TIDMREVB

RNS Number : 3534Q

Revolution Beauty Group PLC

27 October 2021

For Immediate Release 27 October 2021

This announcement contains inside information for the purposes

of Article 7 of the Market Abuse Regulation (EU) 596/2014 as it

forms part of UK domestic law by virtue of the European Union

(Withdrawal) Act 2018 ("MAR"), and is disclosed in accordance with

the Company's obligations under Article 17 of MAR.

REVOLUTION BEAUTY GROUP PLC

("Revolution Beauty", the "Group" or the "Company")

Acquisition of Medichem Manufacturing Ltd

Provides Revolution Beauty with its own, fully-owned and

vertically integrated manufacturing business

Board expects the acquisition to be significantly earnings

enhancing in FY23

Revolution Beauty Group plc (AIM: REVB), the mass beauty

innovator, is pleased to announce Revolution Beauty Holdings

Limited, a direct subsidiary of the Company, has acquired the

entire issued share capital of Medichem Manufacturing Ltd

("Medichem") for total consideration of GBP23.0 million subject to

a net assets adjustment by reference to completion accounts (the

"Acquisition").

Medichem is a long-standing supplier of haircare and skincare

products to Revolution Beauty, manufacturing all products from its

UK facility. Medichem's end-to-end operations include an R&D

laboratory, bulk manufacturing, warehousing and distribution, and

employs more than 170 people. During its last financial year to 31

December 2020, Medichem reported audited revenues of GBP13.4

million and profit before tax of GBP1.6 million. Given the strong

year to date growth in Revolution Beauty's haircare and skincare

categories, Medichem has continued to perform well in 2021.

Medichem has a limited number of customers other than Revolution

Beauty (which has contributed in excess of 90% of Medichem's

revenue in the calendar year to date).

The option to acquire Medichem was disclosed at the time IPO and

today's announcement demonstrates Revolution Beauty's delivery

against its strategy set out at the time of listing. It is

Revolution Beauty's first acquisition and provides the Group with

its own, fully-owned and vertically integrated manufacturing

business. It will enable the Group to enhance margins, increase

control of its supply chain and enhance productivity. The Company

expects the Acquisition will be significantly earnings enhancing

for the financial year ending 28 February 2023.

Transaction overview and financial impact

As disclosed in the Company's Admission Document dated 13 July

2021, Revolution Beauty entered into a call option arrangement

whereby it obtained the right to acquire the entire issued share

capital of Medichem for GBP23.0 million post completion of an

independent due diligence and valuation process managed by the

non-executive directors of the Group.

The Acquisition constitutes a related party transaction under

the AIM Rules as Tom Allsworth, Executive Chairman of Revolution

Beauty, is the sole shareholder of Medichem. In addition Medichem

has four leases for properties with Walbrook Investments Limited, a

company controlled by Tom Allsworth, with an aggregate annual

rental of c.GBP0.2 million (the "Leases").

The consideration due of GBP23.0 million will be payable in

instalments, with GBP7.0 million payable in cash on completion from

the Group's current cash resources, and the balance payable in

equal annual GBP4.0 million instalments over four years (together

with an amount equivalent to interest accrued thereon at the rate

of 2.5% per annum). The cash consideration payable will be subject

to a post-completion net assets adjustment (up to an additional

amount capped at GBP4.5 million) by reference to completion

accounts.

The Board of Revolution Beauty expect Medichem will contribute

c.GBP3.0 million of incremental pre-tax profits to the Group for

the financial year ending 28 February 2023.

As a result of the due diligence undertaken on the Acquisition

and the associated advice provided by the Company's auditors, it

has been determined that under IFRS accounting standards, Medichem

will be consolidated into the Group's results as at the date the

option agreement was entered into on 13 July 2021, as opposed to

being consolidated from the date of the Acquisition. The Company

estimates that such consolidation will make a relatively modest

contribution to profitability in the Group's interim results for

the period ended 31 August 2021 as sales of Medichem produced

products in this period were largely of stock acquired at the

prevailing rates prior to consolidation. Similarly, contribution to

revenue is expected to be modest as the majority of Medichem's

revenues are from Revolution Beauty and will be eliminated on

consolidation.

Related Party Transactions

The Directors of Revolution Beauty, with the exception of Tom

Allsworth, having consulted with Zeus Capital (the Company's

Nominated Adviser), consider that the terms of the Acquisition and

the Leases are fair and reasonable insofar as its shareholders are

concerned.

Adam Minto, CEO and Joint Founder of Revolution Beauty Group

plc, said : "The intention to acquire Medichem was disclosed at the

time of our IPO, and I am pleased to announce today that we are

delivering against our strategy and exercising our option to

acquire this highly-complementary manufacturing business. By

vertically integrating Revolution Beauty in this way and taking

manufacturing in-house for the first time, we will have even more

control of our supply chain, allowing us to improve productivity,

our cost base and margins, while being earnings accretive."

For further information:

Revolution Beauty Group plc

Adam Minto, Founder & CEO

Tom Allsworth, Founder & Executive www.revolutionbeautyplc.com

Chairman

Zeus Capital Limited

(Nominated Adviser & Broker)

Corporate Finance

Nick Cowles / Jamie Peel / Jordan Tel: +44 (0) 161 831 1512

Warburton

Equity Capital Markets Tel: +44 (0) 20 3829 5000

Dominic King / Ben Robertson www.zeuscapital.co.uk

Media enquiries:

Headland Consultancy Tel: +44 (0)20 3805 4822

Rosh Field / Will Smith Revolutionbeauty@headlandconsultancy.com

- Ends -

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

ACQGZMZGGVZGMZZ

(END) Dow Jones Newswires

October 27, 2021 02:00 ET (06:00 GMT)

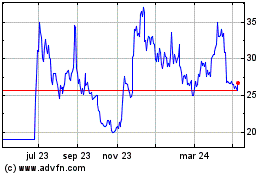

Revolution Beauty (LSE:REVB)

Gráfica de Acción Histórica

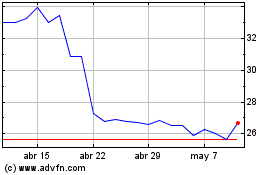

De Mar 2024 a Abr 2024

Revolution Beauty (LSE:REVB)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024