Red Rock Resources plc Investments Update (2918N)

29 Septiembre 2021 - 1:00AM

UK Regulatory

TIDMRRR

RNS Number : 2918N

Red Rock Resources plc

29 September 2021

Red Rock Resources PLC

("Red Rock" or the "Company")

Investments Update

29 September 2021

Red Rock Resources Plc ("Red Rock" or "the Company"), the

natural resource development company with interests in gold,

copper, cobalt and other minerals, announces an update in relation

to its investment in Jupiter Mines Ltd (ASX:JMS) ("Jupiter").

Over recent weeks Red Rock has disposed of a substantial part of

its remaining holding in Jupiter through market sales at an average

price of AUD 0.304 per Jupiter share, for proceeds of AUD

2,327,052.70 (approximately GBP1,239,489.34).

Red Rock retains 5,870,693 Jupiter shares. The current share

price of Jupiter is AUD 0.225, which is 26% below the average price

of Red Rock's recent sales.

Andrew Bell, Red Rock Chairman, states: "Our ability to raise

over a short period a sum in excess of GBP1,000,000 from our share

portfolio demonstrated the Company's ability to respond to events

and to strengthen its liquidity from internal sources as required.

We manage our investments actively and having formed the view that

prospects in the near term for Jupiter had deteriorated, were able

to reduce our holdings in amounts and at prices that did not appear

to affect the price in the market.

Our history with this investment goes back a long way: shortly

after listing in 2005 we sold iron ore assets to Jupiter in

exchange for cash, shares and a royalty, and later increased our

holding to become the largest Jupiter shareholder, bringing in

Pallinghurst Partners as our partner and subsequently seeing the

injection into Jupiter of the Pallinghurst manganese assets in

South Africa, that now after the spin off of the iron ore into Juno

Minerals Ltd (ASX:JNO) are the sole significant asset of

Jupiter.

Jupiter has been an exceptionally well managed company,

achieving over recent years an extraordinary near-30% annual return

on assets, but the recent consolidation of shareholdings into fewer

hands and the likelihood of management changes combined with a dull

outlook for manganese prices convinced us that the time had come to

accelerate the disposal of our stake.

Red Rock retains other listed holdings, or holdings in companies

approaching listing, in businesses where it has played a strategic

role, including 45,000,000 shares valued in the market at over

GBP900,000 in Power Metal Resources PLC (AIM:POW).

Further announcements will be made in relation to these in due

course."

For further information, please contact:

Andrew Bell 0207 747 9990 Chairman Red Rock Resources Plc

Roland Cornish/ Rosalind Hill Abrahams 0207 628 3396 NOMAD Beaumont Cornish Limited

Jason Robertson 020 7374 2212 Broker First Equity Limited

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

MSCBRGDCLUDDGBI

(END) Dow Jones Newswires

September 29, 2021 02:00 ET (06:00 GMT)

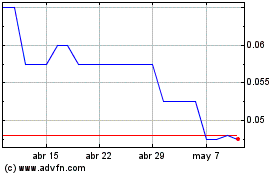

Red Rock Resources (LSE:RRR)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Red Rock Resources (LSE:RRR)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024