TIDMRSG

RNS Number : 6976Q

Resolute Mining Limited

29 October 2021

29 October 2021

Resolute Mining Limited

(Resolute or the Company)

Quarterly Activities Report

for the period ended 30 September 2021

September Quarterly highlights

-- Total Recordable Injury Frequency Rate (TRIFR) of 1.26

consistent with the prior quarter and September 2020 quarter

-- Quarterly production (gold poured) of 76,336 ounces (oz) in line with the prior quarter

-- All-In Sustaining Cost (AISC) of $1,499/oz, impacted by

above-average rainfall at Syama, drawdown of higher cost stockpiles

and the planned cut-back at Mako

-- Gold sales of 89,326oz at an average realised gold price of

$1,738/oz compared to the average spot price of $1,791/oz

-- Sale of Bibiani Gold Mine completed for $90 million in cash

with an initial $30 million received

-- Cash and bullion of $41.6 million with net debt reduced to

$212.9 million, including net debt repayments of $53.6 million

during the quarter

-- Deferral of the planned major shutdown of the sulphide

processing circuit from October 2021 to February 2022

-- Outstanding drill results at Tabakoroni underground sulphide

and Syama North oxide support an expected increase in resources at

Tabakoroni and return to open-pit mining at Syama North in late

2021

-- Significant progress with on-site COVID-19 vaccination

program with double dose vaccination rates nearing 50% across

operations

-- 2021 production guidance maintained at 315,000oz to 340,000oz

at an AISC of $1,290/oz to $1,365/oz.

Resolute Mining Limited (Resolute or the Company) (ASX/LSE: RSG)

is pleased to present its Quarterly Activities Report for the

period ended 30 September 2021.

Group production was 76,336oz of gold, consistent with the June

quarter. A rolling TRIFR of 1.26 was maintained. Production was

affected by a wetter than expected September quarter at Syama, with

rainfall disrupting open pit mining and processing performance.

Production from Mako was in line with expectations as the planned

cut-back to expand and extend operations continued with lower

grades delivered to the plant during the September quarter. At both

sites, higher cost ore stockpiles were drawn down to supplement

mine production. Collectively this resulted in an increase in AISC

for the quarter to $1,499/oz. AISC guidance for the 2021 full year

remains unchanged.

Several projects were commissioned at the Syama sulphide

operations, including a transition to owner-operator of underground

development. Mining progressed at Tabakoroni, focusing on

pre-stripping and accessing higher-grade oxide ore. As noted above,

progress was hindered by the wet weather impacting pit access and

ore haulage.

The sale of the Bibiani Gold Mine in Ghana to Asante Gold

Corporation (Asante) was completed, with an initial $30 million

received and two further instalments of $30 million expected in

February and August 2022. Debt repayments of $53.6 million were

made during the quarter, with $30 million applied to the Revolving

Credit Facility (RCF) and $25 million paid on the amortising Term

Loan Facility

Operating Performance Snapshot

Resolute's group performance compared to the previous quarter

and prior comparable quarter is set out in the table below:

Group Summary Units September June 2021 Change September

2021 Quarter Quarter 2020 Quarter

Mining

Ore Mined t 1,427,109 1,554,097 (8%) 1,169,921

------- -------------- ---------- ------- --------------

Mined Grade g/t 1.91 2.03 (6%) 2.32

------- -------------- ---------- ------- --------------

Processing

Ore Processed t 1,416,368 1,456,921 (3%) 1,320,046

------- -------------- ---------- ------- --------------

Processed Grade g/t 1.91 2.00 (4%) 2.24

------- -------------- ---------- ------- --------------

Recovery % 86.1 85.3 1% 87.4

------- -------------- ---------- ------- --------------

Gold Recovered oz 74,066 79,318 (7%) 83,206

------- -------------- ---------- ------- --------------

Gold Poured (Produced) oz 76,336 77,450 (1%) 87,303

------- -------------- ---------- ------- --------------

Sales

Gold Sold oz 89,326 68,103 31% 90,900

------- -------------- ---------- ------- --------------

Average Realised

Price $/oz 1,738 1,714 1% 1,694

------- -------------- ---------- ------- --------------

Cost

All-In Sustaining

Cost (AISC) $/oz 1,499 1,319 (14%) 1,284

------- -------------- ---------- ------- --------------

Table 1 : Resolute Group Operational Performance Summary

Refer to the Appendix for a full summary of Resolute's

production and costs in the September 2021 quarter.

