TIDMROCK

RNS Number : 6775M

Rockfire Resources PLC

23 September 2021

23 September 2021

Rockfire Resources plc

("Rockfire" or the "Company")

Interim Results

Rockfire Resources plc (LON: ROCK), the gold and base metal

exploration company, is pleased to announce its unaudited interim

results for the six months ended 30 June 2021.

Rockfire continues to focus effort and resources on its

strategic campaign to attain growth, primarily through exploration

success. This forms an integral part of the growth strategy adopted

by the Board to achieve increased asset value and therefore,

shareholder wealth.

The Company's exploration activities have pivoted towards our

large-scale porphyry copper projects in Queensland, Australia at a

time when copper prices have materially increased. The Board

believes the timing of higher copper prices, exploration drilling

at our copper projects and the stable jurisdiction of Queensland

are combining to Rockfire's advantage.

Corporate Summary

On 6 May 2021, the Company announced that it had completed a

placing of 121,429,200 new ordinary shares at a price of 0.7 pence,

raising gross proceeds of GBP850,000. Rockfire's largest

shareholder and Non-executive Director, Nicholas Walley subscribed

for 6,000,000 shares in the placing, thereby increasing his holding

in the Company to 59,000,000 ordinary shares.

The net proceeds of the placing were for

(i) inaugural Reverse Circulation ("RC") drilling at Copper Dome;

(ii) exploration RC drilling close to the resource at Plateau; and

(iii) inaugural drilling at Copperhead.

Rockfire Project Portfolio

Lighthouse

In 2019, Rockfire estimated a maiden JORC resource of 1,147,330

t @ 1.10 g/t Au for a total of 40,400 ounces of gold at the Plateau

gold deposit ("Plateau") within the Lighthouse tenement. On 29

January 2021, Rockfire released an updated resource estimate for

Plateau.

The overall gold envelope at Plateau (grades above 0.2 g/t Au)

now stands at (Indicated and Inferred) 11.4 Million tonnes @ 0.6

g/t Au and 4.0 g/t Ag for 208,278 ounces of gold and 1.5 Million

ounces of silver. Within this envelope and using a more commercial

higher cut-off (grades above 0.5 g/t Au), the Indicated and

Inferred Mineral Resource is 3.9 Million tonnes @ 1.1 g/t Au and

6.4 g/t Ag for 131,302 ounces of gold and 800,000 ounces of

silver.

Using the same 0.5 g/t Au cut-off, a subset of the Mineral

Resource at shallow depths (0-100 m) includes an Indicated and

Inferred 1.4 Million tonnes @ 1.2 g/t Au and 8.8 g/t Ag for 53,336

ounces of gold and 390,000 ounces of silver.

Importantly, the Mineral Resource remains open along strike and

at depth, leaving scope for further resource increases. Within 200

m to the north and south of Plateau, rock chip sampling has

returned 12.10 g/t Au and 6.69 g/t Au, respectively. Both areas are

undrilled and are not included in the current Mineral Resource

estimate.

PLATEAU ALL

Cut-off Au ppm Tonnes Au ppm Au oz Ag ppm Ag oz

----------- ------- -------- ------- ----------

3 45,686 4.15 6,102 20.4 29,974

----------- ------- -------- ------- ----------

2 279,441 2.63 23,586 15.0 135,074

----------- ------- -------- ------- ----------

1 1,490,322 1.63 77,957 8.7 416,638

----------- ------- -------- ------- ----------

0.75 2,274,013 1.36 99,743 7.7 560,363

----------- ------- -------- ------- ----------

0.5 3,896,758 1.05 131,302 6.4 801,373

----------- ------- -------- ------- ----------

0.3 7,811,806 0.72 179,937 4.8 1,206,767

----------- ------- -------- ------- ----------

0.2 11,381,037 0.57 208,278 4.0 1,475,277

----------- ------- -------- ------- ----------

0.1 15,308,341 0.46 227,640 3.4 1,691,638

----------- ------- -------- ------- ----------

0 15,716,940 0.45 228,755 3.4 1,707,657

----------- ------- -------- ------- ----------

Results from a preliminary scoping study at Plateau were

announced to the market on 8 April 2021. The purpose of this study

was to consider the economic potential for open-pit mining at

Plateau.

