TIDMRCN

RNS Number : 7521S

Redcentric PLC

18 November 2021

Redcentric plc

("Redcentric" or the "Company")

Half year results for the six months ended 30 September 2021

(unaudited)

Redcentric plc (AIM: RCN), a leading UK IT managed services

provider, is pleased to announce its unaudited results for the six

months to 30 September 2021.

Key performance indicators on a reported basis excluding Piksel

Industry Solutions Limited ("Piksel") revenue and profit

contribution

As set out in the Company's most recent annual report and

accounts, we monitor our performance against our strategy with

reference to key performance indicators ("KPIs"). These KPIs are

applied on a Redcentric group ("Group") wide basis. Our headline

financial results for the six months to 30 September 2021 are set

out in the table below, together with the prior year comparatives.

Further information on alternative performance measures ("APMs")

can be found below.

Following discussions with the Company's advisors, the trading

results of Piksel for the two months ended 30 September 2021 have

been treated as an adjustment to the acquisition purchase price

rather than included in the consolidated statement of comprehensive

income as was presented in the trading update released on 27

October 2021. A full explanation and reconciliation is given in the

Chief Financial Officer's review below.

Six months Six months

to 30 Sept to 30 Sept

2021 (H1-22) 2020 (H1-21) Change

-------------------------------------- -------------- -------------- --------

Total revenue GBP44.3m GBP46.2m -4.1%

Recurring monthly revenue (RMR) GBP39.6m GBP41.0m -3.4%

Recurring monthly revenue percentage 89.4% 88.7% 0.7ppts

Adjusted EBITDA(1) GBP11.9m GBP12.3m -3.3%

Adjusted operating profit(1) GBP7.4m GBP7.6m -2.6%

Reported operating profit GBP3.3m GBP3.1m 6.5%

Adjusted cash generated from

operations(1) GBP10.0m GBP12.9m -22.5%

Reported cash generated from

operations GBP15.3m GBP10.4m 47.1%

Adjusted net debt(1) GBP0.4m GBP1.1m -63.6%

Reported net debt GBP15.4m GBP17.0m -9.4%

Adjusted basic earnings per share(1) 3.55p 3.61p -1.7%

Reported basic earnings per share 1.71p 1.39p 23.0%

(1) This report contains certain financial APMs that are not

defined or recognised under IFRS but are presented to provide

readers with additional financial information that is evaluated by

management and investors in assessing the performance of the

Group.

This additional information presented is not uniformly defined

by all companies and may not be comparable with similarly titled

measures and disclosures from other companies. These measures are

unaudited and should not be viewed in isolation or as an

alternative to those measures that are derived in accordance with

IFRS.

For an explanation of the APMs used in these results and

reconciliations to their most directly related GAAP measure, please

see the Chief Financial Officer's review

Financial Highlights

-- Total revenue was GBP44.3m (H1-21: GBP46.2m) with recurring

revenue of GBP39.6m (H1-21: 41.0m). Adjusting for the sale of

assets relating to the Company's contract with EDF (the "EDF

Contract") which was completed on 31 March 2021, total revenue

declined by 3.1% and recurring revenue declined by 2.4%.

-- Total revenue for the six-month period is now ahead of pre

Covid-19 levels by 3.7% (H1-20: GBP42.7m H1-21 GBP44.3m) after

adjusting for the EDF Contract.

-- The proportion of recurring revenue increased slightly to

89.4% of total revenue (H1-21: 88.7%).

-- Adjusted operating expenditure reduced by GBP0.6m (3.7%) to

GBP15.8m (H1-21: GBP16.4m) reflecting a continued focus on the cost

base in addition to the annualised impact of cost benefits realised

through the operational efficiencies over the last two financial

years.

-- Adjusted EBITDA(1) was GBP11.9m (H1-21: GBP12.3m) and

adjusted EBITDA margins increased marginally to 26.8% (H1-21:

26.5%). Adjusting for the sale of assets relating to the EDF

Contract which was completed on 31 March 2021 adjusted EBITDA for

H1-22 was in line with the prior year at GBP11.9m.

-- Adjusted operating profit(1) decreased by 2.6% to GBP7.4m

(H1-21: GBP7.6m) with operating margin improving to 16.7% (H1-21:

16.4%).

-- After accounting for exceptional items of GBP0.7m (H1-21:

GBP1.1m) and share-based payment costs of GBP0.3m (H1-21: GBP0.3m),

reported operating profit was 7.8% higher at GBP3.3m (H1-21:

GBP3.1m).

-- Net debt reduced by GBP0.2m since 31 March 2021 to GBP15.4m, reflecting:

o Operating cash flows of GBP10.0m (84% operating cash

conversion);

o the net cash impact of the acquisition of Piksel in the period

of GBP8.4m; and

o the receipt of GBP5.8m consideration resulting from the sale

of assets relating to the EDF Contract which completed on 31 March

2021.

-- Excluding leases previously classified as operating leases

under IAS17 net debt was GBP0.4m (31 March 2021: GBP1.0m cash).

-- Interim dividend maintained at 1.2p per share.

Operational Highlights

-- The acquisition of the entire issued share capital of Piksel

(the "Acquisition"), completed on 29 September 2021, significantly

enhances the Company's cloud services proposition, and provides

full access to the strongest growth areas of the market.

-- The integration of Piksel is currently ahead of plan with

GBP0.7m of annualised cost savings already realised and further

annualised savings of at least GBP0.4m to be realised for the next

financial year.

-- Continued investment in systems and platforms to enhance the

customer experience, drive efficiency and provide a better platform

for the integration of future acquisitions.

-- Work continues in identifying further acquisitions for both scale and capability.

Peter Brotherton, Chief Executive Officer commented:

" The business continues to perform well and is trading

significantly ahead of the pre-Covid period. The strategically

important acquisition of Piksel completes our cloud services

offering and gives us full access to the highest growing areas of

the market. After just six weeks, the integration of Piksel is

significantly ahead of plan with GBP0.7m of annualised synergies

already realised and confidence in delivering further substantial

savings.

The sales pipeline is slowly recovering, and the increasing

number of customer interactions is encouraging. November 2021 is on

target to be the best month for new sales orders this calendar year

and we are hopeful that this is indicative of a return to more

normalised trading levels.

The Company will continue to pursue acquisition opportunities

for both scale and capability and the Board expects the full year

results to be in line with its expectations."

Enquiries:

Redcentric plc +44 (0)800 983 2522

Peter Brotherton, Chief Executive Officer

David Senior, Chief Financial Officer

finnCap Ltd - Nomad and Broker +44 (0)20 7220 0500

Marc Milmo / Simon Hicks / Charlie Beeson (Corporate

Finance)

Andrew Burdis / Sunila de Silva (ECM)

Chief Executive Officer's review

Context

These results demonstrate the robust nature of the business.

Throughout the period of the Covid-19 pandemic we have grown

revenues and increased profits substantially. The pandemic has

presented many unprecedented challenges and we continue to see the

aftershocks.

Immediately following the outbreak of the Covid-19 pandemic, the

Company reacted expediently to meet customer demand resulting from

the requirements of new working environments and this led to an

increase in sales activity in H1-FY21. Post this period we have

experienced a dearth of large-scale IT projects and, more recently,

a shortage of microchips has led to delays in projects which has

depressed both recurring and non-recurring revenues.

On 31 March 2021, the assets relating to the EDF Contract were

disposed of for GBP5.8m. The EDF Contract contributed revenue of

GBP0.5m and EBITDA of GBP0.35m in each six-month period up to and

including H2-FY21. To provide a better understanding of the results

for the six months ended 30 September 2021, the revenue and EBITDA

from the EDF Contract has been excluded from the prior periods in

the table shown above.

