TIDMROQ

RNS Number : 7509S

Roquefort Investments PLC

18 November 2021

NOT FOR RELEASE, PUBLICATION OR DISTRIBUTION, IN WHOLE OR IN

PART, IN OR INTO THE UNITED STATES, AUSTRALIA, CANADA, JAPAN, THE

REPUBLIC OF SOUTH AFRICA, ANY MEMBER STATE OF THE EEA (OTHER THAN

THE UNITED KINGDOM) OR ANY OTHER JURISDICTION WHERE TO DO SO WOULD

CONSTITUTE A VIOLATION OF THE RELEVANT LAWS OF THAT

JURISDICTION

18 November 2021

Roquefort Investments plc

("Roquefort Investments" or the "Company")

Proposed Acquisition of Lyramid Pty Limited

Proposed Placing of up to 30,000,000 Ordinary Shares of GBP0.01

each at GBP0.10 per Ordinary Share

Proposed Change of Name

Roquefort Investments plc ( LSE:ROQ ), the investment company

established to acquire businesses focused on early-stage

opportunities in the medical biotechnology sector , is pleased to

announce that further to the announcement of 29 September 2021, the

Company has now entered into a conditional share sale and purchase

agreement (the "Acquisition Agreement") with Provelmare Holding

S.A. (the "Seller") pursuant to which Roquefort Investments has

agreed to acquire the entire issued share capital of Lyramid Pty

Limited ("Lyramid") for an initial consideration of GBP1 million

payable 50% in cash and 50% in shares (the "Acquisition").

Lyramid has the exclusive worldwide licence to commercialise up

to 37 patents related to Midkine-based therapies for the treatment

of COVID-19 patients, cancer, autoimmune disorders and chronic

inflammation ("Midkine-Based Therapies").

The Directors of Roquefort Investments consider the Acquisition

to represent a transformational, value enhancing transaction for

shareholders, which is fully aligned with the Company's growth

strategy. Lyramid's global patent portfolio for Midkine-Based

Therapies provides a platform to develop first-in-class drugs for

the treatment of severe inflammatory diseases, autoimmune disorders

and cancer. The therapeutic potential of Midkine-Based Therapies

has been validated during more than 10 years of research including

collaborations with leading academic centres and clinicians

resulting in over 900 scientific publications.

Roquefort Investments also proposes to carry out a Placing of

new Ordinary Shares to raise funds of up to GBP3 million (before

expenses) to finance the cash component of the consideration for

the Acquisition, pre-clinical drug development and working capital.

As such, the Acquisition is conditional, inter alia, on a

successful Placing.

The Company will shortly be circulating a notice of general

meeting to shareholders to seek shareholder approval inter alia for

the issue of new Ordinary Shares in connection with the Acquisition

and the Placing and to change the name of the Company to Roquefort

Therapeutics plc.

Should the Acquisition complete, it will constitute a Reverse

Takeover under the Listing Rules and accordingly the Company will

apply for the re-admission of its shares to the Official List and

the Main Market of the London Stock Exchange. The Company's shares

remain suspended from trading pending the publication of a

prospectus prepared in accordance with the Prospectus Regulation

Rules of the FCA and approved by the FCA, or an announcement that

the Acquisition is not proceeding.

Key Highlights

-- Acquiring 100% of Lyramid Pty Limited for Initial Consideration of GBP1 million

o Lyramid is developing first-in-class drugs for the treatment

of COVID-19 patients, cancer, chronic inflammatory and autoimmune

disorders

o Licence holder of the largest global IP portfolio on

Midkine

-- Novel Disease Target

o Potential to exploit the broad therapeutic potential of

Midkine for a number of clinical indications of unmet needs

-- Developing first in class oligonucleotide drugs

o IP portfolio provides a platform to develop first-in-class

drugs for the treatment of COVID-19 patients, cancer, autoimmune

disorders and inflammatory diseases

-- Extensive Validation by Lyramid

o Therapeutic potential of Midkine blocking drugs validated

during more than 10 years of research including collaborations with

leading academic centres and clinicians resulting in over 1,000

scientific publications

Further announcements will be made in due course, as

appropriate.

Stephen West, Executive Chairman, commented:

"I am delighted to announce that we have completed the very

important step of signing the Sale and Purchase Agreement for the

acquisition of Lyramid. We have commenced marketing to potential

investors to fund the acquisition and the very exciting

pre-clinical drug development programme of Lyramid, with very

encouraging

results, and we look forward to completing this Acquisition and re-listing our shares.

