TIDMRKH

RNS Number : 4600N

Rockhopper Exploration plc

30 September 2021

30 September 2021

Rockhopper Exploration plc

("Rockhopper", the "Group" or the "Company")

Half-year results for the six months to 30 June 2021

Rockhopper Exploration plc (AIM: RKH), the oil and gas

exploration and production company with key interests in the North

Falkland Basin, announces its unaudited results for the six months

ended 30 June 2021.

Year to date highlights

Sea Lion

-- Announcement by Harbour Energy plc ("Harbour") in September

2021 that the Sea Lion project does not fit its corporate strategy

and therefore that it will seek to exit the project and its North

Falkland Basin licences

-- Rockhopper to continue to pursue the Sea Lion project with a

handover process to commence shortly

-- Discussions ongoing with Navitas Petroleum LP ("Navitas")

regarding its potential entry to the Sea Lion project

-- Extension of the Company's North Falkland Basin Petroleum

Licences, including the Sea Lion Discovery Area, to 1 November

2022

Corporate and financial

-- Continued focus on corporate costs resulted in reduced

administrative expenses - G&A US$1.6 million in H1 2021 (H1

2020: US$2.7 million)

-- Further corporate cost savings implemented post period end

-- Cash resources of US$7.1 million as at 30 June 2021

Outlook

-- Formal exit by Harbour - Rockhopper expects to regain

operatorship and 100% working interest in Sea Lion and key North

Falkland Basin licences, subject to necessary consents

-- Progress an alternative, lower-cost development scheme for

Sea Lion utilising the existing extensive design and engineering

work undertaken for the project in recent years

-- Potential farm-out of Sea Lion project to Navitas

-- Outcome awaited in relation to Ombrina Mare arbitration -

seeking significant monetary damages

Keith Lough, Chairman of Rockhopper, commented:

"Harbour Energy's decision not to proceed with Sea Lion is both

a disappointment and an opportunity, affording us greater control

through our expected regaining of operatorship and a 100% working

interest.

"Sea Lion is a world-class oil field with the scale and

potential to create very material value for Rockhopper, its

partners and the Falkland Islands as a whole.

"Work will continue on a number of fronts over the coming weeks,

including: (1) progressing Harbour's orderly exit from the

Falklands; (2) advancing plans for an alternative, lower cost,

development of Sea Lion; and (3) progressing discussions with

Navitas Petroleum around their potential entry to the project."

Enquiries:

Rockhopper Exploration plc

Sam Moody - Chief Executive

Stewart MacDonald - Chief Financial Officer

Tel. +44 (0) 20 7390 0234 (via Vigo Communications)

Canaccord Genuity Limited (NOMAD and Joint Broker)

Henry Fitzgerald-O'Connor/James Asensio

Tel. +44 (0) 20 7523 8000

Peel Hunt LLP (Joint Broker)

Richard Crichton

Tel. +44 (0) 20 7418 8900

Vigo Communications

Patrick d'Ancona/Ben Simons

Tel. +44 (0) 20 7390 0234

The information contained within this announcement is deemed by

the Company to constitute inside information as stipulated under

the Market Abuse Regulations (EU) No. 596/2014 ("MAR").

CHAIRMAN AND CHIEF EXECUTIVE OFFICER'S REPORT

Introduction

Rockhopper's strategy is to create value for all our

stakeholders through the safe and responsible development of our

assets in the North Falkland basin. The Company has been operating

offshore the Falkland Islands since 2004 and discovered the

world-class Sea Lion oil field in 2010. We are a long-term partner

of the Falklands and our aim has always been to support the rights

of the Falkland Islanders to develop their natural resources.

Sea Lion development

The recent decision by Harbour Energy plc ("Harbour") that Sea

Lion does not fit its strategy and therefore that it will not

proceed with the project is a disappointment. Nonetheless, whilst

this is a difficult moment for Rockhopper it is also a very real

opportunity.

The Sea Lion project (with independently audited 2C resources in

excess of 500 million barrels) was discovered and appraised by

Rockhopper 100% as Operator. The Company has unrivalled knowledge

of Sea Lion and the North Falkland Basin having held the acreage

since 2004 and plans to continue to pursue the development of the

project.

Work has already commenced on an alternative, lower-cost

development scheme utilising the existing extensive design and

engineering work undertaken for the project in recent years.

Rockhopper is in discussions with Navitas Petroleum LP

("Navitas") around its potential entry to the Sea Lion project

following Harbour's decision not to proceed. In August this year,

Navitas and partners raised project financing in excess of US$900

million and have taken final investment decision on the 330 million

barrel deep water Shenandoah project in the US Gulf of Mexico,

demonstrating their ability to raise capital for large-scale

offshore oil developments.

