TIDMRSE

RNS Number : 8172V

Riverstone Energy Limited

16 December 2021

REL ANNOUNCES CLOSING OF BUSINESS COMBINATION BETWEEN SOLID

POWER, INC. AND DECARBONIZATION PLUS ACQUISITION CORPORATION

III

16 December 2021

-- Solid Power announced closing of its business combination with DCRC on 8 December 2021

-- Solid Power became the only pure-play solid-state battery

company to trade on the public markets

-- Solid Power common stock and warrants began trading on Nasdaq

Global Select Market on 9 December 2021 under the symbols "SLDP"

and "SLDPW," respectively

-- Gross proceeds to Solid Power from the transaction of $542.9

million from fully committed $195 million PIPE and $347.9 million

of cash held in trust net of redemptions; only 0.6% of shares held

by public stockholders of DCRC were redeemed

-- Of the shares voted at the special meeting of DCRC's

stockholders, over 99.9% voted to approve the business

combination

Riverstone Energy Limited ("REL") announces the closing of the

previously announced business combination between Solid Power, Inc.

("Solid Power"), an industry leading developer of all solid state

battery cells for electric vehicles, and Decarbonization Plus

Acquisition Corporation III ("DCRC"), a special purpose acquisition

corporation sponsored by an affiliate of REL. Solid Power announced

the closing on 8 December 2021 and the combined company's common

stock and warrants began trading on the Nasdaq Global Select Market

under the ticker symbols "SLDP" and "SLDPW," respectively, on 9

December 2021.

Solid Power received gross proceeds from the transaction of

approximately $542.9 million from its fully committed $195 million

PIPE and the receipt of approximately $347.9 million of cash from

DCRC's trust account net of redemptions. Of the shares voted at the

special meeting of DCRC stockholders on 7 December 2021, over 99.9%

voted to approve the business combination. In addition, only 0.6%

of shares held by DCRC's public stockholders were redeemed.

On 23 March 2021, REL made a $0.5 million investment in DCRC's

sponsor in connection with DCRC's initial public offering.

On 15 June 2021, REL committed an additional $20 million to the

PIPE that was raised in connection with the business combination

transaction.

Prior to the business combination, REL purchased 1.66 million

shares of Solid Power, which converted to shares of the combined

company in connection with the business combination.

This investment, along with the recent decarbonisation

investments in Decarbonization Plus Acquisition Corporation II

& IV, FreeWire Technologies, GoodLeap and Hyzon Motors,

demonstrates REL's continued efforts to increase its exposure to

the global energy transition thematic while also providing the

opportunity to create value for its shareholders.

About Solid Power:

Solid Power is an industry-leading developer of all-solid-state

rechargeable battery cells

for electric vehicles and mobile power markets. Solid Power

replaces the flammable

liquid electrolyte in a conventional lithium-ion battery with a

proprietary sulfide-based

solid electrolyte. As a result, Solid Power's all-solid-state

battery cells are expected to

be safer and more stable across a broad temperature range,

provide an increase in

energy density compared to the best available rechargeable

battery cells, enable less

expensive, more energy-dense battery pack designs and be

compatible with traditional

lithium-ion manufacturing processes.

For more information, visit https://solidpowerbattery.com/ .

About Riverstone Energy Limited:

REL is a closed-ended investment company that invests

exclusively in the global energy industry across all sectors. REL

aims to capitalise on the opportunities presented by Riverstone's

energy investment platform. REL's ordinary shares are listed on the

London Stock Exchange, trading under the symbol RSE. REL has 13

active investments spanning decarbonisation, oil and gas, renewable

energy and power in the Continental U.S., Western Canada, Gulf of

Mexico and Europe.

For further details, see www.RiverstoneREL.com .

Neither the contents of Riverstone Energy Limited's website nor

the contents of any website accessible from hyperlinks on the

websites (or any other website) is incorporated into, or forms part

of, this announcement.

LEI: 213800HAZOW1AWRSZR47

About Riverstone Holdings LLC:

Riverstone is an energy and power -- focused private investment

firm founded in 2000 by David M. Leuschen and Pierre F. Lapeyre,

Jr. with approximately US$41 billion of capital raised. Riverstone

conducts buyout and growth capital investments in the E&P,

midstream, oilfield services, power, and renewable sectors of the

energy industry. With offices in New York, London, Houston, Mexico

City, Amsterdam and Menlo Park, Riverstone has committed nearly

US$43 billion to more than 200 investments in North America, Latin

America, Europe, Africa, Asia, and Australia.

For further details, see www.RiverstoneLLC.com

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

PFUGPGUWPUPGPGA

(END) Dow Jones Newswires

December 16, 2021 02:00 ET (07:00 GMT)

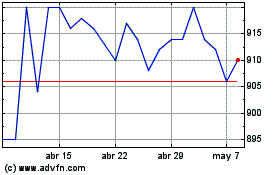

Riverstone Energy (LSE:RSE)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Riverstone Energy (LSE:RSE)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024