TIDMRBGP

RNS Number : 1308N

RBG Holdings PLC

28 January 2021

28 January 2021

RBG Holdings plc

(the "Group")

Pre-Close Trading Update & Investor Presentation

Convex Capital Update

Capital Markets Day

RBG Holdings plc (AIM: RBGP), the professional services group,

today publishes a pre-close trading update ahead of the publication

of its financial results for the year ending 31 December 2020 on 20

April 2021.

The Board expects the Group's revenue (including realised gains)

and EBITDA to exceed analysts' expectations. Furthermore, the

Group's balance sheet remains resilient with net cash of GBP 3.5

million as of 31 December 2020 (2019: GBP1.9 million).

As a result, the Board is pleased to announce it intends to pay

a dividend of 3 pence per share in respect of the 2020 financial

year on 26 February 2021 to shareholders on the register as of 5

February 2021.

The Board believes that the performance in 2020 demonstrates the

Group's resilience despite the challenges presented by the

pandemic. The Group's law firm, Rosenblatt Limited ("RBL"), had its

most successful year in terms of revenue, EBITDA and gross margin

which exceeded 40 per cent. LionFish Litigation Finance (UK) Ltd

("LionFish") which finances litigation matters being run by other

solicitors, using the expertise of RBL, was launched on 1 May 2020.

As of 28 January 2021, LionFish had investments in seven cases and

is seeing a regular flow of opportunities. Finally, while the

pandemic made deal completion difficult, Convex Capital Limited

("Convex Capital"), the Group's specialist sell-side corporate

finance boutique continued to build a strong pipeline of deal

opportunities. The Board expects to see an increase in M&A

activity in 2021 driven by the economic conditions and the possible

changes to the Capital Gains Tax regime. These trends will benefit

both Convex Capital and RBL.

Convex Capital Update and Shares Transactions

Since 1 January 2021, Convex Capital has completed one

transaction, receiving fee income of GBP525,000.

As previously announced, Convex Capital was heavily impacted by

Covid-19 in 2020, which caused material short-term disruption to

the completion of transactions .

Convex Capital completed three deals in 2020 and has converted

its strong pipeline into several active deals over the second half

of 2020. The new financial year has started positively with one

deal already completed, and another waiting Competition and Markets

Authority sign off, with positive progress on several other

deals.

The Convex Capital senior management team have agreed for 2021

to exchange their fixed base salary arrangements for a flexible

commission structure directly linked to income from completed

deals. Under the terms of this scheme Convex Capital management

will instruct N+1 Singer to use 50% of commission earned to acquire

shares in RBG Holdings in the open market [1] .

This new commission scheme replaces the deferred consideration

arrangements under the sale and purchase agreement with the Convex

Capital sellers, announced at the time of the acquisition in

September 2019. This deferred consideration was due to be payable

one year after completion of the purchase, based on certain

performance criteria, which were not met due to the pandemic. The

relevant provision will be released in the accounts for the year

ended 31 December 2020.

Investor Communications and Capital Markets Day

Chief Executive, Nicola Foulston and Chief Financial Officer,

Robert Parker will participate in an investor presentation via the

Investor Meet Company platform on 3 February 2021 at 10 a.m.

Investors can sign up to Investor Meet Company for free:

www.investormeetcompany.com/rbg-holdings-plc/register-investor

Investors who have already registered and added to meet the

Group will be automatically invited.

Furthermore, the Group will host a Capital Markets Day for

investors and analysts on 24 February 2021 from 10 a.m. to 12 p.m.

The event will include presentations from Group CEO, Nicola

Foulston, and the Managing Directors of each of the Group's

divisions: Rosenblatt Limited, Convex Capital Limited and LionFish

Litigation Finance (UK) Ltd, followed by a live Q&A.

Invitations will be sent in due course. If you wish to attend,

please email : RBGP_CMD@n1singer.com

Commenting Group CEO Nicola Foulston, said: "The Group has

demonstrated its resilience during a very challenging year. Our law

firm, RBL has achieved its best financial performance since it was

founded. Following the launch of LionFish, we are building a

portfolio of litigation investments which offer the potential for

high returns for our shareholders. The Group's M&A business,

Convex Capital, naturally saw its ability to complete deals

hindered by the lockdowns. However, the business has built a strong

pipeline, and we expect higher levels of M&A activity in the

current financial year. We are looking forward to the year ahead

with confidence."

Enquiries:

RBG Holdings plc Via SEC Newgate

Nicola Foulston, CEO

N+1 Singer (Nomad and Broker) Tel: +44 (0)20 7496 3000

Shaun Dobson / Alex Bond (Corporate

Finance)

Tom Salvesen (Corporate Broking)

SEC Newgate (for media enquiries) Tel: +44 (0)7540 106366;

Robin Tozer/Tom Carnegie rbg@secnewgate.co.uk

About RBG Holdings plc

RBG Holdings plc is a professional services group, which

includes one of the UK's pioneering law firms, Rosenblatt Limited

("RBL"), which is a leader in dispute resolution.

RBL provides a range of legal services to its diversified client

base, which includes companies, banks, entrepreneurs and

individuals. Complementing this is the Company's increasingly

international footprint, advising on complex cross-jurisdictional

matters. RBL's practice areas include dispute resolution, financial

crime, corporate, banking and finance, insolvency and financial

restructuring, construction and projects, employment, financial

services, IP/technology/media, real estate, regulatory and tax

resolution.

The Group also provides litigation finance in selected cases

through a separate arm, LionFish Litigation Finance (UK) Ltd.

LionFish finances litigation matters being run by other solicitors

in return for a significant return on the outcome of those cases.

As such, the Group has two types of litigation investments - RBL's

own client matters, and litigation matters run by third-party

solicitors. LionFish is positioned to be a unique, alternative

provider to the traditional litigation funders.

The Group also owns Convex Capital Limited, a specialist

sell-side corporate finance boutique, based in Manchester. Convex

is entirely focussed on helping companies, particularly

owner-managed and entrepreneurial businesses, realise their value

through sales to large corporates. Convex identifies and

proactively targets firms that it believes represent attractive

acquisition opportunities.

[1] The authority granted by management under the scheme is

irrevocable and non-discretionary, and during a Close Period the

Board has no power to invoke any changes to the authority. Any

purchases will be undertaken at the sole discretion of N+1 Singer

Limited. The Group confirms that it currently has no unpublished

price sensitive information.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

TSTFFFILLRIDFIL

(END) Dow Jones Newswires

January 28, 2021 02:00 ET (07:00 GMT)

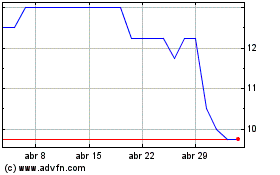

Rbg (LSE:RBGP)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Rbg (LSE:RBGP)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024