

GBP7m.

Chief Executive's Report

Market Overview

The six-month period to the end of September 2021 saw a change

in investment environment and market leadership. Growth once again

outperformed value, and the technology sector was one of the best

performers, with the materials and industrials sectors at the

bottom of the pack.

US 10-year bond yields and the US 2-10 year yield curve hit a

post COVID-19 high on 31 March 2021 and, until recently, had been

moving persistently lower as excitement about economic re-opening

began to wane in the face of continuing COVID-19 outbreaks across

the world. This was the opposite of the prior six-month period;

equity markets had rallied strongly from the point in early

November 2020 when the first announcements on effective COVID-19

vaccines were made, and the victorious US Democrats proposed a

stimulatory set of policy initiatives.

News media are giving extensive coverage to supply chain

problems and intermediate goods shortages across the world. At the

margin, these trends are likely to lead companies to carry more

inventory, and to shorten supply lines in the search for

resilience.

Talk of higher inflation is widespread, particularly in the UK,

where apparent labour shortages in particular industries are

exacerbating goods shortages. Oil and gas prices have risen

rapidly. As ever, the solution has a political dimension. Europe

does not want to concede too much to Russia, which plays a big role

in gas supply.

Despite the possibility that these changes in investment

backdrop bring greater risk, financial markets have so far been

reasonably well behaved.

The reason for such a moderate response may be that growth

remains strong in much of the world; output has probably peaked at

high levels but should remain above trend through 2022. Similarly,

while central banks are starting to remove policy support, it is

likely to be some time before policy becomes restrictive.

Equally, governments have little incentive to endanger the

nascent recovery by tightening fiscal policy too rapidly. Paying

down large amounts of COVID-19 related debt would be much harder in

a lower growth phase.

Data indicates that US consumers have not spent all of the

stimulus cheques which they received. This means that there is

still pent-up consumer demand, but it may be the case that

households want to retain a higher level of savings in these

uncertain times.

There is much greater concern about the impact of climate

change, and this will result in growing demand for greener

technologies and the investment landscape will be shaped by the

conversations and outcomes from COP26 held in Glasgow.

Fund Performance

The past 18 months have seen significant variability in equity

market leadership, visible in the performance of value versus

growth and quality, of small companies versus large and, more

broadly, of disruptors versus more established businesses.

The six months to end September 2021 saw the style pendulum

swing back from value to growth, consistent with lower market

interest rates. Those Polar strategies with greater value

orientation, such as North America and European ex UK Income

underperformed over the period, although strategies which combine

value and quality, such as UK Value and Phaeacian International

Value, outperformed their benchmarks.

In the growth group, Emerging Market Stars and Asian Stars, both

of which incorporate sustainability as an important part of their

process, delivered outperformance, building on their strong

foundations since inception at Polar in 2018.

Polar Capital's Technology and Healthcare teams have had a

tougher time in the first six months of the financial year. The

Global Technology Fund and the Healthcare Opportunities fund

underperformed, in part due to the outperformance of the very large

companies in their respective areas; both strategies have an

all-cap orientation. The Technology team came into 2021 with a

cautious view of their sector, due to high valuations; their

defensive tactics, expressed via cash and index puts, have not yet

borne fruit as valuations across the sector have continued to go

up.

The small and mid-cap Healthcare Discovery fund, the Healthcare

Blue Chip fund, and the Automation and Artificial Intelligence fund

have outperformed their benchmarks nevertheless.

This time last year, Polar Capital established a new Head of

Sustainability role and put in place separate Sustainability and

Diversity committees to increase focus on these areas, in

investment and for the Group. Six of Polar Capital's funds have

been classified as Article 8 under the European Union's SFDR

regulations and there is a pipeline of funds aiming to reclassify

as Article 8. The recently launched Smart Energy and Smart Mobility

funds are classified as Article 9 funds.

As at 29 October 2021, 74% of Polar Capital's UCITS fund AuM is

ranked in the top two quartiles versus peers over three years with

21% ranked in the top quartile over the same period. Over five

years, 74% of AuM is ranked top quartile and 93% ranked in the top

two quartiles versus the Lipper peer group. Since inception, 84% of

AuM is ranked in the top quartile and 99% is ranked in the top two

quartiles.

AuM and Fund Flows

In the six months to 30 September 2021, AuM increased by

GBP2.5bn from GBP20.9bn to GBP23.4bn, an increase of 12% over the

period and since then has increased to GBP25.0bn as at 12 November

2021. The GBP2.5bn increase in AuM comprised net subscriptions of

GBP690m and GBP1,807m relating to market movement and fund

performance. There were net inflows of GBP596m into segregated

mandates, net inflows from share issuance of GBP136m by the

investment trusts and net outflows of GBP42m from the open-ended

funds.

In the six months, the largest beneficiaries of net inflows were

the sustainability oriented Emerging Market Stars Fund with GBP366m

of net inflows and the Asian Stars Fund which had net inflows of

GBP70m. Within the healthcare suite of funds, the Biotechnology

Fund benefited from net inflows of GBP199m and three segregated

healthcare mandates were funded with GBP427m. The Polar Capital

Global Financials Trust had share issuances amounting to GBP154m

while the Polar Capital Technology Trust had net share buy-backs

amounting to GBP18m.

The Convertibles team attracted GBP85m of net inflows into their

Global Convertible Fund and Global Absolute Return Fund. The

Phaeacian International Mutual Fund had net inflows of GBP27m and

the Japan Value Fund benefited from net inflows of GBP20m reversing

a multi-year period of sustained net outflows.