A modest, net positive cash flow, ranging from AUD $6.8m to AUD

$19.4m (GBP GBP3.7m to GBP GBP10.7m), results from a small-scale,

open pit mine. The range of anticipated cash flows depends on

technical and operational variables. Multiple targets within the

proposed pit outlines are yet to be drilled and the study

identified numerous opportunities to increase gold ounces with

additional shallow drilling.

Only the top 70 m was included in the study, yet gold up to 16.9

g/t Au has been intersected more than 400 m below surface. There is

therefore significant potential to increase the economic outlook of

the project based on continued exploration success at depth. The

study assumed utilisation of one of the nearby existing processing

facilities, of which there are several within commercial trucking

distances of Plateau. Average mined grades range between 1.26 g/t

Au and 1.94 g/t Au from within the optimised pit outlines. The

range of anticipated cashflow depends on technical and operational

variables. Several excellent targets within 250 m of Plateau were

identified for future drilling to explore for additional

near-surface gold ounces.

At the end of March 2021, the results from 34 rock chip samples

were announced, collected from several high priority target areas

surrounding Plateau. Rock chip sampling at the "Northwest Breccia"

at Plateau returned high grade results up to 16.8 g/t Au and 50.4

g/t Ag, whilst rock sampling at the "Northern Breccia" returned

results up to 1.89 g/t Au and 24.2 g/t Ag.

Lighthouse Regional

Ten rock chip samples taken from the Bell Rock gold prospect

("Bell Rock"), which lies 3.5 km southeast of Plateau returned

high-grade gold, including 9.9 g/t, 5.2 g/t, 5.0 g/t and 4.1 g/t

Au. This led to the commissioning of a detailed soil sampling

programme. On 3 February 2021, Rockfire released the results of

this soil sampling, which successfully defined a gold/copper

anomaly in excess of 300 m long and 100 m wide. The highest

gold-in-soil value was 1.7 g/t Au (1,700 ppb) and the highest

copper-in-soil value was 605 ppm Cu. Elevated gold and copper

values extend beyond the limits of the expanded survey area.

Detailed soil sampling was completed over the northern half of

the Jeddah gold prospect ("Jeddah"), also within the Lighthouse

tenement and only 2 km southwest of Plateau. A total of 210 samples

were collected at Jeddah, where continuous rock samples, collected

by Rockfire in May 2018 had returned 10 m @ 1.68 g/t Au, 8 m @ 1.23

g/t Au and 5 m @ 1.35 g/t Au. On 10 February 2021, it was announced

that a cohesive gold anomaly has been detected, covering an area of

250 m (east-west), by 150 m (north-south). The anomaly is defined

by a low-order zone of + 10 ppb Au, with a peak value of 62 ppb Au

and remains open towards the south.

Copperhead

Rockfire announced on 6 January 2021, that a helicopter magnetic

survey completed at the Copperhead porphyry project had doubled the

copper target area. The copper target has increased to include an

area of 5 km east-west x 3 km north-south. Faults and fractures

were defined by the aeromagnetics and correlate well with known

copper mineralisation discovered in streams, soils, and drilling

completed by Carpentaria Exploration in 1972.

Three-dimensional magnetic inversion modelling was undertaken on

the helimag data. This work resulted in a magnetic body being

detected, starting at approximately 450 m below surface. The

magnetic feature is approximately 4.5 km long and 1.5 km wide and

is positioned beneath soil samples containing highly anomalous

copper (up to 0.5 % Cu) and directly beneath five mineralised

diamond drill holes drilled in 1972.

On 24 June 2021, Rockfire announced the commencement of access

track development at Copperhead in preparation for diamond

drilling. Within several kilometres from the actual drilling site,

Rockfire geologists were observing weathered sulphides in fractures

and veins within the intrusions.

Copper Dome

On 19 May 2021, Rockfire announced the results of a

helicopter-supported aeromagnetic and radiometric survey at the

Copper Dome porphyry project. High resolution images have been

produced, with the magnetic data offering a detailed insight into

the geology and structure beneath the dome.

A revised and expanded target, based on the new aeromagnetic

signature, occupies an area 4 km x 3.5 km in size. At least three

separate intrusions are now evident, with one intrusion having been

historically drilled and copper successfully found. Abundant

structures, including faults (and possibly veins) were identified,

providing a greater understanding of the structural setting for the

emplacement of the porphyries.

Three-dimensional magnetic interpretation identified two main

targets, with both showing very strong magnetic responses. These

are interpreted as magnetite alteration commencing approximately

500 m below surface. The larger target is 1.5 km long, 700 m wide

and occurs between 400 m and 1.3 km deep and remains open beyond

that depth. The smaller target is 900 m long, 250 m wide and occurs

between 600 m and at least 1 km deep.

