TIDMRGO

RNS Number : 2342N

RiverFort Global Opportunities PLC

29 September 2021

29 September 2021

RiverFort Global Opportunities plc

("RGO" or the "Company")

Unaudited interim results for the 6 months ended 30 June

2021

RiverFort Global Opportunities plc is pleased to announce its

unaudited interim results for the six months to 30 June 2021.

Highlights

-- The excellent progress during 2020 has continued into H1 2021

-- Profit before taxation of GBP1.4 million achieved in H1 2021

-- Significant increase in net asset value of 32% since 31 December 2020

-- NAV per share of 1.57 pence

-- Share price up by around 70% over the period

-- Exciting Pre-IPO investments made in Pluto Digital Assets plc and Smarttech247

-- Around GBP2 million of net cash available for further investment

-- Continued strong demand for the Company's investment capital

-- Declaration of a final dividend of 0.04p per share, making a total of 0.06p per share

Philip Haydn-Slater, Non-Executive Chairman, commented:

"The Company's excellent performance for 2020 has continued into

2021 , with the Company continuing to generate an attractive level

of investment income and to grow its net asset value. Going

forward, we believe that the Company has a very attractive

portfolio of investments which not only has the scope to achieve

income with downside protection but the significant upside

potential to generate substantial capital gains as a result of

carefully chosen pre-IPO investments whilst, at the same time,

being able to provide real cash returns to shareholders."

Chairman's statement

The analysis of income for the period is set out below:

Half year Year to 31

to 30 June December

2021 2020

GBP000 GBP000

------------ -----------

Investment income 909 1,251

Net income from financial instruments

at FVTPL 1,116 1,476

Net foreign exchange losses on financial

instruments (12) (284)

Total investment income 2,013 2,443

------------ -----------

During the period, the Company generated total investment income

of GBP2,013,092 from its investment portfolio, with this level of

profit being underpinned by strong cash generation. The Company

principally invests by way of debt and/or equity-linked debt

instruments which provides equity upside with downside protection

Investment income is therefore principally generated from interest,

fees, with additional income from equity conversion and warrants.

Net income from financial instruments at FVTPL is derived from

changes in the value of the Company's investment portfolio. For

example, increases in the value of the Company's investment in

Pires Investments plc ("Pires") and its pre-IPO investments

together accounted for the majority of this figure. Changes in the

value of the Company's warrant portfolio are also included

here.

The Company's principal investment portfolio categories are

summarised below:

Category Cost or valuation

at 30 June 2021

Debt and equity- linked debt

investments 6,405.829

Pre IPO investments 2,501,753

Equity and other investments 2,688,112

Cash resources 1,919,017

Total 13,514,711

------------------

The Company's debt and equity linked portfolio comprises around

15 positions in companies such as Jubilee Metals plc, Oracle Power

plc, Kodal Minerals plc and Rambler Metals and Mining plc.

The pre-IPO investment category is a new category and reflects

the opportunities that the Company sees in making pre-IPO

investments that have a clear path to a listing or liquidity

events. This category comprises the Company's holdings in

Smarttech247 and Pluto Digital Assets plc.

Smarttech247, a global artificial intelligence based cyber

security cloud business that protects enterprises as they migrate

to cloud-based IT operations. Smarttech247 is profitable with high

forecast revenue growth and has over 100 technology partners,

including Tanium and Crowdstrike, and 50 clients based in Europe

and the US. Smarttech247 has also recently announced its intention

to seek a listing by way of a reverse takeover transaction which is

expected to complete later in the year.

Pluto is a software technology company and operator in the

decentralised finance ("DeFi") and non-fungible tokens

("NFT")/Metaverse (virtual environments) sectors. It is currently

developing a DeFi software platform, that provides a highly usable

web DeFi portal to open up DeFi to a mass audience. This platform

provides vault middleware to find and categorise a set of

proprietary DeFi vaults to offer users the ability to generate

yield from crypto currencies. Furthermore, Pluto has partnered with

a leading NFT metaverse platform and is currently engaging high

quality owners of digital media and rights to offer their content

to the NFT community. In addition to Pluto's operational

activities, it has made further investments in Web3 ventures and

has acquired an NFT portfolio including assets such as Cryptopunks,

Artblocks and BAYCs.

