TIDMRRR

Red Rock Resources plc

16 November 2021

Red Rock Resources PLC

("Red Rock" or the "Company")

Summary of Gold Exposure

16 November 2021

Red Rock Resources Plc, the natural resource development company

with interests in gold, copper/cobalt, and other minerals,

summarises the exposure to gold which runs through its

portfolio.

Highlights

-- A JORC Indicated and Inferred Resource of 15.13 Mt @ 1.49 g/t

Au with contained metal content of 723 koz in greenstones in

Western license, Kenya

-- New exploration targets identified by recent work in Eastern license, Kenya

-- Significant new target zone identified in Western license, Kenya

-- A tailings deposit containing 68koz Au @ 1.7g/t Au in Kenya

-- A gold royalty over the producing El Limon mine in Colombia

-- 50.01% of Red Rock Australasia Pty Ltd, which is preparing to list its Victoria gold assets

-- Royalties over the Company's gold interests

-- A new gold exploration subsidiary in the greenstone belt of the Côte d'Ivoire

-- A new gold exploration subsidiary in the greenstone belt of Burkina Faso

Diagram: Gold assets of Red Rock Resources PLC [INSERT FIGURE

1]

Red Rock Chairman Andrew Bell comments : "After reaching highs

above $2000/oz in late Summer 2020, Gold has underperformed most

other asset classes since, as it came back to consolidate around

its breakout levels. There are now signs, with the better

performance in the last month, that it is breaking this downtrend,

in which case it may reach or exceed last year's highs in the next

months. We have some confidence that fundamentals can support it at

or around current levels.

Since the larger part of the Company's interests are in gold,

this is an appropriate moment to set out Red Rock's gold exposure

across its projects, noting that the Company's gold interests in

the African Greenstone Belts have recently extended with the

submission of five license applications in the Côte d'Ivoire and

the setting up of an operational subsidiary in Burkina Faso.

Except in Australia, the projects are 100% beneficially owned by

Red Rock.

In the course of my recent visit, the manager of our Côte

d'Ivoire subsidiary revisited Djekanou with me and we have

confirmed the prospectivity of this application area which we

expect to be one of the first granted. As many as three of the

applications are over ground we know well and where we can proceed

to exploration with some confidence.

Our choices in Burkina Faso have also been carefully assessed.

Our criterion for selection in both countries has been to ask

ourselves the question: "would the initial selection of assets form

an entity listable in its own right?"

The tenor of discoveries and new mines in West Africa has

exceeded the global average, reflecting the immaturity of

exploration as well as the gold endowment.

It is a great pleasure to us that, with Cluff no longer present,

we are, as we return, the only listed British exploration company

with a permanent presence in these countries. For so prospective a

territory, this is truly extraordinary. We can operate with

confidence because of the high standard of professional formation

of the technocrats and Ministers with whom we deal, and the

excellent local teams of geologists, including our London-based

data manager, a Burkinabe born in Côte d'Ivoire.

Elsewhere in Africa, we continue our drill programme and

geophysics in Kenya, with the three aims of infilling to increase

Resource grade, size, and category, and of defining Resource in new

areas, and of identifying new targets. We are confident that we can

do all three, including building Resource ounces in the areas of

our Eastern license highlighted by our ground geophysics

programmes. Our geophysics is more or less continuous now that we

have our own magnetics and IP (induced polarisation) equipment.

We continue to work on permitting the tailings project in Kenya

and we monitor closely the progress of the operators of our former

Colombian mine at El Limon in Antioquia.

Finally, the preparations for the IPO of our Australian assets

located in the Victorian gold belt are continuing. As in West

Africa, we used research to identify areas that could be picked up

through new license applications, as this can be more

cost-effective than purchase or farm-in. Having been fortunate in

the timing of our initial applications in an area now in high

demand, Covid-related measures in Victoria have slowed both grants

and work since. The highly professional team on the ground in

Australia have however used the extra time - that we would rather

they had not had - this year to great effect in tracking old and

forgotten mines and piecing together immediate drill targets that

look prospective. As Victoria comes out of lockdowns activity by us

and others will be increasing. We believe that we can find new

mines in this nineteenth century gold rush territory and if we have

the right management, enthusiasm, and money we shall do it

quicker.

We remain more a gold company than anything else, and as gold

rises again through $1850 an ounce, and hits new highs in some

currencies, we want to be positioned to take advantage. That is

what much of our recent work has been directed to. As our new gold

subsidiaries, which we hope to fund independently and in due course

list in their own right, are in Francophone Africa, we end with the

words of Louis Pasteur, "le hasard ne favorise que les esprits

préparés" - fortune favours the prepared mind. "

Further Information on Key Gold Assets

The table below sets out the current position in each of the

territories in which we hold gold exploration or production

interests. This material is as previously disclosed by Red Rock,

and as material developments occur, they will be disclosed by new

announcements. All licenses are 100% beneficially owned except

where stated.

Country Holding Project Notes

Australia New Ballarat Gold Victoria Gold Project. Victoria Gold Province.