Health & Safety

Resolute's TRIFR at 30 September 2021 was 1.26, consistent with

the prior quarter of 1.24. The company is focused on a vaccination

campaign at both Syama and Mako with 1,597 employees and

contractors being fully vaccinated (double-dose), representing

approximately 42% of the workforce, with a further 300 having

received a single dose.

Resolute continues to manage strict COVID-19 protocols across

the Group to protect the health, safety and wellbeing of our people

and has not experienced any ongoing disruption to operations as a

result.

Syama, Mali

The Syama sulphide operations produced 34,206oz at an AISC of

$1,431/oz, while the oxide operations produced 13,095oz at an AISC

of $1,690/oz. Further details of these two operations are set out

below.

Syama Sulphide

Mining Processing Costs

Ore Grade Ore Grade Recovery Gold Poured (oz) AISC

Quarter (t) (g/t) (t) (g/t) (%) ($/oz)

---------- ------- ---------- ------- --------- ----------------- --------

March 2021 570,377 2.47 535,706 2.61 78.0 37,217 1,274

---------- ------- ---------- ------- --------- ----------------- --------

June 2021 700,368 2.33 557,755 2.43 77.7 33,463 1,339

---------- ------- ---------- ------- --------- ----------------- --------

September 2021 504,602 2.46 545,029 2.46 79.5 34,206 1,431

---------- ------- ---------- ------- --------- ----------------- --------

YTD 1,775,348 2.42 1,638,489 2.50 78.4 104,886 1,346

---------- ------- ---------- ------- --------- ----------------- --------

Table 2: Sulphide Production and Cost Summary

Sulphide operational performance continued to improve with gold

production up 2% on the June quarter, an increase in processing

head grades to 2.46g/t and improved recovery rates of 79.5%.

AISC was 6% higher than the June quarter, reflecting the planned

processing of ore stockpiles carried at a higher cost as operations

transitioned from contractor to owner-operator underground

development. Total cash costs inclusive of sustaining capital were

$1,392/oz, 10% lower than the June quarter, reflecting lower cash

mining costs.

The planned 36-day shutdown of the processing circuit has been

deferred from October 2021 to February 2022, based on current

condition monitoring and the consistent performance of the Roaster

during 2021 (see ASX Announcement dated 27 September 2021). A short

7-day shutdown is planned for late October 2021 to complete various

routine maintenance activities that are expected to further improve

the performance of the sulphide processing circuit.

The focus remains on implementing key systems and processes to

improve consistency, production and cost performance at Syama. Key

system improvements include:

-- Onstream Analyser installation to improve Roaster feed grades

with real-time process control over concentrate feed; and

-- Installation of floatation circuit cleaner cells has

commenced with final calibration and testing underway.

Syama Oxide

Mining Processing Costs

Ore Grade Ore Grade Recovery Gold Poured (oz) AISC

Quarter (t) (g/t) (t) (g/t) (%) ($/oz)

