TIDMRFX

RNS Number : 8793B

Ramsdens Holdings PLC

15 June 2021

15 June 2021

Ramsdens Holdings PLC

("Ramsdens", the "Group", the "Company")

Interim Results for the six months ended 31 March 2021

Resilient performance and well positioned to resume our growth

strategy

Ramsdens, the diversified financial services provider and

retailer, today announces its Interim Results for the six months

ended 31 March 2021 (the "Period").

The first UK national lockdown was introduced on 23 March 2020,

and so the comparable period for the six months to 31 March 2020

was not substantially impacted by these restrictions.

6 months ended

31 March 2020 18 months ended

6 months ended

31 March 2021 (unaudited) 30 September

(unaudited) HY21 HY20 2020 (audited)

Gross Revenue GBP20.8m GBP27.0m GBP76.9m

------------------ --------------- -----------------

Gross Profit GBP10.5m GBP16.7m GBP47.1m

------------------ --------------- -----------------

Profit/(Loss) before

tax (GBP0.1m) GBP2.3m GBP9.2m

------------------ --------------- -----------------

Net Cash GBP15.0m GBP11.1m GBP15.9m

------------------ --------------- -----------------

Highlights:

-- Resilient performance against challenging trading conditions

caused by Covid-19 restrictions, with pre-tax losses limited to

GBP0.1m (HY20: GBP2.3m profit)

-- Gross revenue decreased 23% to GBP20.8m (HY20: GBP27.0m)

-- Jewellery retail revenue increased 14% to GBP8.1m (HY20:

GBP7.1m) despite the regional lockdown periods. Online revenue

doubled year on year and now represents 17% of total jewellery

sold

-- Pawnbroking gross profit decreased 26% to GBP3.5m (HY20:

GBP4.7m) as a result of the loan book falling as customers repaid

their loans during lockdown and subdued demand for new loans

-- Foreign Currency Exchange severely impacted by the Covid-19

travel restrictions resulting in income down 78% to GBP1.0m (HY20:

GBP4.7m)

-- Gross profit from purchases of precious metals decreased 28%

to GBP2.3m (HY20: GBP3.2m), reflecting reduced high street footfall

during the regional lockdown periods

-- Administration expenses decreased 26% to GBP10.4m (HY20:

GBP14.2m) with overheads well controlled. The Company received

GBP0.9m under the CJRS furlough scheme which is presented as a

reduction to salary costs.

-- Net Assets increased GBP0.5m to GBP35.5m (31 March 2020: GBP35.0m)

-- At the Period end, net cash was GBP15.0m and the Company's

revolving credit facility of GBP10m was undrawn

Given the ongoing impact of the Covid-19 pandemic and the impact

on profitability in the Period, as well as the Group's continuing

use of Government support schemes, the Board believes it is prudent

and in the long-term interests of shareholders to preserve the

Group's available cash resources. Consequently, the Board is not

recommending an interim dividend for the Period. As restrictions

ease, the Board expects the business to return to profitability and

allow it to recommence the payment of dividends, in accordance with

its dividend policy.

Peter Kenyon, Chief Executive, commented:

"We are pleased to have delivered a resilient performance during

the Period despite the difficult trading conditions experienced.

This is a testament to the strength of Ramsdens' diversified

business model, our loyal customer base, and the commitment of our

employees, whom I would like to thank fo r their continued

dedication to serving our local communities throughout the

pandemic.

We are encouraged by the current easing of restrictions across

the UK including the re-opening of non-essential retail and the

lifting of some international travel restrictions.

Whilst the UK Government 'green list' for tourism is currently

very limited, meaning we are unable to provide guidance for this

summer's FX trading, we believe there is significant underlying

consumer demand for international travel which the Group is well

positioned to capitalise on.

Despite restrictions, during the Period we continued to focus on

delivering against our long-term growth strategy. We currently have

six new Ramsdens stores in the pipeline including debut sites in

London and the South East and will continue to appraise new site

opportunities in line with our expansion plans."

