TIDMRUA

RNS Number : 8323E

RUA Life Sciences PLC

12 July 2021

RUA Life Sciences plc

("RUA Life Sciences", the "Company" or the "Group")

Final results for the year ended 31 March 2021

RUA Life Sciences, the holding company of a group of medical

device businesses focused on the exploitation of the world's

leading long-term implantable biostable polymer (Elast-Eon(TM) ),

announces its audited final results for the year ended 31 March

2021.

Highlights :

-- Results include full year trading of RUA Medical acquisition

now fully integrated into the Group, therefore, year-on-year

comparisons are less meaningful

o Revenue amounted to GBP1,528,000 (2020: GBP489,000)

o Operating loss was GBP1,551,000 (2020: GBP941,000), impacted

by Covid restrictions on elective surgeries

-- Year-end cash balances amounted to GBP6,294,000 (2020: GBP1,976,000)

-- Covid disruption successfully managed with little impact on key R&D projects

-- Board strengthened with appointment of two new directors

-- Biomaterials revenues exceeded original expectations

-- Successfully completed GBP7 million equity fund raise

-- Major capital expenditure programme underway to scale up

commercial production of vascular products and accelerate heart

valve R&D

-- Vascular graft testing met expectations - anticipated

commercial launch during current financial year

Bill Brown, Chairman of RUA Life Sciences, commented: "We set

very demanding objectives for the RUA Medical business on its

acquisition and, despite the considerable disruption to normal

business activities caused by the pandemic, I am very proud of how

much the team has achieved over the past year. RUA Life Sciences is

now well positioned to benefit from this hard work with the

anticipated commercial launch of the vascular graft product range

in the current financial year."

For further information contact:

RUA Life Sciences

Bill Brown, Chairman Tel: +44 (0)1294 317073

David Richmond, CEO Tel: +44 (0)1294 317073

Shore Capital (Nominated Adviser and Joint Broker) Tel: +44 (0)20 7408 4080

Tom Griffiths/David Coaten

Cenkos Securities plc (Joint Broker) Tel: +44 (0)20 7397 8900

Max Gould (Corporate Finance)

Michael Johnson (Sales)

About RUA Life Sciences

The RUA Life Sciences group was created in April 2020 when RUA

Life Sciences Plc (formerly known as AorTech International Plc)

acquired RUA Medical Devices Limited to create a fully formed

medical device business. RUA Life Sciences is the holding company

of the Group's four trading businesses, each exploiting the Group's

patented polymer technology.

Our vision is to improve the lives of millions of patients by

enabling medical devices with Elast-Eon (TM) , the world's leading

long-term implantable polyurethane.

Whether it is licensing Elast-Eon (TM) , manufacturing a device

or component, or developing next generation medical devices, a RUA

Life Sciences business is pursuing our vision.

Elast-Eon(TM)'s biostability is comparable to silicone while

exhibiting excellent mechanical, blood contacting and flex-fatigue

properties. These polymers can be processed using conventional

thermoplastic extrusion and moulding techniques. With over 7

million implants and 14 years of successful clinical use, RUA's

polymers are proven in long-term life enabling applications.

The Group's four business units are:

RUA Medical End-to-end contract developer and manufacturer

: of medical devices and implantable fabric specialist.

RUA Biomaterials Licensor of Elast-Eon (TM) polymers to the medical

: device industry.

RUA Vascular: Development of large bore polymer sealed grafts

and soft tissue patches.

RUA Structural Development of tri leaflet polymeric heart valves.

Heart :

A copy of this announcement will be available shortly at

www.rualifesciences.com/investor-relations/regulatory-news-alerts

.

CHAIRMAN'S STATEMENT

On behalf of the Board, I am pleased to present the Company's

audited final results for the year ended 31 March 2021.

On the first day of the financial year under review, the Company

completed the strategically important acquisition of RUA Medical

Devices Limited ("RUA Medical"). Since 2018, the Company has been

pursuing a strategy of moving up the value chain within medical

device manufacturing, from being a licensor of the world class long

term implantable polymer Elast-Eon(TM) to ultimately seeking to

market the Company's own range of Elast-Eon(TM) enabled devices.