Pluto has advised the Company that it currently holds treasury

assets that include Bitcoin, Ethereum, Polkadot, Cardano and

Solana. The company has also advised that its portfolio of venture

and treasury assets has been performing well and the company's

current NAV per share exceeds 6 pence, the price at which Pluto

carried out its most recent fund raise in March 2021. RGO has

already achieved a valuation uplift on this investment.

During the summer of 2021, Pluto has been focusing on expanding

its product team and forming key partnerships. This work has

progressed well and the company now believes that it is

well-positioned to proceed with its planned IPO. Pluto also

recently entered into a strategic partnership with NFT company

Terra Virtua and sports tycoon, Jon Smith OBE to develop

sports-focused NFTs. The partnership has already announced an NFT

agreement between Terra Virtua and the Indian Super League which

was facilitated by the partnership. The understanding and awareness

of NFTs and their potential has been rapidly gaining traction and

the partnership has been established to capitalise on the growing

demand in the NFT sector.

The equity and other investments category principally comprises

the Company's holdings in Pires and its warrant portfolio. Pires,

is an investment company listed on AIM that invests in next

generation technology companies. Pires recently announced its

interim results which included a significant profit of GBP1.4

million and an increase in NAV per share of over 80%. This company

is building a very attractive portfolio of investments. The Pires

share price increased by over 30% during the period.

As previously announced, as part of the Company's overall

strategy when making investments, warrants or their equivalent are

sought which can significantly increase the level of investment

return . However, due to the inherent volatility associated with

this form of instrument, the potential value of this warrant

portfolio is not fully reflected in the Company's net asset value

and a return is only crystallised when the respective warrants are

exercised and resulting shares sold.

The key unaudited performance indicators are set out below:

Performance indicator 30 June 2021 31 December Change

2020

------------------------------------ ------------------ ------------ ----------

Investment income GBP2,013,092 GBP2,443,398

------------------------------------ ------------------ ------------ ----------

Net asset value GBP 12,198,539 GBP9,239,936 +32.0%

Net asset value - fully diluted per

share 1.57p 1.36p +15.4%

Closing share price 1.63p 0.96p +69.8%

Market capitalisation GBP12,639,000 GBP6,552,000 +92.9%

------------------------------------ ------------------ ------------ ----------

On 10 May 2021, the Company announced a placing to raise GBP1.64

million, at the prevailing market price, in order to provide funds

for further investment and to fund the investment into Smarttech247

which was also announced at that time. This fund raising was

supported both by current and new investors.

During the period, the Company has continued to generate

substantial cash through its generation of investment returns

thereby providing the Company with a significant cash balance for

further investment and enabling the Company to pay a final dividend

which was declared on 16 June 2021. The final gross dividend

amounted to, 0.04 pence per share, which would make a total of 0.06

pence per share for the year or equivalent to a gross yield of 4.1%

at the current share price.

Philip Haydn-Slater

Non-Executive Chairman

28 September 2021

This announcement contains inside information for the purposes

of Article 7 of the Market Abuse Regulation (EU) 596/2014 as it

forms part of UK domestic law by virtue of the European Union

(Withdrawal) Act 2018 ("MAR"), and is disclosed in accordance with

the Company's obligations under Article 17 of MAR.

For more information, please contact:

RiverFort Global Opportunities plc: +44 (0) 20 3368 8978

Philip Haydn-Slater, Non-Executive Chairman

Nicholas Lee, Investment Director

Nominated Adviser:

Beaumont Cornish +44 (0) 20 7628 3396

Roland Cornish/Felicity Geidt

Joint Broker: +44 (0) 20 7601 6100

Shard Partners LLP

Damon Heath/Erik Woolgar

Joint Broker: +44 (0) 20 7562 3351

Peterhouse Capital Limited

Lucy Williams

UNAUDITED STATEMENT OF COMPREHENSIVE INCOME

FOR THE SIX MONTHSED 30 JUNE 2021

Unaudited Unaudited

6 months 6 months Audited

ended ended Year ended

30 June 30 June 31 December

2021 2020 2020

GBP GBP GBP

---------------------------------------------- -------------- -------------- --------------