The previously announced Heads of Terms with Harbour and Navitas

expires on 30 September 2021 and as a result Harbour will have an

initial 90 days to elect how to proceed with their exit. Rockhopper

will continue to be funded (excluding licence fees, taxes and

project wind down costs) by Harbour during that period under the

terms announced on 7 January 2020 and 30 April 2020.

Rockhopper has commenced discussions with Harbour and the

Falkland Islands Government ("FIG") to ensure an orderly exit by

Harbour from the Falkland Islands.

Ombrina Mare arbitration

Rockhopper commenced international arbitration proceedings

against the Republic of Italy in relation to the Ombrina Mare field

in March 2017. The hearing took place in early February 2019 in

Paris. In June 2019, the Tribunal rejected Italy's request for the

suspension of the arbitration and Italy's related intra-EU

jurisdictional objections.

Post-hearing briefings were submitted in October and November

2019. The Tribunal confirmed in May 2021 that it anticipated being

in a position to render its award in the course of July 2021. In

late September 2021, Italy made a request, and the Tribunal agreed,

to admit a recent European Court of Justice judgment related to

inter-EU Energy Charter Treaty disputes. The Tribunal has requested

Rockhopper's legal advisers to respond to the European Court of

Justice judgment by 6 October 2021.

Rockhopper continues to believe it has strong prospects of

recovering very significant monetary damages - on the basis of lost

profits - as a result of the Republic of Italy's breaches of the

Energy Charter Treaty. All of Rockhopper's costs associated with

the arbitration to date have been funded on a non-recourse ("no win

- no fee") basis from a specialist arbitration funder.

With the expectation that the Ombrina Mare arbitration is

approaching a conclusion, the Company is considering options to

exit its legacy gas interests in Italy.

Corporate Matters

The Group continues to actively manage its corporate costs and

has reduced G&A by over 50% over the last five years. During

2020 approximately US $2.0 million of recurring annual corporate

costs were identified and removed permanently from the business.

G&A costs decreased to US$1.6 million in H1 2021 (H1 2020:

US$2.7 million) .

Post period end, further actions to preserve the Company's cash

position have been agreed, including:

-- the sub-let of the Company's former London office which is

expected to realise additional cash savings in excess of US$1.0

million over the remaining term of the lease;

-- each of the Executive Directors have agreed to defer all of

their annual base salaries above GBP200,000 until the earlier of

(1) a positive Ombrina Mare arbitration award; or (2) the execution

of a farm-out transaction on Sea Lion. Should neither of these

events occur then that portion of salary will be permanently lost.

This equates to a further 35% reduction for the CEO and a further

20% reduction for the CFO in addition to the permanent 20%

reduction in Executive Director base salaries announced in May

2020;

-- the Chairman has also agreed to defer 25% of his base fee in

addition to a 15% permanent voluntary reduction already taken.

Environmental, Social and Governance

ESG, and Corporate Responsibility more generally, continues to

be a key focus for Rockhopper.

As an oil and gas exploration and production business our role

is to produce hydrocarbons in a safe and environmentally

responsible manner.

The Company will in 2022 (delayed from 2021 due to the recent

decision by Harbour to exit the Sea Lion project) be undertaking a

review of its broader ESG framework to ensure it remains

appropriate to its business and increasing stakeholder interest in

this area.

Outlook

Sea Lion is a world-class oil field with the scale and potential

to create very material value for Rockhopper, its partners and the

Falkland Islands as a whole.

Work will continue on a number of fronts over the coming weeks,

including: (1) progressing Harbour's orderly exit from the

Falklands; (2) advancing plans for an alternative, lower cost,

development of Sea Lion; and (3) progressing discussions with

Navitas around their potential entry to the project. Given the

unique characteristics and challenges of progressing an oil field

development in the Falklands, an innovative approach to funding

will likely be required.

While we can make no guarantees, our expectation, based on

communications from the Tribunal in July, is that the Ombrina Mare

arbitration is approaching a conclusion, although precise timing

remains unclear.

We thank the Falkland Islands government for its continuing

support and will continue to work closely with all stakeholders to

maximise the chance of unlocking the value within the project

long-awaited by all stakeholders.

Keith Lough Sam Moody

Chairman Chief Executive Officer

FINANCIAL REVIEW

Following the sale of the Company's interests in Egypt

(completed February 2020), the Group's sole source of revenue is

from the production and sale of limited volumes of natural gas in

Italy.