-------- ------- ---------- ------- --------- ----------------- --------

March 2021 339,550 2.08 339,625 1.58 86.5 15,508 1,302

-------- ------- ---------- ------- --------- ----------------- --------

June 2021 302,408 1.87 413,041 1.31 86.3 13,424 1,466

-------- ------- ---------- ------- --------- ----------------- --------

September 2021 289,026 1.82 332,707 1.19 88.0 13,095 1,690

-------- ------- ---------- ------- --------- ----------------- --------

YTD 930,984 1.93 1,085,373 1.36 86.9 42,027 1,476

-------- ------- ---------- ------- --------- ----------------- --------

Table 3: Oxide Production and Cost Summary

Oxide mining in the quarter concentrated on expanding the

Tabakoroni Splay pit, to allow access to improved oxide ore grades

for the remainder of 2021. Progress was affected by a wetter than

expected September quarter (17% higher than the average for the

preceding five years), disrupting mining, processing and haulage to

the mill, approximately 35km from Tabakoroni. Improved recoveries

of 88% in the September quarter partially offset the lower

grade.

AISC was significantly higher than the June quarter, reflecting

the impact of the stripping campaign, wet weather and the continued

blending of high-cost low-grade stockpiles.

The plan for the remainder of 2021 is to mine the Beta south

deposit in conjunction with Tabakoroni Splay. An expanded

exploration program at the Syama northern areas commenced, focusing

on oxide resource identification around historical targets at the

Beta, BA-01 and A21 open pits.

Mako, Senegal

Mako produced 29,035oz at an AISC of $1,355/oz during the

quarter, as detailed below:

Mining Processing Cost

Ore Grade Ore Grade Recovery Gold Poured (oz) AISC

Quarter (t) (g/t) (t) (g/t) (%) ($/oz)

---------- ------- ---------- ------- --------- ----------------- --------

March 2021 655,445 2.23 495,746 2.26 93.0 32,943 1,036

---------- ------- ---------- ------- --------- ----------------- --------

June 2021 551,321 1.72 486,125 2.09 93.2 30,563 1,094

---------- ------- ---------- ------- --------- ----------------- --------

September 2021 633,481 1.51 538,632 1.80 91.6 29,035 1,355

---------- ------- ---------- ------- --------- ----------------- --------

YTD 1,840,247 1.82 1,520,504 2.04 92.6 92,542 1,155

---------- ------- ---------- ------- --------- ----------------- --------

Table 4: Mako Production and Cost Summary

Operations at Mako continued steadily with the cut-back of the

main pit advancing ahead of schedule. Ore tonnes mined were up 15%

compared to the June quarter, reflecting progress on the cut-back.

As expected, grades for the quarter were 14% lower than the June

quarter as the pit moved through lower-grade ore. As the cut-back

concludes, higher grade ore will be exposed, resulting in a return

to higher grades, consistent with the life of mine plan.

Recoveries were marginally down on the June quarter reflecting

the lower head grade, and changes in the ore blend. Mill throughput

for the quarter of 538,632t was the second-highest at Mako under

Resolute's ownership (August 2019).

Further project work and fine-tuning of the MillSlicer continues

to provide real-time information to improve processing performance.

Work continues to commission the automation software that enhances

the MillSlicer system to further increase throughput and overall

plant optimisation.

Exploration

Total exploration expenditure for the September quarter was $3.7

million, with exploration programs continuing in Mali, Senegal, and

Guinea focused on near-mine exploration.

In Mali, the ongoing resource drilling program at Tabakoroni

Underground continues to deliver good results with high-grade

sulphide gold intersections from infill and extensional diamond

drilling. Drilling will continue and is expected to increase the

mineral resources, which will be re-estimated in late 2021. Oxide

exploration at Syama North also returned positive results from

shallow drilling, supporting the return to open-pit mining in late

2021. The results of these drilling programs were reported to the

market on 25 August 2021.

Bibiani Gold Mine, Ghana

Resolute announced in August the sale of the Bibiani Gold Mine

to Asante Gold Corporation (Asante) for $90 million in cash. The

first instalment of $30 million was received from Asante and

applied to the Company's Revolving Credit Facility, bringing

Resolute's total voluntary repayments in 2021 to $50 million. The

balance of sale proceeds is payable to Resolute in equal

instalments in February 2022 and August 2022.

