TIDMRCP

RNS Number : 1472H

RIT Capital Partners PLC

02 August 2021

Please click here to view the Company's Report and Accounts

http://www.rns-pdf.londonstockexchange.com/rns/1472H_1-2021-7-30.pdf

2 August 2021

RIT Capital Partners plc

Results for the half year ended 30 June 2021

RIT Capital Partners plc today published its results for the

half year ended 30 June 2021.

Financial Highlights:

-- Net asset value per share (NAV) total return of 19.1%

for the period

-- NAV per share of 2,711 pence at 30 June 2021; a new

all-time high

-- Share price total return of 18.5% for the period

-- Total net assets in excess of GBP4.2 billion at 30

June 2021

-- Growth in net assets of GBP700 million (before distributions)

for the period

Performance Highlights:

-- Emphasis on capital preservation and long-term capital

growth

-- Diversified approach successfully produced distinctive

sources of return with positive contributions from

the majority of asset classes

-- Strong contribution from the private investment portfolio

(both the direct and fund holdings) underpinned by

the successful IPO of Coupang

-- Our quoted equity category contributed positively,

led by cyclical positions buoyed by increased

economic activity as well as some strong single stock

picks

-- The absolute return and credit book continued to provide

steady and largely uncorrelated returns, in particular

from distressed debt managers

-- The main detractor to performance in absolute terms

was the FX translation impact from an appreciating

Sterling

Dividends and Buybacks:

-- Dividend paid in April of 17.625 pence per share

-- The Board has declared a dividend of 17.625 pence per

share for October

-- This represents an increase of 0.7% over the previous

year's dividend

-- The Company bought back shares when they were trading

on a high single-digit discount; and intends to continue

to selectively purchase shares in the market when viewed

as beneficial

Summary:

-- Over the last five years, net assets have grown in

excess of GBP2 billion (before dividends)

-- Since inception, RIT has now participated in 74% of

market upside but only 38% of market declines

-- Over the same period, the total shareholder return

has compounded at 12.1% per annum compared to the ACWI

of 7.6%

-- GBP10,000 invested in RIT at inception in 1988 would

be worth GBP434,000 today (with dividends reinvested)

compared to the same amount invested in the ACWI which

would be worth GBP111,000

Commenting, Sir James Leigh-Pemberton, Chairman of RIT Capital

Partners plc, said:

" I am pleased to report that your Company's net asset value at

the end of June increased to 2,711 pence per share, representing a

total return (with dividends reinvested) of 19.1% over the half

year. For the same period, the total shareholder return was 18.5%,

with the share price on 30 June having increased to 2,430

pence.

The first six months of the year appeared to be a relatively

benign time for equity markets, with many developed markets posting

low double-digit gains, despite continuing Covid-19 concerns and

notably higher inflation figures. However, beneath the surface, the

situation was far more volatile, with material rotations between

market-leading sectors, regions and themes ... All this resulted in

a wide dispersion of underlying asset returns; the first half of

the year reminding us again that decisions over where exposure is

held, and not just how much, is the key to achieving our Corporate

Objective.

Our focus continued to be on ensuring the investment approach

remained disciplined, but with the right amount of agility that

these market conditions require.

The two principal KPIs we use for investment performance, the

ACWI and RPI+3%, measured 12.2% and 3.4% respectively over the half

year, resulting in your Company experiencing healthy outperformance

... we saw positive contributions across the majority of your

Company's asset categories, with private investments in particular

producing strong returns...

Our long-term approach allows us to integrate these private

investments with carefully considered allocations to stocks, equity

and hedge funds, absolute return and credit, and currencies ... We

continue to believe this differentiated approach offers something

truly distinct from many other offerings in both the investment

trust and wider fund universe.

... my Board colleagues and I remain very grateful for the

continuing exceptional efforts of our colleagues in JRCM, our

suppliers and counterparties, which allow your Company to operate

as normal."

Commenting, Francesco Goedhuis, Chairman and Chief Executive

Officer of the Company's Manager, J. Rothschild Capital Management

Limited (JRCM), and Ron Tabbouche, Chief Investment Officer of

JRCM, said:

"While the results so far this year, and over recent years, are

pleasing, we nevertheless remain vigilant, and will not hesitate to

adjust the portfolio should the need arise ... As we emerge from

the most serious public health crisis in modern times, with

systemic market uncertainties remaining, this is not the time to

relax. And rest assured that we will not.

With a strong team around us, we are confident that our dynamic

asset allocation and strong security selection

skills, together with global deal sourcing and integrated risk

management, will provide us with the best platform

to continue to deliver equity-type returns with less risk."

ENQUIRIES:

Brunswick Group LLP:

Tom Burns: +44 (0) 207 404 5959

About RIT Capital Partners plc:

RIT Capital Partners plc is an investment company listed on the

London Stock Exchange. Its net assets have grown from GBP280

million on listing in 1988 to over GBP4.2 billion as at 30 June

2021. Lord Rothschild and his immediate family interests retain a

significant holding.

www.ritcap.com

A description of all terms used above, including further

information on the calculation of Alternative Performance Measures

(APMs) is set out in the Glossary and APMs section at the end of

this RNS.

THE FOLLOWING IS EXTRACTED FROM THE COMPANY'S HALF-YEARLY

FINANCIAL REPORT

Performance for the period 30 June 2021

------------------------------------ ------------

NAV per share total return 19.1%

Share price total return 18.5%

RPI plus 3.0% per annum 3.4%

MSCI All Country World Index (ACWI) 12.2%

------------------------------------ ------------

Key data 30 June 2021 31 December 2020 Change

---------------------------------------- ---------------- ---------------- ---------

NAV per share 2,711 pence 2,292 pence 18.3%

Share price 2,430 pence 2,065 pence 17.7%

Premium/(discount) -10.4% -9.9% -0.5% pts

Net assets GBP4,263 million GBP3,590 million 18.7%

Gearing 9.8% 4.4% 5.4% pts

Average net quoted equity exposure

for the period 46% 43% 3% pts

First interim dividend paid 17.625 pence 17.5 pence 0.7%

Second interim dividend declared/paid 17.625 pence 17.5 pence 0.7%

---------------------------------------- ---------------- ---------------- ---------

Total dividend in year 35.250 pence 35.0 pence 0.7%

---------------------------------------- ---------------- ---------------- ---------

Performance history 1 Year 3 Years 5 Years 10 Years

---------------------------- ------ ------- ------- --------

NAV per share total return 41.6% 51.7% 83.4% 156.3%

Share price total return 38.4% 23.9% 60.9% 125.8%

RPI plus 3.0% per annum 6.9% 17.7% 33.4% 72.4%

ACWI 30.2% 43.8% 88.2% 184.9%

---------------------------- ------ ------- ------- --------

CHAIRMAN'S STATEMENT

I am pleased to report that your Company's net asset value at

the end of June increased to 2,711 pence per share, representing a

total return (with dividends reinvested) of 19.1% over the half

year. For the same period, the total shareholder return was 18.5%,

with the share price on 30 June having increased to 2,430

pence.

The first six months of the year appeared to be a relatively

benign time for equity markets, with many developed markets posting

low double-digit gains, despite continuing Covid-19 concerns and

notably higher inflation figures. However, beneath the surface, the

situation was far more volatile, with material rotations between

market-leading sectors, regions and themes. Central banks continued

to influence market sentiment, as investors sought and reacted to

signs of policy initiatives to address higher inflation. The

10-year US treasury yield rose sharply to a peak of 1.77% in March

before steadily declining over the remainder of the period. And we

saw volatility spike in several well-publicised stocks, driven by

the increasing influence of retail shareholders. All this resulted

in a wide dispersion of underlying asset returns; the first half of

the year reminding us again that decisions over where exposure is

held, and not just how much, is the key to achieving our Corporate

Objective. Our focus continued to be on ensuring the investment

approach remained disciplined, but with the right amount of

agility that these market conditions require.