S

Enquiries:

Ramsdens Holdings PLC Tel: +44 (0) 1642 579957

Peter Kenyon, CEO

Martin Clyburn, CFO

Liberum Capital Limited (Nominated Adviser) Tel: +44 (0) 20 3100 2000

Richard Crawley

Lauren Kettle

Hudson Sandler (Financial PR) Tel: +44 (0) 20 7796 4133

Alex Brennan

Lucy Wollam

About Ramsdens

Ramsdens is a growing, diversified, financial services provider

and retailer, operating in the four core business segments of

foreign currency exchange, pawnbroking loans, precious metals

buying and selling and retailing of second-hand and new jewellery.

Ramsdens does not offer unsecured high cost short term credit.

Headquartered in Middlesbrough, the Group operates from 154

stores within the UK (including 3 franchised stores) and has a

growing online presence.

Ramsdens is FCA authorised for its pawnbroking and credit

broking activities.

www.ramsdensplc.com

www.ramsdensforcash.co.uk

www.ramsdensjewellery.co.uk

CHIEF EXECUTIVE'S REPORT

This interim report covers the six months ended 31 March 2021

(the "Period"). The Period was undoubtedly challenging, with the

Group operating for four months of the Period under lockdown

restrictions in one or all parts of the UK. This contrasts sharply

to the comparable prior period, with the majority of the six month

period to 31 March 2020 being unaffected by the Covid-19

pandemic.

Our strategic priorities during this unusual Period have been

to:

1. operate a secure and safe environment for our staff,

customers and the local communities we serve;

2. accelerate the Group's online strategic objectives;

3. maintain a healthy financial position; and

4. prepare to capitalise on changes across the sector arising

from the disruption caused by Covid-19.

FINANCIAL REVIEW

Despite all of the challenges, the Group broadly broke even with

a reported Loss Before Tax of GBP0.1m (HY20: profit of GBP2.3m).

Gross profit for the Period decreased 37% to GBP10.5m (HY20:

GBP16.7m) as a result of the impact of Covid-19 restrictions.

Administration expenses were reduced by 26% to GBP10.4m (HY20:

GBP14.2m) with overheads well controlled and the UK Government CJRS

furlough grants of GBP0.9m presented as a reduction to salary

costs.

The Group's balance sheet remained strong with net assets of

GBP35.5m (HY20: GBP35.0m), broadly consistent with the position

reported at 30 September 2020 (GBP35.6m). The Group's main assets

are cash (including foreign currency), pawnbroking loans secured on

gold jewellery and watches, and retail jewellery stock. Net cash as

at 31 March 2021 was GBP15.0m. The Group also has the benefit of a

GBP10.0m revolving credit facility, which is currently undrawn. The

facility was extended for a further year during the Period and

expires in March 2024.

Capital expenditure in the Period of GBP0.9m (HY20: GBP0.5m)

includes the cost of relocating stores, store refurbishments and

the purchase of two store freehold properties for GBP0.15m.

Given the ongoing impact of the Covid-19 pandemic, no

profitability in the Period and the Group continuing to receive UK

Government support in the form of furlough to protect jobs, the

Board believes it is prudent and in the long-term interests of

shareholders to preserve its available cash resources.

Consequently, the Board is not recommending an interim dividend. As

Covid-related restrictions ease, the Board expects the business to

return to profitability and allow it to recommence the payment of

dividends, in accordance with its dividend policy.

SEGMENTAL REVIEW

Foreign Currency Exchange

The foreign currency exchange (FX) segment primarily comprises

the sale and purchase of foreign currency notes to holiday-makers.

Ramsdens also offers prepaid travel cards and international

bank-to-bank payments.

