TIDMRBW

RNS Number : 4913Q

Rainbow Rare Earths Limited

28 October 2021

Rainbow Rare Earths Limited

("Rainbow" or the "Company")

(LSE: RBW)

28 October 2021

Preliminary Announcement of results for the year ended 30 June

2021

Rainbow Rare Earths Ltd is pleased to announce its preliminary

results for the year ended 30 June 2021 ("FY 2021").

The financial information in this release does not constitute

the Financial Statements. The Group's Annual Report, which includes

the audit report and audited Financial Statements for the year

ended 30 June 2021, will be available on the Company's website at

www.rainbowrareearths.com .

Highlights

-- As pressure continues to accelerate around the globe to reach

the net-zero goals of the Paris Agreement, we believe Rainbow is

well positioned to develop a responsible, independent, rare earths

supply chain.

-- Strong and diversified demand for the rare earth elements

required for use in permanent magnets, namely Neodymium and

Praseodymium ("NdPr"), together with Dysprosium ("Dy") and Terbium

("Tb"), underpinned by key global macroeconomic trends.

-- Rainbow's rare earths basket prices for the Gakara project

have risen 64% during FY 2021, significantly outstripping forecast

price rises. The Phalaborwa basket is more highly geared to high

value NdPr, with additional economic Dy and Tb credits, and has

seen a 67% increase over FY 2021.

-- JORC (2012) compliant inferred mineral resource estimate at

the Phalaborwa Project in South Africa of 38.3Mt at 0.43% total

rare earth oxide ("TREO").

-- Exclusive rare earths separation technology agreement signed with K-Technologies, Inc.

-- Scope of preliminary economic assessment ("PEA") at

Phalaborwa widened to include additional downstream processing

step, aiming to deliver separated rare earth oxides directly from

the proposed on-site Phalaborwa processing facility.

-- Exploration and trial mining operations at Gakara in Burundi

placed on care and maintenance by the Government of Burundi in June

2021 following an initial export ban put in place in March 2021.

Rainbow has focused on a steadfast approach to resolving issues in

Burundi to recommence the positive contributions we make to the

benefit of all our stakeholders through exploration and trial

mining operations at Gakara.

-- Rainbow's Board has been further strengthened by the

appointment of Ambassador J. Peter Pham as a Non-executive

Director.

-- Strong shareholder support for the business, evidenced by two

recent oversubscribed placings - the first in November 2020 to

raise GBP2.56 million and the second completed post year end in

October 2021 to raise GBP6.435 million. As substantial investment

was made by TechMet, which counts the U.S. government as a major

investor, in the second placement, alongside existing and new

global institutional investors.

-- Continued strong safety performance: 0 lost time injuries

("LTIs") in FY 2021 (FY 2020: 0), with 1.1 million LTI-free hours

worked since February 2019.

Certain information contained in this announcement would have

been deemed inside information for the purposes of Article 7 of

Market Abuse Regulation (EU) No 596/2014 ("MAR") which has been

incorporated into UK law by the European Union (Withdrawal) Act

2018 until the release of this announcement.

For further information, please contact

Rainbow Rare George Bennett

Earths Ltd Company Pete Gardner +27 82 652 8526

SP Angel Corporate Ewan Leggat

Finance LLP Broker Charlie Bouverat +44 (0) 20 3470 0470

--------- ------------------- --------------------------------------

Flagstaff Strategic Tim Thompson +44 (0) 207 129 1474

and Investor Fergus Mellon rainbowrareearths@flagstaffcomms.com

Communications

------------------ --------------------------------------

Notes to Editors:

Rainbow's strategy is to become a globally-significant producer

of rare earth metals. Nd/Pr are vital components of the strongest

permanent magnets used for the motors and turbines driving the

green technology revolution. Analysts are predicting demand for

magnet rare earth oxides will grow substantially over the coming

years, driven by increasing adoption of green technology, pushing

the overall market for Nd/Pr into deficit.

The Phalaborwa Rare Earths Project, located in South Africa,

comprises an Inferred Mineral Resource Estimate of 38.3Mt at 0.43%

total rare earths oxides ("TREO") contained within gypsum tailings

stacked in unconsolidated dumps derived from historic phosphate

hard rock mining. High value Nd/Pr oxide represent 29.1% of the

total contained rare earth oxides, with economic Dysprosium and

Terbium oxide credits enhancing the overall value of the rare earth

basket contained in the stacks. The rare earths are contained in

chemical form in the gypsum dumps, which is expected to deliver a

higher-value rare earth carbonate, with lower operating costs than

a typical rare earth mineral project.

The Company's Gakara Project in Burundi has produced one of the

highest-grade concentrates in the world (typically 54% TREO)

through trial mining operations. The Gakara basket is weighted

heavily towards Nd/Pr, which account for over approximately 19.5%

of the contained TREO and 85% of the value of the concentrate.

Chairman's statement

This has been a transformative year for Rainbow, in which we

have introduced the exciting, near-term growth opportunity

presented by Phalaborwa to our portfolio. The signing of the

co-development agreement for this project in South Africa in FY

2021 represented a step change in Rainbow's business model. Not

only did it add diversification, but most importantly it provided

the potential for us to participate in the downstream stage of rare

earth oxide production. As pressure continues to accelerate around

the globe to reach the net-zero goals of the Paris Agreement, we

believe Rainbow is now well positioned to develop a responsible,

independent, Western rare earths supply chain and become a

significant producer of Neodymium and Praseodymium. This will

enable our business to bridge some of the substantial expected

global gap between current supply and mounting demand and provide

the building blocks which are essential to the success of the green

energy revolution.

Integral to low carbon technologies, the demand for rare earths,

and more specifically NdPr, is increasing and we are therefore

heavily focused on rapidly bringing the Phalaborwa Project into

production. FY 2021 has seen a 78% increase in the price of NdPr

oxide, which has continued to rise since the year-end. As the

automotive industry continues to shift to electric vehicles and the

demand for clean energy further accelerates, the outlook for NdPr

becomes ever more compelling, with analysts predicting a fivefold

increase in the value of global magnet rare earth oxide consumption

by 2030. With rare earth supply still dominated by China, we see

significant opportunities to provide an alternative source and are

committed to producing the metals in a responsible manner. We

believe that our Phalaborwa Project demonstrates this commitment

well - by processing the existing gypsum stacks, our aim is to

deliver a "green" rare earths project, removing existing

environmental liability and redepositing clean, benign gypsum on a

new stack.

The year has brought some challenges for the Company - both as a

result of the ongoing global pandemic, but also more specifically,

the interruptions we are experiencing in Burundi, with the Gakara

exploration and trial mining operation on care and maintenance.

