TIDMREAT

RNS Number : 3960D

React Group PLC

29 June 2021

29 June 2021

REACT Group plc

("REACT", the "Group" or the "Company")

Half Year Results FY 2021

REACT Group plc (AIM:REAT.L), the leading specialist cleaning,

hygiene and decontamination company announces its unaudited results

for the six-month period ended 31 March 2021 ("Interim

Report").

Financial Highlights

for the six months ended 31 March 2021

HY 2021 HY 2020 Change

------------------------------- -------- -------- -------

Revenue (GBP'000) 2,509 2,091 20%

Gross profit (GBP'000) 1,018 695 46%

Gross profit margin 40.6% 33.2% 733bps

EBITDA (GBP'000) 100 85 17%

Adjusted EBITDA (GBP'000) 369 85 332%

Net profit for the period

(GBP'000) 74 50 48%

Earnings per share (basic)

(pence) 0.01 0.01 23%

Earnings per share (adjusted)

(pence) 0.07 0.02 260%

Net cash (GBP'000) 771 306 152%

-- Group revenue up 20% to GBP2,509,000

-- Gross profit up 46% to GBP1,018,000

-- Gross profit margins increased by 733 basis points to over 40%

-- Adjusted EBITDA is calculated excluding exceptional costs (see note 5 for details)

-- Net profit of GBP74,000 and basic EPS of 0.01p

-- Adjusted EPS of 0.07p (see note 6 for details)

-- The acquisition of Fidelis Contract Services Ltd ("Fidelis")

was completed on 26 March 2021. No contribution from Fidelis is

included in these interim figures, but the assets and liabilities

for Fidelis as at 31 March 2021 are included in the Group's

Consolidated Statement of Financial Position as at 31 March

2021

-- The initial cash consideration of GBP1.5m was paid from REACT's existing cash resources

-- The cash balance at the period end represents the balance for

the enlarged Group following the payment of the cash consideration

in connection with the acquisition of Fidelis

Commenting on the results Shaun Doak, Chief Executive Officer of

REACT, said:

"We are delighted with the results for H1 2021; REACT continues

to demonstrate momentum in growth and improvements in operational

performance and profitability.

Although COVID-19 continues to present both opportunities and

challenges to different aspects of the business we have continued

to make strategic progress, investing in sales and marketing, new

technology and people to drive growth, increase operational

efficiency and improve customer value.

H2 has started well; Fidelis, acquired at the end of March 2021,

reported record trading months in April and May to continue their

solid track record of growth. This, together with important

post-period customer contract wins for REACT, announced on 20 April

2021, 26 April 2021 and 18 May 2021, support a strong positive

outlook for the medium to long term."

For more information:

REACT Group Plc.

Shaun Doak, Chief Executive Of cer Tel: +44 (0) 1283 550

Andrea Pankhurst, Chief Financial Officer 503

Mark Braund, Chairman

Allenby Capital Limited

(Nominated Adviser/Broker)

Nick Athanas / Liz Kirchner (Corporate Tel: +44 (0) 203 328

Finance) 5656

Amrit Nahal / Tony Quirke (Sales & Corporate

Broking)

RESULTS SUMMARY & STRATEGY

The REACT business performed strongly in the first half of the

year, making material improvements in all key financial metrics,

and demonstrating the profit potential available to the Company

through operational gearing.

Gross profit margins were particularly strong, in part due to

strong demand for ad hoc emergency project work during the period,

which carries with it a high margin. We estimate that the

underlying blended margin of the REACT business is now in the

region of 30-35%, some 1,000 to 1,500 basis points higher than two

and half years ago, since when the business has gone through a

dramatic improvement in its value proposition and business

controls.

Performance remains strong in the healthcare, rail and

facilities management sectors with growth beginning to emerge from

housing associations as well.

In addition to increased public and commercial expectations for

quality hygiene, consolidation of supply chains continues to

represent opportunity for growth for the REACT business. This has

been demonstrated by the post-period appointment of REACT as the

core vendor for specialist cleaning in mainland Great Britain to

one of the world's leading facilities management firms (announced

by REACT on 26 April 2021). This three-year agreement is aimed at

consolidating their supply chain from several hundred suppliers to

ultimately just one, REACT.