Post-period Highlights

Diamond drilling is in progress at Copperhead. During the

preparation of tracks, pads and infrastructure for drilling,

Rockfire geologists continued to observe weathered sulphides in

fractures and veins. As the access tracks advanced towards the

drill site, zones of malachite and azurite (copper carbonate) were

mapped, as well as occasional fresh chalcopyrite (copper sulphide)

in veins.

On 26 July 2021, the Company announced that it had raised GBP1.0

million, before expenses, through a placing of 125,000,000 new

ordinary shares with an institutional investor at a price of 0.8

pence.

A further 1,640,069 new ordinary shares were issued to Patrick

Elliott on 6 August 2021 in settlement of Director's fees for the

period 01 January 2021 to 30 June 2021.

For further information on the Company, please visit

www.rockfireresources.com or contact the following:

Rockfire Resources plc: info@rockfireresources.com

David Price, Chief Executive Officer

Allenby Capital Limited (Nominated Tel: +44 (0) 20 3328

Adviser & Broker) 5656

John Depasquale / George Payne (Corporate

Finance)

Matt Butlin / Kelly Gardner (Sales

and Corporate Broking)

Yellow Jersey rockfire@yellowjerseypr.com

Sarah Hollins / Henry Wilkinson Tel: +44 (0) 20 3004

9512

ROCKFIRE RESOURCES PLC

UNAUDITED CONSOLIDATED STATEMENT OF COMPREHENSIVE INCOME

FOR THE SIX MONTHSED 30 JUNE 2021

6 months to 6 months to 12 months to

30 June 2021 30 June 2020 31 December 2020

GBP GBP GBP

Note (unaudited) (unaudited) (audited)

Impairment of intangible assets - 1,104 (12,324)

Administrative expenses (425,937) (275,202) (707,663)

Loss before taxation (425,937) (274,098) (719,987)

Taxation - - -

Loss attributable to shareholders of the Company (425,937) (274,098) (719,987)

Items that may be subsequently reclassified to profit or

loss:

Foreign exchange translation movement (42,929) 58,000 50,591

Total comprehensive loss attributable to shareholders of

the Company (468,866) (216,098) (669,396)

============== ============== ==================

Loss per share attributable to shareholders of the Company

Basic and diluted (pence) 3 (0.05) (0.04) (0.10)

ROCKFIRE RESOURCES PLC

UNAUDITED CONSOLIDATED STATEMENT OF FINANCIAL POSITION

AS AT 30 JUNE 2021

6 months to 6 months to 12 months to

30 June 30 June 31 December

2021 2020 2020

GBP GBP GBP

Note (unaudited) (unaudited) (audited)

ASSETS

Non-current assets

Intangible assets 2,925,443 2,096,980 2,655,196

Property, plant and

equipment. 24,760 28,295 25,706

-------------- -------------- ------------

Total non-current

assets 2,950,203 2,125,275 2,680,902

-------------- -------------- ------------

Current assets

Cash and cash equivalents 1,493,441 181,405 1,350,926

Trade and other receivables 27,110 20,676 39,383

-------------- -------------- ------------

Total current assets 1,520,551 202,081 1,390,309

-------------- -------------- ------------

Total assets 4,470,754 2,327,356 4,071,211

============== ============== ============

EQUITY AND LIABILITIES

Equity attributable

to shareholders

of the Company

Share capital 4 6,950,667 6,628,608 6,828,085

Share premium 17,337,252 14,752,576 16,658,354

Other reserves 2,295,035 2,295,035 2,295,035

Foreign exchange reserve (70,105) (19,767) (27,176)

Retained deficit (22,089,406) (21,437,910) (21,779,517)

-------------- -------------- ------------

Total equity 4,423,443 2,218,542 3,974,781

-------------- -------------- ------------

Current liabilities

Trade and other payables 47,311 108,814 96,430

-------------- -------------- ------------

Total current liabilities 47,311 108,814 96,430

-------------- -------------- ------------

Total liabilities 47,311 108,814 96,430

-------------- -------------- ------------

Total equity and liabilities 4,470,754 2,327,356 4,071,211

============== ============== ============

ROCKFIRE RESOURCES PLC

UNAUDITED CONSOLIDATED STATEMENT OF CHANGES IN EQUITY

FOR THE SIX MONTHSED 30 JUNE 2021

Foreign

Share Share Other exchange Accumulated

capital premium reserves reserve losses Total

GBP GBP GBP GBP GBP GBP

At 1 January

2020 6,625,077 14,736,107 2,295,035 (77,767) (21,163,812) 2,414,640

--------------------- ---------- ----------- ---------- ---------- ------------- ----------

