TIDMPRIM

RNS Number : 3394L

Primorus Investments PLC

10 September 2021

Primorus Investments plc

("Primorus" or the "Company")

Interim Results for the six months ended 30 June 2021

Primorus Investments plc (AIM: PRIM) is pleased to announce its

interim results for the six months ended 30 June 2021.

Overview

Primorus has a strong balance sheet with no debt and with total

assets (including cash of GBP1.346 million) as at 30 June 2021

amounting to GBP9.17 million (30 June 2020: GBP8.09 million).

The last six months have been a very busy time at Primorus. The

Board has spent considerable time reorganising the Company and its

balance sheet to provide investors with what it believes to be a

low cost, high impact strategy underpinned by the revised investing

policy.

The Board has reduced the overall operating costs, appointed a

new Chief Executive, fully appraised all the current investments,

and pursued new investment opportunities.

The results of the appraisal of its existing investments led to

the Company increasing its holdings in Fresho and Engage which,

along with Zuuse, are the three companies (from investments made

prior to November 2020) that the Board believes will deliver the

greatest shareholder returns.

In addition to the above, in April the Company made a new

investment into Mustang Energy PLC to gain exposure to the vanadium

flow battery storage market. The Board believes that this sector,

along with other forms of renewable energy and clean technology, is

going to be a financially rewarding market to be invested in.

Financial Results

The operating loss for the six months to 30 June 2021 was

GBP115,000 (30 June 2020: GBP3.29m profit). The net loss after tax

was GBP115,000 (30 June 2020: GBP3.29m profit).

Total assets, including cash, at 30 June 2021 amounted to

GBP9.17 million (30 June 2020: GBP8.09 million).

Outlook

The Board remains confident that significant opportunities exist

for the Company going forward. We look forward to the remainder of

2021 being a period in which we can further demonstrate our

business model which is now underpinned by the new investing

policy.

The Board are currently reviewing several exciting investment

opportunities that are aligned with the new investing policy. The

Board has been screening several opportunities and has identified

at least one that could begin to generate value for shareholders

this calendar year.

We look forward to updating shareholders as and when our

existing investments mature, and new investments present

themselves.

The Directors would like to take this opportunity to thank our

shareholders, staff and consultants for their continued

support.

Rupert Labrum Chairman

10 September 2021

This announcement contains inside information for the purposes

of the UK Market Abuse Regulation and the Directors of the Company

are responsible for the release of this announcement.

For further information please contact:

Primorus Investments plc

Matthew Beardmore, Chief Executive

Officer +44 (0)20 8154 7907

Nominated Advisor

Cairn Financial Advisers LLP

James Caithie / Sandy Jamieson +44 (0) 20 7213 0880

Unaudited Condensed Company Statement of Comprehensive

Income

for the six months ended 30 June 2021

6 months to 6 months to Year to

30 June 30 June 31 December

2021 2020 2020

Unaudited Unaudited Audited

Notes GBP'000 GBP'000 GBP'000

Continuing operations

Revenue

Investment income 48 1 14

Realised gain on disposal of financial

investments 107 834 6,033

Unrealised gain/(loss) on market

value movement of financial investments (21) 2,715 (323)

Total gains on financial investments 134 3,550 5,724

------------ ----------- -----------

Share based payments (13) - -

------------ ----------- -----------

Operating costs (236) (258) (475)

------------ ----------- -----------

Impairment of financial investments - - (633)

------------ ----------- -----------

(Loss)/Profit before tax (115) 3,292 4,616

Taxation - - (447)

------------ ----------- -----------

(Loss)/Profit for the period attributable

to equity shareholders of the company (115) 3,292 4,169

------------ ----------- -----------

- - -

Other comprehensive income

Total Comprehensive Income for

the year attributable to equity

shareholders of the company (115) 3,292 4,169

------------ ----------- -----------

(Loss) per share:

Basic profit/(loss) per share (pence) 2 (0.08) 2.35 2.98

Diluted profit/(loss) per share

(pence) 2 (0.08) 2.09 2.98

Unaudited Condensed Company Statement of Financial Position

as at 30 June 2021

30 June 30 June 31

2021 2020 December

2020

Unaudited Unaudited Audited

Notes GBP'000 GBP'000 GBP'000

ASSETS

Non-current assets

Financial investments 6,998 7,390 4,612

--------- --------- --------

6,998 7,390 4,612

--------- --------- --------

Current assets

Investments 812 - 113

Trade and other receivables 14 22 3

Cash and cash equivalents 1,346 676 4,673

--------- --------- --------

2,172 698 4,789

--------- --------- --------

Total assets 9,170 8,088 9,401

--------- --------- --------

EQUITY

Equity attributable to equity holders

of the parent

Share capital 15,391 15,391 15,391

Share premium account 35,296 35,296 35,296

Share based payment reserve 13 683 -

Retained earnings (42,016) (43,321) (41,901)

--------- --------- --------

Total equity 8,684 8,049 8,786

LIABILITIES

Current liabilities

Trade and other payables 486 39 502

Loans and borrowings - - 113

--------- --------- --------

Total liabilities 486 39 615

--------- --------- --------

Total equity and liabilities 9,170 8,088 9,401

--------- --------- --------

Unaudited Condensed Company Statement of Changes in Equity

for the six months ended 30 June 2021

Share based Total

Share Share payment Retained attributable

capital premium reserve earnings to owners

of parent

Unaudited GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Balance at 31

December 2019 15,391 35,296 683 (46,613) 4,757

=============== ==================== ================ ================ ====================

