TIDMPPC

RNS Number : 4195N

President Energy PLC

30 September 2021

30 September 2021

PRESIDENT ENERGY PLC

("President", "the Company" or "the Group")

Unaudited Interim Results for H1 2021

Current trading

President (AIM:PPC), the oil and gas upstream company with a

diverse portfolio of production and exploration assets focused

primarily in Latin America, announces its unaudited interim results

for the six months ended 30 June 2021.

Selected Results Summary

All numbers in US$ '000 H1 2021 H1 2020 F/Y 2020

unless stated

Average daily production,

boe 2,648 2,747 2,714

-------- -------- ---------

Average realised price per

boe (US$) 39.6 31.2 30.0

-------- -------- ---------

Revenue 17,104 13,737 27,771

-------- -------- ---------

Adjusted EBITDA 4,536 1,049 2,115

-------- -------- ---------

Free cash flow generation

from core operations 6,192 2,644 6,191

-------- -------- ---------

Profit after tax but before

non-cash items 2,132 1,779 2,039

-------- -------- ---------

Loss for the period 3,376 4,035 11,285

-------- -------- ---------

Group net debt 16,746 11,342 16,492

-------- -------- ---------

Administrative expenses

US$ per boe 4.0 4.0 4.7

-------- -------- ---------

Well operating costs US$

per boe 15.4 16.5 16.5

-------- -------- ---------

Selected Current Financial Metrics

Net debt to forecast 12 month adjusted EBITDA at period

end 1.8x

Corporate and Financial Summary

-- Group turnover of US$17.1 million up 24.5% over the same period in 2020

-- Free cash flow from core operations of US$6.2 million up 134%

over the same period in 2020 (1H 2020 US$2.6 million) and

approximately equal to the whole of 2020

-- Adjusted EBITDA of US$4.5 million up 309% over the same

period in 2020 and over 114% versus the full twelve months of

2020

-- Third party financial borrowings US$5.8 million (1H 2020

US$3.7 million) with the balance being covenant lite, long-term

debt from an affiliate of our largest shareholder

-- Net profit after tax before non-cash items (comprising

depletion, depreciation, amortisation, impairment, non-operating

gains/losses and deferred tax) of US$2.1 million (1H 2020 US$1.8

million)

-- Loss for the period of US$3.4 million (1H 2020 US$4.0

million) after non-cash DDA charge of US$5.1 million (1H 2020

US$5.2 million)

-- Agreement signed with a substantial Northern Hemisphere

state-owned energy company to farm in for a 50% participating

interest in the Pirity Concession, Paraguay

-- Atome Limited formed as a UK intermediate holding company

focusing on the commercial production, sales and marketing of

hydrogen and ammonia

Operational Summary

-- Average Group net daily production in the period of 2,648

boepd down 2% on the previous year, impacted by a 34% decline in US

production as explained below.

-- Group production split 64% oil and 36% gas (1H 2020: 71% oil and 29% gas)

-- New oil treatment plant in Puesto Flores constructed on time

and within budget bringing estimated opex savings of some US$ 4 per

barrel coming through in H2

-- Well operating costs per boe decreased by 7% over same period last year

-- Four new gas wells successfully drilled

-- Positive results from secondary recovery pilot project in the main Puesto Flores field

-- In Louisiana, both the Triche and Simmons 2 wells remain

offline as they have for the last three months awaiting workover of

the Triche well to reinstate production. The operation of the

Triche well is required for the Simmons 2 well to operate, as the

Simmons 2 well used the gas produced from the Triche for gas lift.

The Triche well has not performed optimally all year due to the

progressive breakdown of the downhole gravel pack used to constrain

sand production. The frustrating delay in fixing the problem was

materially exacerbated by the effects of Hurricane Ida which

devastated the locality.

Current trading

-- Management reports show average Argentina monthly revenue for

the first two months of Q3 2021 ran at the rate of US$2.9 million,

a 21% increase over the monthly average of US$2.4 million in H1

-- Sales price for oil in Argentina improving and expected to

show an 8% increase in H2 compared to H1

-- Drilling services contract signed for three firm wells to be

drilled at the Puesto Guardian Concession commencing in October,

including an option to retain the rig into the New Year for further

wells after drilling of the third firm well.