HY21 HY20 YOY

Total Currency exchanged GBP20m GBP181m (89%)

-------- --------- ------

Income GBP1.0m GBP4.7m (78%)

-------- --------- ------

Online click & collect orders GBP1.6m GBP18.5m (91%)

-------- --------- ------

% of online FX 8% 10% (2%)

-------- --------- ------

Percentage of GP 10% 28% (18%)

-------- --------- ------

The restrictions on international travel due to the Covid-19

pandemic and the associated quarantine regulations put in place by

governments across the globe have severely impacted the demand for

international holidays and, as a result, the demand for foreign

currency exchange.

The Group has successfully managed commission margins in order

to minimise the impact on profitability of the reduction in total

currency exchanged.

As we look forward, the income from this service is anticipated

to grow with the easing of restrictions and the return of

international travel. We strongly believe that customers' desire to

travel abroad remains high. While we have seen more people use card

payments in the UK, we are confident that the need for foreign

currency cash will remain high given the popular holiday

destinations and known spending patterns while abroad.

Pawnbroking

Pawnbroking is a small subset of the consumer credit market in

the UK and a simple form of asset backed lending dating back to the

foundations of banking. In a pawnbroking transaction an item of

value, known as a pledge (in Ramsdens' case this is jewellery and

watches) is held by the pawnbroker as security against a six-month

loan. Customers pay interest on this loan, repay the capital sum

borrowed and recover their pledged item. If a customer defaults on

the loan, the pawnbroker sells the pledged item to repay the amount

owed and returns any surplus funds to the customer. Pawnbroking is

regulated by the FCA in the UK and Ramsdens is FCA authorised.

000's HY21 HY20 YOY

Gross profit GBP3,480 GBP4,706 (26%)

--------- --------- ------

Total loan book GBP5,749 GBP7,747 (26%)

--------- --------- ------

Past due GBP893 GBP1,115 (20%)

--------- --------- ------

In date loan book GBP4,856 GBP6,632 (27%)

--------- --------- ------

Percentage of GP 33% 28% 5%

--------- --------- ------

The various national lockdowns have impacted the borrowing

patterns of our customer base, in reducing their borrowing needs

alongside an increase in customers repaying their loans. If, as we

expect, the borrowing pattern is similar to that following lockdown

in 2020, we will see normal lending volumes return in the summer

and the loan book will rebuild over time. The typical pawnbroking

customer is cautious; they know that the item pledged is their

store of wealth and that this enables them to borrow when

needed.

The average loan value as at 31 March 2021 was GBP265 (30

September 2020: GBP248). The loan book is considered to be of high

quality with a low loan to value ratio of approximately two thirds

of the gold price at the Period end. Where loans are not repaid,

the current high gold price enables an improved recovery of

interest where goods that are not appropriate for retailing are

scrapped.

The online pawnbroking facility has continued to be popular

amongst customers to make loan repayments. This facility allows the

customer to save interest by repaying when they have the funds and

prior to any store visit. Only a limited number of customers have

chosen to borrow via the website because the goods still need to be

posted to Ramsdens.

Jewellery Retail

The Group retails new and second-hand jewellery to customers

both in store and online. The Board continues to believe there is

further growth potential for Ramsdens in this segment which can be

achieved by leveraging the Group's store estate and e-commerce

operations and by cross-selling to existing customers and acquiring

new customers.

Retailing of new jewellery products complements the Group's

second-hand offering to give our customers greater choice in

breadth of products and price, and enables the Group to attract

some customers who prefer not to buy second-hand. New jewellery

items now account for 39% (HY20: 31%) of jewellery retail

revenue.