Compared to the equivalent pre Covid period (H1-FY20):

-- Revenues have increased 3.9%

-- Adjusted EBITDA has increased by 20.2%

-- Adjusted earnings have increased by 67.6%

Throughout the Covid period we did not take advantage of any

government support packages and profits have remained consistent at

GBP11.9m to GBP12.0m.

Pre Covid During Covid

H1 FY20 H2 FY20 H1 FY21 H2 FY21 H1 FY22

Revenue

- Recurring 38.3 38.3 40.5 40.4 39.6

- Non-recurring 4.4 5.5 5.2 4.3 4.7

-------- -------- -------- -------- --------

42.7 43.8 45.7 44.7 44.3

Recurring Revenue% 89.8% 87.4% 88.6% 90.4% 89.4%

Adjusted EBITDA 9.9 10.0 11.9 12.0 11.9

-------- -------- -------- -------- --------

Adjusted EBITDA margin% 23.1% 22.9% 26.1% 26.8% 26.8%

Capex 4.8 1.9 2.2 1.9 2.1

Adjusted EBITDA less

Capex 5.1 8.1 9.7 10.1 9.8

-------- -------- -------- -------- --------

Adjusted EBITDA less

Capex margin% 12.0% 18.6% 21.2% 22.5% 22.0%

Adjusted earnings 3.3 3.2 5.2 5.3 5.5

-------- -------- -------- -------- --------

Overview of the six months ended 30 September 2021

The revenue performance for the six months ended 30 September

2021 reflects the trading conditions described above which has led

to a reduced volume of new orders from both existing and new

customers.

Whilst like for like (excluding the EDF Contract) revenues have

decreased by GBP0.4m (-0.8%) over the six-month period, costs have

been carefully managed with adjusted EBITDA broadly flat (-GBP0.1m)

on a like for like basis. Operating costs for the period reflect

the last remaining benefits of the data centre and network

rationalisation programme, which was actioned in the previous two

financial years.

Net debt over the period decreased by GBP0.2m primarily

reflecting normalised cash flows of GBP7.1m, GBP5.8m consideration

from the sale of assets relating to the EDF Contract, dividend

payments of GBP3.7m and the Acquisition for GBP8.4m (net of cash

acquired).

The Company has continued to invest in its operational systems

and platforms. These initiatives will improve efficiency and

customer service and provide a better platform for the integration

of future acquisitions:

-- The first stage of the new HR system is now live and when

fully implemented will replace five legacy systems. The new system

provides significantly enhanced information to both management and

employees and prevents duplicate data entry;

-- The first stage of the delivery workflow software is

currently in user acceptance testing with a view to being fully

released in December 2021. This will result in significant

efficiencies in the delivery team, an improvement to customer

service and enhanced customer and management reporting;

-- The Company's principal customer service management software

is in the process of being upgraded and once complete will provide

a better and more consistent customer experience. Pro-active

support using AI and machine learning, automated processes and

workflow tasks will also significantly improve efficiency;

-- A new cloud backup platform has been launched replacing our

previously outdated proposition. The new platform delivers

significantly enhanced functionality and brings our solution fully

up to date;

-- Substantial investment has been made in replacing cooling

equipment in our Harrogate data centre which has led to a circa 7%

reduction of electricity consumption at this site.

During the reporting period we commenced the execution of the

acquisition strategy outlined in the Company's annual report and

accounts for FY21 and on 29 September 2021 the Company completed

the strategically important Acquisition of Piksel. The Acquisition

gives Redcentric leading-edge skills and capabilities in public

cloud and security solutions. The Acquisition has been very well

received by both customer bases and we are already pursuing a good

number of cross-sell opportunities.

Integration of Piksel

Whilst only six weeks into the integration programme the Company

has already made significant progress, as follows:

-- Planning for a new cloud services division is complete and

the management positions are currently being filled with a view to

a new fully integrated management structure being in place by

December 2021. Employee TUPE discussions will commence in December

2021 with a view to all Piksel assets and employees being

transferred to Redcentric Solutions Ltd by the end of this

financial year;

-- Cross connects have been put in place in Telehouse (London)

and Equinix (Manchester) meaning that the Piksel network is now

fully integrated in to the Redcentric national network. Several

Piksel circuits have thus become redundant and ceased as a

result;

-- The equipment for a new cloud platform has been delivered and

is currently being configured in our Shoreditch data centre. Once

fully commissioned, customers will be migrated off the Piksel

platform and significant savings realised as a result of cancelling

racks in third party data centres;

-- The integration of the finance systems is nearing completion.

The opening balances as at 31 July 2021 have been migrated on to

the Company's ERP system, Microsoft Dynamics 365 ("D365"), and all

of the transactions for August and September 2021 have been

recreated. The October transactions are currently being processed

and we expect to be live by the end of the calendar year. Once live

we will cease paying for the Piksel accounting system and

transitional finance service cost;

-- The Piksel customer prospect database has been migrated onto

D365 and the contract for the legacy customer relationship

management system cancelled;

-- All Piksel suppliers have been contacted with the view to

either cancelling contracts or renegotiating better rates. Any new

purchase orders are being placed through Redcentric Solutions Ltd

and plans are in place to migrate suppliers across to Redcentric

Solutions Ltd by the end of the financial year; and

-- Discussions with customers have commenced with a view to

transferring all contracts to Redcentric Solutions Ltd by the end

of the financial year.

To date we have actioned annualised cost savings of GBP0.7m of

which some are effective immediately whilst others will be realised

over the course of the next twelve months. We are fully confident

of achieving at least GBP1.1m of synergies identified at the time

the acquisition was announced.

Environmental, Social and Governance

The Board of directors of the Company (the "Board") is cognisant

of the growing importance of ESG and is currently developing a

comprehensive corporate ESG strategy with targets to drive further

accountability across the business. A full ESG plan will be

published at the time of the Company's preliminary results

announcement.

Dividend policy

The Board has reviewed the financial performance of the business

and has decided to maintain an interim dividend payment of 1.2p per

share, which will be paid on 6 January 2022 to shareholders on the

register at the close of business on 25 November 2021. The

continuation of dividend payments whilst pursuing an acquisition

strategy demonstrates the Board's confidence in the Company and the

strong cash generative nature of the business.

Board changes

With these results, the Company is pleased to announce the

appointment of Nick Bate as independent non-executive chairman.

Nick is an experienced chairman with a proven track record of

successfully delivering both organic and inorganic growth

strategies in the IT managed services sector. Nick will join the

Board with immediate effect replacing Ian Johnson who has stepped

down from the Board and his position as chairman of the

Company.

The Company is also announcing today that Jon Kempster,

non-executive director and chairman of the Company's audit

committee, has notified the Board that he does not intend to stand

for re-election at the Company's next annual general meeting. A

further announcement will be made as soon as a suitable successor

has been appointed.

Summary and outlook

The business continues to perform well under difficult trading

conditions. The Acquisition is strategically important as it

completes our cloud services proposition and gives us full access

to the strongest growing areas of the market. The integration of

Piksel is currently ahead of plan with significant synergies

already realised and increased confidence in delivering further

substantial savings.

We continue to invest in our systems and platforms, which will

enable us to efficiently integrate future acquisitions and to grow

the business, whilst at the same time improving customer

service.

As previously noted, the market continues to be impacted by a

continued lack of IT projects and we will continue to navigate the

supply chain issues in the sector. It has been pleasing to see that

the sales pipeline is slowly recovering, and the increasing number

of customer interactions is encouraging, November 2021 is on target

to be the best month for new sales orders this calendar year which

we hope represents a step in the right direction in returning to

more normalised trading levels.

The Company will continue to pursue acquisition opportunities

for both scale and capability and the Board expects the full year

results to be in line with expectations.

Chief Financial Officer's Review

Accounting for the Acquisition

On 29 September 2021, the Company announced the Acquisition.