Corporate

Cash, Bullion and Liquid Assets

Description September 2021 Quarter ($m) June 2021 Quarter ($m)

Cash 28.8 52.7

---------------------------- -----------------------

Bullion 12.8 36.1

---------------------------- -----------------------

Cash and Bullion 41.6 88.8

---------------------------- -----------------------

Promissory Note 39.4 40.4

---------------------------- -----------------------

Listed Investments 38.5 53.3

---------------------------- -----------------------

Total Cash, Bullion and Liquid Assets 119.5 182.5

---------------------------- -----------------------

Table 5: Total Cash, Bullion and Liquid Assets

The average gold price realised for the quarter was $1,738/oz

compared to the average spot price of $1,791/oz.

The key movements in cash and market value of bullion balances

during the quarter are summarised in Figure 1.

Please see image in the full version of the announcement at

www.rml.com.au

Figure 1: Quarterly Cash and Bullion Movements in US dollars

Balance Sheet

Cash and bullion balances at 30 September 2021 were $41.6

million, with key movements in this balance during the quarter set

out in Figure 1 above. Payment of annual dividends from Mako

commenced during the quarter with $2.4 million paid to the

Senegalese government (Senegalese government holds 10% of the Mako

mine) along with $5.8 million of withholding tax.

After taking into account cash and bullion balances, net debt

was reduced by $6.9 million to $212.9 million at 30 September 2021.

Total borrowings at 30 September 2021 were $254.5 million

comprising $225.0 million drawn on the Term Loan Facility and

Revolving Credit Facility, overdraft facilities with the Bank of

Mali of $27.9 million and asset finance facilities of $1.6

million.

Hedging

Resolute maintains a policy of undertaking discretionary hedging

in compliance with funding obligations, which require a minimum of

30% of the next 18 months of forecast production to be hedged. At

30 September 2021, a quarterly summary of forward sales commitments

is set out in the tables below:

US Dollar Forward Sales EURO Forward Sales

Forward Delivery Forward Delivery

Quarter Price ($/oz) (oz) Price (EUR/oz) (oz)

--------------- --------- ---------------- ---------

December 2021 $1,737 35,000 EUR 1,479 13,000

--------------- --------- ---------------- ---------

March 2022 $1,807 45,000 EUR 1,530 10,000

--------------- --------- ---------------- ---------

June 2022 $1,796 43,000 - -

--------------- --------- ---------------- ---------

Total $1,783 123,000 EUR1,501 23,000

--------------- --------- ---------------- ---------

Table 6: Committed Hedging Forward Sales in US dollars and

Euro

The Company also has in place 30,000oz of zero-cost collars in

2021 comprising put options at an average of $1,700/oz and call

options at an average of $2,059/oz.

Tax

Resolute continues to work with its in-country tax and legal

advisors in resolving tax and VAT assessments that have been levied

by the Malian and Senegalese Tax Authorities.

Reporting Calendar

20 January 2022 - December Quarterly Activities Report

24 February 2022 - Full Year Financial Results

28 April 2022 - March Quarterly Activities Report

Investor and Analyst Conference Calls

Resolute will host two conference calls for investors, analysts

and media on Friday 29 October 2021, to discuss the Company's

Quarterly Activities Report for the period ending 30 September

2021. Both calls will conclude with a question and answer

session.

Conference Call 1 (pre-registration required)

Conference Call 1: 07:30 (AWST, Perth) / 10:30 (AEST,

Sydney)

Pre-Registration Link:

https://s1.c-conf.com/diamondpass/10017783-suc876.html

Participants will receive a calendar invite with dial-in details

once the pre-registration process is complete.