000's HY21 HY20 YOY

Revenue GBP8,074 GBP7,054 14%

---------- --------- -----

Gross Profit GBP3,168 GBP3,113 2%

---------- --------- -----

Margin % 39% 44% (5%)

---------- --------- -----

Jewellery retail stock GBP10,810 GBP8,919 21%

---------- --------- -----

Online sales* GBP1,560 GBP779 100%

---------- --------- -----

% of sales online* 17% 9% 8%

---------- --------- -----

Percentage of GP 30% 19% 11%

---------- --------- -----

* based on total jewellery sold which includes ex-pledge

items

Store sales have been limited through the Period due to varying

restrictions during the lockdown periods. However, we have seen an

increase in demand for higher value items, in particular premium

watches where sales were up 13%. The ongoing development of the

premium watch sales offering continues to generate higher cash

margin per product sold but at a lower percentage margin. The Board

continues to believe that watch sales represent incremental revenue

and profit for the Group.

The investment in our online retail jewellery website,

www.ramsdensjewellery.co.uk continues to deliver improved results.

The total jewellery sold through our ecommerce activities doubled

to GBP1.6m (HY20: GBP0.8m) for the Period. We are continuing to

make further investments in improving the customer experience,

retargeting campaigns, pay per click campaigns, affiliate schemes

and search engine optimisation. The ecommerce department is managed

as a separate business unit and is profitable.

We believe there is an ongoing opportunity for improving and

growing our jewellery retail business. Our investment in

strengthening the retail team, each with a product category focus,

is supporting ongoing growth. Additionally, t he Group has focused

on enhancing the appeal of its jewellery stock offering through

better displays, range expansion and regular replenishment of the

new jewellery range, increased investment in pre-owned premium

watches, and undertaking targeted promotional activity to reinforce

the Ramsdens brand's value-for-money reputation.

Purchases of Precious Metals

Through the precious metals buying and selling service, Ramsdens

buys unwanted jewellery, gold and other precious metals from

customers for cash. Typically, a customer brings unwanted jewellery

into a Ramsdens store and a price is agreed with the customer

depending upon the retail potential, weight or carat of the

jewellery. The Group has second-hand dealer licences and other

permissions and adheres to the approved "gold standard" for buying

precious metals.

Once jewellery has been bought from the customer, the Group's

dedicated jewellery department assesses whether or not to retail

the item through the store network or online. Income derived from

jewellery, which is purchased and then retailed, is reflected in

jewellery retail income and profits. The residual items are smelted

and sold to a bullion dealer for their intrinsic value and the

proceeds are reflected in the accounts as precious metals buying

income.

000's HY21 HY20 YOY

Revenue GBP5,623 GBP7,499 (25%)

--------- --------- ------

Gross Profit GBP2,330 GBP3,214 (28%)

--------- --------- ------

Percentage of GP 22% 19% 3%

--------- --------- ------

In comparing the two six month periods, the average sterling

gold price increased by 14% in HY21.

The weight of gold purchased has decreased primarily due to the

reduced high street footfall as a consequence of the lockdowns plus

a reduced need for additional cash and a lower volume of foreign

currency customers to whom we have traditionally cross-sold this

service. We anticipate the weight purchased will increase as

trading conditions normalise. In the near term, we believe the gold

price will remain high, assisting margins.

Other services

In addition to the four core business segments, the Group also

provides additional services in cheque cashing, Western Union money

transfer and credit broking and it receives franchise fees.

000's HY21 HY20 YOY

Revenue GBP540 GBP1,029 (48%)

------- --------- ------

Gross Profit GBP540 GBP937 (42%)

------- --------- ------

Percentage of GP 5% 6% (1%)

------- --------- ------

Whilst this has been a steady source of income, cheque cashing

was and continues to be a service in decline and represents a large

proportion of the reduction in gross profit in this segment.

OPERATIONAL REVIEW

The retail estate continues to be actively managed. In the main,

landlords have been realistic to the current high street situation.

Where appropriate, lease renewals have generally resulted in rent

reductions, greater flexibility or sometimes both. Two stores were

closed and merged with nearby stores where we could not agree

reasonable lease terms with our landlords. Four stores were

relocated to take advantage of better locations with higher

footfall and two stores were refurbished to provide a better

customer experience. During the next twelve months, we anticipate

relocating a further six stores and refurbishing six stores.