For the period ended 30 June 2021, the Group reported revenues

of US$0.3 million and loss after tax of US$3.3 million.

CASH MOVEMENTS AND CAPITAL EXPITURE

At 30 June 2021, the Group had cash and term deposits of US$7.1

million (31 December 2020: US$11.7 million).

Cash and term deposit movements during the period:

US$m

---------------------------------------------------------------- ------

Opening cash balance (31 December

2020) 11.7

Revenues 0.3

Cost of sales (0.6)

Falkland Islands - (relating to post

1 January 2020) (1.0)

- (relating to pre 1 January 2020) (1.4)

Greater Mediterranean (0.0)

Administrative expenses (1.6)

Miscellaneous (0.3)

Closing cash balance (30 June 2021) 7.1

---------------------------------------------------------------- ------

Falkland Island spend, relating to the period post 1 January

2020, primarily relates to licence fees and internal costs

associated with the Sea Lion development. During H1 2021, the Group

received and subsequently paid a significantly larger than expected

tax liability of US$1.4 million associated with the 2015/16

Falklands drilling campaign. Limited further costs related to the

period prior to 1 January 2020 are expected.

Administrative expenses of US$1.6 million include US$0.4 million

of corporate and administrative costs directly associated with the

Group's legacy interests in Italy.

Miscellaneous includes non-recurring restructuring costs,

foreign exchange and movements in working capital during the

period.

The previously announced Heads of Terms with Harbour and Navitas

expires on 30 September 2021 and as a result Harbour will have an

initial 90 days to elect how to proceed with their exit. Rockhopper

will continue to be funded (excluding licence fees, taxes and

project wind down costs) by Harbour during that period under the

terms announced on 7 January 2020 and 30 April 2020.

TAXATION

On 8 April 2015, the Group agreed binding documentation ("Tax

Settlement Deed") with FIG in relation to the tax arising from the

Group's farm-out to Premier.

The Tax Settlement Deed confirms the quantum and deferment of

the outstanding tax liability and is made under Extra Statutory

Concession 16.

As a result of the Tax Settlement Deed, the outstanding tax

liability was confirmed at GBP64.4 million and is payable on the

earlier of: (i) the first royalty payment date on Sea Lion; (ii)

the date of which Rockhopper disposes of all or a substantial part

of the Group's remaining licence interests in the North Falkland

Basin; or (iii) a change of control of Rockhopper.

During the first half of 2017, as a result of the Group

receiving the full Exploration Carry from Premier during the

2015/16 drilling campaign, the Falkland Islands Commissioner of

Taxation agreed to reduce the tax liability in line with the terms

of the Tax Settlement Deed. As such, the tax liability has been

revised downwards to GBP59.6 million. The outstanding tax liability

is classified as non-current and is discounted to a period-end

value of US$41.0 million.

Full details of the provisions and undertakings of the Tax

Settlement Deed are disclosed in note 7 of these condensed

consolidated interim financial statements and these include

"creditor protection" provisions including undertakings not to

declare dividends or make distributions while the tax liability

remains outstanding (in whole or in part).

As a result of the recently announced decision by Harbour to

exit the Sea Lion project, Rockhopper has commenced discussions

with FIG as to the impact of such a decision on the Group's

deferred tax liability.

LIQUIDITY, COUNTERPARTY RISK AND GOING CONCERN

The Group monitors its cash position, cash forecasts and

liquidity on a regular basis and takes a conservative approach to

cash management, with surplus cash held on term deposits with a

number of major financial institutions.

At 30 June 2021, the Group had cash resources of US$7.1 million

(unaudited). Following the sale of Rockhopper Egypt Pty Limited in

2020, the Group generates limited revenue and cash flow from the

sale of oil or gas.

Historically, the Group's largest annual expenditure has related

to pre-sanction costs associated with the Sea Lion development.

However, following the announcement by Harbour of its intention to

exit the Falklands, the Company will have greater control on the

level and timing of future expenditure on the Sea Lion project.

Management has also considered a number of downside scenarios,

the most significant being one where decommissioning of certain

physical assets (principally the Temporary Dock Facility) in the

Falklands is required. The Group would be liable for its 40% share

of these costs with no funding support from Harbour and/or

Navitas.

Under the base case forecast, the Group will have sufficient

financial headroom to meet forecast cash requirements for the 12

months from the date of approval of these consolidated financial

statements. However, in the downside scenarios, in the absence of

any mitigating actions, the Group may have insufficient funds to

meet its forecast cash requirements. Potential mitigating actions,

some of which are outside the Group's control, could include

collection of arbitration award proceeds, deferral of expenditure

or raising additional equity.