The acquisition of RUA Medical has enabled the Company to

accelerate its ambitions by bringing a fully regulated

manufacturing and device design business into the Group. The

progress made over the past year in pursuit of our strategic

objectives has been very positive particularly given the extended

lock downs and disruption to supply chains as a result of

Covid-19.

Our first range of products, large bore vascular grafts, has

been fully developed and the key mechanical testing and in-vivo

trial results meet all of our design objectives and we are close to

submitting the file for regulatory clearance. However, due to the

unexpected presence of cellulose, a non-toxic, natural plant-based

material, in the recent analysis of the leachable extracts from the

graft samples tested, in what the Board believes is likely due to

contamination at some stage in the chain of custody, the Company

has decided to undertake an additional test on grafts from another

production batch and carry out detailed chemical analysis on the

original samples before submission to confirm the presence of

cellulose as a one-off. The Company continues to anticipate first

revenues from the sale of grafts by the end of the current

financial year. Meeting this timeframe has been enabled by the

acquisition of RUA Medical and the dedication and hard work by the

team. During the year, the Company also completed an equity fund

raise in December 2020, where the Company raised a total of GBP7.0

million (before expenses) providing the finance necessary to take

the business through the next phase of development.

Trading for Year

Trading for the year represents the consolidated results for the

enlarged Group and as such, year on year comparisons are largely

meaningless due to the scale of the acquired business being greater

than the parent company. As a result, I have sought to split out

the key comparatives. Total revenue for the year amounted to

GBP1,528,000 (2020: GBP489,000) which was represented by revenues

from the polymer business of GBP507,000 and RUA Medical,

GBP1,021,000. The polymer business performed ahead of our initial

expectations as a result of royalties from licensees being higher

than anticipated at the time of making the trading statement in

early May 2021. RUA Medical's revenues were derived from sales of

other medical devices produced as a sub-contract manufacturer.

Orders from its major customer were impacted by the deferral of

elective surgeries and we estimate that the impact was a reduction

in revenue of around GBP400,000. The operating loss for the year

was GBP1,551,000 (2020: GBP941,000). Of this loss, GBP249,000 was

recognised in the subsidiary, RUA Medical, which, as mentioned

above, was adversely affected by Covid-19 related reduction in

revenues. Administration expenses within the parent company

amounted to GBP1,818,000 compared to GBP1,123,000 last year. The

increase was due to a significant rise in professional fees for the

acquisition of RUA Medical together with the costs attributed to

the equity fund raise, plus additional expenditure on R&D

activities. Year-end cash balances amounted to GBP6,294,000 (2020:

GBP1,976,000). After the fund raise completed, the Group commenced

a period of capital investment in equipment necessary to scale up

the production capacity for both the manufacture of the vascular

product range and further development of the heart valve project.

Further details of the capital investment plans are discussed in

the Group Chief Executive's Report.

Research and Development costs have been charged through the

profit and loss account. R&D Tax Credits were recognised in the

year of GBP87,000 (2020: GBP81,000) which related to expenditure

incurred in the preceding financial year. During the year,

expenditure on the two main R&D projects, (being the Vascular

Graft and Heart Valve projects) increased by 123% to

GBP541,000.

Board

Following the acquisition of RUA Medical, David Richmond who had

been a Non-Executive Director of the Group became Group Chief

Executive Officer, with the governance benefits of splitting the

role of Chairman and CEO. The Executive Board was also strengthened

by the appointment of Dr Caroline Stretton in January 2021 as Group

Chief Operating Officer.

Gordon Wright, one of the founders of the predecessor company to

RUA Life Sciences retired from the Board during the year and I

would like to both personally, and on behalf of the Company, thank

Gordon for his many years' service and sound counsel. I am pleased

that Gordon continues to have a relationship with the Group as

Honorary Life President.

The Board had recognised the requirement for an independent

Non-Executive director to take on the role of Chair of the Audit

Committee. Our search criteria were very exacting as our preferred

candidate would not only be a qualified accountant and have

experience as a Finance Director of a listed or an AIM quoted

company but also have experience in the highly regulated medical

device industry. I am delighted that Ian Ardill, who joined the

Board in January 2021, was able to meet all of our

requirements.