The two principal KPIs we use for investment performance, the

ACWI and RPI+3%, measured 12.2% and 3.4% respectively over the half

year, resulting in your Company experiencing healthy

outperformance. As the JRCM Manager's Report explains, we saw

positive contributions across the majority of your Company's asset

categories, with private investments in particular producing strong

returns. This asset class has always been a key part of our

strategy, with the strength and breadth of JRCM's network providing

the ability to source and invest in high-quality deals, which would

otherwise be difficult for shareholders to access. Our long-term

approach allows us to integrate these private investments with

carefully considered allocations to stocks, equity and hedge funds,

absolute return and credit, and currencies. These diversified asset

categories are combined using sophisticated and dynamic portfolio

construction, overlaid with the intelligent use of hedges. We

continue to believe this differentiated approach offers something

truly distinct from many other offerings in both the investment

trust and wider fund universe.

With our Corporate Objective focused on long-term capital growth

and preservation, performance over a six--month period, while

desirable, is not our main aim. We seek to ensure that our approach

produces a high--quality return through market cycles. Looking at

recent years, it is gratifying to see continued strong performance,

with a three-year NAV return of 51.7%, and five-year of 83.4%.

However, it is equally important that we target these equity-type

returns with considerably less risk than if we were fully invested

in equity markets, aiming for reasonable participation in up

markets and to protect shareholders from the worst excesses of

market declines. Here, I am therefore also pleased that we compare

favourably, with monthly NAV volatility over five years at 8.3%

compared to the ACWI of 12.3%.

Share capital and dividend

The NAV performance is what we task our Manager with producing,

but we recognise that ultimately the return to shareholders is

through share price growth and dividends. As I have commented on

previously, the Board monitors the share price closely, with the

aim of minimising where possible the volatility for shareholders,

allowing the NAV to drive the share price. In this regard, we

bought back approximately 59,000 shares over March and June at a

cost of GBP1.4m, when we saw the shares trading on a high

single-digit discount. As a result, we now hold some 175,000 shares

in treasury, and we intend to continue to selectively purchase

shares in the market when we believe that it is beneficial to do

so.

We paid a first interim dividend of 17.625 pence per share in

April, and, in line with my comments in March, have declared a

second interim dividend of the same amount. This will be paid on 29

October to shareholders registered on 1 October, providing

shareholders with a total dividend in 2021 of 35.25 pence per

share, a modest increase over 2020.

Governance

We remain committed to the highest governance standards and

continue to spend time with shareholders, ensuring we understand

their views and resolve any concerns. We fully support the moves

towards greater diversity on Boards, and I will be outlining our

policy in this regard in the next Annual Report. In addition, we

are continuing to refine our approach in relation to ESG matters,

investing time with employees, managers and advisers to ensure that

our policy and our behaviour are consistent. We will also report to

shareholders in greater detail on this topic early next year.

I highlighted in March the extraordinary efforts and resilience

of our employees and counterparties over recent times. In the UK at

least, the relative success of the vaccine programme has meant that

things are beginning to ease even as cases rise. However, we have,

of course, not yet seen a return to normality in our day-to-day

lives, and my Board colleagues and I remain very grateful for the

continuing exceptional efforts of our colleagues in JRCM, our

suppliers and counterparties, which allow your Company to operate

as normal.

Outlook

Stock markets are often characterised as reflecting expectations

of the future. And yet, with some countries still experiencing

extraordinary challenges from the pandemic, economies impacted by

output constraints, and the risk of a sustained resurgence of

inflation and higher interest rates, the medium-term outcome could

be very different to the relatively benign one suggested by

markets. We remain temperamentally disinclined to chase short-term

liquidity-fuelled rallies and especially in periods of such

uncertainty. However, with the dedicated support of Board

colleagues and a highly skilled and effective team in our Manager,

I remain confident we have the right approach to continue to

deliver attractive returns to our shareholders.

Sir James Leigh-Pemberton

Chairman

30 July 2021

MANAGER'S REPORT

Overview

The first half of the year saw the gradual easing of Covid-19

restrictions following the successful deployment of vaccination

campaigns. Those nations that fared better in terms of speed and

uptake experienced an improvement in growth, but also the highest

inflation numbers for decades.

Global equity markets responded positively, as the spectre of

short-term interest rate rises was seemingly discounted. The

consensus appeared to view the inflation jump as transitory, with

central banks comfortable overshooting their targets in the short

term. Nonetheless inflation fears and the possibility of an end to

the era of cheap money will continue to be a source of concern.

While equity markets were generally positive, there was a wide

dispersion across sectors, styles and regions. The rotation from so

called 'long-duration' to 'short-duration' stocks, which began in

the last quarter of 2020, continued this year with value stocks

outperforming growth stocks for much of the period. On a regional

basis, many Western markets saw low double-digit returns, with

slower vaccination rates weighing on Japanese equities, and the

Chinese market under pressure from policy and, more importantly,

regulatory tightening.

The fixed income market had a difficult start as yields pushed

higher, particularly on long-dated bonds. With a recent more

hawkish stance on rates from the US Federal Reserve, there has been

a material shift in the shape of the curve with longer-term yields

declining, while yields at the shorter end increased. This

flattening of the curve dented the positive momentum of many

reflationary assets.

Sterling outperformed most major currencies over the last six

months, fuelled by a successful vaccination programme and a Bank of

England that remains resolute in addressing the potential rise of

inflation. The US dollar was on the back foot as US real rates

declined meaningfully, although the currency started to gain

momentum in the second quarter.

Performance highlights

The portfolio produced a NAV total return of 19.1%,

outperforming both our reference hurdles which measured 12.2% for

the ACWI and 3.4% for RPI+3%.

Key drivers of the performance:

-- A strong contribution from the private investment portfolio,

underpinned by the successful IPO of Coupang and supported

by gains across the direct and fund books;

-- Our quoted equity category contributed positively, led

by cyclical positions buoyed by increased economic activity

as well as some strong single stock picks;

-- The absolute return and credit book continued to provide

steady and largely uncorrelated returns, in particular

from distressed debt managers; and

-- In terms of headwinds, the relative strength of sterling

was the main detractor to performance in absolute terms.

In terms of portfolio allocation, our average net quoted equity

exposure was 46%, a slight increase over 2020. The exposure

continues to be largely dominated by our structural themes and in

particular Asian equities where we continue to see a long-term

potential for growth and excess returns. Just under a quarter of

the quoted book was allocated towards what we characterise as value

or cyclical stocks, targeting the gradual re-opening of economies

as the vaccine efficacy and rollout continued. Over the first six

months, we increased our allocation to quality defensive names such

as Unilever and Reckitt Benckiser, which we considered were

disproportionately punished by the rise in bond yields. Other

themes captured in the quoted equity book include biotech, quality

growth and companies benefiting from energy transition trends.

A core feature of our approach to portfolio construction is the

use of hedging. Here we focus both on macro positions (such as

broad equity market exposures or currencies) as well as individual

stocks, funds or themes, where we might decide to moderate the

exposure without having to sell the underlying positions. To help

protect the portfolio in downturns, we may also deploy various

types of 'tail hedges' designed to reduce the impact of such

negative volatility.

It was a strong period for our private investments. The

successful IPO of Coupang, the South Korean e--commerce giant,

contributed 5.5% in our private investments book at the IPO price

of $35.00. It was then transferred to the quoted portfolio, and the

share price ended June at $41.82. The remainder of the direct book

also saw widespread gains, reflecting positive company performance,

new investment rounds, as well as interest from special purpose

acquisition companies (SPACs).