-- Each new Puesto Guardian well is estimated to cost US$3.5

million and have a drilling time of 45 days with a mean success

case initial projected oil production of 40 m(3) /d (250 bopd).

-- In Louisiana, the Company is planning for the workover of the

Triche well to be completed by the end of October and the wells

will work at the levels enjoyed last year namely at 300 boepd net

to President half being oil. Realisation prices there are robust

with oil currently at approximately U$70 per barrel.

-- President continues its focus on reducing costs with the

objective of further reducing its operational expenses next year

assisted by the savings from the new treatment plant in Puesto

Flores

-- On current trading, average production for H2 2021 in

Argentina is estimated to be approximately 2,700 boepd

-- Following prolongation of the Pirity as well as the

Hernandarias exploration concessions terms, approval by the

relevant regulatory authorities in Paraguay to the transfer of

interests contemplated under the farm-out agreements is expected in

the near future, with completion of the Paraguay farm-out following

thereafter

-- In relation to Atome, significant work is being progressed as

is an intended spin off and separate flotation on the London Stock

Exchange. Atome currently has no attributable value in the Group's

balance sheet

-- Subject to appropriate advice and approvals, President is

contemplating declaring a dividend in specie of certain of its

holdings in Atome at or around admission to the stock market.

Commenting on today's announcement, Peter Levine, Chairman

said:

"The results for the first half of the year demonstrate an

operationally profitable and solid business with very significant

near-term potential.

Within the next six months, we look forward to the results of

the three key value drivers mentioned below, each of which can have

a materially beneficial impact on the Group.

"Preparation works for the commencement of drilling at the end

of October of at least three wells in Salta Province, Argentina are

underway.

"The conditions attaining to the long-awaited farm-out in

Paraguay are well on their way to being satisfied with drilling of

the large-scale oil prospect scheduled for H1 2022.

"Finally, work is progressing towards the spin-off and separate

flotation of Atome, our hydrogen and ammonia production business

later this year, subject to regulatory approval. Whilst no

guarantee can be given as to both timing and suitability, on the

assumption that the flotation does take place, then subject to

court sanction of the cancellation of the share premium account of

the Group recently approved by shareholders, the Company will have

at its disposal adequate levels of distributable reserves from

which to make a declaration of dividend in specie of certain of its

Atome shares, should the Directors so determine.

"Accordingly, it's going to be a very busy next few months and

we look forward to keeping shareholders appraised on material

developments as and when they occur."

Peter Levine

Executive Chairman

30 September 2021

* Adjusted EBITDA means Operating Profit before depreciation,

depletion and amortisation, adjusted for non-cash share-based

expenses and certain non-recurring items. Non-recurring items

include where relevant workovers .

* Current Enterprise Value (EV) is calculated by taking the

market value of shares in issue at current US$ fx rates and adding

the value of net debt.

* Cost per boe metrics are adjusted for costs management

consider are exceptional and non-recurring in nature

* Free cash flow from core operations is defined in the 2020

Annual Report. The treasury income which has been included is the

exchange (losses)/gains on cash and cash equivalents as detailed in

the Consolidated Statement of Cashflows

The 2021 Interim Report and Financial Statements will be made

available at www.presidentenergyplc.com

This announcement contains inside information for the purposes

of article 7 of Regulation 596/2014.

Notes to Editors

President Energy is an oil and gas company listed on the AIM

market of the London Stock Exchange (PPC.L) primarily focused in

Argentina, with a diverse portfolio of operated onshore producing

and exploration assets. The Company has independently assessed 1P

reserves in excess of 15 MMboe and 2P reserves of more than 26

MMboe.

The Company has operated interests in the Puesto Flores and

Estancia Vieja, Puesto Prado and Las Bases Concessions, and

Angostura contract area in Rio Negro Province, Argentina and in the

Puesto Guardian Concession, in the Noreste Basin in NW Argentina.

The Company is focused on growing production in the near term in

Argentina. Alongside this, President Energy has cash generative

production assets in Louisiana, USA and further significant

exploration and development opportunities through its acreage in

Paraguay and Argentina.