However, we continue to engage effectively with Government

stakeholders and are confident of reaching a resolution. Whilst the

situation facing Rainbow in Burundi is disappointing, it has

allowed our team to focus on the substantially larger opportunity

presented for the near-term development of Phalaborwa, which we see

as the immediate catalyst of Rainbow's business model. We remain

committed to the positive contributions we are able to make as a

Company within our countries of operation and communities through

the payment of taxes and royalties, the provision of employment,

local investment and the support of local supply chains.

Ensuring a strong governance framework for the business is a

priority for Rainbow and we were delighted to further strengthen

the Board during FY 2021 with the appointment of Ambassador J.

Peter Pham. Peter brings a rich and detailed understanding of

African political and economic issues, as well as insights and

relationships across Africa and Washington. As the architect of

efforts to reform and rebuild US relations with Burundi, Peter's

insights will be invaluable to the Company.

On behalf of the Board of Directors, I would like to thank our

management team, employees and contractors for their continued

dedication to the Company, hard work and determination. I also wish

to express gratitude to our shareholders, who have shown strong

support for the business, as evidenced by two recent oversubscribed

placings - the first in November 2020 to raise GBP2.56 million and

the second completed post year end in October 2021 to raise

GBP6.435 million.

This is a very exciting time for Rainbow as we drive forward

with the development of Phalaborwa and I look forward to updating

shareholders on further developments as we continue to drive value

through the business.

CEO's statement

We have made significant progress with our strategy in FY 2021,

which is testament to the commitment of our team in the light of

the challenges we are all facing as a result of Covid-19. We have

continued to prioritise the health and safety of our employees

throughout the global pandemic and adopt a zero-harm policy in our

operations, remaining focused on ensuring a safe working

environment at all times. I am pleased to report that zero LTIs

occurred at Gakara during 2021, leading to a lost time injury

frequency rate ("LTIFR ") of 0.00 and a total period exceeding 1.1

million hours LTI-free pilot production since February 2019. This

demonstrates our commitment to this fundamental aspect of the

business, which we will aim to mirror at other operations going

forward. Read more about health and safety in the 2021 Annual

Report.

We believe that Phalaborwa provides us with a relatively unique

opportunity for the rapid development of a low-capital and

-operating cost, high-value rare earths processing facility. We

therefore see this asset as the cornerstone of Rainbow's business

in the near term and continue to assess similar assets to

complement the portfolio.

We have long believed that the essence of Rainbow's business

model would come from participating further in downstream

processing in order to realise the full value of the underlying

rare earth oxides for our stakeholders. Therefore, we have enlarged

the scope of the PEA at Phalaborwa to now include an additional

downstream processing step. The original flowsheet already planned

to produce a mixed rare earth carbonate (rather than simply a

mineral concentrate), due to the gypsum stacks being in a "cracked"

chemical rather than mineral form. This removes the requirement

that most global rare earth projects have of firstly producing a

mineral concentrate before undertaking a complex and energy

intensive "cracking" process.

In June, Rainbow released a maiden JORC (2012) compliant mineral

resource estimate for Phalaborwa of 38.3Mt at 0.43% TREO, which

exceeded original expectations of 35Mt from the gypsum stacks.

Importantly, 29% of the total contained rare earth oxides comprise

high-value NdPr oxide, the essential metals for permanent magnets

powering the green revolution. In addition to this, we were pleased

to see economic Dysprosium and Terbium oxide credits, which enhance

the overall value of the rare earth basket contained in the

stacks.

We were particularly excited by the highly positive initial test

work results received from ANSTO Minerals, which were published in

May and support our view that Phalaborwa can be developed as a low

capital intensity project with operating costs near the bottom of

the global rare earth cost curve. As this project entails the

processing of gypsum waste residue resulting from historic

phosphoric acid production, it carries significant environmental

advantages, with anticipated lower energy and reagent requirements

than a traditional rare earths project. As with Gakara, Phalaborwa

benefits from the fact that the gypsum stacks contain low levels of

radioactive elements, which are not expected to pose a problem in

the processing circuit. All these factors combined confirm our

belief that Phalaborwa represents a very exciting, environmentally

sound, fast-track development opportunity for Rainbow.

The signing of our exclusive rare earths separation technology

agreement with K-Technology in September represented another

positive moment for the business. We believe that it provides

Rainbow with a significant competitive advantage and that the

intellectual property ("IP") is ideally suited to Phalaborwa, where

it would enable us to focus on the separation of only the most

valuable rare earth oxides within the basket. In addition to the

anticipated capex and opex savings that could be achieved using

this technology, when compared to a traditional separation circuit,

it will enable Rainbow to participate efficiently in the downstream

separation process, allowing us to capture the full rare earth

oxide price for our material. We are also excited to be in a

position to utilise the technology to secure an interest in other

rare earth phosphogypsum opportunities in the region, where we

believe tremendous value can be unlocked.

However, the year has not been without its complications. In

April 2021, the Company received notification from the Government

of Burundi of a temporary suspension on the export of concentrate

from Gakara. Subsequently, shortly before year end, the Company

received notification of a temporary suspension of exploration,

trial mining and processing operations at Gakara. During this

Government-mandated suspension, operating costs in Burundi have

been minimised, with the vast majority of staff placed on

suspension, such that the ongoing situation is not having a

significant impact on the Company's cash flow forecasts. Whilst the

exploration and trial mining operation remains on care and

maintenance, we continue to take a steadfast approach to resolving

these issues and recommencing the positive contributions we make in

Burundi to the benefit of all our stakeholders.

We enhanced our senior project development team in 2021 through

the appointments of Chris le Roux and Charles Graham who work

closely with Rainbow's Technical Director, Dave Dodd. With their

combined wealth of experience, they will be instrumental in the

successful delivery of Phalaborwa.

Given its unique nature, it is our belief that Phalaborwa will

be capable of reaching production of mixed rare earth carbonate

faster than any other rare earth development project globally.

Therefore, with continued strong progress being made at this

project, coupled with the favourable supply/demand fundamentals in

the rare earths market outlook, I remain confident that Rainbow is

optimally positioned to become a globally-significant producer of

rare earth metals, supplying the building blocks for the green

revolution.

Operations report

Phalaborwa

Located in South Africa, Phalaborwa comprises two gypsum stacks

which contain an inferred mineral resource estimate of 38.3Mt at

0.43% TREO derived from historic phosphate hard rock mining.

High-value NdPr oxides represent 29.1% of the TREO, which is

believed to represent one of the largest weightings of any project

in the world. In addition to this, there are economic Dysprosium

and Terbium oxide credits which enhance the overall value of the

rare earth basket contained in the stacks.

The Company has made strong progress towards the delivery of the

Phalaborwa Project since signing the Joint Venture agreement in

November 2020 for a total consideration of US$750,000. This has

included the publication of initial metallurgical test work results

in May and the announcement of a maiden JORC mineral resource

estimate in June 2021.

