TIDMRHM

RNS Number : 1387N

Round Hill Music Royalty Fund Ltd

28 September 2021

28 September 2021

ROUND HILL MUSIC ROYALTY FUND LIMITED

("RHM" or the "Company")

Acquisition of The O'Jays catalogue

Further diversifies portfolio with increased exposure to classic

R&B and Soul

The Board of Round Hill Music Royalty Fund Limited is pleased to

announce that the Company has acquired 100% of the master royalty

income of 532 original recordings from the iconic American classic

R&B group, The O'Jays.

Key Acquisition Highlights:

-- The catalogue comprises 532 original recordings, including

numerous timeless hits such as "Love Train", "Use Ta Be My Girl",

"Cry Together", "Back Stabbers", "For The Love of Money", "Forever

Mine", "Put Your Hands Together", "Stairway To Heaven" and "I Love

Music";

-- The catalogue acquired includes 100% of The O'Jays master royalty income;

-- "Back Stabbers" was their first million-seller album and it

produced many more hit singles including "992 Arguments",

"Sunshine", "Time to Go Down" and the No. 1 pop hit "Love

Train";

-- The O'Jays "For The Love Of Money" was the theme song to the

US hit reality TV show "The Apprentice", bringing their music to a

whole new generation;

-- The O'Jays are two-time Grammy Hall of Fame inductees for

their songs "Love Train" and "For The Love of Money", and were

honoured with the BET 2009 Life Time Achievement Award and inducted

into the National Rhythm and Blues Hall of Fame in 2013; and

-- The O'Jays have achieved 10 gold and 9 platinum albums throughout their 63-year career.

Background to the Catalogue

The O'Jays made their first chart appearance with the hit

"Lonely Drifter" in 1963 but reached their peak success once they

teamed up with Gamble & Huff, a group of producers and

songwriters, who signed them to their Philadelphia International

label in 1972. Following this, the O'Jays gained notoriety and

emerged at the forefront of Philadelphia soul with "Back Stabbers"

in 1972 and topped the Billboard Hot 100 in 1973, followed by "Love

Train" in 1974. This success followed their debut album, "Comin'

Through". More recently, The O'Jays were welcomed into the Vocal

Group Hall of Fame in 2004, and The Rock and Roll Hall of Fame in

2005, and in 2013 they were inducted into National Rhythm and Blues

Hall of Fame.

Catalogue Details

The Company's acquisition comprises 100% of The O'Jays' master

royalty income in the catalogue.

The c atalogue has significant exposure to Streaming, comprising

64% of revenue mix, with the balance being comprised of 3%

Physical, 10% Download, 17% Sync and 6% Other. In terms of

geographical exposure, 88% of the revenue is from the US, while the

balance is from other countries.

The top songs ranked by revenue are: "Love Train", "Forever

Mine", "For The Love of Money", "Back Stabbers", "Use Ta Be My

Girl", "Cry Together", "Stairway To Heaven" and "I Love Music".

All figures above are based on the c atalogue's royalty

statements in the calendar years 2018-2020.

Disclosure of Financial Detail on Acquisitions

Due to commercial sensitivities, the Company is unable to

disclose financial details for each acquisition as it occurs.

However, on completion of the investment of proceeds from the C

Share fundraise of US$86.5 million, together with the remaining

undrawn balance of its existing revolving credit facility, the

Company will make further financial disclosure on the

acquisitions.

Trevor Bowen, Chair of Round Hill Music Royalty Fund,

commented:

"We are delighted to announce the acquisition of 100% of the

master royalty income of The O'Jays. The acquisition further

demonstrates the ability of Round Hill to source and acquire

catalogues which have produced long-term steady royalty revenue

over the past decades. The addition of the O'Jays' catalogue

provides further diversification in terms of artist, genre, vintage

and income type, making it a welcome addition to our growing

portfolio. We are delighted to see the Investment Manager

competently executing on its pipeline of attractive

opportunities."

Josh Gruss, Chairman and CEO of Round Hill, the Company's

investment manager, commented:

"The O'Jays will be known to many as one of the main figures in

the 70s' Soul scene in Philadelphia, which saw the genre come to

the fore and a funk influence emerge which has shaped disco music

for generations. We are pleased to be able to secure this

exceptionally high quality catalogue, which will make a fantastic

addition to the landmark portfolio of timeless music we are

constructing for RHM, to support predictable and consistent revenue

streams. We look forward to updating Shareholders further on our

near-term pipeline of exciting opportunities."

The O'Jays ' Eddie Levert and Walter Williams commented:

" We are very happy we found Round Hill to look after our

lifelong catalogue. We would like to thank Josh Gruss, Robin

Godfrey-Cass, Michael Selverne, our management company 21 (st)

Century Artists, Toby Ludwig and our attorney Dorothy Weber."

FOR FURTHER INFORMATION

Round Hill

Josh Gruss, Chairman via Buchanan below

and CEO

Neil Gillis, President

Steve Clark, COO

Cenkos

Sales:

Justin Zawoda-Martin +44 20 7397 1923

Daniel Balabanoff +44 20 7397 1909

Andrew Worne +44 20 7397 1912

Corporate:

James King +44 20 7397 1913

Will Talkington +44 20 7397 1910

Buchanan

Charles Ryland +44 20 7466 5107

Henry Wilson +44 20 7466 5111

Hannah Ratcliff +44 20 7466 5102

Notes:

Unless the context otherwise requires, capitalised terms used in

this announcement have the meanings in the Prospectus.

The Company is a non-cellular Guernsey company. The Company's

Investment Objective is to provide investors with an attractive

level of regular and growing income and capital returns from

investment primarily in high quality, music intellectual property.

In order to achieve its Investment Objective, the Company will

invest in a songwriter's copyright interest in a musical

composition or song (being their writer's share, their publisher's

share and their performance rights) together with the rights in the

recording of the musical composition or song (known as the master

recording rights) together with all such rights and assets

considered by its investment manager, Round Hill Music LP (" Round

Hill "), to be ancillary thereto.

Founded in 2010, Round Hill is a fully integrated owner and

operator of music copyright properties and the sixth largest music

publishing company in the US. Headquartered in New York with

additional offices in Nashville, Los Angeles and London, Round Hill

has an experienced management and investment team with an

established reputation and extensive experience in the music and

finance industries.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

ACQSEIESWEFSESU

(END) Dow Jones Newswires

September 28, 2021 02:00 ET (06:00 GMT)

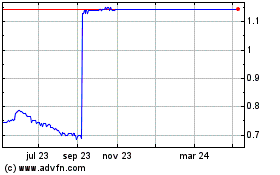

Round Hill Music Royalty (LSE:RHM)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

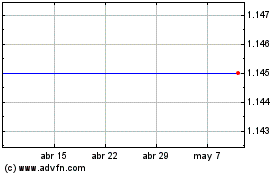

Round Hill Music Royalty (LSE:RHM)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024