The Technology Fund, which had benefited from inflows in 2020,

suffered from client allocation decreasing away from the technology

sector as well as profit taking by investors following excellent

absolute performance over the past years. Net outflows from the

fund, which was soft closed in 2020, were GBP413m and the A&AI

Fund had outflows, for similar reasons, of GBP49m. While the UK

Value Opportunities Fund, also soft-closed in 2020, suffered modest

net outflows of GBP18m in the period, the team benefited from the

funding of a segregated mandate amounting to GBP169m. Our North

American Fund which has suffered sustained prior periods of net

outflows saw this trend reduce and net outflows in the six-month

period were GBP33m with net inflows in the more recent months.

Following the retirement of the lead fund manager, the GEM

Income Fund was closed and merged with the Emerging Market Stars

Fund resulting in GBP34m of net outflows in the period leading up

to the merger of the two funds. Other funds experiencing outflows

in the period were the European ex-UK Income Fund, Global Insurance

Fund and Healthcare Opportunities Fund, although outflows from the

latter were more than offset by the funding of segregated

healthcare mandates.

The launch of the Polar Capital Smart Energy and Smart Mobility

Funds in September 2021 were well received with early flows and

demonstrable appetite from potential investors in these funds.

Results

Average AuM over the six months to 30 September 2021 increased

by 53% to GBP22.5bn from GBP14.7bn in the comparable prior half

year period, while there has been a 20% rise in average AuM

compared to average AuM of GBP18.7bn for the immediately preceding

six months to 31 March 2021. The increase in average AuM resulted

in net management fees, after commission and rebates payable,

increasing by 50% to GBP92.9m compared to the comparable six-month

period and rose 15% compared to the immediately preceding six-month

period. Management fee yield margin declined, as anticipated, by

1bp to 83bp compared to the comparable prior six-month period.

Core operating profit (excluding performance fees, other income

and exceptional items) was up 65% to GBP36.3m compared to the

comparable prior half year period and up 23% from GBP29.5m in the

immediately preceding six-month period to 31 March 2021.

Profit before tax increased by 17% to GBP31.7m compared to the

comparable prior half year period, although it declined compared to

the immediately preceding six-month period which included

performance fee profits which crystalise in the second half of our

financial year. Basic EPS has increased by 13% compared to the half

year period to September 2020. Adjusted diluted core EPS of 28.2p

is a 25% increase on the immediately preceding six months to 31

March 2021 and a 56% increase over the comparable half year period

to September 2020. Adjusted diluted total EPS of 28.1p is a 27%

increase compared to the comparable six-month period to 30

September 2020.

Six months Six months to Six months

to 31 March to

30 September 2021 30 September

2021 GBP 2020

GBP GBP

------------- ------------- -------------

Average AuM 22.5bn 18.7bn 14.7bn

Net management fees 92.9m 80.7m 61.8m

Core operating profit 36.3m 29.5m 22.0m

Performance fee profit - 19.5m 0.5m

Other income * (0.3)m 2.5m 4.9m

Share-based payments on preference

shares (0.4)m 0.7m (0.4)m

Exceptional items (3.9)m (2.8)m -

------------- ------------- -------------

Profit before tax 31.7m 48.9m 27.0m

------------- ------------- -------------

Basic EPS 26.5p 43.8p 23.4p

Adjusted diluted earnings per

share

(non-GAAP measure) 28.1p 40.1p 22.1p

Adjusted diluted core EPS 28.2p 22.6p 18.0p

------------- ------------- -------------

The non-GAAP alternative performance measures shown here are

described on the APM page.

* A reconciliation to reported results is given on the APM page.

In accordance with the stated dividend policy, the Board has

declared an interim dividend of 14p to be paid in January 2022

(January 2021: 9p). This represents a 56% increase in the first

interim dividend which aligns with the increase in adjusted diluted

core EPS.

Net inflows have continued in October 2021 and early November

2021 and the pipeline for the remainder of the financial year is

encouraging.

Strategic progress and thanks

The sustainable thematic team joined Polar Capital in September

2021 and the Polar Capital Smart Energy and Smart Mobility Funds

were launched. This provides additional capacity in appealing

equity strategies and will, over time, further diversify the

concentration of our assets under management across a broader array

of teams. There has been considerable progress in the growth and

diversification of our distribution activities and further

investment in our digital marketing efforts. Following the funding

of further segregated institutional mandates in the period, we had

in excess of GBP1bn in segregated mandates at the period end

including a mandate with an Australian institution marking success

in our expansion into the Asia Pacific region.

Continued progress has been made in the area of sustainability

both at Polar Capital corporate level and within our funds. In

terms of SFDR, we have two Article 9 funds, six Article 8 Funds

with a pipeline of funds aiming to reclassify as Article 8.

With the attainment of a highly credible three-year track record

since joining Polar Capital, the AuM in the sustainable Emerging

Market Stars suite of fund strategies now exceeds GBP1bn and has

been instrumental in establishing a meaningful and valued client

base in the Nordic region.

During the period, Polar Capital was recognised as Boutique of

the Year in the Financial News Fund Manager awards.

We are extremely grateful for the support of our clients and the

hard work and commitment of our partners and staff during the

period as we continue to emerge from lockdown into a more

normalised working environment.

Outlook

Our diverse and differentiated range of sector, thematic and

regional fund strategies and our performance led culture where 74%,

93% and 99% of our AuM is in the top two quartiles against peers

over three years, five years and since inception respectively

together with significant remaining capacity provides confidence

that momentum will continue.