Several new investments were made in the direct portfolio

including GBP21 million in Epic Systems, the largest healthcare

digital record platform in the US. We also invested GBP50 million

in Webull and GBP29 million in Robinhood, two financial technology

platforms disrupting the traditional retail trading ecosystem. As

part of a broad strategy seeking targeted exposure to disruptive

technologies, we made smaller investments totalling some GBP54

million, in promising companies.

The private funds book continued to benefit from strong

performance, with many of our core partners' funds seeing healthy

uplifts, helped by the portfolio tilt towards technology - one of

our structural themes. As normal, the valuation lag for this

industry means the majority of our funds are included at their 31

March valuations. Since the start of the year, we have made GBP173

million of commitments to new funds.

A key feature of our differentiated approach to portfolio

diversification is the absolute return and credit book. This saw

continued steady returns, with the strongest performance from those

managers focusing on distressed debt and special situations. Our

merger arbitrage funds also delivered pleasing returns. With credit

spreads tightening back to pre-pandemic levels, we have adopted a

more cautious approach to direct credit investments.

We continue to hold gold as a portfolio diversifier, especially

in a low interest rate environment and, viewing the US dollar as

again having the potential to provide a safe haven in times of

stress, we increased our allocation here.

While the results so far this year, and over recent years, are

pleasing, we nevertheless remain vigilant, and will not hesitate to

adjust the portfolio should the need arise. Experience suggests

that when there is a widespread consensus, investors can often get

trapped in a false sense of security and let their guard down. As

we emerge from the most serious public health crisis in modern

times, with systemic market uncertainties remaining, this is not

the time to relax. And rest assured that we will not.

With a strong team around us, we are confident that our dynamic

asset allocation and strong security selection skills, together

with global deal sourcing and integrated risk management, will

provide us with the best platform to continue to deliver

equity-type returns with less risk.

Francesco Goedhuis Ron Tabbouche

Chairman and Chief Executive Chief Investment Officer

Officer

J. Rothschild Capital Management J. Rothschild Capital Management

Limited Limited

Asset Allocation and Portfolio Contribution, six months to 30

June 2021

30 June 2021 Contribution

Asset category % NAV %

-------------------------------------- ------------ ------------

Quoted equity 52.1% 6.1%(1)

Private investments 28.9% 13.0%

Absolute return and credit 19.9% 1.6%

Real assets 1.3% -0.1%

Government bonds and rates 0.1% 0.2%

Currency -0.8% -1.2%(2)

------------ ------------

Total investments 101.5% 19.6%

Liquidity, borrowings and other -1.5% -0.5%(3)

-------------------------------------- ------------ ------------

Total 100.0% 19.1%

-------------------------------------- ------------ ------------

Average net quoted equity exposure(1) 46%

-------------------------------------- ------------ ------------

The quoted equity contribution reflects the profits from

(1) the net quoted equity exposure held during the period.

The exposure can differ from the % NAV as the former reflects

notional exposure through derivatives as well as estimated

adjustments for derivatives and/or liquidity held by managers.

Currency exposure is managed centrally on an overlay basis,

(2) with the translation impact and the results of the currency

hedging and overlay activity included in this category's

contribution.

This category's contribution includes interest, mark-to-market

(3) movements in the fixed interest notes and expenses.

ASSET CATEGORY (% OF NAV)

30 June 2021 31 December 2020

Asset category % NAV % NAV

---------------------------- --------------- --------------------

Quoted equity(1) 52% 48%

Private investments 29% 26%

Absolute return and

credit 20% 23%

Real assets 1% 2%

Government bonds and

rates 0% 0%

Currency -1% 1%

Liquidity, borrowings

and other -1% 0%

---------------------------- --------------- --------------------

Net assets 100% 100%

---------------------------- --------------- --------------------

Note: This table excludes exposure from derivatives.

(1) For the period ending 30 June 2021, the underlying net

quoted equity exposure averaged 46% (31 December 2020: 43%).

CURRENCY EXPOSURE (% OF NAV)

30 June 2021 31 December 2020

Currency % NAV % NAV

------------------- ------------------ ----------------------

US dollar 33% 18%

Sterling 49% 59%

Euro 2% 3%

Japanese yen 4% 6%

Other 12% 14%

------------------- ------------------ ----------------------

Net assets 100% 100%

------------------- ------------------ ----------------------

Note: This table excludes exposure from currency options.

REGULATORY DISCLOSURES

Statement of Directors' responsibilities

In accordance with the Disclosure and Transparency Rules 4.2.4R,

4.2.7R and 4.2.8R, we confirm that to the best of our

knowledge:

(a) The condensed set of financial statements has been prepared

in accordance with IAS 34, Interim Financial Reporting,

as contained in UK adopted international accounting standards,

as required by the Disclosure and Transparency Rule 4.2.4R;

(b) The Interim Review includes a fair review of the information

required to be disclosed under the Disclosure and Transparency

Rule 4.2.7R in an interim management report. This includes

an indication of important events that have occurred during

the first six months of the financial year, and their

impact on the condensed set of financial statements presented

in the Half-Yearly Financial Report. A further description

of the principal risks and uncertainties for the remaining

six months of the financial year is set out below; and

(c) In addition, in accordance with the disclosures required

under the Disclosure and Transparency Rule 4.2.8R, there

were no transactions with related parties in the first

six months of the current financial year that have had

a material effect on the financial position or performance

of the Group, or any changes to related party transactions

described in the Group's Report and Accounts for the year

ended 31 December 2020 that could do so.

Principal risks and uncertainties

The principal risk categories facing the Group for the second

half of the financial year are unchanged from those described in

the Report and Accounts for the year ended 31 December 2020. While

we are seeing some easing of restrictions in the UK, cases remain

elevated and the Covid-19 pandemic and the responses to it, are

continuing to influence many of the underlying risks. The principal

risks we identify comprise:

-- Investment strategy risk;

-- Market risk;

-- Liquidity risk;

-- Credit risk;

-- Key person dependency;

-- Legal and regulatory risk; and

-- Operational risk.

As an investment company, the most significant risk is

considered to be market risk. Many equity market indices saw

positive returns over the period, albeit with significant

variations in underlying stock performance. As economies continue

to experience differing levels of success with their response to

the pandemic, and investors also try to price the risks of a

sustained return of higher inflation and higher interest rates, we

may well see elevated levels of uncertainty and volatility over the

second half of the year.

From an operational risk perspective, the Manager has continued

to operate successfully on a predominantly remote basis, and we

remain satisfied with the effectiveness of the Group's internal

control environment. We have also actively monitored, and are

comfortable with, the measures put in place to ensure the health

and well--being of our employees, supported by the continuing

efforts of our many counterparties.

Going concern

The key factors likely to affect the Group's ability to continue

as a going concern were set out in the Report and Accounts for the

year ended 31 December 2020. While the pandemic continues to impact

daily lives, the Group's NAV has proven to be robust with healthy

growth over the period. As a result, the Company remains in a

strong position in relation to its ability to continue to operate.

At 30 June 2021, Group cash balances totalled GBP130 million and

there were committed but undrawn borrowings available of GBP150

million. Furthermore, the Directors have considered cash flow

forecasts for the period to 31 December 2022 as well as what the

Group considers readily realisable securities of GBP299 million,

and the substantial amounts that could be realised from the

remainder of the portfolio.

Having considered the above, the Directors have a reasonable

expectation that the Company and the Group have adequate resources

to continue in operational existence for the foreseeable future.

Accordingly, they continue to adopt the going concern basis in

preparing the condensed interim financial statements.