Conference Call 1 will also be streamed live online at

https://www.openbriefing.com/OB/4465.aspx

Conference Call 2 (via MS Teams Live Event)

Conference Call 2: (MS Teams) 09:00 (BST, London) / 16:00 (AWST,

Perth)

Attendee Link: RSG MS Teams Live Event link

Contact Information

Resolute Berenberg (UK Corporate Broker)

Stuart Gale, Chief Executive Matthew Armitt / Jennifer Wyllie / Detlir

Officer Elezi

James Virgo, GM Finance & IR Telephone: +44 20 3207 7800

Telephone: +61 8 9261 6100

Email: 34TU contact@rml.com.au

U34T Tavistock (UK and African media)

Web: 34T www.rml.com.au 34T Jos Simson / Emily Moss / Annabel de Morgan

Follow Resolute / Oliver Lamb

Telephone: +44 207 920 3150 / +44 778

855 4035

Email: resolute@tavistock.co.uk

FTI Consulting (Australian media)

Cameron Morse / James Tranter

Telephone: +61 433 886 871

Email: cameron.morse@fticonsulting.com

Appendix

September 2021 Quarter Production and Costs (unaudited)

September 2021 Quarter Units Syama Syama Syama Mako Group

Sulphide Oxide Total Total

UG Lateral Development m 455 - 455 - 455

------- ---------- ---------- ---------- ---------- ----------

UG Vertical Development m 20 - 20 - 20

------- ---------- ---------- ---------- ---------- ----------

Total UG Development m 475 - 475 - 475

------- ---------- ---------- ---------- ---------- ----------

UG Ore Mined t 504,602 - 504,602 - 504,602

------- ---------- ---------- ---------- ---------- ----------

UG Grade Mined g/t 2.46 - 2.46 - 2.46

------- ---------- ---------- ---------- ---------- ----------

OP Operating Waste BCM - 1,129,038 1,129,038 1,549,074 2,678,112

------- ---------- ---------- ---------- ---------- ----------

OP Ore Mined BCM - 136,333 136,333 227,758 364,091

------- ---------- ---------- ---------- ---------- ----------

OP Grade Mined g/t - 1.82 1.82 1.51 1.62

------- ---------- ---------- ---------- ---------- ----------

Total Ore Mined t 504,602 289,026 793,628 633,481 1,427,109

------- ---------- ---------- ---------- ---------- ----------

Total Tonnes Processed t 545,029 332,707 877,736 538,632 1,416,368

------- ---------- ---------- ---------- ---------- ----------

Grade Processed g/t 2.46 1.19 1.98 1.80 1.91

------- ---------- ---------- ---------- ---------- ----------

Recovery % 79.5 88.0 82.7 91.6 86.1

------- ---------- ---------- ---------- ---------- ----------

Gold Recovered oz 34,319 11,266 45,585 28,481 74,066

------- ---------- ---------- ---------- ---------- ----------

Gold in Circuit Drawdown/(Addition) oz (113) 1,829 1,716 554 2,270

------- ---------- ---------- ---------- ---------- ----------

Gold Poured (Produced) oz 34,206 13,095 47,301 29,035 76,336

------- ---------- ---------- ---------- ---------- ----------

Gold Bullion in Metal

Account Movement (Increase)/Decrease oz 6,575 1,806 8,381 4,609 12,990

------- ---------- ---------- ---------- ---------- ----------

Gold Sold oz 40,781 14,901 55,682 33,644 89,326

------- ---------- ---------- ---------- ---------- ----------

Achieved Gold Price $/oz - - - - 1,738

------- ---------- ---------- ---------- ---------- ----------

Mining $/oz 470 726 541 532 537

------- ---------- ---------- ---------- ---------- ----------

Processing $/oz 536 542 538 371 474

------- ---------- ---------- ---------- ---------- ----------

Site Administration $/oz 142 259 174 147 164

------- ---------- ---------- ---------- ---------- ----------

Site Operating Cost $/oz 1,148 1,527 1,253 1,050 1,175

------- ---------- ---------- ---------- ---------- ----------

Royalties $/oz 120 126 122 99 115

------- ---------- ---------- ---------- ---------- ----------

By-Product Credits

+ Corp Admin $/oz (2) (2) (2) - 49

------- ---------- ---------- ---------- ---------- ----------

Total Cash Operating

Costs $/oz 1,266 1,651 1,373 1,149 1,339

------- ---------- ---------- ---------- ---------- ----------

Sustaining Capital

+ Other $/oz 126 58 107 62 90

------- ---------- ---------- ---------- ---------- ----------

Total Cash Expenditure $/oz 1,392 1,709 1,480 1,211 1,429

------- ---------- ---------- ---------- ---------- ----------

Stockpile Adjustments $/oz 159 (167) 69 111 85

------- ---------- ---------- ---------- ---------- ----------

Gold in Circuit Movement $/oz (139) 131 (64) 33 (27)

------- ---------- ---------- ---------- ---------- ----------

Asset Reclamation &

Remediation $/oz 19 17 19 - 12

------- ---------- ---------- ---------- ---------- ----------

Total Non-Cash Adjustments $/oz 39 (19) 24 144 70

------- ---------- ---------- ---------- ---------- ----------

All-In Sustaining Cost

(AISC)

