TIDMRBW

RNS Number : 1658C

Rainbow Rare Earths Limited

17 June 2021

Rainbow Rare Earths Limited

("Rainbow" or the "Company")

(LSE: RBW)

17 June 2021

MAIDEN JORC MINERAL RESOURCE ESTIMATE FOR PHALABORWA PROJECT

Rainbow Rare Earths Ltd is pleased to announce a maiden JORC

(2012) compliant Mineral Resource Estimate in respect of the

Phalaborwa Project in South Africa ("Phalaborwa" or the

"Project").

-- Inferred Mineral Resource Estimate of 38.3Mt at 0.43% TREO is

larger than the original 35Mt expected from the gypsum stacks.

-- High value Neodymium ("Nd") and Praseodymium ("Pr") oxide,

the essential metals for permanent magnets powering the green

revolution, represent 29.1% of the total contained rare earth

oxides, with an in-situ value of US$95/t gypsum(1) .

-- Economic Dysprosium ("Dy") and Terbium ("Tb") oxide credits,

with an in-situ value of US$28/t gypsum(1) , enhance the overall

value of the rare earth basket contained in the stacks, with the

in-situ value of these four high value rare earth elements

totalling US$123/t gypsum(1) .

-- Very low levels of radioactive elements confirmed in the

Inferred Mineral Resource Estimate confirm the 'green' credentials

of this project.

1. Based on metal oxide prices published by Argus Media on 11(th) June 2021

George Bennett, CEO, said: "The Maiden Mineral Resource Estimate

for Phalaborwa marks an important milestone for Rainbow,

underpinning the opportunity for the rapid development of a low

capital and operating cost, high value processing facility in South

Africa to provide the essential metals to power the green

revolution from an extremely environmentally beneficial

project.

The fact that the rare earths are present in a chemical rather

than mineral form in the gypsum stacks removes the need, as with

the majority of global rare earth projects, to firstly produce a

mineral concentrate before undertaking a complex and energy

intensive 'cracking' process. The initial Phalaborwa process will

deliver a high value cracked rare earth carbonate and studies are

ongoing to investigate whether the valuable rare earth metals can

be delivered as separated rare earth oxides for direct sale to

industrial users. This gives us confidence that Phalaborwa will

become the cornerstone of Rainbow's business in the near term.

Alongside the recently announced metallurgical test work

results, which have confirmed that the gypsum stacks are amenable

to simple, direct leaching with low-cost sulphuric acid at ambient

temperature and pressure, the road map to commercialising the

Phalaborwa deposit is now clear. We look forward to announcing

further metallurgical test work results ahead of completing an

initial scoping study/preliminary economic assessment in Q3

2021."

The Phalaborwa gypsum is contained in two separate gypsum

stacks, labelled simply as Stack A and Stack B, for which Mineral

Resources have been individually estimated as set out below:

Inferred Mineral Resource Estimate

Contribution of TREO by oxide Grade

Tonnes TREO Nd Pr Dy Tb Other Th U

Mt % % % % % % ppm ppm

------ ---- ------- ----- ----- ---- -------- ---- ---

Stack

A 27.4 0.42 23.3 5.7 1.0 0.4 69.6 49.0 1.8

Stack

B 10.9 0.46 23.6 5.7 1.0 0.3 69.4 44.1 2.0

------ ---- ------- ----- ----- ---- -------- ---- ---

TOTAL 38.3 0.43 23.4 5.7 1.0 0.3 69.6 47.6 1.8

------ ---- ------- ----- ----- ---- -------- ---- ---

-- All Estimated Mineral Resources are classified as Inferred

-- The Inferred Mineral Resource Estimate is reported above a cut-off grade of 0.2% TREO.

-- No constraining pit shell is required for the Inferred

Mineral Resource Estimate due to the gypsum stacks being entirely

above ground level.

-- Mineral resources are not mineral reserves and do not have demonstrated economic viability.

Further metallurgical test work is ongoing with ANSTO Minerals

in Australia to define a preliminary processing flow sheet to

support a scoping study/preliminary economic assessment for the

Phalaborwa project, which is expected to be completed in Q3

2021.

The maiden JORC Mineral Resource has been estimated based on the

assay results received from 1,056.3m of auger drilling completed in

December 2020. The auger drilling was independently assayed by SGS

South Africa on the basis of 1.5m interval samples with appropriate

duplicate, standards and blanks used for QAQC purposes. A further

programme of sonic drilling was undertaken in April 2021 primarily

to recover samples for bulk density estimation - the assay results

from this drill programme were not available at the time of the

initial resource estimation and will be used for a further resource

update ahead of a formal feasibility study for Phalaborwa. Further

drilling/assay samples will also be required to upgrade the mineral

resources to the Measured and Indicated categories required for a

formal feasibility study.

The surface topography of the gypsum stacks was calculated by

use of a LIDAR survey. The Mineral Resource Estimate uses a

1.5t/m(3) estimate for the bulk density of the gypsum stacks, being

the average of the bulk density calculated for competent samples

collected from the sonic drilling programme (1.66t/m(3) ) and the

bulk density calculated from more porous/weathered material near

the surface of the stacks (1.33t/m(3) ). Further work is planned to

validate the overall bulk density of the stacks to upgrade the

mineral resources to the Measured and Indicated categories required

for a formal feasibility study.

Mineral resources were estimated using a block model with a

panel size of 50 x 50 x 3m with block volume resolution down to 5 x

5 x 0.5m. Grades, including rare earth oxides, thorium and uranium,

were estimated by ordinary kriging.