The consideration for the Acquisition was US$13.0m (c.GBP9.5m)

payable in cash of which US$12.0m (cGBP8.8m) was paid on completion

of the transaction and US$1.0m (c.GBP0.7m) being held in escrow for

a period of 12 months. Pursuant to terms of the sale and purchase

agreement relating to the acquisition ("SPA") the purchase price

was subsequently increased by GBP0.1m due to a revised assessment

of Piksel's latest research & development tax claim submission

to HMRC.

The Acquisition was structured using locked box accounts with

the 31 July 2021 balance sheet providing the fixed point for the

valuation. Pursuant to the terms of the SPA, the economic benefits

of Piksel's trade in the period between 1 August 2021 to 29

September 2021 were transferred to Redcentric Solutions Ltd upon

completion of the Acquisition on 29 September 2021. It is the view

of the directors of Redcentric Solutions Limited (the "Directors")

that they exercised sufficient control during this period to enable

the trading for the two-month period to be consolidated into the

Group results. However, following detailed discussions with the

Company's advisors, trading for this period has now been offset

against the purchase price rather than consolidated into the

Company's results. This is purely a presentational adjustment, and

the consolidated statement of financial position remains the same

and reflects the benefit of the trading period.

The tables presented below show the movements in the primary

financial statements between the locked box date of 31 July 2021

and the completion date of 29 September 2021 and include

provisional fair value adjustments to align accounting policies

with Redcentric and to recognise fair values on acquisition which

are subject to revision within the measurement period which ends on

28 September 2022.

The Board considers the presentation of the Group results

including Piksel to be important information for shareholders as

they provide a better understanding of the structure of the

transaction and the economic contribution of Piksel to the

Group.

Reconciliation of reported results to trading update given on 27

October 2021 (unaudited)

Profit resulting from the trade in this period is reflected in

the consolidated net assets of the Group as at 30 September

2021.

Proforma

adjustments

in respect

of Piksel Six months

Six months IS Limited to 30 Sept

to 30 Sept 2 months 2021 Including

2021 (H1-22) trading* Piksel

Unaudited Unaudited Unaudited

-------------------------------------- -------------- ------------- ----------------

Total revenue GBP44.3m GBP2.1m GBP46.4m

Recurring monthly revenue (RMR) GBP39.6m GBP1.5m GBP41.1m

Recurring monthly revenue percentage 89.4% 71.0% 88.6%

Adjusted EBITDA(1) GBP11.9m GBP0.1m GBP12.0m

Adjusted net debt(1) GBP0.4m - GBP0.4m

Reported net debt GBP15.4m - GBP15.4m

*The pro forma adjustments in respect of Piksel trading noted

above, represent the results for the two-month period ended 30

September 2021 of the recently acquired Piksel over which

Redcentric took control from that date.

Reconciliation of net assets acquired (unaudited)

The movements below comprise the impact of Piksel's trading

during August and September 2021, plus provisional fair value

adjustments to align accounting policies with Redcentric and to

recognise fair values on acquisition.

Provisional

Net assets fair value

as at August and of net assets

31 July September Opening at 30 September

2021 2021 trading balance adjustments 2021

GBP'000 GBP'000 GBP'000 GBP'000

------------------------------- ---------- ------------- -------------------- ----------------

Intangible assets 19 13 - 32

Property, plant, and equipment 39 (3) - 36

Deferred tax asset 972 - - 972

Trade and other receivables 6,333 (768) 129 5,694

Cash and cash equivalents 300 665 - 965

------------------------------- ---------- ------------- -------------------- ----------------

Total assets 7,663 (93) 129 7,699

Trade and other payables (5,436) 209 (458) (5,685)

------------------------------- ---------- ------------- -------------------- ----------------

Net assets 2,227 116 (329) 2,014

Alternative performance measures

This interim report contains certain APMs that are not defined

or recognised under IFRS but are presented to provide readers with

additional financial information that is evaluated by management

and investors in assessing the performance of the Group.

This additional information presented is not uniformly defined

by all companies and may not be comparable with similarly titled

measures and disclosures by other companies. These measures are

unaudited and should not be viewed in isolation or as an

alternative to those measures that are derived in accordance with

IFRS.

Recurring monthly revenue

Recurring revenue is the revenue that annually repeats either

under contractual arrangement or by predictable customer habit. It

highlights how much of the Group's total revenue is secured and

anticipated to repeat in future periods, providing a measure of the

financial strength of the business. It is a measure that is well

understood by the Group's investor and analyst community and is

used for internal performance reporting.

Year

ended

Six months Six months 31 March

to 30 Sept to 30 Sept 2021

2021 Unaudited 2020 Unaudited Audited

GBP'000 GBP'000 GBP'000

----------------------- ---------------- ---------------- ----------

Reported revenue 44,322 46,241 91,399

Non-recurring revenue (4,752) (5,194) (9,502)

----------------------- ---------------- ---------------- ----------

Recurring revenue 39,570 41,047 81,897

----------------------- ---------------- ---------------- ----------

Total revenue decreased by 4% to GBP44.3m (H1-21: GBP46.2m)

reflecting a continued absence of large-scale IT projects together

with supply chain issues affecting both recurring and non-recurring

revenues. Excluding the previously disposed assets relating to the

EDF Contract that contributed GBP0.5m of recurring revenues in

H1-21, recurring revenues declined by 2.4% to GBP39.6m (H1-21:

GBP40.5m). Recurring revenues continue to make up 89% of total

revenue (H1-21: 89%).

Non-recurring revenue has decreased to GBP4.8m (H1-21: GBP5.2m)

reflecting lower activity on new projects together with supply

chain issues affecting our ability to deliver product sales. The

volatility of non-recurring revenue has increased since the

announcement of Brexit and more latterly Covid-19, both of which

continue to cause customers to reconsider the timing of largescale

IT investment decisions.

Adjusted EBITDA

Adjusted EBITDA is EBITDA excluding exceptional items (as set

out in note 6), share-based payments and associated national

insurance. Items are only classified as exceptional due to their

nature or size, and the Board considers that this metric provides

the best measure of assessing underlying trading performance.

Year ended

Six months Six months 31 March

to 30 Sept to 30 Sept 2021

2021 Unaudited 2020 Unaudited Audited

GBP'000 GBP'000 GBP'000

------------------------------------------- ---------------- ---------------- -----------

Reported operating profit 3,321 3,080 12,998

Amortisation of intangible assets arising

on business combinations 3,126 3,126 6,252

Amortisation of other intangible assets 407 541 1,085

Depreciation of tangible assets 2,606 2,755 3,408

Depreciation of ROU assets 1,451 1,370 4,932

EBITDA 10,911 10,872 28,675

Exceptional items 665 1,095 (4,782)

Share-based payments 284 294 687

------------------------------------------- ---------------- ---------------- -----------

Adjusted EBITDA 11,860 12,261 24,580

------------------------------------------- ---------------- ---------------- -----------

Adjusted EBITDA decreased by 3.3% to GBP11.9m (H1-21: GBP12.3m),

excluding the previously disposed assets relating to the EDF

Contract that contributed GBP0.4m to adjusted EBITDA in H1-21,

adjusted EBITDA for H1-22 was in line the prior year at

GBP11.9m

Adjusted cash from operations

Adjusted cash from operations is cash from operations excluding

the cash cost of exceptional items

Year ended

Six months Six months 31 March

to 30 Sept to 30 Sept 2021

2021 Unaudited 2020 Unaudited Audited

GBP'000 GBP'000 GBP'000

--------------------------------- ---------------- ---------------- -----------

Reported cash from operations 15,250 10,445 17,577

Cash costs of exceptional items (5,270) 2,452 8,884

--------------------------------- ---------------- ---------------- -----------

Adjusted cash from operations 9,980 12,897 26,461

--------------------------------- ---------------- ---------------- -----------

Maintenance capital expenditure

Maintenance capital expenditure is the capital expenditure that

is incurred in support of the Group's underlying infrastructure

rather than in support of specific customer contracts.