Loss for the

period - - - - (274,098) (274,098)

Foreign exchange

translation

movement - - - 58,000 - 58,000

--------------------- ---------- ----------- ---------- ---------- ------------- ----------

Total comprehensive

loss - - - 58,000 (274,098) (216,098)

--------------------- ---------- ----------- ---------- ---------- ------------- ----------

Issue of share

capital 3,531 16,469 - - - 20,000

Total transactions

with shareholders 3,531 16,469 - - - 20,000

--------------------- ---------- ----------- ---------- ---------- ------------- ----------

At 30 June

2020 6,628,608 14,752,576 2,295,035 (19,767) (21,437,910) 2,218,542

--------------------- ---------- ----------- ---------- ---------- ------------- ----------

Loss for the

period - - - - (445,889) (445,889)

Foreign exchange

translation

movement - - - (7,409) - (7,409)

--------------------- ---------- ----------- ---------- ---------- ------------- ----------

Total comprehensive

loss - - - (7,409) (445,889) (453,298)

---------- ----------- ---------- ---------- ------------- ----------

Issue of share

capital 199,477 2,016,931 - - - 2,216,408

Cost of share

issue - (111,153) - - - (111,153)

Share-based

payments - - - - 104,282 104,282

--------------------- ---------- ----------- ---------- ---------- ------------- ----------

Total transactions

with shareholders 199,477 1,905,778 - - 104,282 2,209,537

--------------------- ---------- ----------- ---------- ---------- ------------- ----------

At 31 December

2020 6,828,085 16,658,354 2,295,035 (27,176) (21,779,517) 3,974,781

--------------------- ---------- ----------- ---------- ---------- ------------- ----------

Loss for the

period - - - - (425,937) (425,937)

Foreign exchange

translation

movement - - - (42,929) - (42,929)

--------------------- ---------- ----------- ---------- ---------- ------------- ----------

Total comprehensive

loss - - - (42,929) (425,937) (468,866)

--------------------- ---------- ----------- ---------- ---------- ------------- ----------

Issue of share

capital 122,582 737,423 - - - 860,005

Cost of share

issue - (58,525) - - - (58,525)

Share-based

payments - - - - 116,048 116,048

Total transactions

with shareholders 122,582 678,898 - - 116,048 917,528

--------------------- ---------- ----------- ---------- ---------- ------------- ----------

At 30 June

2021 6,950,667 17,337,252 2,295,035 70,105 (22,089,406) 4,423,443

===================== ========== =========== ========== ========== ============= ==========

ROCKFIRE RESOURCES PLC

UNAUDITED CONSOLIDATED STATEMENT OF CASH FLOWS

FOR THE SIX MONTHS ENDED 30 JUNE 2021

6 months 6 months

to to 12 months

30 June 30 June to 31 December

2021 2020 2020

GBP GBP GBP

(unaudited) (unaudited) (audited)

Cash flow from operating activities

Loss for the period (425,937) (274,098) (719,987)

- Impairment of intangible

assets - - 12,324

- Share-based payments 116,048 - 104,282

- Expenses settled in shares 10,000 20,000 38,000

- Depreciation 3,312 1,319 769

- Foreign exchange rate changes (20,311) 58,000 (60,984)

----------- ----------- ---------------

(316,888) (194,779) (625,596)

Decrease in trade and other

receivables 12,058 35,296 18,007

Increase in trade and other

payables (48,153) (37,709) (55,803)

Net cash flow from operating

activities (352,983) (253,064) (663,392)

----------- ----------- ---------------

Cash flow from investing activities

Exploration expenditure (293,276) (365,220) (817,153)

Acquisition of property, plant

and equipment (2,705) (19,243) (18,844)

----------- ----------- ---------------

Net cash used in investing

activities (295,981) (348,463) (835,997)

----------- ----------- ---------------

Cash flow from financing activities

Proceeds from issuance of ordinary

shares 850,004 - 2,198,409

Share issue costs (58,525) - (111,153)

----------- ----------- ---------------

Net cash generated by financing

activities 791,479 - 2,087,256

----------- ----------- ---------------

Net decrease in cash and cash

equivalents 142,515 (581,655) 587,867

Cash and cash equivalents at

the beginning of the period 1,350,926 763,060 763,059

Cash and cash equivalents at

the end of the period 1,493,441 181,405 1,350,926

=========== =========== ===============

ROCKFIRE RESOURCES PLC

NOTES TO THE CONDENSED INTERIM CONSOLIDATED FINANCIAL

STATEMENTS

FOR THE SIX MONTHS ENDED 30 JUNE 2021

1 Principal activities

The Company is a public limited company, admitted to trading on

AIM and incorporated and domiciled in England and Wales.