Sir James Leigh-Pemberton

Chairman

30 July 2021

For and on behalf of the Board

CONDENSED INTERIM FINANCIAL STATEMENTS

CONSOLIDATED INCOME STATEMENT AND CONSOLIDATED STATEMENT OF

COMPREHENSIVE INCOME (UNAUDITED)

CONSOLIDATED INCOME STATEMENT

For the six months ended 30 June

2021 2020

GBP million Notes Revenue Capital Total Revenue Capital Total

----------------------------- ----- ------- ------- ------ ------- ------- -------

Income and gains

Investment income 6.2 - 6.2 8.8 - 8.8

Other income 1.9 - 1.9 2.3 - 2.3

Gains/(losses) on fair value

investments - 710.4 710.4 - (80.2) (80.2)

Gains/(losses) on monetary

items and borrowings - 10.3 10.3 - 22.3 22.3

----------------------------- ----- ------- ------- ------ ------- ------- -------

8.1 720.7 728.8 11.1 (57.9) (46.8)

----------------------------- ----- ------- ------- ------ ------- ------- -------

Expenses

Operating expenses (14.0) (12.2) (26.2) (11.1) (2.5) (13.6)

----------------------------- ----- ------- ------- ------ ------- ------- -------

Profit/(loss) before finance

costs and tax 2 (5.9) 708.5 702.6 - (60.4) (60.4)

Finance costs (1.3) (5.2) (6.5) (1.7) (6.8) (8.5)

----------------------------- ----- ------- ------- ------ ------- ------- -------

Profit/(loss) before tax (7.2) 703.3 696.1 (1.7) (67.2) (68.9)

Taxation (0.2) (2.5) (2.7) - (0.2) (0.2)

----------------------------- ----- ------- ------- ------ ------- ------- -------

Profit/(loss) for the period (7.4) 700.8 693.4 (1.7) (67.4) (69.1)

----------------------------- ----- ------- ------- ------ ------- ------- -------

Earnings per ordinary share

- basic 3 (4.7)p 449.2p 444.5p (1.1)p (43.1)p (44.2)p

Earnings per ordinary share

- diluted 3 (4.7)p 446.4p 441.7p (1.1)p (43.1)p (44.2)p

----------------------------- ----- ------- ------- ------ ------- ------- -------

The total column of this statement represents the Group's

consolidated income statement, prepared in accordance with

international financial reporting standards (IFRS) as adopted by

the United Kingdom. The supplementary revenue return and capital

return columns are both prepared under guidance published by the

Association of Investment Companies (AIC). All items in the above

statement derive from continuing operations.

CONSOLIDATED STATEMENT OF COMPREHENSIVE INCOME

2021 2020

GBP million Revenue Capital Total Revenue Capital Total

--------------------------------------- ------- ------- ----- ------- ------- ------

Profit/(loss) for the period (7.4) 700.8 693.4 (1.7) (67.4) (69.1)

Revaluation gain/(loss) on property,

plant and equipment - - - - (1.0) (1.0)

Actuarial gain/(loss) in defined

benefit pension plan 3.9 - 3.9 (1.2) - (1.2)

Deferred tax (charge)/credit allocated

to actuarial gain/(loss) (1.6) - (1.6) 0.3 - 0.3

--------------------------------------- ------- ------- ----- ------- ------- ------

Total comprehensive income/(expense)

for the period (5.1) 700.8 695.7 (2.6) (68.4) (71.0)

--------------------------------------- ------- ------- ----- ------- ------- ------

The notes are an integral part of these condensed interim

financial statements.

CONSOLIDATED BALANCE SHEET (UNAUDITED)

30 June 31 December

GBP million Notes 2021 2020

-------------------------------------- ----- ------- -----------

Non-current assets

Investments held at fair value 4,360.3 3,520.2

Investment property 38.1 37.8

Property, plant and equipment 23.4 23.6

Deferred tax asset - 2.5

Retirement benefit asset 5.1 0.7

Derivative financial instruments 5.6 0.3

-------------------------------------- ----- ------- -----------

4,432.5 3,585.1

-------------------------------------- ----- ------- -----------

Current assets

Derivative financial instruments 12.2 57.3

Other receivables 236.6 105.3

Cash at bank 130.4 296.8

-------------------------------------- ----- ------- -----------

379.2 459.4

-------------------------------------- ----- ------- -----------

Total assets 4,811.7 4,044.5

-------------------------------------- ----- ------- -----------

Current liabilities

Borrowings (236.0) (189.0)

Derivative financial instruments (50.8) (4.5)

Deferred tax liability (1.8) -

Other payables (62.7) (63.5)

Amounts owed to group undertakings (5.1) (5.3)

-------------------------------------- ----- ------- -----------

(356.4) (262.3)

-------------------------------------- ----- ------- -----------

Net current assets/(liabilities) 22.8 197.1

-------------------------------------- ----- ------- -----------

Total assets less current liabilities 4,455.3 3,782.2

-------------------------------------- ----- ------- -----------

Non-current liabilities

Borrowings (172.4) (181.5)

Derivative financial instruments (15.0) (5.4)

Provisions (0.9) (1.1)

Lease liability (3.8) (3.8)

-------------------------------------- ----- ------- -----------

(192.1) (191.8)

-------------------------------------- ----- ------- -----------

Net assets 4,263.2 3,590.4

-------------------------------------- ----- ------- -----------

Equity attributable to owners of

the Company

Share capital 156.8 156.8

Share premium 45.7 45.7

Capital redemption reserve 36.3 36.3

Own shares reserve (7.9) (15.3)

Capital reserve 4,020.6 3,350.1

Revenue reserve - 5.1

Revaluation reserve 11.7 11.7

-------------------------------------- ----- ------- -----------

Total equity 4,263.2 3,590.4

-------------------------------------- ----- ------- -----------

Net asset value per ordinary share

- basic 4 2,728p 2,303p

Net asset value per ordinary share

- diluted 4 2,711p 2,292p

-------------------------------------- ----- ------- -----------

The notes are an integral part of these condensed interim

financial statements.

CONSOLIDATED STATEMENT OF CHANGES IN EQUITY (UNAUDITED)

Six months ended

30 June 2021 Capital Own

Share Share redemption shares Capital Revenue Revaluation Total

GBP million capital premium reserve reserve reserve reserve reserve equity

----------------------------- -------- -------- ----------- -------- -------- -------- ----------- -------

Balance at 1 January

2021 156.8 45.7 36.3 (15.3) 3,350.1 5.1 11.7 3,590.4

Profit/(loss) for

the year - - - - 700.8 (7.4) - 693.4

Revaluation gain/(loss)

on property, plant

and equipment - - - - - - - -

Actuarial gain/(loss)

in defined benefit

pension plan - - - - - 3.9 - 3.9

Deferred tax (charge)/credit

allocated to actuarial

gain/(loss) - - - - - (1.6) - (1.6)

----------------------------- -------- -------- ----------- -------- -------- -------- ----------- -------

Total comprehensive

income/(expense)

for the period - - - - 700.8 (5.1) - 695.7

----------------------------- -------- -------- ----------- -------- -------- -------- ----------- -------

Dividends paid (note

5) - - - - (27.5) - - (27.5)

Purchase of treasury

shares - - - - (1.4) - - (1.4)

Movement in own shares

reserve - - - 7.4 - - - 7.4

Movement in share-based

payments - - - - (1.4) - - (1.4)

----------------------------- -------- -------- ----------- -------- -------- -------- ----------- -------

Balance at 30 June

2021 156.8 45.7 36.3 (7.9) 4,020.6 - 11.7 4,263.2

----------------------------- -------- -------- ----------- -------- -------- -------- ----------- -------

Six months ended

30 June 2020 Capital Own

Share Share redemption shares Capital Revenue Revaluation Total

GBP million capital premium reserve reserve reserve reserve reserve equity

----------------------------- -------- -------- ----------- -------- -------- -------- ----------- -------

Balance at 1 January

2020 156.8 45.7 36.3 (7.8) 2,894.1 7.0 13.5 3,145.6

Profit/(loss) for

the year - - - - (67.4) (1.7) - (69.1)

Revaluation gain/(loss)

on property, plant

and equipment - - - - - - (1.0) (1.0)

Actuarial gain/(loss)

in defined benefit

pension plan - - - - - (1.2) - (1.2)

Deferred tax (charge)/credit

allocated to actuarial

gain/(loss) - - - - - 0.3 - 0.3

----------------------------- -------- -------- ----------- -------- -------- -------- ----------- -------

Total comprehensive

income/(expense)

for the period - - - - (67.4) (2.6) (1.0) (71.0)

----------------------------- -------- -------- ----------- -------- -------- -------- ----------- -------

Dividends paid (note

5) - - - - (27.4) - - (27.4)

Movement in own shares

reserve - - - (3.5) - - - (3.5)

Movement in share-based

payments - - - - 3.6 - - 3.6

----------------------------- -------- -------- ----------- -------- -------- -------- ----------- -------

Balance at 30 June

2020 156.8 45.7 36.3 (11.3) 2,802.9 4.4 12.5 3,047.3

----------------------------- -------- -------- ----------- -------- -------- -------- ----------- -------

The notes are an integral part of these condensed interim

financial statements.