REACT has also used this period to expand its modest investment

in sales and marketing automation tools, improving both the quality

of sales engagement and sales productivity. This is beginning to

yield results, opening new opportunities, broadening our engagement

with customers, and improving both the size and visibility of our

sales pipeline.

Our strategy remains to build a leading position across our

business through organic growth and, if the right opportunities

present themselves, via strategic acquisitions to support our goal

of becoming the country's most trusted name in the provision of

specialist cleaning, decontamination, and hygiene services.

IMPACT OF COVID-19

Although COVID-19 has brought continued challenges to the

business with renewed national lockdown restrictions during the

period, our team responded well to fluctuating demand for deep

cleaning and decontamination services as we continued our rapid

response to often urgent requirements across mainland Great

Britain.

The contracted reactive business was impacted by lockdown

restrictions; less economic activity resulted in fewer incidents in

this area of our business for our teams to attend to. This however

was more than compensated by COVID-19 related decontaminations and

consultancy, which brought with it higher margins. Whilst we

recognise the short to medium term nature of COVID-19, the quality

of our work in this area has been recognised, enhancing the REACT

brand and resulting in increased engagement with both new and

existing customers. As work on COVID-19 decontaminations slows

down, regular emergency cleaning activity returns, and because

(in-part) of our response to COVID-19, REACT benefits from

incremental opportunities amongst expanded and improved customer

relationships.

PEOPLE

The continued dedication and commitment of our people and our

network of REACT-approved specialist partners has been exemplary.

Our service delivery is provided by people who are considered

experts in their field, supported by our dedicated customer-centric

team, who have continued to adapt to the daily challenges while

working from home. The strength of our results is underpinned by

the efforts of the entire team and testament to the superb culture

the management team have cultivated. On behalf of the Board, I

would once again like to thank all my colleagues for their

commitment, resilience, and quality of work.

OUTLOOK

H2 has started well. Fidelis (acquired at the end of March 2021)

reported record trading months in April and May to continue their

solid track record of growth. With long-term contracts of between

3-7 years in length driving strong recurring income, this bodes

well for H2 and the year(s) beyond.

H1 for REACT was very strong, however the start of H2 by

contrast has experienced some softness in the reactive business as

the country stutters towards the end of lockdown. Whilst COVID-19

decontamination work has been reducing, the more typical reactive

emergency cleaning work has been slow to pick up. A similar pattern

emerged last year as the country went from full lockdown into a

more relaxed period during the summer of 2020. Then as we believe

now, REACT had two soft months, which rapidly returned to some form

of normality. Ironically as we pen this report we have experienced

the first few weeks of high demand returning, including a

re-emergence of COVID-19 decontaminations. The contract maintenance

business has continued well, with little or no impact from the

issues surrounding the pandemic.

We also announced some important post-period customer contract

wins for REACT, announced on 20 April 2021, 26 April 2021 and 18

May 2021. These further underpin a strong positive outlook for the

medium to long-term.

Shaun Doak

Chief Executive Officer

29 June 2021

CONSOLIDATED STATEMENT OF COMPREHENSIVE INCOME

For the six months ended 31 March 2021

Unaudited Unaudited Audited

6 months 6 months Year ended

ended ended 30 September

31 March 31 March 2020

2021 2020

Note GBP'000 GBP'000 GBP'000

Continuing Operations

Revenue 2,509 2,091 4,360

Cost of Sales (1,491) (1,396) (2,911)

---------- ---------- --------------

Gross Profit 1,018 695 1,449

Other operating income 2 70

Administrative expenses (971) (632) (1,308)

Exceptional costs included

in administrative expenses 5 (269) - -

--------------------------------- ----- ---------- ---------- --------------

Operating profit 49 63 211

Income tax credit - - -

Finance cost 25 (13) (23)