President Energy's second largest shareholder is Trafigura, one

of the leading commodity and logistics companies in the World, with

operations and a refinery in Argentina. The Company is actively

pursuing development / acquisition of high-quality production and

assets capable of delivering positive cash flows and shareholder

returns. With a strong institutional base of support and an

in-country management teams, President Energy has world class

standards of corporate governance, environmental and social

responsibility.

Contact:

President Energy PLC

Rob Shepherd, Finance Director

Nikita Levine, Investor Relations +44 (0) 207 016 7950

finnCap (Nominated Advisor and Joint

Broker)

Christopher Raggett, Charlie Beeson +44 (0) 207 220 0500

Glossary of terms

Boe(pd) Barrels of oil equivalent (per day)

Bopd Barrels of oil per day

DDA Depletion, depreciation and. amortisation

EV Enterprise value meaning market capitalisation plus debt

MMbbls Million barrels of oil

MMboe Million barrels of oil equivalent

MMBtu Million British Thermal Units (gas)

M(3) /d Cubic metres of production of gas or oil per day (as the case may be)

Condensed Consolidated Statement of Comprehensive Income

Six months ended 30 June 2021

6 months 6 months Year to

to 30 to 30

June June 31 Dec

2021 2020 2020

(Unaudited) (Unaudited) (Audited)

Note US$000 US$000 US$000

Continuing Operations

Revenue 17,104 13,737 27,771

Cost of sales

Depletion, depreciation & amortisation (5,108) (5,142) (10,109)

Other cost of sales (11,493) (11,461) (21,666)

Total cost of sales 3 (16,601) (16,603) (31,775)

------------ ------------ ----------

Gross profit/(loss) 503 (2,866) (4,004)

Administrative expenses 4 (1,942) (1,988) (4,648)

Operating profit / (loss) before

impairment charge

------------ ------------ ----------

and non-operating gains / (losses) (1,439) (4,854) (8,652)

Presented as:

Adjusted EBITDA 4,536 1,049 2,115

Non-recurring items (581) (368) (86)

EBITDA excluding share options 3,955 681 2,029

Depreciation, depletion & amortisation (5,134) (5,207) (10,271)

Share based payment expense (260) (328) (410)

Operating profit / (loss) (1,439) (4,854) (8,652)

----------------------------------------- ----- ------------ ------------

Impairment charge 5 - (125) (1,884)

Non-operating gains /(losses) 6 2 62 (137)

Profit/(loss) after impairment

and non-operating

------------ ------------ ----------

gains and (losses) (1,437) (4,917) (10,673)

Finance income 7 855 3,604 4,506

Finance costs 7 (2,418) (2,178) (4,084)

Profit / (loss) before tax (3,000) (3,491) (10,251)

Income tax (charge)/credit

Current tax income tax (charge)/credit - - (2)

Deferred tax being a provision

for future taxes (376) (544) (1,032)

Total income tax (charge)/credit (376) (544) (1,034)

Profit/(loss) for the period from

continuing operations (3,376) (4,035) (11,285)

Other comprehensive income

- Items that may be reclassified

subsequently

to profit or loss

Exchange differences on translating

foreign operations - - -

Total comprehensive profit/(loss)

for the period

attributable to the equity holders

of the Parent Company (3,376) (4,035) (11,285)

============ ============ ==========

Earnings/ (loss )per share from

continuing operations US cents US cents US cents

Basic earnings/ (loss) per share 8 (0.17) (0.32) (0.69)

Diluted earnings / (loss) per share 8 (0.17) (0.32) (0.69)

============ ============ ==========

Condensed Consolidated Statement of Financial Position

As at 30 June 2021

30 June 30 June 31 Dec

2021 2020 2020

(Unaudited) (Unaudited) (Audited)

