Princess Private Equity Holding Ltd NAV increases by 0.6% in July (7737J)

26 Agosto 2021 - 1:00AM

UK Regulatory

TIDMPEY TIDMPEYS

RNS Number : 7737J

Princess Private Equity Holding Ltd

26 August 2021

News Release

Guernsey, 26 August 2021

NAV increases by 0.6% in July

-- Princess Private Equity Holding Limited's (Princess or the

Company) net asset value increased by 0.6% to EUR 15.32 per

share

-- Portfolio developments (+1.5%) were positive while currency movements were flat

-- Princess received distributions of EUR 265.6 million and invested EUR 15.1 million

Princess received distributions of EUR 265.6 million during the

month, the majority of which stemmed from International Schools

Partnership ("ISP") and GlobalLogic.

EUR 142.7 million was received from ISP, following an agreement

for OMERS, the defined benefit pension plan for municipal employees

in the Province of Ontario , to acquire a minority stake in the

business. Partners Group formed UK-headquartered ISP in 2013 with

the intention of creating a leading international school group

through a buy-and-build strategy, capitalizing on the opportunities

for consolidation in the K-12 school market. Today, ISP is the

fifth largest K-12 international school group globally, operating

50 schools across 15 countries and serving more than 45,000 pupils.

As part of the transaction, Princess reduced its exposure to ISP

but re-invested EUR 15.1 million to participate in the future

growth of the business.

EUR 108.0 million was received from the sale of GlobalLogic, a

leader in design-led digital engineering services , to Japanese

conglomerate Hitachi. The transaction valued GlobalLogic at an

enterprise value of USD 9.5 billion. During its holding period,

Partners Group worked with the company on several transformational

value creation initiatives to drive growth. Key initiatives

included increasing the size of the Company's top accounts and

introducing a more targeted sales strategy in certain customer

segments, including the development of a private equity-focused

sales channel . GlobalLogic also completed four strategic

acquisitions, including three in Europe. Additionally, Partners

Group enhanced GlobalLogic's focus on environmental, social, and

governance ("ESG") initiatives, helping it establish a dedicated

ESG function focused on refining and implementing its ESG strategy

going forward.

The remaining distributions of EUR 14.9 million were received

from the Company's legacy fund portfolio and senior loans.

Further information is available in the monthly report, which

can be accessed via:

http://www.princess-privateequity.net/en/investor-relations/financial-reports/.

Ends.

About Princess

Princess is an investment holding company founded in 1999 and

domiciled in Guernsey. It invests, inter alia, in private equity

and private debt investments. Princess is managed in its investment

activities by Partners Group, a global private markets investment

management firm with USD 119 billion in investment programs under

management in private equity, private debt, private real estate and

private infrastructure. Princess aims to provide shareholders with

long-term capital growth and an attractive dividend yield. Princess

is traded on the Main Market of the London Stock Exchange (ticker:

PEY for the Euro Quote; PEYS for the Sterling Quote).

Contacts

Princess Private Equity Holding Limited:

princess@partnersgroup.com

www.princess-privateequity.net

Registered Number: 35241

LEI: 54930038LU8RDPFFVJ57

Investor relations contact

George Crowe

Phone: +44 20 7575 2771

Email: george.crowe@partnersgroup.com

Media relations contact

Jenny Blinch

Phone: +44 207 575 2571

Email: jenny.blinch@partnersgroup.com

www.partnersgroup.com

This document does not constitute an offer to sell or a

solicitation of an offer to buy or subscribe for any securities and

neither is it intended to be an investment advertisement or sales

instrument of Princess. The distribution of this document may be

restricted by law in certain jurisdictions. Persons into whose

possession this document comes must inform themselves about and

observe any such restrictions on the distribution of this document.

In particular, this document and the information contained therein

are not for distribution or publication, neither directly nor

indirectly, in or into the United States of America, Canada,

Australia or Japan.

This document may have been prepared using financial information

contained in the books and records of the product described herein

as of the reporting date. This information is believed to be

accurate but has not been audited by any third party. This document

may describe past performance, which may not be indicative of

future results. No liability is accepted for any actions taken on

the basis of the information provided in this document. Neither the

contents of Princess' website nor the contents of any website

accessible from hyperlinks on Princess' website (or any other

website) is incorporated into, or forms part of, this

announcement.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

NAVPAMBTMTMTBFB

(END) Dow Jones Newswires

August 26, 2021 02:00 ET (06:00 GMT)

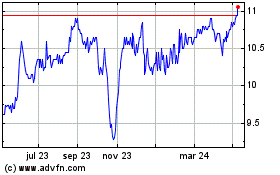

Princess Private Equity (LSE:PEY)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

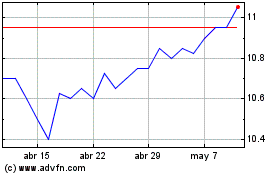

Princess Private Equity (LSE:PEY)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024