---------- ---------- --------------

Profit for the period 74 50 188

Other comprehensive Income - - -

Profit for the financial period

attributable to equity holders

of the company 74 50 188

========== ========== ==============

Basic and diluted profit per

share 6

Basic earnings per share 0.01p 0.01p 0.04p

========== ========== ==============

Diluted earnings per share 0.01p 0.01p 0.04p

========== ========== ==============

Adjusted basic earnings per

share 0.07p 0.02p 0.06p

========== ========== ==============

Adjusted diluted earnings per

share 0.07p 0.02p 0.05p

========== ========== ==============

CONSOLIDATED STATEMENT OF FINANCIAL POSITION

As at 31 March 2021

Unaudited Unaudited Audited

As at 31 As at 31 As at 30

March March 2020 September

2021 2020

Assets Note GBP'000 GBP'000 GBP'000

Non-current assets

Intangibles - Goodwill 4 2,050 174 174

Intangibles - Other 4 1,756 - -

Property, plant and equipment 180 71 85

Right-of-use assets 118 34 27

---------- ------------ -----------

4,104 279 286

---------- ------------ -----------

Current assets

Stock 9 - -

Trade and other receivables 1,781 1,112 1,089

Cash and cash equivalents 771 306 1,783

2,561 1,418 2,872

Total assets 6,665 1,697 3,158

========== ============ ===========

Equity

Shareholders' Equity

Called-up equity share capital 1,270 1,039 1,246

Share premium account 6,028 4,926 5,852

Reverse acquisition reserve (5,726) (5,726) (5,726)

Capital redemption reserve 3,337 3,337 3,337

Merger relief reserve 1,328 1,328 1,328

Share based payments 12 14 15

Accumulated losses (3,787) (3,999) (3,861)

Total Equity 2,462 919 2,191

---------- ------------ -----------

Liabilities

Current liabilities

Trade and other payables 2,342 730 924

Lease liabilities within one

year 64 11 13

Corporation tax 63 - -

---------- ------------ -----------

2,469 741 937

---------- ------------ -----------

Non-current liabilities

Lease liabilities after one

year 61 37 30

Other creditors 1,673 - -

---------- ------------ -----------

1,734 37 30

---------- ------------ -----------

Total liabilities 4,203 778 967

---------- ------------ -----------

Total Liabilities and Equity 6,665 1,697 3,158

========== ============ ===========

CONSOLIDATED STATEMENT OF CASH FLOWS

For the six months ended 31 March 2021

Unaudited Unaudited Audited

6 months 6 months Year

ended ended ended

31 March 31 March 30 September

2021 2020 2020

GBP'000 GBP'000 GBP'000

Net cash generated/(utilised)

by operations 408 (112) 281

Cash flows from financing activities

Proceeds of share issue - - 1,246

Expenses of share issue - - (113)

Lease liability payments (15) (15) (29)

Net cash (outflow)/inflow from

financing activities (15) (15) 1,104

---------- ---------- --------------

Net cash from investing activities

Disposal of fixed assets - 2 2

Capital expenditure (33) (9) (44)

Acquisition of subsidiary 4 (1,345) - -

Exceptional acquisition costs

paid (27) - -

Net cash outflow from investing

activities (1,405) (7) (42)

---------- ---------- --------------

Net (decrease)/increase in

cash, cash

equivalents and overdrafts (1,012) (134) 1,343

Cash, cash equivalents and

overdrafts at

beginning of period 1,783 440 440

Cash, cash equivalents and

overdrafts at end of period 771 306 1,783

========== ---------- --------------

Reconciliation of profit for the period to cash outflow from operations

Unaudited Unaudited Audited

6 months 6 months Year

ended ended ended

31 March 31 March 30 September

2021 2020 2020

GBP'000 GBP'000 GBP'000

Profit for the period 74 50 188

Decrease/(increase) in receivables 301 (394) (371)

(Decrease)/increase in payables (167) 195 389

Depreciation and amortisation

charges 51 22 50

Finance costs (25) 13 21

Exceptional acquisition costs 177 - -

Profit on disposal of fixed

assets - - 1

Share based payment (3) 2 3

------------- ------------- --------------

Net cash inflow/(outflow)

from operations 408 (112) 281

============= ============= ==============

Consolidated Statement of Changes in Equity

For the six months ended 31 March 2021

Share

Merger Capital Reverse Based

Share Share Relief Redemption Acquisition Payments Accumulated Total

Capital Premium Reserve Reserve Reserve Reserve Deficit Equity

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

At 30

September

2019 1,039 4,926 1,328 3,337 (5,726) 12 (4,038) 878

--------- --------- --------- ----------- ------------ ---------- ------------ --------