Year ended

Six months Six months 31 March

to 30 Sept to 30 Sept 2021

2021 Unaudited 2020 Unaudited Audited

GBP'000 GBP'000 GBP'000

--------------------------------- ---------------- ---------------- -----------

Reported capital expenditure 2,118 2,216 4,522

Customer capital expenditure (665) (1,601) (1,927)

--------------------------------- ---------------- ---------------- -----------

Maintenance capital expenditure 1,453 615 2,595

--------------------------------- ---------------- ---------------- -----------

Maintenance capital expenditure has increased by GBP0.8m from

H1-20 (GBP0.6m) and reflects increased investment in cooling

equipment in our main data centre which has already delivered an

electricity consumption reduction of c.7%. Our core network

continues to be upgraded and updated to ensure that capacity,

resiliency, and security are optimised.

Customer capital expenditure has decreased to GBP0.7m (H1-21:

1.6m) and reflects a lower level of new projects as customers

continue to defer investment decisions on large scale IT

projects.

Adjusted operating profit and adjusted earnings per share

Adjusted operating profit is operating profit excluding

amortisation on acquired intangibles, exceptional items, and

share-based payment charges. The same adjustments are also made in

determining the adjusted operating profit margin and in determining

adjusted earnings per share ("EPS"). The Board considers this

adjusted measure of operating profit to provide the best metric of

assessing underlying performance as it excludes exceptional items

and the amortisation of acquired intangibles arising from business

combinations which varies year on year dependent on the timing and

size of any acquisitions.

Year ended

Six months Six months 31 March

to 30 Sept to 30 Sept 2021

2021 Unaudited 2020 Unaudited Audited

GBP'000 GBP'000 GBP'000

------------------------------------------- ---------------- ---------------- -----------

Reported operating profit 3,321 3,080 12,998

Amortisation of intangible assets arising

on business combinations 3,126 3,126 6,252

Exceptional items 665 1,095 (4,782)

Share-based payments 284 294 687

Adjusted operating profit 7,396 7,595 15,155

------------------------------------------- ---------------- ---------------- -----------

The EPS calculation further adjusts for the tax impact of the

operating profit adjustments, as presented in note 9.

Adjusted operating costs

Adjusted operating costs are operating costs less depreciation,

amortisation, exceptional items, and share-based payments.

Year ended

Six months Six months 31 March

to 30 Sept to 30 Sept 2021

2021 Unaudited 2020 Unaudited Audited

GBP'000 GBP'000 GBP'000

----------------------------------------- ---------------- ---------------- -----------

24,317

Reported operating expenditure 24,317 25,573 49,448

Depreciation of ROU assets (1,451) (1,370) (4,932)

Depreciation of tangible assets (2,606) (2,755) (3,408)

Amortisation of intangibles arising on

business combinations (3,126) (3,126) (6,252)

Amortisation of other intangible assets (407) (541) (1,085)

Exceptional items (665) (1,095) 4,782

Other operating income - - (4,507)

Share-based payments (284) (294) (687)

15,778

Adjusted operating expenditure 15,778 16,392 33,359

----------------------------------------- ---------------- ---------------- -----------

Adjusted operating expenditure has reduced by 3.7% to GBP15.8m

(H1-FY21: GBP16.4m) primarily driven by:

-- UK employee costs being reduced by GBP0.2m, driven by lower

commission costs and a focus on overtime expenditure. Excluding

Piksel, the Company employed 301 UK employees at 30 September 2021

(H1-21: 292) with an average headcount of 296 (H1-21: 295);

-- offshore costs being also GBP0.2m lower than prior year,

reflecting a lower average headcount of 103 (H1-21: 135); and

-- a continued focus on rationalising and optimising our core

network resulted in a GBP0.2m reduction in costs.

Adjusted net debt

Adjusted net debt is net debt excluding leases that would have

been classified as operating leases under IAS 17.

Year ended

Six months Six months 31 March

to 30 Sept to 30 Sept 2021

2021 Unaudited 2020 Unaudited Audited

GBP'000 GBP'000 GBP'000

---------------------------------------- ---------------- ---------------- -----------

Reported net debt (15,351) (17,010) (15,569)

Supplier loans 1,038 - 1,491

Lease liabilities that would have been

classified as operating leases under

IAS 17 13,948 15,877 15,058

---------------------------------------- ---------------- ---------------- -----------

Adjusted net (debt) / cash (365) (1,133) 980

---------------------------------------- ---------------- ---------------- -----------

Profitability and dividend policy

Adjusted EBITDA (GBP11.9m) and adjusted operating profit

(GBP7.4m) were down 3.2% and 2.6% respectively, with an adjusted

EBITDA margin of 26.8% (H1-21: 26.5%) and adjusted operating margin

of 16.7% (H1-21: 16.4%).

After accounting for exceptional items of GBP0.7m (H1-21:

GBP1.1m) and share-based payment costs of GBP0.3m (H1-21: GBP0.3m),

reported operating profit was 7.8% higher at GBP3.3m (H1-21:

GBP3.1m).

Net finance costs for the period were GBP0.5m (H1:21: GBP0.8m)

including GBP0.4m (H1-21: GBP0.6m) of IFRS 16 finance charges.

The reported basic and diluted EPS both increased by 23% and

were 1.71p and 1.68p respectively (H1-21: 1.39p and 1.36p

respectively). Adjusted basic and diluted EPS both decreased

marginally by 2% to 3.55p and 3.47p respectively (H1-21: 3.61p and

3.54p respectively).

The Board has reviewed the financial performance of the business

and has decided to maintain an interim dividend payment of 1.2p per

share, which will be paid on 6 January 2022 to shareholders on the

register at the close of business on 25 November 2021.

Cash flow and net debt

The principal movements in net debt are set out in the table

below.

Six months Six months Year ended

to 30 September to 30 September 31 March

2021 2020 2021

Unaudited Unaudited Audited

GBP'000 GBP'000 GBP'000

--------------------------------------------- ----------------- ----------------- -----------

Adjusted EBITDA 11,860 12,261 24,580

Effect of exchange rates - 18 -

Working capital movements (1,880) 636 1,881

--------------------------------------------- ----------------- ----------------- -----------

Adjusted cash generated from operations 9,980 12,915 26,461

Cash conversion 84% 105% 107.7%

Capital expenditure - cash purchases (2,118) (1,235) (2,937)

Capital expenditure - finance lease

purchases - (981) (2,235)

Proceeds from sale and lease back of

assets - - 1,036

--------------------------------------------- ----------------- ----------------- -----------

Net capital expenditure (2,118) (2,216) (4,136)

Corporation tax (5) 149 (149)

Interest paid (292) (261) (398)

Loan arrangement fees/fee amortisation - 41 (17)

Finance lease/term loan interest (509) (634) (1,017)

Effect of exchange rates - 1 (27)

--------------------------------------------- ----------------- ----------------- -----------

Other movements in net debt (806) (704) (1,608)

Normalised net debt movement 7,056 9,995 20,717

--------------------------------------------- ----------------- ----------------- -----------

Cash cost of acquisitions net of cash (8,366) - -

acquired

Cash costs of exceptional items 5,270 (2,452) (8,884)

Remeasurement related to lease modification - 4,221 3,917

Supplier loans - - (1,207)

Share issues - 5,775 5,775

Sale of treasury shares 7 - 494

Cash received on exercise of share

options - - 36

Dividends (3,749) - (1,868)

--------------------------------------------- ----------------- ----------------- -----------

(6,838) 7,544 (1,737)

Decrease in net debt 218 17,539 18,980

Net debt at the beginning of the period (15,569) (34,549) (34,549)

--------------------------------------------- ----------------- ----------------- -----------

Net debt at the end of the period (15,351) (17,010) (15,569)

--------------------------------------------- ----------------- ----------------- -----------

Net debt reduced by GBP0.2m in the period to GBP15.4m and

consists of total borrowings of GBP5.0m (FY-21: GBP5.8m) and leases

previously classified as operating leases under IAS17 of GBP13.9m

(FY-21: 15.1m) less cash balances of GBP3.6m (FY-21: GBP5.3m).