Our new store opening strategy has recommenced. We have a strong

pipeline of target locations and have advanced six locations into

various stages of the planning and legal process. This expansion

includes - for the first time - locations in London and the South

East and we have recruited Deborah Papas, an experienced pawnbroker

and jeweller, to head up this geographic expansion opportunity

which we believe presents a greater opportunity to acquire

independent pawnbrokers. The first store in Kent is scheduled to

open in July.

We have promoted Claire Gebski to head up our staff engagement

and staff development. This important role will ensure that we

continue to focus on our people and develop our culture of seeking

continuous improvement. Amongst other things, our staff forum team

have been challenged to see how we can further improve our

environmental footprint and have recently launched a "Think Green"

initiative.

Ernst & Young have been engaged as our auditors for nine

years and the Board is grateful for their support and challenge

over this period. Following a review, the Board has made the

decision to appoint Grant Thornton for the 2021 audit.

I would like to take this opportunity to thank each and every

staff member for their dedication, commitment, willingness to

strive for continuous improvement and their focus on delivering

fantastic service to our customers.

OUTLOOK

Hopefully, we are nearing the time when the UK Government will

further ease social distancing measures in the UK and also lift

varying restrictions enabling freer but safe international

travel.

The Group has a strong financial footing, the benefit of

diversified income streams, a growing online presence and a

well-invested store network. These attributes, as well as our

belief that there is strong underlying consumer demand for our

services, gives the Board confidence that Ramsdens is well placed

to not only navigate the near term challenges, but also to emerge

in a strong position to return to growth and deliver our strategy

to create value for all of the Group's stakeholders.

Peter Kenyon

Chief Executive Officer

Interim Condensed Financial Statements

Unaudited condensed consolidated statement of comprehensive

income

For the six months ended 31 March 2021

6 months 6 months 18 months

Ended ended ended

31 March 31 March 30 September

2021 2020 2020

Unaudited Unaudited Audited

Note GBP'000 GBP'000 GBP'000

Revenue 2 20,835 26,984 76,938

Cost of sales (10,290) (10,309) (29,789)

---------- ---------------------------- --------------

Gross profit 2 10,545 16,675 47,149

Other Income - - 725

Administrative expenses (10,446) (14,151) (37,858)

---------- ---------------------------- --------------

Operating profit 99 2,524 10,016

Finance Costs 3 (232) (240) (795)

---------- ---------------------------- --------------

(Loss) / profit before tax (133) 2,284 9,221

Income tax expense 29 (592) (2,103)

Total comprehensive (loss)

/ income for the period (104) 1,692 7,118

---------- ---------------------------- --------------

Basic earnings per share in

pence 4 (0.3) 5.5 23.1

Diluted earnings per share

in pence 4 (0.3) 5.3 22.5

Unaudited condensed consolidated statement of changes in

equity

For the six months ended 31 March 2021

6 months 6 months 18 months

ended ended ended

31 March 31 March 30 September

2021 2020 2020

Unaudited Unaudited Audited

GBP'000 GBP'000 GBP'000

Opening total equity 35,555 33,962 30,377

Total comprehensive income

for the period (104) 1,692 7,118

---------- ---------- -------------

Transactions with shareholders:

Share capital issued 6 - -

Dividends paid - (832) (2,313)

Share based payments 103 164 398

Deferred tax on share based

payments (42) (25) (25)

---------- ---------- -------------

Total transactions with

shareholders 67 (693) (1,940)