Contained in a "cracked" chemical form in the gypsum stacks, a

mixed rare earth carbonate can be produced without the need to

first produce a mineral concentrate and then "crack" it prior to

separation of individual rare earth oxides. This removes a complex

and costly stage in the standard process for a typical rare earth

mineral project, enabling the Company to deliver a higher-value

carbonate with lower operating costs. The expected cost benefits

are also enhanced by the fact that the gypsum stacks will not

require hard-rock mining (including waste stripping), or energy

intensive crushing and grinding of the primary ore source.

Metallurgical test work results published, in May 2021, have

confirmed that the gypsum stacks are amenable to simple, direct

leaching with low-cost sulphuric or hydrochloric acid without

pre-treatment, at ambient temperature and pressure. The mineral

resource estimate and metallurgical test work results received to

date have also confirmed that the gypsum stacks are homogenous in

nature, with minimal geological uncertainty, substantially

de-risking the project.

The low levels of radioactive elements present in the stacks

reinforce the view that Phalaborwa will be well suited to a

simplified processing flow sheet, with anticipated lower energy and

reagent requirements than a traditional project. Further

metallurgical test work continues at ANSTO Minerals in Australia,

focused upon optimisation of leach recovery, acid consumption and

initial selective recovery of the rare earths from the leach

solution to design an optimised processing circuit for recovery of

a mixed rare earth carbonate.

The Company plans to complete the PEA for Phalaborwa in H2 2021.

This will compare a conventional route to produce a Cerium-depleted

mixed rare earth carbonate versus an alternative flowsheet that

bypasses the carbonate stage and delivers three higher value

products, comprising NdPr oxide, Tb oxide and Dy oxide. The results

will then guide the direction for development of a feasibility

study.

Further downstream processing to separate and purify individual

oxides is anticipated to deliver the following benefits compared to

a traditional flowsheet:

-- The enhanced flowsheet is expected to be capable of

delivering a higher value product, delivering the full value of the

separated rare earth metal oxides. By comparison, Rainbow's Gakara

Project has produced a high-grade mineral concentrate, which has

been sold to China for further downstream beneficiation/processing,

realising approximately 30% of the contained rare earths metal

oxide value. The traditional flowsheet at Phalaborwa would produce

a mixed rare earth carbonate, realising approximately 60% - 65% of

the contained metal oxide value. This compares to 100% of the metal

oxide value we could achieve by going further downstream to produce

separated individual oxides.

-- Capital and operating expenditure cost savings are expected

compared to the initial traditional flowsheet to produce a mixed

rare earth carbonate for further processing in a dedicated

separation facility.

-- Only the high value rare earths will be separated and

recovered (Nd, Pr, Tb and Dy, which represent 95% of the Phalaborwa

rare earths basket value), thereby enabling the Company to capture

the full benefit of additional value from downstream processing

without superfluous capital and operating expenditure which would

be needed to separate all the individual rare earth elements

present in the stacks.

Located in an established mining town in the Limpopo province of

South Africa, Phalaborwa benefits from all the associated skilled

labour availability and supporting industry (such as the local

production of sulphuric acid, which will likely be a key reagent

for the project). Sasol's pilot plant remains on site, alongside

the Phosphoric Acid Plant equipment. Existing infrastructure

includes a high voltage switchyard (providing access to Eskom grid

power), machine shops, workshops, laboratory buildings,

administration offices, acid storage and ammonia tanks, boilers and

rail sidings.

Rare earths separation technology agreement

Post year end, Rainbow entered into an exclusive IP licensing

agreement with K-Technologies, Inc. ("K-Tech") in September 2021 to

use its rare earths separation technology in the SADC ([1])

region.

-- The IP is suitable for use in the downstream separation of

REEs into separated REOs or carbonates in phosphogypsum

applications.

-- The process achieves the separation of REO in fewer stages

with greater flexibility leading to capital and operating

expenditure savings.

-- The process eliminates the use of toxic and highly flammable

solvents and diluents with significant environmental and safety

advantages.

-- Individual rare earths are targeted in solution, removing the

requirement to separate a full spectrum of REOs, creating

substantial efficiencies in a processing circuit.

In the case of Phalaborwa, K-Tech could develop the IP to target

the specific REOs of value within the asset's gypsum stacks (NdPr,

Dy and Tb), generating cost savings and simplifying the separation

process.

Gakara

Gakara, which is located in Western Burundi, approximately 20km

south-southeast of Bujumbura, has produced one of the highest-grade

concentrates in the world at 54% TREO. Trial mining and processing,

carried out at the operation since 2017, have demonstrated the

deposit's amenability to simple open pit mining and low-cost

gravity separation from ore sourced from high-grade stockwork vein

systems across the licence area.

The Company received notification from the Government of Burundi

in April 2021 of a temporary suspension on the export of

concentrate, and subsequently the suspension of exploration, trial

mining and processing operations in June 2021. Operations were

therefore placed on care and maintenance, with the majority of

local staff being placed on suspension and short-term cash

requirements in Burundi minimised. Due to Gakara's stage of

development, which remains in the exploration and trial mining

phase, this development is not expected to have a material impact

on the Company's short term cash flow projections, which envisage

an ongoing investment programme in Burundi. Rainbow's operating

subsidiary, Rainbow Mining Burundi SM ("RMB") holds approximately

420 tonnes of concentrate available for export which is expected to

provide funding for the re-commencement of operations once

permitted.

The Company understands that the primary concerns of the

Government relate to the pricing of the rare earth mineral

concentrate sold by RMB. Rainbow notes that this was addressed

comprehensively in an independent report, dated 26 July 2019,

commissioned by the World Bank at the request of the Government and

compiled by SRK Consulting. This report, accepted by the Government

in 2020, concluded that:

-- The price paid by ThyssenKrupp, the multinational industrial

group, for the Gakara rare earth mineral concentrate, which is

established on the basis of internationally recognised pricing, is

commercial and forms a reliable foundation for the computation of

royalties payable to the Government.

-- The export grades of each shipment are independently verified

as accurate by two internationally recognised laboratories (ALS

Laboratories in Canada and Baotou Research Institute of Rare Earths

in China) and have been correctly reported to the Government for

each shipment from Gakara to date.

-- That Rainbow is a "model company for new market entrants".

-- Prior to the suspension of trial mining at the end of June,

641 tonnes of concentrate were produced at Gakara in FY 2021,

representing a 77% increase on 363 tonnes produced in FY 2020. This

growth was driven by additional trial mining areas to the east of

the existing Murambi operations, opened up in early March 2021

following the commissioning of a new excavator and expanded fleet

of haulage trucks.

The Company continues to engage constructively with the Ministry

and other stakeholders to resolve this issue and allow exploration

activities including trial mining operations and exports to

recommence.