The teams at Roquefort Investments and Lyramid believe the

Midkine global IP portfolio has significant unrealised value that

can be unlocked through pre-clinical drug development utilising

oligonucleotide drugs. Due to recent progress in oligonucleotide

drug development (for example, mRNA used in Pfizer and Moderna

COVID-19 vaccines) there is an opportunity to progress the

pre-clinical drug development stage rapidly and at a significantly

lower cost than historical traditional methods.

We look forward to updating the market further in due

course."

Enquiries:

Roquefort Investments plc

+44 (0)20 3290

Stephen West (Chairman) 9339

Optiva Securities Limited (Broker)

+44 (0) 20 3411

Christian Dennis 1881

For further information, please visit www.roquefortinvest.com

and @roquefortinvest on Twitter.

LEI: 254900P4SISIWOR9RH34

This announcement contains inside information for the purposes

of Article 7 of the Market Abuse Regulation (EU) No 596/2014

("MAR"). Upon the publication of this announcement via Regulatory

Information Service, this inside information is now considered to

be in the public domain.

DISCLAIMER

Optiva Securities Limited ("Optiva"), which is authorised and

regulated in the United Kingdom by the Financial Conduct Authority,

is acting as broker to the Company in relation to the Placing.

Persons receiving this announcement should note that Optiva will

not be responsible to anyone other than the Company for providing

the protections afforded to its clients or for advising any other

person on the arrangements described in this announcement. Optiva

has not authorised the contents of, or any part of, this

announcement and no liability whatsoever is accepted by it for the

accuracy of any information or opinion contained in this

announcement or for the omission of any information.

This announcement includes statements that are, or may be deemed

to be, "forward-looking statements". These forward-looking

statements can be identified by the use of forward-looking

terminology, including the terms "believes", "estimates", "plans",

"anticipates", "targets", "aims", "continues", "expects",

"intends", "hopes", "may", "will", "would", "could" or "should" or,

in each case, their negative or other variations or comparable

terminology. These forward-looking statements include matters that

are not facts. They appear in a number of places throughout this

announcement and include statements regarding the Directors'

beliefs or current expectations concerning, amongst other things,

the amount of capital which will be returned by the Company and the

taxation of such amounts in the hands of Shareholders. By their

nature, forward-looking statements involve risk and uncertainty

because they relate to future events and circumstances. Investors

should not place undue reliance on forward-looking statements,

which speak only as of the date of this announcement.

The information given in this announcement and the

forward-looking statements speak only as at the date of this

announcement. The Company, Optiva and their respective affiliates

expressly disclaim any obligation or undertaking to update, review

or revise any forward-looking statement contained in this

announcement to reflect actual results or any change in the

assumptions, conditions or circumstances on which any such

statements are based unless required to do so by the Financial

Services and Markets Act 2000, the Listing Rules, the Prospectus

Regulation Rules or other applicable laws, regulations or

rules.

The Existing Ordinary Shares and the New Ordinary Shares have

not, nor will they be, registered under the US Securities Act of

1933, as amended (the "US Securities Act") or with any securities

regulatory authority of any state or other jurisdiction of the

United States or under the applicable securities laws of Australia,

Canada, Japan or the Republic of South Africa. The Existing

Ordinary Shares and the New Ordinary Shares to be issued by the

Company may not be offered or sold directly or indirectly in or

into the United States unless registered under the US Securities

Act or offered in a transaction exempt from or not subject to the

registration requirements of the US Securities Act or subject to

certain exceptions, into Australia, Canada, Japan or the Republic

of South Africa or to, or for the account or benefit of, any

national, resident or citizen of Australia, Canada, Japan or the

Republic of South Africa. The Company has not been, and will not

be, registered under the US Investment Company Act of 1940, as

amended.

The distribution of this announcement may be restricted by law

in certain jurisdictions and persons into whose possession any

document or other information referred to herein comes should

inform themselves about and observe any such restriction. Any

failure to comply with these restrictions may constitute a

violation of the securities laws of any such jurisdiction.