Investment income 909,485 513,643 1,251,681

Net gain/(loss) from financial instruments

at FVTPL 1,115,767 179,662 1,476,201

Foreign exchange (losses)/gains on

financial

instruments (12,160) 77,075 (284,484)

Total income 2,013,092 770,380 2,443,398

Administration expenses (226,296) (187,181) (403,564)

Investment advisory fees (367,357) - (375,446)

Exchange translation losses (38,836) (14,034) (167,083)

Profit before taxation 1,380,603 569,165 1,497,305

Taxation - - -

---------------------------------------------- -------------- -------------- --------------

Profit for the period and total comprehensive

income 1,380,603 569,165 1,497,305

Basic earnings per share

Continuing and total operations 0.20p 0.08p 0.22p

---------------------------------------------- -------------- -------------- --------------

Fully diluted earnings per share

Continuing and total operations 0.20p 0.08p 0.22p

---------------------------------------------- -------------- -------------- --------------

UNAUDITED STATEMENT OF CHANGES IN EQUITY

FOR THE SIX MONTHSED 30 JUNE 2021

Called

up

share Share premium Retained Total

capital account Other reserves earnings equity

GBP GBP GBP GBP GBP

-------------------------- ------------ -------------- --------------- ------------ -----------

Balance at

1 January 2020 10,042,273 3,191,257 27,000 (5,382,113) 7,878,417

Profit for the year

and total comprehensive

income - - - 1,497,305 1,497,305

-------------------------- ------------ -------------- --------------- ------------ -----------

Capital reorganisation (9,974,380) (3,191,257) (27,000) 13,192,637 -

Dividend payment (135,786) (135,786)

Balance at

31 December 2020 67,893 - - 9,172,043 9,239,936

Profit for the period

and total comprehensive

income - - - 1,380,603 1,380,603

-------------------------- ------------ -------------- --------------- ------------ -----------

Share issue 9,647 1,630,353 - - 1,640,000

Share issue expenses - (62,000) - - (62,000)

Balance at

30 June 2021 77,540 1,568,353 - 10,552,646 12,198,539

-------------------------- ------------ -------------- --------------- ------------ -----------

UNAUDITED STATEMENT OF FINANCIAL POSITION

AS AT 30 JUNE 2021

Unaudited Unaudited

6 months 6 months Audited

ended ended Year ended

30 June 30 June 31 December

2021 2020 2020

GBP GBP GBP

---------------------------- ---------- --------- ---------------

ASSETS

Non-current investments

Financial asset investments 8,608,261 1,900,693 4,249,249

---------------------------- ---------- --------- ---------------

Total non-current assets 8,608,261 1,900,693 4,249,249

---------------------------- ---------- --------- ---------------

Current assets

Financial asset investments 2,987,433 2,863,783 2,908,855

Trade and other receivables 174,305 513,917 246,149

Cash and cash equivalents 1,919,017 3,263,326 4,046,856

---------------------------- ---------- --------- ---------------

Total current assets 5,080,755 6,641,026 7,201,860

---------------------------- ---------- --------- ---------------

Total assets 13,689,016 8,541,719 11,451,109

---------------------------- ---------- --------- ---------------

LIABILITIES

Current liabilities

Trade and other payables 1,490,477 87,612 2,211,173

Other financial liabilities - 6,525 -

Total current liabilities 1,490,477 94,137 2,211,173

---------------------------- ---------- --------- ---------------

Net assets 12,198,539 8,447,582 9,239,936

---------------------------- ---------- --------- ---------------

EQUITY

Share capital 77,540 67,893 67,893

Share premium account 1,568,353 - -

Retained earnings 10,552,646 8,379,689 9,172,043

---------------------------- ---------- --------- ---------------

Total equity 12,198,539 8,447,582 9,239,936

---------------------------- ---------- --------- ---------------

UNAUDITED STATEMENT OF CASH FLOWS

FOR THE SIX MONTHSED 30 JUNE 2021

Unaudited Unaudited

6 months 6 months Audited

ended ended Year ended

30 June 30 June 31 December

2021 2020 2020

GBP GBP GBP

--------------------------------------- ---------------- -------------- ----------------

Cash flows from operating activities

Investment income received 999,097 361,559 1,178,181

Operating expenses paid (674,447) (217,024) (489,020)