Financial Review

Profit and loss

Despite the impact of the export ban limiting sales, revenue in

FY 2021 was 51% higher than realised in FY 2020 with 350 tonnes of

concentrate sold at an average realised price of US$1,825/t

compared to 275 tonnes at US$1,535/t. With 420 tonnes of

concentrate on hand at 30 June 2021, with an estimated sale value

of US$3,000/t, the impact of strengthening production and rare

earth prices is not fully reflected in the income statement for the

year.

As the Company remains in an exploration and evaluation stage at

Gakara, US$0.4 million of costs associated with trial mining and

processing, net of associated revenue and movements in the

stockpile of finished concentrate, have been capitalised to

exploration and evaluation assets in the year (FY 2020: US$1.1

million). Depreciation charged in the year relating to the Gakara

mining fleet totalling US$0.3 million (FY 2020: US$0.2 million) was

also capitalised. In the prior year a gross loss was reported,

reflecting the mining and processing costs incurred in July and

August 2019, prior to a strategic review which recognised that the

Gakara asset is not in commercial production. The reduction in

losses both recognised in the income statement and capitalised in

the year reflects the improved performance of the trial mining and

processing activities at Gakara.

Administration expenses in FY 2021 totalled US$2.7 million

compared to US$2.1 million in FY 2020. The increase in the current

year relates primarily to share option charges of US$0.5 million,

with options issued to the new executive management team and

non-executive directors. Prior to the issue of options in January

2021, no options had been issued since 2017, with all costs

associated with issued share options fully expensed at 30 June

2020. Depreciation included in the income statement in the year

totalled US$37k mainly relating to right of use assets.

Finance income of US$0.4 million (FY 2020: US$0.9 million)

relates primarily to foreign exchange gains on movements primarily

between the Burundian Franc ('BIF') and US dollars, the functional

currency of the Group. Finance costs of US$0.5 million (FY 2020

US$0.2 million) include US$0.4 million of costs associated with the

US$0.9 million bridge loan from Pipestone Capital Inc, in which

George Bennett, CEO, has a beneficial interest, together with costs

of a loan with the Group's bank in Burundi, FinBank.

The corporation tax rate in Burundi is 30%, however no taxable

profits were earned during the period. In the absence of taxable

profit, a minimum tax is charged calculated as 1% of revenue,

totalling US$2k in the year (FY 2020: US$9k).

Balance sheet

At 30 June 2021, a total of US$9.8 million of exploration and

evaluation assets were included on the balance sheet (at 30 June

2020: US$7.6 million). Exploration and evaluation assets totalling

US$2.2 million were capitalised during the year including:

-- US$0.75 million consideration for the Phalaborwa earn-in

agreement, of which US$0.25 million was settled in cash, US$0.25

million settled in shares and US$0.25 million (to be settled in

cash or shares at the election of Bosveld Phosphates (Pty) Limited,

remains in creditors at the year end);

-- US$0.4 million of other costs relating to the Phalaborwa

asset, principally relating to the costs of resource definition and

metallurgical test work for the material in the gypsum stacks;

-- US$0.7 million of costs related to the trial mining and

processing operations at Gakara, including US$0.3 million of

associated depreciation for the mining fleet, as explained above;

and

-- US$0.4 million of other costs relating to Gakara including

regional exploration work and costs associated with the mining

licence.

Further investment for property, plant and equipment was also

made at Gakara, with US$0.7 million of additions to expand capacity

of the mining fleet and improve performance at the pilot plant,

including dealing with known bottlenecks to allow for further

growth in trial mining production.

Inventory at 30 June 2021 totalled US$0.9 million (at 30 June

2020: US$0.2 million). The significant growth in available for sale

concentrate in Burundi from US$0.1 million to US$0.7 million

resulted from the build up in concentrate resulting from the export

ban imposed by the Government of Burundi in April 2021. In

addition, consumables representing spare parts for the mining fleet

and plant were in transit from South Africa to Burundi at the

year-end and are included in stock.

Trade and other receivables totalled US$0.4 million at 30 June

2021 (30 June 2020: US$0.9 million). A total of US$0.6 million

receivables from a placing undertaken in June 2020 were received in

July 2020, driving down the overall balance at the current

year-end. The remainder of trade and other receivables primarily

relates to tax receivables in Burundi. The US$0.3 million royalty

receivable was impaired to US$0.2 million at 30 June 2021 to

reflect uncertainty in the recovery of this balance. In addition,

following a tax audit in Burundi, an amount of reverse VAT was

found not to have been paid from the period between 2017 and 2019,

and has been provided for at 30 June 2021, of which US$0.2 million

will be recoverable.

Trade and other payables totalled US$1.0 million at 30 June 2021

(30 June 2020: US$0.7 million). Trade payables were US$0.2 million

lower than at 30 June 2020, reflecting standard trading terms for

all suppliers. The increase includes US$0.3 million accrued for the

results of the Burundi tax audit for 2017-19 noted above and

US$0.25 million for the final consideration payment due for the

Phalaborwa earn-in agreement noted above.

The Company had borrowings of US$1.9 million at 30 June 2021 (30

June 2020: US$1.7 million). The movement reflects monthly

repayments against the FinBank loan in Burundi, off-set by interest

accrued on the Pipestone loan noted above and a revaluation of the

warrants initially issued in lieu of interest on the original loan

in February 2020.

Cashflow

Net cash in the 12 months to 30 June 2021 decreased by US$0.2

million (FY 2020: increase of US$0.7 million). Financing inflows

totalled US$4.3 million (FY 2020: US$5.9 million), as set out

below. These were invested US$2.7 million (FY 2020: US$2.4 million)

in tangible and intangible assets associated with the Phalaborwa

and Gakara Projects and US$1.9 million (FY 2020: US$2.8 million) to

fund operating activities.

Financing

In order to fund ongoing capital and operating cost

requirements, the Company raised a net US$4.6 million (FY 2020

US$5.1 million) via the issue of new equity during the year as set

out below:

-- In November 2020 an equity placing raised net proceeds of

US$3.4 million with new and existing shareholders at a price of 6

pence per share via the issue of 42.7 million shares.

-- Between December 2020 and April 2021, Australian Special

Opportunity Fund, LP exercised options over 10.5 million shares at

an exercise price of 5.28p per share, raising gross cash proceeds

of US$763k.

In addition, during the year the Company drew and repaid a

short-term bridge loan from related parties totalling US$0.3

million and settled US$0.3 million of interest and capital against

the FinBank loan in Burundi.

In February 2020 Pipestone Capital Inc, in which George Bennett,

the Company's CEO, has a beneficial interest, provided a US$1

million bridging loan to the Group. In June 2020 the loan was

refinanced with US$75k settled via the issue of ordinary shares.

From December 2020 the loan has been further refinanced, bearing

interest, with US$84k interest accruing in the year.