Competent Persons Statement

The Mineral Resource Statement presented herein has been

compiled and classified by Malcolm Titley, a Competent Person who

is a Member of The Australasian Institute of Mining and Metallurgy

and the Australian Institute of Geoscientists. Mr Titley is

employed by Maja Mining Limited, an independent consulting company.

Mr Titley has sufficient experience which is relevant to the style

of mineralisation and type of deposit under consideration and to

the activity which he is undertaking to qualify as a Competent

Person as defined in the 2012 Edition of the 'Australasian Code for

Reporting of Exploration Results, Mineral Resources and Ore

Reserves'. Mr Titley is responsible for the preparation of the

Mineral Resource Estimate and takes overall responsibility for the

resource estimation work and resulting Mineral Resource Statement

and consents to the inclusion in this announcement of the matters

based on their information in the form and context in which it

appears.

Appendix

"Indicated Mineral Resource" is that part of a Mineral Resource

for which quantity, grade or quality, densities, shape and physical

characteristics are estimated with sufficient confidence to allow

the application of mining, processing, metallurgical,

infrastructure, economic, marketing, legal, environmental, social

and governmental factors to support mine planning and evaluation of

the economic viability of the deposit. Geological evidence is

derived from adequately detailed and reliable exploration, sampling

and testing and is sufficient to assume geological and grade or

quality continuity between points of observation. An Indicated

Mineral Resource has a lower level of confidence than that applying

to a Measured Mineral Resource and may only be converted to a

probable mineral reserve.

"Inferred Mineral Resource" is that part of a Mineral Resource

for which quantity and grade or quality are estimated on the basis

of limited geological evidence and sampling. Geological evidence is

sufficient to imply but not verify geological and grade or quality

continuity. An Inferred Mineral Resource has a lower level of

confidence than that applying to an Indicated Mineral Resource and

must not be converted to a mineral reserve. It is reasonably

expected that the majority of Inferred Mineral Resources could be

upgraded to Indicated Mineral Resources with continued exploration.

An Inferred Mineral Resource is based on limited information and

sampling gathered through appropriate techniques from locations

such as outcrops, trenches, pits, workings and drill holes.

"JORC Code" means the 2012 edition of the Australasian Code for

Reporting of Exploration Results, Mineral Resources and Ore

Reserves prepared by the Joint Ore Reserves Committee of the

Australasian Institute of Mining and Metallurgy, Australian

Institute of Geoscientists and Minerals Council of Australia. The

JORC Code is an acceptable foreign code for purposes of NI

43-101.

"Mt" means million tonnes

"Dy" means Dysprosium

"TREO" means Total Rare Earth Oxides

"TB" means Terbium

"Nd" means Neodymium

"Pr" means Praseodymium

Market Abuse Regulation ("MAR") Disclosure

This announcement contains inside information for the purposes

of Article 7 of the Market Abuse Regulation (EU) 596/2014 as it

forms part of UK domestic law by virtue of the European Union

(Withdrawal) Act 2018 ("MAR"), and is disclosed in accordance with

the Company's obligations under Article 17 of MAR.

**S**

For further information, please contact

Rainbow Rare George Bennett

Earths Ltd Company Pete Gardner +27 82 652 8526

SP Angel Corporate Ewan Leggat

Finance LLP Broker Charlie Bouverat +44 (0) 20 3470 0470

--------- ------------------- --------------------------------------

Flagstaff Strategic Tim Thompson +44 (0) 207 129 1474

and Investor Fergus Mellon rainbowrareearths@flagstaffcomms.com

Communications

------------------ --------------------------------------

Notes to Editors:

Rainbow's strategy is to become a globally-significant producer

of rare earth metals. NdPr are vital components of the strongest

permanent magnets used for the motors and turbines driving the

green technology revolution. Analysts are predicting demand for

magnet rare earth oxides will grow substantially over the coming

years, driven by increasing adoption of green technology, pushing

the overall market for NdPr into deficit.

The Phalaborwa Rare Earths Project, located in South Africa,

comprises an Inferred Mineral Resource Estimate of 38.3Mt at 0.43%

TREO contained within gypsum tailings stacked in unconsolidated

dumps derived from historic phosphate hard rock mining. High value

NdPr oxide represent 29.1% of the total contained rare earth

oxides, with economic Dysprosium and Terbium oxide credits

enhancing the overall value of the rare earth basket contained in

the stacks. The rare earths are contained in chemical form in the

gypsum dumps, which is expected to deliver a higher-value rare

earth carbonate, with lower operating costs than a typical rare

earth mineral project.

The Company's Gakara Project in Burundi, which produces one of

the highest-grade concentrates in the world (typically 54% total

rare earths oxides ("TREO")) through ongoing trial mining

operations, is currently the only African producer of rare earths.

The Gakara basket is weighted heavily towards NdPr, which account

for over approximately 19.5% of the contained TREO and 85% of the

value of the concentrate.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

MSCEAPKKFLSFEFA

(END) Dow Jones Newswires

June 17, 2021 02:00 ET (06:00 GMT)

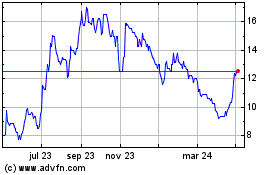

Rainbow Rare Earths (LSE:RBW)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

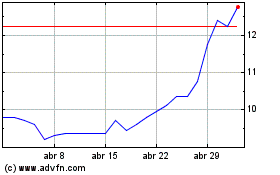

Rainbow Rare Earths (LSE:RBW)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024