CONSOLIDATED CASH FLOW STATEMENT (UNAUDITED)

Six months ended 30 June 30 June

GBP million 2021 2020

--------------------------------------------------------- ------- -------

Cash flows from operating activities:

Cash inflow/(outflow) before taxation and interest (173.6) (53.9)

Interest paid (6.4) (8.5)

--------------------------------------------------------- ------- -------

Net cash inflow/(outflow) from operating activities (180.0) (62.4)

--------------------------------------------------------- ------- -------

Cash flows from investing activities:

Purchase of property, plant and equipment (0.1) (0.2)

--------------------------------------------------------- ------- -------

Net cash inflow/(outflow) from investing activities (0.1) (0.2)

--------------------------------------------------------- ------- -------

Cash flows from financing activities:

Repayment of borrowings (185.0) -

Proceeds of borrowings 235.0 335.0

Purchase of ordinary shares by employee benefit trust(1) (5.4) (6.0)

Purchase of ordinary shares into treasury (1.4) -

Equity dividends paid (27.5) (27.4)

--------------------------------------------------------- ------- -------

Net cash inflow/(outflow) from financing activities 15.7 301.6

--------------------------------------------------------- ------- -------

Increase/(decrease) in cash in the period (164.4) 239.0

--------------------------------------------------------- ------- -------

Cash at the start of the period 296.8 61.1

--------------------------------------------------------- ------- -------

Effect of foreign exchange rate changes on cash (2.0) 8.0

--------------------------------------------------------- ------- -------

Cash at the period end 130.4 308.1

--------------------------------------------------------- ------- -------

(1) Shares are disclosed in the own shares reserve on the

consolidated balance sheet (unaudited).

The notes are an integral part of these condensed interim

financial statements.

NOTES TO THE FINANCIAL STATEMENTS (UNAUDITED)

1. Basis of accounting

These condensed financial statements are the half-yearly

consolidated financial statements of RIT Capital Partners plc (RIT

or the Company) and its subsidiaries (together, the Group) for the

six months ended 30 June 2021. They are prepared in accordance with

the Disclosure and Transparency Rules of the Financial Conduct

Authority, and with International Accounting Standard (IAS) 34,

Interim Financial Reporting, as adopted by the United Kingdom, and

were approved on 30 July 2021. These half-yearly consolidated

financial statements should be read in conjunction with the Report

and Accounts for the year ended 31 December 2020, which were

prepared in accordance with IFRS, as adopted by the European Union,

as they provide an update of previously reported information.

The half-yearly consolidated financial statements have been

prepared in accordance with the accounting policies set out in the

notes to the consolidated financial statements for the year ended

31 December 2020.

Critical accounting assumptions and judgements

As further described in the Report and Accounts for the year

ended 31 December 2020, areas requiring a higher degree of

judgement or complexity and areas where assumptions and estimates

are significant to the consolidated financial statements, are in

relation to the valuation of private investments and property.

Direct private investments are valued at the Manager's best

estimate of fair value in accordance with IFRS, having regard to

International Private Equity and Venture Capital Valuation

Guidelines as recommended by the British Private Equity &

Venture Capital Association. The inputs into the valuation

methodologies adopted include observable historical data such as

earnings or cash flow as well as more subjective data such as

earnings forecasts or discount rates. As a result of this, the

determination of fair value requires significant judgement.

2. Business and geographical segments

For both the six months ended 30 June 2021 and the six months

ended 30 June 2020, the Group is considered to have three principal

operating segments, all based in the UK, as follows:

AUM(1)

Segment Business GBP million Employees(1)

-------- ---------------------------------- ----------- ------------

RIT Investment trust - -

JRCM(2) Investment manager/administration 4,263 42

SHL(3) Events/premises management - 12

-------- ---------------------------------- ----------- ------------

(1) At 30 June 2021.

(2) J. Rothschild Capital Management Limited.

(3) Spencer House Limited.

Key financial information for the six months ending 30 June 2021

is as follows:

Net Income/ Operating Profit/

GBP million assets gains(1) expenses(1) (loss)(2)

--------------- ------- -------- ----------- ---------

RIT 4,152.6 729.2 (37.0) 692.2

JRCM 116.9 34.3 (23.7) 10.6

SHL 0.6 0.9 (1.1) (0.2)

Adjustments(3) (6.9) (35.6) 35.6 -

--------------- ------- -------- ----------- ---------

Total 4,263.2 728.8 (26.2) 702.6

--------------- ------- -------- ----------- ---------

Key financial information for the six months ending 30 June 2020

is as follows:

Net Income/ Operating Profit/

GBP million assets gains(1) expenses(1) (loss)(2)

--------------- ------- -------- ----------- ---------

RIT 2,961.0 (46.6) (21.0) (67.6)

JRCM 93.0 18.4 (11.0) 7.4

SHL 1.0 0.9 (1.1) (0.2)

Adjustments(3) (7.7) (19.5) 19.5 -

--------------- ------- -------- ----------- ---------

Total 3,047.3 (46.8) (13.6) (60.4)

--------------- ------- -------- ----------- ---------

(1) Includes intra-group income and expenses.

(2) Profit/(loss) before finance costs and tax.

(3) Consolidation adjustments in accordance with IFRS 10

Consolidated Financial Statements.

3. Earnings/(loss) per ordinary share - basic and diluted

The basic earnings per ordinary share for the six months ended

30 June 2021 is based on the profit of GBP693.4 million (six months

ended 30 June 2020: loss of GBP69.1 million) and the weighted

average number of ordinary shares in issue during the period of

156.8 million (six months ended 30 June 2020: 156.8 million). The

weighted average number of shares is adjusted for shares held in

the employee benefit trust (EBT) and in treasury in accordance with

IAS 33.

Six months Six months

ended 30 June ended 30 June

GBP million 2021 2020

----------------------------------- -------------- ---------------

Net revenue profit/(loss) (7.4) (1.7)

Net capital profit/(loss) 700.8 (67.4)

----------------------------------- -------------- ---------------

Total profit/(loss) for the period 693.4 (69.1)

----------------------------------- -------------- ---------------

Six months Six months

ended 30 June ended 30 June

Pence 2021 2020

----------------------------------------------- -------------- ---------------

Revenue profit/(loss) per ordinary share

- basic (4.7) (1.1)

Capital profit/(loss) per ordinary share

- basic 449.2 (43.1)

----------------------------------------------- -------------- ---------------

Total earnings/(loss) per ordinary share-basic 444.5 (44.2)

----------------------------------------------- -------------- ---------------

The diluted earnings per ordinary share for the period is based

on the weighted average number of ordinary shares in issue during

the period, adjusted for shares held in the EBT and treasury, and

the weighted average dilutive effect of share-based payment awards

at the average market price for the period.