Accordingly, after making enquiries and considering the risks

described above, the Directors have assessed that the cash balance

held provides the Group with adequate headroom over forecasted

expenditure for the following 12 months - as a result, the

Directors have adopted the going concern basis of accounting in

preparing these consolidated financial statements.

Nonetheless, these conditions indicate the existence of a

material uncertainty which may cast significant doubt on the

Group's and Company's ability to continue as a going concern. The

financial statements do not include the adjustments that would be

required if the Group and Company were unable to continue as a

going concern.

PRINCIPAL RISK AND UNCERTAINTIES

A detailed review of the potential risks and uncertainties which

could impact the Company are outlined in the Strategic Report of

the Group's 2020 Annual Report. The Company identified its key

risks as being:

-- oil price volatility;

-- access to capital;

-- insufficient funds to meet commitments;

-- failure to secure joint venture partners for the Sea Lion project; and

-- failure to secure the requisite funding to allow a Sea Lion Final Investment Decision.

In 2020, the environmental impact of oil and gas extraction

(e.g. climate change) was added to the risk register, reflecting

the increased focus on ESG issues which could have an adverse

impact on investor and lender sentiment towards the Company and the

Sea Lion project.

Stewart MacDonald

Chief Financial

Officer

CONDENSED CONSOLIDATED income statement

for the six months ended 30 June 2021

Six months Six months

Ended Ended

30 June 30 June

2021 2020

Unaudited Unaudited

Notes $'000 $'000

------------------------------------- ------ ----------- -----------

Revenue 2 347 2,467

------------------------------------- ------ ----------- -----------

Other cost of sales (571) (1,283)

Depreciation and impairment of

oil and gas assets (440) (2,598)

Total cost of sales (1,011) (3,881)

------------------------------------- ------ ----------- -----------

Gross loss (664) (1,414)

Exploration and evaluation expenses (131) (223,635)

Administrative expenses (1,578) (2,651)

Charge for share based payments (637) (843)

Foreign exchange movement (262) 2,632

------------------------------------- ------ ----------- -----------

Results from operating activities

and other income (3,272) (225,911)

Finance income 3 36

Finance expense (32) (956)

------------------------------------- ------ ----------- -----------

Loss before tax (3,301) (226,831)

Tax 3 - 8

------------------------------------- ------ ----------- -----------

Loss for the period attributable

to the equity shareholders of the

parent company (3,301) (226,823)

------------------------------------- ------ ----------- -----------

Loss per share: cents

Basic 4 (0.72) (49.81)

Diluted 4 (0.72) (49.81)

------------------------------------- ------ ----------- -----------

CONDENSED CONSOLIDATED statement of comprehensive income

for the six months ended 30 June 2021

Six months Six months

Ended Ended

30 June 30 June

2021 2020

Unaudited Unaudited

Notes $'000 $'000

------------------------------------- ------- ----------- -----------

Loss for the period (3,301) (226,823)

Exchange differences on translation

of foreign operations 394 (28)

---------------------------------------------- ----------- -----------

TOTAL COMPREHENSIVE Loss FOR THE

period (2,907) (226,851)

---------------------------------------------- ----------- -----------

CONDENSED CONSOLIDATED balance sheet

as at 30 June 2021

As at As at

30 June 31 December

2021 2020

Unaudited Audited

----------------------------------------- ------ ---------- ------------

Notes $'000 $'000

NON CURRENT Assets

Exploration and evaluation assets 5 244,907 244,349

Property, plant and equipment 6 784 1,420

Finance lease receivable 381 462

CURRENT Assets

Inventories 300 310

Other receivables 1,934 2,464

Finance lease receivable 190 187

Restricted cash 489 486

Cash and cash equivalents 7,093 11,680

Total assets 256,078 261,358

----------------------------------------- ------ ---------- ------------

CURRENT Liabilities

Other payables 1,437 3,790

Lease liability 570 567

NON-CURRENT Liabilities

Lease liability 856 1,273

Tax payable 7 40,973 40,703

Provisions 14,650 15,158

Deferred tax liability 39,295 39,300

----------------------------------------- ------ ---------- ------------

Total liabilities 97,781 100,791

----------------------------------------- ------ ---------- ------------

Equity

Share capital 7,218 7,218

Share premium 3,622 3,622

Share based remuneration 4,349 5,973

Owns shares held in trust (3,342) (3,342)