The Board is now very well balanced between Executive and

Non-Executive directors with many years' experience and expertise

in all the necessary areas required for RUA Life Sciences to reach

its potential.

Outlook

While the past year has been very difficult for most businesses,

RUA has been able to achieve a great deal during the global

pandemic.

Major progress has been made over the past year with the

vascular graft development being a significant achievement. The

current year is expected to build upon this progress further. The

next major step is obtaining FDA clearance to market and, in

anticipation of this, we are currently making very good progress

with our engagement with potential partners, to both purchase our

grafts to incorporate into OEM devices and to take the grafts into

US hospitals on a distribution basis. Feedback from commercial

partners and key opinion leaders has been positive and the

opportunity to replace current animal-derived solutions to the

problem of sealing grafts with the unique properties of

Elast-Eon(TM) has been recognised as potentially game changing

disruptive technology. Our primary focus will be to secure a

successful commercial launch of this product line during the

current financial year.

The new technology invented as part of the graft project is now

being further exploited for other Group projects. The vascular

patch development is now advancing well utilising the core graft

IP, and a separate 510k incorporating a wider range of applications

than originally anticipated is also expected to be submitted during

the year.

Similarly, the Heart Valve project has now moved beyond the

initial proof of concept stage with the polymeric leaflet system

currently undergoing a number of manufacturing improvements. Some

of the data received from the animal testing on the graft programme

has very interesting implications for the next generation of heart

valves and we are now committing further resources to the project

in both engineers and in house testing equipment.

Your Board looks forward to the current year and beyond with a

great deal of confidence.

William Brown

Chairman

9 July 2021

GROUP CHIEF EXECUTIVE OFFICER'S REPORT

I am pleased to present my Report to shareholders of RUA Life

Sciences on the activities of the last year and our plans for the

current year. I would like to thank two key stakeholder groups for

their support of the Group over the past year. Firstly, the

employees who have embraced the new Group culture and objectives

whilst contributing so much during the uncertainties and disruption

of the global pandemic, and secondly our shareholders, both old and

new, who supported the fund raise to enable us to pursue our

ambitious plans. Our employees should feel very proud of what they

have achieved, and our shareholders are hopefully seeing that we

are delivering on the vision set out for the business. As

development continues, our plans for future investment in the

business are given below.

People

On acquisition of RUA Medical, the head count of the business

amounted to 25 split across production, quality, research and

development and administration functions. Despite the global

pandemic, we have grown the capacity of the business by investing

in our technical departments and recruited a number of highly

experienced engineers in both production and R&D thus head

count has now increased to 32. This growth is anticipated to

continue as the graft project transitions from R&D and is

handed over to production once regulatory clearance is received and

the not inconsiderable task of validating the new equipment

necessary to meet our production targets is achieved.

Capital Investment

On conclusion of the fundraise, the Group set the investment

plans for the business in train. Some of this investment was made

in the year to 31 March 2021 however, the scale of the total

project amounts to just over GBP2.5 million. The plans are

summarised as set out below.

RUA Medical textile capacity - GBP300,000 invested in new warper

and creel system together with weaving looms to scale up production

of graft materials. The capacity introduced should provide the feed

stock to allow around 18,000-20,000 grafts to be manufactured per

annum. Further graft and patch manufacturing equipment has also

been committed to at a total investment of around GBP750,000. The

manufacturing process has been highly automated and designed for a

single shift of 9 operatives to manufacture and pack 900 grafts a

month on a single shift basis (1,700 on a double shift).

The heart valve project also required further capital

investment. The total budget amounts to approximately GBP800,000,

split between testing equipment, manufacturing machinery and

associated tooling. Testing has been brought in house to reduce

lead time on testing prototype valves while shortening the time

between iterations and determination of the ultimate manufacturing

settings. Around 75 per cent. of the heart valve capital budget is

however contingent upon satisfactory results from the initial

testing regime.

