TIDMRBW

RNS Number : 8607O

Rainbow Rare Earths Limited

13 October 2021

THIS ANNOUNCEMENT CONTAINS INSIDE INFORMATION AS DEFINED UNDER

THE MARKET ABUSE REGULATION (EU) NO. 596/2014, AS AMED AS IT FORMS

PART OF UK LAW BY VIRTUE OF THE EUROPEAN (WITHDRAWAL) ACT 2018,

(MAR), IS FOR INFORMATION PURPOSES ONLY AND IS NOT AN OFFER OF

SECURITIES IN ANY JURISDICTION THIS ANNOUNCEMENT AND THE

INFORMATION IN IT, IS NOT FOR PUBLICATION, RELEASE OR DISTRIBUTION,

DIRECTLY OR INDIRECTLY, IN WHOLE OR IN PART, IN OR INTO THE UNITED

STATES, AUSTRALIA, CANADA, NEW ZEALAND, JAPAN, THE REPUBLIC OF

SOUTH AFRICA OR ANY OTHER JURISDICTION WHERE TO DO SO MIGHT

CONSTITUTE A VIOLATION OR BREACH OF ANY APPLICABLE LAW OR

REGULATION.

NOT FOR DISTRIBUTION TO UNITED STATES NEWSWIRE SERVICES OR FOR

DISSEMINATION IN THE UNITED STATES.

FOR IMMEDIATE RELEASE

Rainbow Rare Earths Limited

("Rainbow" or the "Company")

(LSE: RBW)

13 October 2021

Placing of new Ordinary Shares raises GBP6.435 million at 15p

per share

Rainbow is pleased to announce that it has agreed to

conditionally issue 42,900,000 new ordinary shares in the Company

of no par value each ("Ordinary Shares") at a price of 15p per

Ordinary Share (the "Placing Price"), thereby raising gross

proceeds of GBP6.435 million (the "Placing"). The Placing Price

represents a 3.4% premium to the closing mid-market share price of

14.5p per Ordinary Share on 11 October 2021 when the Placing Price

was agreed.

The 42,900,000 Ordinary Shares to be issued at the Placing Price

includes :

-- GBP2.250 million received from TechMet Limited ("TechMet")

via a direct subscription with the Company ("TechMet

Subscription"). TechMet is a private industrial company that is

building strategic positions in world-class projects across the

technology metals supply chain. The U.S. International Development

Finance Corporation, an agency of the U.S. government that invests

in overseas development projects, is a major investor in

TechMet.

-- GBP4.185 million received from other investors, including global institutional investors.

Reasons for the Placing

The Placing proceeds, which total approximately US$8.5 million,

net of estimated costs totalling US$0.3 million, will be used as

follows:

-- US$0.5 million to complete work for the Phalaborwa

preliminary economic assessment ("PEA"), expected in H2 2021.

-- US$3.0 million for further technical work at Phalaborwa

beyond the PEA to work towards a bankable feasibility study,

excluding on site pilot testing of the final processing

flowsheet.

-- Up to US$1.0 million for the Gakara Project in Burundi.

Subject to the approval of the Government of Burundi, concentrate

with an estimated sale value of US$1.3 million is available to fund

the recommencement of trial mining and processing operations at

Gakara, and there is therefore no intention to keep the operation

on care and maintenance. However, a maximum of US$1.0 million of

the Placing proceeds will be used for working capital to maintain

Gakara on care and maintenance until December 2022, if

required.

-- US$1.0 million to allow repayment of the balance of an

unsecured loan, including accrued interest of US$0.1 million,

received in February 2020 from Pipestone Capital Inc ("Pipestone"),

of which George Bennett (Rainbow's CEO) is the ultimate beneficiary

. Under the terms of the Pipestone loan agreement, the loan is

repayable following the Placing and it is anticipated that

repayment will occur in November 2021 following receipt of the

proceeds of the Placing and the renewal of the Company's

authorisation to issue new Ordinary Shares at its Annual General

Meeting to be held on 17 November 2021 ("AGM"). Pipestone can

elect, at its sole discretion, to require all or part of the loan

to be settled in Ordinary Shares at the Placing Price, which may

require the Company to issue up to 5.2 million additional shares

after the AGM.

-- US$3.0 million for general working capital purposes.

Of the 42,900,000 Ordinary Shares issued under the Placing,

10,000,000 Ordinary Shares to be issued to TechMet under the

TechMet Subscription are subject to the approval of shareholders at

the AGM to be held on 17 November 2021 as set out in more detail

below ("Shareholder Approval").

George Bennett, Chief Executive Officer of Rainbow, said:

"We are very encouraged by the strong support we have received

from both existing and new institutional shareholders in the

Placing, which was significantly over-subscribed. With its

stringent investment criteria and its goal to secure the critical

metals for the global technology revolution, we welcome the

substantial investment by TechMet, which counts the U.S. government

as a major investor.

We believe that demand for rare earths required in permanent

magnets is poised for continued strong growth, as evidenced by the

85% increase in the price of both Neodymium and Praseodymium oxide

between November 2020 and September 2021. With our diversified

asset portfolio, which includes the exciting near-term growth

opportunity presented by the Phalaborwa Project in South Africa,

Rainbow is uniquely positioned to deliver into this growing market.

The preliminary economic assessment at Phalaborwa is expected to be

completed shortly and we believe it will serve to demonstrate the

exceptional quality and favourable characteristics of this rare

earths project."

Participation of the Directors

At 13 October 2021 the Company remains in a closed period ahead

of publication of the Annual Report for the year ended 30 June

2021, expected to be announced in October 2021. Accordingly, the

Company's Directors have not been permitted to participate in the

Placing.