At 30 June 2021, the Group had US$0.6 million of available cash.

Subsequent to the year end, in October 2021, the Company has raised

a further US$8.8 million via the issue of 42.9 million shares at a

price of 15 pence per share (including US$2.0 million representing

10 million shares to be issued subject to shareholder approval at

the AGM). The Group's reasonably plausible downside scenario cash

flow forecasts demonstrate that the Group will have US$2.2 million

available at 31 December 2022, excluding the conditional US$2.0

million funds raised and before any discretionary expenditure.

CONSOLIDATED STATEMENT OF COMPREHENSIVE INCOME

For the year ended 30 June 2021

Year ended Year ended

30 June 30 June

Notes 2021 2020

US$'000 US$'000

Revenue 639 422

Production and sales costs (639) (905)

---------- ----------

Gross loss - (483)

Administration expenses (2,707) (2,389)

Loss from operating activities (2,707) (2,872)

---------- ----------

Finance income 433 856

Finance costs (466) (209)

Loss before tax (2,740) (2,225)

---------- ----------

Income tax expense (2) (9)

Total loss after tax and comprehensive expense for the year (2,742) (2,234)

========== ==========

Total loss after tax and comprehensive expense for the year is attributable to:

Non-controlling interest (52) (60)

Owners of parent (2,690) (2,174)

---------- ----------

(2,742) (2,234)

========== ==========

The results of each year are derived from continuing operations

Loss per share (cents)

Basic 3 (0.60) (0.58)

Diluted 3 (0.60) (0.58)

CONSOLIDATED STATEMENT OF FINANCIAL POSITION

As at 30 June 2021

Year ended Year ended

Notes 30 June 30 June

2021 2020

US$'000 US$'000

Non-current assets

Exploration and evaluation assets 4 9,751 7,572

Property, plant, and equipment 5 1,354 942

Right of use assets 70 104

Total non-current assets 11,175 8,618

----------- -----------

Current assets

Inventory 863 167

Trade and other receivables 441 938

Cash and cash equivalents 573 788

----------- -----------

Total current assets 1,877 1,893

----------- -----------

Total assets 13,052 10,511

----------- -----------

Current liabilities

Trade and other payables (1,009) (698)

Borrowings 6 (1,231) (1,093)

Lease liabilities (14) (33)

Total current liabilities (2,254) (1,824)

Non-current liabilities

Borrowings 6 (662) (587)

Lease liabilities (69) (95)

Provisions (61) (100)

----------- -----------

Total non-current liabilities (792) (782)

Total liabilities (3,046) (2,606)

----------- -----------

NET ASSETS 10,006 7,905

Equity

Share capital 7 32,465 28,132

Share-based payment reserve 1,295 1,099

Share warrant reserve - 40

Other reserves 60 60

Retained loss (22,878) (20,542)

----------- -----------

Equity attributable to the parent 10,942 8,789

Non-controlling interest (936) (884)

TOTAL EQUITY 10,006 7,905

=========== ===========

CONSOLIDATED STATEMENT OF CHANGES IN EQUITY

For the year ended 30 June 2021

Shares Share- Share Attributable

Share to be based warrant Other Accumulated to the Non-controlling

capital issued Payments reserve reserves losses parent interest Total

US$'000 US$'000 US$'000 US$'000 US$'000 US$'000 US$'000 US$'000 US$'000

Balance at 1

July 2019 20,056 1,375 1,764 40 - (19,040) 4,195 (824) 3,371

-------- -------- -------- -------- -------- ----------- ------------ --------------- -------

Total

comprehensive

expense

Loss and total

comprehensive

loss for year - - - - - (2,174) (2,174) (60) (2,234)

Transactions

with owners

Issue of shares

during the

year 8,385 (1,375) - - - - 7,010 - 7,010

Share placing

transaction

costs (309) - - - - - (309) - (309)

Discount on

interest free

bridge loan

provided by

shareholder - - - - 60 - 60 - 60

Fair value of

employee share

options in

year - - 7 - - - 7 - 7

Employee share

options

exercised,

lapsed or

cancelled

following

vesting - - (672) - - 672 - - -

-------- -------- -------- -------- -------- ----------- ------------ --------------- -------

Balance at 30

June 2020 28,132 - 1,099 40 60 (20,542) 8,789 (884) 7,905

Total

comprehensive

expense

Loss and total

comprehensive

loss for year - - - - - (2,690) (2,690) (52) (2,742)

Transactions

with owners

Shares placed

during the

year for cash

consideration 3,423 - - - - - 3,423 - 3,423

Share placing

transaction

costs (85) - - - - - (85) - (85)

Non-cash issue

of shares

during the

period 250 - 250 - 250

Share warrants

expired in the

year - - - (40) - 40 - - -

Fair value of

employee share

options in

year - - 510 - - - 510 - 510

Share options

exercised in

the year, net

of costs 745 - (314) - - 314 745 - 745

Balance at 30

June 2021 32,465 - 1,295 - 60 (22,878) 10,942 (936) 10,006

-------- -------- -------- -------- -------- ----------- ------------ --------------- -------

CONSOLIDATED CASH FLOW STATEMENT

For the year ended 30 June 2021

Notes For year ended For year ended

30 June 30 June

2021 2020

US$'000 US$'000

Cash flow from operating activities

Loss from operating activities (2,707) (2,872)

Adjustments for:

Depreciation 37 279

Profit on disposal of fixed assets 13 - 4

Share-based payment charge 22 510 7

Directors fees settled in shares - 96

Operating loss before working capital changes (2,160) (2,486)

Net increase in inventory 14 (121) (22)

Net (increase)/decrease in trade and other receivables 15 (62) 126

Net increase/(decrease) in trade and other payables 17 136 (1,188)

--------------- ---------------

Cash used by operations (2,207) (3,570)

Realised foreign exchange gains 359 855

Finance income 6 - 2

Finance costs 7 (23) (5)

Taxes paid 10 - (41)

--------------- ---------------

Net cash used in operating activities (1,871) (2,759)

--------------- ---------------

Cash flow from investing activities

Purchase of property, plant & equipment 13 (690) (378)

Exploration and evaluation costs 12 (2,024) (2,045)

Proceeds from sale of property, plant & equipment 13 - 3

Net cash used in investing activities (2,714) (2,420)

--------------- ---------------

Cash flow from financing activities

Proceeds of new borrowings 18 275 1,000

Repayment of borrowings 18 (438) (74)

Interest payments on borrowings 18 (104) (137)

Payment of lease liabilities 19 (56) (22)

Proceeds from the issuance of ordinary shares 21 4,727 5,390

Transaction costs of issuing new equity 21 (85) (309)

Net cash generated by financing activities 4,319 5,848

--------------- ---------------

Net increase/(decrease) in cash and cash equivalents (266) 669

--------------- ---------------

Cash & cash equivalents at the beginning of the year 788 119

Foreign exchange gains on cash and cash equivalents 51 -

Cash & cash equivalents at the end of the year 16 573 788

=============== ===============

Notes:

1. Basis of Preparation

The financial information set out herein does not constitute the

Group's statutory financial statements for the year ended 30 June

2021, but is derived from the Group's audited financial statements.