RUA has always sought to anticipate future production needs and

it is currently anticipated that the production capacity for

patches and grafts from the current facility could be exhausted

within 24 months of market launch. For this reason, we recently

agreed to purchase the neighbouring industrial unit to our graft

manufacturing plant in Irvine, Scotland. This factory which is the

mirror image of the current facility includes 11,064 sq ft of

office and production space which can be configured to more than

triple clean room space while meeting production needs for a number

of years to come. Additionally, by consolidating the two units,

this will provide opportunities for further extensions on the

attached land. The budget for both the initial purchase, cleanroom,

office construction and fit out amounts to around GBP700,000 or a

little under GBP60 per square foot.

Research and Development

R&D activities are key to the future value creation of the

business. The investment made over the past year has taken the

grafts through around 80 prototypes, through design freeze and

subsequent in vitro and in vivo testing to allow FDA submission.

Further investment is planned to allow scale up of production

capacity and to bring the patches to a similar level of progress.

The budget for the current year amounts to around GBP700,000 with

deliverables being three FDA cleared product ranges.

The heart valve project is not as far advanced as the graft

project due to the complexity of the task, however, the

achievements of the past year have given the Board the confidence

to commit to an R&D budget of a further GBP700,000 in this area

with the objective of reaching design freeze and having durability

trials well under way. The leaflet system design allows the valve

to function well under hydrodynamic testing whilst the

computational modelling indicates very low stress levels on the

leaflets. The key to success of a polymeric leaflet heart valve is

a combination of long-term durability together with bio-stability

of the material. Having the IP to the Elast-Eon(TM) material is a

major advantage in development of this project. A detailed

literature review indicated that a number of projects were trialled

with textile leaflets which had good durability but fell short in

animal trials due to tissue ingrowth. The trials undertaken on our

graft project confirmed this tissue ingrowth issue with the control

grafts, however, the Elast-Eon(TM) sealant allowed tissue ingrowth

on the inside of the graft only and the external surface remained

remarkably free of any adhesion. As a result, the heart valve

project has been expanded to consider this textile reinforcement

opportunity based on the graft technology. The 100 per cent.

polymer leaflet is still being developed, however, in parallel we

are also pursuing a textile variant of the design. The theory being

that the mechanical properties of the leaflet material expressed as

a factor of the maximum stress on the leaflets would increase by a

factor of 30.

It is intended to trial both manufacturing methods against each

other through durability trials.

Elast-Eon(TM)

RUA Biomaterials is the IP licensing division that owns the

family of medical grade polymers known as Elast-Eon(TM).

Elast-Eon(TM) has been in long term human implants for well over 15

years and is the enabling technology behind over 7 million life

sustaining devices. Elast-Eon(TM) has an FDA Masterfile and testing

data has demonstrated the material to have all of the

characteristics necessary for a long-term implantable

biomaterial.

RUA Biomaterials has licensed manufacturing rights to Biomerics

and the rights to use the material to a number of other medical

device companies. During the year to 31 March 2021, royalty income

and licence fees from this business activity grew from GBP489,000

to GBP507,000. Whilst the increase in GBP terms is approximately 4

per cent., the increase in USD terms is closer to 12 per cent.

increasing from $608,000 to $679,000 in invoiced currency.

Elast-Eon(TM) is also being exploited by other Group companies

as the enabling technology behind the grafts and patches being

developed by RUA Vascular and the heart valve being developed by

RUA Structural Heart. Both RUA Biomaterials and our licensed

manufacturing partner are investing in the marketing of the

Elast-Eon(TM) polymer, and we expect to see further growth in this

area over the next few years as the material is adopted by more

device companies.

RUA Medical

RUA Medical was acquired by the Group at the start of the

financial year under review. It is a specialist end to end

subcontract designer, developer and manufacturer of bespoke

engineered medical devices with two facilities and four cleanrooms.

The business is unique in the field of implantable textile devices,

in being equipped to take a customer's product idea and progress it

from design straight through to delivering retail packaged devices

for clinical use. RUA Medical will continue to provide and grow

these services to third party customers but through the

availability of Elast-Eon(TM) polymers and know how, will expand

the offering to include textile medical devices enabled by

Elast-Eon(TM). Additionally, the RUA Medical team, facilities and

systems are now fully available to continue the product

developments for RUA Vascular and RUA Structural Heart.