Total voting rights and Admission

An application has been made for the initial 32,900,000 Ordinary

Shares issued pursuant to the Placing (the "Unconditional Shares")

to be admitted to the Official List (by way of a Standard Listing)

and to trading on the London Stock Exchange Plc's Main Market for

listed securities ("First Admission"). It is expected that First

Admission will become effective and that dealing in the

Unconditional Shares will commence on or around 18 October 2021.

The Unconditional Shares will rank pari passu with the existing

Ordinary Shares. Following Admission of the Unconditional Shares,

the Company will have 511,811,434 Ordinary Shares in issue.

The issue of a further 10,000,000 Ordinary Shares pursuant to

the TechMet Subscription (the "Conditional Shares") is subject to

Shareholder Approval. It is expected that admission of the

Conditional Shares will become effective and that dealing in the

Conditional Shares will commence on or around 22 November 2021

("Second Admission") following the AGM. The Conditional Shares will

rank pari passu with the existing Ordinary Shares.

Following the First Admission and prior to the AGM and the issue

of the Conditional Shares, the above figures of 511,811,434

Ordinary Shares may be used by shareholders as the denominator for

the calculations by which they will determine if they are required

to notify their interest in, or a change to their interest in, the

Company under the FCA's Disclosure, Guidance and Transparency

Rules.

IMPORTANT NOTICES

This announcement includes "forward looking statements" which

include all statements other than statements of historical facts,

including, without limitation, those regarding the Company's

financial position, business strategy, plans and objectives of

management for future operations, or any statements proceeded by,

followed by or that include the words "targets", "believes",

"expects", "aims", "intends", "will", "may", "anticipates",

"would", "could" or similar expressions or negatives thereof. Such

forward looking statements involve known and unknown risks,

uncertainties and other important factors beyond the Company's

control that could cause the actual results, performance or

achievements of the Company to be materially different from future

results, performance or achievements expressed or implied by such

forward looking statements. Such forward looking statements are

based on numerous assumptions regarding the Company's present and

future business strategies and the environment in which the Company

will operate in the future. These forward-looking statements speak

only as at the date of this announcement. Except as required by the

FCA, the London Stock Exchange or applicable law (including as may

be required by the Listing Rules, the Prospectus Regulation, the

Prospectus Rules, MAR and the Disclosure Guidance and Transparency

Rules), the Company expressly disclaims any obligation or

undertaking to disseminate or release publicly any updates or

revisions to any forward looking statements contained in this

announcement to reflect any change in the Company's expectations

with regard thereto or any change in events, conditions or

circumstances on which any such statements are based.

MARKET ABUSE REGULATION

Market soundings, as defined in MAR, were taken in respect of

the Placing, with the result that certain persons became aware of

inside information, as permitted by MAR. That inside information is

set out in this announcement and has been disclosed as soon as

possible in accordance with paragraph 7 of article 17 of MAR.

Therefore, those persons that received inside information in a

market sounding are no longer in possession of inside information

relating to the Company and its securities.

**S**

For further information, please contact

Rainbow Rare Earths George Bennett +27 82 652 8526

Ltd Company Pete Gardner +44 (0) 771 779 4251

SP Angel Corporate Ewan Leggat

Finance LLP Broker Charlie Bouverat +44 (0) 20 3470 0470

--------- ------------------- --------------------------------------

Flagstaff Strategic Tim Thompson +44 (0) 207 129 1474

and Investor Communications Fergus Mellon rainbowrareearths@flagstaffcomms.com

------------------ --------------------------------------

Notes to Editors:

Rainbow's strategy is to become a globally-significant producer

of rare earth metals. Nd/Pr are vital components of the strongest

permanent magnets used for the motors and turbines driving the

green technology revolution. Analysts are predicting demand for

magnet rare earth oxides will grow substantially over the coming

years, driven by increasing adoption of green technology, pushing

the overall market for Nd/Pr into deficit.

The Phalaborwa Rare Earths Project, located in South Africa,

comprises an Inferred Mineral Resource Estimate of 38.3Mt at 0.43%

total rare earths oxides ("TREO") contained within gypsum tailings

stacked in unconsolidated dumps derived from historic phosphate

hard rock mining. High value Nd/Pr oxide represent 29.1% of the

total contained rare earth oxides, with economic Dysprosium and

Terbium oxide credits enhancing the overall value of the rare earth

basket contained in the stacks. The rare earths are contained in

chemical form in the gypsum dumps, which is expected to deliver a

higher-value rare earth carbonate, with lower operating costs than

a typical rare earth mineral project.

The Company's Gakara Project in Burundi has produced one of the

highest-grade concentrates in the world (typically 54% TREO)

through trial mining operations. The Gakara basket is weighted

heavily towards Nd/Pr, which account for over approximately 19.5%

of the contained TREO and 85% of the value of the concentrate.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

ROIBRBDGGBBDGBD

(END) Dow Jones Newswires

October 13, 2021 02:00 ET (06:00 GMT)

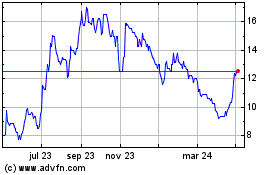

Rainbow Rare Earths (LSE:RBW)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

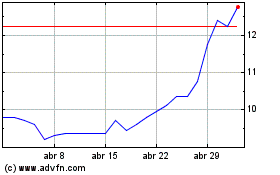

Rainbow Rare Earths (LSE:RBW)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024