Corporation PLC ("NBGC") RRAL holdings comprise One of world's

Red Rock Australasia seven granted licenses largest orogenic

Pty Ltd ("RRAL") totalling 848 sq km gold provinces,

[Share exchange under and six principal license with 13 mines that

way whereby Red Rock applications totalling produced over 1m

will own 50.01% of 1458 sq km. oz of gold. Active

NBGC, which will Three immediate drill 1851 to c1900.

own 100% of RRAL] targets have been identified Recent surge in

and NBGC is being prepared exploration and

for a 2021/2022 IPO. current annual

production c650,000

oz.

--------------------------- ------------------------------- ----------------------------

Burkina Faso Minerals Ltd A number of highly The West African

Faso ("FML") prospective target Greenstone Belts

Faso Greenstone Resources areas have been identified extend from Ghana

SARL ("FGR") and will be applied to Mali with the

FML is 100% owned for upon lifting of most substantial

by Red Rock and owns a current short moratorium. and least explored

100% of FGR. Negotiations continue parts in Ivory

with the owners of Coast and Burkina

two existing licenses Faso.

known to be strongly The Northern and

mineralised that would Eastern borderlands

meet Red Rock's criteria. of Burkina Faso,

historically safe,

are now affected

by radicalisation

of the cross-border

semi-nomadic tribal

population of these

areas.

The Southern and

Western greenstones

are in secure areas.

--------------------------- ------------------------------- ----------------------------

Colombia Royalty over El Limon Mine and surrounding 3% NSR Royalty

Mine and Plant area in Northern Antioquia. on Mine and Plant

Production up to

$2m; thereafter

$1m payable at

1%.

--------------------------- ------------------------------- ----------------------------

Côte Lac Minerals Ltd Five licenses covering The largest portion

d'Ivoire ("LML") 1907 sq km in the greenstones of the West African

LacGold Resources that meet Red Rock's Greenstone Belts

SARL ("LGR") criteria have been lies in Côte

LML is 100% owned applied for. d'Ivoire (Ivory

by Red Rock and owns The Company hopes to Coast), which lies

100% of LGR. have grant of the first to the West of

two shortly. Ghana and South

Near Yamassoukro, a of Burkina Faso

384.2 sq km license and Mali.

at Djekanou will upon Historically underexplored

grant be a high priority (the long-serving

exploration target. post-independence

President did not

favour mining),

the country from

a governance and

geological perspective

is one of the most

prospective gold

plays worldwide.

--------------------------- ------------------------------- ----------------------------

Kenya Mid Migori Mining Two gold exploration Containing in the

Ltd licenses covering 245 South towards the

RRR Kenya Ltd sq km stretching West-East Tanzanian border

along the line of a the northern extension

greenstone belt are of the Tanzanian

held. greenstones, Kenya

Upon restoration of has been a neglected

the licenses in 2020, but now increasingly

a new Mineral Resource recognised gold

Estimate (under JORC province.

2012) on the central

area of the western

license was commissioned

from CSA, identifying

a Resource of 723,000

oz at 1.49 g/t. This

updated the JORC report

by CSA in 2012 (1,192

oz at 1.26 g/t).

Western license: an

RC infill and step-out

drilling programme

is under way and two

existing areas, one

included in former

Resource calculations,

and both previously

drilled, are being

tested by ground geophysics

for a follow up drill

programme to bring

them to Resource status.

Eastern license: earlier

drilling, geochemistry

and mapping programmes

could not be followed

up until license restoration

in late 2020, since

when a rolling programme

of large scale ground

geophysics (magnetics,

IP, and pole-dipole

IP) has been undertaken

and continues in preparation

for drilling for an

Inferred Resource.

Tailings: the previously

announced (but now

non-compliant as under

a previous version

of JORC) 68,000 oz

of gold at 1.7 g/t

is being re-examined

with further work on

the EIA and metallurgy

being commissioned,

in parallel with discussions

with the Council and

community.

--------------------------- ------------------------------- ----------------------------

For further information, please contact:

Andrew Bell 0207 747 9990 Chairman Red Rock Resources Plc

Roland Cornish/ Rosalind Hill Abrahams 0207 628 3396 NOMAD Beaumont Cornish Limited

Jason Robertson 0207 374 2212 Broker First Equity Limited

This information is provided by Reach, the non-regulatory press

release distribution service of RNS, part of the London Stock

Exchange. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

Reach is a non-regulatory news service. By using this service an

issuer is confirming that the information contained within this

announcement is of a non-regulatory nature. Reach announcements are

identified with an orange label and the word "Reach" in the source

column of the News Explorer pages of London Stock Exchange's

website so that they are distinguished from the RNS UK regulatory

service. Other vendors subscribing for Reach press releases may use

a different method to distinguish Reach announcements from UK

regulatory news.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

NRADKPBNDBDBODD

(END) Dow Jones Newswires

November 16, 2021 02:00 ET (07:00 GMT)

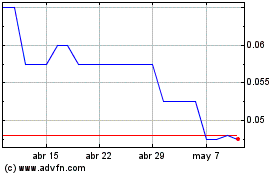

Red Rock Resources (LSE:RRR)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Red Rock Resources (LSE:RRR)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024