This business was impacted most out of the Group by Covid

restrictions on surgeries. We worked hard to support our customers

through these difficult times and have been praised for quality of

service and on-time delivery. Having demonstrated this high level

of service, we believe it provides the opportunity to take on

additional product lines for our major customer.

The business also successfully retained its ISO 13485:2016

certification, and formally added the new cleanrooms to its Irvine

site and 'Contract Design and Development' to its current scope of

certification.

Commercial Opportunities

The priority for the current year on business development

activities is to organise the route to market for initially the

vascular graft products and secondly the soft tissue patches. Due

to the current regulatory regimes in place globally, we have

identified the North American market for first launch which

co-incidentally is also the highest value market by unit hospital

pricing. We estimate that annual global demand for large bore

surgically implanted grafts is around 200,000 units per annum of

which North America represents around 45 per cent. by volume.

Hospital pricing ranges from $1,000 to $3,000 depending on size and

complexity (i.e. our one piece aortic root graft). Additionally,

there is a market for grafts within the medical device industry for

use in heart assist devices and valved conduits. RUA Life Sciences

does not intend to sell grafts direct to hospitals but leverage the

existing infrastructure of cardiovascular salesforces by partnering

with distributors. This strategy reduces sales value potential

through the need to provide distributor margin but is compensated

for by the significantly lower costs of sales and marketing.

We are actively engaged with a number of potential distribution

partners and the product has been met with much enthusiasm both

from these sales focussed organisations and also from the KOL

surgeons who have been exposed to the concept of a non-animal

derived vascular graft. Most new products brought to the market are

"me too" versions of existing technology, ours on the other hand

has been described as a game changer and truly disruptive. We

understand that current recommendations to hospitals is that if a

non-biogenic (not animal sourced) product is available, this should

be offered to patient groups as an alternative.

We are now working on our plans for a European launch and

similar discussions are underway in key European territories

however the focus here is on organising the key centres to

undertake the clinical trials required. European commercial launch

is around 18 months to 2 years behind North America.

David Richmond

Group Chief Executive Officer

9 July 2021

STRATEGY

The strategy of the Group is simple. To exploit the benefits of

the Company's IP and the family of biostable polymers with

exceptional long-term performance. This is being undertaken

through:

-- licensing Elast-Eon(TM) to third parties through RUA Biomaterials;

-- developing textile based and Elast-Eon(TM) coated implantable devices through RUA Vascular;

-- developing a revolutionary and market disrupting

Elast-Eon(TM) leaflet polymeric heart valve through RUA Structural

Heart; and

-- becoming a centre of excellence for designing, developing and

manufacturing Elast-Eon(TM) based medical devices through RUA

Medical, whilst continuing to serve and expand its current customer

base.

RUA Life Sciences is the holding company of each of these

subsidiaries and will seek to maximise shareholder value by growing

each business to achieve attractive levels of profitability or

disposing of business areas if the valuations are attractive.

In the financial year to March 2022 it is intended that RUA

Vascular Limited and RUA Structural Heart Limited will begin to

trade as separate entities. All Research and Development work for

those two business areas has been undertaken through RUA Life

Sciences for the year ended 31 March 2021.

Summarised consolidated income statement

Year ended 31 March Year ended 31

2021 March 2020

Notes GBGBP000 GBGBP000

Revenue 1,528 489

Cost of sales (276) -

Gross Profit 1,252 489

Other income 279 14

Administrative expenses (2,690) (1,123)

Other expenses:

Share-based payments (128) (91)

Bad debt expense 8 (37)

Amortisation & depreciation (193)

---------------------- ----------------

Total administrative expenses (3,082) (1,444)

---------------------- ----------------

Operating loss (1,551) (941)

Finance (expense) / income (43) 44

---------------------- ----------------

Loss before taxation (1,594) (897)

Taxation 143 81

---------------------- ----------------

Loss from continuing operations

attributable to owners of

the parent company (1,451) (816)

---------------------- ----------------

Loss attributable to owners

of the parent company (1,451) (816)

---------------------- ----------------

Loss per share

Basic & Diluted (GB Pence

per share) 4 (8.20) (5.55)

