TIDMROQ

RNS Number : 0448T

Roquefort Investments PLC

22 November 2021

NOT FOR RELEASE, PUBLICATION OR DISTRIBUTION, IN WHOLE OR IN

PART, IN OR INTO THE UNITED STATES, AUSTRALIA, CANADA, JAPAN, THE

REPUBLIC OF SOUTH AFRICA, ANY MEMBER STATE OF THE EEA (OTHER THAN

THE UNITED KINGDOM) OR ANY OTHER JURISDICTION WHERE TO DO SO WOULD

CONSTITUTE A VIOLATION OF THE RELEVANT LAWS OF THAT

JURISDICTION.

FURTHER, THIS ANNOUNCEMENT IS FOR INFORMATION PURPOSES ONLY AND

DOES NOT CONSTITUTE OR CONTAIN ANY INVITATION, SOLICITATION,

RECOMMENDATION, OFFER OR ADVICE TO ANY PERSON TO SUBSCRIBE FOR,

OTHERWISE ACQUIRE OR DISPOSE OF ANY SECURITIES IN ANY

JURISDICTION.

22 November 2021

Roquefort Investments plc

("Roquefort Investments" or the "Company")

Conditional Placing to Raise GBP3 Million (Before Expenses)

Roquefort Investments (LSE:ROQ), the London listed investment

company established to acquire businesses focused on early-stage

opportunities in the medical biotechnology sector , is pleased to

announce that it has conditionally raised GBP3 million (before

expenses) (the "Placing") via the proposed issue of 30,000,000 new

Ordinary Shares (the "Placing Shares") at a price of 10 pence per

new Ordinary Share (the "Placing Price").

As announced on 18 November 2021 the Company has entered into a

conditional share sale and purchase agreement (the "Acquisition

Agreement") with Provelmare Holding S.A. pursuant to which

Roquefort Investments has agreed to acquire the entire issued share

capital of Lyramid Pty Limited for an initial consideration of GBP1

million payable 50% in cash and 50% in shares (the "Acquisition").

The Acquisition is conditional, inter alia, on a successful

Placing.

The net proceeds of the Placing are estimated at GBP2,560,000.

The net proceeds, together with existing cash, are intended to be

used to fund the cash component of the consideration for the

Acquisition, pre-clinical drug development and working capital.

On 19 November 2021 the Company circulated a notice of general

meeting to shareholders to seek shareholder approval inter alia for

the issue of new Ordinary Shares in connection with the Acquisition

and the Placing and to change the name of the Company to Roquefort

Therapeutics plc. The general meeting will take place at 10.00 a.m.

on 13 December 2021.

Should the Acquisition complete, it will constitute a Reverse

Takeover under the Listing Rules and accordingly the Company will

apply for the re-admission of its shares to the Official List and

the Main Market of the London Stock Exchange ("Admission"). The

Company's shares remain suspended from trading pending the

publication of a prospectus prepared in accordance with the

Prospectus Regulation Rules of the FCA and approved by the FCA, or

an announcement that the Acquisition is not proceeding.

Stephen West, Executive Chairman, commented:

"We are delighted to have conditionally raised GBP3 million. We

experienced substantial investor demand and the Placing was

significantly oversubscribed. We would like to thank the new

investors and our existing shareholders for endorsing the highly

attractive Lyramid opportunity that we secured within 6 months of

our IPO. The Placing will enable us to complete the Acquisition and

to fund the very exciting pre-clinical drug development programme

around Midkine-based therapeutics being pursued by Lyramid.

We believe that the Lyramid pre-clinical programme, utilising

oligonucleotide drugs, has the potential to deliver ground breaking

advances in the treatment of several disease targets including

COVID-19, cancer, autoimmune disorders and chronic inflammation -

and that this can be achieved rapidly and at a significantly lower

cost than historical traditional drug methods."

Enquiries:

Roquefort Investments plc

+44 (0)20 3290

Stephen West (Chairman) 9339

Optiva Securities Limited (Broker)

+44 (0)20 3411

Christian Dennis 1881

For further information, please visit www.roquefortinvest.com

and @roquefortinvest on Twitter.

LEI: 254900P4SISIWOR9RH34

This announcement contains inside information for the purposes

of Article 7 of the Market Abuse Regulation (EU) No 596/2014

("MAR"). Upon the publication of this announcement via Regulatory

Information Service, this inside information is now considered to

be in the public domain.