Merger reserve 74,332 74,332

Foreign currency translation reserve (10,177) (10,571)

Special reserve 188,028 188,028

Retained losses (105,733) (104,693)

----------------------------------------- ------ ---------- ------------

Attributable to the equity shareholders

of the company 158,297 160,567

----------------------------------------- ------ ---------- ------------

Total liabilities and equity 256,078 261,358

----------------------------------------- ------ ---------- ------------

These condensed consolidated interim financial statements were

approved by the directors and authorised for issue on 30 September

2021 and are signed on their behalf by:

Stewart MacDonald

Chief Financial Officer

CONDENSED CONSOLIDATED statement of changes in equity

for the six months ended 30 June 2021

Own Foreign

shares Currency

Share

Share Share based held Merger Translation Special Retained Total

---------------

in

capital premium remuneration trust Reserve Reserve reserve losses Equity

$'000 $'000 $'000 $'000 $'000 $'000 $'000 $'000 $'000

--------------- -------- -------- ------------- -------- -------- ------------ ---------- ---------- ----------

Balance at 31

December

2019

(audited) 7,212 3,547 4,871 (3,371) 74,332 (9,678) 433,766 (114,565) 396,114

Total

comprehensive

expense for

the

period - - - - - (28) - (226,823) (226,851)

Other

transfers - - (835) - - - 835 -

Share based

payments - - 843 - - - - - 843

Share issues

in

relation to

SIP 6 75 96 29 - - - - 206

Balance at 30

June

2020

(unaudited) 7,218 3,622 4,975 (3,342) 74,332 (9,706) 433,766 (340,553) 170,312

Total

comprehensive

expense for

the

period - - - - - (865) - (9,681) (10,546)

Other

transfers - - 97 100 - - (245,738) 245,541 -

Share based

payments - - 997 - - - - - 998

Share issues

in

relation to

SIP - - (96) (100) - - - - (196)

--------------- -------- -------- ------------- -------- -------- ------------ ---------- ---------- ----------

Balance at 31

December

2020

(audited) 7,218 3,622 5,973 (3,342) 74,332 (10,571) 188,028 (104,693) 160,567

Total

comprehensive

expense for

the

period - - - - - 394 - (3,301) (2,907)

Other

transfers - - (2,261) - - - 2,261 -

Share based

payments - - 637 - - - - - 637

--------------- -------- -------- ------------- -------- -------- ------------ ---------- ---------- ----------

Balance at 30

June

2021

(unaudited) 7,218 3,622 4,349 (3,342) 74,332 (10,177) 188,028 (105,733) 158,297

--------------- -------- -------- ------------- -------- -------- ------------ ---------- ---------- ----------

CONDENSED CONSOLIDATED CASH FLOW STATEMENT

FOR THE SIX MONTHSED 30 JUNE 2021

Six months Six months

Ended Ended

30 June 30 June

2021 2020

Unaudited Unaudited

Notes $'000 $'000

---------------------------------------- ------ ----------- -----------

Cash flows from operating activities

Net loss before tax (3,301) (226,831)

Adjustments to reconcile net

losses to cash:

Depreciation 654 1,013

Share based payment charge 637 843

Impairment of oil and gas assets 6 - 1,789

Impairment of exploration and

evaluation assets 5 - 223,003

Loss on disposal of property,

plant and equipment - -

Finance expense 31 956

Finance income (1) (36)

Foreign exchange 208 (2,450)

---------------------------------------- ------ ----------- -----------

Operating cash flows before movements

in working capital (1,772) (1,713)

Changes in:

Inventories - 67

Other receivables 682 1,319

Payables (728) (677)

Movement on other provisions 3 3

---------------------------------------- ------ ----------- -----------

Cash utilised by operating activities (1,815) (1,001)

---------------------------------------- ------ ----------- -----------

Cash Flows from investing activities

Capitalised expenditure on exploration

and evaluation assets (2,395) (9,388)

Purchase of property, plant and

equipment (24) (653)

Net proceeds from disposal of

assets held for sale - 8,421

Interest 1 44

Investing cash flows before movements

in capital balances (2,418) (1,576)

Cash flow from investing activities (2,418) (1,576)

---------------------------------------- ------ ----------- -----------

Cash flows from financing activities

Share incentive plan - 12

Lease liability payments (327) (119)

Finance paid (3) (3)

---------------------------------------- ------ ----------- -----------

Cash flow from financing activities (330) (110)