Summarised consolidated statement of financial position

31 March 31 March

2021 2020

Notes GBGBP000 GBGBP000

Assets

Non current assets

Goodwill 301 -

Other intangible assets 574 255

Property, plant and equipment 1,952 5

Total non current assets 2,827 260

----------------- -------------------

Current assets

Inventories 85 -

Trade and other receivables 949 258

Cash and cash equivalents 6,294 1,976

Total current assets 7,328 2,234

----------------- -------------------

Total assets 10,155 2,494

----------------- -------------------

Equity & Liabilities

Equity

Issued capital 12,949 12,574

Share premium 11,729 4,550

Other reserve (1,697) (1,825)

Profit and loss account (14,475) (13,024)

----------------- -------------------

Total equity attributable to equity

holders of the parent 8,506 2,275

----------------- -------------------

Liabilities

Non-current liabilities

Borrowings 223 -

Lease liabilities 124 -

Deferred tax 163 -

Other liabilities 40 -

----------------- -------------------

Total non-current liabilities 550 -

----------------- -------------------

Current liabilities

Borrowings 23 -

Lease liabilities 40 -

Trade and other payables 1,016 219

Other liabilities 20 -

Total current liabilities 1,099 219

----------------- -------------------

Total liabilities 1,649 219

Total equity and liabilities 10,155 2,494

----------------- -------------------

Summarised consolidated cash flow statement

Year ended

Year ended 31 March

31 March 2021 2020

GBGBP000 GBGBP000

Cash flows from operating activities

Group loss after tax (1,451) (816)

Adjustments for:

Amortisation of intangible assets 68 193

Depreciation of property, plant and

equipment 204 1

Share-based payments 128 91

Interest expense/(income) 9 (7)

Tax credit in year (143) (81)

(Increase) / decrease in trade and

other receivables (589) (20)

(Increase) / decrease in inventories 7 -

Increase / (decrease in taxation 122 81

Increase / (decrease) in trade and

other payables 231 120

---------------- -------------------------

Net cash flow from operating activities (1,414) (438)

Cash flows from investing activities

Purchase of property plant and equipment (620) (5)

Proceeds from disposal of property

plant and equipment 18 -

Acquisition of subsidiary net of cash

acquired (341) -

Interest received / (paid) (9) 7

Net cash flow from investing activities (952) 2

---------------- -------------------------

Cash flows from financing activities

Proceeds of issue of share capital,

net of issue costs 6,462 -

Proceeds from borrowing 260

Repayment of borrowings and leasing

liabilities (38)

---------------- -------------------------

Net cash flow from financing activities 6,684 -

---------------- -------------------------

Net (decrease)/increase in cash and

cash equivalents 4,318 (436)

Cash and cash equivalents at beginning

of year 1,976 2,412

Cash and cash equivalents at end of

year 6,294 1,976

================ =========================

Summarised consolidated statement of changes in equity

Issued Profit

share Other and loss

capital Share premium reserve account Total equity

GBGBP000 GBGBP000 GBGBP000 GBGBP000 GBGBP000

--------- ------------- --------- --------- ------------

Balance at 31 March 2019 12,574 4,550 (1,916) (12,208) 3,000

Share-based payments - - 91 - 91

Issue of equity share capital - - - - -

(net of issue costs)

--------- ------------- --------- --------- ------------

Transactions with owners - - 91 - 91

--------- ------------- --------- --------- ------------

Total comprehensive loss for

the year - - - (816) (816)

Balance at 31 March 2020 12,574 4,550 (1,825) (13,024) 2,275

--------- ------------- --------- --------- ------------

Share-based payments - - 128 - 128

Issue of equity share capital

- acquisition

(net of fees) - note 3 75 1,004 - - 1,079

Issue of equity share capital

- exercise of warrants 8 42 - - 50

Issue of equity share capital

(net of issue costs) - fundraise 292 6,133 - - 6,425

Transactions with owners 375 7,179 128 - 7,682

--------- ------------- --------- --------- ------------

Total comprehensive loss for

the year - - (1,451) (1,451)

--------- ------------- --------- --------- ------------

Balance at 31 March 2021 12,949 11,729 (1,697) (14,475) 8,506

--------- ------------- --------- --------- ------------

NOTES TO THE EXTRACTS FROM THE CONSOLIDATED FINANCIAL

STATEMENTS

1. Basis of preparation

The extracts from the Consolidated financial statements are for

the year ended 31 March 2021. They have been prepared in compliance

with International Financial Reporting Standards (IFRS) in

conformity with the requirements of the Companies Act 2006.