DISCLAIMER

This announcement includes statements that are, or may be deemed

to be, "forward-looking statements". These forward-looking

statements can be identified by the use of forward-looking

terminology, including the terms "believes", "estimates", "plans",

"anticipates", "targets", "aims", "continues", "expects",

"intends", "hopes", "may", "will", "would", "could" or "should" or,

in each case, their negative or other variations or comparable

terminology. These forward-looking statements include matters that

are not facts. They appear in a number of places throughout this

announcement and include statements regarding the Directors'

beliefs or current expectations concerning, amongst other things,

the amount of capital which will be returned by the Company and the

taxation of such amounts in the hands of Shareholders. By their

nature, forward-looking statements involve risk and uncertainty

because they relate to future events and circumstances. Investors

should not place undue reliance on forward-looking statements,

which speak only as of the date of this announcement.

The information given in this announcement and the

forward-looking statements speak only as at the date of this

announcement. The Company expressly disclaims any obligation or

undertaking to update, review or revise any forward-looking

statement contained in this announcement to reflect actual results

or any change in the assumptions, conditions or circumstances on

which any such statements are based unless required to do so by the

Financial Services and Markets Act 2000, the Listing Rules, the

Prospectus Regulation Rules or other applicable laws, regulations

or rules.

Further Information on the Placing

In conjunction with the Acquisition and subject to Admission,

the Company has conditionally raised GBP3 million (before expenses)

via the proposed issue of 30,000,000 new Ordinary Shares at a price

of 10 pence per new Ordinary Share.

The net proceeds of the Placing, together with existing cash,

will be used to finance the cash component of the consideration for

the Acquisition, for pre-clinical drug development and for working

capital.

A summary of the intended use of net proceeds of the Placing is

shown in the table below:

Use of Net Proceeds GBP'000

------------------------------------------------- --------

Cash consideration of the Acquisition 500

Estimated working capital adjustment for

the Acquisition 160

Lyramid pre-clinical drug development programme 1,000

Contingency for additional pre-clinical

development funds 500

Working capital of the Enlarged Group 400

------------------------------------------------- --------

Total 2,560

================================================= ========

The Company's Chairman, Stephen West, has agreed to subscribe

for GBP40,000 of new Ordinary Shares pursuant to the Placing.

The Company has engaged Optiva Securities Limited to act as the

Company's placing agent and adviser for the purposes of the

Placing. The Placing is not underwritten and is conditional, inter

alia, on:

-- the Acquisition Agreement becoming unconditional in all respects save for Admission;

-- approval by the FCA of the Prospectus and the publication of the Prospectus;

-- the resolutions being passed at the General Meeting being

held at 10.00 a.m. on 13 December 2021; and

-- Admission occurring no later than 8:00 a.m. on 28 February 2022.

The Placing will result in the issue of in total 30,000,000 new

Ordinary Shares (representing, in aggregate, approximately 41.7 per

cent., of the enlarged issued share capital). The Placing Shares,

when issued and fully paid, will rank pari passu in all respects

with the existing Ordinary Shares and therefore rank equally for

all dividends or other distributions declared, made or paid after

the date of issue of the Placing Shares.

The Placing Price of GBP0.10 represents a discount of 20% to the

Company's mid-market closing price as at 28 September 2021, being

the last date on which the Company's shares were traded prior to

the suspension.

PROSPECTUS

In order to implement the Acquisition, the Placing and

Admission, the Company is required to have approved by the FCA and

to publish a Prospectus, prepared in accordance with the Prospectus

Regulation Rules, and setting out further information on the

Acquisition, the Placing and Admission and the Enlarged Group.

Subject to receving FCA approval, the Prospectus will be available

at the Company's website: www.roquefortinvest.com as soon as

practicable following its publication and a further announcement

will be made in due course.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IOEEANFFALKFFFA

(END) Dow Jones Newswires

November 22, 2021 02:00 ET (07:00 GMT)

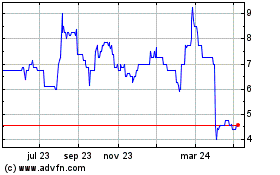

Roquefort Therapeutics (LSE:ROQ)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

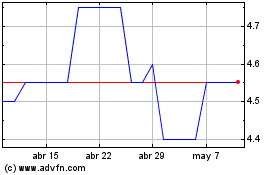

Roquefort Therapeutics (LSE:ROQ)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024