Gavin Rochussen

Chief Executive

19 November 2021

Alternate Performance Measures (APMs)

APM Definition Reconciliation Reason for use

------------------- ------------------------ ------------------- ---------------------------------------

Core operating Profit before APM reconciliation To present a measure of the

profit performance Group's profitability excluding

fee profits, performance fee profits and

other income, other components which may

exceptional be volatile, non-recurring

items and tax. or non-cash in nature.

------------------- ------------------------ ------------------- ---------------------------------------

Performance fee Gross performance APM reconciliation To present a clear view of

profit fee revenue the net amount of performance

less performance fee earned by the Group after

fee interests accounting for staff remuneration

due to staff. payable that is directly attributable

to performance fee revenues

generated.

------------------- ------------------------ ------------------- ---------------------------------------

Core distributions Variable compensation APM reconciliation To present additional information

payable to investment thereby assisting users of

teams from management the accounts in understanding

fee revenue. key components of variable

costs paid out of management

fee revenue.

------------------- ------------------------ ------------------- ---------------------------------------

Performance Variable compensation APM reconciliation To present additional information

fee interests payable to investment thereby assisting users of

teams from performance the accounts in understanding

fee revenue. key components of variable

costs paid out of performance

fee revenue.

------------------- ------------------------ ------------------- ---------------------------------------

Adjusted diluted Profit after APM reconciliation The Group believes that (a)

total EPS tax but excluding as the preference share awards

(a) cost of have been designed to be earnings

share-based enhancing to shareholders

payments on adjusting for this non-cash

preference shares, item provides a better understanding

(b) the net of the financial performance

cost of deferred of the Group, (b) comparing

staff remuneration staff remuneration and profits

and (c) exceptional generated in the same time

items which period (rather than deferring

may either be remuneration over a longer

non-recurring vesting period) allows users

or non-cash of the accounts to gain a

in nature, and better understanding of the

in the case Group's results and their

of adjusted comparability period on period

diluted earnings and (c) removing acquisition

per share, divided related transition and termination

by the weighted costs as well as the non-cash

average number amortisation, and any impairment,

of ordinary of intangible assets and goodwill

shares. provides a better understanding

of the Group's results and

allows users of the accounts

to better compare results

across companies to the extent

the identification, or not,

of intangible assets affects

the relative amortisation

costs.

------------------- ------------------------ ------------------- ---------------------------------------

Adjusted diluted Core operating APM reconciliation To present additional information

core EPS profit after that allows users of the accounts

tax excluding to measure the Group's earnings

the net cost excluding those from performance

of deferred fees and other components

core distributions which may be volatile, non-recurring

divided by the or non-cash in nature.

weighted average

number of ordinary

shares.

------------------- ------------------------ ------------------- ---------------------------------------

Core operating Core operating Chief Executive's To present additional information

margin profit divided report that allows users of the accounts

by to measure the core profitability

net management of the Group before performance

fees. fee profits, and other components,

which can be volatile and

non-recurring.

------------------- ------------------------ ------------------- ---------------------------------------

Net Management Net management Chief Executive's To present additional information

fee yield fees divided report that allows users of the accounts

by average AuM. to measure the fee margin

for the Group in relation

to its assets under management.

------------------- ------------------------ ------------------- ---------------------------------------

Summary of non-GAAP financial performance and reconciliation of

APMs to interim reported results

The summary below reconciles key APMs the Group measures to its

interim reported results for the current year and also reclassifies

the line by line impact on consolidation of seed investments to

provide a clearer understanding of the Group's core business

operation of fund management.

Any seed investments in newly launched or nascent funds, where

the Group is determined to have control, are consolidated. As a

consequence, the statement of profit or loss of the fund is

consolidated into that of the Group on a line by line basis. Any

seed investments that are not consolidated are fair valued through

a single line item (other income) on the Group consolidated

statement of profit or loss.

Reclassification

Interim on consolidation Interim

reported of seed Reclassification Non-GAAP

Results investments of costs results

GBP'm GBP'm GBP'm GBP'm APMs

Investment management

and research fees 103.6 - - 103.6

Commissions and fees

payable (10.7) - - (10.7)

------------------------ ---------- ----------------- ------------------ ---------- ------------------

92.9 - - 92.9

Operating costs (60.5) 0.3 29.0 (31.2)

- - (25.4) (25.4) Core distributions

----------------------- ---------- ----------------- ------------------ ---------- ------------------

Core operating

32.4 0.3 3.6 36.3 profits

Investment performance - - - -

fees

- - - - Performance

fee interests

----------------------- ---------- ----------------- ------------------ ---------- ------------------

- - - - Performance

fee profits

Other income (0.7) (0.3) 0.7 (0.3)

Share-based payments

on preference shares - - (0.4) (0.4)

Exceptional items - - (3.9) (3.9)

------------------------ ---------- ----------------- ------------------ ---------- ------------------

Profit for the year 31.7 - - 31.7

------------------------ ---------- ----------------- ------------------ ---------- ------------------

The effect of the adjustments made in arriving at the adjusted

diluted total EPS and adjusted diluted core EPS figures of the

Group is as follows:

Earnings per share Unaudited

30 September

2021

Pence

-------------------------------------------- -------------

Diluted earnings per share 25.3

Impact of share-based payments - preference

shares only 0.4

Impact of exceptional items 3.9

Impact of deferment, where IFRS defers

cost into future periods (1.5)