The latter adjustment is not required for the period ended 30

June 2020 as an increase in the shares in issue would reduce the

basic loss per ordinary share. As a result, there is no difference

between the basic and diluted loss per ordinary share.

Six months Six months

ended 30 June ended 30 June

Weighted average (million) 2021 2020

------------------------------------- -------------- --------------

Number of shares in issue 156.8 156.8

RIT shares held in EBT (0.7) (0.6)

RIT shares held in treasury (0.1) -

------------------------------------- -------------- --------------

Basic shares 156.0 156.2

Effect of share-based payment awards 1.0 -

------------------------------------- -------------- --------------

Diluted shares 157.0 156.2

------------------------------------- -------------- --------------

Six months Six months

ended 30 June ended 30

Pence 2021 June 2020

------------------------------------------------- -------------- ----------

Revenue profit/(loss) per ordinary share

- diluted (4.7) (1.1)

Capital profit/(loss) per ordinary share

- diluted 446.4 (43.1)

------------------------------------------------- -------------- ----------

Total earnings/(loss) per ordinary share-diluted 441.7 (44.2)

------------------------------------------------- -------------- ----------

4. Net asset value per ordinary share - basic and diluted

Net asset value per ordinary share is based on the following

data:

30 June 2021 31 Dec 2020

----------------------------------------------- ------------ -----------

Net assets (GBP million) 4,263.2 3,590.4

----------------------------------------------- ------------ -----------

Number of shares in issue (million) 156.8 156.8

RIT shares held in EBT (0.3) (0.9)

RIT shares held in treasury (0.2) -

----------------------------------------------- ------------ -----------

Basic shares (million) 156.3 155.9

Effect of share-based payment awards (million) 1.0 0.8

----------------------------------------------- ------------ -----------

Diluted shares (million) 157.3 156.7

----------------------------------------------- ------------ -----------

Pence per share 30 June 2021 31 Dec 2020

--------------------------------------------- ------------ -----------

Net asset value per ordinary share - basic 2,728 2,303

Net asset value per ordinary share - diluted 2,711 2,292

--------------------------------------------- ------------ -----------

5. Dividends

Six months Six months

ended June ended June Six months Six months

2021 2020 ended June ended June

Pence per Pence per 2021 2020

share share GBP million GBP million

------------------------- ----------- ----------- ----------- -----------

Dividends paid in period 17.625 17.5 27.5 27.4

------------------------- ----------- ----------- ----------- -----------

The Board of Directors declared an interim dividend of 17.625

pence per ordinary share (GBP27.5 million) on 1 March 2021, which

was paid on 30 April 2021. The Board has declared the payment of a

second interim dividend of 17.625 pence per ordinary share (GBP27.5

million) in respect of the year ending 31 December 2021. This will

be paid on 29 October 2021, to shareholders on the register on 1

October 2021. Both payments are funded from accumulated capital

profits.

Additional commentary may be found in the Report and Accounts

for the year ended 31 December 2020.

6. Financial instruments

IFRS 13 requires the Group to classify its financial instruments

held at fair value using a hierarchy that reflects the significance

of the inputs used in the valuation methodologies. These are as

follows:

-- Level 1: Quoted prices (unadjusted) in active markets for

identical assets or liabilities;

-- Level 2: Inputs other than quoted prices included within

level 1 that are observable for the asset or liability, either

directly (i.e. as prices) or indirectly (i.e. derived from prices);

and

-- Level 3: Inputs for the asset or liability that are not based

on observable market data (i.e. unobservable inputs).

The vast majority of the Group's financial assets and

liabilities, investment properties and property, plant and

equipment are measured at fair value on a recurring basis.

The Group's policy is to recognise transfers into and transfers

out of fair value hierarchy levels at the end of the reporting year

when they are deemed to occur.

A description of the valuation techniques used by the Group with

regards to investments categorised in each level of the fair value

hierarchy is detailed below. Where the Group invests in a fund or a

partnership, which is not itself listed on an active market, the

categorisation of such investment between levels 2 and 3 is

determined by reference to the nature of the fund or partnership's

underlying investments. If such investments are categorised across

different levels, the lowest level of the hierarchy that forms a

significant proportion of the fund or partnership exposure is used

to determine the reporting disclosure.

If the proportion of the underlying investments categorised

between levels changes during the period, these will be

reclassified to the most appropriate level.

Level 1

The fair value of financial instruments traded in active markets

is based on quoted market prices at the balance sheet date. A

market is regarded as active if quoted prices are readily and

regularly available from an exchange, dealer, broker, industry

group, pricing service, or regulatory agency, and those prices

represent actual and regularly occurring market transactions on an

arm's length basis. The quoted market price used for financial

assets held by the Group is the current bid price or the last

traded price, depending on the convention of the exchange on which

the investment is quoted. Where a market price is available, but

the market is not considered active, the Group has classified these

investments as level 2.

Level 2

The fair value of financial instruments that are not traded in

an active market is determined by using valuation techniques which

maximise the use of observable market data where it is available.

Specific valuation techniques used to value OTC derivatives include

quoted market prices for similar instruments, counterparty quotes

and the use of forward exchange rates to estimate the fair value of

forward foreign exchange contracts at the balance sheet date.

Investments in externally managed funds which themselves invest

primarily in listed securities are valued at the price or net asset

value released by the investment manager or fund administrator as

at the balance sheet date.

Level 3

The Group considers all private investments, whether direct or

funds, (as described in the Investment Portfolio), as level 3

assets, as the valuations of these assets are not typically based

on observable market data. Where other funds invest into illiquid

stocks, these are also considered by the Group to be level 3

assets.

Private fund investments as well as direct co-investments are

held at the most recent fair values provided by the GPs managing

those funds/co-investments, and are subject to periodic review by

the Manager. The remaining directly-held private investments are

valued on a semi-annual basis using techniques including a market

approach, income approach and/or cost approach. The valuation

process involves the investment functions of the Manager who

prepare the proposed valuations, which are then subject to review

by the finance function, with the final valuations being presented

to the independent Valuations Committee of which the Audit and Risk

Committee chair is also a member. The specific techniques used will

typically include earnings multiples, discounted cash flow

analysis, the value of recent transactions, and, where appropriate,

industry specific methodologies. The acquisition cost, if

determined to be fair value, may be used to calibrate inputs to the

valuation. The valuations will often reflect a synthesis of a

number of distinct approaches in determining the final fair value

estimate. The individual approach for each investment will vary

depending on relevant factors that a market participant would take

into account in pricing the asset. These might include the specific

industry dynamics, the company's stage of development,

profitability, growth prospects or risk as well as the rights

associated with the particular security.

Borrowings at 30 June 2021 comprise bank loans and senior loan

notes. The bank loans are revolving credit facilities paying

floating interest and are typically drawn in tranches with a

duration of three or six months. The loans are therefore short-term

in nature, and their fair value approximates their nominal value.

The loan notes were issued in 2015 with tenors of between 10 and 20

years with a weighted average of 16 years. They are valued on a

monthly basis using a discounted cash flow model where the discount

rate is derived from the yield of similar tenor UK Government

bonds, adjusted for any significant changes in either credit

spreads or the perceived credit risk of the Company.

The fair value of investments in non-consolidated subsidiaries

is considered to be the net asset value of the individual

subsidiary as at the balance sheet date. The net asset value

comprises various assets and liabilities which are fair valued on a

recurring basis and is considered to be level 3.

On a semi-annual basis, the Group engages external, independent

and qualified valuers to determine the fair value of the Group's

investment properties and property, plant and equipment held at

fair value.