The auditors have reported on the FY 2021 financial statements and

their reports were unqualified. The financial information in this

statement is audited but does not have the status of statutory

accounts.

The financial statements and the information contained in this

announcement have been prepared in accordance with International

Financial Reporting Standards (IFRS) as adopted by the European

Union (EU), including International Accounting Standards and

Interpretations issued by the International Financial Reporting

Interpretations Committee (IFRIC). This is consistent with the

accounting policies in the 30 June 2020 financial statements.

2. Going Concern

As at 26 October 2021, the last practicable date before the

publication of these accounts, the Company had total cash of US$6.3

million having received GBP4.9 million (US$6.7 million) from an

equity fundraise announced on 13 October 2021. The equity fundraise

includes a further GBP1.5 million (US$2.0 million) of expected

gross proceeds subject to shareholder approval, which is expected

to be received by 22 November 2021.

The Board have reviewed a range of potential cash flow forecasts

for the period to 31 December 2022, including reasonable possible

downside scenarios. This has included the following

assumptions:

Corporate:

The forecast includes US$2.5 million of ongoing general and

administrative costs of the Group over the 18-month period from 1

July 2021 to 31 December 2022, based on the current administrative

costs of the Group.

At 30 June 2021 the Group has US$1.6 million of undiscounted

financing liabilities including:

-- US$1.0 million, including accrued interest, in an unsecured

loan from Pipestone Capital, a Company associated with George

Bennett, CEO, which is expected to be repaid from the proceeds of

the post year end equity fundraise.

-- US$0.6 million in a term loan from FinBank in Burundi.

Capital repayment of this loan is suspended until 31 December 2021

subject to the Gakara operation remaining suspended in Burundi.

From 1 January 2022 repayments will recommence at a rate of US$21k

per month (including interest), which is included in the Group's

cash flow forecasts within the care and maintenance costs for the

Gakara project.

Management's reasonably plausible downside scenario includes

repayment of the above liabilities together with the settlement in

cash of:

-- US$2.7 million for ongoing general and administrative costs

of the Group, inclusive of a 10% contingency for unexpected

costs.

-- US$0.25m for the final balance due in December 2022 under the

Phalaborwa earn-in agreement, which can be settled in cash or

shares at the election of Bosveld Phosphates (Pty) Limited.

The reasonably plausible downside scenario also excludes the

final US$2.0 million placing proceeds expected to be received by 22

November 2021 as these are subject to approval of shareholders for

the disapplication of pre-emption rights at the Annual General

Meeting to be held on 17 November 2022.

Phalaborwa:

This forecast assumes the completion of the Phalaborwa PEA in H2

2021 at a total cost of US$0.5 million. As there are no other

committed costs for Phalaborwa, with the estimated US$3.0 million

costs required to complete the bankable feasibility study being

discretionary, management's reasonably plausible downside scenario

includes no further expenditure for the Phalaborwa project.

Gakara:

The cash flow forecasts assumes ongoing care and maintenance

costs totalling US$1.0 million for the forecast period. In the

event that the Gakara project returns to operations, stock of rare

earth concentrate with an estimated gross sales value of US$1.3

million would be sold to provide the funds to re-commence trial

mining and processing operations. The forecasts show that, with the

current productive capacity of the trial mining operations, the

Gakara project would not require additional financial support from

Rainbow Rare Earths Limited at current rare earth prices.

Conclusion

Based on Management's reasonably plausible downside scenario

outlined above the Group will have US$2.2 million available at the

end of the forecast period before any discretionary expenditure

such as the US$3.0m estimated costs required to complete the

Phalaborwa bankable feasibility study.

Accordingly, the Board are satisfied that the Group has

sufficient cash resources to continue its operations and meet its

commitments for the foreseeable future and have concluded that it

is appropriate for the financial statements to be prepared on a

going concern basis.

3. LOSS PER SHARE

The earnings per share calculations for 30 June 2021 reflect the

changes to the number of ordinary shares during the period.

At the start of the year, 421,981,551 shares were in issue.

During the year, a total of 54,429,883 new shares were allotted

(see note 7 Share Capital) and on 30 June 2021, 476,411,434 shares

were in issue. The weighted average of shares in issue in the year

was 450,749,572.

The loss per share have been calculated using the weighted

average of ordinary shares. The Company was loss making for all

periods presented, therefore the dilutive effect of share options

has not been taken account of in the calculation of diluted

earnings per share, since this would decrease the loss per share

for each reporting period.

Basic and diluted

2021 2020

---------------- ---------------

Loss for the year (US$'000) attributable to ordinary equity holders (2,690) (2,174)

Weighted average number of ordinary shares in issue during the year 450,749,572 373,141,644

Loss per share (cents) (0.60) (0.58)

---------------- ---------------

4. EXPLORATION AND EVALUATION ASSETS

Gakara Phalaborwa Total

US$'000 US$'000 US$'000

At 1 July 2019 - - -

Transferred from Property Plant & Equipment 5,417 - 5,417

Additions 2,155 - 2,155

---------------------------------------------- ------- ---------- -------

At 30 June 2020 7,572 - 7,572

Additions 1,102 1,116 2,218

Adjustment of rehabilitation provision (39) - (39)

---------------------------------------------- ------- ---------- -------

At 30 June 2021 8,635 1,116 9,751

---------------------------------------------- ------- ---------- -------

During the year the Company entered into an agreement to earn up

to an 85% interest in the Phalaborwa rare earths project in South

Africa. The project represents an opportunity to extract rare earth

elements from the chemical re-treatment of gypsum stacks. A JORC

compliant rare earth resource was declared on 17 June 2021 and the

costs of establishing the commercial viability of development for

the project are being capitalised as exploration and evaluation

assets under IFRS 6. Additions in the year include US$750k

consideration payable under the earn-in agreement of which US$500k

was settled during the year: US$250k in cash and US$250k by the

issue of 1,229,883 new Ordinary Shares of no par value in the

Company on 25 June 2021. The remaining US$250k will be settled in

December 2021 in cash or shares at the election of the joint

venture partner, Bosveld Phosphates (Pty) Ltd. The remaining

additions of US$366k represent cost associated with the definition

of the inferred mineral resource, ongoing metallurgical test work

and technical support costs associated with defining the optimal

processing flow sheet for the project.

Included within Gakara additions is US$989k related to gross

losses earned during the exploration phase which represent a

contribution towards exploration costs incurred. Gakara additions

also include US$269k of depreciation on assets used in trial mining

and processing operations at the project.