--------------------------------------------- -------------

Adjusted diluted total EPS 28.1

Performance fee profit and other income 0.1

--------------------------------------------- -------------

Adjusted diluted core EPS 28.2

--------------------------------------------- -------------

Interim Consolidated Statement of Profit or Loss

For the six months to 30 September 2021

(Unaudited) (Unaudited)

Six months Six months

to 30 September to 30 September

2021 2020

GBP'000 GBP'000

----------------------------------------------- ---------------- ----------------

Revenue 103,647 68,826

Other income (722) 5,290

----------------------------------------------- ---------------- ----------------

Gross income 102,925 74,116

Commissions and fees payable (10,735) (6,055)

----------------------------------------------- ---------------- ----------------

Net income 92,190 68,061

Operating costs (60,468) (41,020)

Profit for the period before tax 31,722 27,041

Taxation (6,366) (5,216)

----------------------------------------------- ---------------- ----------------

Profit for the period attributable to ordinary

shareholders 25,356 21,825

----------------------------------------------- ---------------- ----------------

Earnings per share

Basic 26.5p 23.4p

Diluted 25.3p 22.5p

Adjusted basic (Non-GAAP measure) 29.4p 23.0p

Adjusted diluted (Non-GAAP measure) 28.1p 22.1p

----------------------------------------------- ---------------- ----------------

Interim Consolidated Statement of Other Comprehensive Income

For the six months to 30 September 2021

(Unaudited) (Unaudited)

Six months Six months

to 30 September to 30 September

2021 2020

GBP'000 GBP'000

--------------------------------------------------- ---------------- ----------------

Profit for the period attributable to ordinary

shareholders 25,356 21,825

Other comprehensive income - items that will

be reclassified to income statement in subsequent

periods:

Net movement on the fair valuation of cash

flow hedges - 1,167

Deferred tax effect - (222)

--------------------------------------------------- ---------------- ----------------

- 945

Exchange differences on translation of foreign

operations 327 (668)

--------------------------------------------------- ---------------- ----------------

Other comprehensive income for the period 327 277

--------------------------------------------------- ---------------- ----------------

Total comprehensive income for the period,

net of tax, attributable to ordinary shareholders 25,683 22,102

--------------------------------------------------- ---------------- ----------------

All of the items in the above statements are derived from

continuing operations.

Interim Consolidated Balance Sheet

As at 30 September 2021

(Audited)

(Unaudited) 31 March

30 September

2021 2021

GBP'000 GBP'000

-------------------------------------------- ------------- ---------

Non-current assets

Goodwill and intangible assets 26,743 24,998

Property and equipment 4,458 5,104

Deferred tax assets 4,598 5,783

-------------------------------------------- ------------- ---------

35,799 35,885

-------------------------------------------- ------------- ---------

Current assets

Assets at fair value through profit or loss 71,451 57,151

Trade and other receivables 27,621 23,924

Other financial assets 164 84

Current tax assets 3,136 1,966

Cash and cash equivalents 103,382 136,718

205,754 219,843

-------------------------------------------- ------------- ---------

Total assets 241,553 255,728

-------------------------------------------- ------------- ---------

Non-current liabilities

Liabilities at fair value through profit or

loss 7,692 4,258

Provisions and other liabilities 3,505 4,123

Deferred tax liabilities 3,896 4,116

-------------------------------------------- ------------- ---------

15,093 12,497

-------------------------------------------- ------------- ---------

Current liabilities

Liabilities at fair value through profit or

loss 15,076 16,124

Trade and other payables 64,182 71,598

Other financial liabilities 367 4,069

79,625 91,791

-------------------------------------------- ------------- ---------

Total liabilities 94,718 104,288

-------------------------------------------- ------------- ---------

Net assets 146,835 151,440

-------------------------------------------- ------------- ---------

Capital and reserves

Issued share capital 2,502 2,468

Share premium 19,364 19,364

Investment in own shares (21,683) (26,579)

Capital and other reserves 12,451 11,030

Retained earnings 134,201 145,157

--------------------------------------------------- -------- --------

Total equity attributable to ordinary shareholders 146,835 151,440

--------------------------------------------------- -------- --------

Interim Consolidated Statement of Changes in Equity

For the six months to 30 September 2021

Issued Investment

share Share in own Capital Other Retained

capital premium shares reserves reserves earnings Total equity

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

------------------------ --------- -------- ---------- --------- --------- --------- ------------

As at 1 April 2021

(audited) 2,468 19,364 (26,579) 695 10,335 145,157 151,440

Profit for the period - - - - - 25,356 25,356

Other comprehensive

income - - - - 327 - 327

------------------------ --------- -------- ---------- --------- --------- --------- ------------

Total comprehensive

income - - - - 327 25,356 25,683

Dividends paid to

shareholders - - - - - (29,836) (29,836)

Issue of shares 34 - - - - (34) -

Own shares acquired - - (7,629) - - - (7,629)

Release of own shares - - 12,525 - - (10,489) 2,036

Share-based payment - - - - - 4,047 4,047

Current tax in respect

of employee share

options - - - - 2,477 - 2,477

Deferred tax in respect

of employee share

options - - - - (1,383) - (1,383)

------------------------ --------- -------- ---------- --------- --------- --------- ------------

As at 30 September

2021 (unaudited) 2,502 19,364 (21,683) 695 11,756 134,201 146,835

------------------------ --------- -------- ---------- --------- --------- --------- ------------