The following table analyses the Group's assets and liabilities

within the fair value hierarchy, at 30 June 2021:

As at 30 June 2021

GBP million Level 1 Level 2 Level 3 Total

---------------------------------------- ------- ------- ------- -------

Financial assets at fair value through

profit or loss (FVPL):

Portfolio investments 551.0 2,283.1 1,439.8 4,273.9

Non-consolidated subsidiaries - - 86.4 86.4

---------------------------------------- ------- ------- ------- -------

Investments held at fair value 551.0 2,283.1 1,526.2 4,360.3

Derivative financial instruments 4.4 13.4 - 17.8

---------------------------------------- ------- ------- ------- -------

Total financial assets at FVPL 555.4 2,296.5 1,526.2 4,378.1

---------------------------------------- ------- ------- ------- -------

Non-financial assets measured at fair

value:

Investment property - - 38.1 38.1

Property, plant and equipment - - 23.4 23.4

---------------------------------------- ------- ------- ------- -------

Total non-financial assets measured

at fair value - - 61.5 61.5

---------------------------------------- ------- ------- ------- -------

Financial liabilities at FVPL:

Borrowings - - (408.4) (408.4)

Derivative financial instruments (11.9) (53.9) - (65.8)

---------------------------------------- ------- ------- ------- -------

Total financial liabilities at FVPL (11.9) (53.9) (408.4) (474.2)

---------------------------------------- ------- ------- ------- -------

Total net assets measured at fair value 543.5 2,242.6 1,179.3 3,965.4

---------------------------------------- ------- ------- ------- -------

Other non-current assets 5.1

Cash at bank 130.4

Other current assets 236.6

Other current liabilities (69.6)

Other non-current liabilities (4.7)

---------------------------------------- ------- ------- ------- -------

Net assets 4,263.2

---------------------------------------- ------- ------- ------- -------

Movement in level 3 assets

Period ended 30 June 2021

Investments

held at fair

GBP million value Properties Total

---------------------------------- ------------- ---------- -------

Opening balance 1,232.1 61.4 1,293.5

Purchases 261.9 - 261.9

Sales (92.3) - (92.3)

Realised gains/(losses) through

profit or loss 4.5 - 4.5

Unrealised gains/(losses) through

profit or loss 479.7 0.3 480.0

Transfer out of level 3 (359.7) - (359.7)

Other - (0.2) (0.2)

---------------------------------- ------------- ---------- -------

Closing balance 1,526.2 61.5 1,587.7

---------------------------------- ------------- ---------- -------

During the period, one direct private investment with a fair

value of GBP333.4 million was reclassified from level 3 to level 2.

This reflected the fact that, following an IPO, its underlying

investment was listed. A second direct private investment with a

fair value of GBP26.3 million was reclassified from level 3 to

level 1 following an IPO.

Level 3 assets

Further information in relation to the directly-held private

investments is set out in the following table. This summarises the

portfolio by the primary method used in fair valuing the asset. As

we seek to employ a range of valuation methods and inputs in the

valuation process, selection of a primary method is subjective, and

designed primarily to assist the subsequent sensitivity

analysis.

Primary valuation method/approach 30 June 31 December

GBP million 2021 2020

---------------------------------- ------- -----------

Recent financing round(1) 191.5 47.7

Third-party valuations 161.9 202.5

Agreed sale/offer 18.6 -

Discounted cash flow (DCF) 11.3 14.0

Other industry metrics(1) 2.0 1.0

Market multiples 0.1 48.7

---------------------------------- ------- -----------

Total 385.4 313.9

---------------------------------- ------- -----------

(1) Included within these methods are direct private investments

held within the non-consolidated subsidiaries with a total of

GBP14.3 million (2020: GBP4.0 million)

For companies with positive earnings, we seek to utilise an

earnings multiple approach, typically using EBITDA or similar. The

earnings multiple is assessed by reference to similar listed

companies or transactions involving similar companies. When an

asset is undergoing a sale and the price has been agreed but not

yet completed or an offer has been submitted, we use the agreed or

offered price, often with a final discount to reflect the risks

associated with the transaction completing or any price

adjustments. Where a company has been the subject of a recent

financing round which is viewed as representative of fair value, we

will use this transaction price. Other methods employed include

discounted cash flow analysis and industry metrics such as

multiples of assets under management or revenue, where market

participants use these approaches in pricing assets. Where we have

co--invested alongside a GP, we typically utilise the GP's

valuation, consistent with our approach to private funds.

The following table provides a sensitivity analysis of the

valuation of directly-held private investments and the impact on

net assets:

Valuation method/approach Sensitivity analysis

------------------------- ------------------------------------------------------------------

Recent financing A 5% change in the value of these assets would result

round in a GBP9.6 million or 0.22% (2020: GBP2.4 million,

0.07%) change in net assets.

------------------------- ------------------------------------------------------------------

Third-party valuations A 5% change in the value of these assets would result

in a GBP8.1 million or 0.19% (2020: GBP10.1 million,

0.28%) change in net assets.

------------------------- ------------------------------------------------------------------

Agreed sale/offer A 5% change in the value of these assets would result

in a GBP0.9 million or 0.02% (2020: GBPnil) change

in net assets.

------------------------- ------------------------------------------------------------------

Discounted cash flow Assets in this category are valued using a weighted

average cost of capital range of 8% - 20%. A 1% increase/decrease

in the underlying discount rate would result in a

decrease/increase in the net assets of GBP2.4 million

or 0.06% (2020: GBP1.4 million, 0.04%)

------------------------- ------------------------------------------------------------------

Other industry metrics A 5% change in the value of these assets would result

in a GBP0.1 million or 0.002% (2020: GBP0.1 million,

0.001%) change in net assets.

------------------------- ------------------------------------------------------------------

Market multiples Assets in this category are valued using an EV/Revenue

of 4.5x. If the multiple used for valuation purposes

is increased/decreased by 5% then the net assets

would increase/decrease by GBP0.02 million or 0.001%

(2020: GBP0.6 million, 0.02%).

------------------------- ------------------------------------------------------------------

The investment property and property, plant and equipment with

an aggregate fair value of GBP61.5 million (2020: GBP61.4 million)

were valued using a third-party valuation provided by JLL. The

properties were valued using weighted average capital values of

GBP1,655 per square foot (2020: GBP1,652) developed from rental

yields and supported by recent market transactions. A GBP100 per

square foot increase/decrease in values would result in a GBP3.3

million or 0.08% increase/decrease (2020: GBP3.3 million, 0.09%) in

net assets.

The non-consolidated subsidiaries are held at their fair value

of GBP86.4 million (2020: GBP69.5 million) representing GBP80.7

million of portfolio investments (2020: GBP63.4 million) and GBP5.7

million of remaining assets and liabilities (2020: GBP6.1 million).

A 5% change in the value of assets would result in GBP4.3 million

or 0.1% (2020: GBP3.5 million, 0.1%) change in net assets.

The remaining investments held at fair value and classified as

level 3 were valued using third-party valuations from a GP,

administrator, or fund manager totalling GBP1,068.7 million (2020:

GBP852.7 million). A 5% change in the value of these assets would

result in a GBP53.4 million or 1.25% (2020: GBP42.6 million, 1.19%)

change in net assets.

In aggregate, the sum of the direct private investments,

investment property, property, plant and equipment,

non-consolidated subsidiaries and the remaining fund investments

represents the total level 3 assets of GBP1,587.7 million (2020:

GBP1,293.5 million).