Share based

payments - - - - - 2 - 2

Effect of

adoption

of IFRS 16 - - - - - - (11) (11)

Profit for

the

period - - - - - - 50 50

At 31 March

2020 1,039 4,926 1,328 3,337 (5,726) 14 (3,999) 919

--------- --------- --------- ----------- ------------ ---------- ------------ --------

Issue of

shares 207 926 - - - - - 1,133

Share based

payments - - - - - 1 - 1

Effect of

adoption

of IFRS 16 - - - - - - - -

Profit for

the

period - - - - - - 138 138

At 30

September

2020 1,246 5,852 1,328 3,337 (5,726) 15 (3,861) 2,191

--------- --------- --------- ----------- ------------ ---------- ------------ --------

Issue of

shares 24 176 - - - - - 200

Share based

payments - - - - - (3) - (3)

Profit for

the

period - - - - - - 74 74

At 31 March

2021 1,270 6,028 1,328 3,337 (5,726) 12 (3,787) 2,462

--------- --------- --------- ----------- ------------ ---------- ------------ --------

Notes to the interim financial statements

1. Basis of preparation

These consolidated interim financial statements have been

prepared in accordance with International Financial Reporting

Standards ("IFRS") as adopted by the European Union and on a

historical basis, using the accounting policies which are

consistent with those set out in the Group's annual report and

accounts for the year ended 30 September 2020. The interim

financial information for the six months ended 31 March 2021, which

complies with IAS 34 'Interim Financial Reporting' were approved by

the Board of Directors on 29 June 2021.

The unaudited interim financial information for the six months

ended 31 March 2021 does not constitute statutory accounts within

the meaning of Section 435 of the Companies Act 2006. The

comparative figures for the year ended 30 September 2020 are

extracted from the statutory financial statements which have been

filed with the Registrar of Companies and contain an unqualified

audit report and did not contain statements under Section 498 to

502 of the Companies Act 2006.

2. Principal Accounting Policies

The principal accounting policies adopted are consistent with

those of the annual financial statements for the year ended 30

September 2020. The acquisition of Fidelis Contract Services

Limited on 26 March 2021 has been accounted for in accordance with

IFRS 3 Business Combinations.

3. Segmental Reporting

In the opinion of the Directors, the Group has one class of

business, being that of specialist cleaning and decontamination

services. Although the Group operates in only one geographic

segment, which is the UK, it has also analysed the sources of its

business into the segments of Contract Maintenance, Contract

Reactive or Ad Hoc work. The assets and liabilities which have

generated the revenues and profits for the period are those of the

Group excluding Fidelis, therefore the assets and liabilities

reported within the segmental analysis differ from those reported

in the Consolidated Statement of Financial Position.

2020/2021 2019/2020

Contract Contract Ad Hoc Total Contract Contract Ad Hoc Total

Maintenance Reactive Work Maintenance Reactive Work

Work Work Work Work

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Revenue 764 802 943 2,509 729 900 462 2,091

Cost of Sales (492) (530) (469) (1,491) (500) (601) (295) (1,396)

Gross Profit 272 272 474 1,018 229 299 167 695

Administrative

Expenses (259) (259) (451) (969) (208) (272) (152) (632)

Operating Profit

for the year 13 13 23 49 21 27 15 63

============= ========== ======== ======== ============= ========== ======== ========

Total Assets 872 873 1,520 3,265 560 729 408 1,697

------------- ---------- -------- -------- ------------- ---------- -------- --------

Total Liabilities (214) (215) (374) (803) (257) (334) (187) (778)

------------- ---------- -------- -------- ------------- ---------- -------- --------

4. Business combinations during the period

On 26 March 2021, the Group acquired 100% of the issued share

capital and voting rights of Fidelis Contract Services Ltd

('Fidelis'), a successful commercial cleaning, hygiene and facility

support services company headquartered in Birmingham providing

services to customers across England and Wales. The acquisition is

expected to increase the group's market share and reduce costs

through economies of scale.

Fidelis was acquired for an initial consideration of GBP1.7m,

payable as GBP1.5m cash and GBP0.2m through the issue of new

ordinary shares, with contingent consideration of up to GBP3.05m

payable subject to Fidelis fulfilling certain profit criteria.