---------------------------------------- ------ ----------- -----------

Currency translation differences

relating to cash and cash equivalents (24) 9

Net cash outflow (4,563) (2,687)

Cash and cash equivalents brought

forward 11,680 17,223

---------------------------------------- ------ ----------- -----------

Cash and cash equivalents carried

forward 7,093 14,545

---------------------------------------- ------ ----------- -----------

Notes to the condensed CONSOLIDATED group financial

statements

for the six months ended 30 June 2021

1 Accounting policies

1.1 Group and its operations

Rockhopper Exploration plc ('the Company'), a public limited

company quoted on AIM, incorporated and domiciled in the United

Kingdom ('UK'), together with its subsidiaries (collectively, 'the

Group') holds interests in the Falkland Islands and the Greater

Mediterranean. T he Company's registered office address is Warner

House, 123 Castle Street, Salisbury, SP1 3TB.

1.2 Statement of compliance and basis of preparation

These condensed consolidated interim financial statements of the

Group, as at and for the six months ended 30 June 2021, include the

results of the Company and all subsidiaries over which the Company

exercises control.

The condensed consolidated interim financial statements have

been prepared in accordance with International Accounting Standard

("IAS") 34 Interim Financial The accounting policies applied in the

preparation of the condensed consolidated interim financial

statements are consistent with the policies applied by the Group in

the consolidated financial statements as at and for the year ended

31 December 2020. They do not include all information required for

full annual financial statements, and should be read in conjunction

with the consolidated financial statements of the Company and all

its subsidiaries as at the year ended 31 December 2020.

The comparative figures for the year ended 31 December 2020 are

not the Group's statutory accounts for that financial period. Those

accounts have been reported on by the Group's auditor and delivered

to the registrar of companies. The report of the auditor was: (i)

unqualified and (ii) did not contain a statement under section 498

(2) or (3) of the Companies Act 2006.

A number of amended standards became applicable for the current

reporting period. The group did not have to change its accounting

policies or make retrospective adjustments as a result of adopting

these amended standards.

The preparation of condensed consolidated interim financial

statements requires management to make judgements, estimates and

assumptions that affect the application of accounting policies and

the reported amounts of assets and liabilities, income and expense.

Actual results may differ from these estimates.

In preparing these condensed consolidated interim financial

statements, the significant judgements made by management in

applying the Group's accounting policies and the key sources of

estimation uncertainty were the same as those that applied to the

consolidated financial statements as at and for the year ended 31

December 2020.

The condensed consolidated interim financial statements were

approved by the Board on 30 September 2021.

All values are rounded to the nearest thousand dollars ($'000)

or thousand pounds (GBP'000), except when otherwise indicated.

1.3 Going concern

The Group monitors its cash position, cash forecasts and

liquidity on a regular basis and takes a conservative approach to

cash management, with surplus cash held on term deposits with a

number of major financial institutions.

At 30 June 2021, the Group had cash resources of US$7.1 million

(unaudited). Following the sale of Rockhopper Egypt Pty Limited in

2020, the Group generates limited revenue and cash flow from the

sale of oil or gas.

Historically, the Group's largest annual expenditure has related

to pre-sanction costs associated with the Sea Lion development.

However, following the announcement by Harbour of its intention to

exit the Falklands, the Company will have greater control on the

level and timing of future expenditure on the Sea Lion project.

Management has also considered a number of downside scenarios,

the most significant being one where decommissioning of certain

physical assets (principally the Temporary Dock Facility) in the

Falklands is required. The Group would be liable for its 40% share

of these costs with no funding support from Harbour and/or

Navitas.

Under the base case forecast, the Group will have sufficient

financial headroom to meet forecast cash requirements for the 12

months from the date of approval of these consolidated financial

statements. However, in the downside scenarios, in the absence of

any mitigating actions, the Group may have insufficient funds to

meet its forecast cash requirements. Potential mitigating actions,

some of which are outside the Group's control, could include

collection of arbitration award proceeds, deferral of expenditure

or raising additional equity.

Accordingly, after making enquiries and considering the risks

described above, the Directors have assessed that the cash balance

held provides the Group with adequate headroom over forecasted

expenditure for the following 12 months - as a result, the

Directors have adopted the going concern basis of accounting in

preparing these consolidated financial statements.

Nonetheless, these conditions indicate the existence of a

material uncertainty which may cast significant doubt on the

Group's and Company's ability to continue as a going concern. The

financial statements do not include the adjustments that would be

required if the Group and Company were unable to continue as a

going concern.

