TIDMRTW

RNS Number : 5771O

RTW Venture Fund Limited

11 October 2021

LEI: 549300Q7EXQQH6KF7Z84

11 October 2021

RTW Venture Fund Limited

Portfolio Company Update: Pyxis IPO

Pyxis Prices Upsized $168 Million IPO

RTW Venture Fund Limited (the "Company"), a London Stock

Exchange-listed investment company focused on identifying

transformative assets with high growth potential across the

biopharmaceutical and medical technology sectors, is pleased to

note the 07 October 2021 a nnouncement by one of its portfolio

companies, Pyxis Oncology , Inc. ("Pyxis") regarding its pricing of

an upsized $168 million initial public offering ("IPO") and

admission to trade on Nasdaq Global Market under ticker "PYXS".

Pyxis is a preclinical biotechnology company building a

differentiated portfolio of biologics, including antibody-drug

conjugates (ADCs) and immunotherapies, to improve the lives of

patients with difficult-to-treat cancers.

Prior to IPO, the Company, together with other funds managed by

RTW Investments, LP (the "Investment Manager"), co-led Pyxis' $152

million Series B financing round in March 2021.

Pyxis' IPO raised $168 million by offering 10.5 million shares

at $16.00 per share.

Stephanie Sirota, Chief Business Officer of the Investment

Manager and Director of the Company, said:

"We are delighted with Pyxis' successful IPO and look forward to

supporting the company in its effort to develop next generation

therapeutics for patients with difficult-to-treat cancers".

Pyxis' IPO pricing announcement can be accessed on its website

at: www.pyxisoncology.com, the full text of which is contained

below.

For Further Information

RTW Investments, LP +1 (646) 343 9280

Stephanie Sirota, Chief Business Officer

Alexandra Taracanova, PhD, Director of Investor Relations

Julia Enright, Senior Business Development Associate

Buchanan +44 (0)20 7466 5107

Charles Ryland

Henry Wilson

George Beale

About RTW Venture Fund Limited:

RTW Venture Fund Limited (LSE: RTW) is an investment company

focused on identifying transformative assets with high growth

potential across the biopharmaceutical and medical technology

sectors. Driven by a long-term approach to support innovative

businesses, RTW Venture Fund invests in companies developing

next-generation therapies and technologies that can significantly

improve patients' lives.

RTW Venture Fund Limited is managed by RTW Investments, LP, a

leading healthcare-focused entrepreneurial investment firm with

deep scientific expertise and a strong track record of supporting

companies developing life-changing therapies.

Visit the RTW website at www.rtwfunds.com for more

information.

Pyxis Announces Pricing of Upsized Initial Public Offering

CAMBRIDGE, Mass., Oct. 07, 2021 (GLOBE NEWSWIRE) -- Pyxis

Oncology, Inc. (Nasdaq: PYXS), a preclinical oncology company

focused on developing an arsenal of next-generation therapeutics to

target difficult-to-treat cancers and improve quality of life for

patients, today announced the pricing of its upsized initial public

offering of 10,500,000 shares of common stock at an initial public

offering price of $16.00 per share. All of the shares are being

offered by Pyxis. The gross proceeds from the offering, before

deducting underwriting discounts and commissions and other offering

expenses payable by Pyxis, are expected to be $168.0 million. The

shares are expected to begin trading on the Nasdaq Global Select

Market on October 8, 2021 under the ticker symbol "PYXS." The

offering is expected to close on October 13, 2021, subject to the

satisfaction of customary closing conditions. In addition, Pyxis

has granted the underwriters a 30-day option to purchase up to an

additional 1,575,000 shares of common stock at the initial public

offering price, less underwriting discounts and commissions.

BofA Securities, Jefferies, Credit Suisse and William Blair are

acting as joint book-running managers for the offering. LifeSci

Capital is also acting as an underwriter for the offering.

Registration statements relating to the offering have been filed

with the Securities and Exchange Commission and became effective on

October 7, 2021. The offering will be made only by means of a

prospectus. When available, copies of the final prospectus may be

obtained from BofA Securities, NC1-004-03-43, 200 North College

Street, 3rd Floor, Charlotte, North Carolina 28255-0001, Attention:

Prospectus Department, or by email at

dg.prospectus_requests@bofa.com; from Jefferies LLC, Attention:

Equity Syndicate Prospectus Department, 520 Madison Avenue, 2nd

Floor, New York, NY 10022, or by email at

Prospectus_Department@Jefferies.com or by telephone at

877-821-7388; from Credit Suisse Securities (USA) LLC, Attn:

Prospectus Department, 6933 Louis 31 Stephens Drive, Morrisville,

North Carolina 27560, Telephone:1-800-221-1037, or by email at

usa.prospectus@credit-suisse.com; or from William Blair, Attention:

Prospectus Department, 150 North Riverside Plaza, Chicago, IL

60606, or by telephone at (800) 621-0687 or by email at

prospectus@williamblair.com.

This press release shall not constitute an offer to sell or a

solicitation of an offer to buy these securities, nor shall there

be any offer or sale of these securities in any state or

jurisdiction in which such offer, solicitation or sale would be

unlawful prior to the registration or qualification under the

securities laws of any such state or jurisdiction.

About Pyxis

Pyxis Oncology, Inc. is a preclinical oncology company focused

on developing an arsenal of next-generation therapeutics to target

difficult-to-treat cancers and improve quality of life for

patients. Pyxis develops its product candidates with the objective

to directly kill tumor cells, and to address the underlying

pathologies created by cancer that enable its uncontrollable

proliferation and immune evasion. Since its launch in 2019, Pyxis

has developed a broad portfolio of novel antibody drug conjugate,

or ADC, product candidates, and monoclonal antibody, or mAb,

preclinical discovery programs that it is developing as

monotherapies and in combination with other therapies.

Investor Contact

Ashley Robinson

LifeSci Advisors, LLC

arr@lifesciadvisors.com

Media Contact

Jason Braco, Ph.D.

LifeSci Communications

jbraco@lifescicomms.com

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

UPDBIBDGCBBDGBG

(END) Dow Jones Newswires

October 11, 2021 02:00 ET (06:00 GMT)

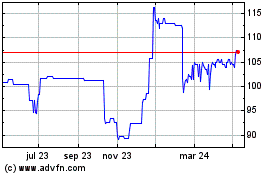

Rtw Biotech Opportunities (LSE:RTWG)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

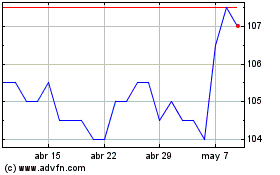

Rtw Biotech Opportunities (LSE:RTWG)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024