TIDMRBGP

RNS Number : 4316F

RBG Holdings PLC

16 July 2021

16 July 2021

RBG Holdings plc

("RBG" or the "Group")

Pre-Close Trading & Dividend Update

RBG Holdings plc (AIM: RBGP), the professional services group,

today publishes a pre-close trading update ahead of the publication

of its financial results for the six months ending 30 June 2021 on

15 September 2021.

The Board is pleased to announce that the Group continues to

trade in line with market expectations. As a result, the Board

intends to pay an interim dividend of 2 pence per share in respect

of the six months to 30 June 2021 on 27 August 2021 to shareholders

on the register as of 30 July 2021.

Legal Services Division

The Group's legal services division, which includes Rosenblatt

Limited ("RBL") and Memery Crystal Limited ("Memery Crystal"), has

performed well across all practice areas, particularly those areas

focused on contentious law such as dispute resolution, and the

Group's corporate division which is focused on commercial

transactions. The acquisition of the business of Memery Crystal LLP

was completed on 28 May 2021.

The integration of Memery Crystal into the legal services

division is progressing well. While RBL and Memery Crystal retain

their own brand identities, the two firms are highly complementary

and are in the process of being combined into one legal services

business. Opportunities have been identified to leverage both

firms' skills, resources, and reputation to enhance the Group's

offering to its combined client base. Looking ahead, the Group

plans to integrate all support functions, including technology

platforms, and implement other changes to deliver further synergies

while retaining the client facing brands of 'Rosenblatt' for

contentious legal services and 'Memery Crystal' for non-contentious

legal services. Further details on the integration plans will be

provided with the Group's interim results in September.

Litigation Finance

The Group has two types of litigation assets - RBG's own client

matters, and litigation matters run by third-party solicitors

funded by LionFish Litigation Finance (UK) Limited ("LionFish").

Both offer opportunities for high potential returns.

The current litigation assets include three large cases, project

named Neptune, Shango, and Mercury. Updates will be provided when

appropriate. In the case of Project Neptune, the Court of Appeal

recently found that because there was a 19-month delay in the judge

providing a judgment, this judgment is not safe. Therefore, a full

re-trial has been ordered with the date not yet set.

LionFish is actively invested in 10 cases with a total cash

investment of GBP3.2 million across the cases and a total capital

commitment of GBP8 million if all cases go to trial. In April,

LionFish recorded its first successful litigation investment since

its launch. While the return is not material to the Group's

forecast financial results, the successful investment provided a

gross two times money return over and above invested cash.

Moreover, the result confirmed that LionFish could deliver

significant returns from its portfolio of assets.

Convex Capital Limited ("Convex Capital")

Convex Capital is the Group's specialist sell-side corporate

finance boutique. After a challenging 2020, where deals were

postponed or delayed due to Covid, the Convex Capital team worked

to pivot its sector focus to rebuild its transaction pipeline.

As a result, since 1 January 2021, Convex Capital has completed

eight deals generating revenue of GBP5.0 million. Furthermore,

Convex Capital has a strong pipeline of 25 deals with several

currently at various stages of completion.

Commenting Group CEO Nicola Foulston, said: "The Group has

continued its strong performance in the first six months, after an

excellent 2020. We have seen demand for all legal services continue

as expected, including a significant increase in corporate and

commercial transactions, such as IPOs and real estate deals, as we

emerge from the pandemic. I am pleased with the progress in terms

of integrating Memery Crystal into the Group. We are identifying

many opportunities for both law firms to work together and enhance

our client offering.

"We continue to build a portfolio of litigation investments

comprising both RBG's own matters and third-party matters through

LionFish which offer the potential for high returns for our

shareholders. Our M&A business, Convex Capital, has sustained

its strong start to the year converting its pipeline. We are

confident about the rest of the year as market conditions continue

to improve."

Enquiries:

RBG Holdings plc Via SEC Newgate

Nicola Foulston, CEO

Singer Capital Markets (Nomad and Tel: +44 (0)20 7496 3000

Broker)

Shaun Dobson / Alex Bond (Corporate

Finance)

Tom Salvesen (Corporate Broking)

SEC Newgate (for media enquiries) Tel: +44 (0)7540 106366;

Robin Tozer/Tom Carnegie rbg@secnewgate.co.uk

About RBG Holdings plc

RBG Holdings plc is a professional services group, which

comprises the following divisions:

Rosenblatt Limited ("Rosenblatt")

Rosenblatt is one of the UK's pioneering law firms and a leader

in dispute resolution. Rosenblatt provides a range of legal

services to its diversified client base, which includes companies,

banks, entrepreneurs and individuals. Complementing this is

Rosenblatt's increasingly international footprint, advising on

complex cross-jurisdictional disputes. Rosenblatt's practice areas

include banking & finance, competition & regulatory,

corporate, dispute resolution, employment, financial crime,

financial services, insolvency & financial restructuring,

IP/technology/media, real estate, serious & general crime, tax

resolution and white-collar crime.

Memery Crystal Limited ("Memery Crystal")

Specialist international law firm Memery Crystal offers legal

services in a range of areas such as corporate (including a

market-leading corporate finance offering), real estate,

commercial, IP & technology (CIPT), banking & finance, tax

& wealth structuring, employment and dispute resolution. Memery

Crystal is one of the leading firms in the UK to advise the

emerging cannabis sector on a wide range of business issues. Memery

Crystal offers a partner-led service to a broad range of clients,

from multinational companies, financial institutions and

owner-managed businesses to individual entrepreneurs.

Together, Rosenblatt and Memery Crystal form the Group's Legal

Services Division - RBGLS.

LionFish Litigation Finance (UK) Limited ("LionFish")

The Group also provides litigation finance in selected cases

through a separate arm, LionFish Litigation Finance (UK) Limited.

LionFish finances litigation matters being run by other solicitors

in return for a significant return on the outcome of those cases.

As such, the Group has two types of litigation assets -

Rosenblatt's own client matters, and litigation matters run by

third-party solicitors. LionFish is positioned to be a unique,

alternative provider to the traditional litigation funders.

Convex Capital Limited ("Convex Capital")

Convex Capital is a specialist sell-side corporate finance

boutique based in Manchester. Convex Capital is entirely focussed

on helping companies, particularly owner-managed and

entrepreneurial businesses, realise their value through sales to

large corporates. Convex Capital identifies and proactively targets

firms that it believes represent attractive acquisition

opportunities.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

TSTUVONRASUBAAR

(END) Dow Jones Newswires

July 16, 2021 02:00 ET (06:00 GMT)

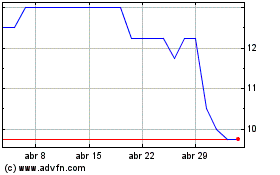

Rbg (LSE:RBGP)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Rbg (LSE:RBGP)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024