As at 1 April 2020

(audited) 2,417 19,101 (24,139) 695 7,646 110,358 116,078

Profit for the period - - - - - 21,825 21,825

Other comprehensive

income - - - - 277 - 277

------------------------ ----- ------ -------- --- ----- -------- --------

Total comprehensive

income - - - - 277 21,825 22,102

Dividends paid to

shareholders - - - - - (23,494) (23,494)

Issue of shares 45 38 - - - (44) 39

Own shares acquired - - (4,277) - - - (4,277)

Release of own shares - - 2,287 - - (1,150) 1,137

Share-based payment - - - - - 2,282 2,282

Current tax in respect

of employee share

options - - - - 145 - 145

Deferred tax in respect

of employee share

options - - - - 414 - 414

------------------------ ----- ------ -------- --- ----- -------- --------

As at 30 September

2020 (unaudited) 2,462 19,139 (26,129) 695 8,482 109,777 114,426

------------------------ ----- ------ -------- --- ----- -------- --------

Interim Consolidated Cash Flow Statement

For the six months to 30 September 2021

(Unaudited) (Unaudited)

Six months Six months

to 30 September to 30 September

2021 2020

GBP'000 GBP'000

--------------------------------------------- ---------------- ----------------

Operating activities

Cash generated from operations 27,015 5,718

Tax paid (5,404) (5,069)

Interest on lease (51) (65)

--------------------------------------------- ---------------- ----------------

Net cash flow from operating activities 21,560 584

--------------------------------------------- ---------------- ----------------

Investing activities

Interest received and similar income 13 37

Investment income 176 137

Sale of assets at fair value through profit

or loss 14,698 18,166

Purchase of assets at fair value through

profit or loss (30,666) (18,357)

Re-measurement of purchase consideration

in respect of business acquisition 38 -

Payments in respect of asset acquisition (363) -

Purchase of property and equipment (30) (50)

Net cash outflow from investing activities (16,134) (67)

--------------------------------------------- ---------------- ----------------

Financing activities

Dividends paid to shareholders (29,836) (23,494)

Issue of shares - 9

Purchase of own shares (7,585) (3,900)

Lease payments (653) (648)

Third-party subscriptions into consolidated

funds 3,194 2,501

Third-party redemptions from consolidated

funds (3,811) (94)

Net cash outflow from financing activities (38,691) (25,626)

--------------------------------------------- ---------------- ----------------

Net decrease in cash and cash equivalents (33,265) (25,109)

Cash and cash equivalents at start of period 136,718 107,753

Effect of exchange rate changes on cash and

cash equivalents (71) (170)

--------------------------------------------- ---------------- ----------------

Cash and cash equivalents at end of period 103,382 82,474

--------------------------------------------- ---------------- ----------------

Notes to the Unaudited Interim Consolidated Financial

Statements

For the six months to 30 September 2021

1. General Information, Basis of Preparation and Accounting Policies

1.1 General information

Polar Capital Holdings plc ("the Company") is a public limited

Company registered in England and Wales.

1.2 Basis of Preparation

The unaudited interim condensed consolidated financial

statements to 30 September 2021 have been prepared in accordance

with IAS 34: Interim Financial Reporting.

The unaudited interim condensed consolidated financial

statements do not include all the information and disclosures

required in annual financial statements and should be read in

conjunction with the Group's annual financial statements as at 31

March 2021, which have been prepared in accordance with

International Financial Reporting Standards (IFRS) as adopted by

the European Union and the Companies Act 2006 applicable to

companies reporting under IFRS.

The accounting policies adopted and the estimates and judgements

used in the preparation of the unaudited interim condensed

consolidated financial statements are consistent with the Group's

annual financial statements for the year ended 31 March 2021.

1.3 Group information

The Group is required to consolidate seed capital investments

where it is deemed to control them. In addition to the operating

subsidiaries and seed capital investments consolidated at 31 March

2021, the Group has consolidated the following two funds as at 30

September 2021:

-- Polar Capital Smart Energy Fund

-- Polar Capital Smart Mobility Fund

1.4 Going concern

The Directors have made an assessment of going concern taking

into account both the Group's current results as well as the

Group's outlook. As part of this assessment the Directors have used

information available to the date of issue of these interim

financial statements and considered the following key areas:

-- Analysis of the Group's budget for the year ending March

2022, longer-term financial projections and its regulatory capital

position and forecasts. The stress testing scenarios applied as

part of the Group's ICAAP have also been revisited to ensure they

remain appropriate.

-- Cash flow forecasts and an analysis of the Group's liquid

assets, which include cash and cash equivalents and seed

investments.

-- The operational resilience of the Group and its ability to

meet client servicing demands across all areas of the Group's

business, including outsourced functions, whilst ensuring the

wellbeing and health of its staff.

The Group continues to maintain a robust financial resources

position, access to cashflow from ongoing investment management

contracts and the Directors believe that the Group is well placed

to manage its business risks. The Directors also have a reasonable

expectation that the Group has adequate resources to continue

operating for a period of at least 12 months from the balance sheet

date. Therefore, the Directors continue to adopt the going concern

basis of accounting in preparing the consolidated financial

statements.

2. Revenue

(Unaudited) (Unaudited)

Six months Six months

to 30 September to 30 September

2021 2020

GBP'000 GBP'000

---------------------------------------- ---------------- ----------------

Investment management and research fees 103,647 67,909

Investment performance fee - 1,050

Loss on forward currency contracts - (133)

---------------------------------------- ---------------- ----------------

103,647 68,826

---------------------------------------- ---------------- ----------------

Effective 1 April 2021, the Group has discontinued its revenue

hedging programme.