---------- -------------

Closing total equity 35,518 34,961 35,555

---------- ---------- -------------

Unaudited condensed consolidated statement of financial

position

At 31 March 2021

6 months 6 months 18 months

ended ended ended

31 March 31 March 30 September

2021 2020 2020

Unaudited Unaudited Audited

Note GBP'000 GBP'000 GBP'000

Assets

Non-current assets

Property, plant and equipment 5,207 5,354 4,845

Intangible assets 807 1,089 870

Investments - - -

Right-of-use assets 8,286 9,009 8,536

Deferred tax assets 76 273 182

---------- ---------- -----------------

14,376 15,725 14,433

Current Assets

Inventories 13,644 13,055 13,360

Trade and other receivables 7,729 10,147 8,743

Cash and short term deposits 14,996 11,051 15,873

---------- ---------- -----------------

36,369 34,253 37,976

---------- ---------- -----------------

Total assets 50,745 49,978 52,409

---------- ---------- -----------------

Current liabilities

Trade and other payables 6,169 4,551 6,422

Lease liability 1,745 1,818 2,005

Income tax payable 70 809 1,157

---------- ---------- -----------------

7,984 7,178 9,584

---------- ---------- -----------------

Net current assets 28,385 27,075 28,392

---------- ---------- -----------------

Non-current liabilities

Lease liability 7,049 7,647 7,094

Accruals and deferred

income 133 - 153

Deferred tax liabilities 61 192 23

---------- ---------- -----------------

7,243 7,839 7,270

---------- ---------- -----------------

Total liabilities 15,227 15,017 16,854

---------- ---------- -----------------

Net assets 35,518 34,961 35,555

---------- ---------- -----------------

Equity

Issued capital 5 314 308 308

Share premium 4,892 4,892 4,892

Retained earnings 30,312 29,761 30,355

---------- ---------- -----------------

Total equity 35,518 34,961 35,555

---------- ---------- -----------------

Unaudited condensed consolidated statement of cash flows

For the six months ended 31 March 2021

6 months 6 months 18 months

ended ended ended

31 March 31 March 30 September

2021 2020 2020

Unaudited Unaudited Audited

GBP'000 GBP'000 GBP'000

Operating activities

(Loss) / profit before tax (133) 2,284 9,221

---------- ---------- -------------

Adjustments to reconcile profit

before tax to net cash flows:

Depreciation and impairment

of property, plant & equipment 506 686 2,238

Depreciation of right-of-use

assets 1,080 1,213 3,523

Amortisation and impairment

of intangible assets 76 188 616

Loss on disposal of property,

plant and equipment 10 44 185

Share based payments 103 164 398

Finance costs 232 240 795

Working capital adjustments:

Movement in trade and other receivables

and prepayments 1,124 833 1,781

Movement in inventories (284) (1,206) (702)

Movement in trade and other

payables (273) (1,904) 170

---------- ---------- -------------

2,441 2,542 18,225

Interest paid (232) (240) (795)

Income tax paid (1,066) (929) (1,678)

---------- ---------- -------------

Net cash flows from operating

activities 1,143 1,373 15,752

---------- ---------- -------------

Investing activities

Proceeds from sales of property,

plant and equipment 10 - 4

Purchase of property, plant

and equipment (888) (527) (1,787)

Purchase of intangible assets (13) (13) (258)

---------- ---------- -------------

Net cash flows used in investing

activities (891) (540) (2,041)

Financing Activities

Dividends paid - (832) (2,313)

Share capital issued 6 - -

Payment of lease liabilities (1,135) (1,268) (3,645)

Bank loans drawn down - - 2,600

Repayment of bank borrowings - (3,884) (7,900)

---------- ---------- -------------

Net cash flows used in financing

activities (1,129) (5,984) (11,258)

---------- ---------- -------------

Net (decrease) / increase

in cash and cash equivalents (877) (5,151) 2,453

Cash and cash equivalents

at start of period 15,873 16,202 13,420

---------- ---------- -------------

Cash and cash equivalents

at end of period 14,996 11,051 15,873

---------- ---------- -------------

Unaudited notes to the interim condensed financial

statements

For the six months ended 31 March 2021

1. Basis of preparation

The interim condensed financial statements of the group for the

six months ended 31 March 2021, which are neither audited or

reviewed, have been prepared in accordance with the International

Financial Reporting Standards ('IFRS') accounting policies adopted

by the group and set out in the annual report and accounts for the

year ended 30 September 2020. As permitted, this interim report has

been prepared in accordance with the AIM rules and not in

accordance with IAS 34 "Interim financial reporting". While the

financial figures included in this preliminary interim earnings

announcement have been computed in accordance with IFRS's

applicable to interim periods, this announcement does not contain

sufficient information to constitute an interim financial report as

that term is defined in IFRS's.

