TIDMRCH

RNS Number : 1917T

Reach PLC

23 November 2021

Reach plc

Digital growth and strengthening print help support further

investment

23 November 2021

Reach plc is issuing a trading update covering 28 June 2021 to

21 November 2021 ('the period').

Jim Mullen, Reach plc Chief Executive

"Strategic delivery is transforming our prospects for growth and

we're progressing towards our goal of doubling digital revenue over

the medium term. Registration numbers are strong, and advertisers

are responding to our expanded portfolio of data-led products.

Together with our efficient operating model, this is enabling us to

invest further in digital content as we build a modern and

inclusive media business."

-- Revenue currently trading ahead of full year expectations, enabling digital investment

-- Customer registrations now over 8m, up from 6.7m at end of July

-- Newly extended and enlarged RCF and strong cash conversion increases financial flexibility

Continued strong growth in digital revenue and further print

resilience

We have seen a more normalised pattern of year-on-year trading

during H2, following the relatively soft H1 comparatives as we

annualised the first COVID lockdown. Revenue has continued to grow

and was up 1.2% overall in the period, with digital up 17.2% and

print declines moderating further to 3.5%.

A strong digital revenue performance in the period was driven by

yield expansion, supported by strategic delivery and a recovery in

digital advertising versus 2020. On a two-year basis, digital

revenue growth remains encouraging, up by 39.0% for the

year-to-date, with average page views growing by 30%.

The full year outlook for print has strengthened, driven

predominantly by circulation which is on an improved two-year

trajectory compared to H1. This reflects a combination of market

recovery, strategic investment in availability, marketing,

promotions and product enhancement.

Delivery of strategy on track with investment programme

accelerating

Customer registrations are now over 8m (6.7m at end of July),

with growth supported by the recent addition of Google 'one tap'

functionality, a more frictionless route to sign-up, which enables

deeper customer understanding. As we approach our target of 10m

registered users, we're focusing on the next phase of the Customer

Value Strategy, driving retention, engagement frequency and dwell

time to grow ARPU. Our 'PLUS' products have now been used to

support over 150 campaigns and we're exploring routes to deeper and

broader integration with advertisers via programmatic exchanges,

curated marketplaces and other digital buying platforms.

Revenue mix and cost savings from last year's transformation

programme are supporting a stronger profit margin and increased

strategic investment, particularly in expanding the breadth and

depth of our digital content. So far this year we have hired c.400

additional digital editorial roles in both national and local

titles and completed the rollout of the local Live network into

every county of England and Wales.

While transformation in 2020 enabled a more efficient and

adaptable operating model, we remain vigilant regarding wider

consumer confidence and inflationary pressure in the post-pandemic

environment. We have begun to see an increase in the cost of print

production, particularly for energy and newsprint. With the

longer-term effect on the cost base still emerging, we are closely

monitoring developments and will continue to prioritise

efficiencies to mitigate the impact.

We have yet to reach agreement with regard to the triennial

review of our pension commitments but we continue to engage in

discussions and remain committed to working towards our objective

of achieving funding of all schemes as agreed in our 2016 triennial

review.

New credit facility underpins strength of balance sheet and cash

flow

We recently concluded an increase in our revolving credit

facility with an expanded syndicate of relationship banks. The

increase in available facilities from GBP65m to GBP120m, for a term

of at least four years, demonstrates growing confidence in our

covenant and provides further flexibility to invest in the

strategy.

Notes

Latest company compiled view of market expectations shows

consensus group revenue of GBP604.1m and adjusted operating profit

of GBP145.8m for 2021.

Revenue movements stated on like-for-like basis excluding ISL

(Independent Star Limited) and impact of regional portfolio

changes. Period relates to 28 June to 21 November 2021 with

November being a latest estimate of revenues.

YOY Breakdown 2yr* Breakdown

---------------------------------

Period H1 Year to date Period H1 Year to

date

% % % % % %

------- ------- ------------- -------- -------- --------

Digital Revenue 17.2% 42.7% 29.2% 36.4% 41.4% 39.0%

------- ------- ------------- -------- -------- --------

Print Revenue (3.5%) (5.2)% (4.5%) (21.4%) (23.9%) (22.8%)

------- ------- ------------- -------- -------- --------

* circulation revenue (3.7%) (5.1)% (4.5%) (15.6%) (16.0%) (15.8%)

------- ------- ------------- -------- -------- --------

* advertising revenue (2.8%) (4.3)% (3.6%) (29.2%) (33.7%) (31.7%)

------- ------- ------------- -------- -------- --------

Group Revenue 1.2% 2.6% 2.0% (11.9%) (14.9%) (13.6%)

------- ------- ------------- -------- -------- --------

*Period 2yr movement is a combined two-year like-for-like

comparison versus the same period in 2019

Preliminary results for the 12 months to 26 December 2021 will

be published on 1 March 2022.

Enquiries

Reach

Jim Mullen, Chief Executive Officer

Simon Fuller, Chief Financial Officer

Ciaran O'Brien, Communications Director

communications@reachplc.com

Matt Sharff, Investor Relations Director +44 (0)7341 470 722

Tulchan Communications reachplc@tulchangroup.com

Giles Kernick +44 (0)207 353 4200

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

TSTFEFFUEEFSEEF

(END) Dow Jones Newswires

November 23, 2021 02:00 ET (07:00 GMT)

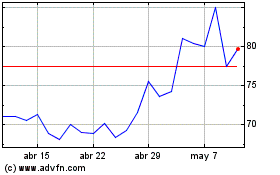

Reach (LSE:RCH)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

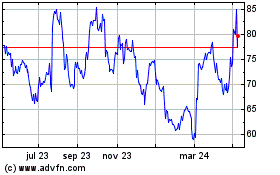

Reach (LSE:RCH)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024