Profit for the

period - - - 4,169 4,169

--------------- -------------------- ---------------- ---------------- --------------------

Total

comprehensive

income for

the

period - - - 4,169 4,169

Termination and

settlement of

share options - - (140) - (140)

Cancellation of

share options - - (543) 543 -

--------------- -------------------- ---------------- ---------------- --------------------

Balance at 31

December 2020 15,391 35,296 - (41,901) 8,786

=============== ==================== ================ ================ ====================

Loss for the

period - - - (115) (115)

--------------- -------------------- ---------------- ---------------- --------------------

Total

comprehensive

income for

the period - - - (115) (115)

Share based

payment 13 - 13

Balance at 30 June

2021 15,391 35,296 13 (42,016) 8,684

=============== ==================== ================ ================ ====================

Unaudited Condensed Company Statement of Cash Flows

for the six months ended 30 June 2021

6 months to 6 months to Year to

30-Jun-21 30-Jun-20 31-Dec-20

Unaudited Unaudited Audited

GBP'000 GBP'000 GBP'000

Cash flows from operating activities

Operating profit/(loss) (115) 3,292 4,616

Adjustments for:

(Profit)/Loss on disposal of financial

investments (107) (835) (6,033)

Fair value movement on listed investments 21 (2,716) 323

Impairment provision on unlisted investments - - 633

Decrease/(increase) in trade and other

receivables (11) (7) 12

Increase/(decrease) in trade and other

payables (16) (69) (53)

Foreign exchange loss/(gain) 81 (2) (65)

Share based payment 13 - (140)

Taxation (paid) - - -

--------- ----------- ---------

Net cash used in operating activities (134) (337) (707)

Cash flows from investing activities

Disposal proceed from sale of financial

investments 2,533 1,048 6,939

Payment for financial investments (5,613) (80) (1,737)

--------- ----------- ---------

Net cash (used in) investing activities (3,080) 968 5,202

Net change in cash and cash equivalents (3,214) 631 4,515

--------- ----------- ---------

Cash and cash equivalents at beginning

of period 4,560 45 45

--------- ----------- ---------

Cash and cash equivalents at end of

period 1,346 676 4,560

--------- ----------- ---------

Notes to the condensed interim financial statements

1. General Information

The condensed interim financial information for the 6 months to

30 June 2021 does not constitute statutory accounts for the

purposes of Section 434 of the Companies Act 2006 and has not been

audited or reviewed. No statutory accounts for the period have been

delivered to the Registrar of Companies.

The condensed interim financial information in respect of the

year ended 31 December 2020 has been produced using extracts from

the statutory accounts for that period. Consequently, this does not

constitute the statutory information (as defined in section 434 of

the Companies Act 2006) for the year ended 31 December 2020, which

was audited. The statutory accounts for this period have been filed

with the Registrar of Companies. The auditors' report was

unqualified and did not contain a statement under Sections 498 (2)

or 498 (3) of the Companies Act 2006.

The auditor's report was approved by the Directors on 07 June

2021 and is available on the Company's website at

www.primorusinvestments.com .

Basis of preparation and accounting

The financial information has been prepared on the historical

cost basis. The Company's business activities, together with the

factors likely to affect its future development, performance and

position are set out in the Chairman's Statement. This statement

also includes a summary of the Company's financial position and its

cash flows.

These condensed interim financial statements have been prepared

in accordance with International Financial Reporting Standards

(IFRS) as adopted by the European Union with the exception of

International Accounting Standard ('IAS') 34 -- Interim Financial

Reporting. Accordingly, the interim financial statements do not

include all of the information or disclosures required in the

annual financial statements and should be read in conjunction with

the Company's 2020 annual financial statements.

2. Earnings per share

Earnings per ordinary share has been calculated using the

weighted average number of shares in issue during the period. The

weighted average number of equity shares in issue was 139,830,968.

IAS 33 requires presentation of diluted EPS when a company could be

called upon to issue shares that would decrease earnings per share

or increase the loss per share.

Six months Six months Year ended

to to

30 June 30 June 31 December

2021 2020 2020

(Unaudited) (Unaudited) (Audited)

restated

(GBP'000) (GBP'000) (GBP'000)

Net profit/(loss) attributable to equity

holders of

the company (115) 3,292 (401)

Weighted average number of shares 139,830,968 139,830,968 139,830,968

Weighted average number of diluted

shares 151,830,968 157,630,968 139,830,968

Basic (loss)/profit per share (pence) (0.08) 2.35 2.98

Diluted (loss)/profit per share (pence) (0.08) 2.09 2.98

------------------------------------------- ----------- ----------- -----------

3. Events after the reporting date

There are no events after the end of the reporting date to

disclose that have not already been the subject of an announcement

by the Company.

, the news service of the London Stock Exchange. RNS is approved by

the Financial Conduct Authority to act as a Primary Information

Provider in the United Kingdom. Terms and conditions relating to

the use and distribution of this information may apply. For further

information, please contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR DBGDCLUGDGBC

(END) Dow Jones Newswires

September 10, 2021 02:00 ET (06:00 GMT)

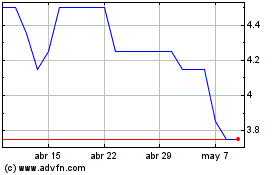

Primorus Investments (LSE:PRIM)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Primorus Investments (LSE:PRIM)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024