calculated on gold

poured $/oz 1,431 1,690 1,504 1,355 1,499

------- ---------- ---------- ---------- ---------- ----------

September 2021 Year Units Syama Syama Syama Mako Group

to date Sulphide Oxide Total Total

UG Lateral Development m 4,631 - 4,631 - 4,631

------- ----------- ----------- ----------- ----------- -----------

UG Vertical Development m 78 - 78 - 78

------- ----------- ----------- ----------- ----------- -----------

Total UG Development m 4,709 - 4,709 - 4,709

------- ----------- ----------- ----------- ----------- -----------

UG Ore Mined t 1,754,475 - 1,754,475 - 1,754,475

------- ----------- ----------- ----------- ----------- -----------

UG Grade Mined g/t 2.42 - 2.42 - 2.42

------- ----------- ----------- ----------- ----------- -----------

OP Operating Waste BCM 5,029 3,181,836 3,186,865 5,344,317 8,531,182

------- ----------- ----------- ----------- ----------- -----------

OP Ore Mined BCM 9,846 435,190 445,036 656,325 1,101,361

------- ----------- ----------- ----------- ----------- -----------

OP Grade Mined g/t 1.81 1.93 1.93 1.82 1.87

------- ----------- ----------- ----------- ----------- -----------

Total Ore Mined t 1,775,348 930,984 2,706,332 1,840,247 4,546,579

------- ----------- ----------- ----------- ----------- -----------

Total Tonnes Processed t 1,638,489 1,085,373 2,723,862 1,520,504 4,244,366

------- ----------- ----------- ----------- ----------- -----------

Grade Processed g/t 2.50 1.36 2.04 2.04 2.04

------- ----------- ----------- ----------- ----------- -----------

Recovery % 78.4 86.9 81.8 92.6 85.6

------- ----------- ----------- ----------- ----------- -----------

Gold Recovered oz 103,235 41,146 144,381 92,392 236,773

------- ----------- ----------- ----------- ----------- -----------

Gold in Circuit Drawdown/(Addition) oz 1,651 881 2,532 150 2,682

------- ----------- ----------- ----------- ----------- -----------

Gold Poured (Produced) oz 104,886 42,027 146,913 92,542 239,455

------- ----------- ----------- ----------- ----------- -----------

Gold Bullion in Metal

Account Movement (Increase)/Decrease oz 1,292 (1,281) 11 1,364 1,375

------- ----------- ----------- ----------- ----------- -----------

Gold Sold oz 106,178 40,746 146,924 93,905 240,829

------- ----------- ----------- ----------- ----------- -----------

Achieved Gold Price $/oz - - - - 1,728

------- ----------- ----------- ----------- ----------- -----------

Mining $/oz 654 483 605 465 551

------- ----------- ----------- ----------- ----------- -----------

Processing $/oz 464 492 472 358 428

------- ----------- ----------- ----------- ----------- -----------

Site Administration $/oz 145 262 179 133 161

------- ----------- ----------- ----------- ----------- -----------

Site Operating Cost $/oz 1,263 1,237 1,256 956 1,140

------- ----------- ----------- ----------- ----------- -----------

Royalties $/oz 103 107 104 87 100

------- ----------- ----------- ----------- ----------- -----------

By-Product Credits

+ Corp Admin $/oz (1) (1) (1) - 49

------- ----------- ----------- ----------- ----------- -----------