The Group's principal activity is exploration for gold and base

metals in Queensland, Australia.

2 Basis of preparation

The unaudited consolidated financial statements are for the

six-month period ended 30 June 2021. They do not include all the

information required for full annual financial statements and

should be read in conjunction with the audited consolidated

financial statements of the Group for the year ended 31 December

2020.

The financial statements are prepared on the historical cost

basis or the fair value basis where the fair valuing of relevant

assets and liabilities has been applied.

The financial statements have been prepared in accordance with

accounting policies consistent with those set out in the Group's

financial statements for the year ended 31 December 2020.

The financial statements incorporate the financial statements of

the Company and subsidiaries controlled by the Company as at 30

June 2021.

The financial information set out in this interim report does

not constitute statutory accounts as defined in Section 435 of the

Companies Act 2006. The Group's statutory financial statements for

the year ended 31 December 2020 have been filed with the Registrar

of Companies. Those financial statements received an unqualified

audit report and did not contain statements or matters to which the

auditors drew attention under the Act.

The Group's consolidated financial statements are presented in

GB pounds sterling ("GBP" or "GBP") which is also the functional

currency.

3 Loss per share

Basic and diluted loss per share

The calculation of basic and diluted loss per share is based on

the loss attributable to ordinary shareholders of GBP425,937 (2020:

GBP274,098) and a weighted average number of ordinary shares in

issue of 833,273,833 (30 June 2020: 631,592,561).

4 Share capital

30 June 30 June 31 December

2021 2020 2020

Issued share capital Number Number Number

Ordinary shares of GBP0.001 each 954,997,653 632,938,535 832,415,592

Deferred shares of GBP0.099 each 51,215,534 51,215,534 51,215,534

30 June 30 June 31 December 2020

2021 2020

Issued share capital GBP GBP GBP

Fully paid 6,950,667 6,628,608 6,828,085

6,950,667 6,628,608 6,828,085

=========== =========== ================

Fully paid ordinary shares carry one vote per share and carry

the right to dividends. There are no shares held by the Company or

its subsidiaries.

The deferred shares carry no voting or income rights. The only

right attaching to deferred shares is to receive the amount paid up

on a winding up of the Company once the holders of ordinary shares

have received GBP1,000,000 per ordinary share.

On 16 February 2021, 1,152,861 new ordinary shares were issued

to Patrick Elliott in settlement of Director's fees for the period

from 01 October to 31 December 2020, at a price of 0.87 pence.

In May 2021, the Company completed a placing of 121,429,200 new

ordinary shares at a price of 0.7 pence, raising gross proceeds of

GBP850,000.

The nominal value of the issued share capital includes a

cumulative foreign exchange difference of GBP925,331 which was

recognised in 2017 when the Group's functional currency was changed

from US$ to GBP.

5 Post balance sheet events

In July 2021, the Company completed a placing of 125,000,000 new

ordinary shares at a price of 0.8 pence to raise GBP1,000,000 to

fund sustained drilling at Copperhead and Copper Dome and provide

the Company with the opportunity to expand exploration at either or

both projects.

In August 2021, 1,640,069 new ordinary shares were issued to

Patrick Elliott in settlement of Director's fees for the period

from 01 January to 30 June 2021.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR SEWFWEEFSEFU

(END) Dow Jones Newswires

September 23, 2021 02:00 ET (06:00 GMT)

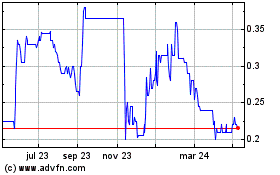

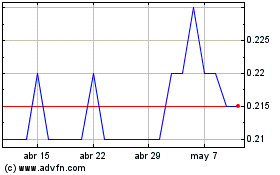

Rockfire Resources (LSE:ROCK)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Rockfire Resources (LSE:ROCK)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024