The financial information contained in the interim report also

does not constitute statutory accounts for the purpose of section

434 of the Companies Act 2006. The financial information for the

period ended 30 September 2020 is based on the statutory accounts

for period ended 30 September 2020 which have been filed with the

Registrar of Companies and are available on the group's website

www.ramsdensplc.com. The auditors, Ernst & Young LLP, reported

on those accounts: their report was unqualified, did not draw

attention to any matters by way of emphasis and did not contain a

statement under section 498 (2) or (3) of the Companies Act

2006.

The financial information for the 6 months ended 31 March 2020

in respect of the consolidated income statement of comprehensive

income is based on the movement between the figures stated in the

unaudited interim financial information for the 12 month period

ended 31 March 2020 and the unaudited Interim accounts covering the

6 month period ended 30 September 2019. The Consolidated statement

of financial position at 31 March 2020 is per the unaudited

financial information as at that date.

The Board have conducted an extensive review of forecast

earnings and cash over the next twelve months, considering various

scenarios and sensitivities given the Covid-19 situation and

uncertainty around the future economic environment. At 31 March

2021 the Group had cash resources of cGBP15m and an undrawn RCF

facility of GBP10m expiring in March 2024.

The Group's activities include services deemed essential

services by the government and therefore the Group's stores are

likely to be able to open in the event of a further lockdown. The

Group's essential services include pawnbroking, foreign currency,

money transfer and cheque cashing. The Group has a strong asset

base and the ability to generate cash quickly through the sale of

jewellery stock for its intrinsic value or by restricting new

pawnbroking lending. The Group has shown resilient trading through

the last year of Covid-19 restrictions, assisted by government

support.

The Board have a reasonable expectation that the Company and

Group have adequate resources to continue in operational existence

for the foreseeable future. Accordingly, they continue to adopt the

going concern basis in preparing the interim condensed financial

statements.

Unaudited notes to the interim condensed financial statements

(continued)

For the six months ended 31 March 2021

2. Segmental Reporting

6 months 6 months 18 months

ended ended ended

31 March 31 March 30 September

2021 2020 2020

Unaudited Unaudited Audited

GBP'000 GBP'000 GBP'000

Revenue

Pawnbroking 5,571 6,697 18,911

Purchases of precious metals 5,623 7,499 23,024

Retail Jewellery sales 8,074 7,054 17,109

Foreign currency margin 1,027 4,705 14,859

Income from other financial

services 540 1,029 3,035

---------- -------------------- -------------

Total Revenue 20,835 26,984 76,938

---------- -------------------- -------------

Gross profit

Pawnbroking 3,480 4,706 12,248

Purchases of precious metals 2,330 3,214 9,856

Retail Jewellery sales 3,168 3,113 7,701

Foreign currency margin 1,027 4,705 14,859

Income from other financial

services 540 937 2,485

---------- -------------------- -------------

Total Gross profit 10,545 16,675 47,149

---------- -------------------- -------------

Other income - - 725

Administrative expenses (10,446) (14,151) (37,858)

Finance costs (232) (240) (795)

---------- -------------------- -------------

(Loss) / Profit before tax (133) 2,284 9,221

---------- -------------------- -------------

Income from other financial services comprises of cheque cashing

fees, Electronics & buybacks, agency commissions on

miscellaneous financial products.