The value of shares and the income from them is not guaranteed

and can fall as well as rise due to stock market and currency

movements. When you sell your investment you may get back less than

you originally invested. All of the value of an investor's

investment in the Company will be at risk. Past performance is not

a guide to future performance and the information in this circular

or any documents relating to the matters described in it cannot be

relied upon as a guide to future performance. Persons needing

advice should contact a professional adviser.

INTRODUCTION

Background to and reasons for the Acquisition

The Company was formed to pursue opportunities to acquire

medical biotechnology businesses that are early stage in the

medical sector. The Company considers businesses that are in the

"research" or "pre-clinical development" stages to be early stage.

Since the Company's IPO on the standard list of the London Stock

Exchange on 22 March 2021, the Company's initial focus has been on

acquiring early stage businesses in the medical biotechnology

sector including (but not limited to) drug and vaccine development,

diagnostics, immuno-therapy and cell and gene therapies.

Lyramid is the exclusive licensee of 36 registered patents and

one application covering composition of matter and method of use

patents for Midkine inhibitors. Midkine is a novel therapeutic

target that provides a platform for drug development to treat

numerous diseases including severe inflammatory diseases (including

COVID-19), autoimmune disorders and cancer.

After careful consideration by the Board, it was unanimously

decided to proceed with the Acquisition. Upon success, the Board

considers the Lyramid opportunity aligned with its investment

strategy and to offer the best chance of providing Shareholders

with an attractive total return achieved primarily through capital

appreciation.

The key reasons for the decision to proceed with the Acquisition

are as follows:

-- Lyramid holds a licenced portfolio of patents for an exciting

novel therapeutic target, Midkine, that provides a platform for

drug development to treat numerous diseases;

-- Lyramid has completed extensive research studies

demonstrating that the blocking of Midkine promotes a positive

response from cells when fighting various diseases including severe

inflammatory diseases, autoimmune disorders and cancer;

-- the research studies have also shown that Midkine is involved

in various lung diseases and multi-organ failure, as well as

impacting on a key molecule required for entry of SARS-CoV-2 virus

into lung cells. Therefore, targeting Midkine may be beneficial for

preventing SARS-CoV-2 infection and the devastating symptoms of

acute and long COVID-19;

-- the Company will be acquiring over 10 years of research and

will benefit from approximately A$40 million of investment into

Midkine research;

-- Lyramid is now entering into the pre-clinical stage of

antisense oligonucleotide drug development to block Midkine;

-- due to recent progress in oligonucleotide drug development

(for example, mRNA used in Pfizer and Moderna COVID-19 vaccines)

there is an opportunity to progress the pre-clinical drug

development stage faster and at a lower cost than small molecule

drugs or therapeutic antibodies; and

-- upon proof of efficacy during the pre-clinical stage, Midkine

blocking drugs to treat SARS-CoV-2 infection and COVID-19 may be

fast-tracked into clinical trials for accelerated approval by

regulators.

History of Lyramid

Lyramid is a private company, incorporated and domiciled in

Australia, which was originally formed in February 2016 to

commercialise the intellectual property owned by its former parent

company, Cellmid Limited ("Cellmid"), around the novel therapeutic

target, Midkine. Midkine is an embryonic growth factor discovered

by Professors Takashi Muramatsu and Kenji Kadomatsu at Nagoya

University, Japan in 1988. The intellectual property associated

with the discovery was acquired by Cell Signals Inc., a Japanese

biotechnology company in 2001 and funded by venture capital

investment until 2008. Cell Signals uncovered basic aspects of

Midkine biology and developed antibodies targeting Midkine, which

have become the subject of an extensive, global patent

portfolio.

In 2008 Cellmid acquired all of the intellectual property

pertaining to Midkine from Cell Signals Inc. for a consideration

amount of A$3.5 million, including patents, know-how and methods

for the detection of Midkine in blood and other tissues. Cellmid

has since, through its own research programs and with

collaborators, developed a large patent portfolio and knowledge

base around Midkine, its inhibitors and its potential to be

targeted for a number of therapeutic indications.

The composition of matter patents acquired from Cell Signals

Inc., covered antibodies that bind to different regions of the

Midkine protein and inhibit its action as well as antisense

oligonucleotides that blocked Midkine expression. The method of use

patents covered the use of these reagents in different disease

settings including chronic inflammatory diseases, autoimmune

disorders, vascular occlusive diseases and cancer.

Lyramid has an exclusive global licence to all Midkine related

intellectual property owned by Cellmid pursuant to a licence

agreement. The license has the term of patent life plus five years

and cannot be terminated except for material breach.