Total Cash Operating

Costs $/oz 1,365 1,343 1,359 1,043 1,289

------- ----------- ----------- ----------- ----------- -----------

Sustaining Capital

+ Other $/oz 111 99 108 98 104

------- ----------- ----------- ----------- ----------- -----------

Total Cash Expenditure $/oz 1,476 1,442 1,467 1,141 1,393

------- ----------- ----------- ----------- ----------- -----------

Stockpile Adjustments $/oz (31) (7) (24) 19 (7)

------- ----------- ----------- ----------- ----------- -----------

Gold in Circuit Movement $/oz (109) 32 (69) (5) (44)

------- ----------- ----------- ----------- ----------- -----------

Asset Reclamation &

Remediation $/oz 10 9 10 - 6

------- ----------- ----------- ----------- ----------- -----------

Total Non-Cash Adjustments $/oz (130) 34 (83) 14 (45)

------- ----------- ----------- ----------- ----------- -----------

All-In Sustaining Cost

(AISC)

calculated on gold

poured $/oz 1,346 1,476 1,384 1,155 1,348

------- ----------- ----------- ----------- ----------- -----------

Year-to-date 2021 Production and Costs (unaudited)

About Resolute

Resolute is a successful gold miner with more than 30 years of

experience as an explorer, developer and operator of gold mines in

Australia and Africa which have produced more than 9 million ounces

of gold. The Company trades on the Australian Securities Exchange

(ASX) and the London Stock Exchange (LSE) under the ticker RSG.

Resolute currently operates the Syama Gold Mine in Mali and the

Mako Gold Mine in Senegal.

Competent Persons Statement

For the purposes of ASX Listing Rule 5.23, Resolute confirms

that it is not aware of any new information or data that materially

affects the information included in the original market

announcements relating to exploration results or estimates of

Mineral Resources or Ore Reserves referred to in this announcement

and, in the case of Mineral Resources and Ore Reserves, that all

material assumptions and technical parameters underpinning the

estimates in the relevant market announcement continue to apply and

have not materially changed. Resolute confirms that the form and

context in which the Competent Person's findings are presented have

not been materially modified from the original market

announcement.

This announcement contains inside information for the purposes

of Article 7 of the Market Abuse Regulation (EU) 596/2014 which

forms part of UK law pursuant to the European Union (Withdrawal)

Act 2018. Upon the publication of this announcement via a

Regulatory Information Service (RIS), this inside information is

now considered to be in the public domain.

Authorised by Mr Stuart Gale, Chief Executive Officer

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

DRLFIFIVIFLAFIL

(END) Dow Jones Newswires

October 29, 2021 02:00 ET (06:00 GMT)

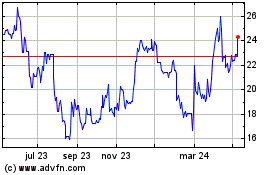

Resolute Mining (LSE:RSG)

Gráfica de Acción Histórica

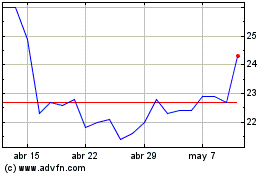

De Mar 2024 a Abr 2024

Resolute Mining (LSE:RSG)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024