3. Operating costs

a) Operating costs include the following items:

(Unaudited) (Unaudited)

Six months Six months

to 30 September to 30 September

2021 2020

GBP'000 GBP'000

----------------------------------------------------- ---------------- ----------------

Staff costs including partnership profit allocations 46,576 30,437

Depreciation 678 670

Amortisation of intangible assets 932 -

Auditors remuneration 175 133

----------------------------------------------------- ---------------- ----------------

b) Auditors' remuneration:

Audit of Group financial statements 68 43

Local statutory audits of subsidiaries 63 51

Audit-related assurance services 5 -

Other assurance services - internal controls

review 39 39

175 133

--------------------------------------------- --- ---

4. Other income

(Unaudited) (Unaudited)

Six months Six months

to 30 September to 30 September

2021 2020

GBP'000 GBP'000

------------------------------------------------ ---------------- ----------------

Interest income and cash and cash equivalents 13 41

Net gain/ (loss) on other financial liabilities

- short positions and futures 1,704 (4,600)

Net (loss)/gain on forward contracts (440) 718

Net gain on financial assets at FVTPL 360 4,308

Net (loss)/ gain on financial liabilities at

FVTPL (3,048) 5,347

Investment income 190 155

Other gain/ (loss) - attributed to third party

holdings 499 (679)

(722) 5,290

------------------------------------------------ ---------------- ----------------

Net loss on financial liabilities at fair value through profit

or loss includes a mark to market charge of GBP0.7m relating to the

deferred consideration payable on the Dalton acquisition .

5. Dividends

(Unaudited) (Unaudited)

Six months Six months

to 30 September to 30 September

2021 2020

GBP'000 GBP'000

-------------- ---------------- ----------------

Dividend paid 29,836 23,494

-------------- ---------------- ----------------

On 31 July 2021, the Group paid a second interim dividend for

2021 of 31p (2020: 25p) per ordinary share.

6. Share-based Payments

A summary of the charge to the consolidated statement of profit

or loss for each share-based payment arrangement is as follows:

(Unaudited) (Unaudited)

Six months Six months

to 30 September to 30 September

2021 2020

GBP'000 GBP'000

------------------------------ ---------------- ----------------

Preference shares 444 429

LTIP and initial share awards 2,303 810

Equity incentive plan 739 380

Deferred remuneration plan 561 663

------------------------------ ---------------- ----------------

4,047 2,282

------------------------------ ---------------- ----------------

Certain employees of the Group and partners of Polar Capital LLP

hold Manager Preference Shares or Manager Team Member Preference

Shares (together 'Preference Shares') in Polar Capital Partners

Limited, a group company.

The preference shares are designed to incentivise and retain the

Group's fund management teams. These shares provide each manager

with an economic interest in the funds that they run and ultimately

enable the manager, at their option and at a future date, to

convert their interest in the revenues generated from their funds

to a value that may (at the discretion of the parent undertaking,

Polar Capital Holdings plc) be satisfied by the issue of ordinary

shares in Polar Capital Holdings plc. Such conversion takes place

according to a pre-defined conversion formula intended to be

earnings enhancing for the Group and that considers the relative

contribution of the manager to the Group as a whole. The equity is

awarded in return for the forfeiture of a manager's current core

economic interest and is issued over three years from the date of

conversion.

In November 2021, the Biotechnology team called for a full

conversion and the Convertible team called for a partial conversion

of preference shares into Polar Capital Holdings equity (2020:

none). At 30 September 2021, three sets of preference shares (2020:

four sets) have the right to call for conversion.

The following table illustrates the number of, and movements in,

the estimated number of ordinary shares to be issued.

Estimated number of ordinary shares to be issued against

preference shares with a right to call for conversion:

(Unaudited) (Unaudited)

30 September 30 September

2021 2020

Number of shares Number of shares

--------------------------- ----------------- -----------------

At 1 April 4,426,258 4,676,882

Conversion/crystallisation (1,350,514) -

Movement during the period (718,593) 147,276

At 30 September 2,357,421 4,824,158

--------------------------- ----------------- -----------------

Number of ordinary shares to be issued against converted

preference shares:

(Unaudited) (Unaudited)

30 September 30 September

2021 2020

Number of shares Number of shares

----------------------------- ----------------- -----------------

Outstanding at 1 April 1,766,541 3,733,904

Conversion/crystallisation 1,350,514 -

Adjustment on re-calculation - (28,261)

Issued during the period (1,333,921) (1,622,380)

Outstanding at 30 September 1,783,134 2,083,263

----------------------------- ----------------- -----------------

7. Earnings Per Share

A reconciliation of the figures used in calculating the basic,

diluted and adjusted earnings per share (EPS) figures is as

follows:

(Unaudited) (Unaudited)

Six months Six months

to to

30 September 30 September

2021 2020

GBP'000 GBP'000

Earnings

Profit after tax for purpose of basic and

diluted EPS 25,356 21,825

Adjustments (post tax):

Add back cost of share-based payments on

preference shares 444 429

Add back exceptional items - acquisition

related costs 2,262 -

Add back exceptional items - amortisation

of intangible assets 932 -

Add back exceptional items - fair value charge

on deferred consideration relating to business

acquisition 686 -

Less net amount of deferred staff remuneration (1,500) (832)

------------------------------------------------ ----------------- -----------------

Profit after tax for purpose of adjusted

basic and adjusted diluted EPS 28,180 21,422

------------------------------------------------ ----------------- -----------------

(Unaudited) (Unaudited)