After completing extensive scientific work with encouraging

results during the research phase, Lyramid is now moving into the

pre-clinical stage of drug development.

In April 2021 Lyramid was acquired by Provelmare Holding SA with

the view to providing the interim funding required to continue with

the Midkine drug development programme whilst a more suitable buyer

with longer term funding was identified.

Strategy for Lyramid

During the research stage, Lyramid obtained extensive

pre-clinical data sets and a licence to the relevant patents in

relation to its Midkine antibodies. Lyramid is now moving into the

pre-clinical stage of developing antisense oligonucleotide drugs to

inhibit Midkine. The advantages of oligonucleotide-based drugs in

clinical deployment include low cost and scalability of

manufacture, well-defined safety profile and pharmacokinetics, as

well as targeted biodistribution to specific organs with

appropriate chemical modifications and delivery vehicles for

nucleic acids. The oligonucleotide drugs are expected to be novel

and form the basis of new patents, adding value to Lyramid's

intellectual property portfolio.

Lyramid's preclinical antisense oligonucleotide programme is

expected to deliver new, patented drugs, which will be further

validated in preclinical models of cancer, autoimmune disorders,

chronic inflammatory diseases, and SARS-CoV-2 infection, including

acute symptoms of COVID-19 and long COVID. Relative to biologic

drugs, such as antibodies, oligonucleotide drugs are expected to

have a more rapid path to the clinic representing earlier potential

value inflection for Lyramid.

Lyramid will initially focus on disease indications that allow

accelerated entry into clinical trials, especially with the

EUA/CTAP programs run by the EMA and FDA for COVID-19 treatments.

In view of the multiple other disease settings that Midkine impacts

on, the Board believes that there is considerable scope for

adapting Midkine oligonucleotides for broad clinical application in

areas of high unmet needs and major global markets.

Lyramid intends to develop its oligonucleotide, and potentially

antibody, drugs through preclinical and early clinical development.

It will consider licensing of these drugs in the various

indications at either IND (investigational new drug) application or

clinical proof of concept (post phase 2 clinical studies) stages

with the objective of delivering value to shareholders.

KEY TERMS OF THE ACQUISITION

Pursuant to the Acquisition Agreement, the Company has

conditionally agreed to acquire the entire issued share capital of

Lyramid.

The consideration for the entire issued share capital will

consist of: (i) payment of GBP500,000 in cash (subject to

adjustment for working capital); (ii) the issue of the Initial

Consideration Shares to the Seller; and (iii) contingent deferred

consideration (if any is due) to be satisfied in the form of

Deferred Consideration Shares, as follows:

-- if prior to the fifth anniversary of Admission, the Company's

market capitalisation exceeds GBP25,000,000 for a period of 5 or

more consecutive trading days the Company shall issue to the Seller

5,000,000 Deferred Consideration Shares; and

-- if prior to the fifth anniversary of Admission the Company's

market capitalisation exceeds GBP50,000,000 for a period of 5 or

more consecutive trading days the Company shall issue to the Seller

(or its nominee) a further 5,000,000 Deferred Consideration

Shares.

The Initial Consideration Shares to be issued pursuant to the

Acquisition will be credited as fully paid and rank pari passu in

all respects with the Existing Ordinary Shares in issue including

the right to receive all future dividends or other distributions

declared, made or paid after the date of issue. The Initial

Consideration Shares (assuming the full number of 30,000,000

Placing Shares are subscribed) will represent approximately 6.9% of

the Enlarged Issued Share Capital. The Consideration Shares

(assuming the full number of 30,000,000 Placing Shares are

subscribed and that no other new Ordinary Shares are allotted) will

represent approximately 18.3% of the Enlarged Issued Share

Capital.

The Acquisition Agreement may be terminated by the Company in

certain customary limited circumstances, including where the

Company becomes aware of a material breach of warranty or material

breach of interim covenant prior to Admission. The agreement

contains customary warranties and indemnities relating to Lyramid

and its business and assets, given by the Seller in relation to

general and operational warranties and a customary tax covenant in

favour of the Company. Claims under the Acquisition Agreement are

subject to certain financial, time and other limitations.