--------------------------------------- ---------------- -------------- ----------------

Net cash inflow from operating

activities 324,650 144,535 689,161

--------------------------------------- ---------------- -------------- ----------------

Cash flows from investing activities

Purchase of investments (6,369,758) (974,419) (4,854,799)

Proceeds from disposal of investments 472,664 175,461 2,562,113

Debt instrument repayments 1,878,765 1,422,057 3,405,246

Settlement of forward currency

contracts - (212,461) (212,456)

Net cash (used in)/from investing

activities (4,018,329) 410,638 900,104

--------------------------------------- ---------------- -------------- ----------------

FINANCING ACTIVITIES

Net proceeds from share issues 1,578,000 - -

Dividend payment - - (135,786)

--------------------------------------- ---------------- -------------- ----------------

Net cash from/(used) in financing

activities 1,578,000 - (135,786)

--------------------------------------- ---------------- -------------- ----------------

Net (decrease)/increase in cash

and cash equivalents (2,115,679) 555,173 1,453,479

Cash and cash equivalents at beginning

of period 4,046,856 2,624,480 2,624,480

Effect of foreign currency exchange

on cash (12,160) 83,673 (31,103)

--------------------------------------- ---------------- -------------- ----------------

Cash and cash equivalents at end

of period 1,919,017 3,263,326 4,046,856

--------------------------------------- ---------------- -------------- ----------------

NOTES TO THE INTERIM REPORT

1. The financial information set out in this interim report does

not constitute statutory accounts as defined in section 434 of the

Companies Act 2006. The group's statutory financial statements for

the period ended 31 December 2020, prepared under International

Financial Reporting Standards (IFRS), have been filed with the

Registrar of Companies. The auditor's report on those financial

statements was unqualified and did not contain a statement under

section 498 (2) or (3) of the Companies Act 2006.

The interim financial information has been prepared in

accordance with the recognition and measurement principles of

International Financial Reporting Standards (IFRS) and on the same

basis and using the same accounting policies as used in the

financial statements for the year ended 31 December 2020. The

interim financial statements have not been audited or reviewed in

accordance with the International Standard on Review Engagement

2410 issued by the Auditing Practices Board.

The financial statements have been prepared on a going concern

basis under the historical cost convention.

The Directors believe that the going concern basis is

appropriate for the preparation of the financial statements as the

Company is in a position to meet all its liabilities as they fall

due.

2. Earnings per share

Earnings per share is calculated by dividing the profit/(loss)

attributable to equity shareholders by the weighted average number

of shares in issue.

Six months Six months Year ended

ended ended

30 June 30 June 31 December

2020 2020 2020

(unaudited) (unaudited) (audited)

-------------------------------------- ------------- ------------- --------------

Weighted average number of shares

in the period 706,115,920 678,933,600 678,933,600

-------------------------------------- ------------- ------------- --------------

Profit/(Loss) from continuing

and total operations GBP1,380,603 GBP569,165 GBP1,497,305

-------------------------------------- ------------- ------------- --------------

Basic and fully diluted earnings

per share:

From continuing and total operations 0.20p 0.08p 0.22p

Exercise of the outstanding warrants would be anti-dilutive

for earnings per share, so the weighted average number of shares

in issue is the same for both basic and fully diluted earnings

per share calculations.

3. Copies of the interim report can be obtained from: The

Company Secretary, RiverFort Global Opportunities plc, Suite 39, 18

High Street, High Wycombe, Buckinghamshire, HP10 8NJ and are

available to view and download from the Company's website :

www.riverfortglobalopportunities.com

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR BGGDCIDDDGBI

(END) Dow Jones Newswires

September 29, 2021 02:00 ET (06:00 GMT)

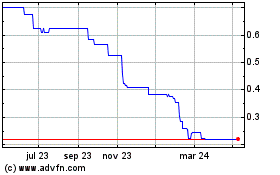

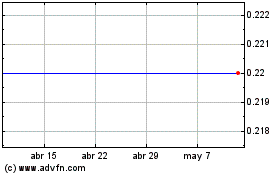

Riverfort Global Opportu... (LSE:RGO)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Riverfort Global Opportu... (LSE:RGO)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024