US$000 US$000 US$000

Note

ASSETS

Non-current assets

Intangible exploration and

evaluation assets 9 52,794 55,657 52,703

Goodwill 705 705 705

Property, plant and equipment 9 56,787 50,913 54,489

------------ ------------ ----------

110,286 107,275 107,897

Deferred tax 507 1,244 567

Other non-current assets 103 102 102

110,896 108,621 108,566

------------ ------------ ----------

Current assets

Trade and other receivables 10 6,299 4,387 4,554

Inventory 1,336 - 1,336

Cash and cash equivalents 555 3,614 1,144

8,190 8,001 7,034

------------ ------------ ----------

TOTAL ASSETS 119,086 116,622 115,600

============ ============ ==========

LIABILITIES

Current liabilities

Trade and other payables 11 14,897 8,481 10,287

Borrowings 12 1,584 1,488 1,539

16,481 9,969 11,826

------------ ------------ ----------

Non-current liabilities

Trade and other payables 11 4,631 2,533 3,536

Long-term provisions 6,985 5,883 6,399

Borrowings 12 15,717 13,468 16,097

Deferred tax 1,691 1,564 1,375

29,024 23,448 27,407

------------ ------------ ----------

TOTAL LIABILITIES 45,505 33,417 39,233

============ ============ ==========

EQUITY

Share capital 35,868 35,506 35,708

Share premium 258,162 257,863 257,992

Translation reserve (50,240) (50,240) (50,240)

Profit and loss account (178,007) (167,381) (174,631)

Other reserve 7,798 7,457 7,538

TOTAL EQUITY 73,581 83,205 76,367

============ ============ ==========

TOTAL EQUITY AND LIABILITIES 119,086 116,622 115,600

============ ============ ==========

Condensed Consolidated Statement of Changes in Equity

Share Share Translation Profit Other Total

capital premium reserve and loss reserve

account

US$000 US$000 US$000 US$000 US$000 US$000

Balance at 1 January

2020 24,465 245,692 (50,240) (163,346) 7,416 63,987

--------- --------- ------------ ---------- --------- --------

Share-based payments - - - - 41 41

Issue of ordinary

shares 2,603 2,213 4,816

Costs of issue (434) - - - (434)

Debt conversion 3,344 3,869 7,213

Subscriptions 4,490 6,010 10,500

Issued in settlement 604 513 - - - 1,117

Transactions with

owners 11,041 12,171 - - 41 23,253

Loss for the period - - - (4,035) - (4,035)

Exchange differences

on

translation - - - - - -

Total comprehensive

income/(loss) - - - (4,035) - (4,035)

Balance at 30 June

2020 35,506 257,863 (50,240) (167,381) 7,457 83,205

Share-based payments - - - - 81 81

Issue of ordinary

shares 1 - - - - 1

Subscription 201 129 - - - 330

Issued in settlement - - - - - -

Transactions with

owners 202 129 - - 81 412

Loss for the period - - - (7,250) - (7,250)

Exchange differences

on

translation - - - - - -

Total comprehensive

income/(loss) - - - (7,250) - (7,250)

Balance at 1 January

2021 35,708 257,992 (50,240) (174,631) 7,538 76,367

Share-based payments - - - - 260 260

Subscriptions 160 170 - - - 330

Issued in settlement - - - - - -

Transactions with

owners 160 170 - - 260 590

Loss for the period - - - (3,376) - (3,376)

Exchange differences

on

translation - - - - - -

Total comprehensive

income/(loss) - - - (3,376) - (3,376)

Balance at 30 June

2021 35,868 258,162 (50,240) (178,007) 7,798 73,581

========= ========= ============ ========== ========= ========

Condensed Consolidated Statement of Cash Flows

Six months ended 30 June 2021

6 months 6 months Year to

to 30 to 30

June June 31 Dec

2021 2020 2020

(Unaudited) (Unaudited) (Audited)

US$000 US$000 US$000

Cash flows from operating activities

- (Note 13)

Cash generated/(consumed) by operations 3,571 2,903 4,438

Interest received 39 69 105

Taxes paid - - -

3,610 2,972 4,543

------------ ------------ ----------

Cash flows from investing activities

Expenditure on exploration and evaluation

assets (91) (32) (173)

Expenditure on development and production

assets

(excluding increase in provision

for decommissioning) (2,446) (5,990) (11,395)

Proceeds from asset sales 31 30 78

Acquisition & licence extension in

Argentina (284) (165) (678)

Release of bond with state authorities - 249 249

USA acquisition - (158) (158)

(2,790) (6,066) (12,077)

------------ ------------ ----------

Cash flows from financing activities

Proceeds from issue of shares (net

of expenses) 330 4,882 5,213

Loan drawdown 1,410 856 4,954

Repayment of borrowings (1,965) (2,194) (5,076)

Payment of loan interest and fees (857) (644) (696)