Conditions of the Acquisition

Completion of the Acquisition is conditional, inter alia,

upon:

-- approval by the FCA, and the publication, of a Prospectus

relating to the issue of the Consideration and Placing Shares;

-- the passing of the Resolutions at the General Meeting;

-- the Initial Consideration Shares and the Placing Shares

having been issued and allotted unconditionally subject only to

their Admission;

-- there having occurred in the period between the signing date

and Completion no material breach of any of the Seller's interim

covenants in the Acquisition Agreement, no material breach of

warranties and no material adverse change in relation to Lyramid;

and

-- Admission.

If the conditions are not satisfied or waived (if capable of

waiver) on or before the 28 February 2022 (or such later date as

the Company and the Seller may agree), the Acquisition Agreement

will terminate and cease to be of any effect save for certain

customary surviving provisions.

Lock-in undertaking

Pursuant to the Acquisition Agreement, the Seller shall also

enter into a lock-in agreement with the Company conditionally on

Admission on standard terms. Under the lock-in agreement, the

Seller will agree that it will not, without the consent of the

Company, dispose of the legal or beneficial interest in the Initial

Consideration Shares or grant a right or charge over such Shares

for a period of 6 months from Admission in relation to all of the

Consideration Shares and for a further period of 6 months in

relation to 50% of the Consideration Shares.

PROPOSED PLACING

In conjunction with the Acquisition and subject to Admission,

the Company proposes to issue up to 30,000,000 Placing Shares to

existing and other institutional shareholders at the Placing Price

of GBP0.10 per share.

Assuming all the Placing Shares are taken up, the Placing is

expected to raise approximately GBP3,000,000 before expenses.

The proceeds of the Placing will be used to finance the cash

component of the consideration for the Acquisition, for

pre-clinical drug development and for working capital .

The Company has engaged Optiva to act as the Company's placing

agent and adviser for the purposes of the Placing . The Placing

will not be underwritten. The Placing will be conditional, inter

alia, on:

-- the Acquisition Agreement becoming unconditional in all respects save for Admission;

-- approval by the FCA of the Prospectus and the publication of the Prospectus;

-- the Resolutions being passed at the General Meeting; and

-- Admission occurring no later than 8:00 a.m. on 28 February 2022.

The Placing Shares (assuming the full number of 30,000,000

Placing Shares are taken up) will represent approximately 41.7% of

the Enlarged Issued Share Capital.

The Placing Price of GBP0.10 represents a discount of 20% to the

Company's mid-market closing price as at 28 September 2021, being

the last date on which the Company's shares were traded prior to

the suspension.

PROPOSED CHANGE OF NAME

Upon completion of the Acquisition, it is proposed that the

Company will change its name to Roquefort Therapeutics plc. It is

expected that the change of name will become effective as soon as

practicable following Admission, upon the issue of a certificate of

incorporation on change of name by the Registrar of Companies. A

resolution to change the name of the Company will be included in

the Resolutions to be put to the General Meeting.

BOARD COMPOSITION

There are no proposals to change the composition of the Board in

connection with the Acquisition and Admission.

PROPOSED GRANT OF WARRANTS

In connection with the Acquisition, Placing and Admission, the

Company proposes to grant the following warrants on the following

terms, in each case conditionally on Admission:

-- 3,000,000 Completion Warrants proposed to be issued to

Stephen West or his nominee. Each Completion Warrant will entitle

Mr West or his nominee to subscribe for one new Ordinary Share at

GBP0.10 per share. The Completion Warrants will be exercisable

within 3 years from the date of Admission.

-- 4,500,000 Senior Management Warrants proposed to be issued to

the Directors and certain senior managers. Each Senior Management

Warrant will entitle the holder to subscribe for one new Ordinary

Share at GBP0.15 per share. In the case of each warrant holder, one

third of the Senior Management Warrants held by the warrant holder

will vest at the end of each year over a 3 year period from the

date of Admission.

-- Up to 1,800,000 broker warrants proposed to be issued to

Optiva in connection with the Placing to be based on 6% of the

aggregate value of the Ordinary Shares at the Placing Price issued

by the Company to placees introduced by Optiva in the Placing. Each

warrant will entitle Optiva to subscribe for one new Ordinary Share

at the Placing Price and will be exercisable within 3 years from

the date of Admission.

-- 175,000 advisor warrants to proposed to be issued to Orana in

connection with the Placing and Admission. Each warrant will

entitle Orana to subscribe for one new Ordinary Share at the

Placing Price and will be exercisable within 3 years from the date

of Admission.