FinBank SA hold security over the fixed and floating assets of

Rainbow Mining Burundi SM ('RMB') which include US$7.3 million of

exploration and evaluation assets associated with the Gakara mining

permit in Burundi.

On 12 April 2021 RMB received notification from the Ministry of

Hydraulics, Energy and Mines of the Republic of Burundi of a

temporary suspension on the export of concentrate produced from the

trial mining and processing operations at the Gakara Project. On 29

June 2021 a further notification was received temporarily

suspending all trial mining and processing operations pending

negotiations on the terms of the Gakara mining convention signed in

2015.

Following various face to face meetings in Burundi in April,

June and July 2021 the Company understands that the primary

concerns of the Government relate to the pricing of the rare earth

mineral concentrate sold by RMB. This was addressed comprehensively

in an independent report, dated 26 July 2019, that was commissioned

by the World Bank at the request of the Government of Burundi and

compiled by SRK Consulting. This report, accepted by the Government

in 2020, concluded that:

-- The price paid by ThyssenKrupp, the multinational industrial

group, for the Gakara rare earth mineral concentrate, which is

established on the basis of internationally recognised pricing, is

commercial and forms a reliable foundation for the computation of

royalties payable to the Government.

-- The export grades of each shipment are independently verified

as accurate by two internationally recognised laboratories (ALS

Laboratories in Canada and Baotou Research Institute of Rare Earths

in China) and have been correctly reported to the Government for

each shipment from Gakara to date.

-- That Rainbow is a "model company for new market entrants"

RMB continues to engage positively with the Government of

Burundi to arrange discussions to allow export of rare earth

concentrate to resume along with trial mining and processing

activities. The Directors have also confirmed from independent

legal advisors that the mining convention in place between RMB and

the Government of Burundi remains legally binding on both parties,

and that the actions of the Government of Burundi have not been in

accordance with that legally binding agreement.

Based on an assessment of both the legal and political position,

the Directors have a reasonable expectation that the current

temporary suspension does not represent a threat to the licence and

activities will be allowed to re-start. Accordingly, the Directors

do not believe this uncertainty represents an indication of

impairment of the exploration and evaluation assets at Gakara, or

the associated property, plant and equipment or inventory within

the Gakara cash generating unit. The Directors do not consider

there to be any indicators of impairment for the Gakara cash

generating unit, however they note that the current suspension of

activities could result in future losses for the Group if it is not

resolved as anticipated.

5. PROPERTY, PLANT AND EQUIPMENT

US$'000 Mine development Plant & machinery Vehicles Office equipment Mine restoration Total

costs

--------------------- --------------------- ----------------- -------- ---------------- ---------------- -------

Cost

At 1 July 2019 9,317 2,665 709 41 100 12,832

Additions - - 370 8 - 378

Disposals - - (5) (4) - (9)

Transfer to

Intangible Fixed

assets (9,134) - - - (100) (9,234)

--------------------- --------------------- ----------------- -------- ---------------- ---------------- -------

At 30 June 2020 183 2,665 1,074 45 - 3,967

Additions - 182 508 - - 690

--------------------- --------------------- ----------------- -------- ---------------- ---------------- -------

At 30 June 2021 183 2,847 1,582 45 - 4,657

--------------------- --------------------- ----------------- -------- ---------------- ---------------- -------

Depreciation

At 1 July 2019 3,510 2,665 142 7 100 6,424

Charge for year 254 - 157 9 - 420

Eliminated on

disposals/transfers - (1) (1) - (2)

Transfer to

Intangible Fixed

assets (3,717) - - - (100) (3,817)

--------------------- --------------------- ----------------- -------- ---------------- ---------------- -------

At 30 June 2020 47 2,665 298 15 - 3,025

Charge for the year 26 2 241 9 - 278

--------------------- --------------------- ----------------- -------- ---------------- ---------------- -------

At 30 June 2021 73 2,667 539 24 - 3,303

--------------------- --------------------- ----------------- -------- ---------------- ---------------- -------

Net Book Value at 30

June 2021 110 180 1,043 21 - 1,354

--------------------- --------------------- ----------------- -------- ---------------- ---------------- -------

Net Book Value at 30

June 2020 136 - 776 30 - 942

--------------------- --------------------- ----------------- -------- ---------------- ---------------- -------

Net Book Value at 30

June 2019 5,807 - 567 34 - 6,408

--------------------- --------------------- ----------------- -------- ---------------- ---------------- -------

Depreciation of US$269k (2020: US$157k) relating to mining

vehicles, plant & machinery and site infrastructure was

capitalised in the year as part of Exploration and Evaluation

costs.

FinBank SA hold security over the fixed and floating assets of

Rainbow Mining Burundi SA which include US$1,353k (2020: US$941k)

of property, plant and equipment in Burundi.

As set out in note 4 the Directors recognise the uncertainty

relating to the temporary suspension of trial mining and processing

activities in Burundi which could impact the carrying value of the

property, plant and equipment within the Gakara cash generating

unit, which comprises US$1,353k of the net book value at the

balance sheet date.

6. BORROWINGS

Year Ended Year Ended

30 June 2020 30 June 2020

US$'000 US$'000

Finbank Loan 579 762

Pipestone Loan 1,008 868

Warrant liability 306 50

Total borrowings 1,893 1,680

-------------- --------------

Borrowings fall due:

Due within one year 1,231 1,093

Due between 2 to 5 years 662 587

-------------- --------------

1,893 1,680

-------------- --------------

The following table analyses the movement in borrowings:

Year ended Year ended

30 June 2021 30 June 2020

US$'000 US$'000 US$'000 US$'000

Borrowings brought forward 1,680 1,562

Cash flows from borrowings

Drawdown of borrowings 275 1,000

Repayment of borrowings (438) (74)

Interest paid (104) (118)

(267) 808

Non-cash movement in borrowings

Interest charge on borrowings 244 171

Settlement of borrowings in shares - (779)

Valuation of warrant liability 256 50

Settlement of interest via issue of warrants - (50)

Extinguishment of Pipestone bridge loan (925) (925)

Drawn down of renewed Pipestone bridge loan 925 925

Discount for deemed interest on related party loan - (60)

Other (20) (22)

480 (690)

--------

Borrowings carried forward 1,893 1,680

-------- --------

Finbank Loan

The Finbank loan facility in Burundi is expressed in BIF and

carries an interest rate of 15%. Interest has been paid throughout

the period. Capital repayments have been suspended since April 2021

as a result of the export ban imposed in Burundi on the Group's

rare earth concentrate from trial mining and processing activities.

This is not a substantial modification of the loan.