Adjusted cash generated from operations of GBP9.9m (84% cash

conversion) has been impacted by the following:

-- In previous periods the age profile of trade debtors has

aided an offset against the normal H1 creditor outflow, the

implementation of D365 in October 2020 facilitated invoices to be

issued an average of 10 days earlier, which accelerated payment

from customers and benefitted H2-21; and

-- tactical decisions to deploy working capital resources to

optimise EBITDA resulting in a GBP0.6m outflow to working

capital.

During H1-22 there has been GBP5.8m of cash benefit due to the

receipt of the consideration for the sale of assets relating to EDF

Contract on 31 March 2021. The Acquisition net of cash balances as

at 30 September 2021 was GBP8.4m.

At 30 September 2021, the Company had committed a revolving

credit facility ("RCF") of GBP5.0m (GBPnil utilised at 30 September

2021) and a GBP7.0m asset financing facility (GBP1.6m utilised at

30 September 2021). In addition, the Company has access to a

GBP20.0m accordion facility.

Related party transactions

There have been no material changes in the related party

transactions described in the last annual report and accounts of

the Company.

Principal risks and uncertainties

The principal risks and uncertainties, which could have a

material impact upon the Group's performance over the remaining six

months of the financial year ending 31 March 2022, have not changed

from those set out on pages 30 and 31 of the Group's 2021 annual

report and accounts, which is available at www.redcentricplc.com .

These risks and uncertainties include, but are not limited to the

following:

Market and economic conditions

Technology and cyber-security

Competition and market pressures

Business continuity

Loss of a major contract

Environmental impact

Covid-19

Covid-19

The Covid-19 pandemic continues to create an unprecedented and

constantly changing challenge to all businesses. As the country

gradually emerges from the depths of the pandemic, businesses are

evaluating operating models and challenging cost bases to adopt the

most efficient way of working. This presents both risks and

opportunities to the Group as businesses evaluate migrating from

traditional on premise and cloud solutions to hyper-scale cloud and

hybrid solutions. The Acquisition furnishes the Group with the

skills and expertise required to provide these services to existing

and new customers and we are already beginning to see increased

activity in this area.

Going concern

As stated in note 2 to the financial statements, the Board is

satisfied that the Group has sufficient resources to continue in

operation for the foreseeable future, a period of not less than 12

months from the date of this report. Accordingly, they continue to

adopt the going concern basis in preparing the condensed financial

statements.

By order of the Board,

Chief Executive Officer Chief Financial Officer

Peter Brotherton David Senior

17(th) November 2021 17(th) November 2021

Redcentric plc

Condensed consolidated statement of comprehensive income for the

six months ended 30 September 2021

Six months Six months Year ended

to 30 September to 30 September 31 March

2021 2020 2021

Unaudited Unaudited Audited

Note GBP'000 GBP'000 GBP'000

---------------------------------------- ----- ----------------- ----------------- -----------

Revenue 5 44,322 46,241 91,399

Cost of sales (16,684) (17,588) (33,460)

---------------------------------------- ----- ----------------- ----------------- -----------

Gross Profit 27,638 28,653 57,939

Operating expenditure (24,317) (25,573) (49,448)

Operating income - - 4,507

---------------------------------------- ----- ----------------- ----------------- -----------

Adjusted EBITDA (1) 11,860 12,261 24,580

Depreciation of property, plant,

and equipment (2,606) (2,755) (3,408)

Amortisation of intangibles (3,533) (3,667) (7,337)

Depreciation and Amortisation of (4,932

ROU assets (1,451) (1,370) )

Exceptional items 6 (665) (1,095) 4,782

Share-based payments (284) (294) (687)

Operating profit 3,321 3,080 12,998

Finance costs 7 (549) (828) (1,460)

---------------------------------------- ----- ----------------- ----------------- -----------

Profit before taxation 2,772 2,252 11,538

Income tax expense 8 (97) (146) (2,311)

---------------------------------------- ----- ----------------- ----------------- -----------

Profit for the period attributable

to owners of the parent 2,675 2,106 9,227

---------------------------------------- ----- ----------------- ----------------- -----------

Other comprehensive income

Items that may be classified to

profit or loss:

Currency translation differences - 18 103

Deferred tax movement on share options - - (224)

---------------------------------------- ----- ----------------- ----------------- -----------

Total comprehensive income for the

period 2,675 2,124 9,106

---------------------------------------- ----- ----------------- ----------------- -----------

Earnings per share

Basic earnings per share 9 1.71p 1.39p 6.01p

Diluted earnings per share 9 1.68p 1.36p 5.93p

---------------------------------------- ----- ----------------- ----------------- -----------

(1) For an explanation of the alternative performance measures

used in this report, please see above

Redcentric plc

Condensed consolidated statement of financial position as at 30

September 2021

30 Sept 30 Sept 31 March

2021 2020 2021

Unaudited Unaudited Audited

Note GBP'000 GBP'000 GBP'000

-------------------------------- ----- ----------- ----------- ---------

Non-Current Assets

Intangible assets 73,106 65,697 65,929

Property, plant, and equipment 5,133 15,826 5,834

Right-of-use assets 17,456 15,694 18,787

Deferred tax asset 2,055 2,098 561

97,750 99,315 91,111

-------------------------------- ----- ----------- ----------- ---------

Current Assets

Inventories 969 134 1,061

Trade and other receivables 10 19,774 17,899 25,663

Cash and short-term deposits 3,553 6,946 5,250

-------------------------------- ----- ----------- ----------- ---------

24,296 24,979 31,974

-------------------------------- ----- ----------- ----------- ---------

Total assets 122,046 124,294 123,085

-------------------------------- ----- ----------- ----------- ---------

Current Liabilities

Trade and other payables 11 (24,054) (18,605) (22,459)

Corporation tax payable (684) (579) (641)

Loans and borrowings 12 (498) (66) (487)

Leases 12 (3,855) (4,030) (3,735)

Provisions 13 (548) (8,572) (574)

-------------------------------- ----- ----------- ----------- ---------

(29,639) (31,852) (27,896)

-------------------------------- ----- ----------- ----------- ---------

Non-current liabilities

Loans and borrowings 12 (540) (2,710) (1,004)

Leases 12 (14,011) (17,151) (15,593)

Provisions 13 (2,744) (2,806) (2,695)

-------------------------------- ----- ----------- ----------- ---------

(17,295) (22,667) (19,292)

-------------------------------- ----- ----------- ----------- ---------

Total liabilities (46,934) (54,519) (47,188)

-------------------------------- ----- ----------- ----------- ---------

Net assets 75,112 69,775 75,897

-------------------------------- ----- ----------- ----------- ---------

Equity

Called up share capital 14 156 156 156

Share premium account 14 73,267 72,931 73,267

Capital redemption reserve (9,454) (9,454) (9,454)

Own shares held in treasury 14 (19) (180) (32)

Retained earnings 11,162 6,322 11,960

-------------------------------- ----- ----------- ----------- ---------

Total equity 75,112 69,775 75,897

-------------------------------- ----- ----------- ----------- ---------

Redcentric plc

Condensed consolidated statement of changes in equity as at 30

September 2021

Share Share Capital Own Shares Retained Total

Capital Premium Redemption Held Earnings Equity

Reserve in Treasury

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

---------------------------- --------- --------- ------------ ------------- ---------- --------

At 1 April 2020 149 65,734 (9,454) (724) 4,096 59,801

Profit for the period - - - - 2,106 2,106

Transactions with owners

Share-based payments - - - - 257 257

Issue of new shares 7 7,197 - - - 7,204

Share options exercised - - - 544 (155) 389

Other comprehensive income

Currency translation

differences - - - - 18 18

---------------------------- --------- --------- ------------ ------------- ---------- --------