SHAREHOLDINGS

Immediately following Admission, and assuming that no further

Ordinary Shares are issued prior to or upon Admission other than

the New Ordinary Shares, the shareholdings of the Directors will be

as follows:

Existing Directors Ordinary Shares % of issued % of Enlarged Share

share

capital Capital

Stephen West(*) 4,000,000 10.8% 5.6%

Mark Freeman - - -

Mark Rollins 4,000,000 10.8% 5.6%

Michael Stein - - -

(*) Shares all held by Cresthaven Investment Pty Ltd (ATF

the Bellini Trust) - an entity associated with Stephen

West.

In addition to the interest in shares of the Directors noted

above, and assuming that no further Ordinary Shares are issued

prior to or upon Admission other than the New Ordinary Shares, it

is expected that immediately following Admission, the following

persons will be interested in 3 per cent. or more of the Enlarged

Issued Share Capital:

Name Ordinary Shares % of issued % of Enlarged Share

share

capital Capital

Jane Whiddon 7,300,000 19.8% 10.2%

Provelmare SA 5,000,000 - 7.0%

If no further issue of Ordinary Shares takes place prior to or

upon Admission other than the New Ordinary Shares, it is not

expected that any other person will have an interest exceeding 3

per cent. of the Enlarged Issued Share Capital.

PROSPECTUS

In order to implement the Acquisition, the Placing and

Admission, the Company is required to have approved by the FCA and

to publish a Prospectus, prepared in accordance with the Prospectus

Regulation Rules, and setting out further information on the

Acquisition, the Placing and Admission and the Enlarged Group. The

Prospectus will be available at the Company's website:

www.roquefortinvest.com as soon as practicable following its

publication and a further announcement will be made in due

course.

GENERAL MEETING

Implementation of the Acquisition, the issue of Consideration

Shares, the Placing, the change of the Company's name and certain

related matters require the approval of Shareholders at a general

meeting of the Company. At the General Meeting resolutions to

approve the following are expected to be proposed:

-- To grant the directors general authority to allot the

Consideration Shares, the Placing Shares and the warrants referred

to in this announcement and a further authority to allot shares

calculated by reference to the Enlarged Issued Share Capital.

-- To disapply statutory pre-emption rights in connection with

the allotment of the Consideration Shares, the Placing Shares and

the warrants referred to in this announcement and a further

authority to allot shares calculated by reference to the Enlarged

Issued Share Capital.

-- To change the name of the Company to Roquefort Therapeutics plc.

A notice convening the General Meeting to approve the

Resolutions will be posted to Shareholders in due course.

DEFINITIONS

Acquisition the proposed acquisition by the

Company of the entire issued

share capital of Lyramid pursuant

to the terms of the Acquisition

Agreement;

Acquisition Agreement means the conditional agreement

dated 17 November 2021 made between

the Company and the Seller relating

to the Acquisition ;

Admission means the re-admission of the

Existing Ordinary Shares and

the admission of the New Ordinary

Shares to the Official List by

way of a Standard Listing and

to trading on the London Stock

Exchange's Main Market for listed

securities;

Company means Roquefort Investments plc,

a company incorporated in England

& Wales whose registered office

address is at Eccleston Yards,

25 Eccleston Place, London, England,

SW1W 9NF with company number

12819145;

Completion means completion of the Acquisition;

Completion Warrants means the 3,000,000 Warrants

proposed to be granted to Stephen

West or nominee to subscribe

for Ordinary Shares at GBP0.10

per Ordinary Share;

Consideration Shares means the Initial Consideration

Shares and the Deferred Consideration

Shares;

Deferred Consideration Shares means up to a maximum of 10,000,000

new Ordinary Shares to be issued

and allotted to the Seller pursuant

to the terms of the Acquisition

Agreement conditional on certain

events;

Directors, Board or Board of means the current directors of

Directors the Company or the board of directors

from time to time of the Company,

as the context requires, and

" Director " is to be construed

accordingly;

Enlarged Group means the Company and Lyramid;

Enlarged Issued Share Capital means the share capital of the

Company immediately following

the issue of the New Ordinary

Shares;

Existing Ordinary Shares means the 36,900,000 Ordinary

Shares of GBP0.01 each in issue

as at the date of this Document;