Repayment of obligations under leases (638) (359) (868)

(1,720) 2,541 3,527

------------ ------------ ----------

Net increase/(decrease) in cash and

cash equivalents (900) (553) (4,007)

Opening cash and cash equivalents

at beginning of year 1,144 895 895

Exchange (losses)/gains on cash and

cash equivalents 311 3,272 4,256

Closing cash and cash equivalents 555 3,614 1,144

============ ============ ==========

Notes to the Half-Yearly Financial Statements

Six months ended 30 June 2021

1 Nature of operations and general information

President Energy PLC and its subsidiaries' (together "the

Group") principal activities are the exploration for and the

evaluation and production of oil and gas.

President Energy PLC is the Group's ultimate parent company. It

is incorporated and domiciled in England. The Group has onshore oil

and gas production and reserves in Argentina and the USA. The Group

also has onshore exploration assets in Paraguay and Argentina. The

address of President Energy PLC's registered office is Carrwood

Park, Selby Road, Leeds, LS15 4LG. President Energy PLC's shares

are listed on the Alternative Investment Market of the London Stock

Exchange.

These condensed consolidated interim financial statements (the

interim financial statements) have been approved for issue by the

Board of Directors on 29th September 2021. The financial

information for the year ended 31 December 2020 set out in this

interim report does not constitute statutory accounts as defined in

Section 434 of the Companies Act 2006. The financial information

for the six months ended 30 June 2021 and 30 June 2020 was neither

audited nor reviewed by the auditor. The Group's statutory

financial statements for the year ended 31 December 2020 have been

filed with the Registrar of Companies. The auditor's report on

those financial statements was unqualified and did not draw

attention to any matters by way of emphasis and did not contain a

statement under section 498(2) or (3) of the Companies Act 2006

2 Basis of preparation

The interim financial statements do not include all of the

information required for full annual financial statements and

should be read in conjunction with the consolidated financial

statements of the Group for the year ended 31 December 2020, which

have been prepared under IFRS.

These financial statements have been prepared under the

historical cost convention, except for any derivative financial

instruments which have been measured at fair value. The accounting

policies adopted in the 2021 interim financial statements are the

same as those adopted in the 2020 Annual report and accounts.

Notes to the Half-Yearly Financial Statements

Six months ended 30 June 2021 - continued

6 months 6 months Year to

to 30 to 30

June June 31 Dec

2021 2020 2020

(Unaudited) (Unaudited) (Audited)

US$000 US$000 US$000

3 Cost of

Sales

Depreciation 5,108 5,142 10,109

Royalties & production

taxes 3,535 2,839 5,176

Well operating costs 7,958 8,622 16,490

16,601 16,603 31,775

============ ============ ==========

4 Administrative expenses

Directors and staff cost 1,306 1,348 2,391

Share-based payments 260 328 410

Depreciation 26 65 162

Other 350 247 1,685

1,942 1,988 4,648

============ ============ ==========

5 Impairment (credit) / charge

Matorras & Ocultar in Argentina

(intangible) - - 1,759

Jefferson Island in USA

(intangible) - 125 125

- 125 1,884

============ ============ ==========

6 Non-operating (gains) / losses

Reversal of provision for

doubtful taxes 29 - 19

Arising on lease modifications - (32) (86)

Other (gains) / losses (31) (30) 204

(2) (62) 137

============ ============ ==========

7 Finance income & costs

Interest income 39 69 105

Exchange gains 816 3,535 4,401

Finance income 855 3,604 4,506

============ ============ ==========

Interest & similar charges 2,418 2,178 4,084

Exchange losses - - -

Finance costs 2,418 2,178 4,084

============ ============ ==========

8 Earnings / (loss) per share

Net profit / (loss) for

the period attributable

to the equity holders

of the

Parent Company (3,376) (4,035) (11,285)

============ ============ ==========

Number Number Number

'000 '000 '000

Weighted average number

of shares in issue 2,030,951 1,262,087 1,641,684

============ ============ ==========

Earnings /(loss) per share US cents US cents US cents

Basic (0.17) (0.32) (0.69)

Diluted (0.17) (0.32) (0.69)