At 30 September 2020 156 72,931 (9,454) (180) 6,322 69,775

Profit for the period - - - - 7,121 7,121

Transactions with owners

Share-based payments - - - - 325 325

Issue of new shares - 336 - - - 336

Dividends paid - - - - (1,868) (1,868)

Share options exercised - - - 148 (43) 105

Other comprehensive income

Deferred tax movement

on share options - - - - 224 224

Currency translation

differences - - - - (121) (121)

---------------------------- --------- --------- ------------ ------------- ---------- --------

At 31 March 2021 156 73,267 (9,454) (32) 11,960 75,897

Profit for the period - - - - 2,675 2,675

Transactions with owners

Share-based payments - - - - 276 276

Issue of new shares - - - - -

Dividends paid - - - - (3,749) (3,749)

Share options exercised - - - 13 - 13

Other comprehensive income

Deferred tax movement - - - - - -

on share options

Currency translation - - - - - -

differences

---------------------------- --------- --------- ------------ ------------- ---------- --------

At 30 September 2021 156 73,267 (9,454) (19) 11,162 75,112

Redcentric plc

Consolidated cash flow statement for the six months ended 30

September 2021

Six months Six months Year ended

to 30 Sept to 30 31 March

2021 Sept 2020 2021

Unaudited Unaudited Audited

GBP'000 GBP'000 GBP'000

----------------------------------------------- ------------ ----------- -----------

Operating profit/(loss) 3,321 3,080 12,998

Adjustment for non-cash items

Depreciation and amortisation 7,590 7,792 15,677

Exceptional items 665 1,095 (4,782)

Share-based payments 284 294 687

----------------------------------------------- ------------ ----------- -----------

Operating cash flow before exceptional

items and movements in working capital 11,860 12,261 24,580

Loss on sale of fixed asset - - -

Exceptional items and NI on share-based

payments 5,270 (2,452) (8,884)

----------------------------------------------- ------------ ----------- -----------

Operating cash flow before changes in working

capital 17,130 9,809 15,696

Changes in working capital

Decrease / (increase) in inventories 390 757 (15)

Decrease in trade and other receivables 1,994 5,754 4,432

Decrease in trade and other payables (4,264) (5,875) (2,536)

----------------------------------------------- ------------ ----------- -----------

Cash generated from operations 15,250 10,445 17,577

----------------------------------------------- ------------ ----------- -----------

Tax (paid) / received (5) 149 (149)

----------------------------------------------- ------------ ----------- -----------

Net cash generated from operating activities 15,245 10,594 17,428

----------------------------------------------- ------------ ----------- -----------

Cash flows from investing activities

Acquisition of subsidiaries net of cash -

acquired (8,366) -

Purchase of property, plant, and equipment (1,664) (1,046) (1,541)

Purchase of intangible fixed assets (454) (189) (1,397)

Net cash used in investing activities (10,484) (1,235) (2,938)

----------------------------------------------- ------------ ----------- -----------

Cash flows from financing activities

Dividends paid (3,749) - (1,868)

Disposal of treasury shares on exercise

of share options 7 - 494

Cash received on exercise of share options - - 36

Interest paid (400) (823) (1,415)

Sale and leaseback - 1,439 1,036

Repayment of leases (2,316) (2,532) (4,481)

Repayment of revolving credit facility - (10,000) (12,500)

Issue of shares - 5,775 5,775

Net cash used in financing activities (6,458) (6,141) (12,923)

----------------------------------------------- ------------ ----------- -----------

Net (decrease) / increase in cash and cash

equivalents (1,697) 3,218 1,567

Cash and cash equivalents at beginning

of period 5,250 3,710 3,710

Effect of exchange rates - 18 (27)

Cash and cash equivalents at end of the

period 3,553 6,946 5,250

----------------------------------------------- ------------ ----------- -----------

Redcentric plc

Notes to the condensed set of financial statements for the six

months ended 30 September 2021

1. General information

The financial statements for the six months ended 30 September

2021 and the six months ended 30 September 2020 do not constitute

statutory accounts within the meaning of Section 434 of the

Companies Act 2006. Statutory accounts for the year ended 31 March

2021 were approved by the Board on 15 July 2021 and delivered to

the Registrar of Companies. The auditor's report on those accounts

was unqualified, did not contain an emphasis of matter paragraph

and did not contain any statement under Section 498 (2) or (3) of

the Companies Act 2006.

These condensed half year financial statements were approved for

issue by the Board on 17 November 2021.

Redcentric plc is a company domiciled in England and Wales.

These condensed half year financial statements comprise the Company

and its subsidiaries (together referred to as the "Company" or the

"Group"). The principal activity of the Company is the supply of IT

managed services .

2. Accounting policies

Basis of preparation

These condensed half year financial statements for the half year

ended 30 September 2021 have been prepared in accordance with the

AIM Rules for Companies, comply with IAS 34 Interim Financial

Reporting as adopted by the European Union and should be read in

conjunction with the annual financial statements for the year ended

31 March 2021, which have been prepared in accordance with

International Financial Reporting Standards (IFRS) as adopted by

the European Union.

Going concern

As at 30 September 2021 the Company was party to a GBP5.0m

revolving credit facility ("RCF") with a GBP20.0m accordion; both

have a termination date of 30 June 2022 and were undrawn as at the

reporting date. The Company also has a GBP7.0m asset financing

facility, with no fixed termination date, of which GBP1.6m was

utilised at the reporting date.

Following the preparation of the Company's budget, which is

planned to be completed in December 2021, the Company will

undertake a comprehensive re-financing exercise. This is expected

to be completed by 31 March 2022, to ensure that sufficient funding

is available for further acquisition activity.

The Board has reviewed a detailed trading and cash flow forecast

for a period which covers at least 12 months after the date of

approval of these condensed half year financial statements. As

Piksel is aligned to Redcentric's payment practices, a negative

working capital impact in the second half of FY22 is expected; it

is expected that Piksel will be cash generative in FY23.

Notwithstanding this, there is a high and continuing level of

recurring revenue and high cash conversion is anticipated for the

foreseeable future.

Whilst the Group's trading and cash flow forecasts have been

prepared using current trading assumptions, the operating

environment presents several challenges which could negatively

impact the actual performance achieved. These risks include, but

are not limited to, achieving forecast levels of order intake, the

impact on customer confidence because of general economic

conditions and Brexit. If future trading performance significantly

under-performs the Group's forecasts, this could impact the ability

of the Group to comply with its covenant tests over the period of

the forecasts.

The uncertainty as to the future impact on the Group of the

Covid-19 pandemic has been separately considered as part of the

Board's consideration of the going concern basis of preparation.

Whilst the Group has observed an absence of large-scale IT projects

these are not seen as materially negative and the trading

performance over the duration of the pandemic to date has been

positive. However, due to the continuing uncertainty over the

duration and extent of the impact of Covid-19, the Board has

modelled a severe but plausible downside scenario when preparing

the forecasts. The Board has also considered the impact of the

ongoing Covid-19 challenges in India on the employees and business

operations.

The downside scenario assumes significant economic downturn over

FY22 resulting in 50% reduction of forecast new order intake and

50% reduction in non-recurring revenues. This scenario also models

the impact of the loss of a key customer and severe negative

working capital assumptions with no mitigating actions implemented

to reduce discretionary spend. Under the downside scenario

modelled, the forecasts demonstrate that the Group is expected to

maintain sufficient liquidity and remain in compliance with

covenants whilst still maintaining adequate headroom against

overall facilities until March 2022 when a new bank facility is

expected to be put in place.