1.4 Period end exchange rates

The period end rates of exchange actually used were:

30 June 30 June 31 December

2021 2020 2020

----------- -------- -------- ------------

GBP : US$ 1.38 1.31 1.36

EUR : US$ 1.19 1.12 1.23

----------- -------- -------- ------------

2 Revenue and segmental information

Six months ended 30 June 2021 (unaudited)

Falkland Greater

Islands Mediterranean Corporate Total

$'000 $'000 $'000 $'000

-------------------------------- --------- -------------- ---------- ---------

Revenue - 347 - 347

Cost of sales - (1,011) - (1,011)

-------------------------------- --------- -------------- ---------- ---------

Gross profit/(loss) - (664) - (664)

Exploration and evaluation

expenses - (4) (127) (131)

Administrative expenses - (412) (1,166) (1,578)

Charge for share based

payments - - (637) (637)

Foreign exchange movement (270) - 8 (262)

-------------------------------- --------- -------------- ---------- ---------

Results from operating

activities and other income (270) (1,080) (1,922) (3,272)

Finance income - 1 2 3

Finance expense - (3) (29) (32)

-------------------------------- --------- -------------- ---------- ---------

Loss before tax (270) (1,082) (1,949) (3,301)

Tax - - - -

-------------------------------- --------- -------------- ---------- ---------

Loss for period (270) (1,082) (1,949) (3,301)

-------------------------------- --------- -------------- ---------- ---------

Reporting segments assets 244,213 3,120 8,745 256,078

Reporting segments liabilities (80,110) (15,235) (2,436) (97,781)

There are no material additions to segment assets.

Six months ended 30 June 2020 (unaudited)

Falkland Greater

Islands Mediterranean Corporate Total

$'000 $'000 $'000 $'000

-------------------------------- ---------- -------------- ---------- ----------

Revenue - 2,467 - 2,467

Cost of sales - (3,881) - (3,881)

-------------------------------- ---------- -------------- ---------- ----------

Gross profit/(loss) - (1,414) - (1,414)

Exploration and evaluation

expenses (222,228) (812) (595) (223,635)

Administrative expenses - (514) (2,137) (2,651)

Charge for share based

payments - - (843) (843)

Foreign exchange movement 2,523 78 31 2,632

-------------------------------- ---------- -------------- ---------- ----------

Results from operating

activities and other income (219,705) (2,662) (3,544) (225,911)

Finance income - - 36 36

Finance expense - (30) (926) (956)

-------------------------------- ---------- -------------- ---------- ----------

Loss before tax (219,705) (2,692) (4,434) (226,831)

Tax - 8 - 8

-------------------------------- ---------- -------------- ---------- ----------

Loss for period (219,705) (2,684) (4,434) (226,823)

-------------------------------- ---------- -------------- ---------- ----------

Reporting segments assets 242,856 6,509 20,237 269,602

Reporting segments liabilities (76,370) (14,401) (8,519) (99,290)

There are no material additions to segment assets.

All of the Group's worldwide sales revenues of oil and gas $347

thousand (2020: 2,467 thousand) arose from contracts to customers.

Total revenue relates to revenue from one customer (2020: two

customers each exceeding 10 per cent of the Group's consolidated

revenue).

3 Taxation

Six months Six months

ended ended

30 June 30 June

2021 2020

$'000 $'000

Unaudited Unaudited

-------------------------------- ------------ -----------

Current tax:

Overseas tax - -

Adjustment in respect of prior

periods - 8

-------------------------------- ------------ -----------

Total current tax - 8

-------------------------------- ------------ -----------

Deferred tax:

Overseas tax - -

-------------------------------- ------------ -----------

Total deferred tax - -

-------------------------------- ------------ -----------

Tax on ordinary activities - 8

-------------------------------- ------------ -----------

4 Basic and diluted loss per share

Six months Six months

ended ended

30 June 30 June

2021 2020

Number Number

Unaudited Unaudited

------------------------------------- ------------ ------------

Shares in issue brought forward 458,482,117 457,979,755

Shares issued

- Issued under the SIP - 502,362

------------------------------------- ------------ ------------

Shares in issue carried forward 458,482,117 458,482,120

------------------------------------- ------------ ------------

Weighted average number of Ordinary

Shares

for the purpose of earnings per

share 455,351,117 455,405,626

------------------------------------- ------------ ------------

$'000 $'000 $'000

------------------------------------- ------------ ------------

Net loss after tax for purposes

of basic and diluted earnings per

share (3,301) (226,823)

------------------------------------- ------------ ------------

Earnings per share - cents

Basic (0.72) (49.81)

Diluted (0.72) (49.81)

------------------------------------- ------------ ------------

The weighted average number of Ordinary Shares takes into

account those shares which are treated as own shares held in trust.