The fair value of the acquired customer list and customer

contracts is provisional pending receipt of the final valuations

for those assets because the acquisition was completed late in the

period. The Group is currently obtaining the information necessary

to finalise its valuation. The goodwill that arose on the

combination can be attributed to the synergies expected to be

derived from the combination and the value of the workforce of

Fidelis which cannot be recognised as an intangible asset. The fair

value of the contingent consideration arrangement was estimated

calculating the present value of the future expected cash

flows.

Acquisition costs of GBP177,000 are not included as part of the

consideration transferred and have been recognised as an expense in

the Consolidated Statement of Comprehensive Income.

a) Subsidiaries acquired

Name Fidelis Contract Services

Limited

Principal activity Commercial Cleaning, Hygiene

& Support Services

Date of acquisition 26 March 2021

Proportion of voting equity interests

acquired 100%

Consideration transferred GBP4,115,000

GBP'000

b) Consideration transferred

Cash 1,730

Equity issued 200

Loan notes 83

Contingent consideration arrangement (included

in Other Creditors) 2,102

4,115

--------------------

c) Assets and liabilities recognised on the date

of acquisition

Non-current assets 156

Current assets 1,392

Non-current liabilities (37)

Current liabilities (1,028)

Net assets acquired 483

--------------------

GBP'000

d) Goodwill arising on acquisition

Consideration transferred 4,115

Fair value of identifiable net assets acquired (483)

Separately identifiable intangible assets arising

on business combination (1,756)

1,876

--------------------

e) Net cash outflow on acquisition

Consideration paid in cash 1,730

Less: cash balances acquired (385)

1,345

--------------------

f) Impact of acquisition on the results of the Group

No contribution element from Fidelis is included in these

interim figures, but the assets and liabilities for Fidelis

as at 31 March 2021 are included in the Consolidated Statement

of Financial Position.

The assets acquired include GBP385,000 of cash balances.

5. Exceptional costs included in administrative expenses

Exceptional items are material items of income or expenses which

have arisen in the normal course of business but are not expected

to re-occur on a regular basis.

Unaudited Unaudited Audited

6 months 6 months Year

ended ended ended

31 March 31 March 30 September

2021 2020 2020

GBP'000 GBP'000 GBP'000

Management restructure costs 92 - -

Acquisition costs 177 - -

269 - -

========== ========== ==============

6. Earnings per Share (basic and adjusted)

The calculations of earnings per share (basic and adjusted) are

based on the net profit and adjusted profit respectively and the

ordinary shares in issue during the period. The adjusted profit

represents the EBITDA for the period with exceptional costs

excluded.

Unaudited Unaudited Audited

6 months 6 months Year

ended ended ended

31 March 31 March 30 September

2021 2020 2020

GBP'000 GBP'000 GBP'000

Net profit for period 74 50 188

============ ============ ==============

Adjustments:

Interest (25) 13 23

Depreciation 51 22 50

Exceptional costs 269 - -

Adjusted profit for the period 369 85 261

============ ============ ==============

Number Number Number

Weighted average shares in

issue for basic earnings

per share 498,665,889 415,407,753 441,291,857

Weighted average dilutive

share options and warrants 62,247,272 65,065,130 65,065,130

------------ ------------ --------------

Average number of shares

used for dilutive earnings

per share 560,913,161 480,472,883 506,356,987

============ ============ ==============

pence pence pence

Basic earnings per share 0.01p 0.01p 0.04p

============ ============ ==============

Diluted earnings per share 0.01p 0.01p 0.04p

============ ============ ==============

Adjusted basic earnings per

share 0.07p 0.02p 0.06p

============ ============ ==============

Adjusted diluted earnings

per share 0.07p 0.02p 0.05p

============ ============ ==============

Copies of this Interim Report are available from the Company

Secretary, 115 Hearthcote Road, Swadlincote, Derbyshire DE11 9DU

and on the Company's website www.reactsc.co.uk/react-group-plc

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR UWRRRASUNUUR

(END) Dow Jones Newswires

June 29, 2021 02:00 ET (06:00 GMT)

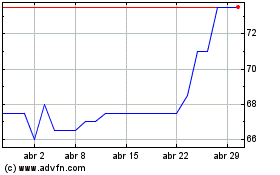

React (LSE:REAT)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

React (LSE:REAT)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024