============ ============ ==========

Notes to the Half-Yearly Financial Statements

Six months ended 30 June 2021 - continued

9 Non-current assets

Property

Plant

E&E and Total

Assets Equipment

US$000 US$000 US$000

Cost

At 1 January 2020 146,287 137,063 283,350

Additions 32 1,194 1,226

Acqusition in USA - 172 172

Right of use assets (IFRS16) - 662 662

At 30 June 2020 146,319 139,091 285,410

Additions 141 7,780 7,921

Transfer to current assets (1,336) - (1,336)

Right of use assets (IFRS16) - 707 707

Disposals - (289) (289)

At 1 January 2021 145,124 147,289 292,413

Additions 91 5,968 6,059

Right of use assets (IFRS16) - 1,464 1,464

At 30 June 2021 145,215 154,721 299,936

======== ========== ========

Depreciation/Impairment

At 1 January 2020 90,537 82,971 173,508

Charge for the period 125 5,207 5,332

-------- ---------- --------

At 30 June 2020 90,662 88,178 178,840

Impaired 1,759 - 1,759

Disposals - (442) (442)

Charge for the period - 5,064 5,064

-------- ---------- --------

At 1 January 2021 92,421 92,800 185,221

Impaired - - -

Charge for the period - 5,134 5,134

At 30 June 2021 92,421 97,934 190,355

======== ========== ========

Net Book Value 30 June 2021 52,794 56,787 109,581

======== ========== ========

Net Book Value 30 June 2020 55,657 50,913 106,570

======== ========== ========

Net Book Value 31 December 2020 52,703 54,489 107,192

======== ========== ========

Notes to the Half-Yearly Financial Statements

Six months ended 30 June 2021 - continued

30 June 30 June 31 Dec

2021 2020 2020

(Unaudited) (Unaudited) (Audited)

US$000 US$000 US$000

10 Trade and other receivables

Trade and other receivables 6,155 4,219 4,141

Prepayments 144 168 413

6,299 4,387 4,554

============ ============ ==========

11. Trade and other payables

Current

Trade and other payables 14,023 7,755 9,537

Current portion of leases 874 726 750

14,897 8,481 10,287

============ ============ ==========

Non-current

Non-current trade and other

payables 1,990 1,444 1,786

Non-current portion of

leases 2,641 1,089 1,750

4,631 2,533 3,536

============ ============ ==========

Total carrying value 19,528 11,014 13,823

============ ============ ==========

12 Borrowings

Current

Bank loan 84 1,488 1,539

Promissory notes 1,500 - -

1,584 1,488 1,539

Non-Current

IYA Loan 11,442 11,074 11,175

Bank loan 4,275 2,394 4,922

15,717 13,468 16,097

------------ ------------ ----------

Total carrying value of

borrowings 17,301 14,956 17,636

============ ============ ==========

Notes to the Half-Yearly Financial Statements

Six months ended 30 June 2021 - continued

13 Reconciliation of operating profit to net cash

outflow from operating activities

6 months 6 months Year to

to 30 June to 30 June 31 Dec

2021 2020 2020

(Unaudited) (Unaudited) (Audited)

US$000 US$000 US$000

Profit/(loss) from operations

before taxation (3,000) (3,491) (10,251)

Interest on bank deposits (39) (69) (105)

Interest payable and loan fees 2,418 2,178 4,084

Depreciation and impairment of

property,

plant and equipment 5,134 5,207 10,271

Impairment charge - 125 1,884

Gain on non-operating transaction (2) (62) 137

Share-based payments 260 328 410

Foreign exchange difference (816) (3,535) (4,401)

Operating cash flows before movements

in working capital 3,955 681 2,029

(Increase)/decrease in receivables (1,933) 1,999 1,421

(Increase)/decrease in inventory - 28 28

(Decrease)/increase in payables 1,549 195 960

Net cash generated by/(used in)

operating activities 3,571 2,903 4,438

============ ============ ==========

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR XKLFLFKLBBBE

(END) Dow Jones Newswires

September 30, 2021 01:59 ET (05:59 GMT)

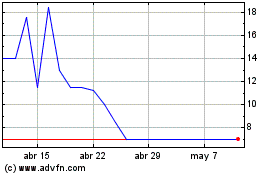

Molecular Energies (LSE:MEN)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Molecular Energies (LSE:MEN)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024