As the Group is reporting a loss in each period in accordance with

IAS33 the share options are not considered dilutive because the

exercise of the share options would have the effect of reducing the

loss per share.

At the period end the Group had the following unexercised

options and share appreciation rights in issue.

Six months

ended

30 June

2021

Number

Unaudited

--------------------------- -----------

Long term incentive plan 11,032,536

Share appreciation rights 611,919

Share options 32,194,588

---------------------------- -----------

5 Intangible exploration and evaluation assets

During the period there have not been any material additions.

The balance carried forward is predominantly in relation to the Sea

Lion project.

At 30 June 2021, the Group reviewed its intangible

exploration/appraisal assets for indicators of impairment, with no

indicators of impairment being identified. No impairment tests were

therefore performed.

6 Property, plant and equipment

During the period there have not been any material additions.

The movement in the period mainly relates to depreciation.

7 Tax payable

Six months Year

ended ended

30 June 31 December

2021 2020

$'000 $'000

Unaudited Audited

------------------------- ----------- ------------

Current tax payable - -

Non current tax payable 40,973 40,703

-------------------------- ----------- ------------

40,973 40,703

------------------------- ----------- ------------

On the 8 April 2015, the Group agreed binding documentation

("Tax Settlement Deed") with the Falkland Island Government ("FIG")

in relation to the tax arising from the Group's farm out to Premier

Oil plc ("Premier").

The Tax Settlement Deed confirms the quantum and deferment of

the outstanding tax liability and is made under Extra Statutory

Concession 16. The Outstanding Tax Liability is intended to be

binding and final except, subject to the satisfaction of the

Falkland Islands' Commissioner of Taxation, Rockhopper shall be

entitled to make an adjustment to the Outstanding Tax Liability if

any part of the Development Carry from Premier becomes

"irrecoverable".

The Outstanding Tax Liability is payable on the earlier of:

-- First royalty payment date, which is expected to occur within

six months of the date of first oil;

-- The date on which Rockhopper disposes of all or a substantial

part of the Company's remaining interest in the Licences, or

otherwise realises value from the Licences;

-- A change of control of Rockhopper Exploration plc.

As security the Group has provided fixed and floating security

over all assets (with limited carve outs where this would conflict

with applicable law or existing terms). While such security is in

place, restrictions, subject to conventional carve outs, exist on

granting further security. The Group also agreed to maintain a

minimum 20% interest in licence PL032 and not to make dividends or

distributions.

The outstanding tax liability is GBP59.6 million and is expected

to be payable on the first royalty payment date on Sea Lion.

Currently the first royalty payment date is anticipated to occur

within six months of first oil production which itself is estimated

to occur three and a half years after project sanction. As such the

tax liability has been discounted at 15% to a US$ equivalent amount

of US$41.0 million.

No deferred tax asset has been recognised in respect of

temporary differences arising on losses carried forward,

outstanding share options or depreciation in excess of capital

allowances due to the uncertainty in the timing of profits and

hence future utilisation.

8 Post balance sheet events

On the 23 September 2021 Harbour announced that Sea Lion did not

fit its strategy and therefore that it will not proceed with the

project.

The previously announced Heads of Terms with Harbour and Navitas

expires on 30 September 2021 and as a result Harbour will have an

initial 90 days to elect how to proceed with their exit. Rockhopper

will continue to be funded (excluding licence fees, taxes and

project wind down costs) by Harbour during that period under the

terms announced on 7 January 2020 and 30 April 2020.

Rockhopper is in discussions with Navitas around its potential

entry to the Sea Lion project following Harbour's decision not to

proceed. Rockhopper has also commenced discussions with Harbour and

the Falkland Islands Government ("FIG") to ensure an orderly exit

by Harbour from the Falkland Islands.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR BCGDCCBDDGBC

(END) Dow Jones Newswires

September 30, 2021 02:00 ET (06:00 GMT)

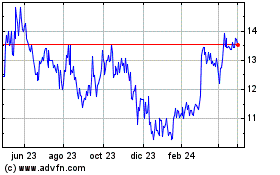

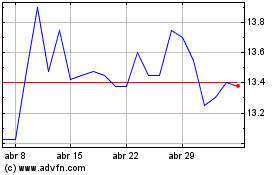

Rockhopper Exploration (LSE:RKH)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Rockhopper Exploration (LSE:RKH)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024