Six months Six months

to to

30 September 30 September

2021 2020

Number of shares Number of shares

------------------------------------------------ ----------------- -----------------

Weighted average number of shares

Weighted average number of ordinary shares,

excluding own shares, for purposes of basic

and adjusted basic EPS 95,743,599 93,307,573

Effect of dilutive potential shares - share

options 2,711,240 1,699,471

Effect of preference shares crystallised

but not yet issued 1,783,134 2,083,263

Weighted average number of ordinary shares,

for purpose of diluted and adjusted diluted

EPS 100,237,973 97,090,307

------------------------------------------------ ----------------- -----------------

(Unaudited) (Unaudited)

Six months Six months

to to

30 September 30 September

2021 2020

Pence Pence

------------------- ------------- --------------

Earnings per share

Basic 26.5 23.4

Diluted 25.3 22.5

Adjusted basic 29.4 23.0

Adjusted diluted 28.1 22.1

------------------- ------------- --------------

8. Goodwill and intangible assets

Goodwill relates to the acquisition of Dalton Capital (Holdings)

Limited, the parent company of Dalton Strategic Partnership LLP

(Dalton), a UK based boutique asset manager, which completed on 28

February 2021.

Intangible assets relate to investment management contracts

acquired as part of the business combination with Dalton and the

asset acquisition related to the International Value and World

Value equity team from the Los Angeles based asset manager First

Pacific Advisors LP (FPA). The net book value of these intangible

assets as at 30 September 2021 were GBP10.9m and GBP9.1m

respectively.

Investment

management

(Unaudited) Goodwill Contracts Total

GBP'000 GBP'000 GBP'000

---------------------------------- ---------- ----------- ---------

Cost

As at 1 April 2021 6,770 18,647 25,417

Re-measurement of goodwill(1) (38) - (38)

Revaluation(2) - 2,715 2,715

---------------------------------- ---------- ----------- ---------

As at 30 September 2021 6,732 21,362 28,094

---------------------------------- ---------- ----------- ---------

Amortisation and impairment

As at 1 April 2021 - 419 419

Amortisation for the period - 932 932

Impairment for the period - - -

---------------------------------- ---------- ----------- ---------

As at 30 September 2021 - 1,351 1,351

---------------------------------- ---------- ----------- ---------

Net book value as at 30 September

2021 6,732 20,011 26,743

---------------------------------- ---------- ----------- ---------

Investment

management

Goodwill Contracts Total

Audited GBP'000 GBP'000 GBP'000

----------------------------------- ---------- ----------- ---------

Cost

As at 1 April 2020 - - -

Acquisition during the year 6,770 18,647 25,417

----------------------------------- ---------- ----------- ---------

As at 31 March 2021 6,770 18,647 25,417

----------------------------------- ---------- ----------- ---------

Amortisation and impairment

As at 1 April 2020 - - -

Amortisation for the year - 419 419

Impairment for the year - - -

----------------------------------- ---------- ----------- ---------

As at 31 March 2021 - 419 419

----------------------------------- ---------- ----------- ---------

Net book value as at 31 March 2021 6,770 18,228 24,998

----------------------------------- ---------- ----------- ---------

1. The re-measurement of goodwill relates to the purchase price

adjustment recognised in the current period.

2. Revaluation of intangible asset relates to investment

management contracts acquired from FPA and is a result of the

subsequent fair value measurement of the deferred consideration

amount payable to FPA.

Goodwill is tested for impairment at least on an annual basis or

more frequently when there are indications that goodwill may be

impaired.

The Group has reviewed the investment management contracts

related intangible assets as at 30 September 2021 and has concluded

that there are no indicators of impairment.

9. Issued Share Capital

(Audited)

(Unaudited) 31 March

30 September

2021 2021

Allotted, called up and fully paid: GBP'000 GBP'000

-------------------------------------------- ------------- ---------

100,113,855 ordinary shares of 2.5p each

(31 March 2021: 98,745,668 ordinary shares

of 2.5p each) 2,502 2,468

-------------------------------------------- ------------- ---------

During the period, Polar Capital Holdings plc has issued 34,266

shares on exercise of employee share options and 1,333,921 shares

in connection with the crystallisation of manager preference

shares.

10. Financial Instruments

The fair value of financial instruments that are traded in

active markets at each reporting date is determined by reference to

quoted market prices or dealer price quotation (bid price for long

positions and ask price for short positions), without any deduction

for transaction costs. For financial instruments not traded in an

active market, such as forward exchange contracts, the fair value

is determined using appropriate valuation techniques that take into

account the terms and conditions and use observable market data,

such as spot and forward rates, as inputs.

The Group uses the following hierarchy for determining and

disclosing the fair value of financial instruments by valuation

technique:

Level 1: quoted (unadjusted) prices in active markets for

identical assets or liabilities.

Level 2: other techniques for which all inputs which have a

significant effect on the recorded fair value are observable,

either directly or indirectly.

Level 3: techniques which use inputs which have a significant

effect on the recorded fair value that are not based on observable

market data.