Under the terms of this loan, Finbank has security over the

fixed and floating assets of Rainbow Mining Burundi SM ('RMB', the

local operating company in Burundi which owns the Gakara project

and mining permit), the shares of RMB, and the cash held in RMB's

Finbank bank accounts. Interest on the loan amounted to US$98k

(2020: US$118k).

Bridge Loan

A US$275k short term bridge loan was received from certain

Directors and senior managers in October 2020 and repaid in full in

December 2020 after a successful equity fundraising. Interest

totalling US$5k was paid on the loan.

Pipestone Bridge Loan

On 21(st) February 2020 Pipestone Capital Inc, in which George

Bennett, the Company's CEO, has a beneficial interest, provided a

US$1 million unsecured bridging loan to the Company. The loan did

not bear interest, with the finance cost provided by the issue of 2

million warrants with a 4 year life over the Company's shares at a

strike price of 4.55p/share (a 30% premium to the 20 day VWAP and a

1.25p premium to the 3.3p/share closing mid-market price on the

date of the loan).

In June 2020 the original Pipestone loan was re-financed, with

US$75k repaid via the issue of 1,993,779 shares as part of the

equity placing announced on 22(nd) June 2020 at a price of GBP0.03

per share. The remaining US$925k was extinguished and replaced with

a new, interest free, unsecured bridging loan of US$925k pending a

larger capital raise. No further warrants were issued.

The loan was further refinanced following an equity raise in

November 2020, which triggered a repayment obligation for the loan.

The Company had no headroom under the prospectus directive

regulations to issue shares at the price of the November 2020

equity raise to repay the loan and had insufficient funds to allow

for repayment in cash. As a result, the US$925k interest-free

liability was extinguished and replaced with a new unsecured bridge

loan from 1 December 2020 which bears interest at a rate of 15% per

annum. The loan is repayable on the earlier of 31 December 2021 or

the date of a future equity fundraise of at least US$5 million.

7. SHARE CAPITAL

Year Ended Year Ended

30 June 2021 30 June 2020

US$'000 US$'000

Share Capital 32,465 28,132

------------- -------------

Issued Share Capital (nil par value) 32,465 28,132

------------- -------------

The table below shows a reconciliation of share capital

movements:

Number of shares US$'000

At 1 July 2019 216,339,000 20,056

July 2019 - share placing - cash receipts net of costs 121,207,779 4,275

July 2019 - share placing - employee bonuses and fees 4,859,603 185

July 2019 - Pella Convertible 18,636,040 704

July 2019 - Lind Convertible 19,272,462 1,376

June 2020 - share placing - cash receipts net of costs 37,138,284 1,366

June 2020 - share placing - non-executive director fees 2,534,604 95

June 2020 - partial repayment of Pipestone loan 1,993,779 75

At 30 June 2020 421,981,551 28,132

November 2020 - share placing - cash receipts net of costs 42,700,000 3,338

December 2020 - Exercise of share options (cash receipts) 3,000,000 215

January 2021 - Exercise of share options (cash receipts) 4,000,000 290

February 2021 - Exercise of share options (cash receipts) 2,700,000 200

April 2021 - Exercise of share options (cash receipts) 800,000 58

Costs associated with exercise of share options - (18)

June 2021 - Phalaborwa consideration shares 1,229,883 250

476,411,434 32,465

---------------- --------

On 3 July 2019 the Company issued 121.2 million new ordinary

shares at a price of 3 pence per share, raising gross cash proceeds

of US$4.6 million (before costs of US$0.3 million). At the same

time the Company issued:

-- 4.9 million new ordinary shares at a price of 3 pence per

share as settlement of employee bonuses and non-executive director

fees.

-- 18.6 million new ordinary shares at a price of 3 pence per

share representing the settlement of an unsecured bridge loan of

US$0.7 million originally drawn in June 2019 from Pella Ventures

Limited (an entity in which the Company's chairman has a beneficial

interest).

-- 19.3 million new ordinary shares representing the conversion

of the Lind facility announced on 10(th) June at a conversion price

of 2.69 pence per share.

On 22 June 2020 the Company issued 37.1 million new ordinary

shares at a price of 3 pence per share, raising gross cash proceeds

of US$1.4 million (before costs of US$38k). At the same time the

Company issued:

-- 2.5 million new ordinary shares at a price of 3 pence per

share as settlement of non-executive director fees.

-- 2.0 million new ordinary shares at a price of 3 pence per

share representing the partial settlement of the Pipestone

loan.

On 27 November 2020, the Company issued 42.7 million new

ordinary shares at a price of 6 pence per share , raising gross

cash proceeds of US$3.4 million (before costs of $85k).

These allotments included the following related parties:

Placing June 2020 Placing November 2020

No of shares US$'000 No of shares US$'000

Adonis Pouroulis (Director) 3,359,648 126 - -

George Bennett (Director) 1,993,779 75 - -

Alex Lowrie (Director) 458,332 17 - -

Atul Bali (Director) 1,783,332 67 - -

Robert Sinclair (Director) 458,332 17 - -

Shawn McCormick (Director) 1,787,518 67 - -

Others (not related parties) 31,825,726 1,167 42,700,000 3,338

------------------ ----------- ---------------- ---------

Total 41,666,667 1,536 42,700,000 3,338

------------------ ----------- ---------------- ---------

Between December 2020 and April 2021 Australian Special

Opportunity Fund, LP exercised options over 10.5 million shares at

an exercise price of 5.28p per share, raising gross cash proceeds

of US$763k (before costs of US$18k).

On 25 June 2021 1,229,882 shares were issued to Bosveld

Phosphates (Pty) Limited to settle US$250,000 consideration due

under the Phalaborwa co-development agreement originally announced

on 3 November 2020.

8. POST BALANCE SHEET EVENTS

On 14 July 2021 Australian Special Opportunity Fund, LP

exercised options over 2.5 million shares at an exercise price of

5.28p per share, raising gross cash proceeds of US$182k.

On 19 October 2021 the Company issued 32.9 million new ordinary

shares at a price of 15 pence per share, raising gross cash

proceeds of GBP4.9 million (US$6.7 million) (before costs of US$0.2

million) by way of a placing, with a further 10 million shares to

be issued raising a further GBP1.5 million (US$2.0 million) subject

to shareholder approval at the Company's AGM.

[1] Southern African Development Community

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

FR KZMZGVNMGMZM

(END) Dow Jones Newswires

October 28, 2021 02:00 ET (06:00 GMT)

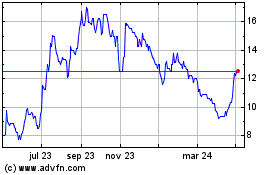

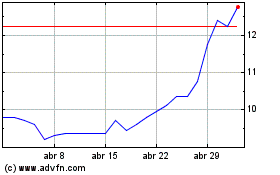

Rainbow Rare Earths (LSE:RBW)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Rainbow Rare Earths (LSE:RBW)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024