The Board therefore remains confident that the Group has

adequate resources to continue to meet its liabilities as and when

they fall due within the period of at least 12 months from the date

of approval of these financial statements. Accordingly, the

financial statements have been prepared on a going concern

basis.

The financial information is presented in sterling, which is the

functional currency of the Company. All financial information

presented has been rounded to the nearest thousand.

3. Critical accounting judgements and key sources of estimation uncertainty

Trade debtors impairment provision

The key source of estimation uncertainty that carries a

significant risk of material change to the carrying value of assets

and liabilities within the next year is with regard to credit note

provisioning, where provision is made for the value of credit notes

that the Company expects to subsequently issue to correct for

estimated inaccurate invoices issued to date. Following the FY21

year end the basis for provision was reviewed considering the level

of historical credit notes raised, and accordingly, the provision

was 1.0% of recurring revenue.

Identification of intangible assets

The allocation of the value of the excess consideration less the

net assets acquired are identified as intangible assets arising as

part of a business combination, these require judgement in respect

of the separately identifiable intangible assets that have been

acquired. These judgements are based upon the Board's opinion of

the identifiable assets from which economic benefits are

derived.

Fair value of assets acquired on business combinations

In accordance with IFRS 3 'Business Combinations', on the

acquisition of Piksel Limited, discussed in note 15, the Group

measured the identifiable assets acquired and the liabilities

assumed at their acquisition--date fair values. In most cases the

fair value was not materially different from the carrying values;

however, GBP3.69m of intangible assets other than goodwill were

recognised.

The valuation was undertaken using a multi-period excess

earnings method and relief from royalty method for valuing customer

relationships and brands respectively. The key estimates which

underly these valuations in addition to management's estimate of

future revenue, profits and cash generation are:

Required rate of return 10.3%

Long term revenue growth

rate 2.0%

----------------------

EBITDA margin for FY24

onwards 11.5%

----------------------

Royalty rate based on

benchmark average 2.0%

----------------------

Corporation tax rate 19% to FY23, 25%

in FY24 and terminal

----------------------

4. Segmental reporting

IFRS 8 requires operating segments to be identified based on

internal financial information reported to the chief operating

decision-maker for decision-making purposes. The Group considers

that this role is performed by the Board. The Board believes that

the Group continues to comprise a single reporting segment, being

the provision of managed services to customers.

5. Revenue analysis

Revenue for the six months ended 30 September 2021 was generated

wholly from the UK and is analysed as follows:

Six months Six months Year ended

to 30 to 30 31 March

Sept 2021 Sept 2020 2021

Unaudited Unaudited Audited

GBP'000 GBP'000 GBP'000

------------------- ----------- ----------- -----------

Recurring revenue 39,570 41,047 81,897

Product revenue 2,875 3,254 5,072

Services revenue 1,877 1,940 4,430

Total revenue 44,322 46,241 91,399

------------------- ----------- ----------- -----------

6. Exceptional items

Six months Six months Year ended

to 30 to 30 31 March

Sept 2021 Sept 2020 2021

Unaudited Unaudited Audited

GBP'000 GBP'000 GBP'000

------------------------------------------------- ----------- ----------- -----------

Professional fees associated with Financial

Conduct Authority investigation 8 (13) 57

Insurance advisor provision - - 553

Staff restructuring 128 383 393

Vacant property lease provisions net of - 13 -

costs

Onerous service contracts - 224 148

Acquisition of subsidiaries 494 - -

Circuit termination charges - - 4

Restitution 28 (225) (2,172)

Loss on lease modification - 649 649

Sale costs - 64 93

Costs / (profit) upon sale of non-core business

unit 7 - (4,507)

665 1,095 (4,782)

------------------------------------------------- ----------- ----------- -----------

7. Finance income and costs

Six months Six months Year ended

to 30 Sept to 30 Sept 31 March

2021 2020 2021

Unaudited Unaudited Audited

GBP'000 GBP'000 GBP'000

----------------------------------------------- ------------ ------------ -----------

Finance income

Other interest receivable - - -

- - -

----------------------------------------------- ------------ ------------ -----------

Finance costs

Interest payable on bank loans and overdrafts (13) (151) (240)

Interest payable on leases (518) (634) (1,165)

Amortisation of loan arrangement fees (18) (43) (55)

----------------------------------------------- ------------ ------------ -----------

(549) (828) (1,460)

----------------------------------------------- ------------ ------------ -----------

For the six months to 30 September 2021 interest payable on

leases includes GBP433,000 (H1-21: GBP562,000) of IFRS 16 interest

expense.

8. Income tax expense

The tax expense recognised reflects management estimates of the

tax charge for the period and has been calculated using the

estimated average tax rate of UK corporation tax for the financial

year of 19.0% (H1-21: 19.0%)

9. Earnings per share (EPS)

The calculation of basic and diluted EPS is based on the

following earnings and number of shares.

Six months Six months Year ended

to 30 Sept to 30 Sept 31 March

2021 Unaudited 2020 Unaudited 2021 Audited

Earnings GBP'000 GBP'000 GBP'000

---------------------------------------------- ---------------- ---------------- --------------

Statutory earnings 2,675 2,106 9,227

Tax charge 97 146 2,311

Amortisation of acquired intangibles 3,126 3,126 6,252

Share-based payments 284 294 687

Exceptional items 665 1,095 (4,782)

Adjusted earnings before tax 6,847 6,767 13,695

Notional tax charge at standard rate (1,301) (1,286) (2,602)

---------------------------------------------- ---------------- ---------------- --------------

Adjusted earnings 5,546 5,481 11,093

---------------------------------------------- ---------------- ---------------- --------------

Number Number Number

Weighted average number of ordinary shares '000 '000 '000

---------------------------------------------- ---------------- ---------------- --------------

Total shares in issue 156,184 151,932 153,930

Shares held in treasury (21) (204) (439)

---------------------------------------------- ---------------- ---------------- --------------

For basic EPS calculations 156,163 151,728 153,491

Effect of potentially dilutive share

options 3,441 2,982 2,215

---------------------------------------------- ---------------- ---------------- --------------

For diluted EPS calculations 159,604 154,710 155,706

---------------------------------------------- ---------------- ---------------- --------------

EPS Pence Pence Pence

Basic 1.71p 1.39p 6.01p

Adjusted 3.55p 3.61p 7.23p

Basic diluted 1.68p 1.36p 5.93p

Adjusted diluted 3.47p 3.54p 7.12p

10. Trade and other receivables

Six months Six months Year ended

to 30 to 30 31 March

Sept 2021 Sept 2020 2021

Unaudited Unaudited Audited

GBP'000 GBP'000 GBP'000

----------------------------- ----------- ----------- -----------

Trade Receivables 9,015 8,414 10,268

Less: credit note provision (1,115) (1,145) (1,104)

----------------------------- ----------- ----------- -----------

Trade receivables - net 7,900 7,269 9,164

Other receivables 594 619 5,825

Prepayments 6,956 5,739 6,579

Commission contract asset 1,877 2,566 2,096

Accrued income 2,447 1,706 1,999

Total 19,774 17,899 25,663

----------------------------- ----------- ----------- -----------

Trade debtor days were 31 at 30 September 2021 (30 September

2020: 33). The ageing of trade receivables is shown below:

Six months Six months Year ended

to 30 to 30 31 March

Sept 2021 Sept 2020 2021

Unaudited Unaudited Audited

GBP'000 GBP'000 GBP'000

------------------------ ----------- ----------- -----------

Current 7,188 7,017 9343

1 to 30 days overdue 1,561 907 600

31 to 60 days overdue 126 530 282

61 to 90 days overdue 115 (74) 21

91 to 180 days overdue 25 46 21

> 180 days overdue - (12) 1

------------------------ ----------- ----------- -----------

Gross trade debtors 9,015 8,414 10,268

Credit note provision (1,115) (1,145) (1,104)

Net trade debtors 7,900 7,269 9,164

------------------------ ----------- ----------- -----------

11. Trade and other payables

Six months Six months Year ended

to 30 to 30 31 March

Sept 2021 Sept 2020 2021 Audited

Unaudited Unaudited

GBP'000 GBP'000 GBP'000

------------------------------ ----------- ----------- --------------

Trade Payables 7,245 6,454 8,470

Other Payables 982 349 243

Taxation and Social Security 3,128 2,021 2,390

Accruals 4,297 2,444 3,885

Deferred Income 8,402 7,337 7,471

Total 24,054 18,605 22,459

------------------------------ ----------- ----------- --------------

Trade creditor days were 41 at 30 September 2021 (30 September

2020: 36).