FCA means the UK Financial Conduct

Authority;

FSMA means the UK Financial Services

and Markets Act 2000, as amended;

GBP, pounds sterling or GBP means British pounds sterling;

General Meeting the general meeting of the Company

at which, inter alia, the Resolutions

will be proposed;

Initial Consideration Shares means the 5,000,000 new Ordinary

Shares to be issued to the Seller

at the Placing Price on as part

of the initial consideration

for the Acquisition;

Listing Rules means the listing rules made

by the FCA under section 73A

of FSMA as amended from time

to time;

London Stock Exchange means London Stock Exchange plc;

Lyramid means Lyramid Pty Limited;

Main Market means the main market for listed

securities of the London Stock

Exchange;

Market Abuse Regulation or MAR the UK version of the EU Market

Abuse Regulation (2014/596/EU)

(incorporated into UK law by

virtue of the EUWA) and the relevant

provisions of the EU Market Abuse

Regulation (2014/596/EU);

New Ordinary Shares means the Placing Shares and

the Initial Consideration Shares;

Official List means the official list maintained

by the FCA;

Optiva means Optiva Securities Limited,

the Company's placing agent and

adviser for the purposes of the

Placing;

Orana means Orana Corporate LLP, the

Company's adviser in connection

with the Admission;

Ordinary Shares means the ordinary shares of

GBP0.01 each in the capital of

the Company including, if the

context requires, the New Ordinary

Shares;

Placee any person that has conditionally

agreed to subscribe for Placing

Shares in the Placing;

Placing means the proposed placing of

the New Ordinary Shares by the

Company at the Placing Price,

conditional inter alia on Admission;

Placing Price means GBP0.10 per New Ordinary

Share;

Placing Shares means the 30,000,000 new Ordinary

Shares proposed to be issued

and allotted pursuant to the

Placing;

Prospectus means the prospectus relating

to the Acquisition, the Placing,

Admission and the Enlarged Group

;

Prospectus Regulation Rules the Prospectus Regulation Rules

made by the FCA under Part VI

of the FSMA;

Regulated Activities Order the Financial Services and Markets

Act 2000 (Regulated Activities)

Order 2001 (as amended)

Resolutions means the resolutions to be put

to the Shareholders at the General

Meeting;

Restricted Jurisdiction means the United States, Canada,

Japan, Australia and the Republic

of South Africa;

Reverse Takeover means a reverse takeover as defined

in the Listing Rules;

SEC means the U.S. Securities and

Exchange Commission;

Securities Act means the U.S. Securities Act

of 1933, as amended;

Seller means Provelmare Holding SA being

the seller of the entire share

capital of Lyramid pursuant to

the Acquisition Agreement;

Senior Management Warrants means the 4,500,000 Warrants

proposed to be granted to certain

Directors and senior managers

to subscribe for Ordinary Shares

at GBP0.15 per Ordinary Share;

Shareholders means the holders of Ordinary

Shares;

Standard Listing means a standard listing under

Chapter 14 of the Listing Rules;

UK Relevant Persons persons who (if they are in the

UK) are (i) persons having professional

experience in matters relating

to investments falling within

the definition of 'investment

professionals' in Article 19(5)

of the Financial Services and

Markets Act 2000 (Financial Promotion)

Order 2005 (the " Order " );

or (ii) persons who are high

net worth bodies corporate, unincorporated

associations and partnerships

and the trustees of high value

trusts, as described in Article

49(2)(a) to (d) of the Order;

or (iii) persons to whom it may

otherwise be lawful to distribute;

United Kingdom or U.K. means the United Kingdom of Great

Britain and Northern Ireland;

United States or U.S. means the United States of America;

and

US$ or USD US dollars, the lawful currency

of the United States of America.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

ACQFFEESWEFSEEF

(END) Dow Jones Newswires

November 18, 2021 02:00 ET (07:00 GMT)

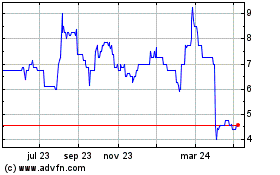

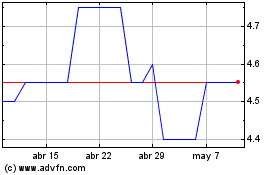

Roquefort Therapeutics (LSE:ROQ)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Roquefort Therapeutics (LSE:ROQ)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024