(Unaudited)

30 September 2021

------------------------------------------

Level 1 Level 2 Level 3 Total

GBP'000 GBP'000 GBP'000 GBP'000

--------- --------- --------- ---------

Financial assets

Assets at FVTPL 71,451 - - 71,451

Other financial assets - 164 - 164

71,451 164 - 71,615

--------- --------- --------- ---------

Financial Liabilities

Liabilities at FVTPL 5,543 - 17,225 22,768

Other financial liabilities 367 - - 367

------ ------- -------

5,910 - 17,225 23,135

------ ------- -------

(Audited)

31 March 2021

------------------------------------------

Level 1 Level 2 Level 3 Total

GBP'000 GBP'000 GBP'000 GBP'000

--------- --------- --------- ---------

Financial assets

Assets at FVTPL 57,151 - - 57,151

Other financial assets - 84 - 84

57,151 84 - 57,235

--------- --------- --------- ---------

Financial Liabilities

Liabilities at FVTPL 6,328 - 14,054 20,382

Other financial liabilities 4,069 - - 4,069

--------- --------- --------- ---------

10,397 - 14,054 24,451

--------- --------- --------- ---------

During the period there were no transfers between levels in fair

value measurements.

Movement in liabilities at FVTPL categorised as Level 3 during

the year were:

(Unaudited) (Audited)

30 September 31 March

2021 2021

GBP'000 GBP'000

------------------------------------------ ------------- ----------

At 1 April 14,054 -

Additions - 15,014

Repayment (363) (517)

Fair value movement 3,402 -

Foreign currency revaluation loss/ (gain) 132 (443)

------------------------------------------ ------------- ----------

At 30 September 17,225 14,054

------------------------------------------ ------------- ----------

11. Notes to the Cash Flow Statement

Reconciliation of profit before taxation to cash generated from

operations

(Unaudited)

(Unaudited) Six months

Six months to

to 30 September 30 September

2021 2020

GBP'000 GBP'000

---------------------------------------------------- ---------------- --------------

Cash flows from operating activities

Profit on ordinary activities before tax 31,722 27,041

Adjustments for:

Interest receivable and similar income (13) (41)

Investment income (190) (155)

Interest on lease 51 65

Amortisation of intangible assets 932 -

Depreciation of non-current property and equipment 678 670

Decrease/ (increase) in fair value of assets

at fair value through profit or loss 2,001 (9,656)

(Decrease)/ increase in other financial liabilities (3,050) 3,311

Increase in receivables (3,697) (15,302)

Decrease in trade and other payables (7,433) (2,059)

Share-based payments 4,047 2,282

(Decrease)/ increase in liabilities at fair

value through profit or loss (1,004) 175

Release of fund units held against deferred

remuneration 2,971 (613)

---------------------------------------------------- ---------------- --------------

Cash generated from operations 27,015 5,718

---------------------------------------------------- ---------------- --------------

12. Related Party Transactions

Transactions between the Company and its subsidiaries, which are

related parties of the Company, have been eliminated on

consolidation and are not included in this note. All related party

transactions during the period are consistent with those disclosed

in the Group's annual financial statements for the year ended 31

March 2021 and have taken place on an arm's length basis.

13. The Publication of Non-Statutory Accounts

The financial information contained in this unaudited interim

report for the period to 30 September 2021 does not constitute

statutory accounts as defined in s434 of the Companies Act 2006.

The financial information for the six months ended 30 September

2021 and 2020 has not been audited. The information for the year

ended 31 March 2021 has been extracted from the latest published

audited accounts, which have been filed with the Registrar of

Companies. The audited accounts filed with the Registrar of

Companies contain a report of the independent auditor dated 30 June

2021. The report of the independent auditor on those financial

statements contained no qualification or statement under s498 of

the Companies Act 2006.

Shareholder Information

Directors

David Lamb Non-executive Chairman

Gavin Rochussen Chief Executive Officer

John Mansell Executive Director

Jamie Cayzer-Colvin Non-executive Director

Alexa Coates Non-executive Director, Chair of Audit and Risk

Committee

Win Robbins Non-executive Director, Chair of Remuneration

Committee

Andrew Ross Non-executive Director

Samir Ayub Executive Director (appointed 17 November 2021)

Laura Ahto Non-executive Director (appointed 17 November

2021)

Company No.

Registered in England and Wales

4235369

Registered Office

16 Palace Street

London, SW1E 5JD

Tel: 020 7227 2700

Group Company Secretary

Neil Taylor

Dividend

A first interim dividend of 14.0p per share has been declared

for the year to 31 March 2022. This will be paid on 14 January 2022

to shareholders on the register on 24 December 2021. The shares

will trade ex-dividend from 23 December 2021.

Remuneration Code

Disclosure of the Group's Remuneration Code will be made

alongside its Pillar 3 disclosure which is available on the

Company's website.

Half Year Report

Copies of this announcement and of the Half Year report will be

available from the Secretary at the Registered Office, 16 Palace

Street, London SW1E 5JD and from the Company's website at

www.polarcapital.co.uk

Neither the contents of the Company's website nor the contents

of any website accessible from the hyperlinks on the Company's

website (or any other website) is incorporated into or forms part

of this announcement .

S , the news service of the London Stock Exchange. RNS is approved

by the Financial Conduct Authority to act as a Primary Information

Provider in the United Kingdom. Terms and conditions relating to

the use and distribution of this information may apply. For further

information, please contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR DBLFLFFLLFBL

(END) Dow Jones Newswires

November 22, 2021 02:00 ET (07:00 GMT)

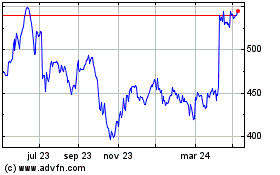

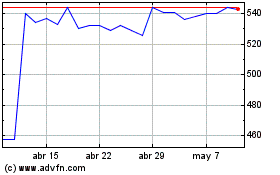

Polar Capital (LSE:POLR)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Polar Capital (LSE:POLR)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024