12. Borrowings

Six months Six months Year ended

to 30 to 30 31 March

Sept 2021 Sept 2020 2021 Audited

Unaudited Unaudited

GBP'000 GBP'000 GBP'000

----------------------------------- ----------- ----------- --------------

Current

Lease liabilities 3,855 4,030 3,735

Term loans 498 101 487

Unamortised loan arrangement fees - (35) -

----------------------------------- ----------- ----------- --------------

Total 4,353 4,096 4,222

----------------------------------- ----------- ----------- --------------

Non-current

Lease liabilities 14,011 17,151 15,593

Term Loans 540 233 1,004

Bank Loans - 2,500 -

Unamortised loan arrangement fees - (23) -

----------------------------------- ----------- ----------- --------------

Total 14,551 19,861 16,597

----------------------------------- ----------- ----------- --------------

13. Provisions

Scheme Vacant

Restitution fees provision Dilapidation property Total

provision provision provision provision

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

---------------------------- -------------- ---------------- --------------- ----------- ------------

At 1 April 2020 11,429 - 2,526 698 14,653

Additional provisions in

the period 130 - 280 - 410

Released during the period (598) - - - (598)

Utilised during the period (2,761) - - (326) (3,087)

---------------------------- -------------- ---------------- --------------- ----------- ------------

At 30 September 2020 8,200 - 2,806 372 11,378

Additional provisions in

the period - 553 53 21 627

Released during the period (1,574) - (164) (193) (1,931)

Utilised during the period (6,626) - - (179) (6,805)

---------------------------- -------------- ---------------- --------------- ----------- ------------

At 31 March 2021 - 553 2,695 21 3,269

Additional provisions in

the period - - 49 - 49

Released during the period - - - - -

Utilised during the period - (26) - - (26)

---------------------------- -------------- ---------------- --------------- ----------- ------------

At 30 September 2021 - 527 2,744 21 3,292

---------------------------- -------------- ---------------- --------------- ----------- ------------

Analysed as:

Current - 527 - 21 548

Non-current - - 2,744 - 2,744

---------------------------- -------------- ---------------- --------------- ----------- ------------

At 30 September 2021 - 527 2,744 21 3,292

---------------------------- -------------- ---------------- --------------- ----------- ------------

14. Share capital and share premium

Ordinary shares of

0.1p each Share premium

----------------------

Number GBP'000 GBP'000

---------------------- ------------ -------- --------------

At 1 April 2020 149,310,713 149 65,734

New shares issued 6,854,997 7 7,533

---------------------- ------------ -------- --------------

At 31 March 2021 156,165,710 156 73,267

New shares issued 50,000 - -

---------------------- ------------ -------- --------------

At 30 September 2021 156,215,710 156 73,267

---------------------- ------------ -------- --------------

At the start of the period the Company held in treasury 33,284

of its ordinary share capital. During the period, following notices

of exercise in relation to employee share options, 13,581 shares

previously held in treasury were transferred to satisfy the

exercises. At 30 September, the Company's issued share capital

consisted of 156,215,710 ordinary shares of which 19,703 which

remain in treasury.

15. Business combinations

On 29 September 2021, the Company's subsidiary, Redcentric

Solutions Ltd, completed the Acquisition for US$13.0m (c.GBP9.5m)

payable in cash, of which US$12.0m (c.GBP8.8m) was payable

immediately and US$1.0m (c.GBP0.7m) held in escrow for a period of

12 months. Pursuant to terms of the sales and purchase agreement in

relation to the Acquisition, the purchase price was subsequently

increased by GBP0.1m due to a revised assessment of Piksel's latest

research & development tax claim submission to HMRC.

Piksel provides IT modernisation and digital transformation

services, focussing on public cloud. It also delivers security and

IT managed services and has a strong application development and

DevOps capability. Its managed IT services are provided across a

broad range of industry verticals, with a particular focus on

Amazon Web Services and Microsoft Azure. The Acquisition gives

Redcentric leading-edge skills and capabilities in public cloud and

security to enable it to immediately provide additional solutions

to an enlarged customer base.

As at 30 September 2021, Piksel had net assets of GBP1.9m

including an assumed intra-group debtor of GBP3.1m, which is to be

written off post acquisition, and cash on the balance sheet of

GBP1.0m. Subsequent to the locked box date, it was agreed that the

purchase price be increased by GBP0.1m due to a revised assessment

of Piksel's latest RDEC claim with HMRC.

In addition, a provisional payment price allocation exercise led

to the recognition of a GBP3.7m intangible asset, which comprises

value associated the Piksel tradename and customer relationships.

Note 3 details the methods used to value these identified

intangible assets and sets out the key estimates and uncertainties

inherent therein.

Effect of the Acquisition

The Acquisition had the following effect on the Group's assets

and liabilities:

Provisional

fair values

on acquisition

GBP'000

------------------------------- ---------------

Intangible assets 32

Property, plant, and equipment 36

Deferred tax asset 972

Trade and other receivables 5,694

Cash and cash equivalents 965

------------------------------- ---------------

Total assets 7,699

Trade and other payables (5,685)

------------------------------- ---------------

Net assets 2,014

Identified intangible assets 3,685

Net assets acquired 5,699

------------------------------- ---------------

Goodwill 7,013

Total consideration 12,712

------------------------------- ---------------

Satisfied by:

Cash 8,782

Cash held in escrow 732

------------------------------- ---------------

Total cash consideration 9,514

Subsequent adjustments to

consideration 129

Intra-group debtor to be

written off 3,069

------------------------------- ---------------

Total consideration 12,712

------------------------------- ---------------

Goodwill

Goodwill arising on the business combination represents the

excess of the cost of the Acquisition over the fair value of the

Group's share of the identifiable net assets of Piksel at the date

of the Acquisition excluding the intra group debtor, which is to be

written off. Goodwill includes intangible assets that do not

qualify for separate recognition such as the value of the future

income from new customers, the potential cross-selling opportunity,

and the assembled work force of highly skilled technical

individuals.

Acquired receivables

The fair value of acquired receivables of GBP2.3m is materially

the same as the gross contractual receivable less the best estimate

of contractual cash flows not expected to be collected.

Acquisition related costs

The Group incurred acquisition related cost of GBP0.5m related

to advisory fees and stamp duty land tax. These costs have been

included in exceptional costs in the Group's consolidated statement

of comprehensive income.

Revenue and profit contribution

As noted above, whilst the Group's consolidated statement of

comprehensive income does not include Piksel's results for August

and September, the consolidated statement of financial position

reflects the benefit generated in that period with Piksel

delivering GBP2.1m of revenue and GBP0.1m profit before tax.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR DKOBKDBDBPDD

(END) Dow Jones Newswires

November 18, 2021 02:01 ET (07:01 GMT)

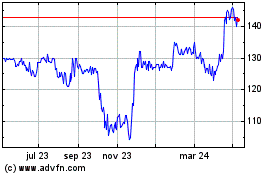

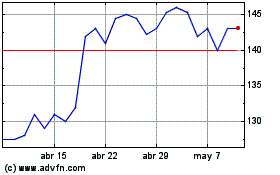

Redcentric (LSE:RCN)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Redcentric (LSE:RCN)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024