The following table analyses the Group's assets and liabilities

within the fair value hierarchy, at 31 December 2020:

As at 31 December 2020

GBP million Level 1 Level 2 Level 3 Total

------------------------------------ ------- ------- ------- -------

Financial assets at FVPL:

Portfolio investments 538.7 1,749.4 1,162.6 3,450.7

Non-consolidated subsidiaries - - 69.5 69.5

------------------------------------ ------- ------- ------- -------

Investments held at fair value 538.7 1,749.4 1,232.1 3,520.2

Derivative financial instruments 5.8 51.8 - 57.6

------------------------------------ ------- ------- ------- -------

Total financial assets at FVPL 544.5 1,801.2 1,232.1 3,577.8

------------------------------------ ------- ------- ------- -------

Non-financial assets measured

at fair value:

Investment property - - 37.8 37.8

Property, plant and equipment - - 23.6 23.6

------------------------------------ ------- ------- ------- -------

Total non-financial assets measured

at fair value - - 61.4 61.4

------------------------------------ ------- ------- ------- -------

Financial liabilities at FVPL:

Borrowings - - (370.5) (370.5)

Derivative financial instruments (0.3) (9.6) - (9.9)

------------------------------------ ------- ------- ------- -------

Total financial liabilities at

FVPL (0.3) (9.6) (370.5) (380.4)

------------------------------------ ------- ------- ------- -------

Total net assets measured at

fair value 544.2 1,791.6 923.0 3,258.8

------------------------------------ ------- ------- ------- -------

Other non-current assets 3.2

Cash at bank 296.8

Other current assets 105.3

Other current liabilities (68.8)

Other non-current liabilities (4.9)

------------------------------------ ------- ------- ------- -------

Net assets 3,590.4

------------------------------------ ------- ------- ------- -------

Movements in level 3 assets

Investments

Year ended 31 December 2020 held at fair

GBP million value Properties Total

----------------------------------------- ------------ ---------- -------

Opening balance 1,132.6 60.3 1,192.9

Purchases 279.3 3.2 282.5

Sales (347.4) - (347.4)

Realised gains/(losses) through profit

or loss 48.9 - 48.9

Unrealised gains/(losses) through profit

or loss 250.6 0.1 250.7

Unrealised gains/(losses) through other

comprehensive income - (1.8) (1.8)

Transfer out of level 3 (131.9) - (131.9)

Other - (0.4) (0.4)

----------------------------------------- ------------ ---------- -------

Closing balance 1,232.1 61.4 1,293.5

----------------------------------------- ------------ ---------- -------

During the year, a direct private investment with a fair value

of GBP91.5 million was reclassified from level 3 to level 2. This

reflected the fact that, following an IPO, its main underlying

investments were listed. Investments in funds with a fair value of

GBP40.4 million were transferred from level 3 to level 2 as a

result of new financial information received during the year in

respect of the underlying investments of the funds.

7. Comparative information

The financial information contained in this Half-Yearly

Financial Report does not constitute statutory accounts as defined

in section 434 of the Companies Act 2006. The financial information

for the half years ended 30 June 2021 and 30 June 2020 has been

neither reviewed nor audited.

The information for the year ended 31 December 2020 has been

extracted from the latest published audited financial

statements.

The audited financial statements for the year ended 31 December

2020 have been filed with the Registrar of Companies and the report

of the auditors on those accounts contained no qualification or

statement under section 498(2) or (3) of the Companies Act

2006.

GLOSSARY AND ALTERNATIVE PERFORMANCE MEASURES

Glossary

Within this Half-Yearly Financial Report, we publish certain

financial measures common to investment trusts. Where relevant,

these are prepared in accordance with guidance from the AIC, and

this glossary provides additional information in relation to

them.

Alternative performance measures (APMs): APMs are numerical

measures of the Company's current, historical or future financial

performance, financial position or cash flows, other than financial

measures defined or specified in the Company's applicable financial

framework - namely IFRS and the AIC SORP. They are denoted with an

* in this section.

Gearing*: Gearing is a measure of the level of debt deployed

within the portfolio. The ratio is calculated in accordance with

AIC guidance as total assets, net of cash, divided by net assets

and expressed as a 'net' percentage, e.g. 110% would be shown as

10%.

30 June 31 December

GBP million 2021 2020

------------- ------- -----------

Total assets 4,811.7 4,044.5

Less: cash (130.4) (296.8)

------------- ------- -----------

Sub total 4,681.3 3,747.7

------------- ------- -----------

Net assets 4,263.2 3,590.4

------------- ------- -----------

Gearing 9.8% 4.4%

------------- ------- -----------

Leverage: Leverage, as defined by the Alternative Investment

Fund Managers Directive (AIFMD), is any method which increases the

exposure of the portfolio, whether through borrowings or leverage

embedded in derivative positions or by any other means.

MSCI All Country World Index: The MSCI All Country World Index

is a total return, market capitalisation-weighted equity index

covering major developed and emerging markets. Described in this

report as the ACWI or the ACWI (50% GBP), this is one of the

Company's KPIs or reference hurdles and, since its introduction in

2013, has incorporated a 50% sterling measure. This is calculated

using 50% of the ACWI measured in sterling and therefore exposed to

translation risk from the underlying foreign currencies. The

remaining 50% uses a sterling hedged ACWI from 1 January 2015 (from

when this is readily available). This incorporates hedging costs,

which the portfolio also incurs, to protect against currency risk

and is an investable index. Prior to this date it uses the index

measured in local currencies. Before December 1998, when total

return indices were introduced, the index is measured using a

capital-only version.

Net asset value (NAV) per share: The NAV per share is calculated

by dividing the total value of all the assets of the trust less its

liabilities (net assets) by the number of shares outstanding.

Unless otherwise stated, this refers to the diluted NAV per share,

with debt held at fair value.

NAV total return*: The NAV total return for a period represents

the change in NAV per share, adjusted to reflect dividends paid

during the period. The calculation assumes that dividends are

reinvested in the NAV at the month end following the NAV going

ex-dividend. The NAV per share at 30 June 2021 was 2,711 pence, an

increase of 419 pence, or 18.3%, from 2,292 pence at the previous

year end. As dividends totalling 17.625 pence per share were paid

during the period, the effect of reinvesting the dividends in the

NAV is 0.8%, which results in a NAV total return of 19.1%.

Net quoted equity exposure: This is the estimated level of

exposure that the trust has to listed equity markets. It includes

the assets held in the quoted equity category of the portfolio

adjusted for the notional exposure from quoted equity derivatives,

as well as estimated cash balances held by externally-managed funds

and estimated exposure levels from hedge fund managers.

Notional: In relation to derivatives, this represents the

estimated exposure that is equivalent to holding the same

underlying position through a cash security.

Premium/discount: The premium or discount (or rating) is

calculated by taking the closing share price on 30 June 2021 and

dividing it by the NAV per share at 30 June 2021, expressed as a

net percentage. If the share price is above/below the NAV per

share, the shares are said to be trading at a premium/discount.

RPI: The RPI refers to the United Kingdom Retail Price Index as

calculated by the Office for National Statistics and published

monthly. It is used as a measure of inflation in one of the

Company's KPIs RPI + 3.0% per annum.

Share price total return or total shareholder return (TSR)*: The

TSR for a period represents the change in the share price adjusted

to reflect dividends paid during the period. Similar to calculating

a NAV total return, the calculation assumes the dividends are

notionally reinvested at the daily closing share price following

the shares going ex-dividend. The share price on 30 June 2021

closed at 2,430 pence, an increase of 365 pence, or 17.7%, from

2,065 pence at the previous year end. Dividends totalling 17.625

pence per share were paid during the period, and the effect of

reinvesting the dividends in the share price is 0.8% which results

in a TSR of 18.5%. The TSR is one of the Company's KPIs.

END OF HALF-YEARLY FINANCIAL REPORT EXTRACTS

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR SDSFMSEFSELW

(END) Dow Jones Newswires

August 02, 2021 02:00 ET (06:00 GMT)

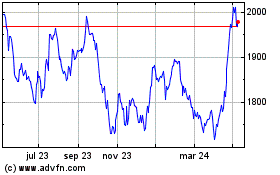

Rit Capital Partners (LSE:RCP)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

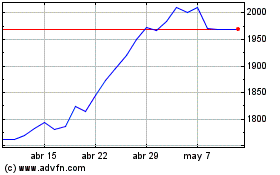

Rit Capital Partners (LSE:RCP)

Gráfica de Acción Histórica