The Group is unable to meaningfully allocate administrative

expenses, or financing costs between the segments due to the fact

that these include staff costs who undertake all services in

branches. Accordingly, the Group is unable to disclose an

allocation of items included in the Consolidated Statement of

Comprehensive Income below Gross profit, which represents the

reported segmental results.

Unaudited notes to the interim condensed financial statements

(continued)

For the six months ended 31 March 2021

2. Segmental Reporting

6 months 6 months 18 months

ended ended ended

31 March 31 March 30 September

2021 2020 2020

Unaudited Unaudited Audited

Other information GBP'000 GBP'000 GBP'000

Capital additions (*) 1,742 1,610 2,045

Depreciation and amortisation

(*) 1,672 2,134 2,854

Assets

Pawnbroking 8,557 11,844 9,685

Purchases of precious metals 768 1,765 1,664

Retail Jewellery sales 11,005 9,089 9,707

Foreign currency margin 3,345 9,019 5,692

Income from other financial

services 175 90 145

Unallocated (*) 26,895 18,171 25,516

---------- -------------

50,745 49,978 52,409

---------- ---------- -------------

Liabilities

Pawnbroking 434 347 375

Purchases of precious metals 3 19 3

Retail Jewellery sales 3,061 1,365 2,130

Foreign currency margin 70 32 471

Income from other financial

services 469 31 438

Unallocated (*) 11,190 13,223 13,437

---------- -------------

15,227 15,017 16,854

---------- ---------- -------------

(*) The Group is unable to meaningfully allocate this

information by segment due to the fact that all segments operate

from the same stores and the assets and liabilities are common to

all segments.

Fixed assets are therefore included in unallocated assets and

lease liabilities are included in unallocated liabilities.

Unaudited notes to the interim condensed financial statements

(continued)

For the six months ended 31 March 2021

3. Finance costs

6 months 6 months 18 months

ended ended ended

31 March 31 March 30 September

2021 2020 2020

Unaudited Unaudited Audited

GBP'000 GBP'000 GBP'000

Interest on debts and borrowings 42 31 181

Interest on right-of-use assets 190 209 614

Total finance costs 232 240 795

---------- ---------- ---------------

4. Earnings per share

6 months 6 months 18 months

ended ended ended

31 March 31 March 30 September

2021 2020 2020

Unaudited Unaudited Audited

Profit for the period (GBP'000) (104) 1,692 7,118

Weighted average number of shares

in issue 31,393,207 30,837,653 30,837,653

Earnings per share (pence) (0.3) 5.5 23.1

Fully diluted earnings per share

(pence) (0.3) 5.3 22.5

5. Issued capital and reserves

Ordinary shares issued and fully paid No. GBP'000

At 30 March 2020 30,837,653 308

At 30 September 2020 30,837,653 308

Share capital issued 555,554 6

At 31 March 2021 31,393,207 314

During the period 555,554 ordinary 1p shares were issued at par

pursuant to the Group's Long Term Incentive Plan (LTIP). A further

250,000 share options have fully vested under the LTIP but have yet

to be exercised.

Unaudited notes to the interim condensed financial statements

(continued)

For the six months ended 31 March 2021

6. Dividends

No dividends have been approved since the 2nd December 2019 as a

result of the Coronavirus pandemic.

On 2 December 2019, the directors approved a 2.7 pence interim

dividend which equates to a dividend payment of GBP832,000 the

dividend was paid on 20 February 2020. The final dividend for the

year ended March 2019 of 4.8p per share was paid on 20 September

2019 totalling GBP1,480,000.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR SFESFIEFSESM

(END) Dow Jones Newswires

June 15, 2021 02:00 ET (06:00 GMT)

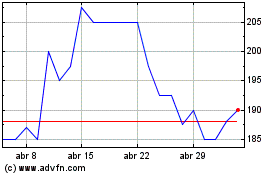

Ramsdens (LSE:RFX)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Ramsdens (LSE:RFX)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024