The Consolidated financial statements have been prepared under

the historical cost convention, with the exception of fair value

adjustments made in connection with the acquisition of RUA

Medical.

The accounting policies remain unchanged from the previous

year.

2. Going concern

After considering the year end cash position, making appropriate

enquiries and reviewing budgets and profit and cash flow forecasts

to 31 October 2022 which incorporate planned investment in new

product development and assumptions related to the return towards

normal business particularly relating to the RUA Medical Devices

subsidiary, the Directors have formed a judgement at the time of

approving the financial statements that there is a reasonable

expectation that the Group has sufficient resources to continue in

operational existence for the foreseeable future. For this reason,

the Directors consider that the adoption of the going concern basis

in preparing the consolidated financial statements is

appropriate.

3. Preliminary announcement

The summary accounts set out above do not constitute statutory

accounts as defined by section 434 of the UK Companies Act 2006.

The summarised consolidated statement of financial position at 31

March 2021, the summarised consolidated income statement, the

summarised consolidated statement of changes in equity and the

summarised consolidated cash flow statement for the year then ended

have been extracted from the Group's statutory financial statements

for the year ended 31 March 2021 upon which the auditor's opinion

is unqualified and did not contain a statement under either

sections 498(2) or 498(3) of the Companies Act 2006. The audit

report for the year ended 31 March 2021 did not contain statements

under sections 498(2) or 498(3) of the Companies Act 2006. The

statutory financial statements for the year ended 31 March 2020

have been delivered to the Registrar of Companies. The 31 March

2021 accounts were approved by the Directors on 9 July 2021, but

have not yet been delivered to the Registrar of Companies.

4. Earnings per share

The basic and diluted loss per ordinary share of 8.20 pence

(2020: loss of 5.55 pence) is calculated on the loss of the Group

of GBP1,415k (2020: loss of GBP816k) and on 17,697,120 (2020:

14,686,608 ) ordinary shares, being the weighted average number of

shares in issue during the year.

Posting and availability of accounts

The annual report and accounts for the year ended 31 March 2021

will be sent by post or electronically to all registered

shareholders on 29 July 2021. Additional copies will be available

for a month thereafter from the Company's office 2 Drummond

Crescent, Riverside Business Park, Irvine, Ayrshire KA11 5AN.

Alternatively, the document may be viewed on, or downloaded from,

the Company's website: www.rualifesciences.com .

Notice of Annual General Meeting

Notice of the twenty-fourth Annual General Meeting of RUA Life

Sciences plc will be posted with the Annual Report and Accounts and

will be held at RUA Medical's premises at 2 Drummond Crescent,

Riverside Business Park, Irvine, Ayrshire KA11 5AN on Tuesday, 31

August 2021 at 11:00am.

COVID-19 AND THE AGM PROCESS

The Company has been monitoring developments in relation to the

Covid-19 pandemic, including the public heath guidance. Given the

continued social distancing, travel restrictions and other safety

measures imposed by the Government as a result of Covid-19, we

strongly advise that shareholders do NOT attend the AGM in person,

but instead appoint the Chairman of the meeting as proxy to vote on

their behalf.

Further details will be included in the Annual Report and will

published on the Company's website at www.rualifesciences.com .

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

FR RLMPTMTBMBRB

(END) Dow Jones Newswires

July 12, 2021 02:00 ET (06:00 GMT)

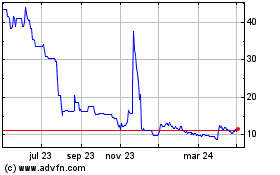

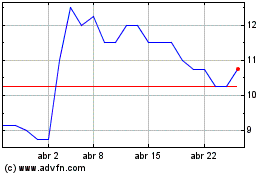

Rua Life Sciences (LSE:RUA)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Rua Life Sciences (LSE:RUA)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024